Metal Target Material Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431851 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Metal Target Material Sales Market Size

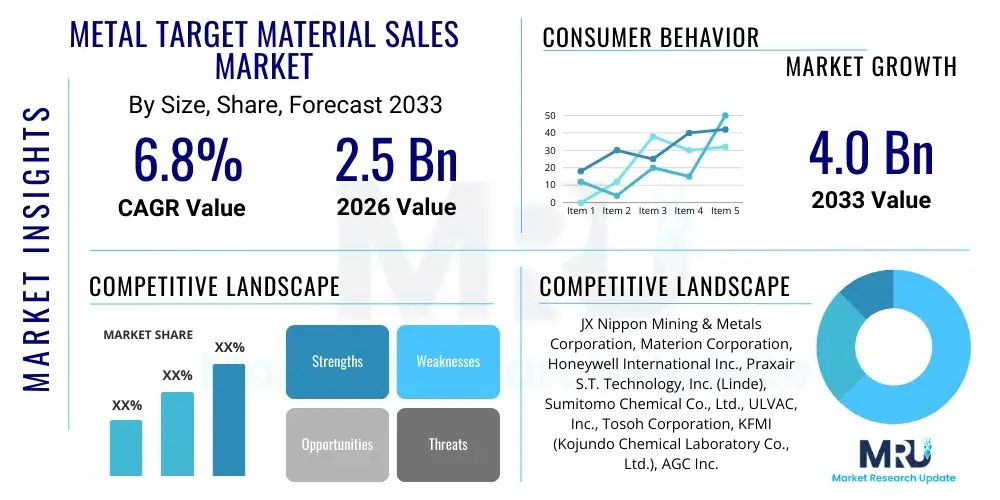

The Metal Target Material Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Metal Target Material Sales Market introduction

The Metal Target Material Sales Market encompasses the manufacturing, distribution, and consumption of high-purity metal and alloy targets utilized primarily in physical vapor deposition (PVD) processes, particularly magnetron sputtering. These targets serve as the source material, which, when bombarded with ions, ejects atoms that deposit onto a substrate, forming thin films essential for advanced electronic and optical devices. The materials range from elemental metals such as Aluminum, Copper, Titanium, and Tantalum to complex alloys and intermetallic compounds, often requiring purity levels exceeding 99.999% (5N) to ensure optimal film quality and device performance. The stringent requirements for purity and homogeneity are critical, particularly in semiconductor and flat panel display (FPD) manufacturing, where even minor contaminants can lead to device defects and reduced yield.

Key product descriptions within this market include planar targets, rotary targets, and specialized targets designed for specific PVD equipment geometry and application requirements. Rotary targets are gaining prominence due to their superior material utilization efficiency and stable deposition rates, making them cost-effective for large-area coating applications like solar panels and large FPDs. Major applications span across integrated circuit (IC) fabrication for interconnect layers and diffusion barriers, advanced display technologies (OLED, Micro-LED), photovoltaic cells for transparent conductive layers, and architectural glass coatings for energy efficiency. The precise control over thin film properties, including electrical conductivity, optical transparency, and mechanical hardness, is directly reliant on the quality and composition of the metal target material supplied.

Market growth is predominantly driven by the continuous expansion of the global semiconductor industry, particularly the demand for smaller feature sizes and three-dimensional (3D) chip structures requiring increasingly sophisticated PVD techniques. Furthermore, the rapid adoption of large-screen high-resolution OLED and QLED displays, coupled with significant investments in renewable energy infrastructure, specifically thin-film solar technologies, substantially bolsters the demand for high-performance metal targets. Benefits derived from these materials include enhanced device reliability, improved power efficiency, and the ability to create complex multi-layered structures, positioning metal targets as indispensable consumables in the high-technology manufacturing sector.

Metal Target Material Sales Market Executive Summary

The Metal Target Material Sales Market is experiencing robust expansion fueled by relentless technological advancements in downstream industries, particularly in Asia Pacific (APAC), which remains the epicenter for high-volume electronics manufacturing. Business trends indicate a strong move towards specialization, with leading manufacturers focusing on ultra-high purity materials (6N and 7N) and novel alloy targets, particularly those containing rare earth elements or platinum group metals, to address emerging requirements in advanced memory chips (DRAM, NAND) and high-speed logic circuits. A significant operational trend involves manufacturers integrating vertically to secure reliable sources of refined raw materials and employing advanced manufacturing techniques such as hot isostatic pressing (HIP) and vacuum arc melting to produce defect-free, high-density targets, thereby mitigating supply chain risks associated with fluctuating commodity prices and geopolitical tensions.

Regional trends highlight APAC’s dominant market share, driven primarily by China, South Korea, and Taiwan, which host the world’s largest semiconductor foundries and FPD fabrication plants. While APAC leads in consumption, North America and Europe maintain critical roles in materials research, high-end PVD equipment innovation, and the production of highly specialized targets for aerospace and defense applications. The competitive landscape is intensely focused on intellectual property, as target bonding and material composition patents grant significant advantages in deposition uniformity and target lifespan. Furthermore, environmental regulations are subtly impacting the market, pushing for better material utilization and recycling programs to reduce waste associated with expensive target materials, influencing procurement strategies among large end-users.

Segmentation trends reveal that the Semiconductor application segment commands the highest value share due to the extremely high purity requirements and the cyclical but consistently upward trajectory of chip fabrication investment. Within materials, refractory metals like Tantalum and Tungsten targets are witnessing high growth due to their essential role as diffusion barriers and interconnects in advanced logic and memory chips. The market is also observing segmentation shifts towards rotary targets over planar targets, especially in large-area coating segments like solar and architectural glass, optimizing production throughput and reducing material wastage. Success in this market is increasingly dependent on the ability of target manufacturers to collaborate closely with PVD equipment providers and end-user process engineers to develop customized solutions that meet specific deposition specifications and high throughput demands, establishing long-term partnership models over purely transactional sales.

AI Impact Analysis on Metal Target Material Sales Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Metal Target Material Sales Market frequently center on how machine learning algorithms can optimize complex sputtering processes, enhance material quality control, and predict market demand volatility. Users are particularly keen on understanding AI’s role in accelerating the discovery and synthesis of new high-performance alloy targets and in automating highly specialized material characterization tests that currently require significant human expertise and time. The key thematic summary suggests that users expect AI to transition the market from reactive quality control to proactive process optimization, minimizing expensive material waste and significantly boosting the efficiency and stability of thin-film deposition, directly impacting the target material consumption rate and specification requirements.

The integration of AI and machine learning (ML) models is revolutionizing the upstream target manufacturing process. Specifically, ML algorithms are now being applied to analyze vast datasets generated during the complex refining and hot isostatic pressing (HIP) stages of target production. This analysis allows manufacturers to precisely control parameters such as vacuum pressure, temperature gradients, and cooling rates, leading to targets with superior microstructure, reduced porosity, and enhanced density. Improved density directly translates to reduced arcing during sputtering and longer target life, offering significant cost savings to end-users. AI-driven quality inspection systems, utilizing computer vision and non-destructive testing data, can automatically detect microscopic defects or impurities in pre-bonded targets that would be invisible or highly labor-intensive for human operators to find, thereby guaranteeing ultra-high purity standards necessary for 7nm and 5nm semiconductor fabrication nodes.

Downstream, in the actual PVD process, AI systems are creating advanced predictive maintenance and real-time process control solutions. ML models analyze hundreds of sensor inputs (plasma stability, power flux, substrate temperature, gas flow rates) to dynamically adjust sputtering parameters, ensuring highly uniform film thickness and composition across large substrates, which is particularly challenging in OLED and large-area solar production. Furthermore, generative AI is accelerating materials informatics, where computational models simulate the performance of novel alloy combinations as sputtering targets before expensive physical trials are initiated. This capability drastically reduces the time-to-market for specialized targets required for next-generation devices, such as high-entropy alloy targets for extreme-condition industrial coatings or novel TCO (Transparent Conductive Oxide) precursors derived from complex metal alloys.

- AI-enhanced Process Control: Optimization of PVD parameters (power, gas pressure) in real-time to maximize material utilization and deposition rate stability.

- Predictive Quality Assurance: Utilization of ML for automated, non-destructive inspection of target microstructure and purity levels (e.g., detecting micro-voids in Tantalum targets).

- Accelerated Material Discovery: AI models simulate and predict the optimal composition and synthesis routes for complex alloy targets, reducing R&D cycles.

- Supply Chain Resilience: AI algorithms forecast demand volatility and optimize inventory management for high-purity rare and precious metals used in target manufacturing (e.g., Ruthenium, Indium).

- Equipment Lifetime Extension: Predictive maintenance enabled by AI monitors sputtering equipment health and recommends optimal target rotation and replacement schedules.

DRO & Impact Forces Of Metal Target Material Sales Market

The market dynamics for Metal Target Materials are fundamentally shaped by the interplay between rapid technological demands from the electronics sector and inherent challenges in maintaining ultra-high purity supply chains. Key drivers include the exponential growth in data generation and processing, necessitating smaller, more powerful semiconductor chips, which consequently mandates higher precision sputtering processes and specialized target materials. Furthermore, the global transition towards renewable energy and advanced display technologies provides persistent structural demand. However, these driving forces are counterbalanced by significant restraints, primarily the capital-intensive nature of target manufacturing, the high cost and volatility of raw material sourcing (especially rare and precious metals), and the extreme technical barrier to achieving the requisite 5N to 7N purity levels. Opportunities abound in emerging fields such as 5G component fabrication, advanced flexible electronics, and sophisticated anti-reflection coatings for optical devices, pushing target manufacturers towards innovation in high-density and composite materials.

Drivers: The miniaturization trend in semiconductor fabrication—moving to sub-10nm nodes—requires novel target materials (e.g., Ruthenium, Cobalt) for stable interconnects and barrier layers, significantly increasing the value per unit of target material sold. The aggressive expansion of global display manufacturing capacity, particularly in OLED and Micro-LED technologies in APAC, fuels massive consumption of Indium-Tin Oxide (ITO) targets and specialized metallic targets (e.g., Molybdenum, Aluminum). Additionally, the robust governmental and private sector investment in thin-film photovoltaics (e.g., CIGS solar cells), which rely heavily on specialized sputtering targets for multiple functional layers, acts as a long-term, stable demand driver, diversifying the market exposure away solely from consumer electronics cycles. The ongoing need for high-performance coatings in industrial wear parts, medical devices, and aerospace components also provides a consistent, high-value niche market requiring specialized target solutions.

Restraints: The primary restraint remains the highly specialized and expensive process required to produce high-density, ultra-high-purity targets, which involves expensive vacuum equipment, specialized bonding techniques, and complex quality assurance protocols. Fluctuations in the global supply and pricing of key input materials, often classified as critical minerals (e.g., Tantalum, Germanium, Indium), create operational volatility and increase production costs. Moreover, the long qualification cycles imposed by large semiconductor fabs and FPD manufacturers—where new materials often require years of testing before mass production adoption—act as a significant barrier to entry for smaller manufacturers and slow down the pace of material innovation deployment. The necessity for high capital expenditure (CapEx) to expand manufacturing capacity further restricts market participation and consolidation.

Opportunities & Impact Forces: Significant opportunities reside in the development of targets optimized for High Power Impulse Magnetron Sputtering (HiPIMS), offering denser and smoother films, critical for next-generation coatings. The rise of flexible electronics, driven by foldable phones and wearable tech, requires specialized flexible targets and low-temperature deposition processes. Furthermore, global initiatives related to energy efficiency and decarbonization drive demand for advanced architectural glass coatings (low-emissivity coatings) and specialized targets for battery technologies (e.g., Lithium-ion thin films). The impact forces, characterized by technological change and market consolidation, continually pressure existing players to innovate or acquire niche expertise, ensuring that only firms capable of large-scale, ultra-pure manufacturing can maintain competitive advantage.

Segmentation Analysis

The Metal Target Material Sales Market is comprehensively segmented based on material composition, target type, end-user application, and geographical region, reflecting the diverse and highly specialized needs of the high-technology manufacturing sector. This segmentation is crucial as the performance and pricing of a target material depend intimately on its purity and suitability for a specific deposition process. The primary differentiation exists between elemental targets (single metal) and alloy/compound targets, with the latter often requiring much more complex manufacturing and exhibiting higher profit margins due to proprietary compositional knowledge. High-purity targets (5N and above) consistently command premium pricing and dominate the semiconductor segment, while slightly lower purity targets find extensive use in large-area coatings like solar and display applications where cost-efficiency is paramount.

The segmentation by application is the most significant driver of market value, with the semiconductor industry setting the bar for required target specifications and consuming the highest value volume, particularly targets made of refractory and noble metals. Conversely, the Flat Panel Display (FPD) and Photovoltaic (PV) segments drive volume demand, especially for common targets like Aluminum, Molybdenum, and Indium-Tin Oxide (ITO) precursors. The growth of these segments is tightly linked to global consumer electronics adoption rates and renewable energy policy frameworks. Furthermore, the differentiation between planar and rotary targets addresses operational requirements, where rotary targets are favored for their longevity and higher utilization rates in high-throughput production lines, marking a critical shift in the manufacturing preference for large-scale operations.

Analyzing the segmentation allows market participants to identify lucrative niches, such as specialized targets for magnetic data storage (e.g., Cobalt alloys) or emerging applications like advanced sensor coatings used in autonomous vehicles. Manufacturers are increasingly focusing R&D on proprietary alloy compositions designed to deliver superior electrical and mechanical properties under specific sputtering conditions, often tailored for specific PVD machine types (e.g., specific targets optimized for HiPIMS systems). Understanding these subtle segmentation nuances is key for targeted marketing and R&D investment, ensuring alignment between material development and evolving end-user technological roadmaps, particularly concerning next-generation memory and display substrates.

- By Material Type

- Aluminum Targets

- Copper Targets

- Titanium Targets

- Tantalum Targets

- Tungsten Targets

- Molybdenum Targets

- Niobium Targets

- Nickel and Nickel Alloy Targets (NiCr, NiV)

- Precious Metal Targets (Gold, Platinum, Ruthenium, Silver)

- Compound/Alloy Targets (ITO, AZO, CIGS Precursors, High-Entropy Alloys)

- By Target Type

- Planar Targets (Rectangular and Circular)

- Rotary Targets (Cylindrical)

- Specialized Targets (e.g., Slotted, High-Density)

- By Application

- Semiconductors and Integrated Circuits (IC)

- Flat Panel Displays (FPD: LCD, OLED, Micro-LED)

- Photovoltaic (PV) Cells and Solar Energy

- Data Storage (Hard Disk Drives, Magnetic Media)

- Optical Coatings and Devices (Lenses, Filters)

- Functional and Industrial Coatings (Wear Resistance, Decoration)

- Architectural and Automotive Glass

- By Purity Level

- Standard Purity (Below 5N)

- High Purity (5N to 6N)

- Ultra-High Purity (6N and above, up to 7N)

Value Chain Analysis For Metal Target Material Sales Market

The value chain for Metal Target Materials is intricate and highly specialized, beginning with the acquisition and refinement of ultra-high purity metals, progressing through complex manufacturing and bonding, and culminating in direct sales to high-technology fabrication facilities. The upstream segment is characterized by rigorous quality control and technical barriers, centered on obtaining metals at purity levels (often 99.999% or higher) required by semiconductor and advanced display manufacturers. This segment includes specialized mining operations, chemical processing firms utilizing techniques like zone refining, vacuum distillation, and electrolytic purification to remove trace impurities (measured in parts per billion). The limited number of suppliers capable of consistently delivering these high-specification raw materials makes the upstream market highly critical and subject to supply chain geopolitical risks, creating significant cost leverage for major material suppliers over downstream target manufacturers.

The midstream phase, involving target fabrication, is the most capital-intensive and technically challenging step. Manufacturers employ various advanced metallurgical processes tailored to the specific material. Refractory metals (Tungsten, Molybdenum, Tantalum) typically require powder metallurgy followed by hot isostatic pressing (HIP) to achieve maximum density and minimal porosity. Reactive metals (Aluminum, Titanium) often utilize vacuum melting and forging. Crucially, the target material must be bonded to a high-conductivity backing plate (usually copper or aluminum alloy) to efficiently dissipate the immense heat generated during the sputtering process, using specialized techniques like Indium soldering, epoxy bonding, or eutectic bonding. This bonding process must ensure an acoustically and thermally uniform interface, as defects here lead to arcing, production shutdowns, and premature target failure, necessitating specialized manufacturing expertise and high investment in controlled atmosphere equipment.

Downstream distribution and sales are dominated by a direct sales model, necessitated by the highly technical nature of the product and the need for tight collaboration between the target manufacturer and the end-user (e.g., semiconductor foundries, FPD fabs). Target specifications—size, composition, purity, and bonding technique—are often customized to fit specific PVD equipment models and deposition requirements. The distribution channel bypasses traditional wholesale networks, relying on application engineers and dedicated sales teams to provide technical support, product qualification services, and manage long-term supply contracts. Indirect channels are generally limited to smaller, specialized coatings applications or through PVD equipment manufacturers (OEMs) who bundle targets with their machinery, though direct relationships remain key for securing high-volume, continuous supply agreements, particularly in the competitive Asian manufacturing hubs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JX Nippon Mining & Metals Corporation, Materion Corporation, Honeywell International Inc., Praxair S.T. Technology, Inc. (Linde), Sumitomo Chemical Co., Ltd., ULVAC, Inc., Tosoh Corporation, KFMI (Kojundo Chemical Laboratory Co., Ltd.), AGC Inc., Hitachi Metals, Ltd., Plansee Group, Umicore, Global Tungsten & Powders (GTP), PAM-XIAMEN, Lesker Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Target Material Sales Market Potential Customers

The primary consumers of Metal Target Materials are highly sophisticated manufacturers operating within the electronics and advanced coatings sectors, requiring high volumes of material with extremely tight specification tolerances. These potential customers fall into three main categories: semiconductor foundries (fabs), large-scale flat panel display (FPD) producers, and photovoltaic (PV) module manufacturers. Semiconductor fabs, including giants like TSMC, Samsung, and Intel, represent the highest value segment, purchasing ultra-high purity targets for critical layers in advanced microprocessors, memory chips (NAND and DRAM), and specialty ICs. Their demand is characterized by cyclical investment in new fab lines and a continuous migration to smaller process nodes (e.g., 5nm, 3nm), requiring materials that address challenges like resistivity and electromigration, such as Tantalum, Copper, and new materials like Ruthenium for interconnects.

FPD manufacturers, led by companies such as BOE, LG Display, and Samsung Display, are massive volume consumers, particularly driving the demand for planar and rotary targets used in depositing transparent conductive oxide (TCO) films, primarily Indium Tin Oxide (ITO) and metallic electrode layers. The shift towards large-format OLED and Micro-LED screens intensifies the requirement for high-uniformity, defect-free deposition across very large substrates, making target quality crucial for yield rates. PV manufacturers, focusing on both crystalline silicon and thin-film solar technologies (e.g., CdTe and CIGS), form another significant consumer base, utilizing large-area targets (Molybdenum, Zinc Oxide, Aluminum) to create various layers including back electrodes and TCO layers. Their purchasing decisions are highly influenced by material utilization efficiency and cost-per-watt optimization, favoring high-throughput rotary targets.

Secondary but important customer segments include data storage companies (producing hard disk media), which require specialized targets (e.g., Cobalt-Platinum alloys) for high-density magnetic recording layers, and industrial coaters specializing in wear-resistant, decorative, or anti-corrosion coatings for automotive, medical, and aerospace components. These industrial clients often demand highly specific alloy targets tailored for hardness and friction performance, often involving transition metals and ceramics. Targeting these customer groups requires a deep understanding of their unique process equipment (PVD, CVD, ALD variations) and the specific defects that target impurities can introduce into their final products. Target suppliers must position themselves as technical partners capable of offering customized materials solutions rather than just material vendors.

Metal Target Material Sales Market Key Technology Landscape

The technological landscape of the Metal Target Material Sales Market is inextricably linked to advancements in physical vapor deposition (PVD) techniques, particularly magnetron sputtering, and the metallurgical processes required to produce materials capable of optimizing these deposition methods. Key technologies revolve around ensuring ultra-high material purity, achieving maximum target density, and developing advanced bonding techniques for efficient thermal management. Metallurgical processes like Hot Isostatic Pressing (HIP) and various vacuum melting methods (Electron Beam Melting, Vacuum Arc Remelting) are foundational, used to consolidate powders or purify melted materials to eliminate voids and achieve uniform grain structure. These techniques are critical for producing refractory metal targets (Tantalum, Tungsten) that must withstand intense thermal and mechanical stress during operation, directly influencing deposition stability and minimizing particle generation.

The evolution of sputtering technologies directly dictates the demand for specialized targets. The shift from standard DC and RF magnetron sputtering to advanced techniques like High Power Impulse Magnetron Sputtering (HiPIMS) requires targets capable of handling significantly higher power densities without melting or cracking. HiPIMS offers the advantage of higher ionization rates, resulting in films with superior density, adhesion, and microstructure, essential for high-performance coatings in aerospace and precision optics. Furthermore, the development of rotating cylindrical targets has significantly improved material utilization (up to 80-90% utilization compared to 30-50% for planar targets) and stability in large-area deposition systems, requiring specialized manufacturing equipment for forming and handling these large, often complex, cylindrical structures.

Crucially, target bonding technology—the method by which the target material is attached to the water-cooled backing plate—is a key technological differentiator. Advanced bonding uses materials like high-purity Indium or proprietary eutectic alloys to ensure a void-free, highly conductive interface, facilitating rapid heat dissipation and preventing overheating which causes microstructural degradation and arcing. Research and development efforts are currently focused on improving target surface quality through advanced machining and polishing techniques to minimize particle contamination during the initial sputtering phase (pre-sputtering). Overall, success in this technology landscape requires continuous investment in both high-purity material science and advanced mechanical engineering to meet the increasingly stringent demands of nanoscale film deposition.

Regional Highlights

- Asia Pacific (APAC)

The APAC region holds the undisputed majority share of the Metal Target Material Sales Market, driven by the massive concentration of high-volume electronics manufacturing, including semiconductor fabrication, Flat Panel Display (FPD) production, and photovoltaic (PV) cell manufacturing. Countries such as China, South Korea, Taiwan, and Japan are the world’s largest consumers. China, specifically, is a dominant force due to aggressive government investment in local semiconductor self-sufficiency (Made in China 2025 initiative) and its status as the leading global manufacturer of solar panels and LCD/OLED displays. South Korea and Taiwan remain paramount for advanced logic and memory chip manufacturing (e.g., Samsung, SK Hynix, TSMC), demanding the highest purity (6N-7N) Tantalum, Copper, and novel alloy targets. Japan, while seeing some manufacturing shift, retains a strong position as a hub for advanced target material innovation and high-purity raw material supply, making it a critical strategic region in the global supply chain.

The sustained regional growth is linked directly to the rapid establishment of new G8 and G10 generation FPD fabs, which utilize extremely large rotary targets for efficient large-area coating. Furthermore, the sheer scale of PV production in Southeast Asia and China dictates high-volume demand for Aluminum and Molybdenum targets. This intense competition and high-volume demand often lead to pricing pressure, yet the complexity of the materials required ensures that quality and technical support remain key differentiating factors, favoring international suppliers who can maintain local technical support teams and stable supply logistics. Geopolitical factors affecting trade tariffs and technology transfer also heavily influence procurement decisions within this region, compelling localized production or redundant sourcing strategies among large fab operators.

- North America

North America is a significant market for specialized, high-value targets, primarily serving the advanced R&D sectors, aerospace and defense applications, and a resurgence in domestic semiconductor manufacturing (driven by the CHIPS Act). While the region does not match APAC in sheer volume consumption, it excels in demanding highly exotic materials, including precious metal targets (Gold, Platinum, Ruthenium) and specialized high-entropy alloys used in next-generation devices, advanced sensors, and high-performance industrial coatings. The focus here is less on cost minimization and more on performance maximization and reliability, particularly for stringent military and automotive standards.

The market in North America is characterized by close collaboration between target manufacturers and academic or corporate research institutions, often leading to the commercialization of cutting-edge materials. Key consumers include leading microelectronics companies, specialized PVD equipment manufacturers, and government research labs. The region’s strength lies in intellectual property surrounding PVD equipment design and novel material synthesis, allowing it to dictate high-end material specifications globally, ensuring steady demand for specialized, low-volume, high-margin products.

- Europe

The European market is distinguished by its strong focus on industrial and functional coatings, optical devices, and sophisticated architectural glass applications, alongside a consistent demand from niche semiconductor and automotive electronics producers. Europe is a leader in developing high-performance surface coatings for tooling, biomedical implants, and decorative applications, driving demand for Titanium, Chromium, and specialized alloy targets. The market benefits from strong environmental and energy efficiency mandates, promoting the use of sophisticated low-emissivity (Low-E) coatings on architectural glass, which requires large-scale targets for deposition.

European target suppliers often specialize in custom-engineered solutions for high-mix, low-volume industrial requirements, prioritizing target life and consistency over high-volume throughput. Countries like Germany and Switzerland are key manufacturing hubs for PVD equipment and advanced material processing. While facing strong competition from APAC in mass-market electronics targets, Europe maintains a stable market for specialized targets used in high-end automotive sensors and power electronics, supporting the region’s strong manufacturing base in critical infrastructure.

- Latin America, Middle East, and Africa (MEA)

The MEA and Latin America regions currently represent emerging or smaller markets, primarily consuming targets for general industrial coatings, architectural glass, and small-scale electronics assembly. Demand is often met through imports from North America, Europe, or APAC, relying on standardized material specifications rather than ultra-high purity custom targets. Growth potential exists in specific national markets investing heavily in local electronics manufacturing or large-scale infrastructure projects, such as solar power farms (driving PV target demand) or sophisticated oil and gas sensor technologies requiring protective coatings.

The market maturity is low compared to APAC, with sales often channeled through distributors or local representatives of global target manufacturers. Future market expansion will depend heavily on successful technological industrialization and the establishment of local semiconductor or display manufacturing hubs, which are currently limited. The region mainly provides a market for mid-purity targets used in general industrial applications, but the installation of new fabs in emerging economies could rapidly transform the demand profile.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Target Material Sales Market.- JX Nippon Mining & Metals Corporation

- Materion Corporation

- Honeywell International Inc.

- Praxair S.T. Technology, Inc. (Linde)

- Sumitomo Chemical Co., Ltd.

- ULVAC, Inc.

- Tosoh Corporation

- KFMI (Kojundo Chemical Laboratory Co., Ltd.)

- AGC Inc. (Asahi Glass Co.)

- Hitachi Metals, Ltd. (Now part of Resonac Group)

- Plansee Group

- Umicore

- Global Tungsten & Powders (GTP)

- PAM-XIAMEN (Powerway Advanced Material Co., Ltd.)

- Lesker Company (Kurt J. Lesker Company)

- Furuya Metal Co., Ltd.

- Heraeus Group

- Advanced Materials Technology (AMT)

- Stanford Advanced Materials (SAM)

- Mitsubishi Materials Corporation

Frequently Asked Questions

Analyze common user questions about the Metal Target Material Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for ultra-high purity metal targets?

The primary factor is the relentless miniaturization in semiconductor manufacturing, particularly the move to sub-10nm nodes. These advanced nodes require target materials (like Tantalum, Copper, and Ruthenium) with purities of 99.999% (5N) and above to prevent defects, ensure stable electrical performance, and maintain high production yields in critical thin-film layers like interconnects and diffusion barriers.

How do rotary targets differ from planar targets, and which application segment prefers rotary targets?

Rotary (cylindrical) targets rotate during the sputtering process, offering a larger utilization surface area compared to stationary planar targets. This rotation results in significantly improved material utilization (up to 90%), better thermal management, and longer operational life. Rotary targets are highly preferred in large-area coating applications, specifically Flat Panel Displays (OLED/LCD) and Photovoltaic (PV) manufacturing, where high throughput and cost-efficiency are critical.

Which region dominates the consumption of metal target materials, and why?

Asia Pacific (APAC), led by China, South Korea, and Taiwan, dominates consumption. This is due to the high concentration of global manufacturing capacity for semiconductors (foundries), Flat Panel Displays (Fabs), and solar panels, which are the largest end-users of metal target materials for high-volume thin-film deposition.

What metallurgical techniques are essential for manufacturing high-density refractory metal targets?

The manufacturing of refractory metal targets, such as Tantalum and Tungsten, relies critically on Powder Metallurgy (PM) combined with Hot Isostatic Pressing (HIP). PM creates the initial compact, while HIP applies high temperature and pressure to achieve near-theoretical maximum density, eliminating porosity, which is vital for reducing arcing and increasing the lifespan and stability of the target during sputtering.

What role does the bonding process play in the performance of a metal target?

The bonding process, which attaches the target material to a cooling backing plate (usually copper), is essential for efficient thermal management. A high-quality, void-free bond (often using high-purity Indium) ensures rapid heat dissipation, preventing the target from overheating, which could otherwise cause microstructural changes, warping, arcing, and particle generation, thus maintaining stable deposition rates and film uniformity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager