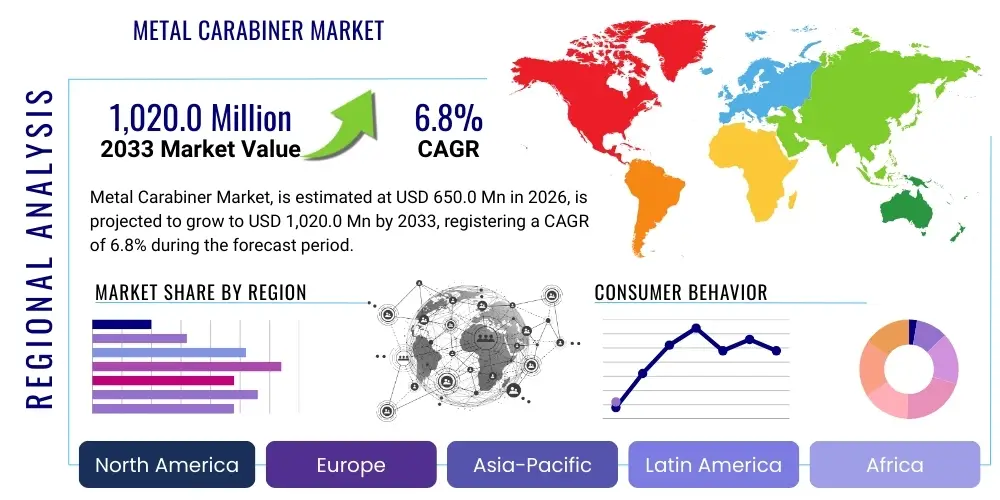

Metal Carabiner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435632 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Metal Carabiner Market Size

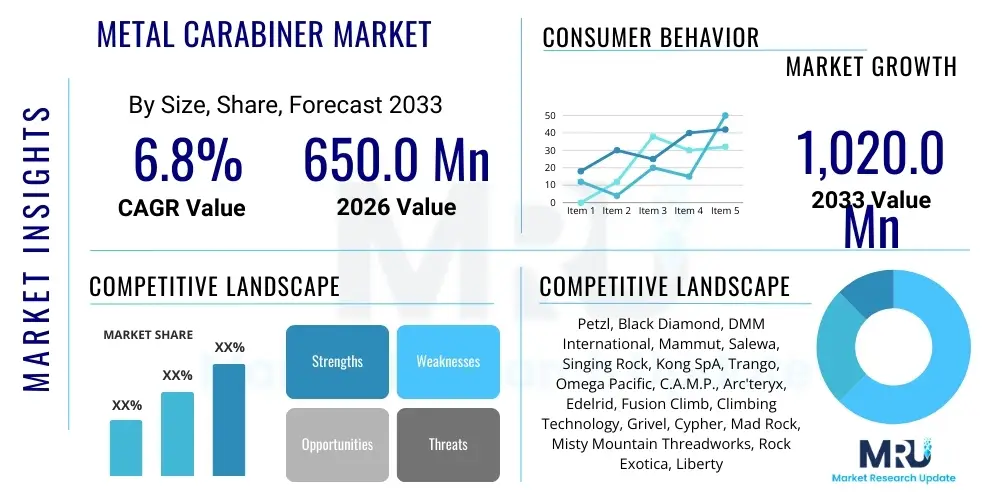

The Metal Carabiner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 1,020.0 million by the end of the forecast period in 2033. This consistent growth trajectory is driven by escalating participation in outdoor recreational activities, stringent industrial safety regulations necessitating reliable rigging equipment, and continuous technological advancements improving the strength-to-weight ratio of metal alloys used in production. The expanding scope of applications, extending from traditional rock climbing into broader industrial, tactical, and rescue sectors, significantly underpins the forecasted market expansion.

Metal Carabiner Market introduction

The Metal Carabiner Market encompasses the global production and distribution of specialized coupling devices, typically featuring a spring-loaded gate, designed for rapidly and reversibly connecting components in critical systems. These essential pieces of hardware are primarily manufactured from high-strength metals such as aluminum alloys, stainless steel, and carbon steel, chosen for their superior tensile strength, durability, and corrosion resistance. The core product design ensures reliability under high load conditions, making them indispensable in applications where safety is paramount. The market is highly influenced by regulatory standards, particularly those established by organizations like the UIAA (Union Internationale des Associations d’Alpinisme) and relevant industrial safety bodies (OSHA, ANSI).

Metal carabiners serve a broad spectrum of major applications, fundamentally categorized into safety-critical environments and general use coupling. Key sectors include climbing and mountaineering, where they form the crucial link between rope, protection, and harness; industrial safety and rigging, used in fall arrest systems, scaffolding, and load securing; and professional rescue operations, aiding in complex lifting and lowering scenarios. Furthermore, they are extensively utilized in military and tactical gear, construction, arboriculture, and increasingly, in specialized recreational sports requiring secure equipment attachment. The versatility and inherent mechanical integrity of metal carabiners drive consistent demand across these diverse vertical markets.

The primary driving factors for market growth include the global surge in adventure tourism and outdoor sports participation, particularly climbing and trekking, post-pandemic. Simultaneously, stricter enforcement of occupational safety regulations in developed and rapidly industrializing economies mandates the use of certified, high-performance safety equipment, directly boosting demand for standardized industrial-grade carabiners. The benefits offered by modern metal carabiners—including significantly reduced weight achieved through advanced aluminum processing while maintaining exceptional ultimate breaking strength, improved gate mechanisms (such as tri-act and auto-locking systems), and better ergonomics—make them highly attractive replacements for older, heavier safety hardware, stimulating cyclical replacement demand and market penetration in new applications.

Metal Carabiner Market Executive Summary

The Metal Carabiner Market is characterized by robust growth stemming from the dual pressures of expanding recreational activities and intensifying industrial safety requirements. Business trends highlight a strong focus on material innovation, specifically the development of lighter, aerospace-grade aluminum alloys to reduce user fatigue in climbing and rescue applications, alongside advancements in forging techniques that enhance critical axis strength. Key manufacturers are increasingly differentiating their products through specialized locking mechanisms (e.g., magnet-assisted closures, triple-action gates) to meet varying degrees of safety requirements across different end-use environments. Mergers, acquisitions, and strategic partnerships centered around distribution networks, particularly in emerging Asia Pacific markets, remain key strategies for expanding global footprint and optimizing supply chain resilience.

Regionally, North America and Europe maintain dominance, driven by high consumer awareness, established safety cultures, and large bases of professional end-users (mountaineers, industrial riggers). However, the Asia Pacific region is poised for the highest growth rate, fueled by rising disposable incomes leading to increased participation in outdoor leisure activities, rapid infrastructure development necessitating industrial safety gear, and the gradual adoption of international safety standards in construction and manufacturing sectors. Latin America and MEA show nascent growth potential, primarily driven by mining and oil & gas safety requirements, though market penetration remains constrained by local regulatory complexity and economic volatility.

Segment trends indicate a strong preference for aluminum carabiners due to their optimal strength-to-weight ratio, particularly in high-volume recreational sales, while stainless steel and specialized carbon steel models maintain their niche dominance in highly corrosive or extremely high-load industrial and maritime applications. The locking carabiner segment, especially the auto-locking and screw-gate variants, commands the largest market share due to their mandatory use in life-support and primary attachment points across all critical applications. The climbing and mountaineering segment remains the primary revenue generator, but the industrial safety and rigging application segment is exhibiting faster growth due to regulatory tailwinds and massive infrastructural investments globally.

AI Impact Analysis on Metal Carabiner Market

User inquiries regarding AI's impact on the Metal Carabiner Market frequently revolve around two main themes: optimization of manufacturing and quality control, and the integration of smart features into safety gear. Users question how AI and machine learning (ML) could enhance material stress testing and predictive maintenance of manufacturing machinery, thus reducing defects and improving product consistency. A secondary focus is on the potential for 'smart carabiners'—devices incorporating miniature sensors for real-time load monitoring, usage tracking, and alerts, which, when coupled with AI analysis, could provide unprecedented levels of safety compliance and proactive gear replacement advice for industrial and tactical operators. Concerns often center on the cost-effectiveness and ruggedization of integrating sensitive electronics into high-impact safety hardware.

- AI-driven optimization of material forging processes to reduce metallurgical defects and enhance uniformity.

- Machine learning algorithms applied to non-destructive testing (NDT) to identify micro-fractures during quality assurance, exceeding human visual inspection capabilities.

- Predictive analytics for estimating the remaining useful life (RUL) of carabiners in high-cycle industrial applications based on environmental exposure and historical load data.

- Development of 'Smart Carabiner' systems using embedded sensors (IoT) and AI to monitor real-time load, gate security status, and fall impact severity, crucial for worker safety reporting.

- Automated inventory management and demand forecasting for specific metal types and locking mechanisms based on regional safety legislation changes.

- Enhanced supply chain efficiency through AI-optimized logistics, ensuring timely delivery of critical safety hardware to remote industrial sites.

- Computer vision systems utilized for high-speed, automated dimensional and feature compliance checking during the assembly of complex locking mechanisms.

DRO & Impact Forces Of Metal Carabiner Market

The Metal Carabiner Market is shaped by dynamic interactions between accelerating demand drivers, inherent operational restraints, significant opportunities for technological expansion, and a variety of external impact forces. Key drivers include the exponential growth in outdoor recreation, stringent occupational safety mandates globally, and continuous innovation in lightweight, high-strength metal alloys such as proprietary 7000-series aluminum and aerospace-grade stainless steels. These factors collectively push both volume growth in consumer segments and value growth in high-performance industrial and tactical sectors. However, the market faces restraints such as the high cost of raw materials (especially specialty alloys), the persistent threat of counterfeit and low-quality products undermining consumer trust, and the necessity for manufacturers to adhere to extremely rigorous and often localized certification standards (e.g., CE, UIAA, ANSI, NFPA), which limits rapid product deployment across jurisdictions.

Significant opportunities are emerging from the increasing sophistication of the industrial sector, particularly in wind energy maintenance, telecommunications tower rigging, and complex urban rescue scenarios, requiring specialized, purpose-built carabiners with unique anti-snag features and higher load ratings. Furthermore, the push towards developing 'smart' safety equipment offers a substantial value-add opportunity, incorporating micro-sensors for load and temperature monitoring, enhancing compliance and traceability for critical gear. The market's stability is heavily reliant on technological integration, moving beyond simple mechanical function to becoming integrated components within larger, digitally managed safety ecosystems. Success depends on navigating the intellectual property landscape surrounding complex locking mechanisms and establishing robust, verifiable compliance documentation for global tenders.

The market is subjected to several critical impact forces, most notably the escalating geopolitical instability affecting global supply chains for specialized metals, which can induce severe price volatility and production delays. Regulatory changes, particularly shifts in OSHA or European Union safety directives, act as powerful external forces, instantly dictating equipment replacement cycles and design requirements across vast industrial bases. Competition from alternative materials, such as high-performance engineered plastics (though primarily limited to non-load-bearing or lower-load applications), poses a long-term substitution threat. Lastly, consumer and professional safety education, driven by climbing organizations and industrial training bodies, significantly impacts purchasing behavior, favoring established brands with impeccable safety records and superior structural integrity testing documentation, thereby concentrating market power among premium producers.

- Drivers: Exponential rise in global outdoor recreational activities; strict enforcement of occupational health and safety (OHS) regulations worldwide; ongoing material science advancements improving strength-to-weight ratios.

- Restraints: High cost and volatile pricing of high-grade metal alloys (e.g., aerospace aluminum); stringent and complex regulatory certification requirements (UIAA, CE, ANSI); proliferation of low-quality counterfeit products eroding market confidence.

- Opportunities: Development and commercialization of IoT-enabled 'Smart Carabiners' for real-time safety monitoring; expansion into high-growth specialized industrial sectors (wind energy, advanced rescue); customization for military and tactical end-users requiring non-reflective coatings and specific dimensions.

- Impact Forces: Global metal commodity price volatility; shifts in international trade policies affecting supply chain costs; consumer safety awareness campaigns favoring certified premium products; technological disruption from advanced composite materials in select applications.

Segmentation Analysis

The Metal Carabiner Market is meticulously segmented based on material composition, locking mechanism type, primary application area, and distribution channel, providing a granular view of market dynamics and end-user preferences. Understanding these segments is crucial for strategic positioning, as the requirements for a specialized industrial rigging carabiner (high static load, stainless steel, auto-locking) differ significantly from a lightweight sport climbing quickdraw component (aluminum, non-locking, high dynamic load absorption). The segmentation reflects the diverse needs of end-users, balancing factors such as ultimate strength, weight, corrosion resistance, ease of use, and cost, which are all critical determinants of product choice and market share distribution within each vertical.

Detailed analysis of the market segments reveals distinct trends. Aluminum carabiners consistently dominate in terms of volume due to their versatility and suitability for weight-sensitive applications like climbing and recreation. Conversely, segments utilizing Stainless Steel or Carbon Steel, while smaller in volume, command a higher average selling price due to their necessity in environments demanding maximum durability, resistance to corrosive chemicals (maritime, offshore drilling), or extreme static load bearing (heavy-duty industrial lifting). The shift towards fully integrated locking systems, often mandated by best practices in professional environments, ensures that the locking type segment remains the fastest growing in terms of value capture, pushing innovation in gate design and mechanism reliability.

- By Material:

- Aluminum (dominant in recreational and lightweight industrial applications)

- Stainless Steel (preferred for corrosive environments and heavy load industrial rigging)

- Carbon Steel (used in highly economical, high-strength industrial safety applications)

- Others (e.g., specialized titanium alloys for niche high-performance tactical uses)

- By Type:

- Locking Carabiners:

- Screw Lock

- Twist Lock (or 2-Stage Lock)

- Auto-Lock (or 3-Stage Lock/Tri-Act)

- Non-Locking/Quickdraws (used primarily in sport and traditional climbing systems)

- Locking Carabiners:

- By Application:

- Climbing & Mountaineering (highest volume segment)

- Industrial Safety & Rigging (fastest growing segment, driven by regulation)

- Rescue Operations (firefighting, SAR, specialized technical rescue)

- Military & Tactical (specialized loadouts, stealth requirements)

- Sports & Recreation (general utility, camping, boating)

- Pet Accessories (lighter loads, general restraint)

- By Distribution Channel:

- Online Retail (e-commerce platforms, brand websites)

- Offline Retail (Specialty Outdoor Stores, Industrial Safety Distributors)

Value Chain Analysis For Metal Carabiner Market

The value chain for the Metal Carabiner Market begins with the upstream segment, primarily focused on the extraction, processing, and alloying of critical metals, predominantly aluminum billets (especially 7075 and 6061 alloys) and high-tensile steel. Raw material suppliers specializing in aerospace or high-performance grades hold significant leverage due to the stringent quality requirements and specific metallurgical composition necessary for safety-critical hardware. Following material sourcing, the manufacturing process, involving specialized hot forging, CNC machining, heat treatment, surface finishing (anodization or galvanization), and critical assembly of the spring-loaded gate and locking mechanism, adds substantial value. Rigorous, mandatory quality control and testing (proof loading, destruction testing) constitute a major non-material cost component in the mid-stream value chain, ensuring compliance with UIAA, CE EN, and ANSI standards.

Downstream analysis focuses on distribution and the end-user interface. Distribution channels are bifurcated: direct sales, which primarily target large industrial enterprises, government agencies (military, rescue services), and large equipment rental companies seeking bulk certified gear; and indirect sales, which utilize established networks of specialty outdoor retailers, industrial safety distributors, and increasingly, sophisticated e-commerce platforms. The specialized knowledge required by sales representatives, particularly for industrial safety applications, adds value at the distribution stage. End-users derive the final value through reliable, life-saving functionality, often guided by professional recommendations and regulatory mandates, making brand reputation and certification status crucial elements in the final purchasing decision.

The choice between direct and indirect distribution channels often depends on the segment. High-volume, standardized recreational carabiners are often sold indirectly through global e-commerce and specialized retail outlets, maximizing reach. Conversely, custom-designed, high-specification carabiners for military or nuclear applications are typically managed through direct, long-term contracts, enabling specialized testing and direct quality oversight. The indirect channel relies heavily on training and expertise provided to retailers to ensure correct product usage and safety information dissemination. The increasing dominance of online retail necessitates robust digital content strategies and transparent supply chain reporting to maintain consumer trust in critical safety products.

Metal Carabiner Market Potential Customers

Potential customers for the Metal Carabiner Market are highly diversified, encompassing professional sectors where equipment failure poses catastrophic risks, and recreational users who depend on reliable gear for personal enjoyment and safety. The primary end-users are professional climbers, mountain guides, and specialized technical rescue teams (Search and Rescue, fire departments, emergency medical services) who demand the highest-performance, certified, and often lightweight locking carabiners. These users prioritize minimum weight, maximum strength ratings, and advanced locking features such equipment often being replaced on a strict, cyclical schedule based on usage intensity and regulatory requirements.

The second major cohort comprises the industrial and commercial sector, including construction workers, arborists, utility linemen, riggers in oil & gas, mining operations, and wind turbine maintenance technicians. For this segment, the focus shifts slightly towards durability, corrosion resistance (often necessitating stainless steel), and adherence to strict OSHA/ANSI standards for fall protection and load restraint. Procurement in this sector is driven by corporate safety policies and regulatory compliance, often involving large-volume orders of heavy-duty, auto-locking steel carabiners designed for prolonged outdoor exposure and minimal user error risk. The third segment includes general recreation, camping, hiking, and pet accessory owners, who require high-utility, moderately priced carabiners for non-life-critical applications, often driving demand for bulk sales through mainstream retail channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 million |

| Market Forecast in 2033 | USD 1,020.0 million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Petzl, Black Diamond, DMM International, Mammut, Salewa, Singing Rock, Kong SpA, Trango, Omega Pacific, C.A.M.P., Arc'teryx, Edelrid, Fusion Climb, Climbing Technology, Grivel, Cypher, Mad Rock, Misty Mountain Threadworks, Rock Exotica, Liberty Mountain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Carabiner Market Key Technology Landscape

The technological landscape of the Metal Carabiner Market is dominated by advancements in material science and precision manufacturing techniques aimed at enhancing both safety and user experience. The primary technological focus is on forging techniques, particularly hot forging of aluminum alloys, which allows manufacturers to precisely control the grain structure of the metal, maximizing strength along the primary load axis while minimizing unnecessary bulk in non-critical areas. This process facilitates the production of complex 3D shapes (e.g., I-Beam cross-sections) that offer superior strength-to-weight ratios compared to traditional cold-stamped or simple forged designs. Continuous improvements in heat treatment processes are also critical, ensuring optimal tempering and aging of alloys to achieve specified hardness and tensile strength required for regulatory compliance under extreme temperature fluctuations and long-term use.

A secondary, yet rapidly evolving, technological area involves the locking mechanisms. The trend is moving towards sophisticated auto-locking systems (e.g., triple-action locks, magnetic closures) that require multiple distinct movements to open, drastically reducing the risk of accidental gate opening (gate flutter or unintentional release) while maintaining a rapid operation sequence for professional users. The technology incorporated into these gates involves precise spring and pin mechanisms often derived from highly engineered automotive or aerospace components to ensure longevity and reliability across tens of thousands of cycles. Furthermore, surface treatment technologies, such as advanced anodization for aluminum and specialized galvanization or coatings for steel, are continuously improved to enhance corrosion resistance, especially vital for maritime, offshore, and tactical applications where stealth (non-reflective finishes) and environmental durability are paramount concerns.

The introduction of digital technologies represents the cutting edge of innovation, primarily through the integration of miniaturized sensors (IoT capabilities). These smart carabiners are embedded with strain gauges and RFID/NFC chips to capture real-time usage data, including exact load applications, frequency of use, and environmental exposure (temperature, humidity). This data is often transmitted wirelessly to management systems for detailed log maintenance, enabling predictive maintenance schedules and ensuring full regulatory compliance by automatically flagging gear that exceeds recommended service limits or has sustained critical impact loads. While currently high-cost, this technology is essential for high-risk industrial sectors seeking total operational transparency and improved accountability regarding safety equipment utilization.

Regional Highlights

The Metal Carabiner Market exhibits distinct regional performance profiles, largely influenced by local regulatory stringency, maturity of outdoor sports participation, and the scale of heavy industry.

- North America (NA): Dominates the high-value segment due to a mature climbing and mountaineering culture, coupled with exceptionally strict occupational safety standards enforced by OSHA and ANSI. NA acts as a primary innovation hub for specialized industrial rigging and tactical applications, driving demand for premium, highly certified auto-locking steel and complex aluminum carabiners. Consumer awareness regarding equipment retirement schedules is high, ensuring steady replacement demand.

- Europe: A significant market anchored by Alpine climbing traditions and deep-rooted outdoor participation, particularly in countries like Germany, France, and Italy. Europe benefits from harmonized safety standards (CE and EN norms), which facilitate cross-border trade and standardize certification requirements. Manufacturers here often prioritize lightweight, ergonomic designs, and sustainable manufacturing practices are increasingly influencing purchasing decisions, particularly within the recreational segment.

- Asia Pacific (APAC): Positioned as the fastest-growing region. This surge is attributed to burgeoning adventure tourism markets, rising disposable incomes, and explosive growth in construction and infrastructure projects across China, India, and Southeast Asia. The industrial safety segment is rapidly adopting international standards, shifting demand away from non-certified, low-cost alternatives toward globally approved safety equipment, presenting substantial long-term growth opportunities, although price sensitivity remains a key factor.

- Latin America (LATAM): Growth is primarily concentrated in the mining, oil & gas, and telecommunications sectors, where professional safety equipment is mandatory. Market growth is often dependent on specific regulatory enforcement cycles and large-scale government investments in infrastructure. The recreational market remains smaller but is expanding in niche climbing destinations.

- Middle East and Africa (MEA): This region is characterized by demand driven heavily by the oil & gas and construction industries, requiring robust, corrosion-resistant steel carabiners suitable for harsh desert or offshore conditions. Growth is episodic, tied directly to large industrial projects and foreign direct investment in infrastructure development, with tactical and military procurement also forming a key segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Carabiner Market.- Petzl

- Black Diamond

- DMM International

- Mammut

- Salewa

- Singing Rock

- Kong SpA

- Trango

- Omega Pacific

- C.A.M.P.

- Arc'teryx

- Edelrid

- Fusion Climb

- Climbing Technology

- Grivel

- Cypher

- Mad Rock

- Misty Mountain Threadworks

- Rock Exotica

- Liberty Mountain

Frequently Asked Questions

Analyze common user questions about the Metal Carabiner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Metal Carabiner Market?

The market is primarily driven by the confluence of increasing global participation in outdoor recreational activities, such as climbing and hiking, and the strict, non-negotiable enforcement of industrial safety regulations (OHS/OSHA) demanding certified, high-strength fall protection and rigging hardware across construction and heavy industry sectors.

How do aluminum carabiners compare to steel carabiners in terms of market applications?

Aluminum carabiners dominate the recreational and lightweight industrial segments due to their superior strength-to-weight ratio, reducing user fatigue. Steel carabiners are essential for heavy-duty industrial rigging, marine environments, and high-load rescue operations where maximum corrosion resistance and ultimate strength, regardless of weight, are mandatory.

Which type of locking mechanism holds the largest market share and why?

Auto-locking carabiners (including 2-stage and 3-stage locks) command the largest value share because they are mandated for use in critical life-safety and primary anchor points across both professional climbing and industrial fall protection, significantly minimizing the risk of accidental gate opening, a key safety concern.

What role does technology play in modern carabiner development?

Technology drives innovation through advanced hot forging techniques to create complex I-Beam profiles for optimized strength-to-weight ratios, the development of sophisticated magnetic or triple-action gate mechanisms for enhanced safety, and the emerging integration of IoT sensors for real-time load monitoring and gear traceability (Smart Carabiners).

Which region is expected to demonstrate the highest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, propelled by rapid infrastructure development necessitating industrial safety gear, increasing middle-class participation in adventure sports, and the ongoing regional adoption of stringent international safety certification standards across key industrial verticals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager