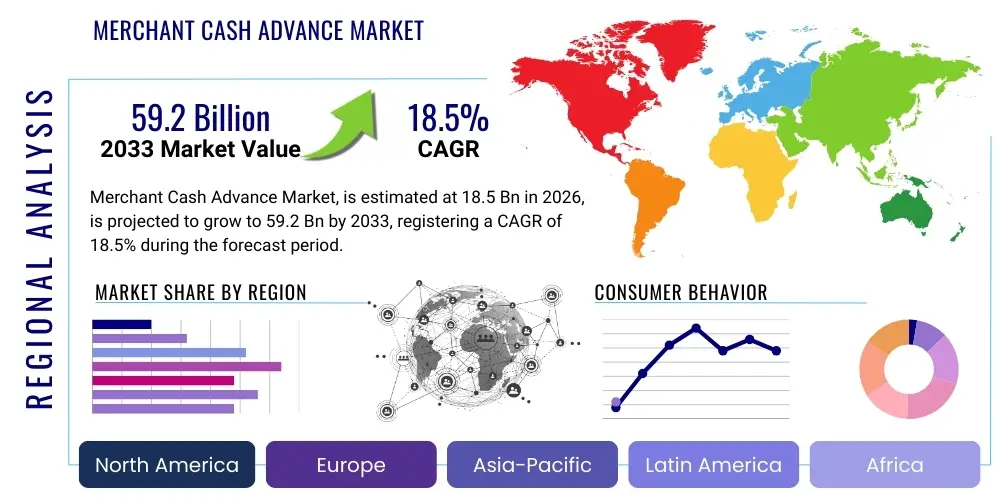

Merchant Cash Advance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440168 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Merchant Cash Advance Market Size

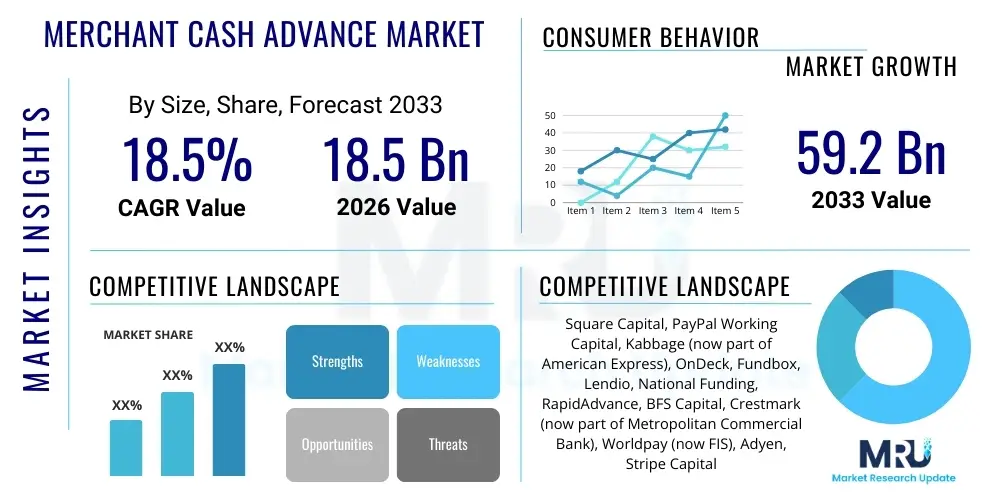

The Merchant Cash Advance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 59.2 Billion by the end of the forecast period in 2033.

Merchant Cash Advance Market introduction

The Merchant Cash Advance (MCA) market represents a vital segment within alternative financing, offering businesses a swift and flexible solution for accessing working capital. Unlike traditional loans, MCAs are not debt instruments but rather an advance on a business's future credit and debit card sales. This funding mechanism primarily caters to small and medium-sized businesses (SMBs) that may struggle to secure conventional bank loans due to credit history, lack of collateral, or urgent funding needs.

The product description of an MCA involves a lump sum payment to a business in exchange for a percentage of its future daily credit and debit card transactions. Repayment is typically automated, deducting a fixed percentage from each card sale until the advance, plus a factor fee, is fully repaid. This structure inherently aligns repayment with the business's revenue flow, making it less burdensome during slower periods.

Major applications for MCAs span a wide array of business needs, including inventory purchases, equipment financing, marketing initiatives, bridge funding for seasonal lulls, or simply maintaining day-to-day operational liquidity. The primary benefits include rapid access to funds, typically within days, a simplified application process compared to traditional lending, and flexible repayment terms that adjust with sales volume. Key driving factors for the MCA market's robust growth encompass the increasing demand for quick and accessible capital among SMBs, the stringent eligibility criteria of traditional banking institutions, the proliferation of digital payment methods, and the continuous innovation within the FinTech sector.

Merchant Cash Advance Market Executive Summary

The Merchant Cash Advance market is experiencing dynamic shifts, driven by evolving business trends, significant regional developments, and diverse segmentation preferences. A prominent business trend is the accelerated digitalization of financial services, with MCA providers increasingly leveraging online platforms and sophisticated algorithms to streamline applications, approvals, and fund disbursements. This digital transformation enhances efficiency and expands reach, particularly to underserved segments of the SMB market. Personalization of MCA offers, based on granular business data and predictive analytics, is also becoming a key competitive differentiator, moving away from one-size-fits-all solutions.

Regionally, North America continues to dominate the MCA market, characterized by a mature ecosystem of providers, high rates of credit card adoption, and a robust small business economy. However, the Asia Pacific (APAC) region is emerging as a significant growth hub, propelled by rapidly expanding digital payment infrastructures, a burgeoning SMB sector, and increasing awareness of alternative financing options. European markets, while growing, face a more fragmented regulatory landscape which influences market development and the entry of new players. Latin America and the Middle East & Africa (MEA) are also showing promising potential, driven by economic development and the increasing need for accessible capital.

From a segmentation perspective, the market is witnessing robust growth in online lender segments, as technology-driven platforms offer unparalleled speed and convenience. The end-user landscape remains diverse, with the retail and hospitality sectors consistently representing a substantial portion of MCA recipients due to their reliance on credit card transactions and often fluctuating cash flows. There is also a growing uptake in service-based industries and specialized sectors like healthcare and automotive. The overarching trend points towards greater integration of MCA services with existing payment processing systems and business management software, creating a more seamless and embedded financing experience for merchants.

AI Impact Analysis on Merchant Cash Advance Market

Artificial intelligence (AI) is fundamentally reshaping the Merchant Cash Advance market by enhancing operational efficiencies, refining risk assessment methodologies, and personalizing financial offerings. Users frequently inquire about how AI can make the MCA application process faster and fairer, expressing interest in AI's capability to analyze vast datasets for more accurate credit decisions, thereby potentially opening access to capital for a broader range of businesses. Concerns often revolve around the transparency and potential biases within AI algorithms, alongside the security implications of utilizing sensitive financial data. Expectations are high for AI to deliver predictive insights into business performance, streamline underwriting, and improve fraud detection.

The integration of AI technologies promises to revolutionize several aspects of the MCA ecosystem. Through machine learning algorithms, providers can process and analyze significantly more data points than traditional methods, including transactional data, social media sentiment, online reviews, and market trends. This capability allows for a more holistic and real-time assessment of a merchant's financial health and future revenue potential, leading to more accurate risk profiles and tailored advance amounts. Such sophisticated analytics can also identify patterns indicative of fraud with greater precision, protecting both providers and legitimate businesses.

Moreover, AI is instrumental in automating various stages of the MCA lifecycle, from initial application processing and document verification to underwriting decisions and even post-funding performance monitoring. This automation drastically reduces processing times, minimizing human error and associated operational costs. Predictive AI models can also anticipate a business's future capital needs, enabling providers to proactively offer financing solutions. While the benefits are clear, the industry is also grappling with the ethical considerations of algorithmic decision-making, ensuring fairness, explainability, and the avoidance of discriminatory outcomes, thereby fostering trust and long-term sustainability in AI-driven MCA solutions.

- Enhanced credit scoring and risk assessment through advanced data analytics.

- Automated underwriting processes leading to faster approval and funding times.

- Personalized MCA offers and terms based on specific business performance and needs.

- Improved fraud detection and prevention mechanisms using pattern recognition.

- Predictive analytics for anticipating merchant repayment capabilities and future business performance.

- Increased operational efficiency and cost reduction for MCA providers.

- Development of intelligent chatbots and virtual assistants for customer service.

- Potential for algorithmic bias and ethical considerations in automated decision-making.

- Streamlined integration with Point-of-Sale (POS) systems and payment processors.

- Dynamic pricing models adjusting factor rates based on real-time risk profiles.

- Identification of underserved market segments through data-driven insights.

- Optimization of marketing and outreach strategies for target businesses.

DRO & Impact Forces Of Merchant Cash Advance Market

The Merchant Cash Advance market is influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces that collectively shape its growth trajectory and competitive landscape. A primary driver is the persistent demand for quick and accessible capital among small and medium-sized businesses, particularly those with fluctuating revenues or limited access to traditional bank financing dueable to stringent credit requirements. The rapid growth of e-commerce and the widespread adoption of digital payment methods, which facilitate the collection of future receivables, further fuel this demand by making MCAs a more viable and easily administered option for a broader range of merchants.

However, the market also faces significant restraints. Chief among these is increasing regulatory scrutiny, as governments and consumer protection agencies worldwide begin to address concerns around transparency, effective annual percentage rates (APR), and the potential for businesses to enter debt cycles if not managed responsibly. The perceived high cost of MCAs compared to traditional loans, often expressed through factor rates, can also deter some merchants, while negative market perception or predatory lending accusations can tarnish the industry's reputation. These challenges necessitate greater transparency and adherence to ethical lending practices within the sector.

Despite the restraints, substantial opportunities exist for growth and innovation. There remains a vast untapped market of SMBs globally that are either underserved by traditional lenders or unaware of alternative financing options. Technological integration, particularly the application of AI, machine learning, and blockchain, offers avenues for creating more efficient, secure, and personalized MCA products. Niche market expansion, targeting specific industries or business models with tailored solutions, also presents significant growth potential. The market is continually impacted by broader economic stability, which influences business confidence and capital needs, alongside evolving regulatory frameworks and the pace of technological advancements which redefine product delivery and risk management. The competitive landscape, characterized by both established players and agile FinTech startups, further necessitates continuous innovation and differentiation.

Segmentation Analysis

The Merchant Cash Advance market is comprehensively segmented to provide a granular understanding of its diverse landscape, categorizing the market primarily by provider type, end-user industry, and specific application of funds. This segmentation helps in identifying key market dynamics, competitive advantages, and unmet needs across various business environments. Analyzing these segments provides strategic insights for both existing providers aiming to optimize their offerings and new entrants seeking viable market niches.

Segmentation by provider type highlights the varied entities offering MCAs, ranging from established financial institutions to specialized FinTech companies. End-user segmentation reveals which industries are most reliant on or best suited for MCA financing, reflecting their operational characteristics and financial needs. Application-based segmentation underscores the primary purposes for which businesses seek MCA funds, showcasing the versatility of this financial product in addressing diverse operational and growth requirements.

Understanding these segments is crucial for effective market penetration and product development. For instance, an online lender might leverage its technological prowess to serve a broad range of small businesses across multiple applications, while a bank might focus on a more traditional clientele within specific end-user industries. This detailed breakdown allows stakeholders to tailor their marketing strategies, product features, and risk assessment models to specific segments, optimizing their market position and fostering sustainable growth within the dynamic MCA landscape.

- By Provider

- Banks

- Non-Banking Financial Companies (NBFCs)

- Online Lenders/FinTech Companies

- Payment Processors

- By End-User Industry

- Retail

- Restaurants & Hospitality

- Healthcare & Wellness

- Automotive Services

- Manufacturing

- Professional Services

- Construction

- E-commerce

- Others (e.g., Salons, Spas, Cleaning Services)

- By Application

- Working Capital

- Inventory Purchase

- Equipment Financing

- Business Expansion & Renovation

- Marketing & Advertising

- Debt Consolidation

- Emergency Funds

Value Chain Analysis For Merchant Cash Advance Market

The value chain for the Merchant Cash Advance market is a complex ecosystem involving multiple stages and participants, from the initial sourcing of capital and data to the final delivery of funds and ongoing service to merchants. Upstream analysis focuses on the foundational elements that enable MCA providers to operate. This includes capital providers, such as institutional investors, banks, or private funds, who supply the necessary capital for advances. Technology vendors play a crucial role by offering specialized software for credit assessment, underwriting, payment processing, and customer relationship management. Furthermore, data providers and credit bureaus supply essential information on merchant performance, creditworthiness, and market trends, which are vital for risk assessment and decision-making processes.

Downstream analysis centers on the engagement with the ultimate recipients of MCAs and the channels through which these services are delivered. The primary downstream entities are the merchants themselves, comprising a vast array of small and medium-sized businesses across various industries. Payment processors are integral, as they handle the daily credit and debit card transactions from which the MCA repayments are drawn. Aggregators and referral partners, such as independent sales organizations (ISOs), brokers, and business consultants, often act as intermediaries, connecting merchants with suitable MCA providers and facilitating the application process, thereby expanding market reach.

Distribution channels for MCAs can be broadly categorized into direct and indirect models. Direct channels involve merchants applying directly to MCA providers, typically through online platforms, proprietary websites, or direct sales teams. This model offers greater control over the customer experience and allows providers to build direct relationships. Indirect channels leverage intermediaries like brokers, ISOs, and payment gateway partners. These partners act as an extended sales force, reaching a wider audience of merchants and often providing localized or specialized advisory services. Both channels are critical for market penetration, with the optimal mix often depending on the provider's strategy, target market, and operational capabilities, emphasizing the importance of robust partner management and seamless technological integration across the entire value chain.

Merchant Cash Advance Market Potential Customers

The potential customer base for the Merchant Cash Advance market is vast and diverse, primarily comprising small and medium-sized businesses (SMBs) across various sectors that share common characteristics making them suitable for this type of financing. These businesses often include those with fluctuating revenue streams, such as seasonal businesses like tourism-related ventures, holiday retailers, or businesses with peak and off-peak periods, where traditional fixed-payment loans may be difficult to manage during slower months. The flexible repayment structure of MCAs, which adjusts with daily sales volume, makes it an attractive option for these enterprises, aligning repayment with their actual cash flow.

Another significant segment of potential customers includes businesses with limited credit history, less-than-perfect credit scores, or those unable to provide substantial collateral, which are typically prerequisites for traditional bank loans. Startups, new businesses, or established businesses undergoing rapid expansion but lacking a long track record of profitability often fall into this category. MCA providers tend to focus more on the business's daily credit card sales volume and operational history rather than personal credit scores, thereby opening access to capital for a broader array of entrepreneurs who are otherwise underserved by conventional financial institutions.

Furthermore, businesses requiring fast access to capital for urgent needs represent a core demographic. This could include situations like unforeseen equipment repairs, capitalizing on a sudden inventory opportunity, covering payroll during a temporary cash flow crunch, or launching an immediate marketing campaign to capture market share. The speed and relative simplicity of the MCA application and approval process, often resulting in funding within days, are critical吸引 factors for these businesses. In essence, any SMB that accepts a significant volume of credit and debit card transactions and values speed, flexibility, and accessibility over the potentially lower cost of traditional debt, could be considered a prime candidate for a Merchant Cash Advance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 59.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Square Capital, PayPal Working Capital, Kabbage (now part of American Express), OnDeck, Fundbox, Lendio, National Funding, RapidAdvance, BFS Capital, Crestmark (now part of Metropolitan Commercial Bank), Worldpay (now FIS), Adyen, Stripe Capital, Shopify Capital, BlueVine, Capify, United Capital Source, Fora Financial, Revel Systems, Toast. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Merchant Cash Advance Market Key Technology Landscape

The Merchant Cash Advance market is heavily reliant on and continuously evolving with advancements in financial technology, creating a dynamic key technology landscape. At the forefront is the pervasive adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies are critical for enhancing risk assessment models, moving beyond traditional credit scores to analyze a vast array of alternative data points such as real-time transactional data, social media sentiment, and industry-specific trends. AI/ML enables more precise underwriting, personalized offer generation, and proactive fraud detection, significantly improving the speed and accuracy of funding decisions while minimizing default risks for providers.

Big Data analytics forms another foundational technological pillar, providing the capability to process, interpret, and derive actionable insights from the immense volumes of data generated by daily business operations and payment transactions. This analytical power supports not only risk assessment but also market segmentation, customer behavior prediction, and the identification of new business opportunities. Coupled with this, Application Programming Interface (API) integration is vital. APIs facilitate seamless connectivity between MCA platforms and various external systems, including Point-of-Sale (POS) systems, accounting software, payment processors, and bank accounts. This integration automates data retrieval, streamlines the application process, and ensures efficient daily repayment deductions, creating a frictionless experience for merchants.

Furthermore, cloud computing provides the scalable and secure infrastructure necessary for MCA providers to host their platforms, manage large datasets, and support rapid expansion without significant upfront hardware investments. Mobile platforms and responsive web designs are also crucial, allowing merchants to apply for and manage their advances conveniently from any device, fostering greater accessibility. While still nascent in broad application, blockchain technology holds future promise for enhancing transparency, security, and efficiency in transaction processing and record-keeping within the MCA ecosystem, potentially revolutionizing how funds are tracked and repaid. The confluence of these technologies defines the operational backbone and innovative edge of the modern Merchant Cash Advance market.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature FinTech ecosystem, high adoption rates of digital payments, and a robust small and medium-sized enterprise (SME) sector with consistent demand for working capital. The U.S. and Canada are leading countries, characterized by significant competition among providers and continuous innovation in product offerings and technology integration. Regulatory frameworks, while evolving, generally support the growth of alternative financing.

- Europe: The European MCA market is experiencing steady growth, with increasing awareness and acceptance among SMEs. However, the market is more fragmented due to diverse regulatory environments across countries. The UK, Germany, and France are key contributors, seeing a rise in specialized FinTech lenders. Emphasis on transparency and consumer protection is shaping product development and market entry strategies.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid economic development, a burgeoning digital payment infrastructure, and a vast, underserved SME population. Countries like India, China, and Australia are at the forefront, with increasing urbanization and technological adoption driving the demand for quick and flexible financing solutions. The region presents significant opportunities for new market entrants.

- Latin America: This region represents an emerging market for MCAs, characterized by a high demand for alternative financing due to limited access to traditional banking services for many SMEs. Brazil and Mexico are leading the charge, with nascent FinTech ecosystems beginning to address the funding gap. Economic volatility in some areas can present both challenges and opportunities for MCA providers.

- Middle East and Africa (MEA): The MCA market in MEA is still in its nascent stages but shows considerable potential, particularly in economies with growing non-oil sectors and increasing digital payment adoption. Countries like UAE, Saudi Arabia, and South Africa are exploring and implementing alternative financing models to support local businesses. Regulatory development and market education are crucial for widespread adoption in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Merchant Cash Advance Market.- Square Capital

- PayPal Working Capital

- Kabbage (now part of American Express)

- OnDeck

- Fundbox

- Lendio

- National Funding

- RapidAdvance

- BFS Capital

- Crestmark (now part of Metropolitan Commercial Bank)

- Worldpay (now FIS)

- Adyen

- Stripe Capital

- Shopify Capital

- BlueVine

- Capify

- United Capital Source

- Fora Financial

- Revel Systems

- Toast

Frequently Asked Questions

What is a Merchant Cash Advance (MCA)?

A Merchant Cash Advance is a type of alternative business financing where a lump sum is provided to a business in exchange for a percentage of its future credit and debit card sales. It is not a loan but an advance on future receivables.

How does an MCA differ from a traditional bank loan?

Unlike traditional bank loans, MCAs have flexible repayment schedules tied to daily sales, do not require collateral, and typically have a faster approval process. They are also often accessible to businesses with less-than-perfect credit, as eligibility is based on sales volume rather than credit score.

What types of businesses typically qualify for a Merchant Cash Advance?

Businesses that accept a significant volume of credit and debit card transactions, such as retail stores, restaurants, salons, e-commerce businesses, and other service-based operations, are common qualifiers. Eligibility often depends on monthly sales volume and operational history rather than strong credit.

What are the primary benefits and drawbacks of an MCA?

Benefits include fast access to capital, flexible repayment aligning with sales, and easier qualification for businesses with lower credit scores. Drawbacks can include higher effective costs compared to traditional loans (factor rates), potential for complex terms if not fully understood, and a daily repayment deduction impacting immediate cash flow.

How is the cost of a Merchant Cash Advance calculated?

The cost of an MCA is determined by a "factor rate," typically ranging from 1.15 to 1.5. If a business receives a $10,000 advance with a factor rate of 1.3, the total repayment amount will be $13,000. This factor rate is applied to the advanced amount, not the remaining balance, meaning it doesn't decrease over time like interest on a loan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager