Metal Sign Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433320 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Metal Sign Market Size

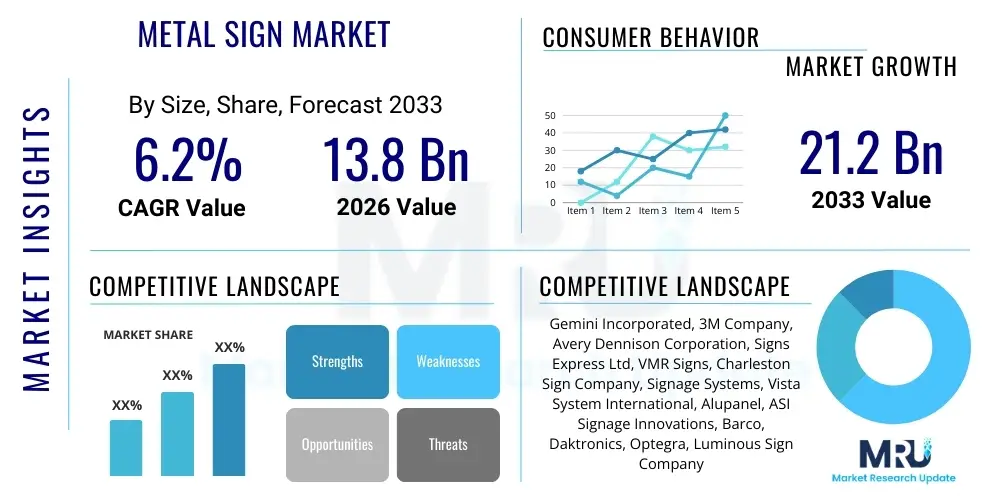

The Metal Sign Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 13.8 billion in 2026 and is projected to reach USD 21.2 billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by expanding commercial infrastructure globally, rising demand for durable and aesthetically pleasing architectural and advertising signage, and continuous technological advancements in metal fabrication and printing processes. The adoption of custom metal signs in interior design and corporate branding strategies further contributes significantly to market expansion over the forecast horizon, particularly in emerging economies undergoing rapid urbanization and commercial development.

Metal Sign Market introduction

The Metal Sign Market encompasses the manufacturing, distribution, and utilization of signage crafted predominantly from metals such as aluminum, stainless steel, brass, bronze, and galvanized steel. These signs serve diverse functionalities, ranging from crucial regulatory and informational purposes to sophisticated architectural and branding applications. Products include directional signs, safety warnings, corporate logos, decorative art pieces, and durable outdoor advertising displays. Major applications span commercial real estate, retail establishments, industrial facilities, public infrastructure (roads, transportation hubs), and the hospitality sector. The primary benefits of metal signs include exceptional durability, resistance to weathering and corrosion, high aesthetic value, and a long lifespan, which translates into lower replacement costs compared to other materials. Key driving factors propelling market growth include the global construction boom, increasing governmental regulation requiring standardized safety and informational signage, and the growing corporate focus on high-impact visual identity and store presence through premium, custom-fabricated metal displays.

Metal Sign Market Executive Summary

The global Metal Sign Market is currently characterized by intense competition driven by specialization in fabrication techniques and material innovation, coupled with shifting preferences towards sustainable and lightweight aluminum alloys. Business trends indicate a strong move towards customization and personalization, leveraging CNC machining, laser cutting, and advanced digital printing directly onto metal substrates to offer complex designs and high-resolution graphics. Regional trends highlight North America and Europe as mature markets demanding high-end architectural signage and utilizing automation in production, while the Asia Pacific region demonstrates the fastest growth due to rapid infrastructure development and high volume demand in manufacturing and retail sectors. Segment trends show that the aluminum segment maintains market dominance owing to its favorable cost-to-strength ratio and versatility, while application-wise, the commercial and institutional segment remains the largest consumer, driven by continuous refurbishment and expansion projects requiring external and internal identification and wayfinding systems.

AI Impact Analysis on Metal Sign Market

User queries regarding AI's influence in the Metal Sign Market often center on how automation technologies, leveraging artificial intelligence, can revolutionize design efficiency, optimize production workflows, and minimize material waste. Key themes include the feasibility of AI-driven generative design for complex sign structures, the application of predictive maintenance algorithms for fabrication equipment (CNC machines, large-format printers), and the potential for AI-powered quality control systems to ensure flawless finishes and adherence to precise specifications. Users are highly concerned with how AI can bridge the gap between initial design concepts and final fabricated products, reducing iteration cycles and lowering customization costs, thereby making high-end metal signage more accessible to small and medium-sized enterprises (SMEs).

The implementation of AI algorithms is poised to significantly optimize the pre-press and fabrication phases of metal sign production. For instance, sophisticated AI tools can analyze input data (brand guidelines, location specifications, mounting constraints) to instantly generate multiple optimized design variations that comply with local regulatory standards for size, visibility, and material usage, drastically cutting down on human design time. Furthermore, in the operational sphere, machine learning is essential for enhancing material yield. AI systems can manage nesting algorithms for large metal sheets, ensuring minimal scrap material during the laser cutting or routing process, directly improving profitability and sustainability metrics for sign manufacturers globally. This shift towards smart manufacturing integrates design optimization with resource management.

Beyond design and material efficiency, AI contributes to enhanced operational predictability and quality assurance within the sign industry. Predictive maintenance programs utilize sensor data from production machinery to forecast potential failures or required service interventions, preventing costly downtime associated with high-precision equipment like advanced metal printers and welding robots. Moreover, AI-powered vision systems are deployed on assembly lines to conduct real-time quality inspections, checking for imperfections in coatings, alignment errors in mounted letters, or inconsistencies in color matching, ensuring every sign meets stringent quality benchmarks before shipment. This robust integration of intelligent systems fundamentally shifts the industry towards higher throughput and superior product quality while managing complex customized orders efficiently.

- AI-driven generative design accelerates complex sign conceptualization and engineering feasibility assessment.

- Machine learning optimizes material nesting, significantly reducing scrap waste (improved yield management).

- Predictive maintenance systems minimize equipment downtime for CNC routers, laser cutters, and finishing machinery.

- Automated visual inspection using AI enhances quality control, detecting minute fabrication or coating defects.

- AI tools facilitate automated compliance checks against local zoning and safety signage regulations.

- Intelligent inventory management systems forecast demand for specialized metal alloys and coatings.

DRO & Impact Forces Of Metal Sign Market

The Metal Sign Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. A major driver is the accelerating global infrastructure and commercial construction activity, which inherently requires vast volumes of mandatory and promotional signage for new facilities, campuses, and retail locations. Additionally, the premiumization of branding, where businesses increasingly utilize high-quality, durable metal signs to project an image of longevity and quality, provides sustained market impetus. Technological advancements in fabrication, such as fiber laser cutting and UV printing directly on metal, also act as a driver, making complex, customized, and durable signs more cost-effective to produce, thus expanding the accessible market segment.

However, the market faces significant restraints. Fluctuations in raw material prices, particularly steel and aluminum, due to global supply chain instability or geopolitical events, directly impact manufacturing costs and pricing structures, occasionally deterring large project commitments. Furthermore, intense competition from alternative, lower-cost materials, such as durable plastics (e.g., acrylics and polycarbonates) and vinyl graphics, especially in temporary or budget-sensitive applications, constrains market growth for metal signs in certain sectors. The environmental impact of metal production and the energy required for fabrication processes also present a restraint, pressuring manufacturers to adopt more sustainable, circular economy practices, including increased reliance on recycled content.

Opportunities for growth are abundant, primarily focused on the integration of digital features and smart signage (e.g., incorporating LEDs, sensors, or AR codes into metal frames), transforming static signs into interactive communication platforms, especially relevant for smart city initiatives and modern retail environments. The burgeoning demand for sophisticated architectural signage in specialized segments like high-end residential developments, luxury retail, and monumental institutional buildings offers higher-margin opportunities for custom fabricators. The dominant impact forces shaping this market include stringent government regulations concerning safety and directional signage standards, forcing continuous updates and replacements, and the escalating importance of corporate visual identity, demanding visually striking and long-lasting external markers that only metal can adequately provide, thus securing the material's premium position in the visual communications ecosystem.

Segmentation Analysis

The Metal Sign Market is intricately segmented across various dimensions, including the type of material used, the method of fabrication, the specific application or end-use sector, and the product type (e.g., standard vs. custom signs). Understanding these segments is crucial for manufacturers to tailor their production capacities and market strategies effectively. Material segmentation, which includes aluminum, steel, and specialty metals like brass or bronze, reflects differences in cost, durability, and aesthetic finish, catering to different budgetary and design requirements. Application segmentation differentiates between highly regulated environments like industrial safety signage and visually driven markets like retail branding. The proliferation of digital fabrication techniques, such as CNC routing and precision laser etching, has also led to segmentation based on manufacturing capability, allowing specialized players to focus exclusively on highly complex, three-dimensional signage solutions.

- By Material:

- Aluminum

- Stainless Steel

- Brass and Bronze

- Galvanized Steel

- Other Specialty Metals

- By Fabrication Process:

- Engraving and Etching

- Laser Cutting and CNC Machining

- Casting

- Digital Printing on Metal

- Welding and Fabrication

- By Application:

- Commercial and Retail (Storefronts, Interior Decor)

- Industrial and Manufacturing (Safety, Regulatory)

- Institutional and Government (Wayfinding, Plaques)

- Transportation and Infrastructure (Road Signs, Airport)

- Residential and Decorative

- By Product Type:

- Plaques and Nameplates

- Dimensional Lettering and Logos

- Traffic and Safety Signs

- Custom Architectural Signage

Value Chain Analysis For Metal Sign Market

The Metal Sign Market value chain commences with upstream activities, primarily involving the procurement of raw metal materials, including sheets, rods, and coils of aluminum, steel, and specialized alloys, sourced from major metal refineries and specialized distributors. This stage also includes the sourcing of protective coatings, primers, and high-performance paints necessary for durability and aesthetic finish. Midstream activities involve the core manufacturing processes: initial design conceptualization (increasingly software-driven), precision cutting (laser or plasma), forming, welding, finishing (polishing, brushing), and the application of graphics through techniques like digital UV printing or silk screening. Quality control checks are rigorously performed throughout the fabrication stage to ensure dimensional accuracy and finish quality. The efficiency of this midstream stage is highly dependent on capital investment in advanced machinery and skilled labor capable of managing complex custom projects.

Downstream activities focus on distribution, logistics, and installation, representing the final link to the end customer. Distribution channels are varied, involving direct sales teams for large corporate or architectural projects, specialized sign distributors who handle regional fulfillment, and online platforms for standard and semi-custom orders (e-commerce channels are growing rapidly). Indirect channels often involve partnerships with general contractors, architects, and interior designers who specify the signage requirements for their projects, making them crucial influencers in the purchasing decision. Installation is a specialized service, often performed by certified sign installation companies, which requires adherence to safety standards and local building codes, especially for large, externally mounted signs. The profitability in the downstream sector is highly dependent on efficient logistics management and quality installation services that minimize post-delivery issues.

The movement through the value chain highlights critical areas for differentiation. Upstream efficiency is vital for managing input cost volatility, while midstream technological adoption determines the complexity and customization level a fabricator can handle. Downstream performance, particularly the reliability of installation and service, significantly influences customer satisfaction and repeat business. The shift towards Direct-to-Consumer (D2C) models, facilitated by advanced 3D visualization tools and online configuration interfaces, is shortening the traditional distribution chain for small to medium businesses, placing pressure on conventional sign distributors to enhance their value-added services, such as comprehensive site surveying and integrated maintenance contracts.

Metal Sign Market Potential Customers

The potential customer base for the Metal Sign Market is exceptionally diverse, spanning nearly every sector that requires physical identification, regulatory compliance, or architectural enhancement. The primary end-users fall into three broad categories: commercial entities, institutional bodies, and industrial operations. Commercial customers, including major retail chains, small businesses, restaurants, hotels, and real estate developers, utilize metal signs extensively for exterior branding, wayfinding within complex structures, and upscale interior decor to project a high-quality brand image. These customers prioritize visual impact, brand consistency, and durability against urban weathering conditions. The hospitality sector, in particular, drives demand for high-grade finishes like polished brass and bronze plaques to convey luxury and permanence.

Institutional and governmental bodies, encompassing schools, universities, hospitals, municipalities, and public transit authorities, represent a steady demand segment focused primarily on compliance, safety, and efficient public navigation. Requirements in this segment are often regulated, mandating specific reflective materials, standardized color codes, and durability requirements for traffic, safety, and ADA (Americans with Disabilities Act) compliant signage. The purchase cycles in this sector are often tied to public works budgets or institutional refurbishment schedules. Industrial and manufacturing facilities are crucial buyers of metal safety signs, machine identification plates, directional flow charts, and warning signs, prioritizing longevity, chemical resistance, and immediate visual clarity in hazardous environments. These signs must often withstand harsh conditions, including extreme temperatures and corrosive substances.

A rapidly emerging segment includes architectural and interior design firms purchasing custom metal signage and decorative panels for high-end residential projects and corporate headquarters. These buyers prioritize aesthetic uniqueness, requiring bespoke fabrication, specialized finishes (e.g., anodization, patina), and integration with sophisticated lighting systems (backlit or halo-lit metal letters). Serving this segment requires high-precision manufacturing capabilities and strong collaborative relationships with design professionals. Therefore, the market caters to customers demanding volume efficiency (industrial safety signs) simultaneously with those requiring artisan quality and bespoke, one-off architectural pieces (luxury branding).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.8 Billion |

| Market Forecast in 2033 | USD 21.2 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gemini Incorporated, 3M Company, Avery Dennison Corporation, Signs Express Ltd, VMR Signs, Charleston Sign Company, Signage Systems, Vista System International, Alupanel, ASI Signage Innovations, Barco, Daktronics, Optegra, Luminous Sign Company, Metal Sign Company, PFI Displays, Sign A Rama, Howard Industries, Heathcoat Signs, National Sign Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Sign Market Key Technology Landscape

The technological landscape of the Metal Sign Market is rapidly evolving, driven by the necessity for greater precision, faster turnaround times, and increased complexity in custom design execution. Core fabrication technologies include Computer Numerical Control (CNC) machining and high-powered laser cutting, predominantly utilizing fiber lasers, which offer unparalleled speed and accuracy for shaping complex geometries and small, intricate lettering from various metal thicknesses. These technologies minimize human error and material waste, significantly improving the cost efficiency of customized jobs. Furthermore, the integration of specialized software, including CAD/CAM systems and 3D rendering platforms, allows fabricators to seamlessly translate architectural specifications into machine code, ensuring dimensional consistency across large, multi-piece projects and reducing the time required for design revisions and client approvals.

Finishing and graphic application technologies are equally crucial. Direct-to-substrate digital printing, utilizing UV-curable inks, allows for high-resolution, full-color images and graphics to be applied directly onto treated metal surfaces, offering durability superior to traditional vinyl overlays and enabling photographic quality finishes on metal signs. Surface treatment technologies, such as anodization, powder coating, and specialized patination processes, are essential for enhancing corrosion resistance, UV stability, and achieving unique aesthetic effects (e.g., matte, gloss, textured). These advanced coating techniques ensure that the longevity and visual integrity of the metal sign are maintained even in challenging outdoor environments, thus supporting the premium positioning of metal signage.

A significant trend involves the incorporation of smart technologies into the physical metal sign structure. This includes the integration of low-voltage LED lighting (halo-lit, back-lit) for enhanced visibility and energy efficiency, transforming traditional static signs into dynamic visual elements, especially for nighttime branding. Additionally, some manufacturers are experimenting with embedded sensors or Near Field Communication (NFC) tags within the sign structure, allowing for interaction with smartphones or enabling features such as remote monitoring of lighting systems or facilitating access to digital information. The continuous advancement in material science, particularly the development of lighter, stronger, and more sustainably produced metal alloys, also represents a critical technological frontier aimed at reducing the environmental footprint and installation complexity of large metal signage installations.

Regional Highlights

- North America: Market Maturity and High Customization Demand

North America, encompassing the United States and Canada, represents a mature yet highly valuable market segment for metal signs, characterized by stringent regulatory requirements (especially for traffic and safety signage) and significant demand from the commercial real estate and corporate branding sectors. The region’s economic stability and high concentration of large multinational corporations drive consistent demand for high-quality, architecturally significant custom signage. Manufacturers in North America often lead in adopting advanced fabrication technologies, such as automated laser welding and sophisticated CNC machinery, focusing heavily on reducing lead times for complex, three-dimensional metal letters and corporate logos. The market is also heavily influenced by trends in sustainability, with increasing preferences for recycled aluminum alloys and low-VOC coating applications, particularly among environmentally conscious large urban developers. The dominance of the retail refurbishment cycle and the construction of massive distribution and logistics hubs continue to anchor the region's steady consumption of durable metal identification and directional systems.

The regulatory landscape, particularly adherence to ADA standards for tactile and Braille signage, is a major spending driver, requiring specialized metal plaques and nameplates in all new and renovated public access buildings. The competition in this region is high, necessitating specialized offerings, often involving integrated digital components (e.g., illuminated metal signs with smart features) and comprehensive installation and maintenance packages to secure contracts. While market growth might not match emerging regions in sheer volume percentage, the average contract value and demand for premium materials (stainless steel and bronze) ensure robust revenue generation. Furthermore, the extensive network of highways and public infrastructure ensures continuous, high-volume demand for standard reflective aluminum road signs managed through governmental procurement cycles. This steady demand, coupled with the high disposable income of businesses allowing investment in superior aesthetic finishes, maintains North America’s leading position in terms of overall market value and technological adoption within the metal signage ecosystem.

Key focus areas for North American sign manufacturers include mastering complex finishes, ensuring regulatory compliance across multiple jurisdictions, and investing in advanced logistics to efficiently manage large-scale rollouts for national chain customers. The demand for weatherproof and vandal-resistant signage is also paramount, pushing innovation in coating and mounting hardware solutions. The market benefits from a strong base of specialized architectural firms who frequently specify unique metal signage solutions, further fueling the need for bespoke, high-tolerance fabrication capabilities. The regional consumption pattern emphasizes durability and prestige, making metal the material of choice over less resilient substitutes in high-visibility corporate and public spaces. The increasing focus on experiential retail also incorporates metal signs into store environments to convey permanence and craftsmanship.

- Europe: Focus on Heritage Preservation and High-Quality Design

The European Metal Sign Market is characterized by a strong emphasis on architectural integrity, historical preservation, and exceptionally high design standards, particularly in Western European nations like Germany, the UK, and France. Demand is driven by the necessity for signage that harmonizes with historic cityscapes, often requiring traditional fabrication techniques (e.g., etching, casting in bronze or brass) alongside modern precision capabilities. Environmental regulations are among the strictest globally, forcing manufacturers to prioritize energy-efficient production processes and the use of sustainable, recyclable materials, giving aluminum a distinct advantage over heavier or less recyclable metals. The continent’s robust manufacturing base provides a strong foundation for high-precision, customized metal sign fabrication, catering to both local small businesses and pan-European corporate branding initiatives.

The market faces challenges related to fragmentation across different national building codes and language requirements, necessitating highly localized production and installation expertise. However, the consistent investment in infrastructure projects, coupled with the luxury retail and automotive sectors' requirement for premium, high-impact branding solutions, ensures stable growth. The rise of sophisticated wayfinding systems in major urban centers, airports, and train stations also contributes significantly to the consumption of durable stainless steel and finished aluminum panels. European consumers typically view signage as a critical component of the overall architectural concept, leading to higher spending on bespoke design and artisanal finishing processes, contrasting with the often more standardized, volume-driven demand seen in certain segments of the North American market. This preference for quality over sheer volume defines the regional market dynamics.

Furthermore, the European Union's focus on occupational safety and the standardization of regulatory symbols ensures a continuous replacement and upgrade cycle for industrial and workplace safety signage, predominantly fabricated from highly visible, coated metals. The integration of LED technology within metal frames is exceptionally high in Europe, driven by stringent energy efficiency targets and the desire for sophisticated visual displays in retail and entertainment districts. Key opportunities exist in exporting specialized fabrication expertise, particularly related to weathering steels (e.g., Corten) and bespoke metal treatments for high-end architectural applications. The market remains sensitive to aesthetic trends, quickly incorporating new metallic colors, textures, and finish options derived from advanced chemical and physical vapor deposition (PVD) coating processes, ensuring the metal sign retains its position as a high-value communication medium.

- Asia Pacific (APAC): Rapid Infrastructure and Volume Demand

The Asia Pacific region, led by China, India, and Southeast Asian nations, is the fastest-growing market for metal signs globally, primarily propelled by unprecedented rates of urbanization, monumental infrastructure development (roads, railways, smart cities), and explosive growth in the commercial and industrial sectors. This market is characterized by high-volume demand for both standardized industrial safety signage and architectural elements for the continuous construction of new commercial centers, residential high-rises, and corporate campuses. China, in particular, dominates both consumption and production, benefiting from scalable manufacturing capabilities and highly competitive pricing, making it a critical hub in the global supply chain for raw metal sign components and finished products.

While price sensitivity is generally higher in the mass-market segments of APAC compared to North America or Europe, the premium segment, particularly in economic hubs like Singapore, Tokyo, and Seoul, demands world-class quality and innovative design, comparable to Western standards. The sheer scale of infrastructural projects means that governments are massive end-users of metal road signage, directional markers, and regulatory plaques, favoring galvanized steel and robust aluminum alloys for longevity in varying climates, which range from tropical humidity to temperate zones. Market growth is closely tied to the governmental rollout of national identity projects and the expansion of transnational corporate entities establishing a large physical footprint across the region, requiring extensive corporate branding signage rollouts.

Challenges in APAC include managing regulatory diversity across numerous nations and ensuring consistent quality output among a highly fragmented network of local sign fabricators. However, this fragmentation also presents opportunities for international players bringing advanced automation, quality control systems, and specialized material expertise to regional manufacturers. The increasing focus on tourism infrastructure and mega-events (e.g., sporting events, world expos) generates sharp spikes in demand for temporary yet durable metal directional and informational signage. The shift toward higher value, backlit, and dimensional metal signs is evident in tier-one cities, reflecting rising consumer affluence and corporate willingness to invest in superior visual identity elements. This region is fundamentally driving global volume and is quickly closing the gap in technological adoption concerning advanced digital printing and fabrication techniques.

- Latin America (LATAM): Urbanization and Economic Stabilization Driving Necessity

The Latin American Metal Sign Market shows high potential, driven by ongoing urbanization trends and attempts at economic stabilization, leading to increased investment in commercial construction, retail infrastructure, and public works projects, particularly in Brazil, Mexico, and Argentina. The market demand is highly polarized, with a significant need for basic, cost-effective regulatory and safety metal signage in industrial and public sectors, coexisting with an emerging, sophisticated demand for high-end metal architectural signage in rapidly developing metropolitan areas like São Paulo and Mexico City. Aluminum is the preferred material due to its balance of cost, corrosion resistance, and relative ease of handling, crucial in diverse climatic conditions.

Restraints in this region include economic volatility, which can lead to project delays or budget cuts, and high import tariffs on specialized fabrication machinery or high-grade imported metal alloys. However, the necessity to meet international standards for industrial safety and highway regulatory signage provides a constant floor of demand. Opportunities are particularly strong in the retail sector, as international brands expand their presence and require consistent, durable branding elements, favoring illuminated metal channel letters and robust exterior plaques. Local manufacturers are increasingly adopting modern technologies like CNC routers and entry-level laser cutters to compete on precision and speed, moving away from older, less efficient manual fabrication methods. The regional market is fundamentally transitioning from a largely fragmented service industry to a more standardized and technology-driven manufacturing sector, albeit unevenly across national markets.

Focus is placed on signs that offer maximum resilience against exposure to sun and intense weather conditions, requiring specialized UV-resistant coatings and high-quality mounting hardware. Public transportation system upgrades, including new metro lines and bus terminals, represent significant, multi-year contracts for durable, vandal-resistant metal wayfinding signs. Overcoming logistical challenges and providing robust, localized installation and maintenance support are key competitive differentiators. The growing awareness of international safety protocols in the construction and mining industries also generates sustainable demand for high-visibility metal warning and informational plates, establishing a baseline necessity that is resilient even during economic downturns, positioning the market for steady, albeit often cyclical, growth.

- Middle East and Africa (MEA): Megaprojects and Luxury Branding Demand

The Middle East and Africa region presents a dual market structure. The GCC countries (Saudi Arabia, UAE, Qatar) are characterized by massive governmental investment in megaprojects (e.g., NEOM, EXPO 2020 sites), luxury retail, and world-class tourism infrastructure, driving demand for the most sophisticated, high-end, and large-scale metal signage solutions, often involving complex illumination and integration with smart building management systems. Fabricators serving this segment emphasize premium materials (stainless steel, specialized finishes), architectural design, and integrated lighting. These projects often involve international design specifications and demand extremely high fabrication tolerances and fast execution timelines, requiring state-of-the-art facilities.

In contrast, the African sub-continent, while displaying high underlying growth potential due to rapid urbanization, focuses primarily on essential functional signage for new commercial developments, infrastructure repair, and industrial sites. Affordability and durability are key considerations, often leading to preference for standard aluminum and galvanized steel products. However, the expansion of multinational businesses into major African cities is gradually increasing the demand for branded metal signage that aligns with global corporate standards. The primary challenge in the African markets remains securing reliable material supply chains and managing complex logistics for distribution across large geographic areas.

The Middle East segment is a key driver for technological adoption in large-format metal fabrication and complex façade integration, where metal signs are seamlessly incorporated into building cladding and architectural elements. Demand is sustained by the highly competitive retail environment, where visual identity is paramount to attracting high-net-worth customers, ensuring continued high expenditure on imposing, custom-fabricated metal logos and store identifiers. The requirement for bilingual or multilingual signage is also a unique regional factor. Overall, the MEA region is a critical market for custom, high-margin architectural sign suppliers, leveraging its capital spending power and continuous drive to construct globally recognized landmarks that necessitate high-quality, durable metal communication systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Sign Market.- Gemini Incorporated

- 3M Company (Focus on reflective materials and sign sheeting)

- Avery Dennison Corporation

- Signs Express Ltd

- VMR Signs

- Charleston Sign Company

- Signage Systems

- Vista System International

- Alupanel (Material Supplier)

- ASI Signage Innovations

- Barco (Related to digital integration)

- Daktronics (Integrated displays)

- Optegra

- Luminous Sign Company

- Metal Sign Company

- PFI Displays

- Sign A Rama

- Howard Industries

- Heathcoat Signs

- National Sign Systems

- Metal Arts Sign Company

- APCO Graphics Inc.

- Elite Signs

Frequently Asked Questions

Analyze common user questions about the Metal Sign market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of choosing metal signs over acrylic or vinyl alternatives?

Metal signs offer superior durability, resistance to extreme weather and UV radiation, and a longer operational lifespan, minimizing replacement costs. Furthermore, metal conveys a higher perceived value and permanence, making it the preferred choice for premium corporate branding and critical architectural installations that require maximum aesthetic impact and structural robustness. Metals like aluminum and stainless steel are also highly recyclable, supporting corporate sustainability goals.

Which metal alloy dominates the market, and why is it preferred by manufacturers?

Aluminum dominates the Metal Sign Market due to its unique combination of characteristics: light weight, excellent corrosion resistance (especially when treated or anodized), versatility in fabrication (easy to cut, form, and print on), and a favorable cost-to-strength ratio. Its light weight also simplifies installation and reduces structural load requirements compared to steel, making it ideal for large exterior signage applications.

How is technological advancement impacting the customization and cost of metal sign production?

Advanced technologies such as fiber laser cutting, CNC machining, and direct-to-metal UV printing have dramatically improved precision and efficiency. These processes reduce material waste and turnaround times, making complex, highly customized metal sign designs more affordable and scalable for medium-sized projects that previously relied on high-cost, specialized manual labor, democratizing access to premium finishes.

What are the main drivers of demand for metal safety and regulatory signage globally?

The primary driver is increasingly stringent governmental and industrial safety regulations (OSHA, international standards) mandating highly visible, durable, and chemically resistant signage in industrial, construction, and public access environments. Continuous infrastructure development, especially in emerging economies, further accelerates the required volume of standard metal traffic and informational signs, driving consistent baseline demand.

What role does sustainability play in the purchasing decisions within the Metal Sign Market?

Sustainability is an increasingly critical factor, particularly for large corporations and public sector procurement. Buyers prioritize signs made from high percentages of recycled aluminum and stainless steel. Furthermore, manufacturing processes that utilize eco-friendly coatings (e.g., powder coating instead of solvent-based paints) and adopt energy-efficient LED illumination are favored, reflecting a growing industry commitment to circular economy principles and environmental responsibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager