MEMS VOA Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431553 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

MEMS VOA Market Size

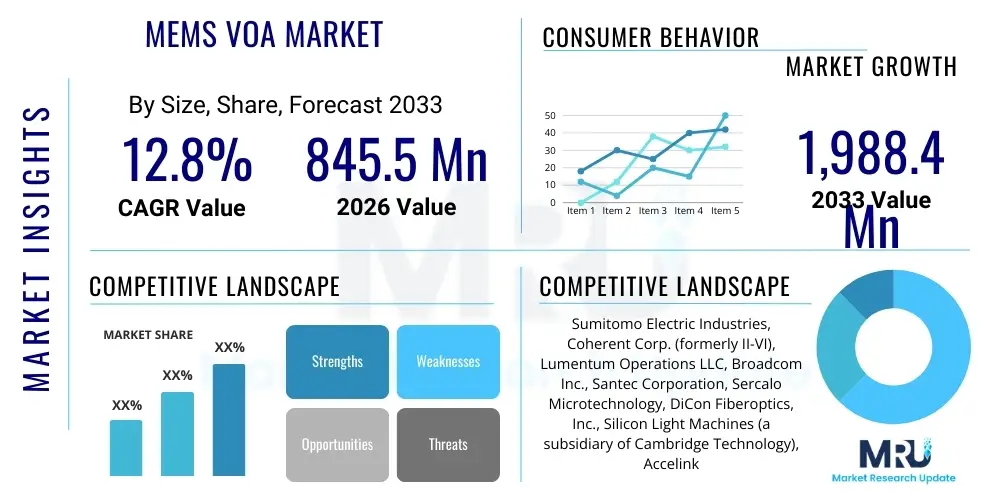

The MEMS VOA Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 845.5 million in 2026 and is projected to reach USD 1,988.4 million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating global demand for high-bandwidth optical networks, primarily driven by the pervasive rollout of 5G infrastructure, the continuous expansion of hyperscale data centers, and the migration toward more efficient, integrated silicon photonics solutions. MEMS Variable Optical Attenuators (VOAs) offer the critical ability to dynamically manage and stabilize optical power levels within dense wavelength division multiplexing (DWDM) systems, ensuring signal integrity and maximizing network performance.

The market expansion is further influenced by the inherent advantages of MEMS technology, including their compact footprint, low power consumption, high response speed, and capability for array integration. These characteristics make them ideally suited for modern optical transceivers and passive optical network (PON) systems where space and energy efficiency are paramount. The shift from traditional bulk optics or thermal-optic attenuators to MEMS-based components is a major catalyst, particularly in high-channel-count fiber optic communication systems that demand precise, real-time power equalization across multiple wavelengths. As network speeds transition to 400G and 800G, the necessity for robust, fast-acting attenuation mechanisms embedded directly within photonic integrated circuits (PICs) solidifies the market’s positive outlook.

Geographically, the Asia-Pacific region, fueled by massive investment in fiber-to-the-home (FTTH) deployment and the establishment of vast data center corridors in countries like China, India, and Japan, is expected to remain the dominant revenue generator and highest growth market. Simultaneously, North America continues to drive technological innovation, focusing on integrating MEMS VOAs into advanced coherent optical modules and specialized defense and aerospace communication systems. Overall market health is directly correlated with global capital expenditure in telecommunications infrastructure and cloud computing services, both of which show sustained, aggressive growth projections throughout the forecast period.

MEMS VOA Market introduction

The Micro-Electro-Mechanical Systems (MEMS) Variable Optical Attenuator (VOA) is a critical component in advanced fiber optic communication systems, designed to control and stabilize the power level of light signals passing through a fiber. Unlike fixed attenuators, VOAs provide dynamic control, allowing network operators to compensate for signal fluctuations, equalize channel power in DWDM systems, and perform power monitoring. MEMS technology utilizes microscopic mechanical structures, often implemented on a silicon substrate, where moving parts—such as tilting mirrors or sliding shutters—physically manipulate the optical path to achieve variable attenuation. This methodology results in devices characterized by low insertion loss, high precision, low polarization dependent loss (PDL), and excellent repeatability, making them superior alternatives to older technologies like thermo-optic or liquid crystal-based attenuators in high-performance applications.

Major applications of MEMS VOAs are concentrated within the telecommunications sector and data center interconnects. In DWDM systems, VOAs are indispensable for dynamically balancing the power levels of numerous wavelength channels, preventing receiver saturation, and ensuring optimum signal-to-noise ratios (OSNR) across the optical link. Furthermore, they are vital components in FTTx networks, particularly in optical line terminals (OLTs) and optical network units (ONUs), where they manage varying signal power levels arising from different fiber lengths. Beyond traditional telecom, MEMS VOAs are increasingly adopted in sophisticated sensing applications, medical diagnostics utilizing fiber optics, and specialized military and aerospace communication links due to their ruggedness and small form factor. The adaptability of MEMS allows for the creation of VOA arrays, facilitating the simultaneous management of multiple optical channels within a single compact package.

The primary driving factors propelling the MEMS VOA market include the exponential growth in global internet traffic and the subsequent need for higher transmission capacity, largely fueled by video streaming, cloud computing, and the proliferation of IoT devices. The global transition to 5G necessitates densification of fiber networks and deployment of advanced optical modules, where the high-speed, precise control offered by MEMS VOAs is essential. Additionally, the ongoing trend toward component miniaturization and integration in silicon photonics platforms significantly favors MEMS technology over bulk optic solutions, offering system architects cost reduction, enhanced scalability, and improved overall system performance. The benefits of low power consumption and small physical size are key differentiators in power-sensitive and space-constrained environments like hyperscale data centers.

MEMS VOA Market Executive Summary

The MEMS VOA market is experiencing robust growth, driven primarily by fundamental shifts in global digital infrastructure investment. Key business trends indicate a strong move toward high-density VOA arrays (e.g., 1x8, 1x16) that support integration into complex photonic integrated circuits (PICs), necessary for next-generation 400G and 800G coherent transceivers. Manufacturers are focusing on reducing insertion loss and improving the long-term reliability of the mechanical microstructures to meet stringent telecommunications standards. Strategic partnerships between MEMS component suppliers and large telecom equipment manufacturers (OEMs) are crucial for accelerating product development and ensuring high-volume deployment. Furthermore, sustainability is emerging as a critical trend, favoring MEMS VOAs due to their ultra-low power consumption compared to thermal alternatives, aligning with green data center initiatives.

Regionally, Asia Pacific (APAC) dominates the market share, largely due to unprecedented investment in 5G rollouts, government-backed FTTH expansion programs, and the concentration of electronic and optical manufacturing capabilities, especially in China, South Korea, and Taiwan. North America remains a leader in technology adoption and high-end application segments, specifically within high-speed data center interconnection (DCI) and specialized defense communications, focusing on low-latency, high-reliability components. Europe shows steady growth, driven by research and development activities in advanced photonics and early adoption of sophisticated metro and long-haul network upgrades, though it lags behind APAC in sheer volume production and deployment scale.

Segmentation trends reveal that the Application segment dominated by DWDM systems maintains the largest market share, but the FTTx segment exhibits the highest projected CAGR, reflecting the sustained investment in broadband infrastructure globally. In terms of Type, the electrostatic actuation mechanism is preferred for its faster response time and negligible power consumption during steady-state operation, especially in dynamic network environments. Moreover, there is an increasing demand for integrated VOAs designed specifically for silicon photonics platforms, shifting the market focus from standalone components to highly integrated sub-systems, paving the way for further miniaturization and cost reduction in optical modules. These converging technological and regional dynamics solidify the MEMS VOA market's role as foundational to future high-speed digital communications.

AI Impact Analysis on MEMS VOA Market

User queries regarding the impact of Artificial Intelligence (AI) on the MEMS VOA market primarily revolve around three key areas: the data center infrastructure requirements imposed by AI workloads, the role of dynamic optical components in enabling AI-driven network automation, and the integration of AI models for predictive maintenance and performance optimization of optical networks. Common questions include: "How does the massive data movement required by generative AI affect VOA demand?", "Can MEMS VOAs handle the dynamic power fluctuations in AI clusters?", and "Will AI lead to fully autonomous optical transport networks (OTNs), increasing the need for precision components like VOAs?". The underlying theme is the critical relationship between AI’s demand for ultra-high-speed, low-latency communication and the technical capabilities of advanced optical components to meet those demands efficiently and dynamically.

AI inference and training models generate unparalleled levels of east-west traffic within data centers and require instantaneous, high-throughput connections between GPU clusters and storage units. This surge in data movement necessitates continuous optical signal integrity management, directly increasing the demand for MEMS VOAs. VOAs are vital for dynamically equalizing power across dense interconnects, compensating for thermal drifts, and maintaining optimal signal quality across complex leaf-spine architectures. The move towards specialized AI data centers adopting advanced topologies like hypercubes and toroidal structures further emphasizes the need for fast, high-density VOA arrays to ensure seamless resource allocation and bandwidth provisioning without manual intervention, thereby acting as critical enablers for massive, scalable AI infrastructure.

Furthermore, AI is not just a consumer of high-speed networks but also a sophisticated tool for managing them. AI-driven network optimization and self-healing algorithms rely on precise feedback and actuation capabilities provided by components such as MEMS VOAs. By using AI to analyze real-time performance data—such as insertion loss, optical signal-to-noise ratio (OSNR), and bit error rate (BER)—the network can autonomously command VOAs to adjust power levels dynamically and preemptively, preventing network degradation or failure. This application of AI transforms the VOA from a passive regulator into an integral component of an active, intelligent optical layer, ensuring unprecedented levels of resilience and operational efficiency in complex cloud environments.

- AI drives massive east-west data center traffic, increasing demand for high-density, dynamic VOA arrays in DCI (Data Center Interconnect) and optical switching fabrics.

- AI requires instantaneous bandwidth provisioning and low latency, relying on the fast response time and precision of electrostatic MEMS VOAs for dynamic power equalization.

- Integration of MEMS VOAs into silicon photonics platforms is crucial for creating compact, high-throughput optical engines demanded by AI accelerators.

- AI algorithms are employed for predictive maintenance and real-time power optimization in optical transport networks, utilizing VOAs as remote, high-precision actuation elements.

- The development of autonomous optical networks (Self-Driving Networks) leverages MEMS VOA technology to achieve real-time, software-defined control over optical power budgets and channel equalization.

- Demand for specialized VOAs with extremely low Polarization Dependent Loss (PDL) increases due to stringent requirements in coherent communications heavily utilized in AI supercomputing interconnects.

DRO & Impact Forces Of MEMS VOA Market

The dynamics of the MEMS VOA market are shaped by a complex interplay of drivers, restraints, and opportunities (DRO), which collectively form the impact forces determining market evolution. The dominant driver is the unrelenting global data traffic explosion, necessitating continuous upgrades to optical network capacity across core, metro, and access networks, including the transition to 5G infrastructure and FTTH expansion. This demand fuels technological advancements, particularly the integration of VOAs into highly scalable silicon photonics platforms, optimizing system size, cost, and power efficiency. Another significant force is the stringent performance requirements of advanced coherent transmission systems (400G/800G), which mandate components with high precision, low PDL, and quick response times, perfectly matching the capabilities of MEMS technology.

Despite strong drivers, the market faces notable restraints. The primary concern revolves around the long-term mechanical reliability and durability of MEMS structures, particularly when deployed in harsh operating environments or when subjected to millions of actuation cycles over a decade. End-users, especially Tier 1 telecom carriers, often mandate extremely high reliability standards, sometimes preferring proven, albeit bulkier, non-MEMS solutions. Furthermore, the specialized fabrication requirements of MEMS devices often result in high initial manufacturing costs and capital expenditure on foundry tooling, creating barriers for new entrants and potentially slowing down mass market adoption compared to simpler optical components. The dependency on highly specialized semiconductor fabrication processes also introduces supply chain complexity and potential vulnerability to geopolitical or trade disruptions affecting key material suppliers.

Opportunities for growth are abundant, particularly in emerging application segments. The proliferation of optical sensing technologies, including Fiber Optic Gyroscopes (FOGs) and advanced biomedical imaging, provides new, high-value markets beyond traditional telecom. Furthermore, the development of hybrid integration techniques, merging MEMS actuation with passive optical components, offers pathways for creating highly functional, customizable photonic integrated circuits (PICs) at reduced costs. The move towards dynamic bandwidth allocation in software-defined networking (SDN) also presents a major opportunity, positioning MEMS VOAs as essential dynamic elements for realizing flexible, reconfigurable optical add/drop multiplexers (ROADMs) and programmable transceivers. These impact forces collectively push the market toward higher integration, greater reliability, and expanded application scope, ensuring steady long-term growth.

Segmentation Analysis

The MEMS VOA market is meticulously segmented to provide granular insights into market dynamics, enabling strategic focus for stakeholders. The segmentation primarily revolves around three key axes: Type, based on the physical mechanism used for attenuation; Application, detailing the end-use scenario; and Wavelength Range, reflecting the compatibility with specific optical standards. The Type segmentation includes reflective/shutter-based VOAs and beam-steering VOAs, predominantly actuated using electrostatic or thermal principles. Electrostatic actuation is favored for high-speed, low-power applications such as high-capacity data center interconnects, while thermal actuation, though slower, is often simpler to manufacture and deploy in less performance-critical metro networks.

The Application segment highlights where MEMS VOAs provide the most value. DWDM systems currently represent the largest revenue share due to the intensive need for channel power equalization in high-capacity long-haul and metro networks. However, the Fiber-to-the-x (FTTx) segment, encompassing passive optical networks (PONs) for broadband access, exhibits the highest expected growth rate, driven by global connectivity initiatives. Emerging applications like military communications, aerospace, and specialized sensing (e.g., LiDAR) require ruggedized, high-reliability MEMS VOAs, offering premium pricing opportunities for specialized manufacturers.

Understanding these segments allows market participants to tailor their product offerings, whether focusing on low-cost, high-volume components for FTTx infrastructure or developing highly integrated, high-precision array VOAs optimized for next-generation coherent optical modules (400G and beyond) essential for data center and core network upgrades. The trend toward integration with silicon photonics is cross-cutting across all major application segments, influencing the design and packaging requirements for all MEMS VOA types, and fostering market consolidation among vendors offering integrated solutions.

- By Type:

- Electrostatic MEMS VOA

- Thermal MEMS VOA

- Magnetic MEMS VOA

- By Configuration:

- Single-Channel VOA

- VOA Array (1x4, 1x8, 1x16, etc.)

- By Application:

- DWDM Systems (Dense Wavelength Division Multiplexing)

- FTTx (Fiber to the x) Networks

- Optical Cross-Connect (OXC) and ROADMs (Reconfigurable Optical Add/Drop Multiplexers)

- Test & Measurement Equipment

- Specialized Military and Aerospace Communications

- By Wavelength Range:

- C-Band and L-Band (1530 nm to 1625 nm)

- O-Band (1260 nm to 1360 nm)

- Broadband (Multi-Wavelength)

- By End-User:

- Telecommunication Service Providers

- Data Center Operators (Hyperscalers)

- Equipment Manufacturers (OEMs)

- Government and Defense Agencies

Value Chain Analysis For MEMS VOA Market

The value chain for the MEMS VOA market is characterized by high technological complexity and specialized manufacturing stages, beginning with the foundational materials and culminating in system integration by end-users. The upstream segment is dominated by specialized suppliers providing high-purity silicon wafers (often Silicon-on-Insulator or SOI) and advanced photoresist chemicals required for microfabrication. This segment also includes providers of sophisticated manufacturing equipment, such as Deep Reactive Ion Etching (DRIE) tools and lithography systems, which are critical for creating the intricate micro-mechanical structures central to MEMS functionality. The control over raw material quality and specialized foundry services dictates the ultimate performance and yield of the final VOA component, necessitating strong supplier relationships.

The midstream phase involves the core component manufacturing and assembly. This includes MEMS design and layout, fabrication (typically outsourced to specialized foundries), die singulation, and critical post-processing steps like optical fiber pigtailing, alignment, and packaging. Packaging is particularly challenging for MEMS VOAs, as it must ensure environmental sealing and mechanical stability while maintaining sub-micron precision for optical coupling, directly impacting insertion loss and long-term reliability. Integration with driver electronics and control circuitry also occurs at this stage. Major component manufacturers often operate integrated facilities or rely on specialized optical packaging houses to manage these stringent requirements. Downstream analysis focuses on system integration and deployment, where the VOAs are incorporated into larger systems such as optical transceivers, multiplexers/demultiplexers, and ROADM line cards by major Tier 1 and Tier 2 telecommunications equipment manufacturers (e.g., Cisco, Huawei, Nokia, Ciena).

Distribution channels are structured to handle high-value, low-volume shipments, often relying on direct sales teams for large OEMs and hyperscale data center operators, particularly for customized or proprietary integrated VOA array solutions. Indirect channels involve specialized electronics and optical component distributors that serve smaller equipment builders, research laboratories, and test and measurement companies globally. The high customization level required for many high-performance optical modules means that direct communication and technical support between the MEMS VOA manufacturer and the end-product OEM are paramount. The efficiency of this value chain, from high-yield fabrication to precise assembly and robust distribution logistics, significantly influences the overall time-to-market and cost competitiveness of optical networking equipment globally.

MEMS VOA Market Potential Customers

The primary potential customers and end-users of MEMS VOAs are entities heavily involved in the deployment, operation, and maintenance of high-speed fiber optic networks and specialized photonic systems. The largest customer base resides within the telecommunications sector, encompassing Tier 1 and Tier 2 Telecom Service Providers (TSPs) who invest heavily in expanding their core and metro networks to handle surging data traffic driven by 5G, fixed broadband services, and enterprise connectivity. These TSPs rely on MEMS VOAs, integrated within equipment manufactured by major OEMs, to ensure the optimal performance of DWDM systems, particularly for channel power equalization and dynamic provisioning of bandwidth in ROADMs. The purchasing decision for TSPs is often driven by reliability, compliance with international standards (Telcordia), and long-term operating cost.

The second major cohort comprises hyperscale Cloud Service Providers (CSPs) and large Data Center Operators (DCOs) such as Amazon, Google, Microsoft, and Meta. As these entities build massive internal data center interconnects (DCI), they require unprecedented density and speed in optical components. MEMS VOA arrays are crucial for managing complex, multi-terabit optical links, often integrated directly into compact, pluggable transceivers (e.g., QSFP-DD, OSFP). These customers demand low power consumption, extremely fast response times, and solutions that can be easily scaled and managed via software-defined networking (SDN) interfaces, driving demand for high-performance electrostatic MEMS VOAs integrated into silicon photonics platforms.

A third, high-value segment includes Original Equipment Manufacturers (OEMs) of optical networking equipment and specialized Test & Measurement (T&M) instruments. OEMs purchase VOAs as components to integrate into their final products (e.g., optical amplifiers, transceivers, ROADMs). T&M companies use high-precision MEMS VOAs in calibration standards, automated test systems, and optical power meters where accuracy and repeatability are non-negotiable. Furthermore, potential customers include military and government agencies that utilize specialized fiber optic sensing and communication systems, prioritizing ruggedization, operational temperature range, and resilience against environmental extremes over cost, thus forming a niche but profitable segment for specialized MEMS VOA suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 845.5 Million |

| Market Forecast in 2033 | USD 1,988.4 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Electric Industries, Coherent Corp. (formerly II-VI), Lumentum Operations LLC, Broadcom Inc., Santec Corporation, Sercalo Microtechnology, DiCon Fiberoptics, Inc., Silicon Light Machines (a subsidiary of Cambridge Technology), Accelink Technology, Go!Foton, Kopin Corporation, Radian Precision, Nanonics Imaging Ltd., Agiltron Inc., Optiwave Systems Inc., Micron Optics (Luna Innovations), Yokogawa Electric Corporation, EXFO Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MEMS VOA Market Key Technology Landscape

The technology landscape for MEMS VOAs is centered on advanced microfabrication techniques, specifically utilizing standard semiconductor manufacturing processes to create movable optical components. The dominant fabrication method is silicon processing, often involving Deep Reactive Ion Etching (DRIE) to create high aspect ratio trenches and structures, which are essential for mirrors or shuttles that interact precisely with the optical beam path. The choice of actuation mechanism—predominantly electrostatic or thermal—defines the performance characteristics. Electrostatic actuation, which uses voltage to generate attractive forces between electrodes, provides sub-millisecond response times and virtually zero holding power, making it the preferred method for dynamic, high-speed network applications like adaptive equalization in coherent systems.

Thermal actuation, conversely, utilizes resistive heating to induce expansion in supporting beams, thereby moving the optical element. While slower and requiring continuous power to maintain a fixed attenuation level, thermal MEMS VOAs are generally simpler in design, less sensitive to dust and particle contamination, and often offer a broader attenuation range. A crucial technological trend shaping the market is the integration of MEMS VOAs into Silicon Photonics (SiPh) platforms. By fabricating the VOA structures directly onto the SiPh chip alongside waveguides, modulators, and photodetectors, manufacturers can drastically reduce the package size, insertion loss, and assembly costs. This highly integrated approach is fundamental to achieving the density and power efficiency required for next-generation 400G and 800G optical transceivers used in hyperscale data centers and high-performance computing environments.

Furthermore, attention is increasingly placed on improving polarization dependence loss (PDL) and spectral flatness across the C and L bands. Advanced designs utilize specific tilting mirror geometries or complex shuttle arrangements to minimize the difference in attenuation experienced by different polarization states, a critical requirement for coherent communication systems. Packaging technology also remains a critical area, with continuous innovation focused on hermetic sealing, robust fiber attachment, and precise active alignment techniques to ensure the longevity and reliability of the microscopic moving parts over the mandated operational lifetime of network equipment, typically 10 to 15 years. This technical focus on reliability and integration drives strategic investment across the entire manufacturing supply chain.

Regional Highlights

The global MEMS VOA market exhibits significant regional variation in terms of growth rate, technological adoption, and market share, reflecting differences in telecommunications investment and manufacturing capacity. Asia Pacific (APAC) stands out as the undisputed leader in market size and growth potential. This dominance is propelled by aggressive government policies supporting fiber optic infrastructure (FTTH) expansion, especially in China and India, coupled with widespread and rapid deployment of 5G networks across the region. APAC also hosts a concentration of major electronic and optical component manufacturing hubs, leading to competitive pricing and high-volume production of MEMS VOAs for global export. The demand from major telecom operators in countries like Japan and South Korea for advanced DWDM systems to handle dense urban traffic further cements APAC's market leadership.

North America is characterized by high capital expenditure on hyperscale data centers and the early adoption of cutting-edge networking technologies, making it a pivotal region for high-performance and integrated MEMS VOA solutions. Demand here is less focused on access networks (FTTx) and more driven by sophisticated coherent optical modules (400G/800G) and specialized defense applications. The presence of major technology innovators and cloud providers dictates a preference for highly reliable, low-latency, and silicon photonics integrated components. The region is a key driver of average selling price (ASP) for advanced MEMS VOA arrays due to the stringent performance specifications required for cloud and enterprise solutions.

Europe represents a mature market with steady demand, primarily focused on upgrading existing metro and long-haul networks and substantial research and development in optical communications. While manufacturing volume lags behind APAC, Europe plays a critical role in developing advanced standards and promoting sustainable networking practices, favoring energy-efficient components like electrostatic MEMS VOAs. Latin America and the Middle East & Africa (MEA) are emerging markets, currently characterized by significant, albeit sporadic, infrastructure investment, particularly in urban fiber rollout and localized data center construction. Growth in these regions is expected to accelerate, driven by improving digital penetration rates and increased access to global investment funds for infrastructure projects.

- Asia Pacific (APAC): Dominant market share fueled by large-scale 5G infrastructure buildout, extensive FTTx deployment, and a high concentration of optical component manufacturing in China, Taiwan, and South Korea.

- North America: Leader in technology adoption, driven by hyperscale data center expansion, deployment of 400G/800G coherent optics, and demand from specialized defense and aerospace segments for robust VOAs.

- Europe: Steady growth driven by core network modernization, regulatory focus on high-speed internet access, and significant investment in photonics R&D and standardization efforts.

- Latin America (LATAM): High growth potential driven by ongoing fiber rollout initiatives and increasing regional data center capacity, transitioning from legacy copper infrastructure.

- Middle East & Africa (MEA): Emerging market driven by strategic government investment in smart city projects, undersea cable landings, and the need for new high-capacity long-haul networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MEMS VOA Market.- Sumitomo Electric Industries

- Coherent Corp. (formerly II-VI Incorporated)

- Lumentum Operations LLC

- Broadcom Inc.

- Santec Corporation

- Sercalo Microtechnology

- DiCon Fiberoptics, Inc.

- Silicon Light Machines (a subsidiary of Cambridge Technology)

- Accelink Technology

- Go!Foton

- Kopin Corporation

- Radian Precision

- Nanonics Imaging Ltd.

- Agiltron Inc.

- Optiwave Systems Inc.

- Micron Optics (Luna Innovations)

- Yokogawa Electric Corporation

- EXFO Inc.

- NeoPhotonics Corporation (now part of Lumentum)

- Molex (Optical Solutions Division)

Frequently Asked Questions

Analyze common user questions about the MEMS VOA market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a MEMS VOA in high-speed optical networks?

The primary function of a MEMS VOA (Variable Optical Attenuator) is to dynamically control and stabilize the optical power level within fiber optic systems. This is crucial for applications like DWDM (Dense Wavelength Division Multiplexing) systems, where VOAs equalize channel power levels, preventing receiver saturation and optimizing the optical signal-to-noise ratio (OSNR) across the network, thereby ensuring reliable high-speed data transmission.

How does silicon photonics integration affect the future demand for MEMS VOAs?

Silicon photonics (SiPh) integration significantly increases demand for highly integrated, compact MEMS VOAs. By fabricating the VOA directly onto the SiPh chip, system designers can achieve ultra-low insertion loss, massive miniaturization, and reduced power consumption, making them essential components for next-generation 400G, 800G, and terabit optical transceivers required by hyperscale data centers and high-performance computing.

Which actuation mechanism—electrostatic or thermal—is preferred for modern data center applications?

Electrostatic actuation is generally preferred for modern high-speed data center applications. Electrostatic MEMS VOAs offer significantly faster response times (sub-millisecond) and consume minimal power when holding a specific attenuation level (zero static power), which is critical for dynamic network environments and massive energy savings in hyperscale facilities.

What are the main reliability concerns associated with MEMS VOA technology?

The main reliability concerns center on the long-term mechanical stability and durability of the microscopic moving components (mirrors or shutters). Issues such as stiction (adhesion between moving parts), potential particle contamination during packaging, and degradation under prolonged cycling or extreme environmental conditions (temperature, humidity) are key focus areas for manufacturers aiming to meet stringent telecom standards.

Which geographical region holds the largest market share for MEMS VOAs and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to massive capital expenditure in telecom infrastructure, including rapid 5G network rollouts, extensive Fiber-to-the-Home (FTTH) expansion programs, and the region's concentration of high-volume optical component manufacturing and assembly facilities, particularly in East Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager