Memory of Connected and Autonomous Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433350 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Memory of Connected and Autonomous Vehicle Market Size

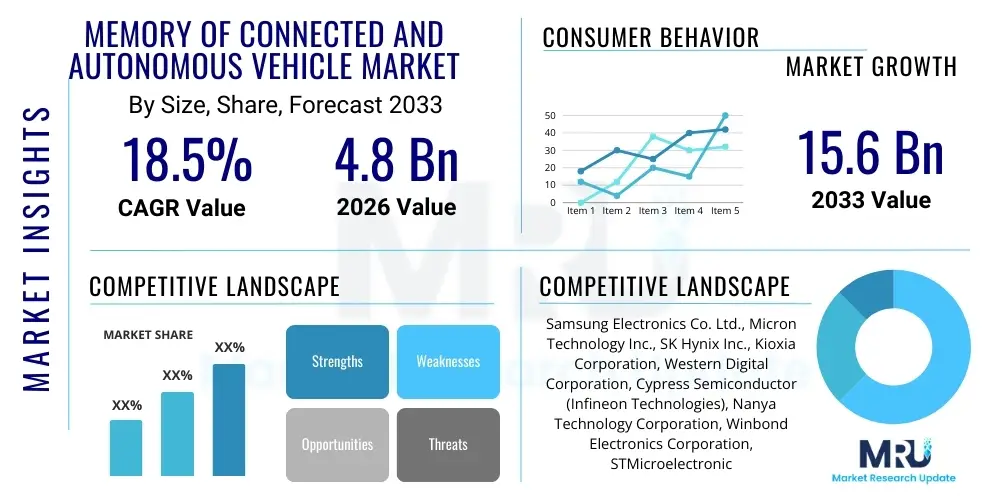

The Memory of Connected and Autonomous Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Memory of Connected and Autonomous Vehicle Market introduction

The Memory of Connected and Autonomous Vehicle (CAV) Market encompasses advanced semiconductor memory solutions critical for the operational integrity, data processing, and intelligence functions within modern automobiles. This market focuses on high-performance, high-reliability memory types, including specialized DRAM (Dynamic Random-Access Memory), high-density NAND Flash, and emerging non-volatile memory (NVM) tailored for demanding automotive environments. These components are essential for processing massive sensor data streams from LiDAR, radar, and cameras, enabling real-time decision-making in Advanced Driver-Assistance Systems (ADAS) and full autonomy (Level 3 to Level 5).

The core product description revolves around memory subsystems characterized by stringent quality standards (AEC-Q100 certified) and functional safety requirements (ISO 26262 and ASIL-D compliance). Major applications span across infotainment systems, telematics control units (TCUs), domain controllers, and, most critically, the central processing units (CPUs) and acceleration hardware responsible for autonomous driving algorithms. The increasing complexity of software-defined vehicles necessitates exponentially greater memory bandwidth and capacity, moving away from distributed Electronic Control Unit (ECU) architectures toward centralized computing platforms.

The primary benefits driving this market include enhanced vehicle safety through low-latency processing, improved user experience via sophisticated infotainment interfaces, and the enablement of vehicle-to-everything (V2X) communication, which relies heavily on fast, reliable storage and retrieval of map and situational data. Key driving factors are the global legislative push for mandatory ADAS features, intense competition among original equipment manufacturers (OEMs) to achieve higher levels of autonomy, and the exponential generation of data within moving vehicles, necessitating specialized memory solutions capable of handling petabytes of information over the vehicle's lifespan.

Memory of Connected and Autonomous Vehicle Market Executive Summary

The Memory of Connected and Autonomous Vehicle Market is experiencing robust expansion, fundamentally driven by the architectural shift in vehicular electronics toward domain and zonal controllers, significantly increasing the demand for high-density, low-power, and functionally safe memory modules. Business trends indicate strong collaboration between semiconductor manufacturers and Tier 1 suppliers to standardize high-speed interfaces like LPDDR5X and UFS 3.1, ensuring compatibility with new generations of high-performance automotive system-on-chips (SoCs). Regional trends highlight Asia Pacific (APAC) as the leading growth region, fueled by massive electric vehicle (EV) adoption and government support for autonomous infrastructure development in China and South Korea, while North America and Europe maintain technological leadership in advanced safety standard implementation. Segment trends show that high-bandwidth DRAM and mission-critical NOR Flash are experiencing the fastest growth rates, specifically within the L4/L5 autonomy segment, where the redundancy and instantaneous retrieval capabilities of memory are paramount for fail-operational performance.

The market landscape is characterized by increasing vertically integrated partnerships, where memory providers are working closely with automotive OEMs early in the design cycle to customize solutions optimized for specific thermal and vibration constraints. This shift demands higher investment in specialized packaging technologies and rigorous testing procedures that exceed standard consumer or enterprise memory requirements. Furthermore, sustainability requirements are beginning to influence material selection and power consumption targets for memory chips, particularly in the EV sector where maximizing driving range is a core objective. The necessity for over-the-air (OTA) update capabilities is also driving the adoption of embedded non-volatile memory that can sustain frequent write cycles and maintain data integrity throughout long vehicle lifecycles.

In terms of competitive dynamics, the market is moderately concentrated, with a few major memory technology giants dominating the high-volume production segments, but niche players are emerging with specialized expertise in radiation-tolerant or ultra-low latency memory crucial for safety applications. Financial performance metrics across leading industry players demonstrate significant capital expenditure allocation towards scaling up automotive-grade fabrication capacity. Geopolitical factors, particularly concerning supply chain resilience and regional manufacturing diversification, continue to shape strategic decisions, pushing automotive manufacturers to secure long-term contracts for critical memory components to mitigate future semiconductor shortages and ensure production continuity for high-volume vehicle platforms.

AI Impact Analysis on Memory of Connected and Autonomous Vehicle Market

User inquiries regarding the impact of Artificial Intelligence (AI) on automotive memory consistently center on data velocity, capacity scalability, and the thermal management challenges associated with running complex neural networks (NNs) on edge computing platforms. Key themes revolve around how AI accelerator hardware—such as specialized NPUs and high-end GPUs—will drive memory requirements far beyond traditional automotive standards, specifically concerning the need for extremely high-bandwidth memory (HBM) for real-time model training and inference. Users also frequently express concerns about the memory needed for edge model updates, focusing on the reliability and endurance of non-volatile storage used to hold vast, constantly evolving AI model parameters. The expectation is that AI will necessitate a paradigm shift from sequential data processing toward parallel, low-latency memory architectures to maintain the functional safety levels required for autonomous driving decisions.

The immediate and most profound impact of AI algorithms in connected vehicles is the explosive demand for high-speed data transfer and storage, primarily driven by sensor fusion. Autonomous driving systems utilize multiple deep learning models simultaneously—for object detection, path planning, and behavioral prediction—all requiring rapid access to cached data and weights. This computational intensity mandates the integration of LPDDR5/LPDDR5X or even specialized memory directly coupled to the AI processor (like stacked memory solutions) to prevent bottlenecks. Standard automotive memory solutions are insufficient to handle the parallelism and low latency (often below 10 milliseconds) required for real-time AI decision loops, thereby creating a premium market for specialized memory controllers and high-density DRAM tailored for automotive AI accelerators.

Furthermore, AI facilitates predictive maintenance and vehicle diagnostics, requiring memory solutions robust enough to log terabytes of operational telemetry and perform local inference tasks before transmitting summarized data via telematics. This introduces a strong requirement for persistent memory technologies, such as enhanced NAND Flash or emerging phase-change memory (PCM), that can withstand extreme temperature variations and maintain data integrity critical for regulatory compliance and accident reconstruction. The continuous refinement of AI models through Over-the-Air (OTA) updates demands large, fast, and durable storage segments to host new software images and model iterations, directly influencing the architectural design and capacity planning of memory subsystems within the domain controller units.

- AI necessitates high-bandwidth LPDDR5X and customized HBM memory solutions to support real-time sensor fusion and neural network inference.

- Increased data logging for AI model training and diagnostics drives demand for high-endurance, automotive-grade NAND Flash and UFS.

- Edge computing performance requires ultra-low latency memory architectures to execute complex deep learning algorithms for Level 4/5 autonomy.

- AI-driven OTA updates mandate larger, faster non-volatile memory segments for storing and switching between evolving software and model weights safely.

- Thermal management complexities associated with high-performance AI processors place stringent requirements on memory packaging and operational temperature ranges (AEC-Q100 Grade 2 or 1).

DRO & Impact Forces Of Memory of Connected and Autonomous Vehicle Market

The Memory of Connected and Autonomous Vehicle Market is significantly shaped by compelling drivers such as increasing vehicle digitization and the global push toward L3+ autonomy, which mandate extreme data processing capabilities. Restraints primarily involve the high cost and complexity of integrating ASIL-D certified memory solutions and the persistent challenges posed by fluctuating global semiconductor supply chains. Opportunities lie in developing advanced non-volatile memory (NVM) technologies that offer inherent security features and ultra-low power consumption for electric vehicles (EVs). Impact forces include stringent regulatory mandates regarding functional safety (ISO 26262), the competitive pressure among OEMs to deliver differentiated digital cockpits, and the transformative effect of software-defined vehicle architectures requiring centralized, high-throughput memory resources.

The primary driving force remains the exponential increase in data generated by sensors in autonomous vehicles, necessitating higher capacity and greater speed in data capture and processing. A typical Level 4 vehicle can generate several terabytes of data per hour, requiring robust, reliable DRAM to handle real-time calculations and persistent high-density NAND flash for mapping, logging, and infotainment content. The integration of advanced infotainment systems (multiple high-resolution displays, augmented reality navigation) also contributes substantially to the memory demand, moving away from simple infotainment toward complex digital cockpit experiences that require specialized graphic rendering memory. Furthermore, V2X communication requires reliable, low-latency memory to store and process incoming data packets from surrounding infrastructure and vehicles, which is crucial for safety applications.

Key restraints center around the stringent qualification processes and the resulting high cost of automotive-grade memory components. Achieving functional safety standards like ASIL-D requires exhaustive testing, redundancy features, and integrated error-correction code (ECC) capabilities, significantly increasing the manufacturing complexity and unit cost compared to standard consumer memory. Moreover, the long design and validation cycles inherent to the automotive industry slow down the adoption rate of the newest memory technologies. Supply chain volatility, exacerbated by recent global events, remains a persistent challenge, forcing OEMs to dual-source memory components and negotiate long-term agreements to secure stable supply, often at a premium, impacting profitability and time-to-market for new vehicle models.

Opportunities are vast, particularly in the development of next-generation memory architectures optimized for automotive constraints. This includes high-reliability magnetoresistive random-access memory (MRAM) and phase-change memory (PCM) which offer faster access times and better endurance than traditional Flash, making them ideal for mission-critical boot code and frequent data logging in harsh environments. The growing EV market presents an opportunity for low-power memory solutions (LPDDR) that help maximize battery range. Furthermore, the increasing need for robust cybersecurity within the vehicle ecosystem creates specialized market niches for memory modules with integrated hardware encryption and secure boot capabilities, addressing the increasing threat of vehicular hacking.

- Drivers: Proliferation of ADAS features (L3+ autonomy), demand for high-resolution sensor fusion, increasing adoption of sophisticated digital cockpit and infotainment systems.

- Restraints: High certification costs (ASIL-D), stringent thermal and vibration requirements, semiconductor supply chain constraints, and long automotive product life cycles slowing technology adoption.

- Opportunities: Development of next-generation non-volatile memory (MRAM, PCM) optimized for automotive reliability, expansion into the burgeoning Electric Vehicle (EV) low-power market segment, and rising demand for memory with integrated hardware security features.

- Impact Forces: Strict ISO 26262 functional safety regulations, accelerated adoption of software-defined vehicle architectures, and intense OEM competition over feature differentiation and performance.

Segmentation Analysis

The Memory of Connected and Autonomous Vehicle Market is segmented primarily based on the type of memory technology, the application within the vehicle, the vehicle autonomy level, and geographical region. Technological segmentation distinguishes between volatile memory (DRAM) critical for real-time processing and non-volatile memory (NAND Flash, NOR Flash, EPROM/EEPROM) used for data storage, system booting, and firmware. Application segments highlight core areas such as ADAS/Autonomous Driving, Infotainment, Telematics, and Body Electronics, each requiring distinct memory characteristics concerning speed, density, and reliability. Analyzing these segments provides strategic insights into where capital expenditure and technological development are most concentrated, guiding future R&D efforts towards high-growth, mission-critical applications.

The segmentation by memory type reveals a high-growth trajectory for specialized volatile memory solutions, particularly Low-Power Double Data Rate (LPDDR) variants, designed to meet the high bandwidth demands of AI accelerators while adhering to tight power budgets in modern vehicles. LPDDR5X, for instance, is rapidly becoming the standard for domain controllers handling L3 and L4 autonomy due to its efficiency and speed. Simultaneously, the market for non-volatile memory remains crucial, with high-density 3D NAND flash being indispensable for storing navigation data, entertainment libraries, and operating system kernels. NOR Flash continues to hold significance in safety-critical applications, primarily due to its superior reliability and fast boot-up times, vital for instantaneous system initialization in braking and steering systems.

From an application perspective, the ADAS and Autonomous Driving segment commands the highest average selling prices (ASPs) and the greatest capacity demand per vehicle, driven by the redundancy requirements for L4/L5 systems. This segment prioritizes fault tolerance, speed, and endurance above cost considerations. Conversely, the Infotainment segment, while demanding high capacity for media consumption and display processing, is slightly more sensitive to cost, yet still requires specialized graphics DRAM and high-speed embedded multimedia card (eMMC) or Universal Flash Storage (UFS) for rapid application loading and data management. The Body Electronics segment, covering fundamental vehicle operations, relies more heavily on highly reliable, lower-density embedded memory like EEPROM and specialized NOR Flash for basic control functions.

- By Memory Type:

- DRAM (LPDDR, DDR4/5, Specialty DRAM)

- NAND Flash (2D/3D NAND, eMMC, UFS)

- NOR Flash

- EEPROM/EPROM

- Emerging NVM (MRAM, PCM)

- By Application:

- ADAS & Autonomous Driving Systems

- Infotainment & Cockpit Systems

- Telematics & V2X Communication

- Body & Comfort Electronics

- Powertrain & Chassis Control

- By Vehicle Autonomy Level:

- Level 1 & 2 (Assisted Driving)

- Level 3 (Conditional Automation)

- Level 4 & 5 (High & Full Automation)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Memory of Connected and Autonomous Vehicle Market

The value chain for the Memory of Connected and Autonomous Vehicle Market is highly specialized, beginning with the silicon IP providers and materials suppliers in the upstream segment, progressing through the complex fabrication and packaging stages, and culminating with integration by Tier 1 suppliers and automotive OEMs in the downstream segment. Upstream activities are dominated by a few key players specializing in advanced lithography and proprietary memory cell architectures (e.g., charge trap flash for NAND, trench capacitors for DRAM). The stringent requirements for automotive qualification necessitate specialized testing and burning processes within the manufacturing step, distinguishing the automotive value chain significantly from consumer electronics production. The channel structure involves both direct sales to major Tier 1 automotive suppliers (who integrate memory into domain controllers) and indirect distribution through specialized electronics distributors who cater to smaller component needs and after-market services.

Upstream analysis highlights the critical role of equipment manufacturers and raw material suppliers (silicon wafers, chemical compounds). Innovation at this stage focuses on enhancing density, improving endurance (write/erase cycles), and reducing power consumption. Memory chip producers, such as Micron, Samsung, and SK Hynix, invest heavily in cutting-edge fabrication plants (Fabs) capable of producing automotive-grade dies (AEC-Q100 certified). A key upstream challenge is maintaining high yield rates for specialized automotive dies, which often have stricter defect tolerance criteria than standard components. This segment dictates the foundational technological capabilities and overall cost structure of the end product.

Downstream processes are characterized by assembly, integration, and stringent validation. Tier 1 suppliers (e.g., Bosch, Continental, Aptiv) procure the qualified memory chips and integrate them alongside CPUs and GPUs onto complex Electronic Control Units (ECUs) or centralized domain controllers. This integration requires significant thermal management expertise and software compatibility validation. Automotive OEMs represent the final buyers, selecting and validating the entire platform architecture. The trend toward software-defined vehicles is increasingly pushing OEMs to exert more control over the memory specifications and sourcing, sometimes bypassing traditional Tier 1 relationships to negotiate directly with chip makers for highly customized solutions.

The distribution channel often involves highly controlled and trackable supply logistics. Direct channels are preferred for high-volume, strategic components sold to major Tier 1 companies for integration into primary safety systems. Indirect channels, using authorized distributors, handle components required for lower-volume applications, repair, and smaller automotive electronics projects. Given the long life cycle of vehicles, maintaining a reliable supply chain for replacement parts years after the original production run is a critical requirement in the automotive memory distribution framework.

Memory of Connected and Autonomous Vehicle Market Potential Customers

Potential customers in the Memory of Connected and Autonomous Vehicle Market are primarily clustered within the automotive manufacturing ecosystem, led by Tier 1 automotive suppliers who act as the key integrators, followed by Original Equipment Manufacturers (OEMs), and increasingly, technology giants developing proprietary autonomous vehicle stacks. The end-users of the memory solutions are the domain controllers, telematics units, and advanced display systems embedded within vehicles. Buyers prioritize components that demonstrate superior functional safety ratings (ASIL compliance), proven longevity under extreme automotive conditions (temperature, vibration), and a robust supply guarantee over the typical 10–15 year lifecycle of a vehicle platform. This demand profile necessitates long-term strategic partnerships between memory producers and these high-volume buyers.

Tier 1 suppliers represent the largest segment of immediate buyers. Companies like Bosch, Continental, ZF, and Aptiv design and manufacture the complex electronic modules (domain controllers, ADAS processors) that require vast quantities of specialized memory. Their purchasing decisions are driven by balancing cost efficiency with technical specifications such as high bandwidth, low power consumption, and thermal resilience. They require rigorous documentation and adherence to automotive standards (IATF 16949) and rely on memory manufacturers to provide comprehensive qualification reports demonstrating reliability in diverse operational environments. Their scale allows them to negotiate favorable long-term pricing and guaranteed capacity allocation.

Original Equipment Manufacturers (OEMs), including traditional automakers (e.g., Ford, Volkswagen, Toyota) and electric vehicle specialists (e.g., Tesla, Lucid, Nio), are increasingly influencing memory purchasing decisions, particularly as they move towards centralized electronic architectures and software-defined vehicle designs. While Tier 1s handle integration, OEMs often dictate the minimum performance requirements and often engage directly with semiconductor companies to ensure supply security and technological compatibility with their next-generation vehicle platforms. The OEM focus is on system performance, brand differentiation through digital experiences, and ensuring the scalability of memory solutions across different vehicle models and autonomy levels.

A growing segment of potential customers includes specialized autonomous driving technology companies (e.g., Waymo, Cruise) and major technology firms (e.g., Nvidia, Qualcomm) that supply core computing platforms to the automotive industry. These buyers require the absolute highest performance memory, such as HBM or large LPDDR5X arrays, optimized for their specific AI accelerators. Their demand is generally focused on raw speed and capacity, often pushing the bleeding edge of semiconductor technology, sometimes accepting memory that falls just below the highest ASIL safety ratings if it is used in highly redundant or non-safety-critical computation clusters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co. Ltd., Micron Technology Inc., SK Hynix Inc., Kioxia Corporation, Western Digital Corporation, Cypress Semiconductor (Infineon Technologies), Nanya Technology Corporation, Winbond Electronics Corporation, STMicroelectronics N.V., Renesas Electronics Corporation, Intel Corporation, MediaTek Inc., Microchip Technology Inc., ISSI (Integrated Silicon Solution Inc.), Adesto Technologies Corporation (Dialog Semiconductor), Rambus Inc., Xilinx (AMD), Tsinghua Unigroup, Macronix International Co. Ltd., GigaDevice Semiconductor Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Memory of Connected and Autonomous Vehicle Market Key Technology Landscape

The Memory of Connected and Autonomous Vehicle Market is defined by a rapidly evolving technological landscape focused on maximizing data throughput, minimizing latency, and ensuring functional safety under extreme conditions. Core technological advancements revolve around High-Bandwidth Memory (HBM) interfaces, the transition from eMMC to faster Universal Flash Storage (UFS) standards, and the adoption of cutting-edge DRAM architectures like LPDDR5X, which provides significantly lower power consumption and higher data rates essential for battery-powered electric vehicles and data-intensive autonomous processing. Furthermore, significant research and development is focused on non-volatile memory (NVM) solutions such as MRAM and PCM, aiming to replace traditional EEPROM and NOR Flash in high-write-cycle, mission-critical applications where instantaneous data integrity and retention are non-negotiable.

One of the most critical technological shifts is the pervasive adoption of the LPDDR standard (specifically LPDDR5 and LPDDR5X) for centralized domain controllers. This memory type offers vastly improved speed and energy efficiency compared to older DDR generations, enabling complex AI algorithms to run effectively without excessive thermal load. Automotive memory controllers must also incorporate robust Error Correction Code (ECC) mechanisms and hardware redundancy features to meet ASIL-D requirements, often implemented through specialized memory packaging techniques like System-in-Package (SiP) or Multi-Chip Package (MCP) solutions that integrate multiple memory types for enhanced reliability and smaller footprint within the constrained vehicle environment. These solutions are often tested against AEC-Q100 Grade 1 standards for high-temperature resilience.

In the non-volatile segment, Universal Flash Storage (UFS) is rapidly replacing eMMC as the preferred choice for high-speed storage in infotainment and telematics units. UFS offers faster read/write speeds through its use of a high-speed serial interface, aligning with the growing need for rapid boot-up times for operating systems and instantaneous access to large navigation databases. Simultaneously, emerging NVM technologies like Magnetoresistive RAM (MRAM) are gaining traction. MRAM provides non-volatility with SRAM-like speed, making it an ideal candidate for storing boot code, critical configuration settings, and firmware logs that require high endurance and fast write capabilities, often used in conjunction with the main processing unit to achieve instantaneous wake-up functionality and fail-safe operation.

- LPDDR5/LPDDR5X: High-speed, low-power volatile memory standard crucial for powering AI accelerators and centralized domain controllers in EVs.

- Universal Flash Storage (UFS 3.1 and higher): Replacing eMMC to provide superior sequential and random read/write performance for automotive infotainment and software updates.

- Automotive-Grade NAND Flash: High-density, robust 3D NAND tailored for extended temperature ranges, mandatory for storing map data, ADAS logs, and OS images.

- MRAM and PCM: Emerging non-volatile technologies offering superior endurance, speed, and non-volatility for mission-critical boot processes and data logging in safety systems.

- AEC-Q100 and ASIL-D Compliance: Specialized qualification and redundancy technologies built into the memory ICs and packaging to ensure functional safety and reliability.

Regional Highlights

The global Memory of Connected and Autonomous Vehicle Market exhibits distinct growth patterns across major regions, heavily influenced by regulatory environments, consumer adoption rates of electric vehicles, and local manufacturing capabilities. Asia Pacific (APAC) is currently the dominant and fastest-growing region, primarily fueled by the aggressive electrification mandates and rapid technological scaling in China, Japan, and South Korea. China’s substantial investment in 5G infrastructure and Smart City initiatives directly supports the development and deployment of V2X communication technologies, which are highly reliant on high-speed, reliable memory solutions in both roadside units and vehicles. South Korean and Japanese manufacturers, global leaders in semiconductor production, are driving innovation in high-density memory tailored specifically for automotive use cases, capitalizing on proximity to major OEM hubs.

North America and Europe represent technologically mature markets where growth is concentrated in the high-value, highly regulated segments of L3 and L4 autonomy. The United States and Germany, in particular, prioritize the stringent implementation of functional safety standards (ASIL requirements), driving demand for premium memory solutions that incorporate advanced redundancy and ECC features. European regulation focuses heavily on cybersecurity and data privacy, boosting demand for memory modules with integrated hardware security features and secure element capabilities. While unit volumes may be lower than APAC, the average memory content per vehicle in high-end European and North American models is significantly higher due to complex driver assistance features and premium digital cockpits.

Latin America and the Middle East & Africa (MEA) currently constitute smaller but emerging markets, with growth primarily concentrated in urban areas adopting basic connected vehicle technologies (Telematics and basic ADAS Level 1/2). Telematics systems for fleet management and insurance monitoring are key drivers in these regions, requiring standard automotive-grade eMMC and LPDDR4 memory solutions. Future growth is expected to align with increasing infrastructure development and local manufacturing initiatives, particularly in countries aiming to reduce reliance on imported vehicles and establish localized EV supply chains, which will gradually increase the demand for specialized memory components.

- Asia Pacific (APAC): Dominates market share and growth rate; driven by high volume EV manufacturing in China, government support for smart mobility, and localized semiconductor fabrication expertise (Samsung, SK Hynix, Kioxia).

- North America: Strong demand for high-performance L4/L5 memory and AI acceleration components; focus on integrating stringent cybersecurity standards and advanced software-defined vehicle architectures.

- Europe: Characterized by high regulatory standards (ASIL-D), driving premium pricing for functionally safe memory; focus on integrating advanced ADAS features and V2X standards.

- Latin America & MEA: Emerging markets with primary adoption centered on telematics, fleet management, and basic connected features (eMMC, LPDDR4).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Memory of Connected and Autonomous Vehicle Market.- Samsung Electronics Co. Ltd.

- Micron Technology Inc.

- SK Hynix Inc.

- Kioxia Corporation

- Western Digital Corporation

- Infineon Technologies AG (Cypress Semiconductor)

- Nanya Technology Corporation

- Winbond Electronics Corporation

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- Intel Corporation

- MediaTek Inc.

- Microchip Technology Inc.

- Integrated Silicon Solution Inc. (ISSI)

- Dialog Semiconductor (Adesto Technologies Corporation)

- Rambus Inc.

- Advanced Micro Devices (AMD, Xilinx)

- Tsinghua Unigroup Co., Ltd.

- Macronix International Co. Ltd.

- GigaDevice Semiconductor Inc.

Frequently Asked Questions

Analyze common user questions about the Memory of Connected and Autonomous Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between memory required for Level 2 versus Level 5 autonomous vehicles?

Level 2 systems rely on distributed memory (eMMC, LPDDR4) with moderate capacity for specific ADAS functions. Level 5 systems require centralized, massive memory arrays (LPDDR5X, HBM) with extremely high bandwidth, low latency, and full ASIL-D certification to handle petabytes of real-time sensor fusion data and complex AI inference necessary for mission-critical operations.

How does functional safety standard ASIL-D impact automotive memory design?

ASIL-D mandates the highest level of system integrity, requiring memory components to incorporate integrated hardware-based Error Correction Code (ECC), redundancy mechanisms, and stringent thermal testing (AEC-Q100 Grade 1). This ensures data integrity and operational reliability even in the event of component failure, which is crucial for critical functions like steering and braking control.

Which non-volatile memory (NVM) technology is replacing eMMC in high-performance connected vehicles?

Universal Flash Storage (UFS), specifically UFS 3.1 and newer standards, is rapidly replacing eMMC. UFS offers superior performance metrics, including significantly faster sequential and random read/write speeds through its serial interface, which is essential for rapid boot-up of complex operating systems and handling continuous OTA software updates.

What role does memory play in vehicle-to-everything (V2X) communication?

Memory provides the low-latency storage and processing buffer needed for V2X communications, handling encrypted data packets from nearby infrastructure and vehicles. Fast DRAM is necessary for real-time processing of situational awareness data, ensuring instantaneous decision-making critical for collision avoidance and traffic optimization algorithms.

What is the expected Compound Annual Growth Rate (CAGR) for the Memory of Connected and Autonomous Vehicle Market?

The market is projected to exhibit a robust growth trajectory, expected to grow at a CAGR of 18.5% between 2026 and 2033, driven primarily by the escalating demand for high-capacity, high-speed memory modules necessary for achieving Level 3 and higher autonomous driving capabilities globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager