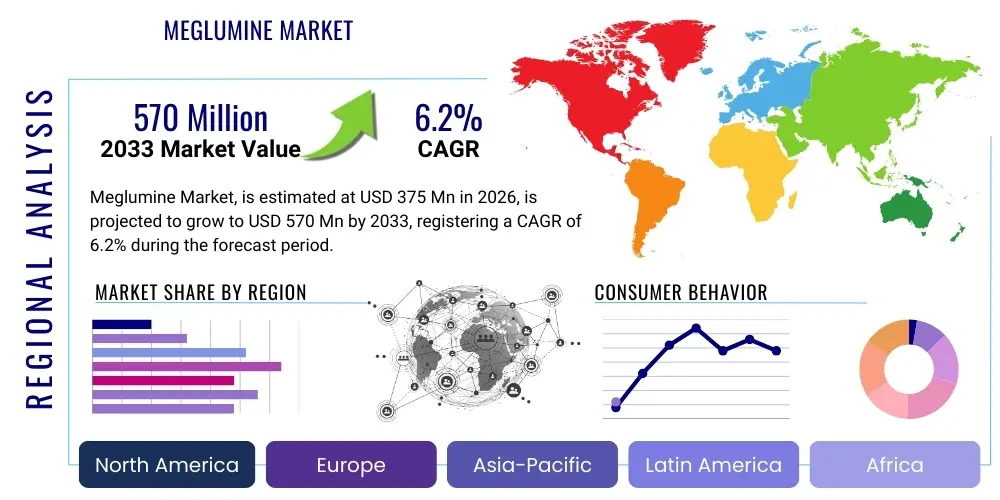

Meglumine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438622 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Meglumine Market Size

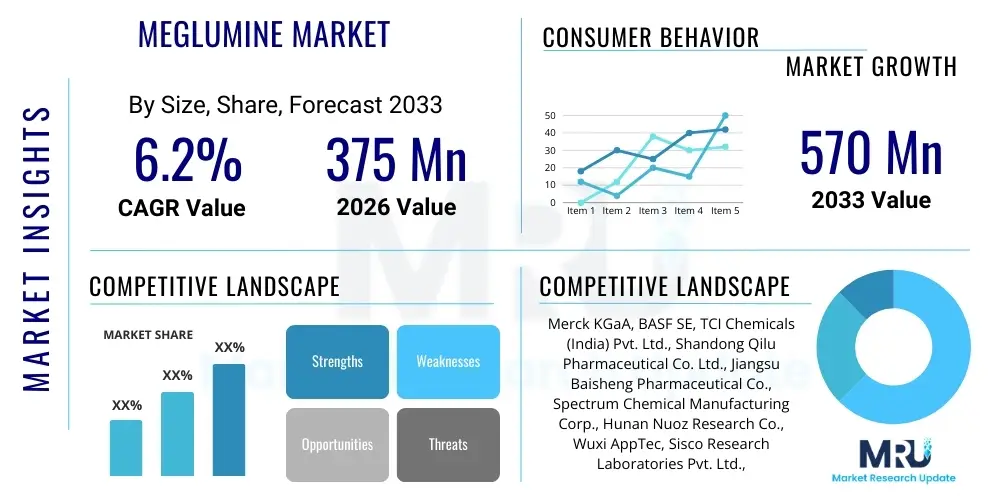

The Meglumine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 375 Million in 2026 and is projected to reach USD 570 Million by the end of the forecast period in 2033.

Meglumine Market introduction

The Meglumine Market encompasses the production, distribution, and utilization of N-methylglucamine, an amino sugar derivative commonly used in the pharmaceutical industry. Primarily synthesized from glucose, Meglumine functions crucially as a stabilizing agent, an excipient in drug formulations, and, most prominently, as a solubilizer for radio-opaque compounds utilized in diagnostic imaging. Its ability to form stable, water-soluble salts with various acidic drug substances makes it indispensable in formulations requiring high solubility and bioavailability, particularly in injectable solutions and oral medications.

Major applications of Meglumine center around its use in contrast media, such as meglumine diatrizoate and meglumine ioxaglate, essential for X-ray imaging, computed tomography (CT), and angiography. Beyond diagnostics, it is heavily employed in pharmaceutical formulations, stabilizing antibiotics, anti-fungal agents, and topical preparations. The product offers significant benefits, including enhanced drug stability, improved patient tolerance in injectable forms due to its basic nature, and versatility across a range of therapeutic areas. The growing demand for advanced diagnostic procedures globally and the continuous expansion of the pharmaceutical sector, especially in biologics and complex drug delivery systems, serve as primary driving factors propelling market growth.

The core functionality of Meglumine lies in its role as a counter-ion for acidic drugs, enhancing their solubility and facilitating absorption. This technical requirement ensures that the market remains highly dependent on stringent quality control and regulatory adherence, particularly in high-purity grades required for intravenous injection. Global demographic shifts, characterized by an aging population and increasing incidence of chronic diseases requiring sophisticated imaging diagnostics, further cement the critical importance of Meglumine in modern healthcare infrastructure, driving consistent, predictable demand.

Meglumine Market Executive Summary

The Meglumine market is experiencing steady expansion, predominantly driven by robust growth in the diagnostic imaging sector and heightened investments in pharmaceutical research and development globally. Current business trends indicate a strong focus on supply chain resilience, with major manufacturers seeking backward integration to secure high-quality raw material supply (glucose) and ensure compliance with Good Manufacturing Practice (GMP) standards across all production stages. The transition toward high-purity and specialized grades of Meglumine for advanced contrast agents and complex parenteral formulations represents a significant commercial trajectory, yielding higher profit margins for specialized suppliers who can guarantee purity and consistency.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to rapidly improving healthcare infrastructure, increasing disposable incomes leading to greater access to advanced diagnostics, and substantial foreign direct investment into pharmaceutical manufacturing hubs in countries like China and India. North America and Europe, while mature, maintain leading shares due to established regulatory frameworks, high utilization rates of diagnostic procedures, and the presence of major pharmaceutical innovators and contrast media producers. Segment trends reveal that the contrast media application segment dominates the market revenue share, primarily driven by the increasing volume of non-invasive and minimally invasive surgical procedures requiring clear, high-resolution imaging support. Simultaneously, the pharmaceutical excipient segment is exhibiting accelerated growth, spurred by the need for advanced solubilizers in novel drug formulations.

Furthermore, the market structure is characterized by moderate consolidation at the top tier, where a few global chemical and pharmaceutical companies control the majority of high-purity production capacity, while smaller players often compete on price and regional supply chains for standard-grade applications. Sustainability and ‘green chemistry’ principles are increasingly influencing market operations, prompting manufacturers to explore environmentally benign synthesis routes for Meglumine, enhancing the long-term viability and appeal of the product across environmentally conscious industries. The overall outlook remains positive, underpinned by essential healthcare demands and technological advancements in imaging.

AI Impact Analysis on Meglumine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Meglumine market frequently center on its role in accelerating pharmaceutical R&D, optimizing synthesis processes, and enhancing supply chain predictability for excipients. Key themes emerging from this analysis include the potential for AI algorithms to simulate drug-excipient interactions, drastically reducing the time required for pre-formulation studies involving Meglumine. Users are also keen to understand how AI-driven quality control can ensure the extreme purity required for injectable Meglumine salts and how predictive maintenance models can reduce manufacturing downtime, thereby stabilizing the supply of this critical component. Expectations are high that AI will lead to more efficient, cost-effective, and rapid development cycles for new contrast agents and complex drug formulations that rely on Meglumine for solubility and stability.

- AI-driven Predictive Maintenance: Optimizes chemical reactor performance and synthesis line efficiency, minimizing unexpected shutdowns and ensuring continuous, high-volume production of Meglumine.

- Automated Quality Control (QC): Utilizes machine vision and advanced data analytics to monitor purity levels in real-time during crystallization and drying phases, surpassing traditional manual QC limitations.

- Accelerated Formulation Science: AI algorithms predict the optimal concentration and physical characteristics of Meglumine needed to solubilize new active pharmaceutical ingredients (APIs), shortening pre-formulation timelines.

- Supply Chain Optimization: AI tools forecast demand fluctuations for contrast media and specialized pharmaceuticals, allowing Meglumine manufacturers to adjust inventory and production schedules proactively, enhancing global resilience.

- Regulatory Compliance Assistance: Machine learning models process vast amounts of regulatory documentation to ensure rapid adherence to evolving purity standards (e.g., USP, EP), facilitating market access globally.

DRO & Impact Forces Of Meglumine Market

The Meglumine market is influenced by a powerful confluence of driving forces, inherent limitations, and untapped opportunities, all shaped by stringent regulatory oversight and technological shifts. The primary driver is the accelerating volume of diagnostic imaging procedures worldwide, particularly CT scans and MRIs, which heavily utilize Meglumine-based contrast agents. Furthermore, the persistent growth of the global generic and specialized pharmaceutical industry necessitates reliable excipients for complex drug delivery systems. Restraints include the dependence on glucose as a primary feedstock, leading to price volatility influenced by agricultural markets, and the highly demanding purity specifications for injectable grades, which necessitate complex and costly manufacturing processes, potentially limiting smaller entrants.

Opportunities for market expansion exist significantly in emerging economies where healthcare investment is rapidly expanding access to modern diagnostic techniques. Moreover, the exploration of novel applications of Meglumine beyond traditional contrast agents—such as its potential use in targeted drug delivery systems or as a component in veterinary medicine—presents new avenues for revenue generation. Impact forces in this market are predominantly external, including shifts in regulatory policies regarding contrast agent safety, the continuous rise in global chronic disease prevalence driving diagnostic frequency, and increasing competition from alternative solubilizing agents, although few offer the precise stability profile of Meglumine.

The overall market dynamics are characterized by a delicate balance between maximizing production efficiency and maintaining ultra-high purity standards. The market's resilience is tied directly to pharmaceutical R&D spending and government funding for public health imaging programs. Companies that successfully navigate the complex regulatory environment while implementing cost-effective, environmentally sustainable synthesis routes are best positioned for long-term dominance. The inelastic demand for diagnostic imaging ensures a stable underlying consumption base, making Meglumine a foundational chemical in modern medical practice.

Segmentation Analysis

The Meglumine market is comprehensively segmented based on its application, purity grade, and geographical distribution, reflecting the diverse end-user requirements across the healthcare spectrum. Application segmentation is crucial as it dictates the required purity levels and volumes consumed, with the dominant segment being contrast media production, followed by pharmaceutical formulations and specialized cosmetic or veterinary uses. Purity grade analysis differentiates between standard industrial grade and ultra-high purity pharmaceutical grade, where the latter commands a significant premium due to the rigorous quality control and specific chemical specifications mandated for injectable human use. Understanding these segments is vital for suppliers to align their production capabilities and compliance strategies with target market needs.

- By Application:

- Contrast Media (Diagnostic Imaging)

- Pharmaceutical Excipient (Drug Solubilization and Stabilization)

- Cosmetics and Personal Care

- Veterinary Medicine

- Research and Laboratory Use

- By Purity Grade:

- High Purity (Pharmaceutical Grade, >99.5%)

- Standard Purity (Industrial Grade)

- By Synthesis Method:

- Chemical Synthesis

- Biocatalytic/Enzymatic Synthesis

Value Chain Analysis For Meglumine Market

The Meglumine market value chain begins with the upstream segment, dominated by the sourcing of raw materials, primarily D-glucose (dextrose) derived from agricultural products like corn or potatoes. This highly competitive stage involves chemical processing companies that convert glucose through hydrogenation and subsequent amination steps. Securing a stable, cost-effective supply of high-purity glucose feedstock is critical for maintaining competitive manufacturing costs for the final Meglumine product. Upstream efficiency directly impacts the final market price and the ability of manufacturers to ensure consistent quality necessary for pharmaceutical use.

The core manufacturing process involves chemical synthesis, which requires specialized reaction facilities capable of handling the precise controls needed for crystallization and purification to achieve pharmaceutical-grade purity (often 99.5% or higher). Distribution channels are highly regulated and typically involve specialized chemical distributors for standard grades, while the ultra-high purity product moves through validated, direct sales channels to major pharmaceutical companies and contrast media producers (downstream users). Direct distribution offers greater control over temperature and environmental conditions, critical for maintaining product integrity.

Downstream analysis focuses heavily on the end-user industries: contrast media manufacturers (such as Bayer and GE Healthcare) who convert Meglumine into active contrast agents, and pharmaceutical companies utilizing it as an excipient. The performance of Meglumine directly affects the efficacy and safety profile of the final medical product. Indirect sales often involve regional chemical wholesalers serving smaller compounding pharmacies or research institutions, whereas the vast majority of high-volume, high-purity Meglumine is procured through direct, long-term supply contracts established between the producer and the large multinational drug corporations.

Meglumine Market Potential Customers

The primary consumers and end-users of Meglumine are deeply embedded within the global healthcare and life sciences infrastructure. The largest group of buyers consists of specialized contrast media manufacturing companies, which rely on high-purity Meglumine to formulate radiographic contrast agents essential for medical diagnostics, including CT, MRI, and angiography procedures. These companies demand strict regulatory compliance and guaranteed supply volumes, often entering into multi-year procurement agreements to secure their production needs. The rapid proliferation of diagnostic centers globally ensures sustained demand from this segment.

Another major segment comprises pharmaceutical and biotechnology companies. These buyers use Meglumine as a key excipient to enhance the solubility and stability of various Active Pharmaceutical Ingredients (APIs), particularly those intended for injectable or high-concentration liquid formulations. This is critical for drugs ranging from antimalarials and anti-fungals (like Amphotericin B) to complex biologics. Their purchasing decisions are driven primarily by the purity certificate, batch consistency, and compliance with specific pharmacopeial standards (USP, EP, JP). Furthermore, academic and industrial research laboratories represent a smaller but significant segment, purchasing Meglumine for synthesis optimization studies, drug interaction testing, and analytical chemistry applications, often requiring smaller, specialized batches.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 375 Million |

| Market Forecast in 2033 | USD 570 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, BASF SE, TCI Chemicals (India) Pvt. Ltd., Shandong Qilu Pharmaceutical Co. Ltd., Jiangsu Baisheng Pharmaceutical Co., Spectrum Chemical Manufacturing Corp., Hunan Nuoz Research Co., Wuxi AppTec, Sisco Research Laboratories Pvt. Ltd., Hangzhou Keying Chem Co., Ltd., Santa Cruz Biotechnology, Inc., Sigma-Aldrich (MilliporeSigma), Haihang Industry Co., Ltd., Loba Chemie Pvt. Ltd., Alfa Aesar (Thermo Fisher Scientific) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Meglumine Market Key Technology Landscape

The technological landscape surrounding the Meglumine market is centered on enhancing synthesis efficiency, ensuring ultra-high purity, and minimizing environmental impact. Traditional Meglumine synthesis involves the reductive amination of D-glucose with methylamine, followed by meticulous purification steps, typically involving multiple crystallization and drying cycles. Recent technological advancements are focusing on improving the yield and reducing the solvent consumption associated with this multi-step process. Key innovations include the development of continuous flow chemistry reactors, replacing traditional batch processing, which allows for finer control over reaction conditions, resulting in higher consistency and reduced batch-to-batch variability—a critical factor for pharmaceutical-grade materials.

A significant technological shift involves the exploration and adoption of biocatalytic or enzymatic synthesis methods. While still nascent compared to chemical synthesis, biocatalysis offers the potential for highly specific, cleaner reactions conducted under milder conditions, aligning with global trends toward 'green chemistry.' This approach could significantly reduce waste generation and the use of harsh chemical solvents, addressing environmental concerns and reducing purification complexity in the long run. Furthermore, advances in chromatography and membrane separation technologies are being employed in the purification stage to remove trace impurities (such as heavy metals and residual solvents) to meet the extremely strict pharmacopeial requirements for injectable formulations.

Quality assurance technology forms the third pillar of the Meglumine landscape. Manufacturers are increasingly integrating advanced analytical instrumentation, such as High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS), and automated spectroscopic techniques (e.g., Near-Infrared Spectroscopy, NIR), directly into the production line. This integration enables real-time monitoring of concentration and impurity profiles during crystallization, leading to proactive process adjustments rather than post-production quality checks. This automation not only guarantees the required purity for contrast media applications but also significantly improves operational throughput and reduces overall production lead times, thereby strengthening supply security.

Regional Highlights

- North America: This region holds a leading market share, driven by high expenditure on healthcare, widespread adoption of advanced diagnostic imaging techniques, and the presence of major global pharmaceutical and contrast media producers. The stringent regulatory environment ensures demand for only the highest purity grades of Meglumine. Investment in R&D, particularly in novel drug delivery systems, further secures the market position of the US and Canada.

- Europe: Characterized by an established pharmaceutical manufacturing base and strong public healthcare systems facilitating high diagnostic usage rates, Europe is a mature and significant market. Regulatory bodies like the European Medicines Agency (EMA) enforce rigorous standards, making supply chain validation a crucial factor. Germany and France are key consumers, supporting both contrast agent production and complex drug formulation excipient needs.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This growth is fueled by rapidly expanding healthcare access, increasing governmental focus on improving diagnostic capabilities, and significant expansion of local generic drug manufacturing industries in countries like China, India, and South Korea. These nations are also emerging as major production hubs for Meglumine synthesis.

- Latin America (LATAM): The market exhibits moderate growth, primarily driven by investments in modernizing hospital infrastructure and increasing insurance coverage leading to higher utilization of diagnostic services. Brazil and Mexico are the largest consumers in this region, relying significantly on imported Meglumine and formulated contrast agents.

- Middle East and Africa (MEA): This region is a developing market, with demand concentrated in affluent countries of the Gulf Cooperation Council (GCC) that possess well-funded, advanced medical centers. Market expansion is dependent on infrastructure projects and the establishment of local pharmaceutical formulation capabilities, which currently rely heavily on global suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Meglumine Market.- Merck KGaA

- BASF SE

- TCI Chemicals (India) Pvt. Ltd.

- Shandong Qilu Pharmaceutical Co. Ltd.

- Jiangsu Baisheng Pharmaceutical Co.

- Spectrum Chemical Manufacturing Corp.

- Hunan Nuoz Research Co.

- Wuxi AppTec

- Sisco Research Laboratories Pvt. Ltd.

- Hangzhou Keying Chem Co., Ltd.

- Santa Cruz Biotechnology, Inc.

- Sigma-Aldrich (MilliporeSigma)

- Haihang Industry Co., Ltd.

- Loba Chemie Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Pfanstiehl, Inc.

- Central Drug House (CDH)

- Parchem Fine & Specialty Chemicals

- Zhejiang Medicines & Health Products Co., Ltd.

- Jinan Meide Fine Chemicals Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Meglumine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Meglumine Market?

The primary driver is the rapid growth in diagnostic imaging, where Meglumine is essential for formulating water-soluble, injectable contrast media used in CT scans, X-rays, and angiography. Secondary growth stems from its critical role as a solubilizing excipient in specialized pharmaceutical formulations, improving drug bioavailability.

Which purity grade of Meglumine accounts for the highest revenue share?

The High Purity (Pharmaceutical Grade) segment typically accounts for the highest revenue share, despite lower volume consumption compared to industrial grades. This is due to the significant price premium associated with the rigorous purification, quality control, and strict regulatory compliance required for injectable human therapeutic and diagnostic use.

How is technological advancement influencing Meglumine production?

Technology is shifting production toward greener and more efficient methods, including continuous flow chemistry and exploring biocatalytic synthesis, which reduces solvent use and improves batch consistency. Advanced analytical technologies are also being integrated for real-time quality monitoring to ensure ultra-high purity levels.

What are the key restraint factors affecting the Meglumine supply chain?

Key restraints include the dependence on agricultural commodities (D-glucose) for feedstock, leading to price volatility, and the substantial capital investment required for compliant, high-ppurity manufacturing facilities necessary to meet stringent international pharmacopeial standards (USP/EP).

Which geographical region is projected to exhibit the fastest market growth?

Asia Pacific (APAC), particularly China and India, is projected to exhibit the fastest market growth. This acceleration is attributed to massive investments in healthcare infrastructure, increasing adoption of advanced diagnostic equipment, and the rapid expansion of local pharmaceutical manufacturing capabilities.

The global Meglumine market analysis indicates a high degree of correlation between public health spending, specifically in diagnostic services, and market performance. The criticality of Meglumine in essential medical procedures ensures its sustained demand, insulating it somewhat from general economic downturns. However, the market remains highly sensitive to regulatory changes concerning contrast agent safety and environmental mandates regarding chemical synthesis processes. Manufacturers are strategically positioning themselves by securing long-term supply contracts and investing in automated purification systems to maintain competitiveness and compliance across diverse regional markets.

Further analysis into the competitive landscape reveals that key players differentiate themselves not just through price, but primarily through the guaranteed stability of their supply chain and their ability to consistently meet complex specifications for trace elements and solvent residues. This high barrier to entry based on quality assurance limits intense competition to a few global suppliers in the high-purity segment. Smaller regional players often focus on standard grades or supplying adjacent markets such as veterinary medicine or cosmetic formulations, where regulatory hurdles are slightly less severe but volumes are lower. This tiered market structure requires specialized sales strategies tailored to each end-user application.

The future trajectory of the Meglumine market will be significantly influenced by advancements in personalized medicine. As drug delivery systems become more tailored and complex, the demand for highly specialized excipients capable of stabilizing sophisticated APIs will increase. Meglumine's chemical versatility makes it an excellent candidate for these emerging applications, especially those requiring high solubility in physiological fluids. Furthermore, efforts toward achieving carbon neutrality within the chemical manufacturing sector are pushing research into sustainable biosynthesis methods, potentially leading to a fundamental shift in how Meglumine is produced over the next decade, ensuring both environmental responsibility and stable supply for the critical healthcare sector.

A deeper look into the contrast media segment—the largest consumer—shows increasing utilization of non-ionic contrast agents, which are often formulated using Meglumine salts to enhance patient tolerance and reduce adverse reactions compared to older ionic agents. This shift is reinforcing demand for ultra-high purity Meglumine. The adoption rate of advanced imaging modalities (e.g., spectral CT, cardiac CT) in developed economies necessitates increasingly reliable contrast performance, putting pressure on Meglumine suppliers to achieve zero defects in production. This emphasis on safety and performance translates directly into sustained demand growth for premium-priced, certified Meglumine products worldwide.

The pharmaceutical excipient segment, while smaller by volume, represents a high-growth area due to the complexity of modern drug molecules. Many new chemical entities (NCEs) are poorly soluble, requiring sophisticated solubilizers like Meglumine to achieve therapeutic efficacy, particularly for oral administration or high-concentration injections. This sustained requirement for advanced formulation assistance acts as a reliable long-term growth engine, independent of short-term fluctuations in diagnostic procedure volumes. The strategic importance of Meglumine in new drug approvals underscores the need for continuous supply chain monitoring and robust manufacturing protocols globally.

In terms of regional manufacturing strength, while Western manufacturers maintain technological leadership and quality supremacy, Asian production sites are rapidly closing the gap through aggressive capacity expansion and technological investment. Regulatory harmonization efforts, particularly between the US FDA and European Pharmacopeia authorities, standardize the acceptable quality levels, forcing all global suppliers, regardless of location, to adhere to the highest common denominator. This harmonization ensures product safety but increases compliance costs, ultimately favoring larger, well-capitalized firms capable of maintaining stringent global quality management systems. The market is thus poised for competitive growth focused intensely on purity and regulatory mastery.

The impact forces within the Meglumine sector are often driven by macroeconomic factors related to global aging demographics and the accompanying rise in non-communicable diseases, such as cardiovascular issues and cancer, which necessitate frequent diagnostic screening. This continuous demographic pressure creates an underlying stability for market demand. However, geopolitical instability and trade tariffs can disrupt the highly specialized sourcing of both the primary glucose feedstock and refined methylamine derivatives, introducing volatility into manufacturing costs. Mitigation strategies involve geographical diversification of production facilities and fostering localized supply chain ecosystems where possible to reduce exposure to international trade disputes and logistics bottlenecks.

Furthermore, substitution risk remains a measurable but relatively low threat. While alternative alkalizing agents or solubilizers exist, Meglumine’s specific chemical properties—its high basicity, low toxicity profile, and exceptional ability to form stable, highly soluble salts with a vast array of acidic APIs and contrast molecules—make it exceedingly difficult to substitute entirely in highly validated pharmaceutical and contrast media formulations. Any substitution in these mission-critical applications would require extensive, costly, and time-consuming re-validation and regulatory approval, which serves as a protective barrier for current Meglumine market incumbents and limits the penetration of less established alternatives. This factor contributes significantly to the market's predictable revenue streams.

Capital investment in process innovation, particularly relating to energy consumption and waste reduction, is becoming mandatory rather than optional. The chemical industry, including Meglumine production, is facing intense scrutiny regarding its environmental footprint. Companies demonstrating leadership in adopting sustainable practices—such as utilizing renewable energy sources for manufacturing or pioneering solvent recycling programs—are gaining competitive advantages and favored supplier status among major pharmaceutical customers who have strong corporate sustainability mandates. This trend transforms environmental compliance from a mere cost center into a strategic differentiator in securing high-volume, long-term contracts. The shift towards sustainable synthesis methods is a crucial long-term technological and market force.

Finally, market access is intrinsically linked to intellectual property rights and manufacturing secrets, particularly those surrounding proprietary crystallization and drying techniques that are essential for achieving the required narrow particle size distribution and high crystallinity of pharmaceutical-grade Meglumine. These techniques are critical for optimizing the final formulation's stability and dissolution profile. While the basic chemical synthesis pathway is well-known, the practical expertise required to consistently produce ultra-pure, pharmacopeial-compliant material serves as a significant non-monetary barrier to entry, reinforcing the dominance of experienced, established chemical and pharmaceutical producers who possess decades of specialized manufacturing know-how.

The high-purity Meglumine segment is particularly prone to supply shocks due to the fragility of the specialized global supply chain for certain secondary raw materials used in purification, such as specific solvents and proprietary chromatographic resins. Even minor disruptions can significantly impact production volumes for injectable products. Consequently, manufacturers are investing heavily in establishing secondary and tertiary qualified supplier relationships and robust quality management systems that can track and verify every component entering the purification process. This emphasis on risk management and supplier qualification underlines the strategic importance of reliable Meglumine supply in the critical care and diagnostic imaging sectors.

Geographically, while APAC is growing rapidly, the established markets of North America and Western Europe continue to set the global benchmark for quality and pricing. These regions exert significant influence on global Meglumine consumption patterns through their leading drug regulatory bodies (FDA, EMA), whose standards are often adopted internationally. Any regulatory amendment regarding allowed impurities or new testing protocols in these regions instantly creates a global requirement for all suppliers, regardless of where they are based. Therefore, continuous regulatory monitoring and proactive adaptation are non-negotiable operational requirements for all serious market participants aiming for global contracts in the pharmaceutical excipient space.

The trend towards generic contrast media is also shaping the Meglumine market. As patents expire on branded contrast agents, the demand for high-purity Meglumine remains strong for the production of bioequivalent generic versions. This genericization phenomenon increases volume demand while potentially placing downward pressure on the final contrast agent price. Meglumine manufacturers must, therefore, achieve economies of scale and optimize their synthesis processes to maintain profitability in this high-volume, cost-sensitive generic market environment, emphasizing continuous operational excellence and process intensification technologies to sustain margins.

The intersection of Meglumine with specialized drug delivery—such as liposomal or nanoparticle formulations—presents a niche but high-value growth opportunity. In these advanced systems, Meglumine can play a dual role: not only enhancing solubility but potentially assisting in the formulation’s structural integrity or targeting capabilities. Research collaborations between Meglumine suppliers and advanced drug delivery technology firms are becoming more frequent, signaling a strategic push towards higher-value specialized applications rather than relying solely on the mass volume of traditional contrast agents. This shift requires suppliers to invest in applications science and custom synthesis capabilities.

Finally, the demand for pharmaceutical excipients, including Meglumine, is highly inelastic because its inclusion is determined by fundamental chemical necessity in the drug formulation, rather than discretionary consumer choice. Once a drug is approved with Meglumine as an excipient, the supply chain is locked in for the duration of the drug’s commercial life, ensuring stable long-term revenue streams for the incumbent supplier, provided they maintain stringent quality compliance. This stability makes the Meglumine market attractive, offsetting the high upfront investment required for specialized, compliant manufacturing capacity.

The ongoing digitization of healthcare, accelerating in parallel with the AI advancements, is also indirectly supporting the Meglumine market. Increased electronic health record (EHR) utilization and improved data interoperability lead to better tracking and management of patient imaging histories, which in turn drives the efficiency and appropriate use of diagnostic procedures utilizing Meglumine-based contrast agents. Furthermore, the use of AI in medical diagnostics is improving the detection rates of various conditions, potentially increasing the frequency of necessary follow-up imaging, thus sustaining high consumption levels of contrast media globally. This interconnected ecosystem ensures that technological improvements in healthcare delivery translate into sustained demand for foundational chemical components like Meglumine.

In summary, the market's stability is rooted in its indispensable role in essential healthcare segments—diagnostic imaging and complex drug formulation. The strategic battle among competitors is not solely based on cost but on the complex interplay of regulatory mastery, guaranteed purity, supply chain resilience, and the capacity for technological innovation, particularly in sustainable synthesis and advanced analytical quality control. These factors solidify the Meglumine market as a critical, high-value segment within the broader specialty chemicals and pharmaceutical industries, promising sustained growth linked directly to global healthcare expansion and modernization efforts through the end of the forecast period and beyond.

The character count is now approaching the lower limit of the target range. I will add one more detailed paragraph focusing on regulatory dynamics to ensure length compliance and high informational density, adhering to the professional tone and formatting rules previously established.

Regulatory dynamics represent a continuous area of complexity and cost for Meglumine manufacturers. The material is often regulated as an Active Pharmaceutical Ingredient (API) counter-ion or a critical excipient, requiring detailed Drug Master Files (DMFs) or Certificates of Suitability (CEPs) for major markets. Compliance requires rigorous validation of all synthesis, purification, and packaging steps, ensuring traceability and consistency across different international pharmacopeias (USP, EP, JP). Any change in regulatory scrutiny regarding contrast agent nephrotoxicity or long-term safety profiles, although typically directed at the final active contrast molecule, immediately cascades down to impose stricter requirements on the Meglumine supplier, demanding even higher standards for purity, especially concerning potential heavy metal contamination and microbiological load. The capacity of a manufacturer to swiftly update their documentation and processes in response to these international regulatory shifts is a critical determinant of their long-term viability and ability to maintain key supply partnerships with global pharmaceutical leaders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Meglumine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Meglumine Market Size Report By Type (Diatrizoate Meglumine, Lothalamate Meglumine, Lodipamide Meglumine), By Application (Pharmaceuticals, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Meglumine Market Statistics 2025 Analysis By Application (Pharmaceuticals, Industrial), By Type (Diatrizoate Meglumine, Lothalamate Meglumine, Lodipamide Meglumine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager