Metal Working Equipment Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439502 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Metal Working Equipment Oil Market Size

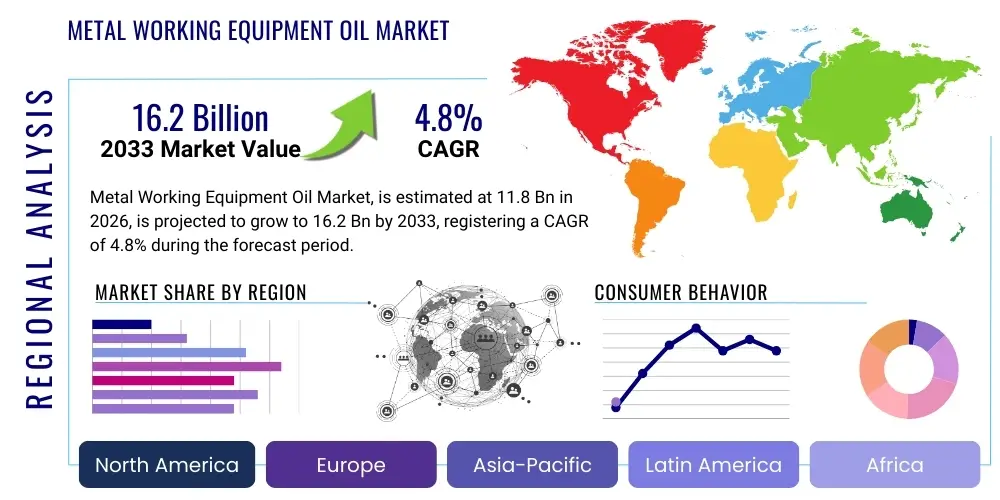

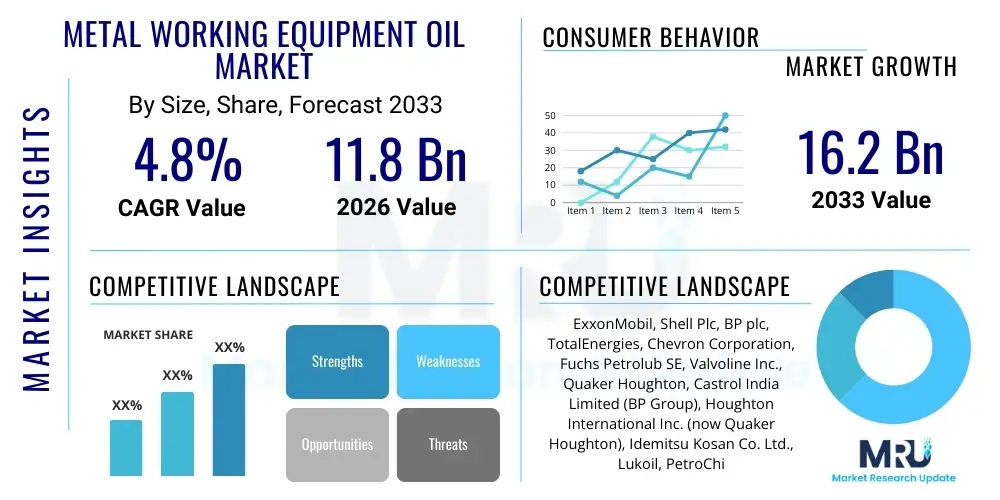

The Metal Working Equipment Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 11.8 billion in 2026 and is projected to reach USD 16.2 billion by the end of the forecast period in 2033.

Metal Working Equipment Oil Market introduction

The Metal Working Equipment Oil Market encompasses a diverse range of lubricants and fluids specifically designed for use in various metal fabrication and machining processes. These specialized oils are crucial for enhancing operational efficiency, extending tool life, improving surface finish, and ensuring the smooth functioning of machinery across numerous industrial applications. Their primary functions include lubrication to reduce friction and wear, cooling to dissipate heat generated during cutting or forming, and corrosion protection to safeguard both the workpiece and machinery components. The intricate demands of modern manufacturing, requiring higher precision, faster production speeds, and the processing of advanced materials, directly drive the continuous innovation and demand within this market segment.

Major applications for metal working equipment oils span a broad spectrum of manufacturing activities, including cutting operations such as turning, milling, drilling, and grinding; forming processes like stamping, drawing, and forging; and protective treatments such as rust prevention. The benefits derived from these oils are multifaceted, ranging from significant reductions in energy consumption and maintenance costs to improved worker safety through advanced formulations. The market is also heavily influenced by the adoption of automation and robotics in manufacturing, which necessitates high-performance lubricants capable of supporting continuous, high-speed operations. This technological integration, coupled with the increasing emphasis on manufacturing efficiency and product quality, serves as a fundamental driving factor for the consistent expansion and evolution of the metal working equipment oil sector.

Metal Working Equipment Oil Market Executive Summary

The Metal Working Equipment Oil Market is currently experiencing robust growth, propelled by several key business trends including the rapid industrialization in emerging economies, the burgeoning demand for high-performance and environmentally friendly lubricants, and the widespread adoption of automation and advanced manufacturing technologies across various industries. Businesses are increasingly investing in premium synthetic and semi-synthetic oils to enhance operational longevity, reduce downtime, and meet stringent regulatory requirements, particularly in developed regions. The drive towards sustainable manufacturing practices is also fostering innovation in bio-based and low-toxicity fluid formulations, thereby shaping market offerings and influencing consumer preferences for more sustainable solutions. Manufacturers are focusing on custom formulations that cater to specific material processing needs, such as exotic alloys used in aerospace and medical devices, driving segmentation within the market.

Regional trends indicate that the Asia Pacific region continues to be the primary growth engine for the market, driven by its expansive manufacturing base, significant automotive production, and increasing foreign direct investment in industrial infrastructure. North America and Europe, while more mature, are characterized by a strong emphasis on specialized, high-value-added products and a rapid shift towards sustainable and high-performance solutions. Latin America and the Middle East & Africa are emerging as promising markets, buoyed by industrial expansion and diversification efforts, albeit with varying paces of adoption for advanced oil technologies. Segment trends highlight a noticeable shift from traditional mineral oils towards synthetic and semi-synthetic variants due to their superior performance characteristics and extended service life. Additionally, water-miscible cutting fluids are gaining traction due to their enhanced cooling properties and cleaner operational profiles, while specialty oils for forming and protective applications continue to see steady demand as industries seek to optimize every stage of metal processing for efficiency and quality.

AI Impact Analysis on Metal Working Equipment Oil Market

User questions frequently revolve around how artificial intelligence (AI) can revolutionize the management and formulation of metal working equipment oils, seeking insights into its potential for optimization and cost reduction. Common inquiries explore AI's role in predictive maintenance for fluid systems, smart fluid monitoring to prevent contamination or degradation, and the development of next-generation lubricants with enhanced performance characteristics. There is significant interest in understanding how AI can contribute to more sustainable practices by optimizing fluid usage, extending lifespan, and reducing waste. Furthermore, users often question the practical implementation of AI-driven solutions within existing manufacturing frameworks and the data infrastructure required to support such advanced analytical capabilities, highlighting a broad expectation for AI to bring unprecedented levels of efficiency and intelligence to the selection, application, and lifecycle management of these critical industrial fluids.

- AI-powered predictive maintenance optimizes fluid change intervals, reducing waste and downtime.

- Real-time monitoring of fluid conditions using AI enhances performance and prevents contamination.

- AI assists in the development of new, high-performance lubricant formulations by simulating molecular interactions.

- Automated dosing and mixing systems guided by AI ensure precise fluid concentrations, improving consistency.

- AI analyzes operational data to recommend optimal fluid types for specific machining tasks, increasing efficiency.

- Smart sensors integrated with AI algorithms detect early signs of wear or degradation, extending equipment and fluid life.

- Supply chain optimization for base oils and additives through AI improves procurement and inventory management.

- Environmental impact reduction through AI-driven waste minimization and recycling process optimization.

DRO & Impact Forces Of Metal Working Equipment Oil Market

The Metal Working Equipment Oil Market is significantly shaped by a dynamic interplay of drivers, restraints, and opportunities, alongside various impact forces. Key drivers include the ongoing global industrialization, particularly in emerging economies where manufacturing activities are rapidly expanding, leading to increased demand for metal processing. The growth of the automotive, aerospace, and general manufacturing sectors, all heavy users of metalworking fluids, further fuels market expansion. Additionally, the increasing focus on precision manufacturing, automation, and the need for higher productivity and extended tool life compel industries to adopt advanced, high-performance metalworking oils. The rising demand for specialized fluids that can handle complex materials and high-speed machining operations also acts as a strong market impetus, pushing innovation in fluid formulations.

However, the market also faces considerable restraints. Stringent environmental regulations and health safety concerns regarding certain chemical components in conventional metalworking fluids pose significant challenges, necessitating costly reformulation and disposal practices. Fluctuations in crude oil prices, which directly impact the cost of base oils, lead to price volatility and uncertainty for manufacturers. The high initial cost associated with premium synthetic and bio-based fluids, despite their long-term benefits, can deter adoption by small and medium-sized enterprises (SMEs). Moreover, the increasing adoption of dry machining and minimum quantity lubrication (MQL) techniques in some applications presents a potential, albeit niche, substitute that could marginally impact demand for traditional flood coolants.

Opportunities within the market largely revolve around the development and adoption of bio-based and sustainable metalworking fluids, addressing environmental concerns and catering to a growing demand for eco-friendly solutions. The continuous innovation in additive technology allows for the creation of smart fluids with self-healing properties or enhanced sensor integration, offering predictive maintenance capabilities. Emerging economies, with their expanding industrial bases and less mature regulatory environments, present substantial untapped market potential for both conventional and advanced fluid technologies. Furthermore, strategic collaborations between oil manufacturers and machinery OEMs to develop application-specific fluids represent a lucrative avenue for market penetration and technological advancement, ensuring compatibility and optimized performance for new generation equipment.

Segmentation Analysis

The Metal Working Equipment Oil Market is extensively segmented to reflect the diverse applications and product requirements within the industrial landscape. This comprehensive segmentation allows for a detailed analysis of market dynamics, competitive positioning, and growth opportunities across various product types, functional applications, and end-use industries. Understanding these segments is crucial for manufacturers to tailor their offerings, for distributors to optimize their supply chains, and for end-users to select the most appropriate solutions for their specific operational needs, ensuring optimal performance, cost-efficiency, and compliance with industry standards and environmental regulations. The market's complexity necessitates a granular view of its components to effectively navigate its trends and future directions, reflecting a continuous evolution driven by technological advancements and shifting industrial demands.

- By Product Type

- Mineral Oils

- Synthetic Oils

- Semi-synthetic Oils

- Bio-based Oils

- By Application

- Cutting Oils

- Neat Cutting Oils

- Soluble Cutting Oils (Emulsifiable Oils)

- Forming Oils

- Stamping Oils

- Drawing Oils

- Forging Oils

- Protective Oils

- Rust Preventatives

- Corrosion Inhibitors

- Quenching Oils

- Grinding Oils

- Rolling Oils

- Cutting Oils

- By End-Use Industry

- Automotive

- Aerospace and Defense

- Heavy Machinery

- Metal Fabrication

- Electrical and Electronics

- Marine

- General Manufacturing

Value Chain Analysis For Metal Working Equipment Oil Market

The value chain for the Metal Working Equipment Oil Market begins with upstream activities primarily centered on the sourcing and refining of base oils and the production of various additives. Base oil suppliers, ranging from major petrochemical companies to specialty refiners, constitute a critical part of the upstream segment, providing the fundamental components for lubricant formulations. Simultaneously, the chemical industry supplies a wide array of additives such as extreme pressure (EP) agents, anti-wear agents, corrosion inhibitors, antioxidants, and emulsifiers, which are essential for imparting specific performance characteristics to the finished oils. The quality and availability of these raw materials directly influence the cost, performance, and environmental profile of the final metal working fluids, making strong supplier relationships and effective raw material procurement vital for lubricant manufacturers.

Moving downstream, the value chain involves the blending and formulation of these base oils and additives into finished metal working fluids, followed by their distribution to end-users. Lubricant manufacturers, who may also engage in research and development to innovate new formulations, perform the blending process, often tailoring products for specific applications or industries. The distribution channel plays a pivotal role in reaching the diverse customer base, which includes automotive manufacturers, aerospace companies, heavy machinery producers, and numerous small and medium-sized metal fabrication shops. This distribution can be direct, where large manufacturers sell directly to major industrial clients, or indirect, involving a network of wholesalers, distributors, and agents who provide localized sales, technical support, and inventory management for a broader range of customers. The choice of distribution channel often depends on the scale of the customer, the complexity of the product, and geographical reach, with indirect channels proving particularly effective for reaching a fragmented SME market, while direct channels facilitate closer technical collaboration with large industrial accounts.

Both direct and indirect distribution channels aim to efficiently deliver products and provide essential technical support, which is often crucial for specialized industrial lubricants. Direct channels enable manufacturers to maintain tighter control over sales, pricing, and customer service, fostering direct relationships and feedback loops. Conversely, indirect channels leverage the extensive networks and specialized logistics of distributors, allowing manufacturers to penetrate wider markets without significant capital investment in their own sales infrastructure. The effectiveness of the entire value chain is therefore dependent on seamless coordination between raw material suppliers, lubricant formulators, and a robust distribution network that can cater to the specific needs and geographical dispersion of the diverse end-user industries, ensuring timely delivery and comprehensive technical assistance, especially for sophisticated metalworking applications.

Metal Working Equipment Oil Market Potential Customers

The potential customers for metal working equipment oils are highly diverse, spanning a wide array of industrial sectors that engage in metal fabrication, machining, and treatment processes. At the forefront are automotive manufacturers and their extensive supply chain, including component suppliers and aftermarket service providers. These entities rely heavily on metalworking fluids for precision machining of engine blocks, transmission parts, chassis components, and body panels, making them significant consumers. The aerospace and defense industry also represents a critical customer segment, demanding highly specialized, high-performance lubricants for machining exotic alloys and ensuring the integrity of critical aircraft and defense system components, where precision and reliability are paramount. These industries frequently require fluids that can withstand extreme temperatures and pressures, necessitating advanced synthetic or semi-synthetic formulations tailored to their unique material and processing requirements.

Beyond automotive and aerospace, heavy machinery manufacturers, involved in producing construction equipment, agricultural machinery, and industrial turbines, constitute another substantial customer base. Their operations involve extensive cutting, forming, and welding of large metal components, requiring robust and durable metalworking oils to maintain machinery efficiency and prolong tool life. General metal fabrication workshops, ranging from large industrial facilities to smaller job shops, form a broad and fragmented customer segment, using these oils for various processes like stamping, bending, drilling, and welding. Furthermore, the electrical and electronics industry utilizes metalworking fluids for manufacturing components such as circuit boards, connectors, and casings, often requiring specific fluids that minimize residue and ensure electrical integrity. The marine industry, particularly in ship construction and repair, also consumes metalworking oils for various fabrication tasks, highlighting the pervasive need for these specialized lubricants across nearly all industrial sectors that handle metals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.8 billion |

| Market Forecast in 2033 | USD 16.2 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell Plc, BP plc, TotalEnergies, Chevron Corporation, Fuchs Petrolub SE, Valvoline Inc., Quaker Houghton, Castrol India Limited (BP Group), Houghton International Inc. (now Quaker Houghton), Idemitsu Kosan Co. Ltd., Lukoil, PetroChina Company Limited, Sinopec Group, Indian Oil Corporation Ltd., JXTG Nippon Oil & Energy Corporation, Klüber Lubrication, Blaser Swisslube AG, Motul SA, Lubrizol Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metal Working Equipment Oil Market Key Technology Landscape

The Metal Working Equipment Oil Market is continuously evolving with significant technological advancements aimed at improving performance, sustainability, and operational efficiency. One of the most prominent technological shifts involves the development of advanced additive packages. These packages integrate novel extreme pressure (EP) agents, anti-wear compounds, corrosion inhibitors, and anti-foaming agents that deliver superior protection and lubrication under increasingly severe operating conditions, such as high temperatures and pressures common in modern high-speed machining. Researchers are focusing on synergistic additive combinations that can enhance the multifunctionality of oils, allowing a single fluid to perform effectively across a broader range of applications, thereby simplifying inventory and reducing complexity for end-users. The goal is to maximize tool life, improve surface finish quality, and enable faster machining cycles, directly contributing to higher productivity in manufacturing processes.

Another crucial aspect of the technology landscape is the rapid growth in bio-based and environmentally friendly fluid formulations. Driven by stricter environmental regulations and growing corporate sustainability initiatives, there's a strong push towards developing fluids derived from renewable resources, such as vegetable oils, which offer comparable or even superior performance to traditional mineral oils, coupled with reduced toxicity and easier biodegradability. This includes advancements in emulsifier technology for water-miscible fluids, ensuring stable and long-lasting emulsions with minimal impact on health and the environment. Furthermore, the integration of smart fluid technologies is gaining traction. This involves incorporating sensors and advanced analytics to monitor fluid condition in real-time, allowing for predictive maintenance, optimized fluid replacement cycles, and early detection of contamination or degradation. These smart systems enable manufacturers to maintain optimal fluid performance, extend operational life, and minimize waste, aligning with Industry 4.0 principles.

The advent of nano-lubricants, incorporating nanoparticles into fluid formulations, represents another cutting-edge technological development. These nanoparticles, often made of materials like graphene, molybdenum disulfide, or various ceramics, can significantly enhance the anti-friction and anti-wear properties of metal working oils, even at very low concentrations. This results in superior lubrication, reduced heat generation, and extended tool and equipment lifespan. Additionally, advancements in fluid filtration and recycling technologies are crucial, contributing to the extended service life of metal working oils and reducing disposal costs and environmental impact. These technologies, combined with the continuous refinement of base oil production, are collectively shaping a future where metal working fluids are not just lubricants but integral, high-performance components of advanced manufacturing systems, offering unprecedented levels of efficiency, sustainability, and precision.

Regional Highlights

- Asia Pacific (APAC): This region dominates the Metal Working Equipment Oil Market, primarily driven by the rapid industrialization, burgeoning manufacturing sector, and significant automotive production hubs in countries like China, India, Japan, and South Korea. The increasing demand for precision components and the expansion of heavy machinery industries further fuel market growth, with a growing emphasis on adopting advanced lubricants to enhance productivity and efficiency.

- North America: Characterized by a mature industrial base and a strong focus on advanced manufacturing, the North American market exhibits stable demand for high-performance and specialized metal working oils. Key drivers include the aerospace and defense sectors, robust automotive industry, and increasing adoption of automation, leading to a demand for fluids that support high-speed, precision machining while adhering to evolving environmental regulations.

- Europe: Europe is a significant market driven by stringent environmental policies, a strong emphasis on sustainability, and a highly sophisticated manufacturing sector, particularly in Germany, France, and Italy. There is a high demand for bio-based and low-toxicity fluids, alongside advanced synthetic and semi-synthetic oils, to meet high technical specifications and eco-friendly standards in industries such as automotive, machinery, and electrical & electronics.

- Latin America: This region is an emerging market for metal working equipment oils, with growth primarily influenced by industrial expansion, infrastructure development, and increasing automotive manufacturing activities in countries like Brazil and Mexico. The market is gradually shifting towards more efficient and higher-quality lubricants as manufacturing processes become more sophisticated and demand for industrial output rises.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, propelled by investments in industrial diversification, infrastructure projects, and the expansion of the energy and manufacturing sectors. Countries like Saudi Arabia and the UAE are investing in developing local manufacturing capabilities, creating new opportunities for metal working fluids, with a growing interest in high-performance and cost-effective solutions for various industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metal Working Equipment Oil Market.- ExxonMobil

- Shell Plc

- BP plc

- TotalEnergies

- Chevron Corporation

- Fuchs Petrolub SE

- Valvoline Inc.

- Quaker Houghton

- Castrol India Limited (BP Group)

- Houghton International Inc. (now Quaker Houghton)

- Idemitsu Kosan Co. Ltd.

- Lukoil

- PetroChina Company Limited

- Sinopec Group

- Indian Oil Corporation Ltd.

- JXTG Nippon Oil & Energy Corporation

- Klüber Lubrication

- Blaser Swisslube AG

- Motul SA

- Lubrizol Corporation

Frequently Asked Questions

Analyze common user questions about the Metal Working Equipment Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of metal working equipment oils?

Metal working equipment oils primarily provide lubrication to reduce friction and wear, cool the workpiece and tools to dissipate heat, and protect against corrosion to extend equipment and workpiece life, ultimately improving machining efficiency and surface finish.

How do environmental regulations impact the Metal Working Equipment Oil market?

Environmental regulations significantly influence the market by driving demand for bio-based, low-toxicity, and easily disposable fluids. These regulations encourage manufacturers to reformulate products, reducing harmful chemicals and promoting sustainable practices to comply with stricter health and environmental standards.

What are the advantages of synthetic metal working oils over mineral oils?

Synthetic metal working oils offer superior performance, including enhanced thermal stability, extended tool life, better cooling capabilities, and longer fluid service life compared to traditional mineral oils. They often provide better lubrication at extreme temperatures and reduce residue build-up.

Which regions are driving the growth of the Metal Working Equipment Oil market?

The Asia Pacific region is the leading growth driver, fueled by its extensive manufacturing base, rapid industrialization, and significant automotive production. North America and Europe also contribute with high demand for specialized, high-performance, and sustainable fluid solutions.

How is AI transforming the metal working oil industry?

AI is transforming the industry through applications like predictive maintenance for fluid systems, real-time condition monitoring, optimizing fluid formulations, and enhancing operational efficiency through smart dosing. It helps extend fluid life, reduce waste, and improve overall process control and sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager