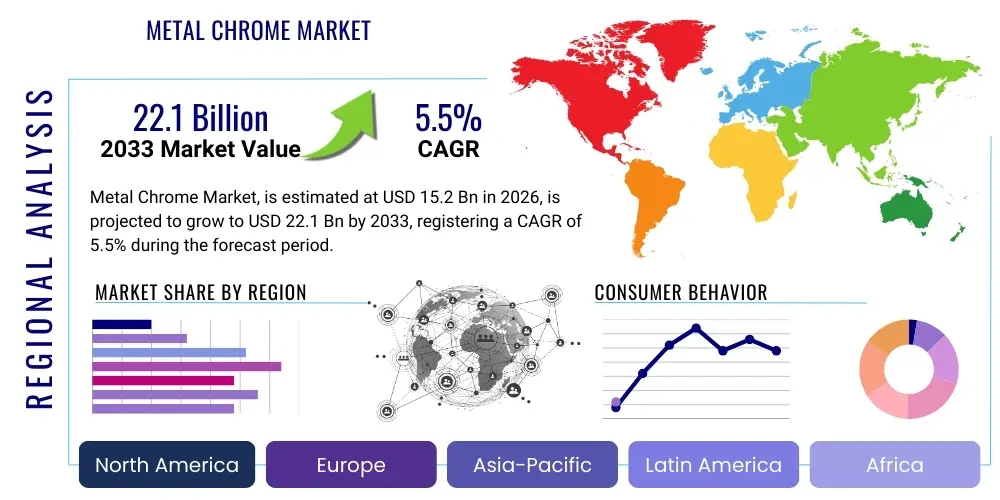

Metal Chrome Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434606 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Metal Chrome Market Size

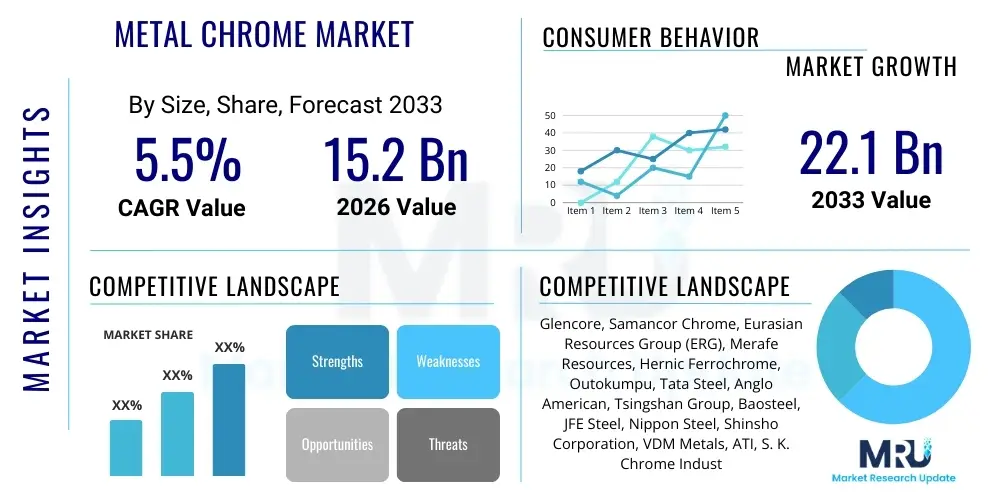

The Metal Chrome Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 22.1 Billion by the end of the forecast period in 2033.

Metal Chrome Market introduction

The Metal Chrome Market encompasses the production, trade, and application of chromium metal and its primary alloy, ferrochrome, which is essential for manufacturing stainless steel and various high-performance alloys. Chromium, valued for its exceptional hardness, high melting point, and resistance to corrosion and oxidation, serves as a critical strategic raw material across numerous heavy industries. Market dynamics are fundamentally driven by global stainless steel production, which consumes the vast majority of ferrochrome, thereby linking the market’s trajectory directly to infrastructure development, construction activity, and the automotive sector in emerging economies.

Chromium metal is distinct from ferrochrome in its purity and specific applications, primarily serving high-end requirements in chemical catalysts, vacuum metallizing, thermal spraying, and the production of specialized superalloys utilized in aerospace turbine blades and medical implants. The product description highlights chromium's role in providing luster and anti-tarnish properties through plating processes, significantly boosting the durability and aesthetic appeal of finished goods. Key applications beyond metallurgy include its use in chrome chemicals (e.g., chromic acid, sodium dichromate) for leather tanning and pigment manufacturing, although environmental regulations regarding hexavalent chromium continually pressure manufacturers to innovate safer alternatives.

The market benefits from several intrinsic advantages chromium offers, notably imparting superior mechanical properties to alloys, especially resistance to high temperatures and aggressive chemical environments. Major driving factors include the surging demand for corrosion-resistant materials in marine and industrial settings, the expansion of renewable energy infrastructure requiring specialized steel grades, and technological advancements in high-efficiency ferrochrome smelting processes aimed at reducing energy consumption and greenhouse gas emissions. Furthermore, the sustained growth of the aerospace and defense sectors, requiring specialized nickel and cobalt-based superalloys rich in chromium, provides a high-value niche driving market stability.

Metal Chrome Market Executive Summary

The Metal Chrome Market is characterized by a strong interplay between supply concentration, primarily in South Africa, Kazakhstan, and India, and demand dispersion, dominated by Asia Pacific’s stainless steel industry, particularly China and India. Current business trends indicate a shift towards advanced smelting technologies, such as closed-furnace operations, which improve energy efficiency and environmental compliance, addressing increasing regulatory scrutiny globally. Furthermore, volatility in pricing is often dictated by global ferrochrome inventory levels and the benchmark price negotiations between major miners and large stainless steel producers, leading to cyclical market behavior.

Regional trends highlight the dominance of the Asia Pacific (APAC) region, which is the epicenter of stainless steel manufacturing and end-use consumption, accounting for over two-thirds of global demand. While China maintains its position as the largest consumer, Southeast Asian countries like Indonesia are rapidly expanding their stainless steel capacities, potentially reshaping regional trade flows and reducing reliance on traditional import sources. Conversely, established markets in North America and Europe maintain stable, though mature, demand driven by high-specification applications in the aerospace, chemical processing, and precision engineering sectors, focusing more on high-purity metal chrome rather than bulk ferrochrome.

Segmentation trends reveal that the High Carbon Ferro Chrome (HCFeCr) segment remains the largest by volume, primarily due to its cost-effectiveness and widespread use in stainless steel grades. However, the Electrolytic Chrome Metal (ECM) and high-purity grades are projected to exhibit higher growth rates, fueled by the accelerating technological demands of superalloys and advanced electronics where impurity levels must be minimized. The Application segment shows persistent strength in Stainless Steel Production, yet the Chemical and Refractories segments are undergoing transformation, necessitating specialized chrome compounds that meet stringent environmental and performance standards, thereby diversifying product offerings.

AI Impact Analysis on Metal Chrome Market

User inquiries regarding AI's impact on the Metal Chrome market frequently center on how machine learning algorithms can optimize energy-intensive smelting processes, predict volatile raw material pricing, and improve resource efficiency in mining operations. Key concerns revolve around the integration costs and the reliability of AI models in handling the complex, heterogeneous nature of chrome ore grades and furnace conditions. Expectations are high regarding AI’s potential to enhance predictive maintenance of large-scale production equipment, optimize supply chain logistics by predicting demand fluctuations across diverse end-use markets (e.g., construction vs. aerospace), and, crucially, streamline quality control in high-purity metal chrome production, ensuring adherence to rigorous specifications required by aerospace and medical industries.

- Optimization of Ore Blending: AI algorithms analyze ore composition data in real-time, optimizing the blend input for the smelting furnace to maximize chrome recovery and minimize slag waste, leading to substantial cost savings.

- Predictive Maintenance: Machine learning monitors sensor data (temperature, vibration, power consumption) of critical equipment like electric arc furnaces and crushers, forecasting potential failures and scheduling maintenance proactively, significantly reducing unplanned downtime.

- Demand Forecasting and Inventory Management: Advanced analytical models integrate global economic indicators, stainless steel production forecasts, and geopolitical risks to predict ferrochrome demand with higher accuracy, optimizing inventory levels and mitigating price exposure.

- Energy Consumption Reduction: AI models fine-tune furnace parameters (power input, electrode regulation) to achieve optimal thermal efficiency during the reduction process, directly lowering the high energy costs associated with ferrochrome production.

- Environmental Compliance Monitoring: AI systems track emissions and process variables to ensure continuous compliance with strict environmental standards, particularly regarding sulfur dioxide and particulate matter, facilitating quicker regulatory reporting.

- Automated Quality Control: Computer vision and data analytics improve the precision of quality checks for finished metal chrome products, especially in identifying minute impurities in high-ppurity applications.

DRO & Impact Forces Of Metal Chrome Market

The Metal Chrome Market is propelled by robust drivers, primarily the sustained global demand for stainless steel, particularly in rapidly urbanizing regions, alongside the escalating necessity for high-performance superalloys in critical sectors like aerospace and energy generation. These growth factors are tempered by significant restraints, most notably the high energy intensity of ferrochrome production, which subjects operational costs to volatile electricity prices and increasing carbon taxation pressures. Geopolitical risks associated with supply concentration in key regions (South Africa and Kazakhstan) pose substantial supply chain vulnerabilities. Opportunities lie in the development and adoption of cleaner smelting technologies, particularly those utilizing hydrogen or natural gas to reduce the carbon footprint, and the growing market for specialized, high-purity chrome metal products catering to advanced manufacturing. The impact forces underscore the constant tension between maximizing production efficiency and adhering to increasingly strict global environmental and regulatory frameworks concerning emissions and the management of byproducts.

Segmentation Analysis

The Metal Chrome Market segmentation provides a granular view of its structure based on alloy grade (Type), chemical purity, and ultimate end-use (Application). Segmentation by Type reveals a hierarchy of value, ranging from bulk High Carbon Ferro Chrome used primarily in structural steel to the highly refined Electrolytic Chrome Metal essential for sensitive aerospace and specialized chemical applications. Analyzing these segments is critical as market growth and profitability diverge significantly across these product types. The Application segmentation dictates the stability and cyclicity of demand; while stainless steel ensures a high volume baseline, the refractories and chemical segments require unique product specifications and exhibit different demand sensitivities to global economic shifts, driving differentiation in marketing and production strategies across the industry value chain.

- By Type:

- High Carbon Ferro Chrome (HCFeCr)

- Low Carbon Ferro Chrome (LCFeCr)

- Medium Carbon Ferro Chrome (MCFeCr)

- Electrolytic Chrome Metal (ECM)

- Chromium Powder

- By Application:

- Stainless Steel Production

- Engineering and Tool Steel

- Refractories

- Foundry and Casting

- Automotive Industry

- Aerospace and Defense

- Chemical Manufacturing (Pigments, Tanning)

- By Grade Purity:

- Metallurgical Grade

- Chemical Grade

- Refractory Grade

Value Chain Analysis For Metal Chrome Market

The Metal Chrome value chain begins with the highly concentrated upstream segment, encompassing the mining and beneficiation of chromite ore, primarily extracted in South Africa, Turkey, and Kazakhstan. This initial stage involves significant capital investment in mining infrastructure and specialized processing to upgrade the ore concentration. Upstream stability heavily influences overall market pricing, as fluctuations in ore quality and extraction efficiency directly impact the cost of the final alloy. Key players in this phase often possess integrated operations, controlling both the mining and subsequent smelting processes, thereby gaining substantial cost advantages and market leverage.

The midstream phase involves the energy-intensive process of smelting the chromite ore into ferrochrome using electric arc furnaces (EAF) or submerged arc furnaces (SAF). Technological sophistication in this phase determines the final product grade (e.g., HCFeCr vs. LCFeCr) and environmental footprint. Downstream analysis focuses on the large-scale consumers, predominantly stainless steel mills (such as Outokumpu, Tsingshan, and Baosteel), which act as the primary demand drivers. The purchasing decisions of these massive consumers, often negotiated via long-term contracts, stabilize the bulk ferrochrome segment. The specialized downstream users, including superalloy manufacturers and chemical processors, require higher purity chrome metal, driving differentiation in the refining and alloying processes.

Distribution channels for ferrochrome are typically direct, involving long-term supply agreements between major miners/smelters and large steel producers, facilitated by specialized commodity traders. Indirect distribution, though smaller in volume, is critical for supplying smaller foundries, specialty chemical companies, and regional distributors who require specific quantities or grades of chrome powder or refined metal. Efficiency in logistics, including bulk shipping and warehousing, is crucial due to the commodity nature of HCFeCr. The market structure favors direct engagement for large volume transactions, minimizing intermediary costs and ensuring secure supply lines for strategic industrial inputs.

Metal Chrome Market Potential Customers

The Metal Chrome Market's customer base is highly specialized, dominated by heavy industry, primarily focused on corrosion and heat resistance applications. The primary end-users are integrated stainless steel manufacturers who require vast quantities of ferrochrome as the fundamental alloying element, responsible for giving stainless steel its namesake properties. These buyers are typically highly sensitive to price fluctuations and require consistent quality and secure supply chains to maintain continuous production cycles in their steel mills, making long-term procurement relationships essential.

Another significant customer segment comprises manufacturers in the aerospace, energy (gas turbines), and petrochemical industries, which rely on high-purity metal chrome and low-carbon ferrochrome to produce superalloys. These alloys are critical for components operating under extreme conditions, such as high temperatures and high pressures. For these buyers, product reliability, traceability, and strict adherence to certification standards (e.g., AS9100) are paramount, often overriding cost considerations. The defense sector also falls into this category, demanding specialized, high-strength, chromium-containing armor and component materials.

Furthermore, the chemical industry forms a distinct customer group, purchasing chrome chemicals (derived from chromium ore) for processes such as metal finishing, leather tanning, and the creation of pigments and dyes. This segment is characterized by strict environmental compliance requirements, as users must navigate regulations concerning the handling and disposal of hexavalent chromium compounds. Refractory manufacturers, utilizing chromium oxide and related materials for lining high-temperature furnaces and kilns in the steel and glass industries, constitute the fourth major category, prioritizing thermal stability and longevity in their chrome-based purchases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 22.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Glencore, Samancor Chrome, Eurasian Resources Group (ERG), Merafe Resources, Hernic Ferrochrome, Outokumpu, Tata Steel, Anglo American, Tsingshan Group, Baosteel, JFE Steel, Nippon Steel, Shinsho Corporation, VDM Metals, ATI, S. K. Chrome Industries, MidUral Group, AfroMet (PTY) Ltd, Felman Production, CRONIMET Holding GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Chrome Market Key Technology Landscape

The technological landscape of the Metal Chrome Market is primarily defined by advancements in smelting efficiency and purity enhancement. The dominant technology remains the Submerged Arc Furnace (SAF) for ferrochrome production, but modern installations increasingly feature closed-furnace designs. Closed furnaces are superior as they capture off-gases, enabling energy recovery (preheating charge materials or generating electricity) and significantly reducing atmospheric emissions, addressing the core environmental challenges of the industry. These technological upgrades not only improve thermal efficiency but also allow producers to use lower-grade chromite ores more effectively, expanding the viable resource base and ensuring long-term sustainability.

A crucial area of innovation revolves around alternative reduction processes aimed at decoupling ferrochrome production from high reliance on carbon reductants and electricity. Plasma arc technology and DC furnaces represent high-capital alternatives that offer greater flexibility in raw material inputs and can potentially achieve higher recoveries and lower specific energy consumption compared to traditional AC-SAF methods. Furthermore, the push for high-purity metal chrome requires sophisticated refining technologies, including vacuum treatment, electroslag remelting (ESR), and electrolytic refining. These secondary refining steps are essential for minimizing critical tramp elements (such as sulfur, phosphorus, and silicon) that are detrimental to the performance of aerospace-grade superalloys, establishing a technological barrier for entry into the high-end market segments.

Digitization and automation are also playing an increasing role, particularly in optimizing process control. Modern smelting plants integrate advanced sensor technology, real-time data analytics, and machine learning models to monitor and control complex furnace parameters, including temperature distribution, reduction agent ratios, and electrode movement. This level of automation is critical for maintaining consistent product quality and maximizing throughput in a highly competitive environment. The continuous technological pursuit focuses on metallurgical breakthroughs that allow for the production of cleaner, more sustainable chrome products while maximizing the utilization of chrome resources through improved recovery rates from slag and tailings.

Regional Highlights

- Asia Pacific (APAC): APAC is the undisputed engine of demand, largely driven by China, which dominates global stainless steel manufacturing and consumption. The region benefits from massive infrastructural investments and rapid urbanization, fueling high volume demand for High Carbon Ferro Chrome (HCFeCr). Emerging markets like India and Southeast Asia (especially Indonesia and Vietnam) are rapidly expanding their domestic stainless steel production capacity, positioning APAC as the primary growth market for the forecast period. The regional focus is heavily skewed towards bulk consumption and operational scale.

- Europe: The European market is characterized by mature, high-value demand, focusing less on volume and more on specialized applications, particularly in high-grade stainless steel, chemical processing equipment, and automotive catalytic converters. European consumption is highly sensitive to environmental regulations, driving demand for cleaner production processes and low-carbon ferrochrome grades. Germany, Italy, and Sweden remain key consuming nations, emphasizing quality and sustainability standards across their supply chains.

- North America: North America, specifically the United States, demonstrates stable demand, primarily concentrated in high-specification sectors such as aerospace, defense, and oil and gas infrastructure. Due to limited domestic smelting capacity, the region is highly dependent on imports, necessitating secure and traceable supply lines. The market here places a premium on Electrolytic Chrome Metal (ECM) and high-purity alloys required for critical, high-performance components, focusing on long-term supply resilience rather than short-term cost minimization.

- Middle East and Africa (MEA): MEA is critical primarily as the key source of supply, with South Africa accounting for the largest share of global chromite ore reserves and ferrochrome production. Market dynamics in this region are tied to mining policy, labor relations, and infrastructural capacity (especially electricity supply). While consumption in the Middle East is growing, driven by regional construction booms, the region’s dominant role remains upstream production and global export facilitation.

- Latin America: Latin America represents a smaller, yet growing, consumer market driven by domestic construction, mining operations, and automotive manufacturing in Brazil and Mexico. Although primary production capacity is limited compared to South Africa or Kazakhstan, increasing industrialization drives local demand for stainless steel and related chrome alloys, positioning the region as a steady, moderate growth opportunity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Chrome Market.- Glencore

- Samancor Chrome (Joint Venture between Samancor Holdings and Merafe Resources)

- Eurasian Resources Group (ERG)

- Merafe Resources

- Hernic Ferrochrome (Part of the Mitsubishi Group)

- Outokumpu

- Tata Steel

- Anglo American

- Tsingshan Group

- Baosteel

- JFE Steel

- Nippon Steel

- Shinsho Corporation

- VDM Metals

- ATI (Allegheny Technologies Incorporated)

- S. K. Chrome Industries

- MidUral Group

- AfroMet (PTY) Ltd

- Felman Production

- CRONIMET Holding GmbH

Frequently Asked Questions

Analyze common user questions about the Metal Chrome market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Metal Chrome Market?

The primary factor driving demand is the global stainless steel industry, which accounts for approximately 90% of ferrochrome consumption. Stainless steel is essential for construction, infrastructure, automotive manufacturing, and various consumer goods, linking chromium demand directly to global economic expansion and urbanization rates, particularly in the Asia Pacific region where the majority of production is concentrated.

How do environmental regulations impact the cost and production of ferrochrome?

Environmental regulations significantly increase production costs, particularly mandates regarding emissions of sulfur dioxide and the handling of hexavalent chromium compounds. Producers are pressured to invest in cleaner technologies, such as closed-furnace smelting and advanced off-gas treatment systems, leading to higher capital expenditure and operational costs, ultimately favoring producers who can demonstrate high environmental compliance.

Which region dominates the global supply of chromite ore and ferrochrome?

The Middle East and Africa (MEA) region, specifically South Africa, dominates the global supply chain, holding the world's largest proven chromite ore reserves and leading global ferrochrome production capacity. This geographical concentration makes the market susceptible to geopolitical, labor, and energy supply risks originating in Southern Africa.

What differentiates Electrolytic Chrome Metal (ECM) from standard High Carbon Ferro Chrome (HCFeCr)?

ECM is a high-purity product, typically containing 99% or more chromium, achieved through electrolytic refining processes. HCFeCr is an alloy used in bulk steelmaking (containing high levels of carbon and impurities). ECM is reserved for highly specialized applications, such as superalloys for aerospace and high-precision chemical uses, where strict control over trace elements is critical for performance.

What role does technological innovation play in securing future market growth?

Technological innovation is crucial for sustainability and competitiveness. Key advancements include the adoption of energy-efficient closed-furnace technology to lower operational costs and carbon footprint, and the development of new processes (like plasma smelting) that allow producers to utilize lower-grade chrome ores efficiently, ensuring resource availability and meeting stringent global decarbonization goals required for strategic raw materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager