Mesocarbon Microbeads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431756 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Mesocarbon Microbeads Market Size

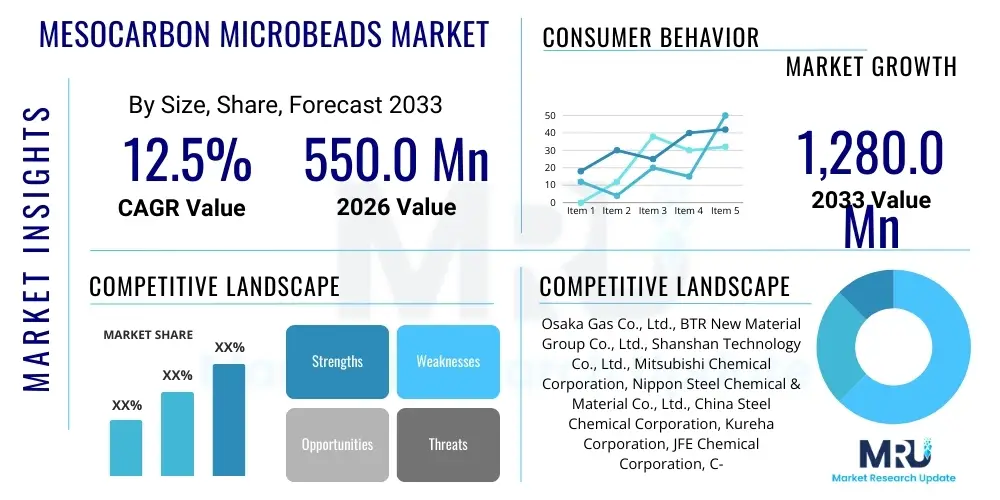

The Mesocarbon Microbeads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 550.0 Million in 2026 and is projected to reach USD 1,280.0 Million by the end of the forecast period in 2033.

Mesocarbon Microbeads Market introduction

Mesocarbon Microbeads (MCMBs) are specialized, spherical carbon materials derived primarily from coal tar pitch or petroleum pitch through controlled heat treatment processes, such as polymerization and carbonization, followed by graphitization. These materials exhibit highly desirable properties, including high purity, excellent sphericity, low coefficient of thermal expansion, and superb electrochemical performance. MCMBs serve as a crucial component, primarily utilized as the anode material in high-performance lithium-ion batteries (LIBs), especially those requiring high cycling stability, rapid charge/discharge rates, and enhanced safety features.

The core application of MCMBs lies in the rapidly expanding electric vehicle (EV) sector, portable consumer electronics, and large-scale energy storage systems (ESS). Their structure—a highly ordered, graphitized arrangement—allows for efficient lithium-ion intercalation and deintercalation, contributing significantly to the longevity and reliability of battery systems. While competition exists from synthetic graphite, MCMBs often offer superior performance stability under specific high-power density requirements, making them indispensable in specialized applications, including aerospace and medical devices.

Major driving factors fueling the market include global governmental mandates pushing for electric mobility, substantial investments in grid modernization and renewable energy integration requiring robust ESS solutions, and the continuous technological advancements in battery chemistry demanding higher quality anode materials. Furthermore, the inherent stability of MCMBs helps mitigate risks associated with thermal runaway in batteries, a critical safety consideration across all end-use sectors, particularly in the automotive industry.

Mesocarbon Microbeads Market Executive Summary

The Mesocarbon Microbeads market trajectory is defined by robust demand stemming from the global electrification trend, dominated primarily by the burgeoning electric vehicle and grid-level energy storage sectors. Asia Pacific (APAC) stands as the undisputed epicenter of production and consumption, driven by the massive concentration of lithium-ion battery manufacturing capabilities located in countries such as China, South Korea, and Japan. Strategic business trends revolve around capacity expansion, vertical integration by key manufacturers, and intense focus on developing ultra-high-purity MCMBs tailored for extreme performance requirements, particularly in premium EV models and high-duration ESS installations. The shift towards higher energy density and faster charging necessitates continuous innovation in MCMB structure and surface modification.

Segment trends reveal that battery-grade MCMBs, specifically those used in lithium-ion batteries, account for the vast majority of market revenue, overshadowing industrial applications like structural composites and refractories. Within the battery segment, the demand for anode materials that can efficiently handle fast charging without compromising cycle life is paramount. Regionally, while APAC maintains dominance, significant growth opportunities are emerging in North America and Europe, stimulated by substantial government subsidies and private sector investments aimed at establishing localized, secure supply chains for EV battery production, thereby reducing reliance on Asian imports.

The market faces concurrent challenges, notably the escalating cost and supply volatility of precursor materials (coal/petroleum pitch) and the technological rivalry presented by advanced materials such as silicon-carbon composites. However, MCMBs maintain a strong market position due to their established safety profile and cost-efficiency relative to newer, riskier alternatives. Manufacturers are strategically investing in advanced graphitization techniques and process optimization, including artificial intelligence (AI)-driven quality control, to ensure consistent product specification fulfillment across diverse end-use applications, solidifying MCMBs' role as a foundational material in the transition to sustainable energy solutions.

AI Impact Analysis on Mesocarbon Microbeads Market

User queries regarding the impact of AI on the Mesocarbon Microbeads Market typically center on three core areas: how AI can accelerate materials discovery, optimize complex manufacturing processes, and enhance quality control/yield rates. Users are concerned with whether AI can help manufacturers overcome the inherent inconsistencies in pitch feedstock and graphitization processes, which traditionally rely heavily on empirical knowledge and manual oversight. Expectations are high that AI, particularly machine learning (ML) models, can predict optimal precursor blend ratios and thermal profiles necessary to achieve target sphericity, purity, and crystal structure, thereby reducing production costs and lead times significantly.

The integration of AI systems into the MCMB production lifecycle, particularly in the high-temperature graphitization phase, allows for real-time monitoring and predictive adjustments. Traditional manufacturing involves substantial time lags between process parameters setting and quality assessment. AI utilizes sensor data—temperature, pressure, gas flow, and composition—to build predictive models, identifying potential defects or deviations instantly. This predictive capacity not only improves batch consistency but also drastically minimizes waste, leading to enhanced operational efficiency and resource utilization. Furthermore, generative AI is beginning to be explored in the molecular design phase, suggesting novel pitch chemistries that could lead to MCMBs with even better cycling performance and higher packing density.

Ultimately, AI integration addresses the core market restraint of high manufacturing complexity and variability. By enabling tighter control over particle morphology and surface chemistry, AI accelerates the material iteration cycle required for specialized battery applications. This technological shift is essential for MCMB manufacturers to remain competitive against alternative anode materials, ensuring that MCMBs continue to meet the increasingly stringent performance and cost demands imposed by the rapidly evolving electric vehicle and grid storage industries globally.

- AI optimizes thermal processing parameters (graphitization) to ensure uniform crystal structure and high conductivity.

- Machine Learning models predict optimal precursor pitch composition, reducing variability in raw material quality.

- Predictive maintenance schedules for high-temperature furnaces minimize downtime and prolong equipment lifespan.

- AI-driven image analysis accelerates quality control, ensuring strict adherence to spherical morphology specifications.

- Generative AI supports the discovery of new, cost-effective methods for surface modification to enhance electrolyte compatibility.

- Data analytics improve supply chain resilience by forecasting demand and optimizing inventory management for specialized carbon products.

DRO & Impact Forces Of Mesocarbon Microbeads Market

The Mesocarbon Microbeads market dynamics are dictated by a powerful convergence of electrification drivers and inherent material challenges. Primary growth drivers include the exponential adoption of electric vehicles globally, which relies heavily on high-performance lithium-ion batteries where MCMBs ensure stability and longevity. Complementing this is the massive governmental and private investment in stationary energy storage systems (ESS) essential for integrating intermittent renewable energy sources into the power grid. These macro trends create sustained, high-volume demand for reliable anode materials. Conversely, the market is constrained by the relatively high capital expenditure required for establishing MCMB production facilities, especially the high-temperature graphitization phase, and the volatility and limited global sourcing options for high-quality precursor pitch materials, which introduces supply chain risks.

Significant opportunities lie in the diversification of MCMB applications beyond traditional lithium-ion batteries, extending into next-generation battery architectures like sodium-ion batteries and advanced solid-state electrolytes, where the spherical structure and uniform size distribution of MCMBs can offer unique advantages in stability and interfacial contact. Furthermore, developing low-cost, high-yield manufacturing processes, perhaps through continuous flow reactors or catalyzed carbonization, represents a critical avenue for market expansion. The intense rivalry from synthetic graphite and the rapid development of silicon-based anode materials act as powerful restraining forces, pressuring MCMB manufacturers to continually justify the higher cost basis through superior long-term performance and safety features.

The market is subject to intense impact forces derived from regulatory shifts, particularly battery performance and safety standards mandated by automotive and consumer safety bodies. Technological inertia, driven by the existing dominance of established graphite alternatives, requires substantial performance leaps from MCMBs to secure new design wins. The overall impact forces are strongly positive, favoring growth, underpinned by the essential role MCMBs play in delivering the performance metrics required for critical mass adoption of EVs and utility-scale energy storage, even as manufacturers actively mitigate the material substitution risk through innovation in purity and coating technologies.

Segmentation Analysis

The Mesocarbon Microbeads market is primarily segmented based on material grade, application, and end-use industry. Segmentation by grade often focuses on purity levels, distinguishing between battery-grade MCMBs (requiring extremely low impurity levels and precise morphology for electrochemical use) and industrial-grade MCMBs (used in refractories, composites, and specialized fillers). The critical determinant of market value is the application segment, overwhelmingly dominated by the anode material requirements for various types of rechargeable batteries, followed by secondary markets like supercapacitors and metallurgical powders. This structured segmentation allows manufacturers to tailor production specifications—such as particle size distribution and specific surface area—to meet the distinct performance demands of high-rate power applications versus high-capacity energy applications, optimizing both production efficiency and market penetration strategy.

- By Grade:

- Battery Grade Mesocarbon Microbeads (High Purity)

- Industrial Grade Mesocarbon Microbeads (Standard Purity)

- By Application:

- Lithium-ion Battery Anodes

- Supercapacitors

- High-Performance Composites

- Refractories and Friction Materials

- Specialized Lubricants and Coatings

- By End-Use Industry:

- Automotive (Electric Vehicles, Hybrid Vehicles)

- Consumer Electronics (Smartphones, Laptops, Wearables)

- Energy Storage Systems (Grid Storage, Renewable Integration)

- Aerospace and Defense

- Industrial Manufacturing

Value Chain Analysis For Mesocarbon Microbeads Market

The Mesocarbon Microbeads value chain begins at the upstream stage with the sourcing and preparation of precursor materials, primarily specialized grades of coal tar pitch or petroleum pitch. This raw material acquisition is crucial as the quality and chemical composition of the pitch directly determine the yield, sphericity, and final electrochemical performance of the MCMBs. Upstream analysis focuses on securing consistent, high-quality pitch supply, often involving long-term contracts with coking plants and refineries. Following acquisition, the pitch undergoes pre-treatment (such as heat soaking and filtration) before entering the crucial mesophase formation and carbonization processes, where the unique spherical structure is generated under highly controlled thermal conditions.

The midstream of the value chain encompasses the sophisticated manufacturing process, including spheroidization, carbonization, and the extremely high-temperature graphitization step (typically above 2500°C), which imparts the final crystalline structure necessary for battery anodes. Post-graphitization, the material undergoes milling, classification (sizing), and often surface treatment/coating to enhance stability and electrolyte interaction. Distribution channels are generally direct for large-volume battery manufacturers, involving specialized logistics due to the high value and required purity, and indirect for smaller industrial end-users through specialized chemical distributors and agents. Direct sales ensure tight technical collaboration between the MCMB manufacturer and the battery cell maker, which is essential for customized material specifications.

The downstream segment focuses on the integration of MCMBs into final products. The primary downstream consumers are lithium-ion battery cell manufacturers, who process the MCMBs into slurry formulations for coating the anode current collector. These cells are then assembled into battery packs used by major end-users in the electric vehicle, consumer electronics, and stationary grid storage markets. The stringent performance and safety requirements of these end-users heavily influence the upstream manufacturing specifications, creating a robust feedback loop that drives continuous innovation and quality assurance throughout the entire value chain, emphasizing technical partnerships over purely transactional relationships.

Mesocarbon Microbeads Market Potential Customers

The primary consumers and buyers of Mesocarbon Microbeads are large-scale lithium-ion battery manufacturers and their associated supply chain partners. These entities require high-volume, consistently performing anode materials that can withstand rigorous charging cycles and contribute to the overall safety profile of the battery pack. Potential customers include major global automotive cell producers who prioritize stability and fast charging capacity for EV platforms, leading to a strong demand for ultra-high-purity battery-grade MCMBs. The selection criteria for these customers are stringent, focusing not only on price but heavily on specific capacity, first-cycle efficiency, and long-term cycle life validation data.

Beyond the core battery sector, there is significant uptake from specialized electronics and energy storage sectors. Manufacturers of high-reliability supercapacitors, which utilize MCMBs for their superior rate capability and low resistivity, represent a niche but high-value customer segment. Additionally, companies involved in developing high-temperature or radiation-resistant structural composites, particularly in the aerospace and defense industries, utilize industrial-grade MCMBs for their unique thermal stability and mechanical reinforcement properties. These non-battery applications, while smaller in volume, often require highly customized particle specifications and premium pricing.

The transition toward electrification means that end-user giants in the automotive industry (OEMs) and utility sectors (grid operators) are increasingly influencing material procurement, often requiring their battery suppliers to source certified, sustainable, and high-performance MCMBs. Therefore, potential customers are broadly categorized into Battery Cell Producers (the direct buyer), Electric Vehicle Manufacturers, Grid Energy Storage Integrators, and Specialized Industrial Material Producers, all seeking the distinctive performance attributes offered by highly graphitized, spherical carbon materials to enhance their final product performance and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550.0 Million |

| Market Forecast in 2033 | USD 1,280.0 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Osaka Gas Co., Ltd., BTR New Material Group Co., Ltd., Shanshan Technology Co., Ltd., Mitsubishi Chemical Corporation, Nippon Steel Chemical & Material Co., Ltd., China Steel Chemical Corporation, Kureha Corporation, JFE Chemical Corporation, C-Chem Co., Ltd., Shanghai Shida Carbon Technology Co., Ltd., Zichen Group Co., Ltd., Sichuan Xingneng New Materials Co., Ltd., Hengyi Petrochemical Co., Ltd., Fuxin Chemical Co., Ltd., Huzhou Xingxing Carbon Co., Ltd., Dalian Hongguang Carbon Co., Ltd., Hubei Chuyuan Fine Chemical Co., Ltd., Shanxi Jiaozuo Coal Group Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mesocarbon Microbeads Market Key Technology Landscape

The technological landscape of the Mesocarbon Microbeads market is defined by sophisticated high-temperature thermal processing and stringent particle engineering designed to optimize electrochemical performance. The core manufacturing technology revolves around the preparation of the isotropic carbonaceous mesophase. Techniques such as liquid crystal carbonization, where pitch is heated under pressure in inert conditions (often using methods like fluidized bed reactors or mechanical stirring systems), are critical for generating the highly uniform spherical morphology that defines MCMBs. Recent technological focus has shifted toward enhancing the purity and size homogeneity, employing advanced filtration and fractional crystallization methods during the pitch pre-treatment stage to minimize impurities that detrimentally affect battery cycle life.

Post-carbonization, the graphitization technology represents the most energy-intensive and technologically critical step. Modern graphitization furnaces operate at extremely high temperatures (up to 3000°C) to convert the amorphous carbon structure into a highly ordered, graphite-like lattice. Innovation here focuses on increasing furnace efficiency and utilizing continuous processing methods rather than traditional batch furnaces to lower manufacturing costs and energy consumption. Furthermore, advanced laser diffraction techniques and computer-vision systems are being implemented for real-time particle size analysis and quality control, ensuring strict adherence to the narrow particle size distribution required by high-end battery manufacturers.

A burgeoning area of innovation involves surface modification and coating technologies. While MCMBs offer excellent stability, they can be reactive with certain non-aqueous electrolytes. Manufacturers are utilizing proprietary chemical vapor deposition (CVD) or physical vapor deposition (PVD) techniques to apply thin, protective amorphous carbon or metallic oxide coatings. These coatings significantly improve the solid electrolyte interphase (SEI) formation, reducing irreversible capacity loss during the first charge cycle and boosting overall cycling stability. Continuous R&D into these coating layers is paramount for MCMBs to remain viable as battery energy densities continue to climb.

Regional Highlights

The Mesocarbon Microbeads market exhibits distinct regional dynamics heavily skewed toward Asia Pacific (APAC), which currently accounts for the largest market share in both production and consumption. This dominance is intrinsically linked to the geographical concentration of major lithium-ion battery manufacturers in China, South Korea, and Japan, which collectively supply the vast majority of the world's EV and consumer electronics battery capacity. China, in particular, possesses significant upstream expertise in pitch procurement and large-scale, cost-effective MCMB production, often benefiting from favorable government industrial policies. The intense investment in new Gigafactories across the region ensures that APAC will remain the primary market driver throughout the forecast period, emphasizing high-volume, high-standard material procurement to meet global electrification targets.

North America and Europe represent the fastest-growing regions, albeit from a smaller base, due to strategic efforts to localize the battery supply chain. Driven by robust environmental regulations and ambitious electrification targets, both continents are witnessing unprecedented investment in domestic battery manufacturing capacity (Gigafactories). This localization initiative is primarily aimed at securing domestic supply for the rapidly expanding EV markets in Germany, France, the US, and Canada. While regional MCMB production capacity is still maturing, the demand pull from new manufacturing hubs ensures high growth rates, favoring manufacturers who can demonstrate adherence to strict Western environmental and sustainability standards.

Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares, though nascent opportunities are emerging. In MEA, interest is growing due to large-scale renewable energy projects requiring grid storage solutions, particularly in the Gulf Cooperation Council (GCC) countries. Latin America's market growth is constrained but shows potential, particularly in countries focusing on localizing EV production or leveraging natural resources for battery component manufacturing. Overall, the market remains globally interconnected, with APAC serving as the essential supplier, but the rising regionalization of battery production in the West is creating crucial new strategic demand centers for specialized anode materials like MCMBs.

- Asia Pacific (APAC): Dominates the market due to the concentration of global lithium-ion battery manufacturing hubs (China, South Korea, Japan). High production volumes and established supply chains.

- North America: Experiencing rapid expansion fueled by significant public and private investments in Gigafactories (e.g., US Inflation Reduction Act incentives). Strong demand for battery-grade MCMBs for premium EV models.

- Europe: High growth driven by stringent EU decarbonization policies and the establishment of local battery supply chains across Germany, Poland, and Hungary. Focus on high-quality, sustainably sourced materials.

- Latin America, Middle East, and Africa (MEA): Emerging markets with moderate growth, primarily tied to utility-scale energy storage projects and nascent EV adoption in certain industrialized zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mesocarbon Microbeads Market.- Osaka Gas Co., Ltd.

- BTR New Material Group Co., Ltd.

- Shanshan Technology Co., Ltd.

- Mitsubishi Chemical Corporation

- Nippon Steel Chemical & Material Co., Ltd.

- China Steel Chemical Corporation

- Kureha Corporation

- JFE Chemical Corporation

- C-Chem Co., Ltd.

- Shanghai Shida Carbon Technology Co., Ltd.

- Zichen Group Co., Ltd.

- Sichuan Xingneng New Materials Co., Ltd.

- Hengyi Petrochemical Co., Ltd.

- Fuxin Chemical Co., Ltd.

- Huzhou Xingxing Carbon Co., Ltd.

- Dalian Hongguang Carbon Co., Ltd.

- Hubei Chuyuan Fine Chemical Co., Ltd.

- Shanxi Jiaozuo Coal Group Co., Ltd.

- Puyang Ruiteng Carbon Co., Ltd.

- Sinosteel Anshan Research Institute Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Mesocarbon Microbeads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Mesocarbon Microbeads (MCMBs) in modern technology?

The primary function of MCMBs is serving as a high-performance anode material in lithium-ion batteries (LIBs). Their spherical structure and high graphitic purity ensure excellent stability, safety, and long cycle life, making them crucial for electric vehicles and high-capacity energy storage systems.

How do MCMBs compare to traditional synthetic graphite in battery performance?

MCMBs typically offer superior cycle life stability, better rate capability (faster charging/discharging), and enhanced safety characteristics compared to standard synthetic graphite, although they may have a slightly lower theoretical capacity, making them preferred for high-power, high-reliability applications.

Which geographical region dominates the production and consumption of MCMBs?

Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates the global market for both the manufacturing and consumption of MCMBs, driven by the massive concentration of the global lithium-ion battery production ecosystem within these countries.

What are the key technological challenges facing the MCMB manufacturing sector?

Key challenges include controlling the purity and consistency of precursor pitch materials, reducing the substantial energy consumption and associated costs of the high-temperature graphitization process, and developing surface modifications to optimize the material's interaction with novel battery electrolytes.

What impact is the rise of silicon anode materials having on the MCMB market?

Silicon anodes pose a competitive threat due to their significantly higher theoretical energy density. However, silicon's major issue (volume expansion and degradation) means MCMBs are increasingly being utilized in hybrid anode formulations (Si/C composites) to stabilize performance, ensuring MCMBs retain critical market relevance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager