Merino Wool Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435687 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Merino Wool Apparel Market Size

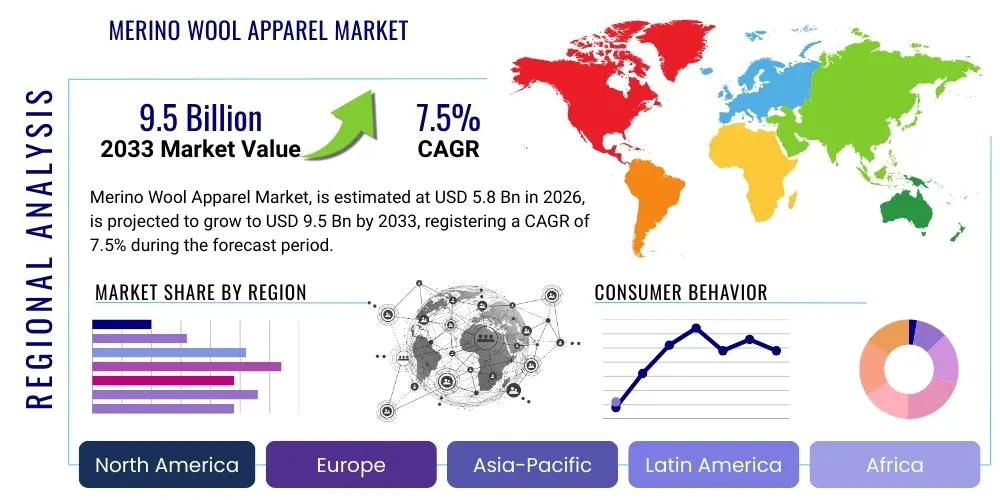

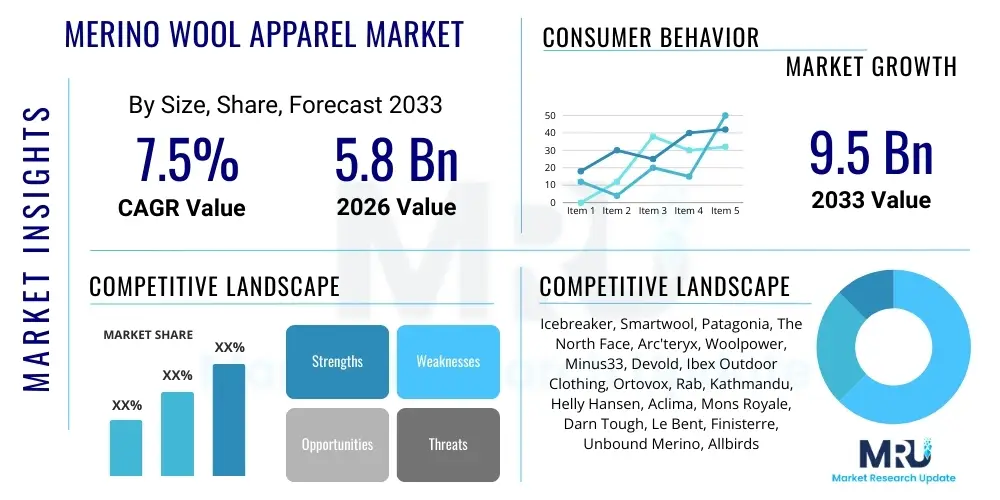

The Merino Wool Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.5 Billion by the end of the forecast period in 2033.

Merino Wool Apparel Market introduction

The Merino Wool Apparel Market encompasses clothing manufactured from the highly specialized wool derived from Merino sheep, renowned globally for its superfine diameter, exceptional softness, superior natural thermal regulation, and inherent advanced moisture-wicking properties. These characteristics collectively position merino wool as a premium and high-value material, fundamentally favored across high-performance sportswear, essential outdoor gear, and luxury everyday base layers. The market growth trajectory is intrinsically linked to the escalating global consumer demand for natural, sustainable, and renewable fibers, serving as ecologically sound alternatives to traditional synthetic textile materials, coupled simultaneously with a significant expansion in participation rates in outdoor adventure tourism, fitness activities, and wilderness exploration across key demographic groups worldwide.

Merino wool products span an exceptionally wide application spectrum, reliably covering fundamental garment categories including high-tech base layers, versatile mid-layers, durable outerwear, and essential accessories such as performance socks, specialized headwear, and insulating gloves. The primary and most rapidly expanding applications reside within the competitive athletic wear and demanding outdoor sports segments, where the fabric's critical attributes of advanced odor resistance, superior temperature management, and fast-drying capabilities are paramount for sustained comfort during endurance activities suching as ultra-running, extended hiking, alpine skiing, and competitive cycling. Furthermore, the material's unique combination of aesthetic quality, structural drape, and inherent wrinkle resistance has increasingly spurred its adoption within the high-end casual wear, travel clothing, and professional corporate apparel sectors, significantly broadening the overall market scope far beyond its traditional historical niche in performance-centric domains.

Key driving factors currently accelerating the market’s expansion include continuous technological advancements achieved in industrial wool processing and fiber treatment, specifically innovations that successfully enhance the material’s intrinsic durability, mechanical strength, and, crucially, machine washability, effectively mitigating historical consumer concerns regarding the specialized maintenance requirements associated with natural wool fibers. The rapid global expansion of the affluent middle class in rapidly developing emerging economies, alongside rigorous, targeted marketing campaigns that emphatically emphasize the holistic health benefits, exceptional comfort, and environmental circularity of choosing natural fibers, further catalyzes robust market penetration across diverse geographical regions. The inherent biodegradability, superior resource renewal cycle, and low carbon footprint of high-quality merino wool align precisely with global macro-economic movements towards circular fashion methodologies and fundamentally responsible consumption patterns, definitively cementing its crucial role as a high-value, strategically important commodity within the entire global textile manufacturing industry ecosystem.

Merino Wool Apparel Market Executive Summary

The Merino Wool Apparel Market is currently undergoing a pivotal transformation, characterized by strong business trends centered on sustainability certification (such as Responsible Wool Standard - RWS) and the vertical integration of supply chains to ensure ethical sourcing and full traceability from farm to finished garment. Business models are increasingly shifting towards direct-to-consumer (DTC) channels and subscription services, capitalizing on digital engagement and personalized customer experiences to maintain premium pricing and foster brand loyalty among discerning consumers. Technological enhancements focused on improving fiber longevity and incorporating blends with biodegradable synthetics are key areas of product development, ensuring that merino wool maintains its competitive edge against high-tech synthetic alternatives in demanding performance environments. Investment in localized production and transparency software is dominating the strategic landscape, reflecting the consumer desire for authenticity.

Regionally, North America and Europe remain the principal revenue generators, driven by high disposable incomes and a pervasive, well-established culture of specialized outdoor recreational pursuits. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, primarily fueled by the rapid expansion of the middle class in China and India, coupled with increasing Western lifestyle adoption and burgeoning interest in luxury athleisure. European markets are particularly sensitive to environmental regulations and ethical procurement, making fiber origin and processing standards a critical determinant for market access and success. Conversely, emerging markets often prioritize the intrinsic thermal and comfort benefits for practical, cold-weather use, offering diverse entry points for manufacturers.

Segmentation trends reveal significant dynamism, with the Base Layer segment maintaining its leading position due to merino wool’s unparalleled effectiveness in next-to-skin temperature regulation. However, the Mid Layer and Outerwear segments are experiencing accelerated growth, driven by technical innovations that allow for the creation of water-resistant and windproof merino blends, expanding its functional utility beyond traditional insulating layers. Furthermore, the segmentation by end-user highlights the increasing mainstream adoption of merino wool in Casual and Fashion wear, moving the fiber from a niche performance material into a desirable staple for high-quality, sustainable daily clothing. The ultrafine wool micron category is dominating the luxury apparel segment, commanding the highest average selling prices and symbolizing premium quality and unmatched softness.

AI Impact Analysis on Merino Wool Apparel Market

Common user inquiries regarding AI's impact on the Merino Wool Apparel Market frequently center on three core themes: the potential for AI to optimize the complex wool supply chain, the role of machine learning in predicting fashion and performance trends for localized production, and the use of generative AI in designing innovative garment patterns that maximize the unique properties of merino wool fibers. Users express concerns about maintaining ethical sourcing standards while integrating automated tracking systems, and expectations are high for AI to enhance transparency, minimize textile waste, and refine inventory management across the seasonal nature of apparel production. The core expectation is that AI will bridge the gap between premium material costs and manufacturing efficiency, making high-quality merino apparel more accessible while preserving its luxury and sustainable appeal.

- AI-driven supply chain optimization enhances raw wool traceability, verifying ethical sourcing and RWS compliance from sheep stations to processing facilities.

- Predictive analytics utilizing machine learning models forecasts consumer preferences for specific micron counts and garment styles, minimizing overproduction and reducing textile inventory risk.

- Generative design algorithms assist in creating complex knitting patterns and seamless garment structures tailored to optimize merino wool’s natural stretch, thermal regulation, and durability characteristics.

- Automated quality control systems (AI-vision) ensure fiber diameter consistency and detect contaminants early in the scouring and spinning processes, improving overall product quality and reducing manufacturing defects.

- AI-powered customer service bots and virtual try-on technologies enhance the digital retail experience, providing personalized recommendations based on usage scenario (e.g., skiing vs. daily wear) and optimizing fit precision.

DRO & Impact Forces Of Merino Wool Apparel Market

The market is predominantly driven by increasing consumer prioritization of sustainability, superior comfort, and high-performance attributes inherent in merino wool, contrasting sharply with synthetic materials. However, growth faces significant restraints, primarily stemming from the material’s high procurement cost relative to synthetics, which limits affordability and mass-market penetration, coupled with persistent concerns regarding long-term durability and specialized care requirements. Opportunities abound in leveraging innovative fiber technology to create durable, blended fabrics suitable for extreme conditions and expanding into untapped market segments like corporate uniforms and tactical gear. These forces collectively dictate the strategic priorities for manufacturers, requiring a delicate balance between premium pricing, supply chain transparency, and continuous product innovation to sustain competitive advantage.

The most significant driving factor remains the global shift toward eco-conscious consumption. Consumers are actively seeking materials that are renewable, biodegradable, and derived from ethically managed agricultural systems, positioning merino wool favorably against petroleum-derived plastics and synthetic fabrics. The superior moisture management, natural elasticity, and inherent odor resistance—a crucial benefit for extended outdoor trips or travel—reinforce its premium status, justifying the higher price point for performance-oriented buyers. Additionally, marketing efforts have successfully moved merino wool beyond merely a cold-weather material, promoting its trans-seasonal versatility due to its dynamic temperature-regulating capabilities, thereby broadening its applicability year-round and increasing purchasing frequency.

Restraints include the inherent volatility of raw wool commodity prices, which are heavily influenced by agricultural and climatic conditions, making stable long-term pricing and procurement planning challenging for manufacturers. Furthermore, despite processing advancements, some consumers remain hesitant due to past experiences with traditional wool shrinkage and pilling, necessitating continuous consumer education and investment in technical finishes like machine-washable treatments (e.g., chlorine-free finishing). Opportunities are vast in blending merino wool with sustainable technical fibers (like Tencel, recycled polyester, or spandex) to mitigate durability concerns while retaining natural benefits, thereby creating next-generation hybrid performance fabrics. Geographical expansion into rapidly developing athletic markets in Asia Pacific and enhanced product differentiation through specialized micron categories (e.g., 17.5-micron ultrafine wool for luxury wear) represent key areas for profitable market penetration.

Segmentation Analysis

The Merino Wool Apparel Market segmentation provides a granular view of demand distribution based on product type, end-user application, and fiber specification (micron count). The dominant product segment is Base Layers, which leverages merino wool's intrinsic capability to regulate body temperature against the skin, offering unparalleled comfort for prolonged periods. The market is also heavily influenced by the differentiation in micron count, with high-end luxury and high-performance brands focusing intensely on the ultrafine category (below 18.5 microns) to guarantee maximum softness and minimize potential itchiness. End-user segmentation shows a migration from purely Outdoor Enthusiasts to include mainstream Casual Wear consumers seeking sustainable, quality staple clothing, thereby diversifying revenue streams significantly.

- By Product Type:

- Base Layers (T-shirts, Long Sleeves, Leggings)

- Mid Layers (Sweaters, Hoodies, Jackets)

- Outerwear (Coats, Parkas - often blended)

- Accessories (Socks, Hats, Gloves, Neck Gaiters)

- By End User:

- Men

- Women

- Children

- By Application/Use:

- Outdoor and Performance Sports

- Casual and Fashion Wear

- Corporate and Uniforms

- By Fiber Micron Count:

- Ultrafine (Below 18.5 microns)

- Superfine (18.6 to 20.5 microns)

- Fine (20.6 to 22.5 microns)

- Medium/Strong (Above 22.5 microns)

- By Distribution Channel:

- Online Retail (E-commerce, Brand Websites)

- Offline Retail (Specialty Stores, Department Stores, Supermarkets)

Value Chain Analysis For Merino Wool Apparel Market

The Merino Wool Apparel value chain begins with highly specialized upstream activities involving sheep farming and raw wool production, requiring meticulous animal husbandry practices to achieve the desired fiber micron count and quality. This stage is characterized by high investment in sustainable grazing and animal welfare standards (e.g., non-mulesing certifications). Following sourcing, the midstream processes involve complex industrial scouring (cleaning), carding, spinning, and knitting/weaving, often requiring specialized machinery capable of handling superfine fibers without causing breakage or excessive waste. These midstream activities significantly add value by transforming raw fiber into textile ready materials with enhanced performance features.

Downstream activities focus on garment design, branding, and distribution, which are critical for capturing consumer preference and maximizing market price. Due to the premium nature of the product, distribution relies heavily on controlled channels, primarily through direct-to-consumer (DTC) digital platforms and specialized brick-and-mortar outdoor retail stores, ensuring accurate product education and brand image maintenance. The long lifecycle of merino apparel also involves post-consumer value retention initiatives, such as repair services and recycling programs, which contribute to the circularity mandate of the market.

Distribution channels exhibit a duality: Direct channels (brand websites, flagship stores) allow for complete control over pricing and customer data, driving higher profitability margins, especially for luxury and niche performance brands. Indirect channels, including multi-brand specialty outdoor retailers (like REI or MEC) and major e-commerce marketplaces (Amazon, Zalando), provide crucial volume and widespread geographical access. Transparency in the supply chain, particularly tracking certifications like RWS and ZQ Merino, is a core value-added step throughout the entire chain, directly influencing brand credibility and competitive positioning in highly regulated Western markets.

Merino Wool Apparel Market Potential Customers

The primary target demographic for merino wool apparel consists of discerning, mid-to-high income consumers who actively engage in outdoor recreational activities such as skiing, hiking, backpacking, and trail running, and who prioritize material performance, environmental sustainability, and functional longevity over initial purchase price. These consumers, often categorized as 'Outdoor Enthusiasts' and 'Adventure Travelers,' rely on merino wool for its critical thermal and moisture management properties in fluctuating weather conditions, viewing it as an essential investment in their gear portfolio. This group seeks specific certifications and verifiable claims regarding ethical sourcing and animal welfare, reflecting a deeply ingrained commitment to responsible consumption patterns.

A rapidly expanding secondary customer base includes the 'Athleisure Consumer' and the 'Sustainable Fashion Advocate.' The Athleisure segment utilizes merino wool for high-end casual wear, travel clothing, and yoga/studio practices, valuing its softness, wrinkle resistance, and natural odor control for seamless transition between active and professional settings. These buyers often purchase ultrafine micron apparel and are driven by aesthetic quality and comfort. The Sustainable Fashion Advocate, irrespective of specific athletic interest, chooses merino wool fundamentally for its natural biodegradability and renewable nature, aligning their purchasing decisions with broader environmental and ethical values, often preferring simple, timeless designs.

Furthermore, specialized institutional buyers, including military, police, and corporate entities operating in cold or extreme environments, represent a stable, high-volume B2B segment. These organizations purchase merino wool primarily for its functional attributes—superior warmth-to-weight ratio, fire resistance (inherent), and durability under heavy use—for high-performance uniform requirements. Retail distribution focuses on optimizing access for these diverse buyer groups: specialty stores serve the outdoor enthusiast with technical expertise, while high-street boutiques and online platforms cater to the fashion-conscious sustainable buyer, necessitating tailored marketing strategies based on channel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Icebreaker, Smartwool, Patagonia, The North Face, Arc'teryx, Woolpower, Minus33, Devold, Ibex Outdoor Clothing, Ortovox, Rab, Kathmandu, Helly Hansen, Aclima, Mons Royale, Darn Tough, Le Bent, Finisterre, Unbound Merino, Allbirds |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Merino Wool Apparel Market Key Technology Landscape

The technological landscape in the Merino Wool Apparel Market is primarily focused on overcoming the material’s inherent weaknesses (durability, tendency to pill, and wash constraints) while capitalizing on its strengths (softness, breathability). Core innovations revolve around fiber processing techniques, including advanced plasma treatments and chemical finishes (often chlorine-free or polymer-based) that enhance fiber scale resistance, thereby improving machine washability and minimizing shrinkage. A major development is the use of core-spun technology, where merino wool is spun around a core filament (typically nylon or recycled polyester) to significantly boost mechanical strength and tear resistance, making the fabric suitable for rugged outdoor use without compromising the wool’s benefits.

Knitting and weaving technologies are also advancing rapidly. Seamless 3D knitting machines are widely adopted to produce garments (especially base layers) that eliminate chafing seams, improve fit, and allow for differential fabric densities in specific body zones for targeted insulation and ventilation. Furthermore, the market utilizes sophisticated micron sorting technology, which employs laser diffraction equipment to precisely measure fiber diameter, ensuring consistency and maximizing the value of ultrafine wool batches, which are essential for luxury and anti-itch claims. These technical advances facilitate diversification into lightweight, high-gauge fabrics previously unattainable with natural fibers.

Crucially, traceability technology, utilizing blockchain and RFID tagging, is becoming standard practice. These technologies allow consumers and manufacturers to track the wool's origin, verifying ethical practices, animal welfare standards (non-mulesing), and environmental compliance (RWS). This transparency is no longer merely a marketing tool but a fundamental technical requirement for gaining market access in ethically conscious regions like Western Europe. The integration of advanced technical finishes for water repellency and wind resistance is also expanding merino's utility into the outer layer segment, historically dominated by synthetic membranes.

Regional Highlights

- North America (The United States, Canada, and Mexico): North America represents a mature and highly lucrative market for merino wool apparel, primarily driven by strong consumer purchasing power and a deeply entrenched culture of outdoor recreation, particularly in areas like the Pacific Northwest and the Rocky Mountains. The market is characterized by high demand for premium-priced technical gear, where brands specializing in alpine sports, hiking, and camping leverage merino wool’s high-performance attributes. Consumers in this region are generally well-informed about sustainability and material sourcing, placing significant value on ethical wool production and supply chain transparency, which directly influences brand preference and market share distribution. The United States leads consumption within the region, spurred by aggressive marketing from domestic and international brands targeting both performance enthusiasts and the 'athleisure' market. The proliferation of direct-to-consumer (DTC) models has allowed specialized merino wool brands to bypass traditional retail challenges, offering customized experiences and detailed educational content regarding the fiber’s benefits. Regulatory support for sustainable practices and initiatives promoting local sourcing, although challenging, are increasingly shaping market dynamics, pushing manufacturers towards verifiable environmental certifications. Furthermore, the growing adoption of merino wool base layers for military and tactical applications contributes a stable, high-volume demand component to the overall regional market structure. Market expansion is also fueled by innovation in blending merino wool with other technical fibers (like Tencel or Nylon) to improve durability and moisture management suitable for intense summer activities, broadening the traditional seasonal usage. Major retail chains and specialized outdoor stores continually expand their merino wool inventory, recognizing the high margin and customer loyalty associated with these premium products. This region’s strong alignment with wellness and fitness trends ensures sustained growth, with merino wool gaining prominence not just as performance wear, but also as everyday, highly functional casual clothing suitable for varying climates and travel needs. This regional complexity, combining high-end performance, sustainability focus, and broad lifestyle integration, solidifies North America's status as a critical driver for global market innovation and revenue generation.

- Europe (Germany, UK, France, Scandinavia, Italy): Europe is a historically significant market, deeply embedded in mountaineering and winter sports traditions, providing a robust foundational demand for merino wool. The region is characterized by high fragmentation in consumer preference, where Scandinavian countries show a strong historical allegiance to traditional, heavy-gauge wool for extreme cold, while Central and Western Europe exhibit high demand for ultrafine, lightweight layers utilized in layered systems for diverse sports. European regulations concerning textiles, including stringent environmental and chemical standards (like REACH), exert a powerful influence on sourcing and processing methods, often favoring suppliers who adhere to certified ethical and organic standards, which reinforces the demand for RWS-certified wool. The UK and Germany are leading commercial hubs, demonstrating high sales volumes through specialized outdoor retailers and burgeoning online marketplaces focusing on natural, sustainable apparel. The cultural acceptance of premium-priced, long-lasting clothing drives sustained market penetration. The trend towards sustainable fashion is particularly strong in Europe, encouraging rapid adoption of circular economy models among major apparel brands. This includes offering repair services, buy-back schemes, and clear end-of-life recycling pathways for merino garments, appealing directly to the highly ethical consumer base. Localized production, though constrained by cost, is a niche but growing trend, particularly in Italy and the Nordic countries, focusing on high craftsmanship and traceability. The prevalence of hiking, skiing, and winter camping across the continent ensures merino wool remains a core necessity, supported by technological shifts that make it suitable for urban commuter wear as well.

- Asia Pacific (APAC) (China, Japan, Australia, New Zealand): The Asia Pacific region is anticipated to record the highest Compound Annual Growth Rate (CAGR) over the forecast period, driven primarily by macroeconomic factors such as unprecedented growth in disposable incomes, rapidly expanding urbanization, and the increasing globalization of Western fitness and outdoor lifestyles, particularly within China and South Korea. While Australia and New Zealand are foundational to the market as the largest global producers of raw merino wool, their consumer markets are also significant, showing strong preference for locally sourced, high-quality brands. China represents the most dynamic consumption market, where premium merino apparel is increasingly viewed as a status symbol, appealing to both the technical outdoor user and the high-end luxury consumer. However, the market structure is complex due to varying climate zones, necessitating diverse product offerings—from ultra-lightweight, high-breathability garments for humid regions to heavy thermal base layers for northern climates. The challenge in APAC lies in consumer education regarding merino wool care and benefits, as many traditional textile preferences favor cotton or synthetics. Strategic marketing, often leveraging social media influencers and local celebrity endorsements, is essential for building brand awareness and trust. Japanese consumers, known for their focus on technical innovation and quality craftsmanship, drive demand for specialized, high-functionality merino blends. Furthermore, the development of domestic manufacturing capabilities within APAC, moving beyond raw fiber export to finished apparel production, is reshaping the global competitive dynamics. The adoption rate of sustainable and ethical consumerism is rising, albeit slower than in Europe, presenting a long-term growth opportunity as transparency certifications become more widely recognized.

- Latin America, Middle East, and Africa (LAMEA): The LAMEA region currently holds the smallest market share but presents specialized growth opportunities, mainly centered around specific geographical and economic niches. In Latin America, demand is concentrated in the cooler climates of the Andes region (Chile and Argentina) and among consumers participating in rapidly expanding adventure tourism sectors. Key applications here are often focused on functional outerwear and durable trekking gear, with a preference for mid-range pricing due to lower average disposable income compared to North America or Europe. In the Middle East, high demand exists for specialized merino products tailored for cooler desert nights or high-altitude travel, particularly among affluent consumers seeking luxury, high-quality travel wear. The market is highly import-dependent, making distribution costs and logistics crucial factors influencing final retail price. Africa's market for merino apparel is highly fragmented, with consumption concentrated among expatriate populations, international tourists, and niche performance athletes. However, South Africa, as a significant producer of raw wool, exhibits a nascent domestic market for finished goods, capitalizing on local production efficiencies. Challenges across LAMEA include underdeveloped retail infrastructure for specialized outdoor goods and a requirement for targeted marketing that addresses local climate variations and cultural preferences. Strategic entry requires focusing on accessible pricing and emphasizing the longevity and multi-functional use of the garments to overcome price barriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Merino Wool Apparel Market.- Icebreaker (VF Corporation)

- Smartwool (VF Corporation)

- Patagonia Inc.

- The North Face (VF Corporation)

- Arc'teryx (Amer Sports)

- Woolpower AB

- Minus33 Merino Wool

- Devold of Norway

- Ibex Outdoor Clothing

- Ortovox Sportartikel GmbH

- Rab Equipment

- Kathmandu Holdings Limited

- Helly Hansen AS

- Aclima AS

- Mons Royale

- Darn Tough Vermont

- Le Bent

- Finisterre

- Unbound Merino

- Allbirds Inc.

Frequently Asked Questions

Analyze common user questions about the Merino Wool Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Merino Wool Apparel Market?

The market growth is fundamentally driven by the heightened global consumer demand for sustainable, natural textile fibers, coupled with merino wool's intrinsic high-performance attributes, including superior temperature regulation, natural odor resistance, and exceptional softness, making it ideal for outdoor activities and athleisure wear.

How does the high cost of merino wool affect its market penetration?

The high procurement cost of raw merino wool serves as a primary market restraint, limiting mass-market penetration compared to cheaper synthetic alternatives. Manufacturers mitigate this by focusing on premium, high-value segments and emphasizing the long-term durability and superior performance benefits to justify the higher retail price for discerning customers.

Which product segment holds the largest share in the Merino Wool Apparel Market?

The Base Layer segment currently holds the largest market share. Merino wool is highly favored for next-to-skin garments due to its unparalleled ability to manage moisture and regulate body temperature efficiently across a wide range of climates and activity levels, ensuring maximum wearer comfort.

What role does the micron count play in Merino Wool apparel segmentation?

Micron count is critical as it determines fiber diameter and softness. Ultrafine wool (below 18.5 microns) commands the highest prices and dominates the luxury and high-end base layer segments due to its supreme softness and non-itch properties, while coarser wool is used more commonly in durable outerwear and accessories like socks.

What key technological advancements are influencing the market?

Key advancements include core-spun technology to enhance durability and tear resistance, advanced finishing treatments (often chlorine-free) to improve machine washability and reduce shrinkage, and the integration of blockchain technology to ensure verifiable ethical sourcing and supply chain transparency (e.g., RWS certification).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager