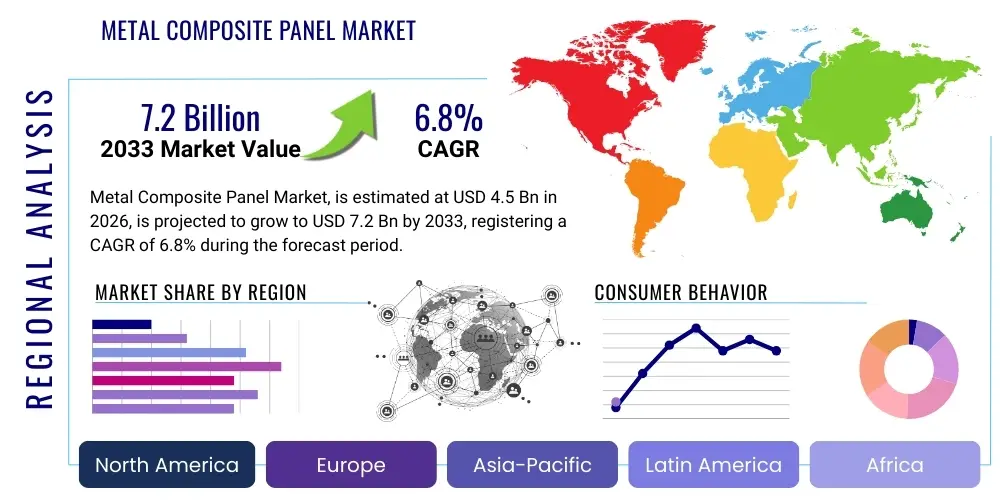

Metal Composite Panel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437627 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Metal Composite Panel Market Size

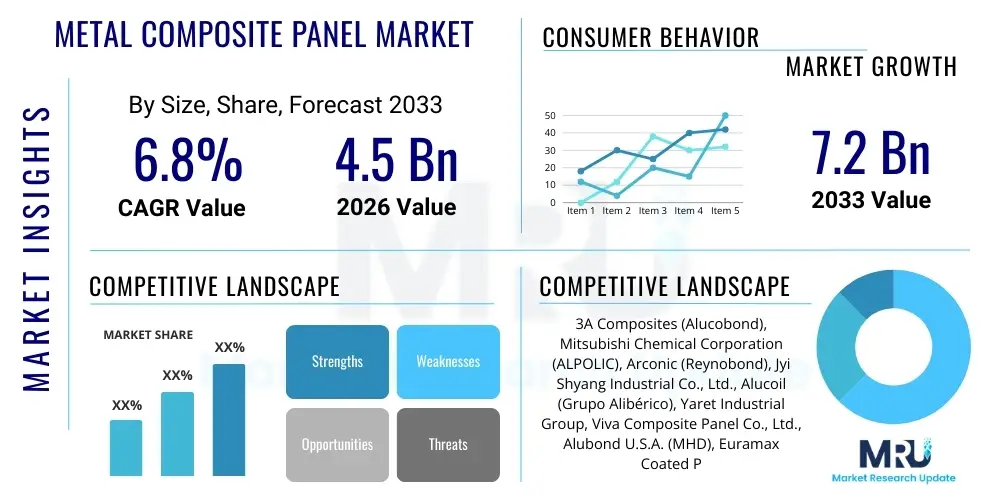

The Metal Composite Panel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Metal Composite Panel Market introduction

Metal Composite Panels (MCPs), frequently identified as Aluminum Composite Materials (ACMs) or Aluminum Composite Panels (ACPs) when aluminum is the primary skin constituent, are advanced multilayered construction components utilized extensively in contemporary architecture, signage, and transportation sectors. These engineered panels typically comprise two thin, pre-finished metal sheets bonded to an inner core material, which historically was polyethylene (PE) but is now predominantly fire-retardant (FR) or non-combustible mineral-filled compounds. The foundational design objective of MCPs is to deliver a combination of exceptional rigidity, superior flatness, and a remarkably lightweight structure, making them highly desirable for exterior cladding, curtain walls, and interior finishing. Their versatility in aesthetic application is paramount, offering architects and designers an enormous palette of finishes, including high-gloss solid colors, metallic hues, and realistic simulations of natural materials such as stone, wood, and specialized textures, all achieved through sophisticated coating processes like PVDF and FEVE application.

The principal applications driving the burgeoning demand for MCPs include the façade construction of high-rise commercial offices, institutional buildings, retail centers, and critical transportation infrastructure, such as modern railway stations and airport terminals. In these environments, MCPs are selected not only for their visual appeal and structural performance but also for their functional benefits, which include excellent weather resistance, superior thermal insulation capabilities that contribute to building energy efficiency, and low lifecycle maintenance costs. The inherent ease of fabrication—allowing panels to be cut, routed, folded, and formed into complex, three-dimensional shapes—is a core advantage, facilitating rapid construction timelines and enabling intricate architectural designs that would be prohibitively complex or expensive using traditional solid metals or masonry. This adaptability positions MCPs as foundational elements in modern, prefabricated building envelope systems across diverse global climates and regulatory regimes.

Key market driving factors include the accelerating pace of global urbanization, particularly in emerging economies of the Asia Pacific and the Middle East, necessitating the construction of vast, modern commercial and public infrastructure. Concurrently, stringent global governmental regulations focused on enhancing building safety, specifically mandating the use of non-combustible (A2-rated) core materials for high-rise residential and commercial structures, are forcing a massive technological transition within the manufacturing base, thereby increasing the market value of compliant products. The intrinsic benefits of MCPs, such as their outstanding durability against corrosion and impact, the significant reduction in structural load compared to heavier materials, and their increasingly favorable environmental profiles through the use of recyclable aluminum and sustainable core fillers, collectively ensure their sustained preference over competing facade materials in high-specification projects globally. The pursuit of highly durable and maintenance-free building envelopes further solidifies the market trajectory.

Metal Composite Panel Market Executive Summary

The Metal Composite Panel market is undergoing a fundamental structural transformation, characterized by intensified regulatory pressure and a corresponding boom in high-value, compliant product innovation. A key business trend involves the global phase-out of standard polyethylene (PE) core panels in favor of specialized, fire-retardant (FR) and non-combustible (A2-grade) mineral cores. This shift necessitates substantial capital investment from manufacturers for process retooling, driving consolidation among smaller, less compliant players and favoring large multinational corporations with advanced material science capabilities. Furthermore, manufacturers are focusing heavily on developing specialty coatings, notably advanced PVDF and FEVE systems, coupled with integrated digital services such as BIM modeling and digital fabrication instructions, to cater to sophisticated architectural requirements and enhance material customization and quality assurance across the supply chain.

Regional market dynamics are stratified by maturity and regulatory rigor. The Asia Pacific (APAC) region continues to dominate the market in terms of sheer volume and rapid capacity expansion, fueled by massive government-led infrastructure projects and high-density residential development in countries like China and India. Conversely, North America and Europe, representing mature and highly regulated markets, lead in terms of market value per unit, primarily due to the mandatory adoption of premium A2-grade panels and the use of specialized metals such as zinc and copper for high-end architectural facades. Growth in the Middle East and Africa (MEA) is driven by large-scale, future-oriented urban development projects in the Gulf region, where panels must meet demanding specifications for both fire safety and extreme climate resilience, creating lucrative opportunities for certified suppliers.

Segmentation analysis clearly highlights the dominance of the Aluminum Composite Panel (ACP) segment, owing to aluminum’s optimal cost-to-performance ratio. Within the crucial core materials segment, the demand trajectory is decisively moving toward the non-combustible A2 mineral core, reshaping the competitive landscape and driving pricing strategy. Application-wise, the commercial and institutional construction sector maintains the largest share, constantly seeking materials that blend superior aesthetic flexibility with stringent safety compliance. The secondary segments, including transportation and specialized signage, show stable, sustained growth, emphasizing requirements for tailored panel solutions capable of withstanding high vibration and demanding environmental conditions, confirming the market’s reliance on continuous material science advancement to meet diverse regulatory and application needs globally.

AI Impact Analysis on Metal Composite Panel Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) in the Metal Composite Panel market frequently revolve around its potential to revolutionize manufacturing throughput and assure quality consistency at scale. Users are particularly interested in how predictive analytics can be deployed to manage complex continuous lamination processes, specifically optimizing heating and cooling cycles and adhesive application rates to prevent delamination failures and maintain the ultra-flatness required for facade panels. A significant theme emerging from user questions is the utility of AI in raw material management, using sophisticated forecasting models to predict price fluctuations in aluminum and specialty polymers, thereby informing procurement strategies to mitigate supply chain cost risks. Furthermore, there is considerable user interest in leveraging Generative Design AI to rapidly produce complex, custom fabrication blueprints, ensuring architectural designs are instantly optimized for manufacturability, reducing expensive rework cycles.

The overarching themes identified in user expectations center on achieving a "zero-defect" manufacturing environment and accelerating the design-to-installation workflow. Stakeholders anticipate AI models will provide real-time, high-fidelity defect detection during the high-speed coating and bonding stages using advanced machine vision systems, far exceeding human inspection capability, thus guaranteeing that high-value A2-grade panels meet precise regulatory and aesthetic specifications. Expectations extend into the realm of intelligent logistics, where AI algorithms optimize panel cutting patterns to minimize waste (crucial for expensive specialty metals) and schedule just-in-time delivery to volatile construction sites, thereby enhancing project efficiency and sustainability credentials. This shift signifies AI moving beyond simple monitoring to becoming an integral cognitive layer managing complex material interactions and optimizing operational economics.

Ultimately, the successful adoption of AI technology is poised to provide early adopters in the MCP market with a decisive competitive advantage, particularly by enabling Hyper-Customization and superior operational resilience. AI is facilitating the development of digital twins for entire production lines, allowing manufacturers to simulate material variations, test new core compositions, and predict the long-term performance (e.g., weathering characteristics) of custom coatings before full-scale production begins. This capability drastically reduces R&D cycle times and speeds up the certification process for new fire-rated products. Moreover, integrating AI with BIM tools allows for seamless data flow from the architect's design brief directly to the factory's CNC fabrication machinery, effectively automating the translation of complex geometry into ready-to-install cassette systems, thereby significantly compressing the timeline and mitigating human error in high-stakes projects.

- AI-driven predictive analytics optimizing continuous lamination parameters for enhanced panel adhesion and flatness consistency.

- Implementation of deep learning machine vision systems for real-time, automated defect identification in coating and surface finish.

- Generative design tools enabling architects to rapidly prototype complex panel geometries optimized for material usage and fabrication feasibility.

- Optimization of raw material procurement and inventory management using AI forecasting models to hedge against price volatility (aluminum, polymers).

- Development of digital twins of manufacturing plants to simulate material behavior and accelerate R&D cycles for A2-grade core composites.

- Intelligent waste reduction strategies via AI-optimized panel nesting and cutting patterns, enhancing sustainability metrics.

DRO & Impact Forces Of Metal Composite Panel Market

The dynamics of the Metal Composite Panel market are fundamentally shaped by the confluence of robust market drivers, significant regulatory restraints, and compelling technological opportunities, collectively acting as powerful impact forces. A primary driver is the accelerating global investment in modern infrastructure and commercial real estate, particularly the shift toward aesthetically striking, high-performance facade systems that MCPs are uniquely qualified to deliver due to their lightweight, durable, and highly customizable nature. This demand is amplified by the inherent speed of construction associated with composite panels, which is essential for meeting tight deadlines in rapid urbanization centers. Furthermore, the persistent push for energy-efficient buildings, where MCPs, when properly integrated with insulating materials, significantly reduce thermal bridging and cooling/heating loads, continues to provide a strong, intrinsic market impetus for adoption across both new builds and deep energy retrofits globally.

The most immediate and stringent restraint currently impacting the market is the global response to fire safety, translating into mandatory regulatory requirements for non-combustible A2-grade panels in multi-story construction across key markets in Europe, North America, and parts of Asia. This transition imposes substantial capital expenditure burdens on manufacturers to reformulate core materials, upgrade lamination equipment, and secure expensive compliance certifications, which acts as a barrier to entry for smaller firms and increases the final product cost. Compounding this, the high volatility in the pricing of core raw materials, predominantly primary aluminum coils and petroleum-derived polymers and additives, presents a persistent challenge to stable gross margins, requiring sophisticated hedging strategies and optimized internal processing to maintain competitive pricing structures against alternatives like fiber cement or glass facades.

Opportunities for exponential market expansion lie significantly in advanced material science and application diversification. There is immense potential in developing next-generation core materials that can achieve A2 compliance at a lower cost structure than current mineral-filled systems, democratizing access to safer cladding. Furthermore, the burgeoning market for Building Integrated Photovoltaics (BIPV) offers a significant niche, where MCPs serve as the structural substrate for integrated solar panels, simultaneously providing facade aesthetics and energy generation capabilities. Geographically, major opportunities reside in emerging Tier 2 and Tier 3 cities across Asia and Africa, where construction standards are rapidly professionalizing and demand for high-quality, standardized building materials is beginning to surge. The overarching impact forces compel manufacturers towards continuous innovation in fire safety and sustainable material sourcing, redefining market leadership based on compliance and material sophistication rather than purely volume or price.

Segmentation Analysis

The Metal Composite Panel market segmentation provides a granular view of the industry structure, differentiated primarily across material composition, core safety rating, end-use application, and surface finish. Segmentation by material is foundational, with Aluminum Composite Panels (ACPs) holding the dominant position due to their excellent balance of cost, weight, corrosion resistance, and ease of fabrication, making them the default choice for the vast majority of commercial and institutional projects. However, the premium segment is defined by panels utilizing other high-value metals, such as Zinc Composite Panels (ZCPs) known for their self-healing patina and exceptional longevity, and Copper Composite Panels (CCPs) favored for their distinct visual appearance and historical appeal in specialized architectural contexts, driving market value growth in high-specification projects.

The segmentation based on Core Type is currently the most dynamic area, reflecting intense regulatory upheaval. The market is witnessing a rapid contraction of the traditional low-cost Polyethylene (PE) core segment, which is increasingly restricted to low-rise or non-building applications (e.g., signage). The market growth is concentrated in the Fire-Retardant (FR) B1 grade and, most critically, the Non-Combustible A2 grade mineral-filled cores. The mandatory adoption of A2 cores for high-rise residential, public, and institutional buildings in developed markets is not merely a segment shift but a paradigm change, requiring sophisticated, proprietary blends of mineral hydrates and fillers. This segment’s growth trajectory is tied directly to global commitment to enhanced public safety standards, placing a premium on manufacturers who have successfully navigated complex international certification processes like Euroclass A2 and relevant ASTM standards.

In terms of application, the Building and Construction sector remains the primary consumer, accounting for the overwhelming majority of market revenue, subdivided into Commercial (offices, hotels, retail), Residential (high-rise condominiums), Institutional (hospitals, universities), and Industrial facilities. Commercial application requires aesthetic flexibility and strict fire compliance, while transportation (railway carriages, shipbuilding) demands lightweight panels with superior vibration and impact resistance, often requiring specific anti-graffiti coatings. The Signage and Display segment, utilizing thinner gauge materials and focused on graphic fidelity, constitutes a stable but specialized market. Furthermore, the segmentation by Coating Type, dominated by PVDF for exterior longevity and standard Polyester (PE) for interior or shorter-term applications, highlights the critical role of surface science in determining the panel’s final performance and suitability for the intended environmental exposure, with FEVE coatings emerging as a high-performance alternative to PVDF for superior color depth and gloss retention.

- By Material:

- Aluminum Composite Panel (ACP)

- Zinc Composite Panel (ZCP)

- Copper Composite Panel (CCP)

- Stainless Steel Composite Panel

- Titanium Composite Panel

- By Core Type:

- Polyethylene (PE) Core (Restricted Use)

- Fire-Retardant (FR) Core (B1 Grade)

- Non-Combustible (A2 Grade) Mineral Core (High Growth)

- By Application:

- Building and Construction

- Commercial and Retail

- Residential (High-Rise)

- Institutional (Healthcare, Education)

- Industrial

- Transportation (Rail, Aviation, Marine)

- Signage, Advertising, and Display

- Industrial Enclosures and OEM Applications

- Building and Construction

- By Coating Type:

- PVDF (Polyvinylidene Fluoride) Coatings

- Polyester (PE) Coatings

- FEVE (Fluoroethylene Vinyl Ether) Coatings

- Specialty Finishes (Self-Cleaning, Anti-Graffiti)

Value Chain Analysis For Metal Composite Panel Market

The Metal Composite Panel value chain commences with a highly strategic upstream phase focused on the procurement of primary inputs, dominated by high-quality aluminum coils, advanced fire-retardant mineral fillers, and specialized coating resins. Price dynamics and supply chain security for aluminum are critical, as it constitutes the largest cost component. Manufacturers often engage in long-term hedging contracts or vertical integration to secure consistent supply and quality of specific aluminum alloys required for achieving optimal panel flatness and structural integrity. For non-combustible panels, strong collaboration with chemical suppliers to source certified, proprietary mineral blends is essential, differentiating compliant manufacturers from the non-compliant competition and defining the initial cost structure and regulatory capability of the final product.

The midstream phase, centered on manufacturing, involves complex, capital-intensive processes: coil coating, where the protective and aesthetic finish (PVDF, FEVE) is applied to the aluminum skin; and the continuous lamination process, where the coated skins are permanently bonded to the core under precise temperature and pressure controls. Quality control, particularly the adhesion strength and the surface flatness across large panels, is paramount at this stage, heavily relying on advanced sensor technology and sophisticated lamination lines. Midstream efficiency directly impacts profitability; therefore, manufacturers continually seek to optimize line speed, reduce start-up waste, and implement advanced process control techniques, often leveraging AI and IoT solutions to maintain consistent output quality, especially for highly regulated A2 products where material uniformity is non-negotiable.

The downstream segment involves distribution, fabrication, and installation, representing the critical link to the end-customer. Distribution channels include both direct sales—preferred for major, high-value, custom architectural projects requiring extensive technical support and large volumes—and indirect sales via a network of specialized distributors and certified fabricators. Fabricators serve a crucial value-add role, taking the bulk MCP sheets and using sophisticated CNC machinery to cut, rout, and fold the panels into proprietary cassette or spline systems ready for site installation. The quality of fabrication and installation is a core determinant of the panel system's overall performance, weather resistance, and compliance, making the training and certification of downstream partners a vital strategic consideration for manufacturers seeking to protect brand reputation and assure long-term product warranties. Effective digital tools supporting design-to-fabrication workflow are increasingly important for downstream partner success.

Metal Composite Panel Market Potential Customers

The foundational customer segment for Metal Composite Panels comprises developers, general contractors (GCs), and specialized façade consultants engaged in large-scale commercial and institutional construction projects globally. Developers initiate projects, setting budget parameters and aesthetic goals, while GCs are the direct purchasers, prioritizing panel suppliers based on reliability, documented fire safety compliance, logistical support (just-in-time delivery capabilities), and overall installed cost-effectiveness. Crucially, the influential segment of architectural and engineering firms acts as a key specifying customer, dictating material type, core safety rating, and coating finish early in the design phase. Manufacturers invest heavily in providing these firms with comprehensive technical data, high-fidelity digital models (BIM objects), and aesthetic samples to ensure their products are written into the project specifications, thereby guaranteeing future sales.

A second, high-growth potential customer group involves corporate owners and asset managers engaged in comprehensive building renovation and rebranding initiatives. As older structures require modernization to meet contemporary energy efficiency standards and aesthetic demands, MCPs are highly favored for retrofitting existing facades due to their light weight, which minimizes the load added to the original structure, and their ability to rapidly transform a building’s appearance. These customers often prioritize long-term performance, demanding specialized, maintenance-free coatings like FEVE and robust warranties that cover material performance and color stability over decades, driving demand for premium products that offer compelling lifecycle cost advantages over cheaper alternatives requiring frequent repair or repainting.

The specialized non-building sector represents a stable and discerning customer base. This includes public transportation authorities (e.g., railway and metro operators), which require MCPs for both vehicle exteriors (due to lightweight, vibration resistance, and cleanability) and station construction. Signage and corporate identity customers, such as global retail chains, rely on MCPs for large format displays and consistent exterior branding, prioritizing custom color matching and durability under various climate conditions. For these niche applications, customers require tailored specifications, such as specific abrasion resistance or anti-graffiti finishes, demonstrating a highly specialized purchasing decision based on application-specific functional performance criteria rather than general construction aesthetics or cost, requiring manufacturers to maintain flexible production capabilities and specific product certifications for these sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3A Composites (Alucobond), Mitsubishi Chemical Corporation (ALPOLIC), Arconic (Reynobond), Jyi Shyang Industrial Co., Ltd., Alucoil (Grupo Alibérico), Yaret Industrial Group, Viva Composite Panel Co., Ltd., Alubond U.S.A. (MHD), Euramax Coated Products, Guangzhou Xinghe Aluminum Composite Panel Co., Ltd., JPV Aluminium Composite Panel, Panel Rey, Jindal Aluminium Limited, Norsk Hydro ASA, A.D. Global Synergies, Changzhou Lingtong Decorative Material Co., Ltd., Shanghai Jixiang Industry Co., Ltd., Albond Aluminium Composite Panels, Multipanel, Fairland Composites. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Composite Panel Market Key Technology Landscape

The current technology landscape in the Metal Composite Panel market is fundamentally defined by relentless innovation aimed at achieving mandatory fire safety compliance and improving long-term material sustainability and performance. The most critical technological advancement lies in the formulation and mass production techniques for A2-grade non-combustible core materials. This involves precise, high-shear mixing and proprietary extrusion methods to evenly distribute high volumes of specialty mineral fillers (such as magnesium hydroxide or aluminum hydroxide) within a minimal polymeric matrix, ensuring the core remains structurally sound yet non-flammable when subjected to intense heat. Manufacturers are continually investing in sophisticated continuous lamination lines that can effectively bond metal skins to these dense mineral cores without compromising the required aesthetic flatness or inducing premature material fatigue, a significant technical hurdle that differentiates market leaders.

Surface technology constitutes the second pillar of technological focus, specifically refining advanced coating systems. While standard PVDF (Polyvinylidene Fluoride) continues to dominate due to its decades-proven performance against UV degradation and weathering, the emerging use of FEVE (Fluoroethylene Vinyl Ether) coating systems offers superior gloss retention and broader pigment compatibility, enabling deeper, richer color finishes favored by high-end design projects. Furthermore, a growing area of specialized coating R&D involves integrating smart functionalities. This includes self-cleaning surfaces utilizing photocatalytic titanium dioxide nanoparticles that chemically break down organic pollutants and anti-microbial coatings for use in sensitive environments like healthcare and food processing facilities, adding significant functional value beyond mere aesthetics and protection, thus extending the panel's utility and maintenance efficiency over its operating lifecycle.

Process innovation is also centered on integrating Industry 4.0 principles, particularly in fabrication and quality assurance. High-precision Computer Numerical Control (CNC) routing and cutting systems are essential for bespoke architectural detailing, minimizing waste and ensuring that cassette panel systems achieve perfect fitment on site, crucial for weatherproofing and installation speed. Concurrently, manufacturers are implementing sophisticated sensor arrays and Artificial Intelligence (AI) vision systems throughout the production line to monitor and automatically adjust parameters like coating thickness and bonding temperature in real-time. This closed-loop quality control minimizes human error, ensures batch-to-batch color consistency, and guarantees that every panel meets the rigorous, zero-tolerance standards for flatness and fire rating compliance necessary for international market acceptance and long-term structural warranties, thereby safeguarding the manufacturer's global reputation for quality.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of global Metal Composite Panel volume demand and manufacturing capability. This dominance is driven by unprecedented rates of population migration to urban centers, vast national infrastructure projects (e.g., high-speed rail networks, new airport construction), and booming commercial real estate development across China, India, and Southeast Asia. While cost-sensitivity is prevalent, the regulatory environment is maturing rapidly, particularly in major cities, leading to a significant and accelerating demand shift towards premium, higher-margin A2-grade and FR core panels for new public and commercial high-rise construction, marking a major investment opportunity for manufacturers with certified products.

- North America: The North American market is highly regulated and mature, prioritizing quality, certification, and long-term system performance. Demand is heavily concentrated in the commercial and institutional sectors, driven by extensive high-rise construction and robust renovation cycles that adhere to stringent fire codes (e.g., local state laws and NFPA standards). The market shows a strong preference for fully tested, integrated facade systems that incorporate A2-grade ACPs and specialized metals like Zinc and Copper composites, reflecting a willingness to pay a premium for materials that offer superior durability, aesthetics, and demonstrable compliance with complex local building regulations.

- Europe: Defined by the rigorous Euroclass standards (especially A2 non-combustible requirements) and a strong emphasis on sustainable and circular economy practices, the European MCP market is stable and characterized by high value. The market benefits from substantial activity in building refurbishment, especially projects designed to meet stringent thermal performance and energy efficiency mandates. Key markets like Germany, the UK, and France show steady demand for highly engineered, certified panels, with a growing focus on product lifecycle assessments (LCAs) and materials featuring low volatile organic compounds (VOCs) and high recycled content, aligning façade material choice with broader green building certifications.

- Middle East & Africa (MEA): This region is characterized by project-specific, high-volume demand associated with government-backed mega-projects, particularly in the UAE and Saudi Arabia. The market requires materials that can withstand extreme solar radiation, high temperatures, and sand abrasion while meeting increasingly strict, localized fire safety regulations instituted for landmark skyscrapers and public structures. While historical demand leaned towards less expensive options, regulatory tightening and the high visibility of major urban projects are successfully pushing the market towards compliant FR and A2-rated panels imported from leading international suppliers capable of managing the logistical complexities of the region.

- Latin America: The Latin American MCP market is rapidly evolving, driven by infrastructure upgrades and the expansion of modern commercial centers, particularly in Brazil, Mexico, and Chile. The market is moderately price-sensitive but shows increasing awareness and demand for quality and safety standards. Growth is characterized by the adoption of modern construction techniques that favor prefabricated, lightweight facade solutions, gradually transitioning from purely cost-driven procurement towards materials offering better long-term durability and resistance to seismic activity prevalent in parts of the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Composite Panel Market.- 3A Composites (Alucobond)

- Mitsubishi Chemical Corporation (ALPOLIC)

- Arconic (Reynobond)

- Jyi Shyang Industrial Co., Ltd.

- Alucoil (Grupo Alibérico)

- Yaret Industrial Group

- Viva Composite Panel Co., Ltd.

- Alubond U.S.A. (MHD)

- Euramax Coated Products

- Guangzhou Xinghe Aluminum Composite Panel Co., Ltd.

- JPV Aluminium Composite Panel

- Panel Rey

- Jindal Aluminium Limited

- Norsk Hydro ASA (Primary Aluminum Supplier)

- A.D. Global Synergies

- Changzhou Lingtong Decorative Material Co., Ltd.

- Shanghai Jixiang Industry Co., Ltd.

- Albond Aluminium Composite Panels

- Multipanel

- Fairland Composites

Frequently Asked Questions

Analyze common user questions about the Metal Composite Panel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor driving the shift in Metal Composite Panel core materials?

The primary factor is the global tightening of fire safety regulations and building codes, particularly following major fire incidents. This regulatory shift mandates the use of non-combustible (A2 grade) mineral-filled cores, replacing traditional polyethylene (PE) cores, to ensure higher life safety standards in high-rise and public infrastructure projects worldwide, significantly increasing manufacturing complexity and cost.

How does the use of PVDF coating enhance the longevity and value of Metal Composite Panels?

PVDF (Polyvinylidene Fluoride) coatings offer superior resistance to ultraviolet (UV) radiation, weathering, acid rain, and airborne pollutants. This chemical resilience prevents chalking and fading, ensuring the panel maintains its aesthetic integrity and color stability for decades, which is essential for preserving the long-term value and appearance of external building facades under harsh environmental exposure conditions.

Which geographical region dominates the consumption of Metal Composite Panels, and why?

The Asia Pacific (APAC) region dominates the consumption market in terms of volume, driven by unprecedented levels of urbanization, massive infrastructure development, and substantial investment in commercial and residential construction, particularly in rapidly expanding economies like China and India, creating immense scale and volume requirements.

What is the difference between Aluminum Composite Panels (ACPs) and Zinc Composite Panels (ZCPs) in architectural application?

ACPs are lightweight, cost-effective, and highly versatile, used for most general cladding applications due to ease of fabrication. ZCPs, while significantly more expensive, are selected for high-end architectural projects due to zinc’s unique ability to develop a natural, protective patina over time, offering superior self-healing properties, exceptional longevity, and a distinct, sophisticated aesthetic appeal favored by specific designers.

How is technology, specifically AI, influencing the manufacturing process of MCPs?

AI is increasingly being integrated to enhance operational efficiency through predictive maintenance of continuous lamination lines, minimizing costly downtime, and optimizing yield. Furthermore, AI vision systems are crucial for real-time, automated quality control, ensuring strict adherence to flatness, adhesion, and color consistency standards required for large-scale, defect-free production, thereby assuring compliance and reducing waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager