Metal Finishing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432012 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Metal Finishing Market Size

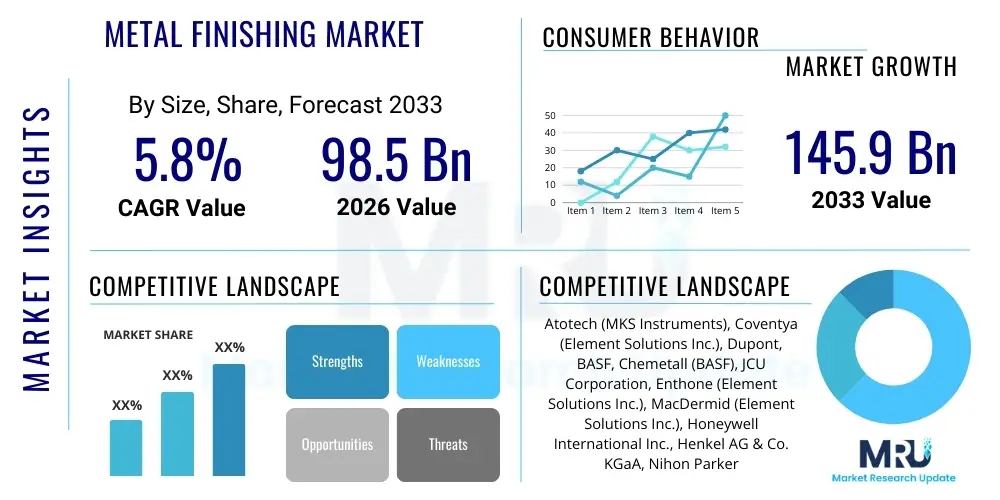

The Metal Finishing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 98.5 Billion in 2026 and is projected to reach USD 145.9 Billion by the end of the forecast period in 2033.

Metal Finishing Market introduction

The Metal Finishing Market encompasses a broad range of industrial processes designed to modify the surface of metallic components to enhance properties such as corrosion resistance, durability, conductivity, wear resistance, adhesion, and aesthetic appeal. These processes are fundamental to modern manufacturing, serving as a critical step in the production of high-performance parts used across almost every major industry. Key product descriptions within this market include electroplating, anodizing, chemical conversion coatings, thermal sprays, and mechanical finishing techniques. The demand for increasingly stringent performance specifications in demanding environments, particularly in automotive lightweighting and sophisticated electronics, acts as a primary market driver. This technological evolution requires finishes that can withstand extreme thermal cycling, chemical exposure, and high mechanical stress, making metal finishing innovation indispensable for achieving product longevity and operational safety.

Major applications of metal finishing are highly diverse, spanning sectors like automotive (anti-corrosion coatings for chassis and engine components, decorative trims), aerospace (thermal barrier coatings, specialized plating for conductivity and shielding), electronics (gold and silver plating for connectors and PCBs), and construction (protective coatings for structural steel). The benefits derived from these processes are non-negotiable for product integrity; for instance, electroplated zinc or nickel prevents rust formation in outdoor applications, while hard chrome plating significantly extends the service life of industrial machinery through superior wear resistance. Furthermore, the push towards miniaturization in electronics mandates extremely precise and uniform coating deposition, driving technological advancements in precision surface engineering.

Driving factors for sustained market growth include the robust expansion of the electric vehicle (EV) sector, which requires specialized coatings for battery packs and thermal management systems that must be lightweight yet extremely resilient. Additionally, tightening global environmental regulations, particularly regarding the use of hexavalent chromium, are forcing the industry to adopt sustainable and compliant alternatives, such as trivalent chromium plating and advanced PVD/CVD techniques. This regulatory pressure, while initially a challenge, serves as a powerful catalyst for innovation, pushing key market players to invest heavily in environmentally friendly chemistries and highly efficient automation systems, thereby ensuring both compliance and superior functional output.

Metal Finishing Market Executive Summary

The Metal Finishing Market is characterized by accelerating technological transitions driven by twin forces: the need for enhanced performance characteristics and the imperative for environmental sustainability. Key business trends indicate a significant shift away from traditional, hazardous chemical processes towards advanced dry finishing techniques like Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), as well as highly automated, closed-loop electroplating systems that minimize waste generation. The competitive landscape is consolidating, with larger chemical suppliers and service providers engaging in strategic mergers and acquisitions to integrate vertical capabilities, secure raw material supply, and expand their regional footprints, particularly in high-growth industrial clusters in Asia Pacific. Investment in R&D is heavily focused on developing high-solids coatings, functional nanocomposites, and tailored surface architectures that can meet specific electrical, thermal, and mechanical specifications demanded by next-generation products in the electronics and medical device industries.

Regional trends reveal the Asia Pacific (APAC) region maintaining its dominance, fueled by massive manufacturing bases in China, India, and Southeast Asian countries, especially for automotive components and consumer electronics. North America and Europe, while experiencing slower overall volume growth compared to APAC, are leading the charge in adopting sophisticated, high-value finishing technologies and stringent environmental compliance standards, thereby commanding premium pricing for specialty services such as aerospace coatings and medical device finishing. The market in Latin America and the Middle East & Africa (MEA) is experiencing steady growth, largely tied to infrastructure development, oil and gas sector maintenance, and growing domestic manufacturing capabilities, demanding protective coatings suitable for harsh climatic conditions.

Segmentation trends highlight the rapid expansion of the plating and coating segment, particularly functional plating (nickel, zinc-nickel, chrome replacements) driven by performance requirements in automotive powertrain and EV battery components. The equipment and consumables segments are witnessing high demand for robotic arms, automated handling systems, and specialized filtration and purification equipment necessary to maintain process baths and ensure regulatory compliance. End-user trends show the fastest growth emanating from the electronics and electrical sector, where the need for reliable, corrosion-free contacts and heat dissipation capabilities is paramount. Furthermore, the shift towards modular, repairable, and lighter components across all end-use sectors is propelling the demand for multi-functional coatings that offer protection and lubrication simultaneously.

AI Impact Analysis on Metal Finishing Market

Common user questions regarding AI in metal finishing predominantly revolve around how artificial intelligence can optimize historically manual and chemically sensitive processes, specifically asking about predictive quality control, efficiency gains in complex plating baths, and the feasibility of autonomous process parameter adjustment. Users are keen to understand if AI can reduce the variability inherent in traditional electroplating, leading to consistent film thickness, adherence, and compositional homogeneity, which are critical for high-reliability applications like aerospace and semiconductors. Another major theme centers on the environmental and cost implications: can AI-driven maintenance and chemical usage optimization significantly lower waste generation and operational expenses? Users also frequently inquire about the integration challenges of implementing complex machine learning models with legacy finishing equipment, focusing on data acquisition capabilities and the required investment in smart sensors and real-time monitoring infrastructure.

- AI-driven Predictive Quality Control: Machine learning models analyze real-time sensor data (temperature, pH, current density, flow rates) to predict potential quality defects (e.g., pitting, burning, poor adhesion) before they manifest, drastically reducing rework rates.

- Optimized Chemical Bath Management: AI algorithms track chemical concentrations, consumption patterns, and contamination build-up, generating precise dosing recommendations to maintain optimal bath equilibrium, extending solution lifespan and minimizing chemical waste.

- Autonomous Process Parameter Tuning: Advanced control systems use reinforcement learning to dynamically adjust plating parameters based on part geometry, material substrate, and desired coating specifications, achieving ultra-high consistency and throughput.

- Predictive Maintenance for Equipment: Monitoring systems analyze vibrations, energy consumption, and thermal patterns of rectifiers, pumps, and filters to forecast equipment failure, enabling scheduled maintenance and preventing costly unplanned downtime.

- Material Informatics and Formulation: AI accelerates the R&D cycle for new, environmentally compliant coating formulations by simulating material interactions and predicting performance characteristics (e.g., hardness, corrosion resistance) of novel alloys and composites.

DRO & Impact Forces Of Metal Finishing Market

The Metal Finishing Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant Impact Forces on industry evolution. The principal drivers include the relentless global push toward durable, high-performance goods across automotive, aerospace, and electronics sectors, where superior surface properties are essential for product lifespan and reliability. Coupled with this is the massive investment in electric vehicle manufacturing, which demands highly specialized corrosion-resistant and thermally stable coatings for battery enclosures and power electronics. These drivers create an expansive force demanding innovation in material science and process engineering, compelling manufacturers to adopt finishes that are both robust and precise.

However, the industry faces substantial restraints, primarily centered on high regulatory hurdles and significant environmental costs. The mandated phasing out of highly effective but toxic substances, such as hexavalent chromium and certain heavy metals, necessitates costly transitions to new chemistries and processes, requiring substantial capital expenditure for facility retrofitting and compliance monitoring. Furthermore, metal finishing often involves high energy consumption and generates complex wastewater streams containing regulated pollutants, imposing stringent requirements for waste treatment and disposal, which limits entry for smaller players and increases operational complexity for all participants. These restraints exert a powerful limiting force, prioritizing investment in waste minimization technologies and sustainable process design over pure volume expansion.

Opportunities for growth lie primarily in leveraging advanced automation, digitization, and sustainable chemical alternatives. The development and adoption of bio-based coatings, non-toxic pre-treatment chemistries, and highly efficient dry processes (PVD/CVD, plasma treatments) offer pathways for both performance enhancement and regulatory compliance. The integration of Industry 4.0 technologies—including IoT, AI, and robotics—provides opportunities to increase throughput, reduce human error, and achieve unprecedented precision in deposition, unlocking potential markets in microelectronics and precision medical devices. These opportunities represent a transformative force, rewarding early adopters who can successfully integrate sustainability with high-performance manufacturing capabilities, fundamentally shifting the market structure toward technologically advanced service providers.

Segmentation Analysis

The Metal Finishing Market is fundamentally segmented based on the type of process utilized, the primary material applied, the equipment involved, and the end-user industry served. This structured classification allows for a detailed understanding of technological adoption rates, regional demand patterns, and the specific performance requirements dictating market behavior. The primary processes, such as electroplating, chemical finishing, and anodizing, have distinct cost structures and functional outputs, influencing their adoption across various industries. For instance, electroplating dominates applications requiring uniform thickness and high conductivity (electronics), while thermal spraying is preferred for high-wear resistance and specialized material deposition (aerospace turbine blades).

Material-wise segmentation focuses heavily on metals like Nickel, Zinc, Chromium, and precious metals (Gold, Silver, Platinum), alongside non-metallic coatings such as specialized polymers and ceramics applied through various finishing techniques. The market for environmentally benign materials, particularly trivalent chromium and zinc-nickel alloys, is expanding rapidly due to regulatory mandates. Moreover, the end-user segmentation reveals where the highest value resides, with aerospace and electronics requiring the most specialized and high-margin services due to zero-defect requirements and complex specifications, contrasting with the high-volume, cost-sensitive demands of the general manufacturing and construction sectors.

The intricate nature of metal finishing necessitates detailed segmentation analysis for strategic planning, highlighting that growth rates are highly differential across segments. While the construction segment provides stable, high-volume demand for basic protective coatings, the fastest growth is observed in niche segments like micro-plating for semiconductors and specialized coatings for advanced battery components. Therefore, market players are increasingly focusing on vertical specialization—offering highly optimized solutions for specific industry needs rather than generalized finishing services—to capture premium market share and navigate the high capital and regulatory barriers to entry.

- By Process Type:

- Electroplating (Nickel Plating, Zinc Plating, Chrome Plating, Copper Plating, Precious Metal Plating)

- Chemical and Electrochemical Finishing (Anodizing, Phosphating, Chromate Conversion)

- Thermal Spraying (Plasma Spray, Flame Spray, High-Velocity Oxy-Fuel (HVOF))

- Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD)

- Mechanical Finishing (Polishing, Buffing, Mass Finishing)

- By End-User Industry:

- Automotive and Transportation (Chassis, Powertrain, Decorative Trim, EV Components)

- Aerospace and Defense (Turbine Components, Landing Gear, Structural Parts)

- Electronics and Electrical (Connectors, Printed Circuit Boards (PCBs), Semiconductor Components)

- Heavy Machinery and Industrial (Hydraulic Cylinders, Bearings, Tools)

- Construction and Infrastructure

- Medical and Healthcare (Implants, Surgical Tools)

- Consumer Goods

- By Coating Material:

- Zinc and Zinc Alloys (Zinc-Nickel, Zinc-Cobalt)

- Nickel and Nickel Alloys (Electroless Nickel)

- Chromium (Trivalent and Hexavalent)

- Copper

- Precious Metals (Gold, Silver, Palladium)

- Anodized Coatings

- Specialty Polymers and Composites

Value Chain Analysis For Metal Finishing Market

The Metal Finishing Value Chain commences with the Upstream Analysis, which focuses on the sourcing and preparation of essential raw materials. This includes the highly specialized sourcing of commodity metals (e.g., zinc, nickel, copper), precious metals (gold, silver), and the manufacturing of proprietary chemical additives, electrolytes, and process cleaners. Supply chain volatility, particularly regarding precious metals and critical input chemicals like boric acid or specialized brighteners, significantly influences upstream costs and pricing stability within the market. Key suppliers in this stage are large chemical companies and specialized metal refiners, whose capacity and environmental compliance directly impact the entire finishing process downstream. Controlling the purity and availability of these inputs is critical, as even minor contaminants can severely compromise coating quality.

The Midstream component involves the core metal finishing services, encompassing the equipment manufacturing (tanks, rectifiers, robotics), the process operations, and quality assurance testing. This stage is dominated by captive finishing operations within large OEMs (especially automotive and aerospace) and specialized job shops that provide services to multiple smaller clients. The distribution channel for the necessary chemicals and equipment often utilizes a hybrid model: direct sales for large, customized automated lines, and indirect distribution through specialized chemical distributors for recurring consumables and maintenance supplies. Efficiency in the midstream is determined by the level of automation, energy efficiency of the rectifiers, and the optimization of chemical bath management to reduce waste generation and ensure consistent quality output.

Downstream analysis focuses on the end-user industries (automotive, electronics, aerospace) which serve as the final buyers of the finished components. Demand is fundamentally derived from the production schedules and specification requirements of these OEMs. Direct distribution occurs when large captive facilities finish components immediately before assembly. Indirect distribution involves job shops serving OEMs through Tier 1 and Tier 2 suppliers, where specialized finishing is outsourced. The downstream success is measured by the ability of the finished part to meet stringent functional specifications (e.g., salt spray resistance, hardness tests, electrical resistivity) and the speed of turnaround time, making logistics and quality certification crucial competitive differentiators in the final stage of the value chain.

Metal Finishing Market Potential Customers

The Metal Finishing Market's potential customers are diverse, characterized primarily as End-Users (Original Equipment Manufacturers or OEMs) and their immediate Tier 1 and Tier 2 suppliers who require functional or decorative surface enhancements on their metallic components. The largest segment of buyers is currently the Automotive sector, driven by the persistent demand for reliable anti-corrosion protection for vehicle frames, brake systems, and engine components, now heavily shifting towards specialized finishes for high-voltage battery enclosures and power electronics in electric vehicles. These customers prioritize finishes that offer lightweighting benefits alongside extreme durability, making technologies like zinc-nickel plating and specialized polymer coatings highly attractive.

Another high-value customer group consists of the Aerospace and Defense industries. Buyers in this sector, including airframe manufacturers and jet engine producers, require highly specialized processes such as hard chrome plating replacements, cadmium plating replacements (due to toxicity concerns), and thermal barrier coatings. These customers are exceptionally quality-sensitive, demanding adherence to rigorous Nadcap and military specifications, and their purchasing decisions are based on certified process reliability and performance longevity, rather than cost minimization. The high barriers to entry in serving this segment ensure that only highly certified and technologically advanced finishers are considered viable suppliers.

Furthermore, the Electronics and Semiconductor industries represent a rapidly growing customer base. These buyers require micro-level precision finishing, such as selective plating of gold, silver, and palladium on connectors, contacts, and printed circuit boards (PCBs) to ensure flawless electrical conductivity and signal integrity. The move towards miniaturization necessitates innovative finishing techniques capable of depositing uniform coatings in complex geometries at the nanoscale. These customers prioritize suppliers who offer high-purity processes, cleanroom environments, and exceptional control over deposition thickness, making them primary targets for suppliers of advanced PVD/CVD equipment and specialized chemical formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 98.5 Billion |

| Market Forecast in 2033 | USD 145.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atotech (MKS Instruments), Coventya (Element Solutions Inc.), Dupont, BASF, Chemetall (BASF), JCU Corporation, Enthone (Element Solutions Inc.), MacDermid (Element Solutions Inc.), Honeywell International Inc., Henkel AG & Co. KGaA, Nihon Parkerizing Co., Ltd., Materion Corporation, Precision Plating Co., Pioneer Metal Finishing, A Brite Company, OTEC Präzisionsfinish GmbH, PPG Industries, KC Jones Plating Company, Columbia Chemical, Asterion LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Finishing Market Key Technology Landscape

The Metal Finishing Market is undergoing rapid technological transformation, moving beyond traditional wet chemical processes towards highly sophisticated, digitized, and environmentally sustainable methods. A key area of innovation is in surface preparation and activation, where traditional acidic pickling is being supplemented or replaced by advanced plasma cleaning and electrolytic degreasing methods, ensuring superior surface cleanliness before coating deposition. In the core processing stage, significant technological effort is directed towards pulse plating and reverse pulse plating techniques, which allow for the control of crystal structure, density, and stress within the deposit, enabling the creation of specialized, high-performance alloys and functional nanocomposite coatings that possess enhanced wear resistance and reduced porosity compared to standard DC plating.

The adoption of Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) processes is accelerating, particularly for hard, ultra-thin coatings required in tool manufacturing, aerospace, and semiconductor fabrication. These dry finishing technologies offer exceptional material efficiency and generate significantly less hazardous waste compared to electroplating. Advances in PVD/CVD involve the development of multi-layer and gradient coatings, such as Titanium Nitride (TiN) or Diamond-Like Carbon (DLC), which provide unique combinations of hardness, low friction, and chemical inertness. Furthermore, advancements in thermal spraying, specifically High-Velocity Oxy-Fuel (HVOF) and cold spraying, are enabling the deposition of dense, low-porosity metallic and ceramic materials onto thermally sensitive substrates, vital for repair and life extension in high-value components like gas turbine blades.

Finally, the technological landscape is fundamentally shaped by Industry 4.0 integration. The deployment of advanced robotics for automated racking, transfer, and quality inspection is becoming standard practice, minimizing human handling errors and increasing throughput consistency. Critical to this transition is the use of Internet of Things (IoT) sensors for continuous, real-time monitoring of bath parameters (pH, temperature, conductivity, elemental analysis), coupled with advanced data analytics and closed-loop control systems. These technologies allow for dynamic process optimization and predictive maintenance, transitioning the industry from reactive troubleshooting to proactive process management, significantly enhancing resource efficiency and ensuring compliance with zero-defect quality mandates, particularly in high-reliability sectors.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, primarily driven by China, India, Japan, and South Korea, which collectively house the world’s major manufacturing hubs for automotive components, consumer electronics, and general machinery. China's enormous domestic consumption and its role as a global exporter necessitate massive metal finishing capabilities. The region exhibits a high volume of demand for both basic anti-corrosion finishes (zinc, galvanization) and high-end, specialized plating for advanced electronics and electric vehicle battery systems. Regulatory environments are tightening, particularly in leading economies, pushing local players to adopt more sustainable Western standards while maintaining competitive pricing advantages, driving dual investment in high-volume efficiency and technological compliance.

- North America: This region is characterized by high-value, specialized finishing services, dominated by the stringent requirements of the aerospace, defense, and medical device industries. North America leads in the adoption of sophisticated technologies, including advanced PVD/CVD, automated robotic finishing, and innovative chemical replacements for substances like hexavalent chromium and cadmium. Strict environmental regulations (EPA standards) and the focus on circular economy principles ensure that capital investment is directed towards waste minimization, resource recovery systems, and sustainable, closed-loop processing solutions. The growth is steady and quality-driven, focusing on niche, high-margin applications.

- Europe: The European market is highly regulated (e.g., REACH, RoHS directives), making environmental compliance the central driver of technological change. Europe is a frontrunner in developing and implementing sustainable and non-toxic finishing chemistries, specifically focusing on alternatives for chrome and nickel plating. Key drivers include the robust German automotive sector (premium vehicles and EVs) and the strong presence of industrial machinery manufacturers. The market emphasizes process optimization, energy efficiency, and the implementation of Industry 4.0 technologies to manage complex, multi-step finishing processes with guaranteed traceability and reduced environmental impact across the value chain.

- Latin America (LATAM): Growth in LATAM is closely tied to regional infrastructure development, localized automotive assembly plants (especially Brazil and Mexico), and the raw material extraction industries. The demand is predominantly for protective and anti-corrosion coatings suitable for harsh tropical or mining environments. While the market relies on established finishing techniques, there is increasing investment in modernization and automation, particularly in Mexico, due to its integration into North American supply chains and the need to meet international quality standards for exported goods.

- Middle East and Africa (MEA): The MEA market growth is stimulated by significant investments in the oil and gas infrastructure, construction projects, and nascent domestic manufacturing in countries like Saudi Arabia and the UAE. The primary requirement is for extremely durable, high-performance protective coatings that can withstand high temperatures, abrasive desert conditions, and constant exposure to corrosive petrochemicals. Specialized coatings like thermal sprays and thick epoxy/polymer finishes dominate demand for pipeline and structural protection, with steady expansion expected as industrial diversification efforts continue.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Finishing Market.- Atotech (MKS Instruments)

- Coventya (Element Solutions Inc.)

- Dupont

- BASF

- Chemetall (BASF)

- JCU Corporation

- Enthone (Element Solutions Inc.)

- MacDermid (Element Solutions Inc.)

- Honeywell International Inc.

- Henkel AG & Co. KGaA

- Nihon Parkerizing Co., Ltd.

- Materion Corporation

- Precision Plating Co.

- Pioneer Metal Finishing

- A Brite Company

- OTEC Präzisionsfinish GmbH

- PPG Industries

- KC Jones Plating Company

- Columbia Chemical

- Asterion LLC

Frequently Asked Questions

Analyze common user questions about the Metal Finishing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Metal Finishing Market?

The key drivers include the global transition to electric vehicles (requiring specialized battery and thermal management coatings), the miniaturization trend in the electronics sector demanding micro-precision plating, and stringent industry requirements for enhanced component durability and corrosion resistance across aerospace and industrial machinery sectors. Regulatory pressure enforcing the use of non-toxic substitutes also drives innovation and market transformation.

How are environmental regulations impacting metal finishing technologies?

Environmental regulations, particularly the phase-out of hexavalent chromium (Cr(VI)) and cadmium, are fundamentally transforming the industry by accelerating the adoption of sustainable alternatives such as trivalent chromium (Cr(III)), zinc-nickel alloys, and highly efficient dry processes like PVD and CVD. These mandates necessitate significant investment in sophisticated waste treatment facilities and closed-loop process systems to minimize effluent discharge and ensure compliance.

Which metal finishing process is currently experiencing the fastest technological advancement?

The most rapid advancements are occurring in Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), alongside advanced electroplating techniques such as pulse plating. PVD/CVD offers superior hardness, low friction, and exceptional material efficiency for high-performance applications (e.g., tools and aerospace), while pulse plating allows for precise control over coating microstructure in functional plating applications for electronics and specialized automotive components.

Which geographical region dominates the global Metal Finishing Market?

The Asia Pacific (APAC) region currently holds the dominant market share, driven by its expansive and rapidly growing manufacturing bases, particularly in China and India, for consumer electronics and automotive production. APAC leads in volume demand, although North America and Europe often lead in terms of technological adoption for high-value, specialized finishing services like aerospace and medical device coatings.

What is the role of automation and Industry 4.0 in modern metal finishing?

Automation and Industry 4.0 technologies (IoT, AI, and robotics) are essential for achieving high quality and efficiency. Robotics handle material transfer, ensuring consistency, while IoT sensors provide real-time monitoring of chemical baths. AI algorithms analyze this data to perform predictive quality control and dynamic parameter tuning, reducing variability, minimizing human error, and ensuring compliance with stringent regulatory and performance specifications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Caustic Scrubber for Hydrogen Sulfide Market Statistics 2025 Analysis By Application (Petrochemical, Pharmaceutical Industry, Water and Wastewater, Metal Finishing Processes, Pulp And Paper Industry), By Type (Vertical Scrubbers/ Counter-flow, Horizontal Scrubbers / Cross-flow), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metal Finishing Chemicals Market Statistics 2025 Analysis By Application (Electronics & Electricals, Aerospace, Motor Vehicle Equipment, Industrial Machinery), By Type (Cleaning Solutions, Conversion Coating, Plating Chemicals), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager