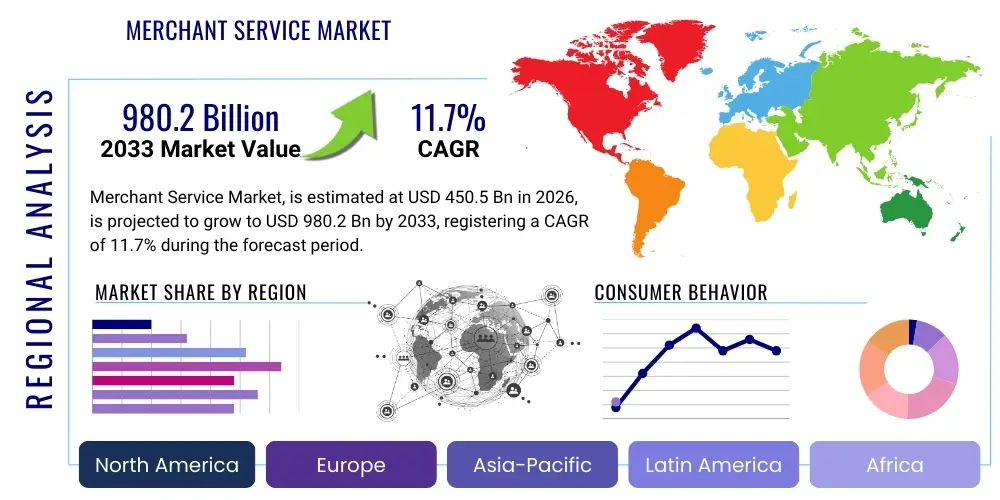

Merchant Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434798 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Merchant Service Market Size

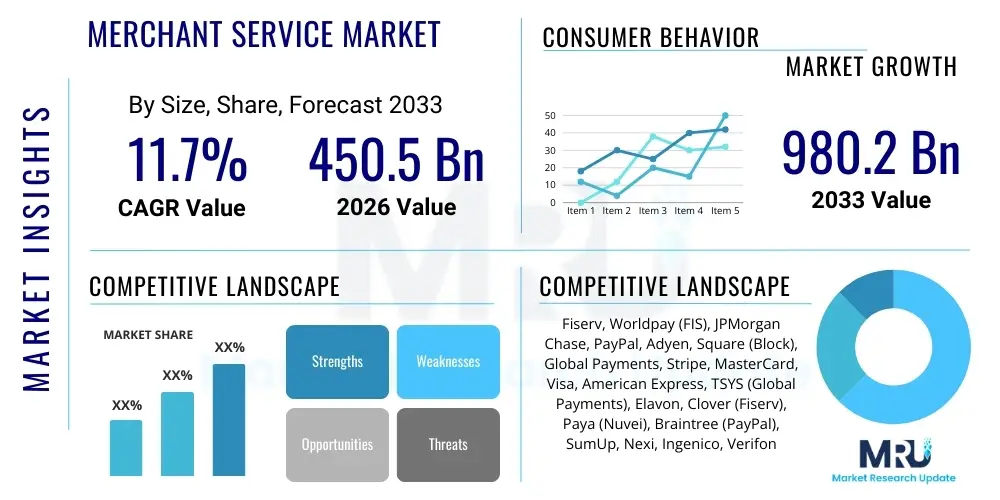

The Merchant Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.7% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 980.2 Billion by the end of the forecast period in 2033.

Merchant Service Market introduction

The Merchant Service Market encompasses a broad range of financial and technological services provided to businesses, enabling them to accept and process electronic payments. These essential services facilitate commerce across various channels, including physical point-of-sale (POS) systems, e-commerce platforms, and mobile applications. Key components of merchant services include payment gateway integration, transaction processing, risk management, chargeback handling, and settlement services. The primary goal is to provide a seamless, secure, and compliant environment for merchants to convert customer transactions into revenue, thereby supporting the global shift towards cashless economies and digital consumption.

The core product offering involves payment acceptance solutions, which vary significantly based on the size and operational needs of the merchant. For small and medium enterprises (SMEs), simpler, integrated systems like mobile POS (mPOS) are prevalent, while large enterprises require complex, omnichannel solutions capable of handling massive transaction volumes and sophisticated data analytics. Major applications span retail, hospitality, travel, healthcare, and financial services, each sector demanding specialized compliance and security protocols. Benefits derived by merchants include enhanced operational efficiency, reduced risk of fraud through advanced security tools (like tokenization and encryption), and improved customer experience resulting from flexible payment options, such as contactless and alternative payment methods.

Driving factors for market expansion are multifaceted, anchored by the rapid global adoption of digital payment methods, especially in emerging economies. The proliferation of e-commerce and m-commerce significantly increases the demand for robust payment processing infrastructure. Furthermore, increasing regulatory requirements for payment security (e.g., PCI DSS compliance) necessitate specialized third-party services, while advancements in fintech, such as instant payments and blockchain-based solutions, continually push the boundaries of service innovation and efficiency within the merchant service ecosystem.

Merchant Service Market Executive Summary

The Merchant Service Market is undergoing rapid transformation, fueled primarily by accelerated digitalization and the rise of unified commerce platforms. Current business trends indicate a strong move toward integrated software-as-a-service (SaaS) offerings where payment processing is bundled with inventory management, customer relationship management (CRM), and loyalty programs, enhancing merchant stickiness and value proposition. Consolidation among major players, alongside the disruptive innovation from agile fintech startups focusing on niche segments like cross-border payments and specific vertical needs (e.g., subscription models), defines the competitive landscape. Merchants are increasingly prioritizing providers that offer transparent pricing models and superior data analytics capabilities to optimize sales and manage inventory effectively, shifting away from purely transactional relationships toward strategic partnerships.

Regionally, North America and Europe maintain dominance due to established digital infrastructure and high consumer spending via card and digital wallets, yet the Asia Pacific (APAC) region exhibits the highest growth trajectory. This APAC surge is attributed to burgeoning mobile commerce penetration, government initiatives promoting digital inclusion in countries like India and China, and a massive, untapped SME market undergoing rapid technological adoption. While North America focuses on technological sophistication, particularly in fraud detection and omnichannel integration, Latin America and MEA are primarily focused on expanding basic acceptance infrastructure and reducing reliance on cash, offering high potential for initial market entry and infrastructure buildout.

Segment trends reveal that the Payment Processing segment retains the largest market share, but the Value-added Services segment, particularly those relating to data analytics, fraud management, and loyalty solutions, is experiencing accelerated growth. Large enterprises, while contributing the highest volume, are mature customers, whereas Small and Medium Enterprises (SMEs) represent the most dynamic growth engine, driven by the accessibility and affordability of mobile POS and cloud-based solutions. Deployment strategies show a strong preference for cloud-based platforms due to their scalability, lower upfront costs, and ease of integration, positioning cloud deployment as the dominant technological pathway for future market development.

AI Impact Analysis on Merchant Service Market

Common user questions regarding AI's influence in the Merchant Service Market primarily revolve around how artificial intelligence can enhance security, automate risk management, personalize the customer journey, and optimize operational costs for merchants. Users frequently inquire about the effectiveness of AI in real-time fraud detection, given the increasing sophistication of cyber threats, and how machine learning algorithms are utilized to predict transactional patterns and manage chargeback disputes more efficiently. Furthermore, there is significant interest in AI's capacity to transform value-added services, such as predictive analytics for inventory management and hyper-personalized marketing offers delivered at the point of sale. The consensus expectation is that AI will move merchant services from reactive processing to proactive business intelligence and autonomous risk mitigation.

- Enhanced Fraud Detection: AI algorithms analyze billions of data points in real-time, identifying complex, non-linear patterns indicative of fraudulent activity, significantly lowering false positives compared to traditional rule-based systems.

- Optimized Payment Routing: Machine learning optimizes transaction success rates by dynamically routing payments through the most reliable and cost-effective networks based on historical performance and network stability.

- Personalized Customer Experience: AI analyzes purchasing behavior and transaction history to enable merchants to deliver highly personalized promotions, dynamic pricing, and relevant product recommendations at checkout.

- Automated Risk and Compliance: AI automates routine compliance checks (e.g., KYC, AML) and assesses merchant risk profiles continuously, reducing manual overhead and ensuring adherence to rapidly changing global regulations.

- Predictive Business Intelligence: AI transforms transactional data into actionable insights regarding inventory demands, peak sales periods, and customer lifetime value, aiding strategic decision-making for merchants.

- Improved Chargeback Management: ML models predict the likelihood of chargebacks and help automate the dispute submission process, utilizing historical data to build stronger evidence against unwarranted claims.

DRO & Impact Forces Of Merchant Service Market

The Merchant Service Market dynamics are shaped by powerful Drivers and significant Restraints, balanced by high-potential Opportunities, all culminating in critical Impact Forces that dictate market direction. Key drivers include the relentless growth of e-commerce globally, necessitating scalable digital payment infrastructure, and the widespread consumer preference for convenience, favoring contactless, mobile, and instant payment methods. Furthermore, government mandates in various regions pushing for financial inclusion and the formalization of digital economies are providing a substantial tailwind for market penetration and usage expansion, especially among SMEs transitioning away from cash-only operations.

Conversely, the market faces considerable restraints. Regulatory complexity, particularly the need to comply with diverse local and international standards like GDPR, PCI DSS, and local banking regulations across different operating regions, poses a significant barrier, especially for global service providers. High initial setup costs for advanced omnichannel POS systems and the persistent threat of sophisticated cyberattacks and data breaches necessitate continuous investment in security infrastructure, which can be prohibitive for smaller merchants. Furthermore, the lack of digital literacy and trust in electronic payments in certain undeveloped or rural areas continues to impede full market saturation.

Opportunities are abundant, particularly in leveraging advanced technologies and targeting underserved segments. The proliferation of APIs and open banking frameworks allows for enhanced integration of payment services into core business management systems (ERP, CRM), creating seamless financial ecosystems. Geographical expansion into high-growth emerging markets, coupled with the development of vertical-specific solutions tailored for industries like quick-service restaurants (QSR) or specialized healthcare providers, offers clear pathways for differentiation and market capture. The rising demand for integrated B2B payment solutions, moving beyond traditional consumer-facing models, also represents a major untapped revenue stream, especially for providers specializing in complex cross-border settlements and supply chain financing integration.

The primary Impact Forces are centered on technological disruption and competitive pricing. The pressure to offer integrated, user-friendly solutions at competitive interchange rates forces providers to innovate constantly and optimize their underlying infrastructure costs. The COVID-19 pandemic acted as a massive accelerant, rapidly shifting consumer behavior toward digital and contactless transactions, permanently elevating the importance of robust and resilient merchant service offerings. This environment necessitates continuous investment in cybersecurity, data analytics, and scalable cloud infrastructure to maintain relevance and competitive advantage in a rapidly evolving, high-stakes financial technology ecosystem.

Segmentation Analysis

The Merchant Service Market is comprehensively segmented based on various technical, operational, and structural criteria to reflect the diverse needs of the modern business environment. Understanding these segments is crucial for strategic planning, allowing providers to tailor services effectively. Key segmentation dimensions include the method of service deployment (Cloud versus On-premise), the nature of the service offering (Processing, Value-added, Data Analytics), the size of the utilizing enterprise (SMEs versus Large Enterprises), and the specific Industry Vertical being served. This granular categorization highlights areas of accelerated growth, such as cloud solutions targeting SMEs in the retail and hospitality sectors, driving targeted marketing and product development efforts within the market.

- Deployment Type

- Cloud-based

- On-premise

- Service Type

- Payment Processing (Acquiring, Gateway, POS terminals)

- Value-added Services (Loyalty Programs, Gift Cards, Billing)

- Data Analytics and Reporting

- Fraud and Risk Management

- Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industry Vertical

- Retail and E-commerce

- Hospitality and Travel

- Healthcare

- Banking, Financial Services, and Insurance (BFSI)

- Media and Entertainment

- Others (Education, Public Sector)

Value Chain Analysis For Merchant Service Market

The value chain of the Merchant Service Market is complex, involving numerous interconnected entities from technology infrastructure providers to the end merchant. The upstream segment primarily involves hardware manufacturers (POS terminals, NFC readers) and core software developers (payment gateway technology, risk management tools, compliance software). These entities provide the foundational technology required for secure transaction initiation and transmission. Strategic partnerships in the upstream market are crucial for providers to maintain technological agility and ensure compatibility with evolving payment standards, such as EMV chip technology and contactless protocols, thus providing the necessary tools for digital acceptance.

The core processing segment includes the merchant acquirers, payment service providers (PSPs), and the card networks (Visa, Mastercard, Amex). Acquirers hold the direct relationships with the merchants, ensuring they can accept card payments and managing the flow of funds, while PSPs provide the technical connectivity. This midstream activity is the most intensive in terms of operational complexity, data security management, and regulatory compliance. Efficiency in this stage, driven by highly optimized transaction routing and low latency, determines profitability and service quality. Maintaining robust redundancy and high availability is critical to service continuity in this high-volume processing environment.

The downstream analysis focuses on the distribution channels and the direct engagement with the end-users (merchants). Distribution can be direct, where large providers manage their own sales teams to onboard major enterprise clients, or indirect, leveraging ISOs (Independent Sales Organizations) and strategic partnerships with banks or technology integrators. Indirect channels are often vital for penetrating the fragmented SME market efficiently. For example, partnering with commerce platforms like Shopify or CRM providers enables embedded payment acceptance, creating a sticky and integrated service offering. The effectiveness of the value chain is ultimately measured by the speed of settlement, the transparency of fee structures, and the quality of integrated value-added services offered directly to the merchant.

Merchant Service Market Potential Customers

Potential customers for merchant services encompass any commercial entity, regardless of size or sector, that requires the ability to accept non-cash payments from consumers or other businesses. This broad customer base spans from small, sole-proprietor businesses needing basic mobile POS capabilities to massive multinational corporations requiring bespoke omnichannel solutions integrated across multiple geographic regions and currencies. The growth trajectory is heavily influenced by the speed at which micro-merchants and SMEs, historically reliant on cash, adopt digital acceptance technologies, a transition driven by consumer demand and the increasing accessibility of low-cost, cloud-based POS systems.

Specific end-user segments with high growth potential include the quick-service restaurant (QSR) sector, which is rapidly adopting self-ordering kiosks and integrated loyalty apps; the healthcare industry, transitioning from paper billing to digital patient payment portals; and the e-commerce sector, which continually demands enhanced fraud protection and seamless cross-border payment functionalities. Beyond consumer-facing businesses, the B2B sector represents a burgeoning customer segment, demanding specialized services for large-volume, complex transactions, focusing on invoicing, automated reconciliation, and enhanced visibility into supplier payments. Consequently, market providers are increasingly specializing their offerings to address the unique compliance, operational, and security requirements of these distinct vertical markets to maximize customer conversion and retention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 980.2 Billion |

| Growth Rate | 11.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fiserv, Worldpay (FIS), JPMorgan Chase, PayPal, Adyen, Square (Block), Global Payments, Stripe, MasterCard, Visa, American Express, TSYS (Global Payments), Elavon, Clover (Fiserv), Paya (Nuvei), Braintree (PayPal), SumUp, Nexi, Ingenico, Verifone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Merchant Service Market Key Technology Landscape

The technology landscape underpinning the Merchant Service Market is defined by a shift toward cloud-native architectures, emphasizing scalability, API-led connectivity, and real-time data processing. Key technological developments include the widespread adoption of modern payment gateways that support diverse payment types, from traditional cards to digital wallets and cryptocurrencies. The infrastructure relies heavily on advanced tokenization and end-to-end encryption protocols to secure sensitive cardholder data, meeting stringent PCI DSS requirements while minimizing the merchant's data handling liability. Furthermore, the integration of biometric authentication and secure chip technology (EMV) at the Point-of-Sale (POS) enhances physical transaction security and speed, contributing significantly to customer satisfaction and operational throughput.

Crucially, the rise of open banking and Application Programming Interfaces (APIs) has revolutionized how merchant services are delivered, allowing third-party developers and fintech firms to seamlessly integrate payment functionalities into existing business applications, thereby fostering innovation and customizing services for specific vertical demands. This API-centric approach facilitates the creation of unified commerce platforms that blur the lines between in-store and online purchasing experiences. Beyond transactional security, sophisticated Machine Learning (ML) models are foundational for next-generation fraud prevention, enabling providers to analyze vast amounts of behavioral data in milliseconds to approve legitimate transactions while flagging suspicious activities before financial loss occurs. This move from static rule sets to dynamic, predictive security models is a technological imperative.

Furthermore, technologies enabling faster settlement and transparent reconciliation are gaining prominence. Real-time payments infrastructure, driven by initiatives like the RTP network in the US and similar instantaneous schemes globally, allows merchants to access funds almost immediately, drastically improving cash flow management, especially for SMEs. Blockchain technology is also being explored, primarily for cross-border payments, offering potential solutions for high intermediary fees and slow settlement times, although its mainstream adoption remains nascent. The overall technological direction favors embedded finance, where payment processing becomes an invisible, seamless part of the merchant’s core operating software, driven by advanced, modular, cloud-based technology stacks designed for maximum flexibility and resilience in a constantly evolving payment ecosystem.

Regional Highlights

Regional dynamics play a vital role in shaping the Merchant Service Market, with varying levels of digital maturity, regulatory environments, and consumer preferences influencing growth. North America, characterized by high card usage and established e-commerce penetration, remains the largest revenue generator, focusing intensely on sophisticated omnichannel integration and advanced fraud management solutions tailored for large retailers and highly digitized service industries. Europe follows closely, driven by strong regulatory harmonization (e.g., PSD2, GDPR) and a high adoption rate of contactless payments and mobile wallets, with strong growth originating from pan-European PSPs like Adyen and Nexi.

The Asia Pacific (APAC) region stands out as the highest growth market globally. This expansion is propelled by exploding mobile commerce adoption, particularly in Southeast Asia and India, the massive scale of the Chinese digital payment ecosystem (dominated by Alipay and WeChat Pay), and governmental pushes toward financial inclusion and digital payment adoption. The market here is fragmented, with intense competition between global players and strong local fintechs, leading to rapid innovation in QR code payments and super-app integration. Latin America (LATAM) and the Middle East and Africa (MEA) are emerging hotspots, where market growth is driven primarily by the transition from cash to digital, requiring fundamental infrastructure build-out and localized solutions addressing high levels of unbanked populations and regional currency complexities.

- North America: Dominant market share focused on omnichannel integration, tokenization, and sophisticated AI-driven fraud analytics, serving mature e-commerce and retail sectors.

- Europe: Strong regulatory framework (PSD2) fostering open banking and instant payment proliferation, leading to high adoption of localized and cross-border payment schemes.

- Asia Pacific (APAC): Fastest-growing region, fueled by mobile commerce, rapid digitalization of SMEs, and widespread use of regional super-apps and QR code payment methods.

- Latin America (LATAM): High growth potential driven by digital penetration in historically cash-heavy economies, focusing on affordable mPOS solutions and localized installment payment options.

- Middle East and Africa (MEA): Significant investment in digital infrastructure and fintech hubs (e.g., UAE, South Africa) aimed at increasing financial inclusion and developing robust e-commerce capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Merchant Service Market.- Fiserv, Inc.

- Worldpay (FIS)

- JPMorgan Chase & Co.

- PayPal Holdings, Inc.

- Adyen N.V.

- Square (Block, Inc.)

- Global Payments Inc.

- Stripe, Inc.

- MasterCard Incorporated

- Visa Inc.

- American Express Company

- TSYS (A Global Payments Company)

- Elavon, Inc. (U.S. Bank)

- Clover (A Fiserv Solution)

- Paya (A Nuvei Company)

- Braintree (A PayPal Service)

- SumUp Holdings Ltd.

- Nexi S.p.A.

- Ingenico (A Worldline Company)

- Verifone, Inc.

Frequently Asked Questions

Analyze common user questions about the Merchant Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a Payment Gateway and a Merchant Acquirer?

The Payment Gateway is the software interface that securely captures payment details and transmits them from the merchant's website or POS to the acquiring bank. The Merchant Acquirer (or acquiring bank) is the financial institution that maintains the merchant's account, processes the transaction request, and ultimately deposits the funds into the merchant's bank account.

How is AI impacting fraud detection in merchant services?

AI utilizes machine learning algorithms to analyze real-time transactional data, identifying complex behavioral anomalies and patterns of fraud much faster and more accurately than traditional rule-based systems, leading to lower chargeback rates and improved security protocols for merchants.

Which geographical region is showing the fastest growth rate for merchant services?

The Asia Pacific (APAC) region exhibits the fastest growth due to massive mobile commerce penetration, increased government initiatives promoting digital payments, and rapid adoption among the large population of Small and Medium Enterprises (SMEs).

What are the primary factors driving SME adoption of digital merchant services?

SME adoption is driven by the affordability and accessibility of cloud-based solutions (like mPOS), consumer demand for digital payment flexibility, the need for integrated inventory and sales data, and the availability of simplified, flat-rate pricing models.

What role does omnichannel play in the future of the Merchant Service Market?

Omnichannel capability is essential, allowing merchants to unify payment acceptance and data across all touchpoints (in-store, online, mobile). This provides customers with a consistent experience and gives the merchant a single, holistic view of customer spending behavior and inventory management, significantly improving business intelligence and operational efficiency.

The total projected size and growth of the Merchant Service Market reflect fundamental shifts in global commerce toward digital and integrated financial solutions. The sustained demand for seamless, secure, and flexible payment acceptance across all channels—e-commerce, mobile, and physical POS—is the core driver of expansion. Providers are increasingly focusing on delivering value beyond simple transaction processing, incorporating sophisticated data analytics, proactive risk management powered by AI, and scalable cloud infrastructure to meet the evolving needs of modern businesses. The high growth trajectory in APAC, coupled with the ongoing technological maturation in North America and Europe, signals a robust and competitive future where embedded finance and unified commerce platforms will define market leadership and performance.

The complexity introduced by global regulatory heterogeneity, coupled with the persistent need for heightened cybersecurity measures, remains a critical challenge that necessitates significant operational and technological investment. However, these challenges also solidify the position of expert Merchant Service Providers (MSPs) as essential partners for businesses navigating the intricate payment landscape. Opportunities related to B2B payment digitization, specialized vertical offerings, and the integration of emerging technologies like instant payments and open banking continue to unlock new revenue streams, ensuring that the Merchant Service Market remains one of the most dynamic and rapidly evolving sectors within the broader fintech industry.

Furthermore, the competitive environment is demanding more transparency and integration. Merchants are no longer satisfied with stand-alone payment terminals; they require integrated solutions that communicate directly with their Enterprise Resource Planning (ERP) systems and Customer Relationship Management (CRM) tools. This mandate for ecosystem integration accelerates the trend toward cloud-native platforms and API deployment models, favoring providers like Stripe and Adyen, who excel at developer-centric solutions, while legacy players like Fiserv and Global Payments continually adapt through strategic acquisitions and modernization efforts to maintain relevance in this fast-paced market. The long-term success of stakeholders will hinge on their ability to deliver speed, security, and actionable business intelligence through their comprehensive service portfolios.

The focus on environmental, social, and governance (ESG) factors is also subtly influencing the market, with merchants and consumers increasingly favoring providers who demonstrate commitment to sustainable practices. While not a core operational component, the efficiency and reduced paper usage inherent in digital payments align with broader ESG goals. Providers who can articulate their contribution to financial inclusion, particularly in emerging markets, through accessible and low-cost payment solutions, gain a reputational advantage. This overarching trend suggests that future competitive differentiation will involve not only superior technological capabilities but also demonstrated ethical and social responsibility in facilitating global commerce and secure financial transactions for all business sizes.

Technological advancement in the realm of tokenization is a key differentiator. Tokenization replaces sensitive payment data with a non-sensitive equivalent, or 'token,' which can be used to process payments without exposing the primary account number (PAN). This technology is fundamental to enhancing security for e-commerce, mobile, and in-app purchases, significantly reducing the scope of PCI compliance for merchants. As the threat of large-scale data breaches persists, the providers who offer robust, frictionless tokenization across multiple channels are better positioned to capture and retain enterprise-level clientele who face the highest risk exposure. The utilization of dynamic tokens, which change with each transaction, further strengthens this layer of security, creating a more resilient payment infrastructure that protects both the consumer and the merchant from financial and reputational harm, thus driving market innovation and confidence in digital acceptance systems globally.

Finally, the evolution of the supply chain management requires advanced B2B merchant services. Traditional paper-based invoicing and check payments are inefficient and costly. The market is witnessing increased demand for integrated B2B payment solutions that facilitate electronic invoicing, automated reconciliation, and corporate card acceptance with enhanced data reporting. These systems often require specialized compliance features related to corporate expense management and tax reporting, diverging significantly from consumer-facing merchant services. Providers who successfully bridge the gap between consumer (B2C) and corporate (B2B) payment requirements, offering a truly unified financial service platform, stand to capitalize on the vast, untapped potential within the business-to-business sector, which historically lags behind B2C in terms of payment digitalization and efficiency.

The ongoing integration of alternative payment methods (APMs) is another transformative element. While traditional card payments remain dominant, local payment schemes, bank transfers (through open banking), Buy Now, Pay Later (BNPL) options, and even certain cryptocurrencies are gaining traction, especially among younger consumer demographics and in e-commerce environments. Merchant Service Providers must continuously update their gateway infrastructure and back-end processing capabilities to accept and settle these diverse APMs seamlessly. Failure to support a customer's preferred payment method leads directly to cart abandonment and lost sales, making the breadth and flexibility of payment method acceptance a critical competitive metric in the rapidly diversifying global payment landscape.

In summary, the Merchant Service Market is characterized by intense competition driven by technological innovation and a deep integration into the merchant's operational workflow. Success is defined by superior security, unmatched processing speed, comprehensive omnichannel support, and the ability to deliver business-critical insights derived from transactional data. The substantial projected growth validates the ongoing necessity for advanced financial technology services that facilitate the secure and efficient movement of money in the global digital economy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager