Metal Credit Cards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433824 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Metal Credit Cards Market Size

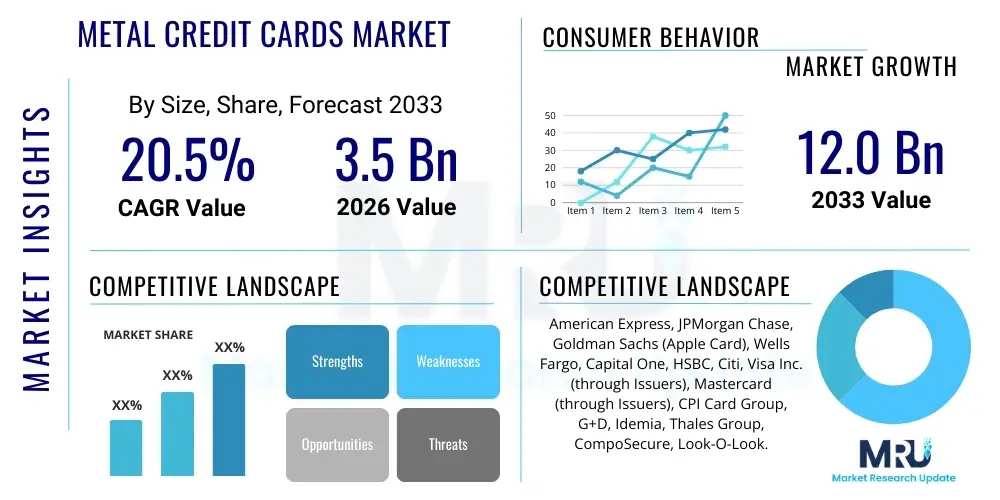

The Metal Credit Cards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 12.0 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing consumer preference for premium financial products that offer both exclusivity and enhanced durability, particularly among high-net-worth individuals and affluent millennial populations globally. The perception of metal cards as a status symbol, coupled with the rising adoption of sophisticated rewards programs by issuing banks, acts as a primary catalyst for market expansion, driving significant investment in card manufacturing and personalization technologies.

Metal Credit Cards Market introduction

The Metal Credit Cards Market encompasses the production and distribution of payment cards constructed primarily from materials such as stainless steel, brass, titanium, or specialized alloys, offering enhanced tactile feel, durability, and perceived premium value compared to standard PVC cards. These cards function across standard payment networks (Visa, Mastercard, Amex) but are differentiated by their aesthetics, weight, and the exclusive, often high-tier, benefits they typically unlock for cardholders, including specialized travel perks, concierge services, and elevated rewards structures. Major applications include premium rewards cards, secured credit products, exclusive debit card offerings, and specialized corporate expense cards targeted at executive tiers. The intrinsic benefits of metal cards, such as their longevity, resistance to damage, and strong brand association with luxury, drive their appeal across various affluent consumer segments.

Driving factors for this market include the global rise in disposable income among key demographics, the competitive differentiation strategies employed by financial institutions seeking to capture and retain high-value clientele, and advancements in card manufacturing technology that allow for thinner, lighter, and more complex metallic designs. Furthermore, the strong influence of social media and aspirational branding reinforces the perception of metal cards as essential accessories for modern, status-conscious consumers. The convergence of payment technology innovation—such as enhanced contactless features and integrated security elements—with premium materials ensures that metal cards remain relevant in an increasingly digital payment landscape, bridging the gap between physical utility and psychological luxury in financial instruments.

Metal Credit Cards Market Executive Summary

The Metal Credit Cards Market is experiencing a rapid transformation, characterized by aggressive strategic partnerships between FinTech disruptors and traditional banking giants, focusing intensely on co-branded luxury lifestyle products. Business trends indicate a shift from simply offering metal cards as a differentiator to embedding them within holistic premium ecosystems that include exclusive access to airport lounges, personalized wealth management tools, and enhanced insurance coverage, thereby justifying the higher annual fees often associated with these products. Furthermore, environmental considerations are beginning to influence material choices, with some issuers exploring sustainable or recycled metals, signaling a move toward environmentally conscious luxury in the financial sector. The competitive landscape is defined by innovation in card design and the continuous refinement of rewards categories to align with the spending patterns of affluent travelers and digitally savvy consumers, solidifying the market's high growth potential despite niche segmentation.

Regionally, North America maintains market dominance due to its established culture of premium credit card usage, sophisticated loyalty programs, and a large concentration of high-net-worth individuals, especially within the United States. However, the Asia Pacific (APAC) region, driven by rapid wealth creation in economies like China and India, is emerging as the fastest-growing market, with local banks increasingly launching high-status metal card offerings tailored to localized luxury consumption patterns. Europe also demonstrates robust growth, primarily focusing on design aesthetics and security features, aligning with stringent regional regulatory standards. These regional trends highlight the global acceptance of metal cards as a universal symbol of financial achievement, although the specific benefits and marketing approaches are highly localized based on consumer maturity and cultural preferences.

Segmentation trends reveal that the stainless steel segment remains the primary choice due to its balance of durability, cost-effectiveness, and premium feel, while high-end options like titanium and specialized alloys cater to ultra-high-net-worth segments demanding maximum exclusivity and lightness. By application, the premium rewards credit card category holds the largest market share, directly benefiting from issuers aiming to maximize interchange revenue and customer retention through generous points systems and travel perks. The debit card segment, though smaller, is gaining momentum as challenger banks utilize metal cards to attract core deposit accounts, appealing to younger, aspirational consumers who value the aesthetic and tactile quality of their daily banking instruments. This dual-track segmentation—focusing on both ultra-premium credit products and mass-affluent debit offerings—ensures sustained market vitality.

AI Impact Analysis on Metal Credit Cards Market

User inquiries regarding AI's influence on the Metal Credit Cards Market typically center on how artificial intelligence will enhance the exclusivity and personalization inherent in these premium products, specifically asking about predictive rewards optimization, advanced fraud detection tailored to high-limit spending profiles, and AI-driven concierge services. Users are keenly interested in whether AI can justify the high cost of metal cards by delivering hyper-personalized experiences that standard financial services cannot match. Key concerns revolve around data privacy when utilizing AI for behavioral spending analysis and the potential for AI algorithms to inadvertently create or reinforce social stratification in access to elite financial products. Overall user expectation is that AI will move beyond basic customer support, becoming integral to the value proposition through intelligent, predictive benefit delivery and robust, real-time security management for high-value transactions.

The direct impact of AI is less about the physical card material and more about the digital ecosystem supporting it. AI algorithms are crucial in developing highly complex, dynamic rewards programs that automatically adjust based on cardholder behavior, optimizing cashback or travel points accumulation without manual intervention. Furthermore, in the realm of credit underwriting and risk management for high-limit metal cards, AI models provide superior granularity in assessing creditworthiness and detecting subtle patterns of sophisticated fraud, significantly lowering institutional risk associated with large-value transactions. This integration elevates the overall security and functional value of the metal card offering, transitioning it from a merely aesthetic product to a cutting-edge financial technology package.

- AI-powered Predictive Rewards Optimization: Analyzing spending data to proactively offer tailored benefits (e.g., automatically booking preferred flight segments or optimizing loyalty point redemption).

- Enhanced Fraud Detection: Utilizing machine learning to detect anomalies in large transaction volumes typical of premium cardholders, ensuring minimal false positives and maximum security.

- AI-driven Personalization: Delivering sophisticated, real-time personalized concierge and customer service experiences through intelligent chatbots and voice interfaces.

- Dynamic Credit Limit Management: Using AI to adjust high credit limits dynamically based on instantaneous financial health assessments, minimizing risk for the issuer.

- Customized Marketing Segmentation: Identifying and targeting specific demographic niches (e.g., luxury travelers, high-frequency diners) most likely to respond to new metal card product launches.

DRO & Impact Forces Of Metal Credit Cards Market

The Metal Credit Cards Market is subject to powerful Drivers (D), Restraints (R), and Opportunities (O) that collectively define its trajectory and the underlying competitive dynamics (Impact Forces). The foremost driver is the unwavering consumer demand for prestige and perceived exclusivity, where the tangible nature and weight of a metal card serve as a powerful psychological differentiator in a world increasingly dominated by invisible digital payments. This is significantly supported by issuer marketing strategies that link metal cards to aspirational lifestyles and curated luxury experiences, enabling high annual fee structures that boost profitability. Conversely, the market faces significant restraints, primarily the high manufacturing cost associated with complex metallic construction and embedding secure chips, making it economically challenging for issuers to offer these products to non-premium market segments. Regulatory scrutiny over interchange fees and consumer debt levels in key markets also acts as a dampener, forcing banks to continually reassess the profitability and risk profile of their high-limit card portfolios.

Key opportunities in the market lie in penetrating emerging economies, particularly in Latin America and Southeast Asia, where rapid middle-class expansion creates new cohorts of status-seeking consumers eager for premium financial products. The development of advanced, sustainable, and biodegradable metal alloys presents a crucial opportunity to address environmental concerns, enhancing brand image and attracting eco-conscious affluent consumers. Impact forces are currently dominated by the intense competitive rivalry among top global banks and new challenger FinTech companies, who continuously leverage product design, rewards innovation, and speed-to-market to gain share. The bargaining power of suppliers (specialized metal fabricators and chip manufacturers) is moderate, mitigated by technological diversification, while the bargaining power of consumers is high, as they frequently switch between issuers to maximize rewards and sign-up bonuses, compelling issuers to maintain high levels of product value and service quality.

Segmentation Analysis

The Metal Credit Cards Market is meticulously segmented based on the type of metal used, the specific card application, and the profile of the issuing entity, providing a granular view of consumer preferences and operational complexities. Segmentation by material type is crucial as it directly dictates manufacturing costs, durability, and the perceived premium quality of the card, ranging from robust stainless steel to exotic, lightweight titanium. Segmentation by application distinguishes between high-yield credit products, standard charge cards, and debit instruments, reflecting differing target audiences and revenue models for issuers. This detailed segmentation allows financial institutions to tailor their product offerings precisely to distinct wealth brackets and lifestyle needs, maximizing market penetration and profitability across the entire financial services spectrum.

- By Material Type:

- Stainless Steel

- Titanium

- Brass/Copper Alloy

- Hybrid (Metal Core with PVC Laminate)

- By Application:

- Premium Rewards Credit Cards

- Charge Cards

- Debit Cards

- Prepaid/Corporate Cards

- By Issuing Entity:

- Traditional Banks and Financial Institutions

- Challenger Banks and FinTechs

- By End-User:

- High-Net-Worth Individuals (HNWI)

- Affluent Mass Market

Value Chain Analysis For Metal Credit Cards Market

The value chain for the Metal Credit Cards Market is complex, beginning with highly specialized upstream activities involving sourcing, refining, and preparing specific metal alloys that meet stringent durability and electrical conductivity requirements. Upstream suppliers are pivotal, providing specialized materials such as premium stainless steel sheets, titanium blanks, and high-security EMV chips and antennae, which are then integrated into the card body. The midstream involves specialized card personalization bureaus and manufacturing facilities responsible for metal etching, laser engraving, secure chip embedding (contact and contactless), and stringent quality control processes to ensure compliance with global payment network specifications (e.g., ISO standards for thickness and rigidity). This manufacturing stage requires high precision and secure environments to handle proprietary cardholder data.

Downstream activities focus heavily on secure distribution and card issuance. Direct distribution channels involve banks mailing the finished, activated cards directly to the high-value cardholders, often utilizing specialized, premium packaging that reinforces the luxury brand identity of the product. Indirect distribution involves leveraging established payment networks (Visa, Mastercard, Amex) to facilitate transactions globally, ensuring universal acceptance at points of sale (POS) and ATMs. Furthermore, a critical component downstream is the ongoing customer relationship management (CRM) and the delivery of the premium benefits package—such as concierge services, travel benefits, and loyalty program management—which significantly influences customer retention and the overall lifetime value of the cardholder, distinguishing the product beyond its physical attributes.

Metal Credit Cards Market Potential Customers

The primary potential customers and end-users of metal credit cards are distinct groups unified by a demand for premium services, exclusivity, and a high-status aesthetic associated with their financial instruments. This market fundamentally targets High-Net-Worth Individuals (HNWI) and Ultra-High-Net-Worth Individuals (UHNWI), who possess significant disposable income, frequently engage in international travel, and require high credit limits compatible with luxury purchases and robust wealth management services. A secondary, rapidly expanding target segment includes the Affluent Mass Market, particularly younger millennials and Gen Z professionals who are upwardly mobile, digitally native, and prioritize design and brand cachet, often utilizing metal cards from challenger banks that offer attainable premium features with lower annual fee structures. These customers are not only seeking financial utility but are also buying into a lifestyle brand that reinforces their social and professional standing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 12.0 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express, JPMorgan Chase, Goldman Sachs (Apple Card), Wells Fargo, Capital One, HSBC, Citi, Visa Inc. (through Issuers), Mastercard (through Issuers), CPI Card Group, G+D, Idemia, Thales Group, CompoSecure, Look-O-Look. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Credit Cards Market Key Technology Landscape

The technology landscape for metal credit cards is sophisticated, combining advanced material science with secure payment hardware and manufacturing techniques. Key technologies employed include precision laser etching and engraving, which allow for high-definition personalization of cardholder names, numbers, and intricate designs without compromising the structural integrity of the metal. Furthermore, the integration of dual-interface chips (EMV contact and NFC contactless payment capabilities) requires specialized embedding techniques to ensure reliable signal transmission through the dense metallic body. Card manufacturers utilize proprietary lamination processes for hybrid cards, ensuring secure bonding of metal cores with polymer layers, maintaining the card's compliance with ISO standards for durability and flexibility while preserving the metallic aesthetic.

Another crucial technological area is the development of robust security features. This includes advanced biometric verification (though still nascent, some premium cards are exploring integrated fingerprint sensors) and tokenization technology, which ensures that physical metal cards leverage the same high-security standards as digital wallets. In terms of materials, ongoing research focuses on lightweight, high-strength alloys like specific grades of titanium that provide maximum durability while minimizing the card's overall weight, enhancing the user experience. The secure personalization process, involving complex software and hardware systems to encode financial data onto the chip, is paramount, ensuring each card adheres to the strict security protocols mandated by global payment networks and national regulatory bodies.

Regional Highlights

- North America (US and Canada): Dominates the global market share, characterized by high consumer spending, established loyalty ecosystems, and aggressive competition among major issuers (Amex, Chase). The region is a leader in product innovation and features the highest concentration of high-annual-fee metal card products aimed at the top-tier consumer segment.

- Europe (UK, Germany, France): A mature market focusing heavily on aesthetic design, advanced contactless technology integration, and regulatory compliance (especially GDPR). Growth is driven by FinTech challenger banks (e.g., Revolut, N26) utilizing metal cards to attract core banking customers seeking premium, non-traditional banking experiences.

- Asia Pacific (APAC) (China, India, Japan): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, burgeoning middle and affluent classes, and local banks aggressively launching localized premium rewards programs tailored to regional travel and luxury consumption habits, especially in metropolitan hubs.

- Latin America (Brazil, Mexico): An emerging market driven by the desire for status symbols and financial inclusion initiatives. While the market is smaller, it shows robust growth potential, with issuers leveraging metal cards to capture early market share in increasingly digitized economies and distinguish their offerings from traditional bank products.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high per capita wealth and a strong culture of luxury spending make metal cards highly desirable. Issuers focus on exclusive, personalized lifestyle benefits such as dedicated concierge services and elite travel perks to cater to this highly demanding clientele.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Credit Cards Market.- American Express Company

- JPMorgan Chase & Co.

- Goldman Sachs Group (Issuer of Apple Card)

- Wells Fargo & Company

- Capital One Financial Corporation

- Citigroup Inc. (Citi)

- HSBC Holdings plc

- Visa Inc. (Network Provider)

- Mastercard Incorporated (Network Provider)

- CPI Card Group

- Giesecke+Devrient (G+D)

- Idemia

- Thales Group

- CompoSecure

- Look-O-Look

- Revolut Ltd (Challenger Bank)

- N26 GmbH (Challenger Bank)

- Sands & Company

- Gemalto (part of Thales)

- Discover Financial Services

Frequently Asked Questions

Analyze common user questions about the Metal Credit Cards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between metal and traditional PVC credit cards?

Metal credit cards are primarily differentiated by their superior durability, heavier tactile feel, and premium aesthetic, often signaling exclusivity and higher status. Functionally, they typically unlock access to enhanced loyalty programs, specialized travel perks, and concierge services, justifying significantly higher annual fees compared to standard PVC cards, though both use the same EMV chip and payment network infrastructure.

Why are metal credit cards generally perceived as a status symbol?

The status associated with metal cards stems from the exclusivity required for eligibility, often demanding high credit scores and substantial annual incomes. The physical weight, distinct sound during payment, and high-quality construction contribute to a palpable luxury experience, actively marketed by issuers to align the card with high-end lifestyles, making it a visible marker of financial success and elite membership.

Which metal material is most commonly used in manufacturing credit cards?

Stainless steel is the most common material due to its optimal balance of durability, cost-effectiveness, and premium weight. However, ultra-premium cards often utilize lighter, more expensive materials like titanium for maximum exclusivity and reduced bulk, catering specifically to the highest-tier clientele who prioritize minimal weight alongside maximum material prestige.

What role does sustainability play in the future development of metal credit cards?

Sustainability is becoming a critical consideration. Issuers are increasingly exploring opportunities to incorporate recycled metals (e.g., reclaimed ocean plastic/metal hybrids) or highly sustainable alloys to mitigate the environmental impact associated with traditional metal card manufacturing. This strategic shift aims to appeal to environmentally conscious affluent consumers while maintaining the luxury perception necessary for market growth.

How do advancements in AI impact the user experience of premium metal cardholders?

AI significantly enhances the premium user experience by enabling hyper-personalization of benefits and robust security measures. AI algorithms analyze high-value spending patterns to proactively optimize rewards, tailor exclusive offers, and deliver predictive risk management, providing a seamless, highly secure, and uniquely customized financial service environment for the affluent cardholder base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager