Meso Erythritol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433976 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Meso Erythritol Market Size

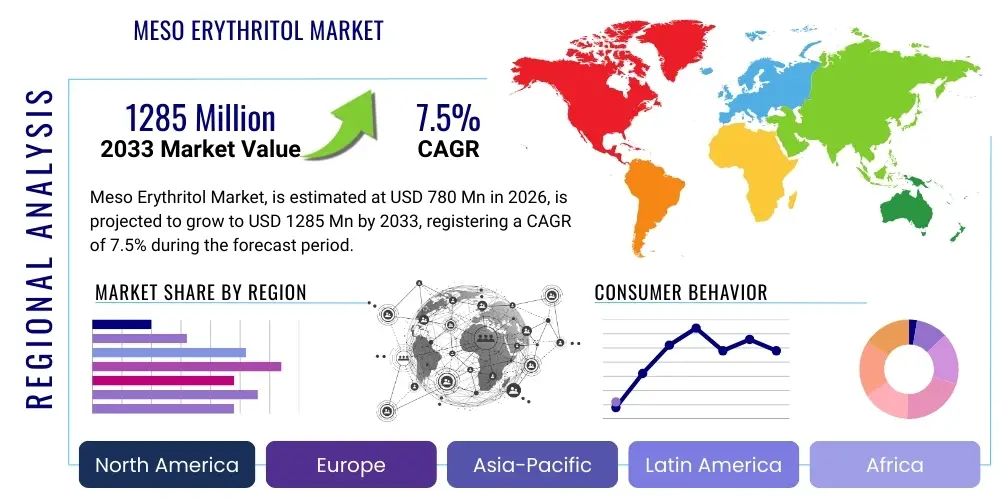

The Meso Erythritol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $780 Million in 2026 and is projected to reach $1285 Million by the end of the forecast period in 2033.

Meso Erythritol Market introduction

Meso Erythritol, a natural polyol (sugar alcohol), is gaining prominence in the global food and beverage industry as a highly favored bulk sweetener alternative. Derived typically through the fermentation of glucose by yeast, it distinguishes itself from other sugar alcohols due to its high digestive tolerance, extremely low caloric value (nearly zero calories per gram), and high sweetness profile (approximately 60-80% the sweetness of sucrose). The compound occurs naturally in certain fruits and fermented foods, bolstering its appeal as a clean-label ingredient for health-conscious consumers and manufacturers aiming to reduce sugar content without sacrificing mouthfeel or taste.

The primary applications of Meso Erythritol span across dietary products, sugar-free confections, baked goods, beverages, and pharmaceuticals. Its physiological benefit lies in its non-glycemic response, making it exceptionally suitable for diabetic and ketogenic diets. Furthermore, its chemical properties, such including stability across various temperatures and pH levels, make it an invaluable component in formulating complex food matrices. The rising global incidence of obesity and diabetes, coupled with intensified regulatory focus on lowering sugar consumption, acts as a pivotal driver for the expanded adoption of this low-calorie sweetener across diverse consumer packaged goods segments.

The market introduction phase has successfully transitioned into a rapid growth phase, propelled by continuous innovation in fermentation techniques and cost-effective production scaling. Benefits such as superior sensory properties, including the minimization of the cooling effect often associated with other polyols like xylitol, further solidify its market position. Driving factors include escalating demand for functional foods, clean-label certification requirements, and the necessity for flavor enhancers in highly customized, reduced-sugar product lines globally. The versatility of Meso Erythritol allows it to be efficiently blended with high-intensity sweeteners, addressing both bulk volume requirements and desired sweetness levels in numerous applications.

Meso Erythritol Market Executive Summary

The global Meso Erythritol Market is characterized by robust growth, primarily fueled by prevailing business trends emphasizing sugar reduction and health optimization across consumer packaged goods (CPG). Key business trends include aggressive capacity expansion by leading Asian manufacturers, increased strategic partnerships between ingredient suppliers and major global food and beverage corporations, and heavy investment in research focused on optimizing crystalline structure and minimizing aftertaste when blended with other ingredients. Supply chain resilience, particularly post-pandemic, is a critical area of focus, driving efforts toward localized sourcing and enhanced inventory management to mitigate price volatility observed in raw materials such like glucose.

Regionally, the market exhibits divergent maturity levels. Asia Pacific (APAC), led by China and India, maintains dominance in both production capacity and consumption growth due to large populations, increasing disposable incomes, and the established presence of large-scale fermentation facilities. North America and Europe, however, represent high-value consumption markets, driven by stringent health regulations, high consumer awareness regarding caloric intake, and rapid adoption in premium and specialty dietary products, especially keto-friendly and paleo-certified goods. Latin America and the Middle East and Africa (MEA) are emerging rapidly, motivated by global trade expansion and rising health consciousness, particularly in urban centers where Western dietary habits are being integrated.

Segmentation trends indicate that the powdered form of Meso Erythritol remains the dominant segment due to its versatility and ease of integration into dry mixes and baked goods. However, the granulated and liquid segments are experiencing accelerated growth, particularly in the beverage and dairy industries where solubility and stability are paramount. Application-wise, the food and beverage sector holds the largest share, although the pharmaceutical and cosmetic applications are projected to witness the highest CAGR, spurred by demand for excipients and functional ingredients in drug formulations and personal care products designed for sensitive skin or oral hygiene benefits.

AI Impact Analysis on Meso Erythritol Market

User queries regarding AI's influence on the Meso Erythritol market typically revolve around optimizing fermentation yields, predicting raw material pricing volatility, and accelerating new product development (NPD) timelines for optimal sweetener blends. Users are keen to understand how AI can reduce the currently high production costs associated with fermentation and purification processes, inquiring specifically about predictive maintenance models for large bioreactors and data-driven insights into metabolic pathway engineering. A primary concern is whether AI can stabilize the supply chain by forecasting glucose availability and transport logistics, thereby ensuring consistent pricing for end-users, such as major confectionery manufacturers.

AI is poised to revolutionize the manufacturing phase of Meso Erythritol production by enhancing process efficiency and quality control. Machine learning algorithms can analyze vast datasets from bioreactors, including temperature, pH, nutrient levels, and dissolved oxygen, to predict optimal fermentation endpoint conditions and detect anomalies early. This capability minimizes batch losses, significantly improves yield predictability, and reduces energy consumption associated with lengthy or poorly controlled fermentation cycles. Furthermore, predictive modeling powered by AI assists in identifying the most cost-effective and highest-purity separation and crystallization techniques, leading to a superior final product that meets stringent food safety standards and reduces overall operational expenditure.

In the downstream market, AI and large language models (LLMs) are transforming market intelligence and consumer trend identification. AI tools analyze social media sentiment, consumer purchasing patterns, and nutritional data to pinpoint emerging demand for specific sweetener profiles, such as blends incorporating stevia or monk fruit alongside Erythritol. This rapid market insight allows manufacturers to tailor product formulations, accelerate the commercialization of new sugar-reduced offerings, and strategically position their products for AEO dominance in online retail channels. AI also plays a crucial role in managing complex regulatory compliance by quickly interpreting and applying regional labeling laws related to polyols and caloric claims.

- AI-driven optimization of microbial strains and fermentation parameters for maximized yield.

- Predictive maintenance analytics for large-scale bioreactors to minimize operational downtime.

- Enhanced supply chain forecasting using ML models to stabilize raw material costs (glucose).

- Rapid formulation development and sensory testing optimization using AI to perfect sweetener blends.

- Automated quality control systems (QC) ensuring high purity and crystal uniformity.

- Advanced market trend analysis for precise targeting of clean-label and keto consumer segments.

DRO & Impact Forces Of Meso Erythritol Market

The Meso Erythritol market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver is the pervasive global health movement focusing on weight management and blood sugar control, particularly in developed economies where lifestyle diseases are prevalent. Simultaneously, manufacturers face significant restraints, notably the relatively high cost of production compared to traditional sucrose, which necessitates continuous process optimization, and occasional consumer concerns related to digestive tolerance, although Erythritol generally performs better than other polyols in this regard. The key opportunity lies in expanding applications beyond standard confectionery into high-growth areas like clinical nutrition, specialized infant formulas, and nutraceuticals, leveraging its favorable metabolic profile.

Key impact forces further accelerate or decelerate market progression. Government regulations demanding reduced sugar content in packaged foods (e.g., sugar taxes in Mexico, UK, and South Africa) act as a strong external force compelling manufacturers to adopt alternatives like Erythritol. Furthermore, the rising awareness of the gut microbiome's role in health is increasing scrutiny on non-digestible ingredients, pushing manufacturers to conduct and publicize extensive research on Erythritol's minimal impact on gut flora. Technological advances in bioconversion and purification techniques are a positive impact force, driving down the cost curve and improving the sensory profile, thereby mitigating the restraint of high production expenses over the medium term.

The current environment is characterized by intense competition from both artificial (e.g., sucralose) and high-intensity natural sweeteners (e.g., stevia derivatives). This competitive pressure forces continuous innovation in blending solutions, where Meso Erythritol acts as a crucial bulking agent. Opportunities also arise from product diversification, such as marketing crystalline Erythritol as a tabletop sweetener under proprietary brands, appealing directly to the end-consumer market. Managing public perception regarding sweetener safety, often amplified by misinformation on digital platforms, is a crucial internal force that necessitates proactive, scientifically supported content strategies by key market players to maintain consumer trust and market momentum.

Segmentation Analysis

The Meso Erythritol market is meticulously segmented based on format, application, source, and distribution channel to provide granular insights into market dynamics and growth potential across various consumer bases and industrial uses. The segmentation reveals specific areas of high investment return, particularly in the beverage and dietary supplement sectors, where demand for zero-calorie, clean-label bulking agents is exceptionally strong. Analyzing these segments helps stakeholders understand geographical consumption patterns and tailor their production capabilities and marketing efforts to target specific industry needs, whether it be supplying bulk powder for industrial baking or specialized blends for high-end functional beverages.

Segmentation by format highlights the importance of physical characteristics in processing. Powdered Erythritol dominates due to its widespread use in dry mixes, baking, and blending operations. However, the granulated form, which offers improved flowability and reduced dusting, is increasingly preferred in large-scale industrial mixing operations. The growing trend toward ready-to-drink (RTD) beverages is simultaneously boosting the liquid concentrate segment, as liquid forms are easier to integrate into high-speed liquid processing lines without requiring extensive dissolving steps, thereby reducing manufacturing costs and time.

From an application perspective, the food and beverage industry remains the largest revenue contributor, encompassing confectionery, dairy, snacks, and bakery items. However, the high growth potential resides in emerging applications such as pharmaceuticals (used as a low-glycemic excipient, coating agent, and binder) and personal care (utilized in sugar-free toothpaste, mouthwash, and dermatological products for moisturizing effects). Segmentation by source is critical for clean-label positioning, differentiating fermentation-derived (typically from corn or wheat starch) products from synthetically produced alternatives, with the former commanding a premium due to natural sourcing appeal.

- By Format:

- Powder

- Granulated

- Liquid/Concentrate

- By Application:

- Food and Beverages

- Confectionery and Gums

- Baked Goods

- Dairy and Frozen Desserts

- Beverages (Soft Drinks, Juices, Energy Drinks)

- Tabletop Sweeteners

- Pharmaceuticals

- Personal Care and Cosmetics

- Nutraceuticals and Dietary Supplements

- Food and Beverages

- By Source:

- Natural Fermentation (Corn Starch, Tapioca)

- Synthetic/Chemical Synthesis

- By Distribution Channel:

- Direct Sales (Business-to-Business)

- Indirect Sales (Distributors, Wholesalers, Retail)

Value Chain Analysis For Meso Erythritol Market

The value chain for the Meso Erythritol market begins with upstream activities heavily focused on raw material sourcing, primarily glucose derived from corn, wheat, or tapioca starch. The stability and cost of these agricultural commodities are critical factors influencing the final ingredient price. Upstream analysis involves assessing the efficiency of starch hydrolysis and ensuring a consistent supply of high-purity glucose feedstock necessary for the subsequent fermentation process. Key activities at this stage involve managing agricultural supply contracts, implementing sustainable sourcing practices, and utilizing advanced enzyme technology for efficient starch conversion, ensuring both cost competitiveness and raw material traceability for natural claims.

The core midstream activity involves the proprietary bioconversion process, where specialized yeasts (e.g., Moniliella pollini or Candida lipolytica) ferment the glucose substrate into Erythritol. This is followed by energy-intensive purification, crystallization, and drying stages. Efficiency in these manufacturing processes is paramount, requiring substantial capital investment in large-scale bioreactors and advanced separation technologies like ion exchange and ultrafiltration. Companies that hold proprietary strains or possess highly efficient purification methods gain a significant competitive advantage in terms of yield and purity, which directly impacts the ingredient's suitability for premium food and pharmaceutical applications.

Downstream analysis focuses on distribution and final application. Direct distribution channels involve B2B sales to large food and beverage multinational corporations (MNCs) and pharmaceutical companies, often via long-term contracts tailored to specific formulation needs. Indirect channels utilize specialized food ingredient distributors and brokers who manage logistics and inventory for smaller and medium-sized enterprises (SMEs). Marketing and sales activities are crucial downstream, emphasizing technical support, formulation assistance, and regulatory documentation to facilitate client adoption. Ultimately, the successful delivery hinges on maintaining product quality, ensuring global regulatory compliance, and integrating seamlessly into customer supply chains.

Meso Erythritol Market Potential Customers

The primary customers for Meso Erythritol are large-scale industrial entities seeking high-quality, zero-calorie bulking agents to reformulate their products in compliance with changing public health standards and consumer preferences. The largest segment of end-users consists of multinational food and beverage corporations specializing in confectionery (chewing gums, hard candies), beverages (diet sodas, flavored water, sports drinks), and baked goods (low-carb breads, cakes, and cookies). These customers prioritize bulk availability, consistency in crystal size and purity, and cost-effectiveness that allows for competitive retail pricing while meeting clean-label requirements.

A rapidly growing customer base includes manufacturers of specialized dietary products and nutraceuticals. This segment comprises companies focusing on the ketogenic, diabetic, and weight management markets, where Erythritol is highly valued for its non-glycemic index and minimal impact on insulin levels. These buyers demand extremely high purity levels, often requiring pharmaceutical or food-grade certifications, and require extensive supporting documentation regarding clinical safety and metabolic profiles. Custom blends incorporating other high-intensity sweeteners are frequently requested by these customers to achieve specific taste profiles optimized for low-sugar environments.

Further potential customers are found within the pharmaceutical and oral care industries. Pharmaceutical companies use Meso Erythritol as a sweetening and bulking excipient in chewable tablets, oral suspensions, and medical nutritional supplements, replacing sucrose or lactose. Oral care manufacturers integrate it into toothpaste and mouthwash formulations, leveraging its non-cariogenic properties and ability to inhibit plaque formation. These industrial customers typically require stringent regulatory compliance, often necessitating sourcing from facilities adhering to Good Manufacturing Practices (GMP) specifically tailored for pharmaceutical or cosmetic inputs, thus representing a premium tier of customer engagement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $780 Million |

| Market Forecast in 2033 | $1285 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, Zhucheng Dongxiao Biotechnology, Jungbunzlauer Suisse AG, Shandong Sanyuan Biotechnology Co. Ltd., Mitsubishi Chemical Corporation, Futaste Co. Ltd., Xylitol Canada Inc., GLG Life Tech Corp., Zhejiang Huakang Pharmaceutical Co., Ingredion Incorporated, Tate & Lyle PLC, Wuxi Cima Science Co., Ltd., Baolingbao Biology Co., Shandong Lujian Biological Technology Co., Inc., Changzhou Aladdin Biomedical Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Meso Erythritol Market Key Technology Landscape

The technology landscape governing the Meso Erythritol market is centered around advanced bioconversion and separation techniques designed to enhance yield, purity, and sustainability. The fundamental technology relies on microbial fermentation, primarily using osmophilic yeasts to convert glucose feedstock into Erythritol. Recent advancements have focused heavily on strain engineering through genetic modification or adaptive evolution to improve the efficiency and speed of the yeast metabolism, specifically aiming to increase the final concentration of Erythritol in the fermentation broth and reduce the overall batch processing time. Furthermore, continuous fermentation systems are replacing traditional batch processes, offering higher throughput and improved capital utilization.

Post-fermentation processing necessitates specialized purification technologies. Key technologies in this phase include high-performance chromatography and membrane separation (ultrafiltration and nanofiltration) systems, which are instrumental in efficiently removing unwanted byproducts, salts, and residual glucose from the broth. Ion exchange resins are critical for demineralization and achieving the high purity levels required for premium food and pharmaceutical grades (typically >99.5%). Continuous investment in these separation technologies is crucial for manufacturers to maintain competitiveness, as lower purity requires higher doses for the same sweetness, impacting cost in use for the customer.

Innovation is also evident in crystallization and drying processes. Manufacturers are adopting specialized crystallizers that control cooling rates and agitation to produce uniform crystal sizes, which is vital for product handling, flowability, and sensory performance in end applications. Furthermore, sustainable technology is a growing focus; companies are investing in technologies that minimize wastewater generation and improve energy recovery during the evaporation stage, aligning production with increasing global environmental, social, and governance (ESG) standards. The integration of advanced sensors and process control software (often utilizing AI mentioned previously) across all technological stages ensures robust quality assurance and operational excellence.

Regional Highlights

Regional dynamics are critical to understanding the Meso Erythritol market's overall trajectory, reflecting differential regulatory environments, consumer health priorities, and manufacturing capacities. Asia Pacific (APAC) dominates the global supply chain, driven by extensive production capabilities in China, which benefit from cost advantages in raw materials (corn starch) and well-established fermentation infrastructure. This region not only serves as the largest exporter but also represents a rapidly expanding consumption market, fueled by urbanization and increasing awareness of diabetic control, making it central to volume growth.

North America and Europe constitute the highest value markets, characterized by stringent quality demands and high consumer willingness to pay a premium for certified health products. In North America, the market is heavily influenced by the popularity of keto and low-carb diets, resulting in robust demand across specialized snack bars, ready-to-mix powders, and dietary supplements. European adoption is driven by aggressive sugar reduction targets set by both governmental bodies and major retailers, making Erythritol a primary ingredient in the reformulation of breakfast cereals, confectionery, and dairy alternatives. These regions demand highly customized blends and impeccable supply chain transparency.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as significant growth areas. LATAM markets, particularly Brazil and Mexico, are seeing rapid adoption due to high rates of diabetes and the imposition of sugar taxes, encouraging local food manufacturers to switch to polyols. In MEA, particularly the Gulf Cooperation Council (GCC) countries, rising disposable income and exposure to international health trends are boosting the demand for zero-sugar beverages and functional foods. While production capacity in these regions is currently low, increasing imports and potential localized facility investments signal future market expansion opportunities, particularly focused on satisfying regional demands for customized halal-certified ingredients.

- Asia Pacific (APAC): Dominates manufacturing capacity; highest consumption growth driven by China, India, and Southeast Asian nations focused on combating metabolic disorders.

- North America: High-value market segment leader; strong demand driven by ketogenic diets, diabetic formulations, and specialized supplements; emphasis on clean-label sourcing.

- Europe: Key market for regulatory-driven sugar reduction; strong adoption in confectionery and beverages; strict adherence to Novel Food regulations governing new ingredient blends.

- Latin America (LATAM): Fastest emerging growth region due to government anti-obesity initiatives and sugar taxation; major markets include Brazil and Mexico.

- Middle East and Africa (MEA): Growing market influenced by rising health awareness and Western import trends; increasing focus on functional and low-calorie food security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Meso Erythritol Market.- Cargill Incorporated

- Zhucheng Dongxiao Biotechnology

- Jungbunzlauer Suisse AG

- Shandong Sanyuan Biotechnology Co. Ltd.

- Mitsubishi Chemical Corporation

- Futaste Co. Ltd.

- Xylitol Canada Inc.

- GLG Life Tech Corp.

- Zhejiang Huakang Pharmaceutical Co.

- Ingredion Incorporated

- Tate & Lyle PLC

- Wuxi Cima Science Co., Ltd.

- Baolingbao Biology Co.

- Shandong Lujian Biological Technology Co., Inc.

- Changzhou Aladdin Biomedical Co. Ltd.

- ADM (Archer Daniels Midland Company)

- Beneo GmbH

- PureCircle (a subsidiary of Ingredion)

- Tianjin North Food Co., Ltd.

- Sanwa Starch Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Meso Erythritol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Meso Erythritol and how does it compare to other zero-calorie sweeteners?

Meso Erythritol is a naturally derived sugar alcohol (polyol) used as a bulk sweetener. It is unique among polyols because it provides nearly zero calories (0.2 kcal/g) and has a non-glycemic effect, making it safe for diabetics. Compared to stevia or sucralose, Erythritol offers crucial bulking properties similar to sugar, essential for texture in baked goods, and generally causes less digestive distress than sorbitol or xylitol.

What are the primary drivers accelerating the growth of the Meso Erythritol market?

The market growth is primarily driven by rigorous global public health initiatives and government mandates aimed at reducing refined sugar consumption, coupled with the exponential increase in consumer adoption of specialized dietary trends such as ketogenic and low-carb lifestyles. Its classification as a clean-label, natural ingredient further boosts its adoption in the CPG industry seeking better ingredient transparency.

How does the production cost of Meso Erythritol impact its competitive positioning?

Meso Erythritol's production involves complex fermentation and extensive purification, leading to a higher cost compared to commodity sweeteners like sucrose or high-fructose corn syrup. This higher cost acts as a key restraint, particularly in price-sensitive developing markets. However, ongoing technological advancements in continuous fermentation and process efficiency are steadily reducing the cost barrier, improving its competitiveness against artificial sweeteners.

Which application segment holds the largest share of the Meso Erythritol market?

The Food and Beverage segment holds the largest market share, specifically driven by its use in confectionery, gums, and low-calorie beverage formulations where its superior taste profile and bulking properties are essential. However, the fastest growth is anticipated in the nutraceutical and pharmaceutical segments, where it serves as a critical, non-cariogenic, and metabolically neutral excipient.

What regulatory factors influence the market adoption of Meso Erythritol globally?

Regulatory factors are highly favorable, as Meso Erythritol is generally recognized as safe (GRAS) by the U.S. FDA and approved in major regions including the EU and Japan. The main regulatory influence stems from mandatory nutritional labeling requirements and sugar taxation policies, which functionally incentivize manufacturers to incorporate zero-calorie bulk ingredients like Erythritol into reformulated products to meet governmental health targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager