Melamine Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436269 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Melamine Tableware Market Size

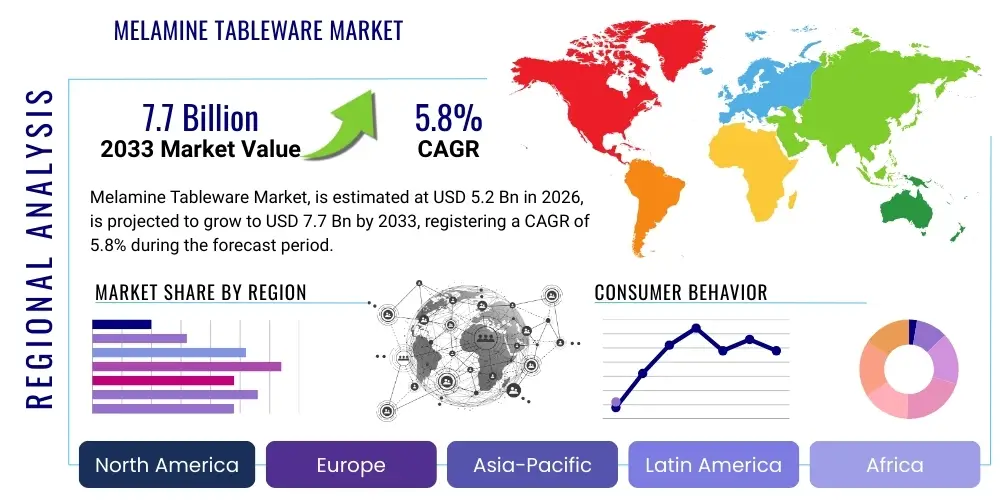

The Melamine Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Melamine Tableware Market introduction

The Melamine Tableware Market encompasses the production and distribution of serving ware, eating utensils, and preparatory items primarily manufactured from melamine resin. Melamine, a durable, lightweight, and thermosetting plastic material, offers several advantages over traditional materials like ceramics and glass, particularly in settings where resistance to breakage and chipping is paramount. Its inherent strength, coupled with its ability to replicate the aesthetic appeal of porcelain through high-quality finishes and printing, makes it an increasingly preferred option across various end-user segments globally. The growth of this market is intrinsically linked to the expansion of the hospitality, catering, and institutional sectors, which prioritize operational efficiency and longevity of assets.

Melamine products are characterized by their excellent heat retention properties and chemical resistance, making them suitable for commercial dishwashing environments. The core product categories include plates, bowls, trays, cups, and specialized serving dishes. Major applications span institutional dining (schools, hospitals, corporate cafeterias), Quick Service Restaurants (QSRs), full-service restaurants, catering services, and residential kitchens, especially outdoor and casual dining. The versatility in design, ranging from basic utility ware to sophisticated, patterned premium collections, allows manufacturers to cater to a broad spectrum of consumer tastes and budgetary requirements, thus driving consistent market penetration.

Key driving factors propelling the market include the rapid urbanization and concurrent rise in disposable incomes in emerging economies, leading to increased consumer spending on HORECA (Hotel, Restaurant, and Cafe) services. Furthermore, the stringent demands of the catering industry for durable, lightweight, and aesthetically pleasing serving solutions favor melamine. While concerns related to safety and environmental impact persist, ongoing advancements in manufacturing processes and regulatory compliance, particularly regarding food-grade standards and the elimination of harmful additives, continue to reinforce consumer trust and market momentum.

Melamine Tableware Market Executive Summary

The Melamine Tableware Market demonstrates robust growth driven by escalating demand from the commercial food service sector and the global trend toward casual dining. Business trends indicate a strong shift towards customization, where operators seek bespoke designs and branding opportunities on their tableware to enhance the customer experience and differentiate their establishments. Manufacturers are increasingly focusing on producing eco-friendly or sustainable alternatives, often incorporating recycled content or bio-based fillers, to address growing environmental scrutiny. Competitive dynamics show consolidation among major players who leverage advanced manufacturing techniques, such as compression molding and high-definition printing, to achieve superior product finishes that mimic high-end ceramic and stoneware.

Regionally, Asia Pacific (APAC) remains the dominant market, serving as both a primary manufacturing hub and the largest consumer base, fueled by rapid expansion in the HORECA sector in countries like China and India. North America and Europe exhibit high growth potential, characterized by a preference for premium, heavier-gauge melamine designed for upscale casual dining and outdoor entertaining. Regulatory frameworks, particularly in the EU and North America, impose strict standards regarding migration limits of melamine and formaldehyde, influencing product innovation and sourcing strategies. The Middle East and Africa (MEA) are emerging regions, driven by tourism growth and substantial infrastructure investment in hospitality.

In terms of segmentation, the commercial application segment dominates the market due to the high volume and replacement frequency required by restaurants and institutional buyers. Product-wise, plates and platters hold the largest market share, essential for main courses and serving presentation. Segment trends highlight a growing consumer interest in products certified as BPA-free and those featuring advanced glazing techniques that improve stain resistance and durability. The market also sees bifurcation, with standard-grade melamine dominating institutional purchases based on cost efficiency, while premium, heavy-weight melamine is increasingly penetrating the high-end restaurant and residential markets, blurring the lines between plastic and ceramic aesthetics.

AI Impact Analysis on Melamine Tableware Market

Common user questions regarding AI's impact on the Melamine Tableware Market frequently revolve around optimizing complex supply chains, predicting shifting consumer dining trends, and enhancing quality assurance processes in high-volume manufacturing environments. Users are keen to understand how AI can assist in forecasting demand fluctuations driven by seasonal events or changes in regional tourism, minimizing costly inventory surpluses or shortages. Furthermore, there is significant interest in utilizing machine learning algorithms for visual inspection during the molding and finishing stages to detect minute defects in patterns or structure, ensuring adherence to rigorous food-safety and aesthetic standards before distribution. The overarching themes reflect expectations for efficiency improvements, reduced material waste, and the acceleration of new product development cycles through rapid analysis of design popularity and material performance.

- AI-driven demand forecasting optimizes production schedules based on regional hospitality indices and seasonal shifts, reducing inventory risk.

- Machine learning algorithms enhance quality control by automating the visual inspection of finished products for surface defects, color inconsistencies, and structural integrity.

- Predictive maintenance schedules for molding machinery are optimized using AI, minimizing downtime and extending the operational life of high-capital assets.

- AI analyzes large datasets of consumer reviews and social media trends to inform design decisions, accelerating the development of popular patterns, shapes, and colors (Generative Design).

- Supply chain optimization through AI models determines the most efficient sourcing and logistics pathways for raw materials (melamine and formaldehyde resins), mitigating geopolitical risks and reducing transportation costs.

- Chatbots and AI-powered sales platforms offer personalized product recommendations and streamlined B2B ordering processes for commercial customers (HORECA procurement).

DRO & Impact Forces Of Melamine Tableware Market

The Melamine Tableware Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities that dictate its trajectory. Primary drivers include the robust expansion of the global hospitality and tourism sectors, requiring frequent replacement and expansion of durable, cost-effective tableware inventories. Melamine’s inherent characteristics—light weight, high durability, and resistance to chipping—make it highly suitable for high-traffic environments like cafeterias, hospitals, and outdoor catering, providing a substantial operational advantage over fragile alternatives. This operational efficiency is further enhanced by its low replacement rate compared to ceramics, positioning melamine as an attractive capital investment for commercial entities.

However, the market faces significant restraints, chiefly concerning public perception related to health and environmental sustainability. Historical concerns regarding the migration of melamine and formaldehyde, particularly under high heat or acidic conditions, necessitate strict adherence to food contact material regulations (such as FDA and EU standards), which increases manufacturing complexity and compliance costs. Furthermore, as a thermoset plastic, melamine is challenging to recycle using traditional methods, generating significant waste management concerns and subjecting the industry to growing pressure from environmental advocacy groups and sustainability-conscious commercial buyers.

Opportunities for growth are concentrated in product innovation, focusing heavily on premiumization and sustainable material development. The opportunity to develop melamine products that are certified BPA-free and feature enhanced surface technologies (e.g., anti-microbial coatings, high-gloss, scratch-resistant finishes) allows manufacturers to capture higher price points in the premium segment. Furthermore, exploring avenues for advanced recycling technologies or integrating certified circular economy models provides an avenue to overcome environmental restraints and cater to the rising demand for green procurement among major institutional buyers, ultimately shaping the market's long-term viability and driving impact forces.

Segmentation Analysis

The Melamine Tableware Market is extensively segmented based on product type, application, and grade, reflecting the diverse end-user requirements across residential, institutional, and commercial settings. Product segmentation helps identify consumer preferences for various functional categories, with plates and platters consistently holding the highest market share due to their fundamental role in dining services, followed closely by bowls and serving trays essential for catering and buffet setups. The increasing complexity of modern cuisine presentation also drives demand for specialized items such as dipping dishes and segmented plates, further diversifying the product landscape and encouraging innovation in form and function across all grades of melamine.

Application segmentation distinctly divides the market into commercial and residential usage. The commercial sector—encompassing HORECA, schools, healthcare facilities, and airlines—represents the largest and most dynamic segment, characterized by bulk purchasing, stringent durability requirements, and a preference for standardized, heavy-gauge products. Conversely, the residential segment, while smaller in volume, emphasizes aesthetic appeal, design trends, and lighter, often colored or patterned melamine, primarily used for outdoor dining, children’s tableware, and casual indoor settings where breakage risk minimization is prioritized. This dichotomy necessitates distinct marketing strategies and distribution channels for manufacturers targeting different application environments.

Grade segmentation, defined primarily by thickness, weight, and finish quality, separates standard-grade utility melamine from premium-grade products. Standard-grade tableware is primarily cost-driven, often utilized in high-volume institutional settings where longevity and affordability outweigh aesthetic considerations. Premium-grade melamine is characterized by higher resin content, a porcelain-like feel, heavier weight, and sophisticated finishing techniques (such as reactive glazes or matte textures) that allow it to compete visually with ceramic ware. The shift towards premiumization is a critical trend, allowing manufacturers to mitigate margin pressure often associated with basic melamine production by targeting upscale restaurants and specialty retail chains seeking durable, yet aesthetically refined, serving solutions.

- By Product Type:

- Plates and Platters

- Bowls and Containers

- Cups and Mugs

- Serving Trays and Accessories

- By Application:

- Commercial (HORECA, Institutional Dining, Catering)

- Residential (Household Use, Outdoor Dining)

- By Grade:

- Standard Grade (Utility, Basic)

- Premium Grade (Heavy-weight, Porcelain-like Finish)

Value Chain Analysis For Melamine Tableware Market

The value chain for the Melamine Tableware Market begins with the upstream segment, dominated by the procurement and supply of raw materials, primarily melamine-formaldehyde resins, along with necessary additives, colorants, and specialized glazing compounds. The quality and purity of these raw materials directly impact the final product's performance characteristics, including durability, heat resistance, and compliance with food safety regulations. Efficient management of these upstream resources, often sourced from large petrochemical and chemical manufacturers, is crucial for maintaining competitive manufacturing costs and ensuring a consistent supply flow, which is particularly sensitive to global commodity pricing and energy costs.

The core manufacturing process, involving compression molding, injection molding, and subsequent finishing (decaling, glazing, polishing), constitutes the primary value addition stage. Manufacturers invest heavily in automated machinery and quality control systems to ensure uniformity, aesthetic appeal, and structural integrity. Downstream activities involve the distribution and sale of finished products, catering to diverse customer segments. Distribution channels are bifurcated, utilizing both direct B2B sales to large commercial buyers (hotels, catering chains) and indirect sales through wholesale distributors, retail stores, and increasingly, specialized e-commerce platforms targeting residential consumers and smaller independent restaurants.

Direct distribution allows for stronger client relationships and customized order fulfillment for major commercial accounts, offering control over branding and delivery timelines. Indirect channels, including large retail chains and online marketplaces, provide broader market access and cater efficiently to scattered residential demand. The rise of e-commerce has significantly streamlined the purchasing process for both consumers and smaller HORECA businesses, leading to improved price transparency and faster market penetration for niche and premium product lines. Successfully navigating this value chain requires strategic partnerships at both the raw material sourcing level and the final distribution stage to maintain cost advantages and market responsiveness.

Melamine Tableware Market Potential Customers

The primary end-users and potential customers of the Melamine Tableware Market fall predominantly into two major categories: the vast commercial sector and the growing residential market. Within the commercial sphere, the hospitality industry, encompassing hotels, resorts, and organized catering companies, represents a crucial customer base, constantly seeking durable, presentable, and cost-efficient tableware solutions that can withstand rigorous commercial cleaning cycles. Quick Service Restaurants (QSRs) and fast-casual dining establishments are significant bulk buyers, valuing melamine for its low replacement cost and quick turnaround capabilities, especially for high-volume transactions.

Beyond the HORECA segment, institutional buyers form another substantial customer group. This includes educational institutions (schools and universities), healthcare facilities (hospitals and nursing homes), and corporate and government cafeterias. These entities prioritize hygiene, safety (reduced breakage risk), and volume purchasing capacity. Procurement decisions in this sector are often guided by stringent budgetary constraints and specific regulatory standards, leading to a strong demand for utility and standard-grade melamine products that offer maximum durability and minimal maintenance requirements.

The residential market, while lower in volume per transaction, contributes significantly to market diversity and innovation. Target customers here are families seeking durable, lightweight, and safe alternatives for outdoor events, picnics, and households with young children. This segment shows a strong preference for aesthetic trends, driving demand for premium, decorative melamine that mimics high-end ceramics, thereby providing key opportunities for manufacturers to introduce novel colors, patterns, and sustainable product variations aimed at modern home aesthetics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mepra S.p.A., Gibson Overseas, Inc., Zak Designs, Inc., Carlisle FoodService Products, Dongguan Hongtai Tableware Ltd., PolyScience, Huaji Industry Co. Ltd., TableCraft Products, LLC, Cambro Manufacturing, Inc., GET Enterprises, Milton Plastics, Vista Alegre, Pacific Merchants, Continental Commercial Products, Ko-Sin Tableware Co., Ltd., J. S. International, Sundrella Outdoor Furniture, Ltd., Fissler GmbH, New Asia Tableware Co. Ltd., BBP Plastic Industry |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Melamine Tableware Market Key Technology Landscape

The manufacturing of melamine tableware relies on sophisticated thermoset molding technologies, primarily compression molding, which allows for the creation of heavy-gauge, durable products with complex shapes. Recent technological advancements focus heavily on process automation to achieve higher production rates, improve material consistency, and reduce manual intervention, leading to substantial cost savings. Furthermore, innovations in mold design are enabling the production of items with varying thicknesses and intricate textures, successfully mimicking the weight and feel of high-end ceramic and stoneware. This technological shift is crucial for supporting the premiumization trend, as consumers demand melamine products that offer superior aesthetics without compromising on the material's inherent durability advantages in commercial settings.

A critical area of technological focus is surface finishing and printing. High-definition decal and in-mold labeling technologies allow manufacturers to apply intricate, multi-color designs that are permanently sealed within the resin, ensuring longevity and resistance to fading from rigorous commercial dishwashing. This capability is paramount for commercial clients seeking strong brand integration or unique visual identity for their dining services. Additionally, advanced glazing techniques, often proprietary chemical formulations, are being deployed to enhance the scratch and stain resistance of the final product, addressing a common weakness of earlier generation melamine and significantly extending the service life of the tableware in demanding applications.

Beyond aesthetics and durability, technology is also addressing health and safety concerns. The introduction of certified BPA-free melamine resins and advanced manufacturing processes that rigorously control the curing temperature and pressure minimize the potential for chemical migration, ensuring compliance with strict international food contact material regulations. Furthermore, some manufacturers are experimenting with the integration of anti-microbial technologies directly into the resin compound, providing an added layer of hygiene protection, particularly relevant for institutional and healthcare applications. These technological developments collectively aim to elevate the performance, safety profile, and aesthetic appeal of melamine tableware, maintaining its competitive edge against traditional and emerging materials.

Regional Highlights

The global Melamine Tableware Market exhibits significant regional variations in consumption patterns, manufacturing capabilities, and regulatory landscapes. Asia Pacific (APAC) dominates the market, primarily due to its position as the world's largest manufacturing base for melamine resin and finished goods. Countries like China and India drive immense consumption owing to rapid economic growth, expansion of the middle class, and explosive growth in the HORECA and tourism sectors. The cost-effectiveness of local production and large domestic market demand contribute to APAC's leadership, although the region is also experiencing a rapid shift toward producing higher-quality, export-grade melamine to meet Western standards.

North America and Europe constitute mature markets characterized by high per capita spending on casual and outdoor dining and stringent regulatory requirements regarding food contact safety (e.g., FDA, EU Regulation 10/2011). These regions show a strong preference for premium, heavy-weight, and designer melamine products, often utilized in high-end casual restaurants and for specialized outdoor entertaining. Innovation in these markets is focused on sustainability, with a growing demand for BPA-free and eco-friendly melamine alternatives or mixed material products. The competitive environment is driven by branding, design originality, and compliance certifications.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as high-growth regions. LATAM market expansion is tied to rising urbanization and the development of organized retail and commercial food services across key economies like Brazil and Mexico. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees substantial demand fueled by massive investment in the hospitality infrastructure, driven by high-volume international tourism and large-scale institutional projects. This demand typically starts with standard utility-grade products but is rapidly transitioning toward premium offerings as disposable income and consumer sophistication increase.

- Asia Pacific (APAC): Market leader and manufacturing hub; high growth driven by China, India, and Southeast Asian HORECA expansion and institutional demand. Focus on volume and efficiency.

- North America: Mature market characterized by demand for premium, design-centric, and BPA-free melamine; high regulatory compliance standards drive product safety innovation.

- Europe: High adoption in catering and outdoor dining; emphasis on eco-friendliness, sophisticated aesthetics, and compliance with strict EU migration limits (e.g., Germany, UK, France).

- Latin America (LATAM): Growing commercial applications due to urbanization and formalization of the food service sector; high growth potential in Brazil and Mexico.

- Middle East & Africa (MEA): Rapid expansion linked to tourism, hospitality infrastructure projects (especially GCC countries), and increasing institutional catering requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Melamine Tableware Market.- Mepra S.p.A.

- Gibson Overseas, Inc.

- Zak Designs, Inc.

- Carlisle FoodService Products

- Dongguan Hongtai Tableware Ltd.

- PolyScience

- Huaji Industry Co. Ltd.

- TableCraft Products, LLC

- Cambro Manufacturing, Inc.

- GET Enterprises

- Milton Plastics

- Vista Alegre

- Pacific Merchants

- Continental Commercial Products

- Ko-Sin Tableware Co., Ltd.

- J. S. International

- Sundrella Outdoor Furniture, Ltd.

- Fissler GmbH

- New Asia Tableware Co. Ltd.

- BBP Plastic Industry

- Fujian Quanzhou Zhaoxin Import and Export Trade Co., Ltd.

- Shandong Jiguang Mould Co., Ltd.

- Dongguan City Rongxing Industrial Co., Ltd.

- Qingdao Jicun Arts & Crafts Co., Ltd.

- Guangzhou Aoting Plastic Products Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Melamine Tableware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Melamine Tableware Market?

The Melamine Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% from 2026 to 2033, driven primarily by increasing adoption in the global HORECA and institutional sectors.

Is melamine tableware safe for food contact and long-term use?

Modern, high-quality melamine tableware is generally considered safe for food contact, provided it adheres to strict regulatory standards, such as those set by the FDA and the European Union, concerning temperature limits and chemical migration (especially BPA-free certification).

Which segment holds the largest share in the Melamine Tableware Market by application?

The Commercial application segment, encompassing hotels, restaurants, cafes, and institutional dining facilities, holds the largest market share due to the high durability requirements and volume purchases necessary for professional food service operations.

What are the primary restraints affecting the growth of the melamine tableware industry?

The primary restraints include persistent environmental concerns regarding the limited recyclability of thermoset plastics like melamine and strict regulatory scrutiny over the potential for chemical leaching, particularly when exposed to high heat (e.g., microwave use).

How is technology influencing the aesthetic quality of melamine products?

Key technologies like high-definition decaling, advanced compression molding, and proprietary glazing techniques allow manufacturers to produce premium-grade melamine that closely mimics the heavy weight, sophisticated textures, and appearance of ceramic or porcelain ware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager