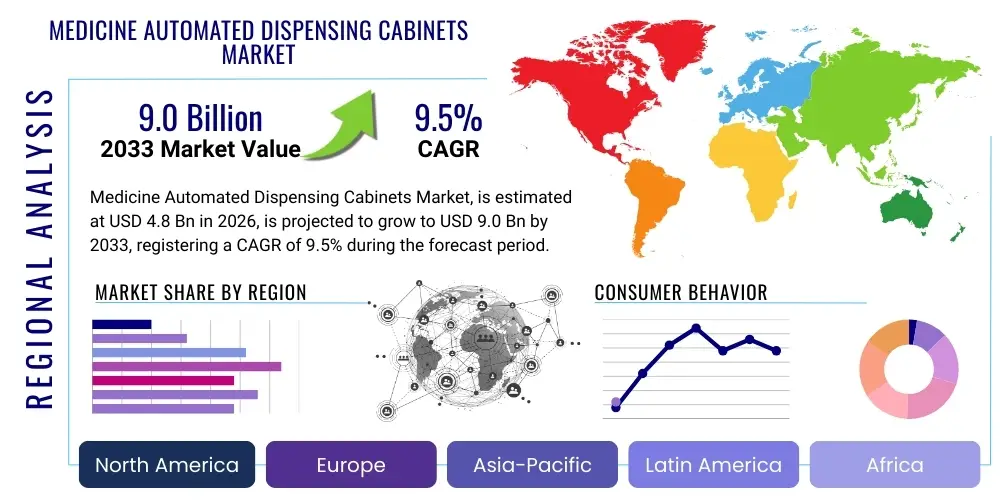

Medicine Automated Dispensing Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436897 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Medicine Automated Dispensing Cabinets Market Size

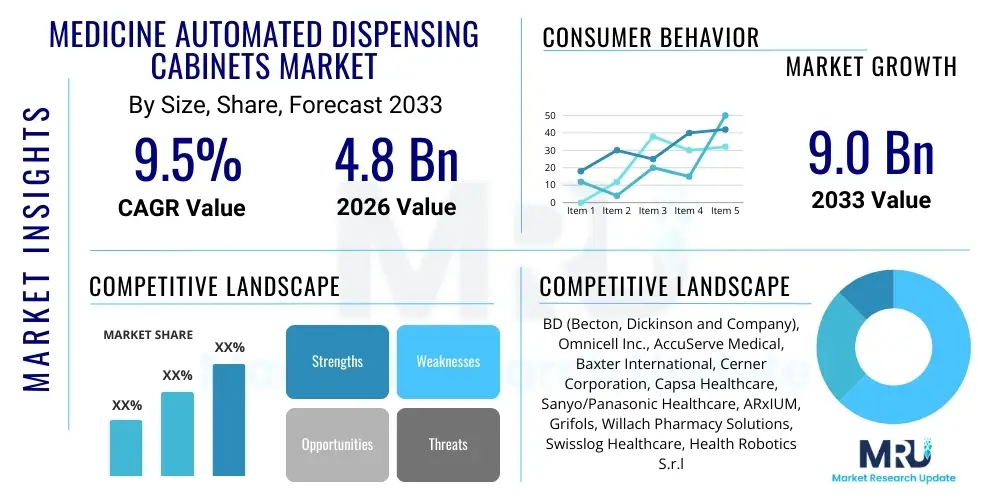

The Medicine Automated Dispensing Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Medicine Automated Dispensing Cabinets Market introduction

The Medicine Automated Dispensing Cabinets (ADCs) Market encompasses highly specialized systems designed to automate the storage, security, inventory management, and dispensing of medications within clinical settings, primarily hospitals, ambulatory surgery centers, and long-term care facilities. These systems replace manual processes, offering significant improvements in medication safety, inventory control, and staff efficiency. ADCs are pivotal in reducing medication errors, which are a major concern in healthcare, by ensuring that the right patient receives the correct drug at the appropriate dosage and time. The product range includes centralized dispensing systems, decentralized units, and specialized cabinets for controlled substances, each optimized for specific workflow needs within the healthcare environment.

Major applications of ADCs span across emergency departments, operating rooms, critical care units, and standard patient floors. These applications leverage technology such as barcode scanning, biometric security, and integration with Electronic Health Records (EHRs) and Hospital Information Systems (HIS) to streamline the medication administration process. The core benefit derived from the adoption of ADCs is the enhanced patient safety profile, achieved through reduced human intervention in critical dispensing moments and improved documentation accuracy. Furthermore, these systems provide real-time inventory tracking, minimizing drug diversion risk and reducing waste associated with expired or lost medications, thereby offering substantial cost-saving advantages to healthcare providers.

The market growth is fundamentally driven by the escalating demand for advanced patient safety solutions and the persistent focus on operational efficiency in overburdened healthcare systems globally. Demographic shifts, leading to an increasing geriatric population requiring complex medication regimens, further necessitate reliable and automated dispensing technologies. Regulatory mandates promoting medication error reduction and interoperability between healthcare technology platforms also fuel the adoption of these sophisticated cabinets, positioning them as essential infrastructure investments for modern hospitals striving for accreditation and quality care standards.

Medicine Automated Dispensing Cabinets Market Executive Summary

The Medicine Automated Dispensing Cabinets Market is undergoing robust expansion, characterized by significant business trends focusing on integration, miniaturization, and enhanced security features. Key business trends include the shift towards sophisticated, decentralized dispensing solutions that integrate seamlessly with existing hospital infrastructure, specifically EHR systems, enabling closed-loop medication management. Technologically, there is a strong emphasis on developing ADCs with predictive analytics capabilities, powered by AI, to forecast demand and optimize inventory levels dynamically, thereby reducing stock-outs and excess holding costs. Furthermore, consolidation within the vendor landscape and strategic partnerships between ADC manufacturers and healthcare technology providers are accelerating the deployment of integrated solutions globally, pushing the market towards more standardized and interconnected platforms.

Regional trends indicate that North America and Europe remain the dominant markets, attributed to high healthcare expenditure, stringent safety regulations, and early adoption of health IT infrastructure. However, the Asia Pacific region is demonstrating the highest growth trajectory, driven by increasing government investments in modernizing healthcare facilities, rising awareness regarding medication safety, and the rapid establishment of new hospitals in developing economies like China and India. These emerging markets are prioritizing scalable and cost-effective ADC solutions. Meanwhile, regions like Latin America and MEA are seeing steady, albeit slower, adoption, predominantly concentrated in private sector hospitals seeking to align with international clinical standards and operational excellence benchmarks.

Segment trends reveal that the Application segment dominated by hospitals continues to hold the largest market share due to the volume and complexity of medications handled in these large facilities. Within the Product Type segment, the trend leans heavily toward decentralized automated dispensing cabinets, favored for their ability to bring medications closer to the point of care, thus improving nurse workflow efficiency and minimizing transportation delays. The Software and Services segment is also exhibiting exceptional growth, reflecting the growing need for specialized support, maintenance, and complex data analytics platforms that enhance the utility and effectiveness of the physical dispensing hardware, transforming raw inventory data into actionable clinical insights.

AI Impact Analysis on Medicine Automated Dispensing Cabinets Market

User inquiries regarding AI's influence on the Medicine Automated Dispensing Cabinets Market frequently revolve around concepts such as proactive error detection, dynamic inventory optimization, and the role of machine learning in workflow efficiency. Users are keenly interested in how AI moves ADCs beyond simple automation into predictive management tools. Key concerns center on data privacy and security when integrating sophisticated AI algorithms with sensitive patient data stored in EHRs, and the reliability of AI predictions in high-stakes clinical environments. Expectations are high for AI to significantly reduce the incidence of critical medication errors, automate complex decision-making processes related to formulary management, and provide personalized dosing recommendations based on real-time patient status, fundamentally redefining the concept of a smart dispensing cabinet.

The integration of Artificial Intelligence transforms traditional automated dispensing cabinets from passive storage units into intelligent inventory and decision support systems. AI algorithms are crucial for analyzing vast datasets encompassing prescribing patterns, historical usage, seasonal variations, and patient acuity levels to provide highly accurate forecasts of medication demand. This predictive capability allows hospital pharmacies to maintain optimal stock levels, significantly reducing both the costly issue of drug expiration and the dangerous scenario of stock-outs for critical medications. Furthermore, AI enhances security by identifying unusual access patterns or dispensing habits that might indicate drug diversion, flagging these anomalies for immediate human review.

Beyond inventory, AI is revolutionizing clinical workflow safety within the ADC framework. Machine learning models can analyze prescription orders and cross-reference them with patient biometric data, allergies, and concurrent medications in real-time to flag potential drug-drug interactions or contraindications immediately prior to dispensing. This layer of computational intelligence acts as an indispensable safety net, augmenting the capabilities of pharmacists and nurses. The operational benefit includes faster turnaround times for dispensing while maintaining an unparalleled level of safety, making the ADC an integral component of the automated closed-loop medication management process, driven by smart, adaptive technology.

- Enhanced Predictive Inventory Management: AI forecasts medication demand based on clinical trends and historical data, minimizing waste and improving stock availability.

- Real-time Error Detection: Machine learning flags potential dosage discrepancies, drug interactions, and contraindications before dispensing, significantly boosting patient safety.

- Optimized Workflow Scheduling: AI analyzes usage patterns to optimize cabinet placement, replenishment schedules, and internal configurations, improving nursing efficiency.

- Advanced Drug Diversion Monitoring: Algorithms detect anomalous user access or dispensing behaviors indicative of diversion, strengthening security protocols.

- Personalized Dispensing Recommendations: Future AI systems could integrate with genomic data and patient monitoring to suggest optimal drug choice and dosage.

DRO & Impact Forces Of Medicine Automated Dispensing Cabinets Market

The Medicine Automated Dispensing Cabinets Market is shaped by a powerful confluence of driving forces centering on patient safety and operational efficiency, balanced by substantial restraining factors predominantly related to capital investment and infrastructure complexities. The primary driver is the global imperative to reduce medication administration errors, recognized internationally as a leading cause of preventable harm in healthcare settings. This imperative, coupled with mandatory accreditation standards requiring advanced safety protocols, forces healthcare organizations to invest in reliable automation. Opportunities abound in emerging markets where new hospitals are being built with integrated automation plans, and in the segment of long-term care facilities which are increasingly recognizing the necessity of secure and traceable medication handling. The resulting impact forces create intense pressure on healthcare providers to adopt sophisticated, integrated dispensing technologies that can deliver tangible improvements in patient outcomes and cost-effectiveness.

Key drivers underpinning market growth include the increasing complexity of patient care, demanding high-fidelity dispensing accuracy, and the rising labor costs associated with manual medication management, making automation a compelling economic proposition. Furthermore, the integration capabilities of modern ADCs with Electronic Health Records (EHRs) facilitate the creation of a closed-loop medication system, providing unprecedented levels of documentation and traceability required for regulatory compliance. Conversely, significant restraints include the high initial capital investment required for purchasing and installing these complex systems, which can be prohibitive for smaller hospitals or facilities in resource-constrained environments. Additionally, the need for extensive staff training and the potential for resistance to change among clinical personnel pose implementation challenges, alongside the continuous requirement for complex system maintenance and software updates, adding to the total cost of ownership.

Opportunities for expansion are primarily derived from the potential for penetration into untapped end-user segments, notably ambulatory care centers, retail pharmacies, and specialized clinics, which are increasingly handling complex, high-cost injectable medications. Technological innovation, specifically the development of smaller, modular, and more affordable ADCs tailored for smaller facilities, represents a significant growth pathway. Moreover, the increasing focus on specialty pharmacy management and high-alert medication protocols creates niche demands for specialized dispensing cabinets equipped with enhanced security and monitoring features. Impact forces such as regulatory pressures from bodies like the FDA and European Medicines Agency push the industry toward standardization and enhanced cybersecurity features, ensuring that dispensed medicines meet the highest safety benchmarks, thereby continually reinforcing the demand for sophisticated, compliant ADCs.

Segmentation Analysis

The Medicine Automated Dispensing Cabinets Market is comprehensively segmented based on product type, application, and end-user, providing a granular view of market dynamics and adoption trends across various healthcare settings. Segmentation by product type primarily distinguishes between centralized and decentralized systems, reflecting the operational philosophy of the healthcare facility. Centralized systems are typically found in hospital pharmacies for large-scale dispensing, whereas decentralized cabinets, located closer to the patient bedside, are increasingly favored for maximizing nursing efficiency and improving response times in critical care environments. The evolution of hybrid models, which combine the benefits of both centralized control and decentralized access, is a key trend within this segment.

Application-based segmentation highlights the primary environments where ADCs deliver the most value, dominated by hospital pharmacy applications for dispensing complex inpatient and outpatient medications. Other critical applications include emergency department use, where speed and accuracy are paramount, and operating room settings, which require controlled access to anesthesia and high-alert medications. End-user segmentation further refines the market view, with hospitals (comprising large, mid-sized, and small facilities) being the dominant revenue generators. However, the ambulatory care centers segment is projected to show accelerated growth, reflecting the shift of complex procedures and medication management outside the traditional inpatient hospital setting, thereby increasing demand for specialized, smaller-footprint ADC solutions tailored for outpatient use.

The strategic differentiation achieved through segmentation allows manufacturers to target specific customer needs with customized solutions. For instance, developing small, high-security cabinets for specialized infusion centers addresses the need within the growing ambulatory care sector, distinct from the large, high-throughput cabinets designed for a major hospital's critical care unit. Furthermore, the services and software segment, although often grouped within product types, represents a crucial dimension of market value, encompassing installation, training, maintenance contracts, and advanced analytics software, all of which drive recurring revenue and improve the long-term efficacy and utility of the installed hardware base.

- By Product Type:

- Centralized Automated Dispensing Cabinets

- Decentralized Automated Dispensing Cabinets

- Mobile Automated Dispensing Cabinets

- By Application:

- Emergency Departments

- Operating Rooms

- Intensive Care Units

- Standard Patient Wards

- By End-User:

- Hospitals (Large, Mid-sized, Small)

- Ambulatory Care Centers

- Long-Term Care Facilities

- Retail Pharmacies

Value Chain Analysis For Medicine Automated Dispensing Cabinets Market

The value chain for the Medicine Automated Dispensing Cabinets Market commences with upstream activities focusing on the sourcing of high-precision components, including advanced sensor technology, secure locking mechanisms, robotic elements, and specialized IT hardware necessary for reliable operation. Key upstream suppliers include component manufacturers specializing in embedded systems, biometrics, and industrial automation. Critical activities at this stage involve rigorous quality control and integration testing of these complex components to ensure the cabinet’s reliability and compliance with strict medical device standards. Successful upstream management is crucial for minimizing manufacturing costs and maximizing system robustness and longevity in demanding clinical environments.

The midstream segment involves the design, manufacturing, assembly, and testing of the ADC hardware and proprietary software platforms. Manufacturers invest heavily in R&D to enhance cabinet ergonomics, security features (e.g., tamper-proofing, remote monitoring), and seamless integration capabilities with hospital IT systems. Once manufactured, the downstream segment encompasses the distribution, installation, service, and maintenance of the cabinets. Distribution channels are typically a mix of direct sales teams for large hospital networks and specialized medical equipment distributors who provide local support and expertise. Direct distribution allows manufacturers to maintain tighter control over installation and customization, while indirect channels provide wider geographical reach, especially in emerging markets where establishing a strong local presence is challenging.

Post-installation services, including regular maintenance, software updates, and staff training, represent a high-value element of the downstream chain, providing ongoing revenue streams and ensuring optimal system performance. The complexity of the technology necessitates specialized, highly skilled service personnel. Furthermore, the integration service, which connects the ADC to the hospital’s Electronic Health Records (EHR) and Pharmacy Information Systems (PIS), is a critical step, often requiring collaboration between the ADC vendor, the EHR vendor, and the hospital IT department. The successful execution of the value chain ensures not only the delivery of advanced hardware but also the sustained provision of a fully operational, integrated medication management solution to the end-user.

Medicine Automated Dispensing Cabinets Market Potential Customers

The primary and largest segment of potential customers for Medicine Automated Dispensing Cabinets consists of hospitals, ranging from major academic medical centers and large urban hospitals to smaller community hospitals. These institutions manage vast and diverse drug formularies, complex patient populations, and high medication turnover rates, making the investment in ADCs essential for achieving the highest standards of safety and inventory efficiency. Hospitals are typically categorized based on bed count and specialty focus, which dictates the type and scale of ADC solution required, with large tertiary care centers often requiring thousands of decentralized units across multiple departments. The increasing focus on cost containment and accreditation further compels hospital administrators to prioritize automation technologies that minimize waste and maximize compliance.

Beyond traditional hospitals, the potential customer base is rapidly expanding into specialized healthcare settings. Ambulatory Care Centers (ACCs), including outpatient surgery centers, diagnostic centers, and specialized clinics (e.g., oncology, dialysis), represent a burgeoning segment. As healthcare delivery shifts toward outpatient models, these facilities require secure, smaller-footprint dispensing solutions to manage controlled substances and high-value medications administered during short stays. Although their volume requirements are lower than those of large hospitals, the need for stringent security and accurate inventory control remains paramount, driving specific demand for modular and compact ADC models designed for non-inpatient environments.

A third crucial customer group includes Long-Term Care (LTC) Facilities, Nursing Homes, and Assisted Living Centers. These facilities face unique challenges related to the medication administration of residents with complex, chronic conditions, often requiring frequent and varied doses. ADCs offer these centers a mechanism to improve medication traceability, reduce the high labor costs associated with manual dispensing rounds, and significantly enhance regulatory compliance regarding controlled substance security. While adoption rates have historically lagged behind hospitals, regulatory pushes and the economic benefits of error reduction are accelerating the purchase cycle within the LTC segment, making them a significant area of future market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Omnicell Inc., AccuServe Medical, Baxter International, Cerner Corporation, Capsa Healthcare, Sanyo/Panasonic Healthcare, ARxIUM, Grifols, Willach Pharmacy Solutions, Swisslog Healthcare, Health Robotics S.r.l., Yuyama Co., Ltd., Euclid Medical Products, Talyst, LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medicine Automated Dispensing Cabinets Market Key Technology Landscape

The technology landscape of the Medicine Automated Dispensing Cabinets Market is characterized by the convergence of robotics, sophisticated software platforms, and advanced security mechanisms, all aimed at creating a seamless, error-free medication distribution process. A foundational technology is the integration of proprietary dispensing hardware with Hospital Information Systems (HIS) and Electronic Health Records (EHRs) using standardized interoperability protocols such as HL7. This integration facilitates closed-loop medication management, ensuring that every dispensed medication is accurately matched to the physician’s order and patient profile, thereby reducing transcription errors and improving clinical documentation accuracy. The cabinets themselves rely on high-reliability mechatronics and sensors for secure storage and accurate retrieval of individual doses.

Security features represent another crucial technological area. Modern ADCs utilize multi-factor authentication, including biometric scanners (fingerprint, iris recognition) and proximity cards, to restrict access strictly to authorized personnel and maintain a meticulous audit trail of every interaction. Furthermore, advanced inventory tracking technologies, such as RFID tagging and weight-sensing scales within the drawers, provide real-time, highly accurate counts of medications, which is especially critical for monitoring controlled substances and complying with regulatory requirements. These technologies drastically reduce the potential for drug diversion by making every medication unit accountable from the moment it enters the cabinet until it is administered to the patient.

The emerging technological frontier involves incorporating Artificial Intelligence (AI) and Machine Learning (ML) into the ADC software. AI algorithms are increasingly being used not only for predictive inventory management, optimizing stock based on complex demand patterns, but also for clinical decision support. Future-generation ADCs will leverage ML to analyze patient data in real time, flagging potential dosing errors or therapeutic redundancies that human staff might overlook during high-pressure dispensing moments. This transition from passive automation to intelligent, active decision support systems defines the current trajectory of technological advancement, ensuring the cabinets remain integral to improving both operational efficiency and clinical outcomes in complex healthcare environments.

Regional Highlights

- North America (NA): North America, particularly the United States, commands the largest share of the Medicine Automated Dispensing Cabinets Market, primarily due to the mandatory adoption of health information technology and stringent patient safety regulations established by organizations such as The Joint Commission. High healthcare spending, coupled with widespread implementation of Electronic Health Records (EHR) systems, provides the necessary technological foundation for seamless ADC integration. The region is characterized by high adoption rates in large hospital systems and aggressive investment in advanced, often AI-enabled, dispensing solutions to combat the opioid crisis and improve controlled substance monitoring. The US market drives innovation in decentralized cabinet design and software analytics.

- Europe: Europe represents the second-largest market, driven by favorable government initiatives supporting healthcare digitization and automation, particularly in countries like Germany, the UK, and France. European hospitals are increasingly replacing older manual systems with automated solutions to cope with aging populations and rising labor costs. Regulatory bodies are pushing for harmonization in medication safety standards, which accelerates ADC deployment. A key focus in Europe is on modular systems that can adapt to diverse hospital structures and varying levels of centralized pharmacy support, with significant investment coming from both public and private hospital groups seeking enhanced operational efficiencies.

- Asia Pacific (APAC): The APAC region is anticipated to exhibit the fastest growth over the forecast period. This rapid expansion is fueled by massive infrastructure development, including the construction of new, large-scale hospital facilities, particularly in China, India, and Southeast Asian countries. Increasing public awareness regarding medication errors, coupled with substantial government funding aimed at modernizing healthcare systems, provides a fertile ground for ADC adoption. While the price sensitivity is higher compared to Western markets, the demand for scalable, high-volume centralized systems and decentralized cabinets is soaring as these nations prioritize achieving global clinical standards.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily concentrated in major urban centers and private healthcare chains in countries such as Brazil and Mexico. Market penetration is generally lower due to economic constraints and fragmented healthcare infrastructure. However, the private sector is steadily adopting ADCs to attract foreign patients and comply with international accreditation standards. The region presents opportunities for vendors offering cost-effective and functionally robust systems, often through distributor networks that can provide localized technical support and training necessary for successful implementation.

- Middle East and Africa (MEA): The MEA market shows promising potential, largely driven by significant government spending on healthcare infrastructure development in wealthy Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE) and increasing investments in health tourism. These countries are building state-of-the-art hospitals designed for immediate automation integration. The adoption focuses heavily on high-security dispensing systems due to the strict control required for certain medications. The African sub-region, while highly fragmented, offers long-term growth potential as foundational health IT systems are established and centralized medical supply chains become formalized.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medicine Automated Dispensing Cabinets Market.- BD (Becton, Dickinson and Company)

- Omnicell Inc.

- Baxter International

- AccuServe Medical

- Cerner Corporation (now Oracle Health)

- Capsa Healthcare

- Sanyo/Panasonic Healthcare

- ARxIUM

- Grifols

- Willach Pharmacy Solutions

- Swisslog Healthcare

- Health Robotics S.r.l.

- Yuyama Co., Ltd.

- Euclid Medical Products

- Talyst, LLC.

- McKesson Corporation

- TOSHO Co., Ltd.

- Parata Systems, LLC

- ScriptPro LLC

- Medacist Solutions Group

Frequently Asked Questions

Analyze common user questions about the Medicine Automated Dispensing Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Automated Dispensing Cabinet (ADC) in a hospital setting?

The primary function of an ADC is to securely store, track, and dispense medications at the point of care, providing authorized clinical staff with immediate access to drugs while maintaining an electronic audit trail, thereby significantly reducing medication errors and improving inventory control.

How does the integration of ADCs with Electronic Health Records (EHRs) benefit patient care?

Integration with EHRs facilitates closed-loop medication administration, ensuring that medication orders entered by physicians are directly communicated to the ADC and verified against patient profiles before dispensing, maximizing safety and ensuring accurate documentation for billing and compliance.

What is the difference between centralized and decentralized automated dispensing cabinets?

Centralized ADCs are typically large systems located within the main hospital pharmacy for bulk dispensing and inventory management, whereas decentralized ADCs are smaller units placed in patient wards or departments (e.g., ICU, ED) to provide medications quickly at the patient's bedside.

What are the major drivers of growth in the Medicine Automated Dispensing Cabinets Market?

Major drivers include the persistent pressure to reduce preventable medication errors, increasing regulatory demands for secure handling of controlled substances, rising healthcare labor costs, and the global trend toward digitizing hospital workflows to enhance operational efficiency.

How is Artificial Intelligence (AI) influencing the next generation of automated dispensing cabinets?

AI is being integrated to enable predictive inventory management, forecasting drug needs dynamically to prevent stock-outs and waste. Furthermore, AI enhances safety by using machine learning to detect anomalous dispensing patterns and potential prescribing errors in real time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager