Mercury Removal Adsorbents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433583 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Mercury Removal Adsorbents Market Size

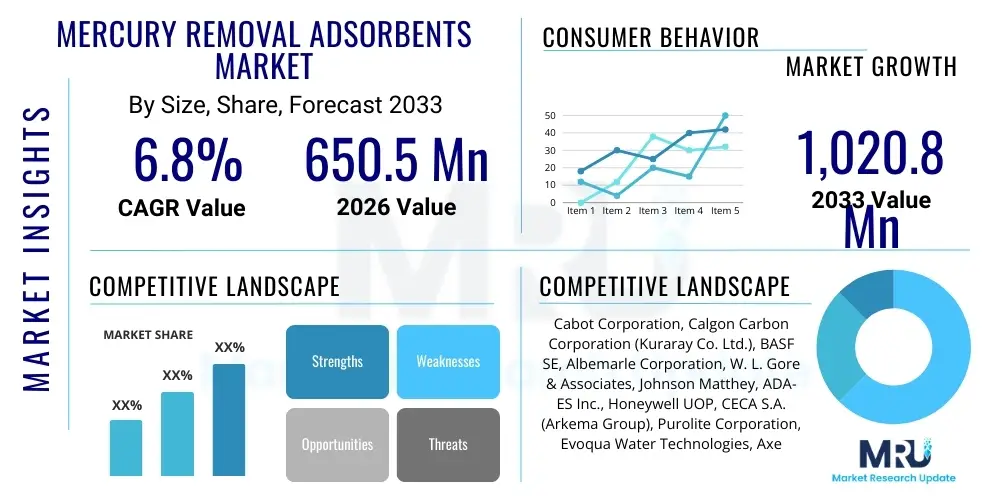

The Mercury Removal Adsorbents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.5 Million in 2026 and is projected to reach USD 1,020.8 Million by the end of the forecast period in 2033.

Mercury Removal Adsorbents Market introduction

The Mercury Removal Adsorbents Market encompasses specialized chemical products and materials engineered to capture and sequester mercury vapor and compounds from industrial flue gases, liquid streams, and natural gas. These adsorbents, predominantly based on activated carbon, molecular sieves (zeolites), or specialized metal oxides and sulfides, function through chemisorption or physisorption, converting toxic mercury into stable, handleable compounds or physically binding it to the surface structure. The primary application sectors are heavily polluting industries such as coal-fired power generation, cement manufacturing, waste incineration, and petrochemical refining, where regulatory mandates require strict adherence to air and water quality standards to minimize environmental mercury contamination.

The increasing global emphasis on environmental protection, underscored by international agreements such as the Minamata Convention on Mercury, serves as the paramount driving factor for this market. Adsorbents offer a highly effective, reliable, and often retrofit-friendly solution for mercury abatement compared to other, more complex technologies. Furthermore, the rising demand for cleaner energy sources and the necessary purification of natural gas streams (which often contain trace elemental mercury corrosive to pipeline infrastructure and harmful upon combustion) further propel the demand for high-performance adsorbents designed for both gaseous and liquid phase removal.

Key benefits of utilizing these adsorbents include compliance assurance with stringent emission limits, operational simplicity, high mercury capture efficiency across varying temperatures and contaminant loads, and relative cost-effectiveness when integrated into existing pollution control infrastructure. Ongoing research focuses on developing materials with higher capacity, greater selectivity, and regenerability, reducing operating costs and waste volumes. This technological push is essential as industries face continuous pressure to lower their environmental footprint while maintaining operational efficiency.

Mercury Removal Adsorbents Market Executive Summary

The Mercury Removal Adsorbents Market is experiencing robust expansion, primarily fueled by intensified environmental regulations worldwide, notably the implementation of stringent limits on mercury emissions from coal-fired power plants and industrial boilers, particularly in the Asia Pacific region. Business trends indicate a shift towards specialized, high-capacity, and regenerative adsorbents, moving away from conventional single-use materials, driven by the need for sustainable waste management and improved lifecycle economics. Strategic partnerships between chemical manufacturers and industrial users are becoming crucial for tailoring adsorbent solutions to specific process conditions, such as high moisture content or varying flue gas compositions.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market due to rapid industrialization, high reliance on coal for energy generation, and the increasing adoption of pollution control measures mirroring Western standards. North America and Europe, while mature markets, maintain high demand due to perpetual regulatory compliance needs and significant activity in the oil and gas sector requiring efficient mercury removal from natural gas and refinery processes. The Middle East and Africa (MEA) are emerging areas, primarily driven by upstream oil and gas development and associated gas purification requirements.

Segment trends show the Activated Carbon segment dominating the market based on volume, due to its versatility and cost-effectiveness, though specialized segments like Metal Sulfides and Zeolites are exhibiting higher growth rates owing to their superior selectivity and performance in specific, demanding environments, particularly liquid-phase treatment. The fastest-growing application segment remains flue gas treatment in coal-fired power plants, followed closely by natural gas processing, reflecting the global energy transition dynamics and the critical requirement for infrastructure protection against mercury corrosion.

AI Impact Analysis on Mercury Removal Adsorbents Market

User inquiries regarding AI's impact on the Mercury Removal Adsorbents Market typically center on how artificial intelligence and machine learning (ML) can optimize material efficacy, predict abatement system performance, and enhance real-time process control. Key themes include the use of AI for discovering novel adsorbent structures with enhanced selectivity and capacity, optimizing the industrial synthesis process to reduce manufacturing costs, and applying predictive maintenance models to mercury capture systems. Users are concerned about the implementation costs versus the long-term efficiency gains and expect AI to deliver highly tailored, dynamic solutions that adjust to fluctuating mercury loads and gas stream conditions, thereby maximizing compliance and minimizing operational expenditure.

AI algorithms are fundamentally transforming material science research in this sector. By employing machine learning models, researchers can rapidly screen thousands of potential porous materials, predict their mercury adsorption isotherms, and identify optimal functionalization strategies far faster than traditional laboratory testing allows. This accelerated discovery process is critical for developing the next generation of high-performing adsorbents, such as functionalized nano-materials or Metal-Organic Frameworks (MOFs), which offer superior capture kinetics and capacity essential for meeting ultra-low emission targets.

Furthermore, within industrial operations, AI provides sophisticated data analytics tools crucial for process optimization. By analyzing real-time sensor data—including flue gas composition, temperature, moisture content, and mercury concentration—AI systems can dynamically adjust the dosing rate of powdered activated carbon (PAC) injection or optimize the flow through fixed-bed adsorbent columns. This proactive control minimizes reagent wastage, ensures continuous regulatory compliance by preventing intermittent breakthrough, and extends the operational life of the adsorption units, significantly enhancing the overall economic viability of mercury abatement strategies.

- AI-driven optimization of adsorbent material composition and structure for enhanced selectivity.

- Machine learning models used for predictive maintenance of mercury removal systems, reducing downtime.

- Real-time process control using AI analytics to dynamically adjust adsorbent injection rates based on fluctuating mercury levels.

- Accelerated discovery of novel, high-capacity materials (e.g., MOFs, functionalized carbons) through computational screening.

- Improved operational efficiency and reduced chemical waste via precise consumption forecasting and dosing strategies.

DRO & Impact Forces Of Mercury Removal Adsorbents Market

The Mercury Removal Adsorbents Market is powerfully driven by tightening global environmental regulations, particularly those established by regional bodies like the U.S. EPA (MATS rule) and multinational treaties like the Minamata Convention, compelling industries to invest heavily in abatement technologies. Restraints primarily involve the high capital expenditure required for installing advanced adsorption systems, especially in smaller industrial facilities, and the significant operational challenge of disposing of spent, mercury-laden adsorbents, which are classified as hazardous waste. Opportunities lie in the rapidly expanding application scope beyond traditional coal combustion, particularly in the growing natural gas sector purification, hydrogen production, and specialized wastewater treatment. The dominant impact force is the immutable global push toward decarbonization and strict pollution control, making compliance a non-negotiable aspect of industrial licensing and operation.

Market growth is intricately tied to the development of regenerative adsorbents that can be recycled or regenerated in situ, mitigating the high disposal costs and environmental risk associated with hazardous waste. The demand for these sustainable solutions creates a positive feedback loop, encouraging innovation in material science. However, the cyclical nature of commodity markets, particularly the fluctuations in oil and gas prices which influence drilling activity and refinery utilization, can temporarily restrain investment in new mercury removal infrastructure, despite underlying regulatory requirements remaining constant.

Impact forces stemming from technological breakthroughs include the development of highly selective, non-carbonaceous adsorbents (like polymer-supported systems) that perform robustly even in harsh industrial environments containing high levels of sulfur dioxide, nitrogen oxides, or moisture, which often poison traditional activated carbon. These superior materials command a premium, influencing market structure. Furthermore, public health concerns related to mercury neurotoxicity continue to amplify governmental and corporate commitment to effective remediation, serving as a constant, underlying force demanding immediate and effective market solutions.

Segmentation Analysis

The Mercury Removal Adsorbents Market is comprehensively segmented based on the type of material used, the physical form of the adsorbent, and the diverse applications across end-user industries. Material segmentation includes key categories like Activated Carbon, Zeolites, Metal Sulfides, and other specialized functionalized materials, reflecting varying performance characteristics and cost points. Form segmentation differentiates between powdered, granular, and extruded forms, which are selected based on the specific system design, such as fluid bed, fixed bed, or injection systems. Application analysis focuses heavily on the requirements of major polluting sectors, primarily coal-fired power plants, cement production, waste incineration, and petrochemical operations, each requiring tailored adsorbent specifications.

- By Adsorbent Type:

- Activated Carbon (Impregnated and Non-impregnated)

- Zeolites and Molecular Sieves

- Metal Sulfide Adsorbents

- Functionalized Silica/Alumina

- Others (Polymer-based, Specialty Resins)

- By Form:

- Powdered Activated Carbon (PAC)

- Granular Activated Carbon (GAC)

- Extruded/Pelletized Forms

- By Application:

- Coal-Fired Power Plants (Flue Gas Treatment)

- Natural Gas Processing

- Cement Manufacturing

- Waste Incineration

- Non-Ferrous Metals Production

- Oil Refining and Petrochemicals

- Industrial Water Treatment

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Mercury Removal Adsorbents Market

The value chain for mercury removal adsorbents begins with the upstream sourcing and refinement of raw materials, which include coal, coconut shells, wood, or petroleum pitch for activated carbon production, and natural mineral sources for zeolites and metal precursors (sulfur, iron, copper) for specialty adsorbents. This stage is capital-intensive and requires rigorous quality control to ensure optimal porosity and surface area for effective adsorption. Upstream competitive advantage often relies on securing stable, cost-effective sources of high-quality raw material and efficient manufacturing processes, such as thermal or chemical activation techniques.

Midstream activities involve the highly specialized manufacturing, functionalization, and formulation of the adsorbents, converting base materials into high-performance products tailored for specific gaseous or liquid streams. This phase includes impregnation processes, where materials are chemically treated (e.g., sulfur or halogen doping) to enhance chemisorption properties and mercury capture efficiency. The distribution channel is crucial, typically involving specialized distributors or direct sales teams who possess deep technical knowledge about environmental engineering and industrial compliance. Direct sales are common for large-scale industrial consumers like major utility companies or integrated oil and gas firms, facilitating customized technical support and supply chain management.

The downstream segment involves the installation, operation, and eventual disposal or regeneration of the spent adsorbents. Technical service providers and engineering firms play a vital role in integrating these materials into existing pollution control infrastructure (e.g., SCR systems or scrubbers). Due to the hazardous nature of spent adsorbents, waste management and disposal services form a critical, high-cost component of the downstream value chain. Innovations focused on extending adsorbent lifespan and implementing closed-loop regeneration cycles are key to optimizing downstream cost structures and improving overall market sustainability.

Mercury Removal Adsorbents Market Potential Customers

The primary customers for mercury removal adsorbents are industrial entities operating processes that result in significant mercury emissions or contamination, driven almost exclusively by regulatory mandates. These end-users, or buyers, include the operators of thermal power generation facilities, particularly those relying on coal, where flue gas treatment is mandatory under rules like the Mercury and Air Toxics Standards (MATS) or equivalent regional legislation. Their purchasing criteria prioritize high removal efficiency, compatibility with existing plant infrastructure, and total cost of ownership, including disposal costs.

A second major customer base comprises the oil and gas industry, specifically companies involved in natural gas extraction, processing, and transmission. Mercury naturally occurs in many hydrocarbon reserves and must be meticulously removed during processing to prevent corrosion of aluminum components in cryogenic equipment used for liquefaction (LNG) and to meet purity specifications for pipelines. These customers require highly selective adsorbents capable of performing under high-pressure, low-temperature conditions characteristic of gas processing plants.

Further potential customers include organizations engaged in the production of cement, which is a significant source of mercury emissions due to calcination processes, municipal and hazardous waste incinerators, and non-ferrous smelters (e.g., copper and gold production) which also generate mercury-containing off-gases. Procurement decisions across all these sectors are typically managed by environmental, health, and safety (EHS) departments in coordination with procurement specialists, necessitating solutions that are robust, verifiable, and support long-term compliance strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.5 Million |

| Market Forecast in 2033 | USD 1,020.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, Calgon Carbon Corporation (Kuraray Co. Ltd.), BASF SE, Albemarle Corporation, W. L. Gore & Associates, Johnson Matthey, ADA-ES Inc., Honeywell UOP, CECA S.A. (Arkema Group), Purolite Corporation, Evoqua Water Technologies, Axens, Clariant AG, Lenntech B.V., Jacobi Carbons (Osaka Gas Chemicals), EP Minerals, General Electric (GE), TDA Research, Inc., Norit Activated Carbon (Cabot), Veolia Water Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mercury Removal Adsorbents Market Key Technology Landscape

The technology landscape for mercury removal adsorbents is characterized by continuous material innovation aimed at improving capacity, selectivity, and operational efficiency, particularly in challenging high-temperature or wet environments. The foundational technology remains activated carbon, but the performance differentiator lies in chemical impregnation, typically with sulfur, halogens (like bromine), or specialized metal salts. Brominated activated carbon (BAC) has gained significant traction, especially in the US utility sector, as it offers superior oxidation and capture efficiency of elemental mercury in flue gas streams compared to non-impregnated or simple sulfur-treated versions, often mandated for systems operating without specialized SCR units.

Beyond carbon, the use of specialized inorganic materials represents a critical area of technological advancement. Metal sulfide adsorbents, particularly those utilizing copper sulfide or iron sulfide compounds supported on alumina or silica carriers, are increasingly employed, especially for liquid streams and natural gas purification. These materials offer high selectivity for mercury even in the presence of other contaminants like water or hydrogen sulfide, and often possess regenerative capabilities, allowing them to be stripped of mercury and reused, significantly lowering long-term operating costs and waste generation volumes.

Emerging technologies focus on nanotechnology and advanced polymer chemistry. Nano-adsorbents, utilizing materials like functionalized magnetic nanoparticles, offer ultra-high surface area and rapid adsorption kinetics, potentially miniaturizing treatment systems. Furthermore, research into Metal-Organic Frameworks (MOFs) and specialized polymeric resins shows promise for highly customized applications, particularly in water treatment and high-purity chemical processes, where traditional materials struggle to meet ultra-low detection limits. The overall technology trajectory is moving toward hybrid systems that combine multiple adsorbent types to address complex, multi-component industrial streams efficiently.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of market growth, driven primarily by China and India's immense coal-fired power generation capacity and their rapidly evolving regulatory frameworks. While historical compliance was lagging, recent years have seen massive investment in environmental controls due to severe air quality issues, pushing demand for mercury abatement solutions. The industrial expansion across Southeast Asia in cement and non-ferrous metals production further cements APAC's dominant consumption profile.

- North America: This region is a highly mature market, characterized by stringent enforcement of EPA regulations, particularly the MATS rule. Demand here is stable and driven by ongoing compliance, replacement cycles, and high requirements from the established oil and gas extraction and refining industries for natural gas purification. The focus is heavily on high-performance, cost-effective solutions like brominated activated carbon.

- Europe: European demand is governed by the Industrial Emissions Directive (IED) and national regulatory standards focusing on maximizing environmental protection. The market here is characterized by high adoption rates of advanced, often regenerative, adsorbent technologies, particularly in waste incineration and specialty chemical manufacturing. The European market emphasizes sustainable solutions and minimizing waste residue.

- Latin America (LATAM): Market growth in LATAM is more nascent but gaining momentum, correlated with infrastructure modernization and increasing awareness of the Minamata Convention. Key demand originates from major resource extraction operations, including mining (which can release mercury) and nascent petrochemical development projects in countries like Brazil and Mexico.

- Middle East & Africa (MEA): This region's demand is heavily concentrated in the upstream oil and gas sector, particularly the GCC countries, where mercury removal is vital for protecting LNG and petrochemical facilities from corrosion. Industrialization initiatives, especially in sectors requiring high-purity gas, are expected to drive significant, albeit targeted, growth in specialized adsorbent products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mercury Removal Adsorbents Market.- Cabot Corporation

- Calgon Carbon Corporation (Kuraray Co. Ltd.)

- BASF SE

- Albemarle Corporation

- W. L. Gore & Associates

- Johnson Matthey

- ADA-ES Inc.

- Honeywell UOP

- CECA S.A. (Arkema Group)

- Purolite Corporation

- Evoqua Water Technologies

- Axens

- Clariant AG

- Lenntech B.V.

- Jacobi Carbons (Osaka Gas Chemicals)

- EP Minerals

- General Electric (GE)

- TDA Research, Inc.

- Norit Activated Carbon (Cabot)

- Veolia Water Technologies

Frequently Asked Questions

Analyze common user questions about the Mercury Removal Adsorbents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for mercury removal adsorbents?

The primary driver is the rigorous enforcement of global environmental regulations, such as the Minamata Convention and regional standards like the U.S. EPA's MATS rule, which mandate significant reductions in mercury emissions from industrial sources, particularly power plants and incinerators.

How does the Activated Carbon segment compare to Metal Sulfide adsorbents?

Activated Carbon (especially brominated) is cost-effective and widely used for gaseous mercury removal in flue gas treatment. Metal Sulfide adsorbents offer superior selectivity and high capacity, making them preferred for specific applications like high-pressure natural gas purification and liquid stream treatment.

What is the greatest challenge facing manufacturers of these adsorbents?

The greatest challenge is the costly and complex disposal of spent, mercury-laden adsorbents, which are classified as hazardous waste. This drives innovation toward developing reusable or regenerative material technologies to improve lifecycle economics.

Which application segment holds the largest share of the market?

The coal-fired power plant application segment currently holds the largest market share globally due to the vast volumes of flue gas requiring treatment and the strict emission limits imposed by regulatory bodies on thermal power generation facilities worldwide.

How is AI influencing the future development of mercury adsorbents?

AI and Machine Learning are utilized to accelerate the discovery and design of novel, high-performance adsorbent materials (like MOFs), optimize manufacturing processes, and enable dynamic, real-time control of abatement systems in industrial settings, leading to higher efficiency and lower operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager