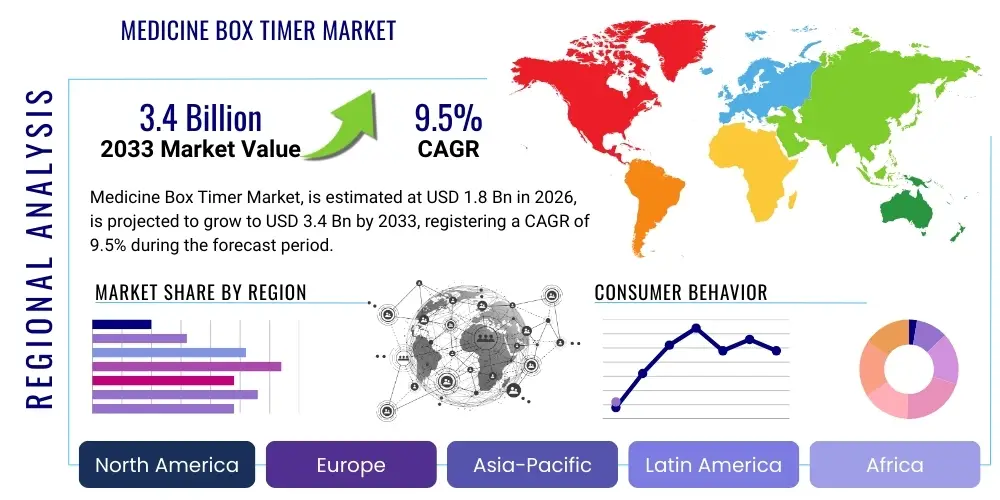

Medicine Box Timer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438841 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Medicine Box Timer Market Size

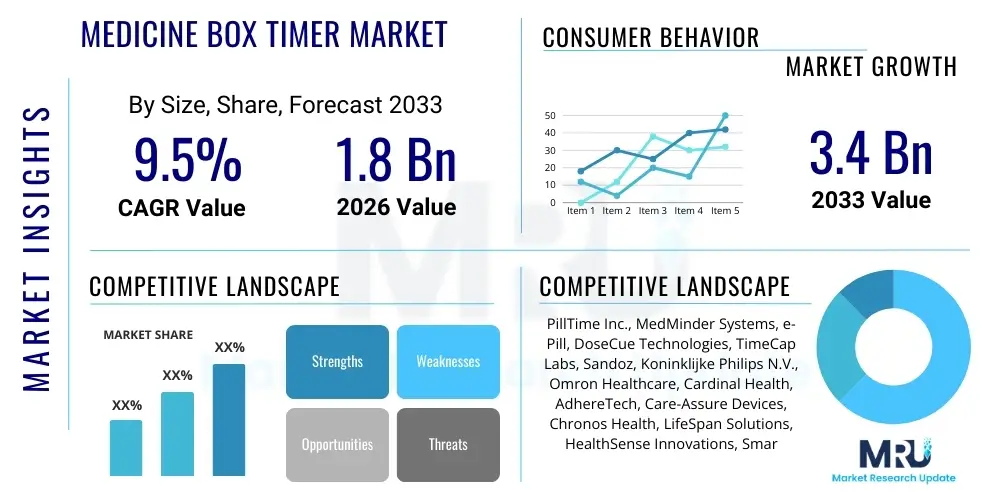

The Medicine Box Timer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Medicine Box Timer Market introduction

The Medicine Box Timer Market encompasses devices designed to enhance medication adherence by integrating temporal reminders, alarms, and dispensing mechanisms into pill storage containers. These devices range from simple timed alarms integrated into weekly pill organizers to complex, IoT-enabled smart medicine boxes that track doses, notify caregivers, and manage complex polypharmacy regimens. The fundamental purpose of these products is to solve the critical public health issue of non-adherence, which leads to suboptimal treatment outcomes, increased hospitalization rates, and escalating healthcare expenditures globally, particularly among the geriatric population and those managing chronic diseases.

Major applications of medicine box timers are predominantly found in home care settings, where individuals or their caregivers manage daily medication schedules independently. They are also increasingly deployed in assisted living facilities and certain specialized hospital units to ensure accurate and timely drug administration, thereby minimizing errors and improving patient safety protocols. The evolution of these devices includes features such as lockout mechanisms to prevent overdosing, biometric authentication for secure access, and integration with telehealth platforms, transforming them from passive storage units into active health management tools. This technological leap is broadening their appeal beyond traditional users to encompass younger individuals managing specific treatments and clinical trial participants requiring highly accurate dosing logs.

The primary benefits driving market demand include improved patient compliance with prescribed regimens, reduced burden on formal and informal caregivers, and the provision of verifiable data on consumption patterns, which is invaluable for physicians adjusting treatment plans. Key driving factors accelerating market expansion involve the rapid growth of the elderly population worldwide, the rising prevalence of chronic conditions such as diabetes, hypertension, and cardiovascular diseases necessitating long-term medication, and significant technological advancements in sensor technology and connectivity (5G, Wi-Fi, Bluetooth Low Energy). Furthermore, increasing awareness among healthcare providers regarding the cost-effectiveness of adherence-enhancing tools, coupled with supportive regulatory environments focusing on patient-centric care, fuels market momentum.

Medicine Box Timer Market Executive Summary

The Medicine Box Timer Market is characterized by robust technological integration and shifting consumer preferences towards smart, connected healthcare solutions. Current business trends indicate a strong focus on developing integrated ecosystems where smart pill boxes communicate directly with Electronic Health Records (EHRs) and remote patient monitoring (RPM) platforms. Venture capital funding is increasingly flowing into startups specializing in predictive adherence analytics, utilizing AI algorithms to anticipate non-adherence risks before they occur. Key manufacturers are differentiating themselves through superior battery life, user-friendly interfaces suitable for the elderly, and data privacy compliance (such as HIPAA and GDPR) to gain trust among healthcare institutions and consumers.

Regionally, North America maintains market dominance due to high healthcare expenditure, significant adoption rates of advanced health technologies, and a well-established infrastructure for integrating digital health devices. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR, driven by the rapidly expanding geriatric population, improving healthcare infrastructure in developing economies like China and India, and government initiatives promoting digital health solutions to manage chronic disease prevalence. European growth is steady, fueled by standardized healthcare policies emphasizing cost reduction through preventative care and medication error reduction. Middle Eastern and African markets are nascent but showing promise, particularly in urban areas prioritizing specialized medical care.

Segment trends reveal that the Smart Medicine Boxes (IoT Enabled) segment is growing faster than traditional basic and programmable timers, capturing significant market share due to their superior functionality, data logging capabilities, and ability to facilitate real-time caregiver interventions. In terms of application, the Home Care setting remains the largest segment, reflecting the increasing trend towards aging-in-place and decentralized healthcare delivery models. The segmentation by End-User underscores the geriatric population and patients with multiple chronic illnesses as the primary revenue drivers, necessitating tailored product designs that address complex dosing schedules and potential physical limitations.

AI Impact Analysis on Medicine Box Timer Market

Common user questions regarding AI’s impact on the Medicine Box Timer Market often center on how these technologies can move beyond simple reminders to truly personalize medication management, prevent dosing errors proactively, and predict adherence issues. Users are concerned about data security, the accuracy of AI-driven adherence predictions, and whether these systems will be intuitively usable by older adults. The key themes revolve around the transition from reactive alarming systems to proactive, intelligent assistants capable of optimizing medication intake based on real-time physiological data (e.g., activity levels, sleep patterns) and environmental factors. Users anticipate AI integrating into telehealth consultations, providing nuanced, actionable insights derived from usage patterns logged by the timer devices, thus enhancing doctor-patient communication and improving treatment efficacy.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming medicine box timers into intelligent medication adherence systems. AI algorithms analyze vast amounts of user behavior data, including time of day, skipped doses, and environmental context, to generate highly personalized reminder schedules that maximize the likelihood of adherence. For example, an AI-powered box can learn that a patient frequently misses their 8 AM dose if they are traveling and adjust the reminder location or modality accordingly. This predictive analytics capability shifts the technology from a basic compliance tool to a sophisticated personalized health coach, significantly improving its therapeutic value and market appeal.

Furthermore, AI facilitates advanced anomaly detection, instantly identifying patterns that suggest misuse, potential overdose, or unauthorized access to medication, particularly vital for controlled substances. By integrating optical sensors or weight sensors within the compartments, AI verifies the actual removal of the pill, not just the opening of the lid, providing a higher fidelity of adherence data. This level of verification is crucial for pharmaceuticals, clinical trials, and high-risk patients. The influence of AI extends to supply chain management within the market, optimizing inventory levels for pharmacies and healthcare systems based on aggregated adherence data and refill predictability.

- AI enables predictive adherence analytics, forecasting patient compliance risk scores.

- Machine learning algorithms optimize personalized reminder timing based on behavioral patterns.

- AI facilitates real-time anomaly detection, flagging potential misuse or security breaches.

- Integration with voice assistants (NLP) improves accessibility for the visually impaired and elderly users.

- AI processes sensor data (weight, optics) to verify actual pill consumption versus just lid opening.

DRO & Impact Forces Of Medicine Box Timer Market

The market dynamics are primarily driven by the imperative to improve patient outcomes amidst rising chronic disease rates and the associated economic burden of non-adherence. Restraints include technological complexity for non-tech-savvy users and persistent concerns over data privacy, especially with IoT-enabled devices tracking sensitive personal health information. Opportunities lie in expanding functionalities to include medication interaction warnings and integrating payment/refill systems. The combined impact forces strongly favor market expansion, as healthcare systems worldwide pivot toward decentralized, adherence-focused care models.

The primary drivers include the global aging population, necessitating solutions for managing complex, long-term medication regimens. Moreover, the quantifiable reduction in healthcare costs achieved through enhanced adherence provides a powerful economic incentive for healthcare providers and insurance companies to subsidize or promote these devices. Governments are also contributing through favorable regulatory pathways for digital health tools, recognizing their role in preventative care. Conversely, major restraints involve the high initial cost of advanced smart medicine boxes compared to traditional organizers, creating an adoption barrier for low-income populations. Additionally, issues related to device interoperability with diverse EHR systems and the standardization of data formats pose significant technical hurdles for widespread clinical integration.

Opportunities for market growth stem from the burgeoning telehealth sector, where medicine box timers serve as essential remote monitoring endpoints, providing crucial dosage confirmation data. Expanding the product portfolio to offer specialized units for high-value drugs, such as biologics requiring specific administration protocols or temperature monitoring, represents a niche growth area. Impact forces such as the increasing public awareness of medication errors and the persistent pressure on pharmaceutical companies to demonstrate drug efficacy through documented adherence further solidify the market's positive trajectory. The overall impact of these forces suggests sustained, accelerated growth driven by both clinical necessity and economic efficiency.

Segmentation Analysis

The Medicine Box Timer Market is fundamentally segmented based on the technology level of the device, the environment in which it is used, and the primary demographic utilizing the product. This structural segmentation allows stakeholders to target specific consumer needs, ranging from simple temporal organization required in basic home care to sophisticated remote monitoring necessary for complex institutional settings. The analysis of these segments highlights the rapid migration of consumer preference towards technologically advanced, data-logging smart devices, indicating a future dominated by connectivity and intelligence in medication management tools.

Product Type segmentation differentiates simple mechanical timers from advanced digital and smart networked systems, reflecting varying price points and functional complexities. Application segmentation helps in understanding the dominant consumption areas, confirming that home environments represent the largest operational segment, demanding features like portability and ease of use. The End-User analysis ensures manufacturers design products tailored to the specific cognitive, physical, and logistical needs of the geriatric population, chronic patients, and professional caregivers.

- By Product Type:

- Basic Timers (Manual alarms, non-programmable)

- Programmable Timers (Multiple alarms, fixed schedules)

- Smart Medicine Boxes (IoT Enabled, connectivity, data logging, mobile alerts)

- By Application:

- Home Care Settings

- Hospitals and Clinics

- Assisted Living and Nursing Facilities

- By End-User:

- Geriatric Population

- Patients with Chronic Illnesses (e.g., Diabetes, Cardiac conditions)

- Caregivers and Families

Value Chain Analysis For Medicine Box Timer Market

The value chain for the Medicine Box Timer Market begins with upstream activities involving component suppliers, primarily focusing on microchip fabrication, sensor manufacturing (optical and weight sensors), and materials science for durable, biocompatible plastics. Key raw material procurement is centered around specialized electronics and connectivity modules (e.g., Bluetooth, Wi-Fi), requiring strong supplier relationships to ensure component quality, cost efficiency, and supply continuity, especially given global semiconductor shortages. Research and Development (R&D) is a critical upstream activity, focusing on miniaturization, power efficiency, and security protocols for data transmission, representing a significant portion of the initial product cost.

Midstream activities involve the design, assembly, and manufacturing of the final product. This stage includes sophisticated software development for the device firmware, mobile applications, and cloud-based data storage infrastructure. Quality control and regulatory compliance (e.g., FDA clearance, CE marking) are paramount at this stage, influencing market access and credibility. Manufacturers must also invest heavily in user interface (UI) and user experience (UX) design to ensure the devices are accessible to the target demographic, particularly the elderly, integrating large displays and voice prompts where necessary. Efficiency in scalable production is vital to meet growing global demand while maintaining competitive pricing.

Downstream activities include distribution and sales channels. Direct channels involve manufacturers selling directly to large healthcare systems (Hospitals, Assisted Living chains) through specialized contracts, offering bulk pricing and integration support. Indirect channels involve sales through traditional retail pharmacies, e-commerce platforms (a rapidly growing segment), and specialized medical device distributors. Marketing efforts focus heavily on demonstrating clinical efficacy and adherence improvement to physicians and insurance providers, who often act as key recommenders or funders. Post-sales service, technical support, and data privacy maintenance are essential components of the downstream value proposition, securing customer loyalty and ensuring long-term utility of the devices.

Medicine Box Timer Market Potential Customers

The primary end-users and buyers of Medicine Box Timer devices encompass a broad spectrum of individuals and institutions concerned with medication management, adherence, and patient safety. The largest customer base is the rapidly expanding geriatric population globally, individuals often dealing with multiple comorbidities and complex medication schedules that require structured assistance to prevent errors. These users typically prioritize ease of use, auditory and visual alerts, and reliability, often relying on family members or professional caregivers for the final purchase decision and setup.

The second major customer segment consists of patients diagnosed with chronic illnesses requiring rigorous, often long-term, medication regimens. This includes individuals managing conditions like Type 2 Diabetes, hypertension, HIV/AIDS, cancer, or psychiatric disorders where adherence directly impacts morbidity and mortality. For this group, the data logging capabilities of smart boxes are highly valued, as they facilitate more informed consultations with their treating physicians, contributing significantly to closed-loop care management and better health outcomes.

Institutional buyers represent a significant B2B customer segment. This includes hospitals and clinics seeking to improve discharge planning adherence and reduce readmission rates caused by medication mismanagement at home. Furthermore, assisted living facilities and professional home healthcare agencies purchase these devices in bulk to standardize care protocols, monitor multiple patients remotely, and mitigate legal liabilities associated with medication errors. These institutional customers often require centralized data management capabilities and seamless integration with existing operational software.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PillTime Inc., MedMinder Systems, e-Pill, DoseCue Technologies, TimeCap Labs, Sandoz, Koninklijke Philips N.V., Omron Healthcare, Cardinal Health, AdhereTech, Care-Assure Devices, Chronos Health, LifeSpan Solutions, HealthSense Innovations, SmartDose Solutions, Lincare Holdings, HealthBeacon PLC, McKesson Corporation, Apex Healthware, Pria Robotics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Medicine Box Timer Market Key Technology Landscape

The technological landscape of the Medicine Box Timer Market is rapidly evolving, driven primarily by advancements in the Internet of Things (IoT) and miniaturized electronics. Core technologies include sophisticated microcontrollers that manage timing and alarm functions, coupled with various connectivity modules such as Bluetooth Low Energy (BLE) and Wi-Fi for linking the device to smartphones, cloud servers, and telehealth platforms. Sensor technology plays a crucial role; many advanced boxes now incorporate weight sensors or optical sensors in each compartment to accurately detect when a pill is physically removed, moving beyond simple lid opening detection and dramatically increasing the reliability of adherence data. Robust security protocols, including encryption (e.g., TLS/SSL) and multi-factor authentication, are essential to protect the transmission and storage of sensitive patient data, satisfying increasingly stringent regulatory requirements.

Recent innovations focus heavily on enhancing user interaction and reducing technical friction. This includes the implementation of voice prompting systems using embedded speakers and microphones, allowing users to receive reminders and confirm doses verbally, which is particularly beneficial for users with visual impairments or dexterity issues. Furthermore, integration with Artificial Intelligence (AI) and Machine Learning (ML) is becoming standard in premium offerings. These intelligent algorithms analyze adherence data against prescribed schedules, identifying deviations and potentially adjusting reminder frequencies or timing to optimize patient response rates. This personalized approach to digital intervention represents a critical technological differentiator in the market.

The convergence of these technologies supports the development of comprehensive medication management ecosystems. For instance, some smart medicine boxes now integrate temperature and humidity sensors, crucial for medications requiring specific storage conditions, alerting both the user and the care provider if environmental parameters exceed safe limits. Power management remains a key technological challenge and focus area, with companies striving to achieve long battery life (often measured in months or even years) to ensure consistent operation without requiring frequent recharging, a factor critical for user satisfaction and continuous adherence monitoring in home care settings.

Regional Highlights

North America is the dominant region in the Medicine Box Timer Market, driven by high consumer awareness, robust healthcare IT infrastructure, and substantial investment in remote patient monitoring technologies. The region benefits from early adoption of smart health devices and a high prevalence of chronic diseases requiring stringent medication adherence. The strong presence of major market players and favorable reimbursement policies for digital health solutions in the US and Canada contribute significantly to market expansion. The high average disposable income also supports the purchasing of premium, feature-rich smart medicine boxes.

Europe holds a significant market share, characterized by mature healthcare systems that prioritize cost-effectiveness and patient safety. Countries such as Germany, the UK, and France show high adoption rates, supported by national initiatives to reduce medication errors and improve care for the aging population. The emphasis on standardized data protection (GDPR) has necessitated high security and privacy standards for smart medicine box manufacturers operating in the region, fostering trust but also imposing higher development costs. Regional growth is steady, focusing on integrating these devices into national electronic health records.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This accelerated growth is primarily attributed to the massive geriatric population base in countries like Japan and China, rapidly improving healthcare access in developing nations, and increasing government spending on digital health infrastructure. While basic timers still hold substantial share due to price sensitivity, the demand for sophisticated smart medicine boxes is surging in urban centers, fueled by growing middle-class populations and the need for remote monitoring solutions in densely populated areas. Regulatory liberalization regarding medical device approval is further encouraging market entry.

- North America (US, Canada): Market leader, driven by advanced digital health integration and high chronic disease prevalence.

- Europe (Germany, UK, France): Mature market focused on compliance standards (GDPR) and institutional adoption for error reduction.

- Asia Pacific (China, Japan, India): Highest growth potential, fueled by massive aging population and expanding access to technology.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing healthcare investments and rising chronic illness rates.

- Middle East & Africa (MEA): Nascent growth, primarily concentrated in Gulf Cooperation Council (GCC) countries due to high-quality private healthcare services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Medicine Box Timer Market.- PillTime Inc.

- MedMinder Systems

- e-Pill

- DoseCue Technologies

- TimeCap Labs

- Sandoz

- Koninklijke Philips N.V.

- Omron Healthcare

- Cardinal Health

- AdhereTech

- Care-Assure Devices

- Chronos Health

- LifeSpan Solutions

- HealthSense Innovations

- SmartDose Solutions

- Lincare Holdings

- HealthBeacon PLC

- McKesson Corporation

- Apex Healthware

- Pria Robotics

Frequently Asked Questions

Analyze common user questions about the Medicine Box Timer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Medicine Box Timer Market?

The Medicine Box Timer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033, driven by increasing elderly populations and rising chronic disease management needs globally.

Which product segment is expected to show the fastest growth?

The Smart Medicine Boxes (IoT Enabled) segment is anticipated to exhibit the fastest growth, primarily due to their integration of connectivity, data logging, real-time remote monitoring capabilities, and AI-driven personalized adherence features.

How does AI impact medication adherence systems?

AI transforms medicine box timers by implementing predictive analytics, which forecasts adherence risks and customizes reminder schedules based on individual behavioral patterns, moving beyond simple, fixed alarms to proactive, intelligent intervention.

What is the largest end-user segment for these devices?

The Geriatric Population represents the largest and fastest-growing end-user segment, as these individuals typically manage polypharmacy (multiple medications) and benefit significantly from structured and easy-to-use adherence assistance tools for aging-in-place.

What are the primary restraints affecting market expansion?

Key restraints include the relatively high initial cost of advanced smart devices compared to conventional pill organizers, alongside persistent user concerns regarding the security and privacy of sensitive personal health data logged by connected IoT devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager