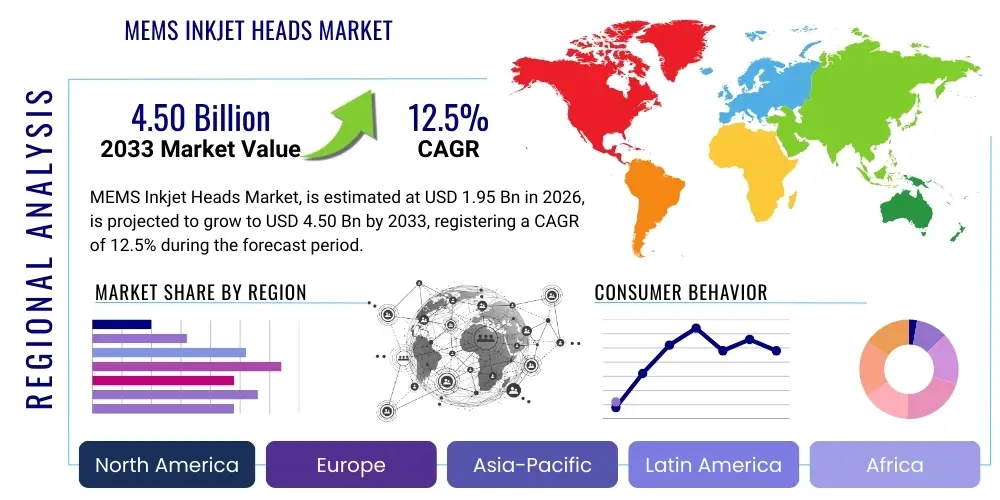

MEMS Inkjet Heads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437269 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

MEMS Inkjet Heads Market Size

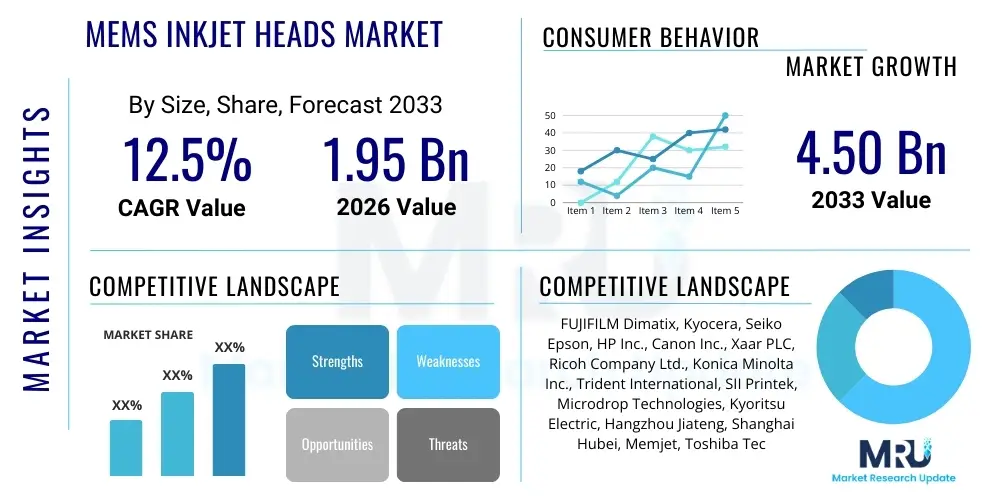

The MEMS Inkjet Heads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $4.50 Billion by the end of the forecast period in 2033.

MEMS Inkjet Heads Market introduction

The Micro-Electro-Mechanical Systems (MEMS) inkjet heads market encompasses precision components crucial for digital printing systems across various industries. These devices utilize semiconductor manufacturing techniques to create highly precise nozzles and firing mechanisms, enabling faster, higher resolution, and more reliable jetting of inks, functional fluids, or specialized materials. MEMS technology allows for the integration of thousands of nozzles onto a single chip, significantly improving droplet control and operational efficiency compared to traditional bulk manufacturing methods. This advancement is fundamental to the rapid adoption of digital printing in industrial sectors, including textiles, packaging, and additive manufacturing.

MEMS inkjet heads are categorized primarily based on their actuation mechanism: thermal and piezoelectric. Thermal MEMS heads, predominantly used in consumer and office printing, generate bubbles through heating elements to eject ink. Piezoelectric MEMS heads, favored in industrial and commercial applications, use PZT (lead zirconate titanate) materials that deform when an electric field is applied, offering greater fluid compatibility and durability. The core benefits driving market growth include exceptional durability, high operational frequency, reduced power consumption, and the ability to handle a broader range of viscous and particle-laden fluids, making them indispensable for advanced manufacturing processes such as printed electronics and biomedical applications.

Major applications span from traditional high-speed graphics and photography to cutting-edge functional deposition. Driving factors include the accelerating shift from analog to digital processes in manufacturing, the demand for mass customization in packaging and textiles, and the continuous technological push for smaller drop sizes and higher resolutions. Furthermore, the integration of inkjet technology into 3D printing and advanced display manufacturing (OLED) positions MEMS heads as essential enablers for next-generation fabrication methods requiring precise material placement.

MEMS Inkjet Heads Market Executive Summary

The MEMS Inkjet Heads Market is experiencing robust expansion, fundamentally driven by the industrial shift towards digital workflows and the inherent advantages of MEMS technology in precision fluid handling. Key business trends indicate intensified merger and acquisition activities focused on integrating advanced materials science with semiconductor fabrication expertise, particularly in Asia Pacific, where manufacturing capacity is rapidly scaling. Technological innovation is centered on developing higher density arrays and heads compatible with increasingly complex, functional fluids (e.g., metallic inks, conductive polymers), pushing the boundaries of jetting frequency and drop volume consistency essential for critical industrial applications like high-speed singulation and photovoltaic manufacturing. Supply chain optimization, driven by geopolitical considerations and the need for component reliability, is also a critical theme.

Regional trends highlight the Asia Pacific (APAC) as the epicenter of both demand and production capacity, fueled by the vast consumer electronics, textile, and packaging industries in China, Japan, and South Korea. Europe and North America maintain significant market shares, largely dominating the high-value industrial and specialty printing segments, focusing on R&D for biomedical, pharmaceutical, and 3D printing applications where stringent reliability standards are mandated. The competitive landscape remains oligopolistic, with established Japanese, American, and European players holding proprietary intellectual property related to micro-fabrication processes and actuation mechanisms, making market entry challenging for new participants.

Segmentation analysis underscores the dominance of piezoelectric MEMS heads in terms of revenue, attributed to their suitability for heavy-duty, continuous industrial use, superior chemical inertness, and ability to handle variable viscosities. Conversely, thermal MEMS technology continues to lead in unit volume within the consumer segment, benefiting from cost-effectiveness and compact design. Application trends show the industrial printing segment (including decorative laminates, ceramics, and direct-to-garment) exhibiting the fastest CAGR, surpassing traditional document printing as the primary growth accelerator. This segmentation performance reflects the broader macroeconomic shift towards personalization, efficient manufacturing, and reduced material waste enabled by precise digital deposition.

AI Impact Analysis on MEMS Inkjet Heads Market

User inquiries regarding AI's impact on MEMS inkjet heads frequently center on how machine learning optimizes printing consistency, predicts component failure, and enhances material deposition precision. Specific concerns involve the integration of sophisticated algorithms for real-time monitoring of nozzle health, optimizing fluid characteristics based on environmental conditions, and automating complex industrial printing setups. Users seek assurance that AI can minimize downtime in high-volume production environments and improve yield rates in sensitive applications like printed electronics, where micrometer accuracy is mandatory. The consensus expectation is that AI will transform heads from passive components into smart, self-optimizing systems, necessitating deeper integration between software control layers and the MEMS hardware.

AI's influence is multi-faceted, extending from manufacturing quality control to operational performance optimization. In the fabrication of MEMS heads, AI-driven visual inspection and defect classification systems significantly reduce manufacturing variance and improve yield rates for complex silicon wafers. Operationally, predictive maintenance algorithms utilize historical data on pressure, temperature, and waveform characteristics to anticipate nozzle clogging or performance degradation before it impacts print quality, thereby maximizing throughput and minimizing expensive material waste. Furthermore, AI is crucial in material science research, assisting in the rapid formulation and testing of novel inks and fluids compatible with specific MEMS architectures, accelerating product development cycles.

The application of deep learning in industrial settings allows for adaptive print parameter adjustments. For example, in high-speed textile printing, AI can dynamically compensate for fabric warp or environmental humidity changes by instantly modulating waveform voltage and frequency, ensuring consistent color density and droplet placement across vast areas. This capability moves beyond simple automation to genuine system intelligence, addressing the core limitations of fixed-parameter printing processes. This integration of computational intelligence ensures that MEMS inkjet systems remain at the forefront of digital manufacturing capabilities, delivering unprecedented levels of precision and reliability across diverse applications.

- AI-driven Predictive Maintenance: Enhances nozzle health monitoring and predicts component lifespan, minimizing industrial downtime.

- Real-time Process Optimization: Algorithms dynamically adjust firing parameters (waveform, voltage, frequency) based on fluid viscosity and environmental feedback.

- Automated Quality Control: Uses computer vision and machine learning for defect detection during head manufacturing, boosting fabrication yield.

- Ink Formulation Acceleration: AI assists in simulating and testing new functional fluids (conductive, biological) for compatibility with MEMS structures.

- Adaptive Manufacturing: Enables self-correction in high-precision applications like printed electronics and OLED display manufacturing.

DRO & Impact Forces Of MEMS Inkjet Heads Market

The MEMS Inkjet Heads market dynamics are shaped by a complex interplay of high-growth drivers, stringent technical restraints, and burgeoning opportunities in high-value industrial sectors. Primary drivers include the escalating global demand for digital printing across packaging, ceramics, and textiles, fueled by the necessity for shorter production runs, customization, and sustainable, on-demand manufacturing models. The unique selling proposition of MEMS—its capacity for high resolution, high speed, and compatibility with diverse functional fluids—reinforces its position as the preferred technology foundation. However, restraints such as the substantial upfront capital investment required for MEMS fabrication facilities, the steep technical complexity involved in micro-nozzle manufacturing, and the intellectual property barriers held by key established players pose significant limitations to market expansion and diversification.

Opportunities are largely concentrated in emerging industrial applications that require precise material deposition beyond traditional graphic arts. This includes advanced manufacturing fields such as 3D bioprinting, printed circuit board (PCB) fabrication, flexible electronics, and drug delivery systems, where the ability to jet picoliter-scale volumes of highly specific materials offers transformative potential. Furthermore, the push towards sustainability drives opportunity, as digital inkjet reduces water consumption and material waste compared to conventional analog printing methods. Successfully capitalizing on these opportunities requires deep collaboration between MEMS manufacturers, material scientists, and end-user system integrators.

The impact forces within the market are predominantly technological and regulatory. The rapid evolution of fluid dynamics simulation and materials science continuously pushes the operational limits of the heads, demanding higher reliability and resolution. Regulatory pressure concerning environmental impact, especially the solvents and heavy metals used in industrial inks, necessitates continuous R&D into greener, compliant fluid chemistries that must still function flawlessly within the tiny apertures of MEMS devices. Competitive intensity among the top-tier manufacturers also acts as a forceful driver for innovation, compelling companies to develop proprietary actuation methods and sophisticated driver electronics to maintain market dominance.

Segmentation Analysis

The MEMS Inkjet Heads Market is meticulously segmented based on key technological attributes, operational parameters, and end-use applications, providing a granular view of market structure and growth trajectory. The segmentation by technology—Thermal vs. Piezoelectric—is foundational, dictating suitability for consumer versus industrial applications, respectively. Piezoelectric heads command the high-value industrial segment due to superior durability and compatibility with specialized, high-viscosity inks required in ceramics and functional printing. Application segmentation reveals the fastest growth in non-graphic industrial sectors such as additive manufacturing (3D printing) and printed electronics, reflecting the technology's critical role in next-generation fabrication processes.

- By Technology

- Thermal Inkjet (TIJ)

- Piezoelectric Inkjet (PIJ)

- By Application

- Consumer Printing (Office/Home)

- Commercial Printing (Signage, Graphics)

- Industrial Printing

- Textile Printing (DTG, Digital Fabric)

- Packaging Printing (Corrugated, Flexible)

- Ceramics and Decorative Printing

- Printed Electronics (OLED, PCB, Conductive Traces)

- 3D Printing and Additive Manufacturing

- Specialty Applications (Bioprinting, Pharmaceutical)

- By Drop Volume

- Picoliter (1 pL to 100 pL)

- Femtoliter (Sub-picoliter)

- By Resolution (DPI)

- 300-600 DPI

- 600-1200 DPI

- 1200+ DPI (High-resolution industrial)

Value Chain Analysis For MEMS Inkjet Heads Market

The value chain for the MEMS Inkjet Heads market is highly specialized, beginning with complex upstream activities involving raw material procurement and highly advanced semiconductor manufacturing. Upstream activities are dominated by suppliers of silicon wafers (often customized for MEMS), advanced piezoelectric materials (PZT ceramics), and precision metals necessary for nozzle plate fabrication. These processes require extremely clean environments (cleanrooms) and sophisticated micro-lithography and etching techniques, making this stage a significant barrier to entry. Key vendors here include specialized material scientists and semiconductor foundries that adhere to stringent quality control standards essential for functional reliability.

Midstream involves the core manufacturing and assembly of the inkjet heads. This stage includes micro-fabrication, bonding (wafer-to-wafer or film bonding), packaging, and integration with drive electronics and fluidic manifolds. MEMS manufacturers (the core players like Epson, Canon, and HP) not only fabricate the chip but also design proprietary ASIC driver chips and fluid delivery systems tailored to their specific head architecture (e.g., thin-film piezoelectric actuators versus silicon heater elements). The technical superiority and intellectual property residing in this midstream fabrication define competitive advantage within the market.

Downstream activities involve the distribution channel and the integration of the heads into finished printing systems. MEMS heads are rarely sold directly to end-users; rather, they are channeled through Original Equipment Manufacturers (OEMs) who design and build industrial printers (e.g., large format printers, digital textile machines, 3D printers). Distribution is primarily indirect through these OEMs and system integrators. Direct channels are mostly limited to providing replacement heads or specialized R&D units. Success in the downstream market hinges on strong technical support, efficient logistics for sensitive components, and robust partnerships with major system manufacturers that service the diverse industrial end-user base.

MEMS Inkjet Heads Market Potential Customers

The potential customer base for MEMS Inkjet Heads is highly diversified, spanning major industrial and commercial sectors that rely on digital deposition technologies. The primary end-users are Original Equipment Manufacturers (OEMs) of digital printing equipment, who integrate the heads into final products like wide-format graphic printers, high-speed single-pass industrial machines, and specialty 3D printers. These OEMs constitute the largest direct buyer segment, driving demand based on the features and performance metrics required by their targeted vertical markets, such as high-resolution textile printing or robust corrugated packaging lines.

Beyond traditional printing OEMs, a rapidly growing segment of potential customers includes advanced manufacturing firms involved in printed electronics and functional material deposition. Companies manufacturing OLED displays, flexible solar cells, specialized sensors, and high-density circuit boards are crucial buyers. These organizations prioritize specific head characteristics such as material compatibility (handling conductive inks, insulating polymers), drop volume control (often sub-picoliter), and long-term chemical inertness. Their purchasing decisions are driven by process yield and ability to handle high-value materials with minimal waste.

Furthermore, research institutions, pharmaceutical companies, and biomedical device manufacturers represent a niche but high-growth customer segment. These buyers utilize MEMS heads for applications like 3D bioprinting (jetting living cells), drug discovery assays, and micro-array fabrication. For these critical applications, the unmatched precision and gentle fluid handling capabilities of certain piezoelectric MEMS architectures are indispensable. They are not merely buying a printing component but a highly sophisticated, repeatable micro-dosing mechanism essential for biological or chemical experimentation and production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $4.50 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FUJIFILM Dimatix, Kyocera, Seiko Epson, HP Inc., Canon Inc., Xaar PLC, Ricoh Company Ltd., Konica Minolta Inc., Trident International, SII Printek, Microdrop Technologies, Kyoritsu Electric, Hangzhou Jiateng, Shanghai Hubei, Memjet, Toshiba Tec Corporation, Agfa-Gevaert NV, Meteor Inkjet Ltd., Kodak. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MEMS Inkjet Heads Market Key Technology Landscape

The technology landscape of the MEMS Inkjet Heads market is defined by continuous advancements in actuation methods, materials science, and integration capabilities. The fundamental divergence lies between thermal and piezoelectric mechanisms. Thermal MEMS technology relies on micro-heaters to vaporize a small volume of ink, creating a bubble that ejects a droplet. While cost-effective and capable of high speeds, TIJ heads are generally limited to water-based inks and suffer from material degradation due due to high heat cycles. Conversely, Piezoelectric MEMS heads utilize voltage-induced mechanical deformation of PZT film integrated onto the silicon wafer, pushing the ink droplet out. PIJ is superior for industrial applications as it supports a vast range of fluid viscosities and chemistries (including UV, solvent, and highly viscous functional fluids) and offers significantly longer lifespan.

Recent technological focus has shifted toward improving the density and uniformity of nozzle arrays. High-density arrays, featuring thousands of nozzles per inch (NPI), are crucial for achieving the single-pass industrial printing speeds demanded by packaging and textile sectors. Manufacturers are investing heavily in advanced silicon etching techniques and fluidic design to ensure minimal cross-talk and uniform droplet characteristics across the entire print width. Furthermore, the development of thin-film piezoelectric materials (TFP) deposited directly onto silicon wafers represents a major technological leap, allowing for miniaturization, lower drive voltage, and higher actuation frequency compared to older bulk piezo ceramics, further enhancing print speed and energy efficiency.

Another pivotal area is the integration of advanced driver electronics and waveform generation capabilities. MEMS heads require precise electrical pulses (waveforms) to control droplet size and velocity accurately. Modern systems incorporate sophisticated Application-Specific Integrated Circuits (ASICs) that allow for multi-level grayscale printing (variable drop sizes) and complex waveform tuning, which is essential when jetting non-standard, particle-laden functional materials. The ability to dynamically adjust these waveforms in real-time based on fluid temperature and viscosity ensures stable, reliable jetting, directly addressing reliability concerns that previously hampered the widespread adoption of inkjet in high-precision manufacturing environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of both consumption and production capacity. Driven by massive textile, packaging, and consumer electronics manufacturing hubs in China, Japan, and South Korea. APAC's robust industrial base necessitates continuous adoption of high-speed digital systems, particularly piezoelectric MEMS heads for industrial processes and display fabrication (OLED printing).

- North America: Characterized by high investment in R&D and specialty applications. Strong focus on 3D printing, advanced biomedical applications (bioprinting), and high-security document printing. The region demands high-performance, complex systems and is a key early adopter of new MEMS technologies, often prioritizing precision and compatibility over sheer volume.

- Europe: A mature market segment leader in high-end industrial and commercial printing, including ceramics, decorative surfacing, and specialized packaging. Germany and Italy are major manufacturing centers for industrial printing equipment, driving consistent demand for durable, reliable piezoelectric MEMS heads capable of continuous operation in rigorous factory environments.

- Latin America (LATAM): Emerging market primarily driven by growth in consumer and commercial printing, with increasing penetration of digital textile printing in countries like Brazil and Mexico. Market growth is sensitive to economic volatility but shows potential for industrial adoption as manufacturing localizes.

- Middle East and Africa (MEA): Smallest regional share, focused mainly on commercial signage and nascent packaging industries. Demand is steadily increasing, supported by urbanization and infrastructure development, leading to investment in graphic and entry-level industrial digital printing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MEMS Inkjet Heads Market.- FUJIFILM Dimatix Inc.

- Kyocera Corporation

- Seiko Epson Corporation

- HP Inc.

- Canon Inc.

- Xaar PLC

- Ricoh Company Ltd.

- Konica Minolta Inc.

- Trident International Inc.

- SII Printek Inc.

- Microdrop Technologies GmbH

- Kyoritsu Electric Co., Ltd.

- Hangzhou Jiateng Digital Technology Co., Ltd.

- Shanghai Hubei Inkjet Technology Co., Ltd.

- Memjet Technology Ltd.

- Toshiba Tec Corporation

- Agfa-Gevaert NV

- Meteor Inkjet Ltd.

- Kodak (Eastman Kodak Company)

- Brother Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the MEMS Inkjet Heads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Thermal and Piezoelectric MEMS inkjet heads?

Thermal inkjet (TIJ) heads use heat to vaporize ink and eject droplets, typically limited to water-based fluids and consumer applications. Piezoelectric inkjet (PIJ) heads use mechanical pressure from ceramic deformation to eject ink, offering compatibility with a wider range of industrial fluids (UV, solvent, functional inks) and superior durability, making them dominant in industrial sectors.

Which application segment drives the highest growth rate for MEMS inkjet technology?

The Industrial Printing segment, particularly sub-segments such as Printed Electronics (OLED, circuit fabrication), 3D Printing, and Digital Textile Manufacturing, exhibits the highest growth rate due to the increasing demand for high-precision material deposition and mass customization capabilities that MEMS technology uniquely supports.

How does the high capital cost of MEMS fabrication impact market competition?

The substantial capital investment required for cleanroom facilities, highly specialized semiconductor equipment, and proprietary lithography processes acts as a significant barrier to entry, resulting in an oligopolistic market structure dominated by a few large, experienced players (like Epson, Canon, and HP) who possess the necessary expertise and intellectual property (IP).

What role does Artificial Intelligence play in optimizing MEMS inkjet operations?

AI is crucial for predictive maintenance by monitoring real-time performance metrics to anticipate nozzle failures and minimize downtime. It also enables dynamic, real-time optimization of printing waveforms, ensuring consistent droplet quality and placement, especially when handling complex functional fluids under varying environmental conditions.

Which geographic region holds the largest market share and why?

The Asia Pacific (APAC) region holds the largest market share, driven by its expansive and rapidly digitizing industrial sectors, including high-volume manufacturing of consumer electronics, textiles, and packaging. These industries require the speed, precision, and efficiency offered by advanced MEMS inkjet systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Piezo MEMS Inkjet Heads Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Silex, ST, ROHM, Silicon Sensing), By Application (Consumer, Office, Industrial & Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Mems Inkjet Heads Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thermal Inkjet Heads, Piezo Inkjet Heads), By Application (Residential, Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager