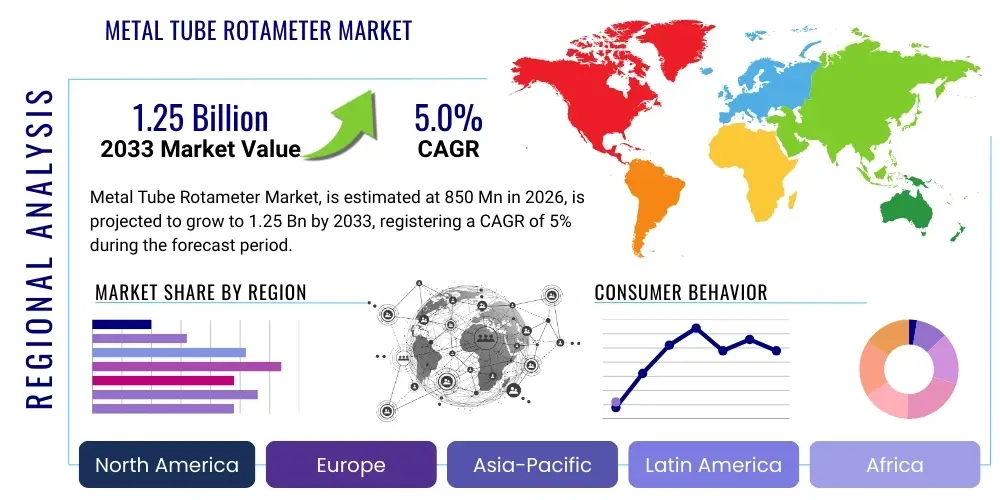

Metal Tube Rotameter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440432 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Metal Tube Rotameter Market Size

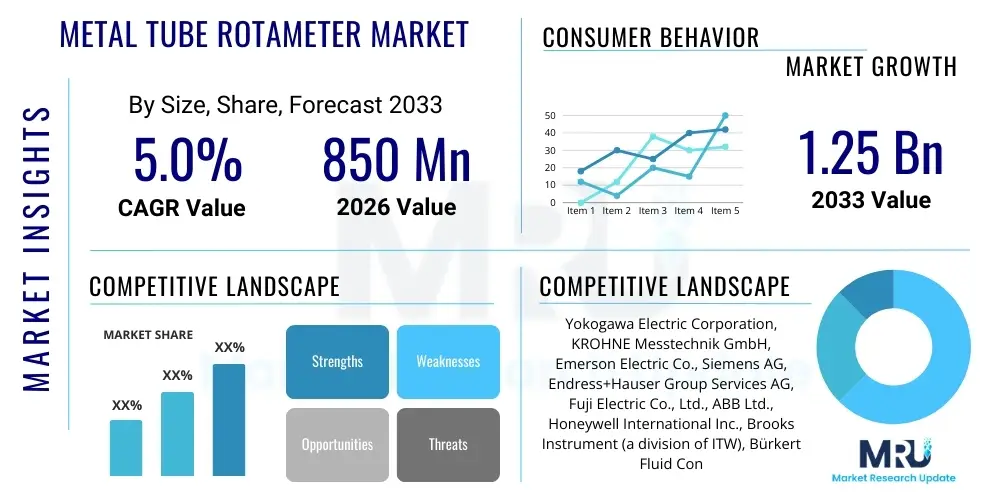

The Metal Tube Rotameter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.0% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1.25 Billion by the end of the forecast period in 2033.

Metal Tube Rotameter Market introduction

The Metal Tube Rotameter Market encompasses a critical segment within the broader flow measurement instrumentation industry, offering robust and reliable solutions for various industrial applications. A metal tube rotameter is a variable area flow meter designed to measure the volumetric flow rate of liquids and gases. Unlike glass tube rotameters, metal tube variants are engineered for high-pressure, high-temperature, and corrosive environments, making them indispensable in demanding industrial processes where safety and durability are paramount. Their construction typically involves a tapered metal tube, usually stainless steel, a float that moves freely within the tube, and an external indicator or transmitter for local or remote reading.

The primary function of a metal tube rotameter is to provide accurate and repeatable flow measurement under challenging conditions. As fluid enters the bottom of the tapered tube, it lifts the float until the upward force exerted by the fluid on the float balances the downward force of gravity. The position of the float, which is directly proportional to the flow rate, is then read via a magnetic coupling to an external scale or electronic transmitter. Major applications span across chemical and petrochemical processing, oil and gas exploration and refining, pharmaceutical manufacturing, water and wastewater treatment, power generation, and food and beverage production. These instruments are particularly valued for their simplicity, reliability, and low maintenance requirements in critical process lines.

The benefits of metal tube rotameters include their ability to handle opaque fluids, high pressures, and extreme temperatures, making them suitable for aggressive chemicals and steam. They offer a linear flow scale, do not require external power for local indication, and are relatively cost-effective for a wide range of flow measurement tasks. The market's growth is largely driven by ongoing industrial expansion, increasing demand for process automation and control, stringent regulatory requirements for environmental and safety compliance, and the need for durable flow measurement devices in harsh operating environments. Furthermore, advancements in sensor technology and integration capabilities are enhancing their appeal for modern industrial infrastructures.

Metal Tube Rotameter Market Executive Summary

The Metal Tube Rotameter Market is characterized by steady growth, propelled by robust demand from diverse industrial sectors globally. Current business trends indicate a strong focus on enhancing product durability, improving measurement accuracy in challenging conditions, and integrating with advanced control systems. Manufacturers are increasingly investing in research and development to offer specialized rotameters capable of handling ultra-high pressures, extremely corrosive media, and sanitary applications, thereby expanding their utility. Furthermore, there is a rising trend towards modular designs and smart features that allow for easier installation, calibration, and remote monitoring, catering to the evolving needs of industrial automation and predictive maintenance strategies. Competitive landscapes highlight innovation in materials science and magnetic coupling technologies to improve overall performance and longevity.

Regional trends significantly influence market dynamics, with Asia Pacific emerging as a dominant force due to rapid industrialization, particularly in countries like China, India, and Southeast Asian nations. The burgeoning chemical, pharmaceutical, and wastewater treatment sectors in these regions are primary consumers of metal tube rotameters. North America and Europe, while mature markets, continue to demonstrate consistent demand, driven by stringent regulatory frameworks, continuous upgrades of existing infrastructure, and a strong emphasis on process optimization and energy efficiency. Latin America and the Middle East & Africa are also witnessing growth, fueled by investments in oil and gas, mining, and infrastructure development, which require reliable flow measurement solutions.

Segmentation trends within the metal tube rotameter market reveal a growing preference for advanced material compositions such as Hastelloy and Monel for highly corrosive applications, and stainless steel for general industrial use. By application, the chemical and petrochemical industries remain the largest segment, followed closely by oil and gas and water & wastewater treatment, reflecting the critical need for precise flow control in these sectors. In terms of flow rate, demand spans across low, medium, and high flow variants, indicating the versatility and widespread applicability of these devices. The ongoing evolution of end-user industries, including the expansion of biotechnology and food & beverage sectors, further diversifies the market, necessitating customized and hygienic flow measurement solutions.

AI Impact Analysis on Metal Tube Rotameter Market

The integration of Artificial Intelligence (AI) presents a transformative, albeit indirect, impact on the Metal Tube Rotameter Market. While rotameters themselves are inherently mechanical devices relying on physical principles, AI's influence primarily manifests in enhancing their surrounding operational ecosystem. Users frequently inquire about how AI can improve the efficiency, predictive maintenance, and data analysis capabilities associated with flow measurement systems. Key themes revolve around leveraging AI for better process control, optimizing plant operations where rotameters are deployed, and extracting deeper insights from the flow data generated. Concerns often include the perceived complexity of integrating AI with traditional instrumentation and the initial investment required, while expectations focus on increased operational reliability and reduced downtime.

AI's impact on the market centers on its ability to process vast amounts of operational data, including flow rates from rotameters, alongside other process variables like temperature, pressure, and fluid composition. This data aggregation and analysis, facilitated by machine learning algorithms, allows for the identification of subtle patterns indicative of impending equipment failure or process inefficiencies. For instance, deviations in flow readings from expected norms, when analyzed in conjunction with historical data, can trigger predictive maintenance alerts, enabling proactive intervention before a critical failure occurs. This capability significantly extends the operational lifespan of rotameters and minimizes costly unscheduled downtimes, transforming maintenance strategies from reactive to predictive across industrial facilities.

Furthermore, AI can optimize process control loops where metal tube rotameters serve as crucial feedback elements. By continuously analyzing flow data and correlating it with desired output parameters, AI-powered systems can suggest or even automatically implement fine-tuned adjustments to pumps, valves, and other control elements, thereby optimizing resource consumption, improving product quality, and enhancing overall plant efficiency. This extends beyond simple control to overall process optimization, allowing for dynamic adjustments in response to varying operational conditions or raw material inputs. The ability of AI to learn from historical process data and adapt to new scenarios makes it a powerful tool for maximizing the utility and performance of flow measurement instruments like metal tube rotameters in complex industrial environments.

- Enhanced Predictive Maintenance: AI algorithms analyze rotameter data to predict potential failures, reducing downtime.

- Optimized Process Control: AI systems can integrate rotameter readings for more precise and adaptive process adjustments.

- Data Analytics & Insights: AI tools can uncover hidden patterns and efficiencies from flow rate data.

- Remote Monitoring & Diagnostics: AI facilitates advanced remote monitoring, identifying anomalies and optimizing operations.

- Energy Efficiency Optimization: AI can correlate flow data with energy consumption to suggest operational improvements.

- Automated Anomaly Detection: AI flags unusual flow patterns that might indicate leaks, blockages, or equipment malfunction.

DRO & Impact Forces Of Metal Tube Rotameter Market

The Metal Tube Rotameter Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces influencing its growth trajectory. Key drivers include the persistent global trend of industrialization and the escalating demand for process automation across manufacturing, chemical, oil & gas, and pharmaceutical sectors. As industries strive for higher efficiency, product quality, and safety standards, the need for accurate and reliable flow measurement becomes paramount, directly boosting the adoption of robust instruments like metal tube rotameters. Furthermore, increasingly stringent environmental regulations regarding emissions and waste treatment necessitate precise fluid control, reinforcing the demand for reliable flow meters in critical applications. The inherent robustness and reliability of metal tube rotameters in harsh environments also serve as a significant driver, positioning them as a preferred choice for high-pressure, high-temperature, or corrosive fluid applications where other flow technologies may falter. The overall industrial growth, coupled with a focus on resource optimization and energy efficiency, further underpins the market expansion.

However, the market also faces notable restraints. The relatively high initial cost of advanced metal tube rotameters, especially those with specialized materials or integrated transmitters, can be a barrier for small and medium-sized enterprises (SMEs) or budget-constrained projects. The emergence and increasing sophistication of alternative flow measurement technologies, such as Coriolis, magnetic, ultrasonic, and vortex flow meters, pose a competitive challenge. These alternatives often offer advantages like higher accuracy, suitability for a wider range of fluid types, or less sensitivity to mounting conditions, potentially diverting market share. Additionally, metal tube rotameters typically require specific mounting configurations, including adequate straight pipe runs upstream and downstream, which can be a limitation in space-constrained installations. Maintenance requirements and the need for periodic calibration, though often simple, represent ongoing operational considerations that can influence purchasing decisions.

Despite these restraints, significant opportunities exist for market growth and innovation. The rapid industrial expansion and infrastructure development in emerging economies, particularly in Asia Pacific, Latin America, and Africa, present vast untapped potential. These regions are witnessing increased investments in chemicals, pharmaceuticals, power generation, and water management, creating new avenues for metal tube rotameter adoption. Moreover, the ongoing trend of digital transformation and Industry 4.0 offers opportunities for integrating rotameters with IoT-enabled platforms for enhanced remote monitoring, data analytics, and predictive maintenance. Developing customized solutions for niche applications, such as hygienic designs for food and beverage or biotechnology, or specialized versions for high-purity gases, can open new market segments. Furthermore, manufacturers can leverage opportunities in providing value-added services, including installation, calibration, and maintenance, to differentiate their offerings and capture a larger market share. The continuous pursuit of energy efficiency and waste reduction across industries also drives demand for more precise and reliable flow measurement instruments.

Segmentation Analysis

The Metal Tube Rotameter Market is segmented to provide a granular view of its diverse landscape, enabling a comprehensive understanding of various product types, materials, flow rate capabilities, applications, and end-use industries. This segmentation helps in identifying specific growth areas, market trends, and competitive dynamics within each category, offering insights into consumer preferences and technological advancements. The intricate needs of modern industrial processes necessitate a wide range of rotameter configurations, making segmentation crucial for both manufacturers and end-users to optimize product development and selection.

- By Type:

- Flanged Rotameters

- Threaded Rotameters

- Wafer Rotameters

- Others (e.g., sanitary connections, hose connections)

- By Material:

- Stainless Steel (304, 316, 316L)

- Hastelloy

- Monel

- PVDF/PTFE Lined

- Others (e.g., Titanium)

- By Flow Rate:

- Low Flow Rotameters

- Medium Flow Rotameters

- High Flow Rotameters

- By Application:

- Chemical & Petrochemical

- Oil & Gas

- Water & Wastewater Treatment

- Pharmaceutical & Biotechnology

- Food & Beverage

- Power Generation

- Pulp & Paper

- Metals & Mining

- General Industrial

- Others

- By End-Use Industry:

- Process Industries

- Manufacturing Sector

- Research & Development Facilities

- Commercial Utilities

- Environmental Monitoring

Value Chain Analysis For Metal Tube Rotameter Market

The value chain for the Metal Tube Rotameter Market begins with the upstream activities centered around raw material suppliers and component manufacturers. This stage involves the sourcing of high-grade metals such as stainless steel (304, 316, 316L), Hastelloy, Monel, and other specialty alloys, along with precision components like floats, magnets, seals, and indicators. Suppliers of these materials and components play a crucial role in determining the quality, durability, and cost-effectiveness of the final product. Manufacturers often establish long-term relationships with trusted suppliers to ensure consistent material quality and timely delivery, which are critical for maintaining production schedules and product reliability. Research and development activities, including material science advancements and design innovations, are also integral to the upstream segment, feeding directly into the manufacturing process.

The midstream of the value chain involves the core manufacturing and assembly processes. This stage includes precision machining of the tapered metal tubes, fabrication of the float and other internal components, and the intricate assembly of the rotameter with its magnetic coupling system and external indication mechanism. Quality control and calibration are paramount at this stage to ensure accuracy and compliance with industry standards. Manufacturers differentiate themselves through proprietary designs, advanced manufacturing techniques, and the integration of smart features like transmitters and alarms. After manufacturing, products move to distribution channels, which can be direct or indirect. Direct channels involve manufacturers selling directly to large industrial end-users or through their own regional sales offices, often for custom or large-volume orders. This allows for direct customer engagement, tailored solutions, and better control over service quality.

The downstream segment of the value chain encompasses distribution, sales, installation, and after-sales services, reaching the end-users. Indirect channels involve a network of distributors, wholesalers, system integrators, and value-added resellers who provide localized sales, technical support, and inventory management. These intermediaries are crucial for reaching a broader customer base, especially SMEs, and for providing expertise in specific regional or industrial contexts. Post-sale services, including installation assistance, commissioning, calibration, maintenance, and spare parts supply, are vital for customer satisfaction and long-term product performance. End-users, who include various process industries such as chemical, oil & gas, water treatment, and pharmaceuticals, ultimately derive value from the accurate and reliable flow measurement provided by metal tube rotameters, optimizing their processes, ensuring safety, and meeting regulatory requirements. The efficiency and effectiveness of this entire value chain are crucial for the market's sustained growth and the delivery of high-quality flow measurement solutions.

Metal Tube Rotameter Market Potential Customers

The potential customer base for metal tube rotameters is incredibly diverse, spanning across nearly all heavy and light industrial sectors where precise and reliable fluid flow measurement is critical. These instruments are predominantly utilized by engineering, procurement, and construction (EPC) firms involved in building new industrial plants, as well as by existing manufacturing and processing facilities that require upgrades, replacements, or expansion of their instrumentation. The primary buyers are typically plant managers, process engineers, instrumentation technicians, and maintenance personnel who are responsible for ensuring the efficient, safe, and compliant operation of their industrial processes. Their purchasing decisions are often influenced by factors such as the specific fluid characteristics, operating conditions (pressure, temperature), required accuracy, material compatibility, and overall cost of ownership.

Key end-user industries represent significant segments of potential customers. The chemical and petrochemical industry, for instance, relies heavily on metal tube rotameters for measuring aggressive chemicals, solvents, and catalysts in various stages of production due to the rotameter's robust construction and material compatibility. In the oil and gas sector, both upstream and downstream operations utilize these devices for monitoring the flow of crude oil, natural gas, refined products, and various chemicals injected during processing. The water and wastewater treatment sector employs rotameters for precise dosing of chemicals, monitoring filtration rates, and managing effluent discharge, where the devices' durability against corrosive water treatment chemicals is highly valued.

Furthermore, the pharmaceutical and biotechnology industries are crucial customers, demanding hygienic and accurate flow measurement for raw materials, intermediate products, and finished goods, often utilizing specialized sanitary connection rotameters. The food and beverage industry also employs these instruments for ingredient dosing and process control, particularly where high temperatures or corrosive cleaning agents are used. Other significant customer segments include power generation plants for boiler feed water and chemical injection, pulp and paper mills for process chemicals, and metals and mining operations for water and chemical flows in harsh environments. Essentially, any industrial setting requiring a rugged, reliable, and relatively simple solution for volumetric flow measurement under challenging conditions represents a potential customer for metal tube rotameters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1.25 Billion |

| Growth Rate | 5.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yokogawa Electric Corporation, KROHNE Messtechnik GmbH, Emerson Electric Co., Siemens AG, Endress+Hauser Group Services AG, Fuji Electric Co., Ltd., ABB Ltd., Honeywell International Inc., Brooks Instrument (a division of ITW), Bürkert Fluid Control Systems, Dwyer Instruments, Inc., Cole-Parmer Instrument Company, Inc., King Instrument Company, AW-Lake Company, Inc., Fluid Components International (FCI), Hedland Flow Meters, Key Instruments, Omega Engineering Inc., Sierra Instruments, Inc., Vögtlin Instruments GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Tube Rotameter Market Key Technology Landscape

The technology landscape of the Metal Tube Rotameter Market, while fundamentally rooted in the variable area principle, is continuously evolving to meet modern industrial demands for enhanced reliability, accuracy, and connectivity. At its core, the technology relies on a precisely machined tapered metal tube and a free-moving float, typically made of a dense, corrosion-resistant material. The primary technological advancements in this area focus on improving the float's design for better stability and linearity, and optimizing the tube's internal surface finish to minimize fluid friction and ensure consistent performance. Materials science plays a crucial role, with ongoing research into new alloys and linings that can withstand increasingly aggressive media, extreme temperatures, and higher pressures, thereby extending the application range of these instruments. This includes the use of stainless steels (304, 316, 316L) for general industrial applications, and more exotic alloys like Hastelloy, Monel, or titanium for highly corrosive or specialized environments.

Beyond the mechanical fundamentals, a significant aspect of the key technology landscape involves the integration of advanced sensing and transmission capabilities. Modern metal tube rotameters frequently incorporate magnetic coupling systems that isolate the process fluid from the external indicator, ensuring safety and allowing for the measurement of opaque fluids. These systems often include magnetic followers that mimic the float's position, transmitting it to a local analog scale. Further technological evolution includes the integration of electronic transmitters that convert the float's position into standardized electrical or digital signals (e.g., 4-20 mA, HART, Foundation Fieldbus, Profibus). This enables seamless integration with distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and programmable logic controllers (PLCs), facilitating remote monitoring, data logging, and automated process control. The adoption of such smart features transforms traditional mechanical devices into integral components of modern industrial automation architectures.

Another crucial technological development is the focus on enhanced diagnostic and communication features. Some advanced metal tube rotameters are now equipped with built-in diagnostics that can detect issues like float sticking, sensor malfunctions, or calibration drift, providing alerts for predictive maintenance. Wireless communication options are also emerging, allowing for greater flexibility in installation and reducing cabling costs, particularly in extensive or hazardous industrial settings. Furthermore, there is a growing trend towards modular designs, enabling easier field replacement of parts, simplified maintenance, and adaptability to various process connections. The emphasis on robust construction, explosion-proof certifications (e.g., ATEX, IECEx) for hazardous areas, and adherence to international standards (e.g., ISO, ASME) further underscore the technological sophistication required to meet stringent industry requirements and ensure operational integrity across diverse and demanding applications.

Regional Highlights

- North America: A mature market with steady demand, driven by stringent environmental regulations, ongoing infrastructure upgrades, and robust investment in the chemical, oil & gas, and pharmaceutical sectors. The region emphasizes high-precision and safety-certified instrumentation.

- Europe: Characterized by a strong focus on advanced manufacturing, process optimization, and sustainability. Countries like Germany, the UK, and France are key contributors, driven by the chemical, food & beverage, and water treatment industries, with a growing emphasis on smart factory integration.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapid industrialization, urbanization, and significant investments in infrastructure, chemicals, power generation, and wastewater treatment across countries like China, India, and Southeast Asian nations. Cost-effectiveness and robust performance are key drivers.

- Latin America: Experiencing growth fueled by increasing investments in oil & gas exploration, mining, and industrial expansion in countries such as Brazil, Mexico, and Argentina. The demand is often for durable and reliable instruments capable of operating in challenging industrial conditions.

- Middle East and Africa (MEA): A developing market with substantial growth potential, primarily driven by large-scale projects in the oil & gas industry, petrochemicals, and water desalination plants. Investments in industrial diversification and infrastructure development are key market boosters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Tube Rotameter Market.- Yokogawa Electric Corporation

- KROHNE Messtechnik GmbH

- Emerson Electric Co.

- Siemens AG

- Endress+Hauser Group Services AG

- Fuji Electric Co., Ltd.

- ABB Ltd.

- Honeywell International Inc.

- Brooks Instrument (a division of ITW)

- Bürkert Fluid Control Systems

- Dwyer Instruments, Inc.

- Cole-Parmer Instrument Company, Inc.

- King Instrument Company

- AW-Lake Company, Inc.

- Fluid Components International (FCI)

- Hedland Flow Meters

- Key Instruments

- Omega Engineering Inc.

- Sierra Instruments, Inc.

- Vögtlin Instruments GmbH

Frequently Asked Questions

Analyze common user questions about the Metal Tube Rotameter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Metal Tube Rotameter and how does it work?

A metal tube rotameter is a robust variable area flow meter used to measure the volumetric flow rate of liquids and gases. It operates by allowing fluid to flow upwards through a tapered metal tube, lifting a free-moving float until the drag force on the float balances its weight. The float's position, read against an external scale via a magnetic coupling, directly indicates the flow rate.

What are the primary applications of Metal Tube Rotameters?

Metal tube rotameters are primarily used in demanding industrial applications where high pressure, high temperature, or corrosive fluids are present. Key sectors include chemical and petrochemical, oil & gas, pharmaceutical, water and wastewater treatment, power generation, and food & beverage industries for process control and monitoring.

How do Metal Tube Rotameters compare to other flow measurement technologies?

Metal tube rotameters offer advantages in terms of robustness, suitability for harsh conditions, and relatively low cost for specific applications. Unlike magnetic or Coriolis meters, they typically don't require external power for local indication. However, they might have lower precision than some advanced technologies and are sensitive to fluid viscosity changes and mounting requirements.

What factors drive the adoption of Metal Tube Rotameters in industrial settings?

Key drivers include the increasing need for reliable flow measurement in harsh industrial environments, stringent regulatory requirements for process control and safety, global industrial expansion and automation trends, and the rotameter's inherent simplicity, durability, and cost-effectiveness for a wide range of fluids and conditions.

What are the key considerations when selecting a Metal Tube Rotameter?

When selecting, consider the fluid type (liquid/gas), maximum and minimum flow rates, operating pressure and temperature, fluid viscosity and density, material compatibility with the fluid, required accuracy, process connection type, hazardous area classifications, and the need for local or remote indication/transmission.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager