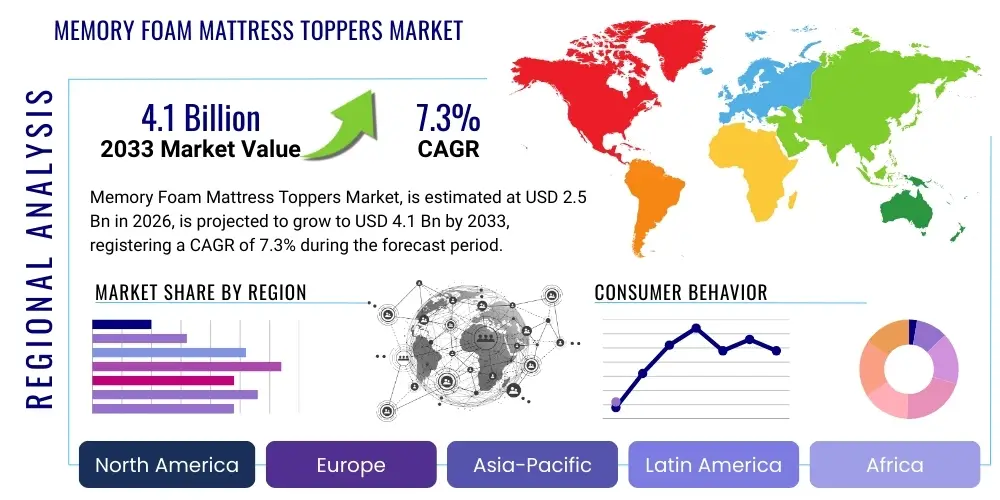

Memory Foam Mattress Toppers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438972 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Memory Foam Mattress Toppers Market Size

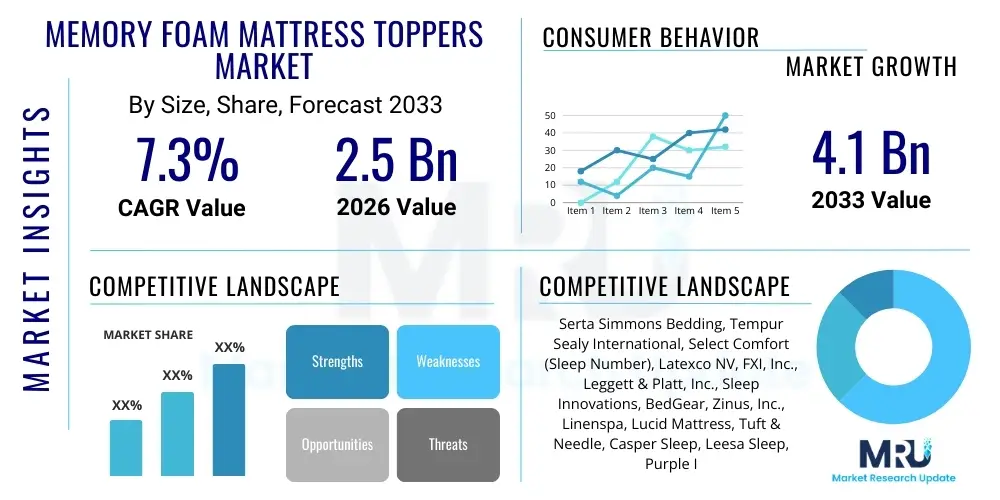

The Memory Foam Mattress Toppers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Memory Foam Mattress Toppers Market introduction

The Memory Foam Mattress Toppers Market encompasses the global sale and distribution of supplementary bedding layers designed primarily to enhance comfort, support, and longevity of existing mattresses. Memory foam, originally developed by NASA, is viscoelastic polyurethane foam characterized by its ability to mold precisely to the body's contours in response to heat and pressure, offering superior pressure point relief and personalized cushioning. This product category serves as an economical alternative to purchasing a new mattress, providing consumers with a viable solution to revitalize older bedding or modify the firmness of a relatively new mattress that does not meet personal comfort specifications. Key product variations include traditional memory foam, gel-infused memory foam (for cooling properties), and plant-based memory foam, catering to diverse consumer needs related to temperature regulation and material preference.

Major applications of memory foam mattress toppers span residential use, hospitality sectors (hotels, resorts), healthcare facilities (hospitals, nursing homes), and institutional settings (dormitories). The primary benefit driving adoption is enhanced sleep quality, particularly for individuals suffering from chronic back pain or joint discomfort, as the material ensures spinal alignment and minimizes motion transfer. Furthermore, these toppers protect the underlying mattress from wear and tear, spillages, and allergens, thus extending the lifespan of the major bedding investment. The versatility and ease of integration make them a highly desirable commodity in the bedding accessories market, supported by strong direct-to-consumer (D2C) online sales channels globally.

Driving factors underpinning the market expansion include the increasing consumer focus on sleep wellness and ergonomic bedding solutions, coupled with the rising prevalence of orthopedic conditions demanding specialized sleeping surfaces. Urbanization and smaller living spaces have fueled the demand for durable and multipurpose bedding products. Moreover, continuous innovation in material science, such as the introduction of open-cell structures and cooling technologies like copper or graphite infusion, addresses the historic issue of heat retention associated with traditional memory foam, thereby broadening the product's appeal across various climates and demographics. The affordability relative to new mattresses positions toppers favorably during periods of economic restraint, further cementing their market position.

Memory Foam Mattress Toppers Market Executive Summary

The global Memory Foam Mattress Toppers Market is experiencing robust growth driven by favorable business trends focused on personalization and sustainability, while regional dynamics show distinct consumption patterns influenced by climate and disposable income. Business trends highlight a strong shift toward e-commerce platforms, enabling manufacturers to engage directly with consumers, offering personalized product recommendations based on sleep profiles and preferences. Furthermore, significant investment in sustainable manufacturing practices, particularly the utilization of CertiPUR-US certified or plant-based foams, is addressing growing environmental concerns and capturing eco-conscious consumer segments. Technological integration, such as smart fabric covers and integration with sleep tracking devices, represents a key innovation pathway aimed at increasing product value and market differentiation among competitors. Competitive pricing strategies, supported by optimized logistics and supply chain efficiency, are crucial for maintaining market penetration in high-volume regions.

Regionally, North America and Europe currently dominate the market share due to high consumer awareness regarding sleep health, mature retail infrastructures, and substantial disposable incomes allowing for investment in high-quality bedding accessories. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period, fueled by rapid urbanization, increasing middle-class populations, and the expanding hospitality sector, especially in developing economies like China and India. Latin America and the Middle East and Africa (MEA) are also showing promising potential, characterized by increasing adoption of western lifestyle products and expanding modern retail formats. Localized climate considerations significantly impact product demand, with hotter regions driving innovation in cooling foam technologies, while colder regions prioritize superior insulation and density.

Segment trends demonstrate a clear preference for medium to high-density toppers, reflecting consumer desire for durability and effective support, particularly in the orthopedic application segment. Thickness segmentation indicates that 2-inch and 3-inch options remain the most popular, balancing cost-effectiveness with substantial comfort improvement. The fastest-growing product type is anticipated to be gel-infused memory foam, directly addressing the primary restraint of heat discomfort and enhancing overall user satisfaction. Distribution channels are highly fragmented, though the online retail segment continues its aggressive expansion, offering convenience, wider product selections, and competitive pricing, often surpassing traditional brick-and-mortar sales in terms of volume and market velocity. Application segmentation confirms the residential sector as the primary revenue driver, although the growth in commercial sectors, especially high-end hospitality, is increasingly influential on market size and product quality standards.

AI Impact Analysis on Memory Foam Mattress Toppers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Memory Foam Mattress Toppers Market predominantly center on three core themes: personalized recommendation engines, optimization of the supply chain and manufacturing processes, and the development of next-generation smart sleep products. Users frequently question how AI can move beyond generic product descriptions to precisely match a topper's density, thickness, and material type to an individual's specific body weight, sleeping position, and existing mattress condition, ensuring maximum therapeutic benefit. Another major concern involves the application of machine learning in forecasting demand fluctuations, optimizing inventory management, and reducing material waste in complex foam production, leading to lower costs and more sustainable operations. Furthermore, there is significant interest in how AI can be integrated into the product itself, for instance, through sensor-embedded toppers that analyze sleep patterns and automatically adjust firmness or temperature, ushering in an era of truly dynamic sleep systems.

The implementation of AI algorithms in e-commerce platforms is revolutionizing the consumer purchasing journey for mattress toppers. By analyzing vast datasets encompassing customer reviews, return rates, geographical climate, and purchase history, AI-powered systems can recommend the optimal topper based on objective data rather than subjective marketing claims. This precision in matching product to need drastically reduces return rates, a significant cost factor in the bedding industry. Moreover, AI is being deployed in quality control during the foaming process, utilizing computer vision to detect microscopic flaws in the foam structure, ensuring consistent density and resilience across batches, which is critical for maintaining high brand reputation and meeting rigorous certification standards.

In manufacturing, predictive maintenance driven by AI is minimizing downtime of complex machinery involved in mixing and cutting the foam, thereby enhancing operational efficiency and throughput. Logistics and warehousing benefit immensely from machine learning models that optimize stocking locations and shipping routes, especially crucial for bulky, high-volume, low-margin products like mattress toppers. This strategic application of AI across the value chain from raw material sourcing to final delivery ensures a quicker time-to-market and allows companies to respond dynamically to global market shifts, such as sudden increases in demand linked to seasonal promotions or major health awareness campaigns, providing a significant competitive advantage over traditional manufacturing models.

- AI-driven personalization engines enhance product-to-customer matching, reducing return rates.

- Machine learning optimizes foam formulation and quality control during manufacturing, ensuring material consistency.

- Predictive analytics improves demand forecasting and inventory management for bulky items.

- AI facilitates dynamic pricing models responsive to competitor activity and stock levels.

- Integration of AI with smart toppers for real-time sleep data analysis and dynamic adjustment capabilities.

- Robotics and computer vision streamline automated cutting and packaging processes, improving efficiency.

DRO & Impact Forces Of Memory Foam Mattress Toppers Market

The Memory Foam Mattress Toppers Market is shaped by powerful Impact Forces categorized into Drivers (D), Restraints (R), and Opportunities (O). Key Drivers include the rising global awareness of the link between quality sleep and overall health, coupled with the necessity of an affordable solution to refresh aging mattresses in residential and commercial settings. The rapid growth of the e-commerce sector acts as a significant catalyst, democratizing access to specialized bedding products previously limited by geographic location. Restraints primarily involve the inherent material properties, notably the issue of heat retention often associated with standard memory foam, which necessitates costly technological mitigation efforts like gel or copper infusion. Furthermore, intense competition from alternative materials, such as latex and down alternatives, coupled with variability in product quality and counterfeit issues, poses structural challenges to market players. Opportunities lie in expanding product lines to include specialized medical or therapeutic toppers, penetrating untapped emerging markets in APAC and MEA, and exploiting circular economy principles through the development of fully recyclable or biodegradable foam options, aligning with global consumer shifts toward sustainable purchasing.

Drivers: The dominant driver is the growing consumer investment in orthopedic and therapeutic bedding due to an increasing prevalence of lifestyle-related back and joint problems, particularly among aging populations and desk workers. Consumers are increasingly viewing high-quality sleep as a preventative health measure, directly translating into higher spending on accessories that promise comfort and support. The replacement market is also substantial; rather than undertaking the expense of purchasing a new mattress every 7–10 years, consumers opt for toppers to extend the usable life of their existing bedding, creating a continuous demand cycle. Furthermore, the aggressive adoption of these toppers by the global hospitality industry seeking to upgrade guest comfort without incurring massive capital expenditures on full mattress replacement significantly contributes to the overall market velocity and acceptance of the product category, setting high standards for performance and durability that filter down to the consumer market.

Restraints: Significant restraints include consumer skepticism regarding product lifespan and the potential for off-gassing, the chemical odor associated with new foam products, despite rigorous industry standards like CertiPUR-US. Although manufacturers have made strides in mitigating heat retention, it remains a perceived drawback that often directs consumers toward higher-priced cooling alternatives or away from memory foam entirely. Economic volatility and fluctuations in the price of petroleum-based raw materials, which are core components of polyurethane foam, introduce supply chain risks and cost variability that can erode profit margins for manufacturers. Regulatory hurdles regarding flame retardancy standards and chemical composition in different regional markets also complicate global expansion efforts and necessitate customized product formulations, increasing operational complexity and compliance costs.

Opportunities: Opportunities for market growth are abundant through technological innovation, specifically the development of advanced hybrid toppers combining memory foam with micro-coils or phase change materials (PCMs) to deliver personalized comfort and cooling far beyond current capabilities. Expanding distribution networks in Tier 2 and Tier 3 cities across developing countries offers immediate high-volume growth potential as consumer spending power rises. Furthermore, strategic partnerships with specialized medical facilities and physical therapy centers can open up niche, high-value markets for clinically validated therapeutic toppers. The emerging trend of customizable toppers, allowing consumers to choose specific zones of firmness or material composition within a single product, represents a high-potential segment for premium pricing and brand loyalty.

Segmentation Analysis

The Memory Foam Mattress Toppers Market is segmented comprehensively based on key functional and commercial characteristics, including Product Type, Thickness, Density, Application, and Distribution Channel. This detailed segmentation allows manufacturers to tailor product offerings precisely to distinct consumer groups and industry requirements, maximizing market penetration and revenue potential across diverse geographical and demographic landscapes. Analyzing these segments is crucial for identifying high-growth niches, such as the rapidly expanding market for infused foams that solve historical material constraints, and understanding the purchasing preferences of large institutional buyers versus individual residential users. The performance and pricing architecture across all segments are highly competitive, necessitating continuous innovation in materials and manufacturing efficiency to maintain market share. The complexity of segmentation reflects the maturity and responsiveness of the market to highly specific consumer demands for tailored sleep solutions.

The market primarily differentiates products by composition and function. Product types include traditional, gel-infused, bamboo-infused, and copper-infused options, with the infused segments driving premiumization due to their added functional benefits like cooling, anti-microbial properties, or enhanced resilience. Thickness, typically ranging from 1 inch to 4 inches, is a critical variable influencing the level of support and cost, with 2-inch and 3-inch models dominating mass market sales. Density segmentation, measured in pounds per cubic foot (PCF), directly correlates with durability and firmness, where high-density toppers (4 PCF and above) command higher prices but are sought after for orthopedic applications and longevity. The combination of these variables defines the final user experience and market positioning of any given product, requiring manufacturers to maintain a wide and varied inventory to capture the breadth of consumer requirements.

Application segmentation clearly demarcates the primary end-users, with the Residential sector accounting for the vast majority of consumption. However, the Commercial sector, encompassing hotels, resorts, cruise ships, and healthcare facilities, provides a critical segment focused on bulk purchasing, high durability requirements, and specific fire safety certifications, often dictating bespoke product specifications. Distribution channels remain highly influential, with the transition toward online retail accelerating rapidly due to convenience, extensive customer reviews, and better price transparency, although traditional specialized bedding stores and department stores still play a vital role in consumer trials and premium segment sales. Understanding the nuances within each segment, such as the preference for medium-density, 3-inch, gel-infused toppers in the mid-range residential market, is essential for effective inventory management and targeted marketing campaigns.

- By Product Type:

- Traditional Memory Foam

- Gel-Infused Memory Foam

- Copper/Graphite Infused Memory Foam

- Plant-Based/Bio-Foam Memory Toppers

- Aromatic/Lavender Infused Toppers

- By Thickness:

- 1 Inch to 2 Inches

- 2 Inches to 3 Inches

- 3 Inches to 4 Inches

- Above 4 Inches (Specialty Applications)

- By Density (PCF):

- Low Density (Below 3 PCF)

- Medium Density (3 to 5 PCF)

- High Density (Above 5 PCF)

- By Application:

- Residential

- Commercial (Hotels, Hospitals, Institutional)

- By Distribution Channel:

- Online Retail (E-commerce platforms, Company Websites)

- Offline Retail (Department Stores, Specialty Stores, Supermarkets)

Value Chain Analysis For Memory Foam Mattress Toppers Market

The value chain for the Memory Foam Mattress Toppers Market begins with upstream activities involving raw material procurement, primarily polyols and isocyanates (petrochemical derivatives), alongside specialized additives like fire retardants, blowing agents, and cooling gels or infusions. Upstream analysis focuses heavily on managing price volatility of crude oil and ensuring sustainable sourcing of chemical components, with suppliers often engaging in long-term contracts to stabilize input costs. This stage demands stringent quality control and regulatory compliance, particularly concerning environmental and health standards (e.g., CertiPUR-US certification). Specialized chemical companies dominate this initial stage, supplying bulk materials to foam manufacturers, who then conduct the chemical foaming process, which is highly capital-intensive and requires sophisticated machinery and environmental controls to maintain product consistency and safety.

The midstream phase involves the core manufacturing of the toppers, including the foaming, curing, cutting, and finishing processes (e.g., adding covers, branding). Efficiency at this stage is critical, utilizing large-scale continuous pouring machines and sophisticated computer-controlled cutting equipment to minimize scrap material and optimize dimensions. The downstream segment focuses on distribution and sales. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers selling through their own branded e-commerce websites, allowing for maximum control over pricing, branding, and customer experience. This channel is increasingly popular due to lower intermediary costs and direct access to consumer data, enabling better product development.

Indirect distribution encompasses sales through third-party e-commerce giants (Amazon, Walmart online), specialized bedding retailers, department stores, and large-format furniture outlets. These channels provide broader market reach and physical touchpoints for consumers to evaluate the product. The strong reliance on e-commerce necessitates highly efficient logistics partners specializing in shipping large, compressible, but bulky items. Key success factors in the downstream segment include effective digital marketing, leveraging strong customer reviews, and providing attractive warranty and return policies. The entire value chain is currently undergoing optimization driven by AI and data analytics to enhance forecasting accuracy, reduce lead times, and ensure compliance with complex global trade regulations, increasing the overall cost efficiency from raw chemical procurement to final home delivery.

Memory Foam Mattress Toppers Market Potential Customers

The Memory Foam Mattress Toppers Market targets a diverse range of end-users and institutional buyers seeking affordable and effective solutions to improve sleep quality, modify mattress firmness, or extend the lifespan of existing bedding investments. The largest customer base resides in the residential sector, comprising individuals and households that purchase toppers for personal use. Within this segment, potential customers are broadly categorized into two major groups: those looking to revitalize an aging or overly firm mattress without the cost of replacement, and those actively seeking therapeutic relief for orthopedic issues such as chronic back pain, fibromyalgia, or arthritis, who require specific pressure-relieving qualities associated with high-density memory foam. This residential segment is highly driven by online reviews, health recommendations, and effective digital marketing emphasizing comfort and cooling features, with repeat purchases often correlated with satisfactory previous experiences.

Beyond individual consumers, a significant and increasingly critical group of buyers includes the commercial and institutional sectors. The hospitality industry, particularly mid-range to luxury hotels and cruise lines, represents a major bulk purchaser. These entities utilize toppers to maintain consistent, high levels of guest comfort across different properties and to quickly upgrade rooms during renovation cycles without replacing entire mattress inventories. Requirements in this segment are stringent, focusing on extreme durability, compliance with commercial fire safety standards, and ease of cleaning. Furthermore, healthcare facilities, including hospitals, long-term care facilities, and nursing homes, constitute another essential segment. These buyers prioritize medical-grade, pressure-reducing toppers designed to mitigate the risk of pressure ulcers (bedsores) and enhance patient recovery and comfort, often requiring specialized, antimicrobial, liquid-resistant covers.

Other institutional buyers include university dormitories, military bases, and government housing programs, which purchase based primarily on volume, durability, and strict budget constraints. For manufacturers, targeting these commercial segments requires specialized sales teams, direct engagement with procurement officers, and the ability to handle large, customized orders with assured quality consistency. Success in addressing the diverse needs of residential, hospitality, and healthcare buyers depends heavily on offering a specialized product portfolio that clearly segments quality, durability, and functional attributes (e.g., cooling vs. orthopedic support) across all potential price points and purchasing volumes, ensuring sustained market relevance across the entire customer spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Serta Simmons Bedding, Tempur Sealy International, Select Comfort (Sleep Number), Latexco NV, FXI, Inc., Leggett & Platt, Inc., Sleep Innovations, BedGear, Zinus, Inc., Linenspa, Lucid Mattress, Tuft & Needle, Casper Sleep, Leesa Sleep, Purple Innovation, Brooklyn Bedding, Malouf, Classic Brands, Honeywell International, Carpenter Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Memory Foam Mattress Toppers Market Key Technology Landscape

The technological landscape of the Memory Foam Mattress Toppers Market is defined by continuous advancements aimed at overcoming the intrinsic limitations of traditional viscoelastic foam, primarily poor breathability and heat retention, while also enhancing material sustainability and durability. A critical technology is the utilization of open-cell structure manufacturing, which involves creating a more porous foam structure during the foaming process. This architectural modification allows air to circulate more freely within the topper, dissipating heat and moisture more effectively than the standard closed-cell foams, significantly improving the sleep experience, especially in warmer climates. Furthermore, the adoption of variable density layering techniques allows manufacturers to create hybrid toppers with targeted zones of support, catering to different body parts—softer foam for the shoulders and firmer foam for the lumbar region—enhancing orthopedic efficacy and personalization.

Infusion technology represents another major technological frontier. Manufacturers are increasingly infusing memory foam with phase change materials (PCMs), such as micro-encapsulated cooling gels, which absorb and release heat to maintain a regulated surface temperature throughout the night. Other popular infusions include copper, known for its antimicrobial properties and heat conductivity, and graphite, which dramatically improves heat dissipation. These advanced materials directly address consumer pain points and allow for premium pricing, fueling research and development investment within the industry. The technological arms race centers on achieving the optimal balance between viscoelastic comfort, heat neutrality, and minimal off-gassing, driven by rigorous third-party certifications like CertiPUR-US and OEKO-TEX, which are essential marketing tools verifying the safety and low VOC content of the materials used.

Beyond material composition, smart technology integration is emerging, albeit primarily in the premium segment. This includes the incorporation of non-invasive sensors and micro-electronics embedded within the topper cover or the foam itself. These sensors track vital sleep metrics such as heart rate, respiration, and movement, transmitting data to external devices via Wi-Fi or Bluetooth. The underlying technology uses algorithms to analyze this data, providing personalized insights into sleep quality. Although still nascent, this technology promises to eventually enable dynamic adjustment features, where the topper could slightly alter its firmness or temperature based on real-time feedback, transforming the passive product into an active participant in sleep optimization. The convergence of material science, sustainable chemistry, and IoT connectivity dictates the future trajectory of innovation in this sector.

Regional Highlights

- North America: This region holds a dominant market share due to high consumer spending power, strong emphasis on health and wellness, and established retail infrastructure. The U.S. and Canada show a high propensity for investing in premium, high-density, and gel-infused toppers. The market is highly mature, characterized by strong brand loyalty and intense competition from major global players. E-commerce penetration is exceptionally high, making digital marketing strategies crucial for success.

- Europe: Western European countries, particularly Germany, the UK, and France, exhibit stable growth, driven by a preference for orthopedic and sustainable bedding solutions. The region has strict regulatory standards regarding material safety and chemical emissions, favoring manufacturers utilizing OEKO-TEX and CertiPUR-US certified foams. Demand is highly segmented, with northern countries prioritizing insulation and southern countries demanding advanced cooling technologies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, powered by rapid economic development, urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asia. The expanding hospitality and commercial sectors significantly contribute to bulk demand. Price sensitivity is higher than in Western markets, but there is growing demand for branded, quality products as disposable incomes increase, focusing on balancing cost-effectiveness with functional cooling features due to prevalent hot and humid climates.

- Latin America (LATAM): The LATAM market is characterized by increasing awareness of specialty bedding products and expanding organized retail. Economic fluctuations pose periodic challenges, but underlying demand remains steady, driven by urbanization in Brazil and Mexico. Local manufacturers are strong contenders, often focusing on localized distribution and competitive pricing, while international brands compete in the premium segment.

- Middle East and Africa (MEA): This region presents considerable growth potential, particularly within the Gulf Cooperation Council (GCC) countries, driven by robust luxury tourism and high investment in new hotel developments. Extreme climate conditions necessitate demand for superior cooling technologies in mattress toppers. The market is highly import-reliant, with a preference for high-end international brands guaranteeing quality and durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Memory Foam Mattress Toppers Market.- Serta Simmons Bedding

- Tempur Sealy International

- Select Comfort (Sleep Number)

- Latexco NV

- FXI, Inc.

- Leggett & Platt, Inc.

- Sleep Innovations

- BedGear

- Zinus, Inc.

- Linenspa

- Lucid Mattress

- Tuft & Needle

- Casper Sleep

- Leesa Sleep

- Purple Innovation

- Brooklyn Bedding

- Malouf

- Classic Brands

- Honeywell International

- Carpenter Co.

Frequently Asked Questions

Analyze common user questions about the Memory Foam Mattress Toppers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a memory foam mattress topper?

The primary benefit is superior pressure point relief and contouring support, which helps align the spine and alleviate pain. Toppers provide an affordable way to upgrade the comfort and extend the life of an existing mattress, especially for side sleepers or those with chronic back pain.

How do cooling technologies in memory foam toppers work?

Cooling technologies primarily involve infusing the foam with temperature-regulating materials like gel beads, copper, or graphite, and using an open-cell structure. These materials absorb excess heat from the body and promote airflow, mitigating the traditional heat retention issue of viscoelastic foam.

Which thickness and density are recommended for general use?

For general residential use, a thickness of 2 to 3 inches provides an optimal balance of cushioning and support. A medium density (3 to 4 pounds per cubic foot) is typically recommended for durability and comfort for most average-weight users, offering robust contouring without being excessively firm.

Is the memory foam mattress topper market growth driven more by residential or commercial demand?

While the residential sector accounts for the largest volume of sales, providing the primary market base, commercial demand (hotels, hospitals) is a major growth driver for high-quality, durable, and certified toppers, influencing product specifications and bulk sales significantly across developing regions.

What role does e-commerce play in the distribution of mattress toppers?

E-commerce is the dominant distribution channel, offering consumers competitive pricing, extensive product reviews, and convenient home delivery. Online platforms allow manufacturers to bypass traditional retail overheads, enabling direct-to-consumer sales and higher market velocity, particularly for younger and tech-savvy demographics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager