Metaldehyde Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435266 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Metaldehyde Market Size

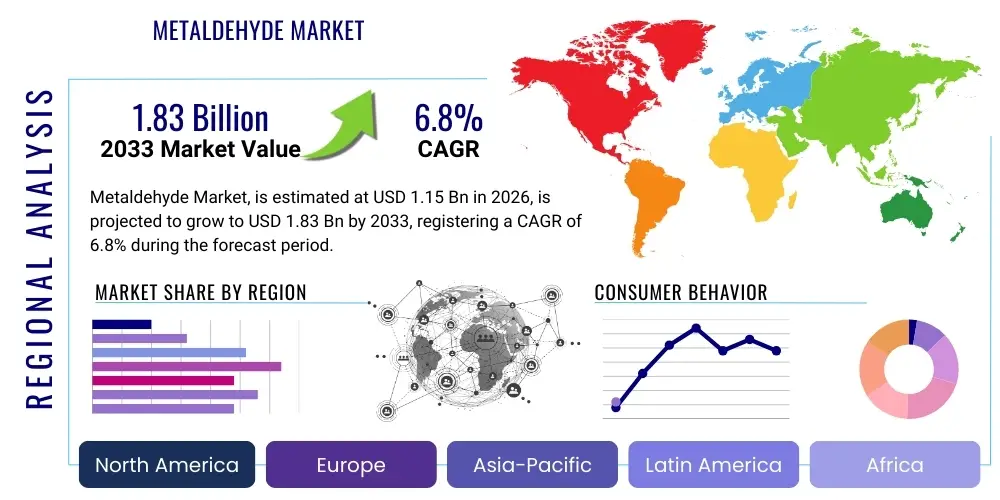

The Metaldehyde Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% (CAGR) between 2026 and 2033. The market is estimated at 1.15 Billion USD in 2026 and is projected to reach 1.83 Billion USD by the end of the forecast period in 2033.

Metaldehyde Market introduction

Metaldehyde, chemically known as 2,4,6,8-tetramethyl-1,3,5,7-tetraoxocane, is a foundational molluscicide extensively utilized worldwide to control gastropods, primarily slugs and snails, which cause significant damage to high-value agricultural crops, ornamental plants, and gardens. Derived from acetaldehyde polymerization, metaldehyde primarily functions as a stomach poison that, upon ingestion by pests, leads to the destruction of mucus-producing cells, severe dehydration, and eventual mortality. Its efficacy, combined with relative cost-effectiveness and ease of application, has cemented its role as a critical component in traditional and conventional crop protection strategies, particularly in regions characterized by high moisture and humidity favorable for gastropod proliferation. The substance is typically formulated into highly attractive baits, often consisting of bran, rice, or other edible matrices, to ensure targeted ingestion by the target pests while minimizing broad environmental exposure.

The primary applications of metaldehyde span professional agriculture, focusing heavily on protecting vulnerable crops such as cereals, oilseeds, potatoes, and various fruits and vegetables, which are highly susceptible to early-stage mollusk damage. Beyond large-scale farming, metaldehyde formulations are also indispensable in horticulture, controlling pests in greenhouses, nurseries, and managed turf environments, including golf courses and public parks. The enduring benefit of using metaldehyde centers on its rapid knockdown power and reliable efficacy under diverse environmental conditions, providing growers with a dependable solution for managing sudden and severe mollusk infestations that could otherwise result in substantial economic losses and yield reductions. Furthermore, innovations in formulation science have led to the development of robust, wet-proof pellets, which maintain their structural integrity and palatability even after exposure to irrigation or rainfall, thereby enhancing their persistence and overall effectiveness in the field.

Driving factors for the sustained demand for metaldehyde include the expansion of protected cropping areas globally, the increasing intensity of agricultural practices necessitated by rising population demands, and the documented development of resistance in target pest populations to some alternative active ingredients. Although facing regulatory pressures, the specific mode of action offered by metaldehyde remains difficult to substitute entirely in certain high-risk cropping systems, ensuring its continued relevance. The market is also heavily influenced by climatic variables; regions experiencing prolonged periods of mild, wet weather often witness heightened slug and snail activity, directly translating into increased emergency demand for effective molluscicides like metaldehyde, emphasizing its role as a tactical, necessary tool in integrated pest management (IPM) programs where conventional chemical control is deemed essential.

Metaldehyde Market Executive Summary

The Metaldehyde market exhibits moderate but stable growth, primarily driven by persistent challenges posed by gastropod pests in global agriculture and horticulture, especially in temperate regions. Business trends indicate a strong focus on enhancing product safety profiles, largely in response to stringent regulatory scrutiny concerning non-target organism risk, particularly domestic animals and wildlife. Key manufacturers are strategically investing in developing less concentrated, highly precise pellet formulations that degrade more rapidly post-application or incorporate bittering agents (such as Bitrex) to mitigate accidental ingestion risks, ensuring the product aligns better with evolving public safety and environmental standards. Furthermore, regional supply chains are becoming more localized, aiming to reduce logistics costs and provide timely delivery during peak planting and pest seasons, which is crucial for maximizing efficacy and minimizing crop loss, reflecting a shift towards more resilient and responsive market operations.

Regional trends reveal significant market concentration in Europe and North America, historically the largest consumers due to extensive farming of slug-susceptible crops like oilseed rape, wheat, and specialty produce, coupled with high awareness and established distribution networks. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, spurred by intensified rice and high-value vegetable production in countries like China and India, where favorable climatic conditions increasingly support mollusk proliferation. Conversely, regulatory hurdles are most pronounced in the European Union, leading to phased withdrawals or severe restrictions on usage, prompting regional manufacturers to explore high-precision application technologies, such as GPS-guided variable rate applicators, to demonstrate responsible stewardship and maintain market access by minimizing environmental loading.

Segmentation trends highlight the dominance of the granular and pelleted formulations segment, which offers superior handling, targeted efficacy, and improved persistence compared to liquid alternatives. The agricultural sector remains the most significant end-user, though the non-crop area application segment, encompassing professional lawn and garden care and pest control operations, is showing specialized growth driven by heightened aesthetic standards for commercial properties and residential landscaping. There is a perceptible movement toward integrating metaldehyde applications within sophisticated Integrated Pest Management frameworks, positioning it not as a standalone solution but as a targeted intervention tool used judiciously when mollusk population thresholds necessitate chemical control, ensuring compliance with sustainable farming principles and retailer supply chain requirements.

AI Impact Analysis on Metaldehyde Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Metaldehyde market often revolve around how precision agriculture, fueled by AI, might either reduce the need for widespread chemical application or optimize its deployment, potentially extending the product's lifespan amidst regulatory pressures. Users frequently inquire about AI's role in predictive modeling—specifically, forecasting slug and snail outbreaks based on complex environmental data (soil moisture, temperature, crop growth stage) to enable just-in-time, localized metaldehyde application. Key concerns also focus on whether AI-driven robotic applicators could drastically lower dosage rates while maintaining field efficacy, thereby addressing public safety and environmental contamination worries associated with current broadcasting methods, and how data analytics might influence the formulation design itself, optimizing pellet size, durability, and attractiveness based on real-time field data feedback.

The integration of AI into mollusk pest management is poised to transform the Metaldehyde distribution and usage paradigms, shifting the market emphasis from volume sales towards value-added, data-driven services. AI algorithms, leveraging satellite imagery, drone surveillance, and ground-based sensors, can now create highly accurate pest density maps, identifying specific hotspots within a field that require intervention, which drastically contrasts with traditional uniform blanket application methods. This hyper-localization capability directly leads to substantial reductions in the total amount of metaldehyde applied per hectare, improving economic efficiency for farmers while concurrently diminishing the environmental footprint. This shift is crucial for preserving the utility of metaldehyde in markets facing stringent usage restrictions, proving that advanced technology can facilitate the responsible use of conventional chemistry.

Furthermore, AI facilitates predictive analytics concerning the long-term effectiveness of various pest control rotations. By processing historical infestation data, crop susceptibility indices, and molluscicide performance records, AI models can recommend optimal timing for metaldehyde application, often identifying narrow windows of highest efficacy, thereby preventing the waste associated with poorly timed treatments. This data-centric approach also extends to supply chain management, where AI-powered forecasting tools help manufacturers predict regional demand fluctuations based on real-time climate predictions, optimizing inventory levels, and ensuring that distributors can supply the market rapidly when environmental conditions trigger widespread outbreaks. Consequently, AI does not necessarily substitute metaldehyde but refines its usage, supporting its continued, highly targeted inclusion within modern, sustainable farming systems.

- AI-driven pest mapping enables hyper-localized, spot treatment application of metaldehyde, drastically reducing overall usage volume.

- Predictive modeling forecasts mollusk outbreaks based on environmental variables (e.g., soil moisture, rainfall), optimizing application timing for maximum efficacy.

- AI-integrated drone and robotic systems facilitate variable rate technology (VRT) application, ensuring precise dosing only where infestation thresholds are met.

- Data analytics assist manufacturers in formulating optimized metaldehyde baits (e.g., size, palatability) based on real-world consumption patterns and field performance feedback.

- Enhanced supply chain logistics using AI forecasting ensure timely product availability during critical, climate-driven pest outbreak windows.

DRO & Impact Forces Of Metaldehyde Market

The dynamics of the Metaldehyde market are dictated by a powerful combination of factors encompassing sustained agricultural need, severe environmental and regulatory constraints, and innovative technological opportunities. Key drivers include the inherent susceptibility of major global crops, such as oilseed rape and wheat, to mollusk damage, especially during vulnerable early growth stages, where the application of a highly effective, fast-acting molluscicide is paramount for securing yields. Furthermore, the development of documented resistance to alternative, less potent active ingredients, such as ferric phosphate, in certain geographic areas, reinforces the crucial reliance on metaldehyde as the primary chemical control option, particularly in conventional farming systems where high efficacy is non-negotiable. This dependency ensures a stable, foundational demand for the product, insulating it partially from economic downturns specific to other agricultural inputs.

However, the market faces profound restraints, primarily stemming from heightened environmental scrutiny regarding the persistence and toxicity of metaldehyde, particularly its risks to non-target organisms like pets, wildlife, and aquatic life. Regulatory bodies across key Western markets, notably in the European Union and the UK, have imposed strict usage limits, application buffers near water bodies, and, in some cases, outright bans or phased withdrawals, severely restricting market access and forcing substitution strategies. The pervasive negative public perception, amplified by media coverage concerning pet poisonings, also compels farmers and governing bodies to seek cleaner, bio-based alternatives, placing significant downward pressure on volume growth and necessitating substantial investment in risk mitigation strategies, such as the incorporation of deterrents.

Opportunities for growth are concentrated in the development and marketing of advanced, safer formulations, specifically those utilizing encapsulation or highly durable pellet technology designed to minimize dust drift and aquatic contamination while ensuring that the active ingredient remains localized and effective. The expansion of precision agriculture techniques, as discussed in the AI analysis, offers a crucial pathway for market longevity, allowing manufacturers to promote metaldehyde as a precise, necessary tool within Integrated Pest Management (IPM) protocols, rather than a broad-spectrum chemical. Moreover, expanding market penetration into high-growth agricultural regions in Asia and South America, where intensification of crop production is accelerating and mollusk pest issues are becoming more prevalent, represents a significant avenue for volume growth, offsetting regulatory declines observed in mature Western markets.

Segmentation Analysis

The Metaldehyde market segmentation is fundamentally structured around the physical form of the product, the environment in which it is applied, and the specific crop type being protected, reflecting the diverse needs of end-users ranging from large-scale commercial farmers to residential horticulturists. Analyzing these segments provides strategic insights into consumer preferences and regulatory hotspots, particularly concerning the shift from less durable, older formulations toward high-quality, weather-resistant pellets. The dominance of the pelleted segment highlights the industry's success in addressing historical challenges related to product effectiveness under wet conditions and improved targeting, ensuring efficacy is maintained even after heavy rainfall or irrigation, which is critical for successful mollusc control.

Segmentation by application clearly delineates the massive influence of the professional agriculture sector, which accounts for the vast majority of consumption due to the high acreage of susceptible field crops globally and the acute need to prevent economically significant damage. Within agriculture, the crop type segmentation reveals that cereals & grains, and particularly oilseeds (like canola/oilseed rape), are the primary drivers of demand, given their high susceptibility to mollusk damage during critical early growth stages. Conversely, the non-crop segment, although smaller in volume, demands specialized, often aesthetically pleasing formulations suitable for commercial landscaping and public amenity areas, highlighting a divergence in performance requirements across different end-use markets.

The strategic implication of these segmentations lies in tailoring product development and marketing efforts. Manufacturers are increasingly focused on creating low-dose, high-efficacy pellets targeted specifically for large-scale row crops, optimizing delivery systems for aerial or precision application. Simultaneously, the market is seeing specialized, higher-margin products developed for the fruits & vegetables segment, which requires extremely strict residue control and compliance with specialized organic or low-input farming standards, showcasing the need for adaptability in formulation strategy to navigate complex residue limit restrictions imposed by major retailers and export markets.

- By Type: Granules, Pellets, Liquid Formulations.

- By Application: Agriculture (Field Crops, Specialty Crops), Horticulture (Nurseries, Greenhouses), Non-Crop Areas (Residential, Commercial Turf).

- By Crop Type: Cereals & Grains (Wheat, Barley), Fruits & Vegetables (Lettuce, Strawberries), Oilseeds & Pulses (Oilseed Rape, Peas), Turf & Ornamentals.

Value Chain Analysis For Metaldehyde Market

The Metaldehyde value chain initiates with the upstream supply of fundamental petrochemical precursors, primarily acetaldehyde, which is critical for the synthesis of the metaldehyde polymer. This upstream phase requires specialized chemical manufacturing capabilities and is subject to volatility in global crude oil and natural gas markets, which dictates the cost structure of the raw materials. Following the synthesis, the active ingredient is then passed to specialized formulators who blend it with inert carriers, attractants (like bran or molasses), stabilizers, and often the bittering agent (Bitrex) to create the final commercial molluscicide baits, predominantly pellets or granules. This formulation stage is highly capital-intensive, requiring strict quality control to ensure uniform pellet size, density, and persistence in the field, which are direct determinants of product efficacy and market acceptance.

The midstream component involves rigorous quality assurance, packaging, and regulatory compliance clearance, which is particularly challenging for metaldehyde due to the varied and stringent restrictions across different global regions regarding application rates and environmental safety data requirements. The downstream distribution network is complex, relying heavily on established agricultural channels. This includes large multinational agrochemical distributors, regional cooperatives, specialized pest control wholesalers, and increasingly, direct e-commerce channels for smaller, residential applications. Direct sales often cater to very large commercial farming operations seeking bulk purchasing, while indirect channels through retail garden centers dominate the consumer and smaller professional horticulture segments, emphasizing the need for a multi-faceted distribution strategy.

The efficiency of this value chain is significantly impacted by seasonal demand cycles and highly localized weather events; timely delivery of products during peak planting and pest emergence periods is paramount, making reliable logistics and inventory management critical success factors. Innovations in the value chain are focused on utilizing advanced manufacturing techniques, such as micro-encapsulation, to improve the safety profile and persistence of the finished product, thereby increasing its competitiveness against alternative bio-molluscicides. Furthermore, integrating digital tools to provide application advice and regulatory compliance documentation enhances the value proposition for the end-user, ensuring responsible product stewardship throughout the supply chain and maintaining compliance with rapidly changing environmental standards.

Metaldehyde Market Potential Customers

The primary and most significant customer segment for metaldehyde products comprises large-scale commercial farming enterprises dedicated to the production of high-value and mollusk-susceptible crops. This includes, critically, growers of oilseed rape (canola), winter wheat, potatoes, and various leafy vegetables such as lettuce and brassicas, particularly in temperate climates where persistent moisture favors slug and snail populations. These customers utilize metaldehyde as a preventative measure and a critical curative intervention tool, making purchasing decisions based heavily on documented efficacy, weather-proof formulation quality, and cost-per-acre effectiveness. Their purchasing cycles are closely tied to seasonal planting schedules and real-time pest monitoring data, typically sourcing products in high volume through agricultural cooperatives or direct contracts with major agrochemical distributors.

A secondary, yet crucial, customer base is found within the professional horticulture and specialty agriculture sector, including greenhouse operations, ornamental plant nurseries, and specialty crop producers (e.g., strawberries, wine grapes). These end-users demand pristine, blemish-free produce or plants, making zero-tolerance for pest damage essential, which often mandates the reliable efficacy of metaldehyde. This segment tends to prioritize product safety and specialized application methods, often utilizing smaller pack sizes and requiring products that comply with integrated pest management (IPM) standards applicable to protected environments. Decision-making here is heavily influenced by technical advisors, certifying bodies, and the need to meet strict residue limits imposed by export markets and high-end retailers, leading to preference for products with detailed use instructions.

The third major customer category encompasses facility managers, turf professionals, and residential consumers. Turf managers, particularly those maintaining golf courses, sports fields, and public parks, rely on metaldehyde for controlling slugs that damage high-quality turf grass, where aesthetic standards are exceptionally high. The residential segment, though consuming lower volumes individually, represents a large base of customers purchasing products through retail garden centers for use in small-scale vegetable gardens and landscaping. These retail products are heavily regulated concerning consumer safety and are often clearly branded with usage warnings and non-toxic additives, ensuring they are accessible but minimize risk to household members and pets. The purchasing decisions in this segment are significantly influenced by brand reputation, perceived safety, and ease of use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.15 Billion USD |

| Market Forecast in 2033 | 1.83 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, W. Neudorff GmbH KG, AMVAC Chemical Corporation, Huihe Chemical, Adama Agricultural Solutions Ltd., Gowan Company, Certis USA, Jiangsu Huifeng Agrochemical Co. Ltd., Green Dragon I & E Co. Ltd., Sino Harvest Chemical Co. Ltd., Limaru NV, Bailing Agrochemical, Arysta LifeScience (UPL), Sipcam Agro USA, BASF SE, Bayer CropScience, Syngenta AG, Drexel Chemical Company, PBI Gordon Corporation, Marrone Bio Innovations |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metaldehyde Market Key Technology Landscape

The technology landscape for the Metaldehyde market is increasingly focused on formulation science and precision application methods designed to mitigate environmental risks while maximizing targeted efficacy, moving away from simple bulk chemical delivery. A critical technological advancement involves the development of high-quality, extruded pellet technology. These modern pellets are engineered for exceptional hardness and wet-weather durability, ensuring they remain palatable and structurally sound despite exposure to irrigation or prolonged rainfall, a significant improvement over older, easily dissolved granular forms. Furthermore, advancements in pellet design often include optimized particle size distribution, which directly influences the likelihood of slug consumption and reduces the amount of non-target contamination risk, thereby supporting responsible usage protocols required by regulators.

Another pivotal area of technological innovation is the integration of advanced application machinery, especially Variable Rate Technology (VRT) systems, often controlled by GPS and digital mapping software. This technology allows farmers to utilize field scouting data and AI-generated maps of pest hotspots to apply metaldehyde only in areas where mollusk population thresholds are met, achieving precise spot treatments rather than indiscriminate blanket coverage. The VRT approach dramatically reduces the overall quantity of active ingredient used across an entire farm, translating directly into reduced environmental load and substantial cost savings for the grower, which enhances the sustainability profile of the molluscicide and provides a key defense against regulatory efforts to restrict its use.

Finally, chemical modification and additive technologies are essential to the current landscape. This includes the mandated or voluntary incorporation of strong bittering agents, such as denatonium benzoate (Bitrex), into bait formulations. While Bitrex does not affect mollusc consumption, it acts as a taste repellent to mammals (including pets and children), significantly decreasing the risk of accidental poisoning—a critical marketing and safety technology. Furthermore, research is ongoing into developing metaldehyde complexes that exhibit faster environmental degradation profiles post-application, aiming to maintain acute molluscicidal activity while minimizing long-term persistence in soil and water systems, which is the core regulatory concern dictating the product's future market viability and necessitating substantial R&D investment.

Regional Highlights

Geographic market performance is highly uneven due to disparate regulatory environments and regional agricultural focus areas, though temperate regions globally remain central to metaldehyde consumption because of climatic factors conducive to mollusk breeding. North America, particularly the US and Canada, maintains a robust market sustained by extensive oilseed and grain cultivation, where the product is essential for managing persistent slug pressure during vulnerable planting periods, although regulatory focus on aquatic safety is becoming increasingly stringent in critical agricultural watersheds.

- North America (NA): Characterized by high usage in large-scale agriculture, particularly in the Midwest (corn, soybeans) and Pacific Northwest (specialty crops). The market is driven by efficacy demands but faces evolving state-level restrictions regarding runoff prevention and water quality protection, necessitating VRT deployment.

- Europe: Historically the largest market, though facing severe regulatory fragmentation. The EU's restrictive approach, including bans in certain member states like the UK (though usage often returns after appeals), mandates the adoption of ultra-low application rates and strict compliance protocols, focusing the market intensely on high-specification, premium safety formulations.

- Asia Pacific (APAC): Expected to exhibit the highest growth rate, fueled by agricultural intensification in China, India, and Southeast Asia. The expanding cultivation of high-value crops (rice, vegetables) and less stringent immediate regulation compared to the West drives demand, establishing this region as the future volume growth engine.

- Latin America (LATAM): A moderate but growing market, primarily utilizing metaldehyde for non-conventional crops and high-intensity horticulture. Market expansion is correlated with increased investment in modern agricultural techniques and the development of organized distribution channels tailored for efficient product delivery in diverse climates.

- Middle East and Africa (MEA): Represents the smallest current market share, limited by diverse climate profiles and specialized farming systems. Demand is restricted to localized, irrigated agricultural zones and specialty crop production (e.g., flowers, high-end produce) where pest control standards must meet export requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metaldehyde Market.- Lonza Group AG

- W. Neudorff GmbH KG

- AMVAC Chemical Corporation (American Vanguard Corporation)

- Huihe Chemical (Jiangsu Huihe Agrochemical Co., Ltd.)

- Adama Agricultural Solutions Ltd.

- Gowan Company, LLC

- Certis USA LLC (Certis Biologicals)

- Jiangsu Huifeng Agrochemical Co. Ltd.

- Green Dragon I & E Co. Ltd.

- Sino Harvest Chemical Co. Ltd.

- Limaru NV

- Bailing Agrochemical Co., Ltd.

- Arysta LifeScience (UPL Limited)

- Sipcam Agro USA, Inc.

- BASF SE

- Bayer CropScience AG

- Syngenta AG

- Drexel Chemical Company

- PBI Gordon Corporation

- Marrone Bio Innovations (part of Bioceres Crop Solutions)

Frequently Asked Questions

Analyze common user questions about the Metaldehyde market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the long-term demand for metaldehyde despite environmental concerns?

The persistent demand for metaldehyde is fundamentally driven by its high efficacy and unique mode of action against slugs and snails, which remains difficult to replicate with bio-based or alternative chemical options, particularly in high-moisture agricultural environments. Furthermore, increasing global acreage of susceptible crops (like oilseed rape and wheat) and documented cases of mollusk resistance to ferric phosphate compounds necessitate the continued, targeted use of metaldehyde as an essential tool in rotation for effective mollusk control and yield security.

How are strict regulatory environments impacting metaldehyde market growth, particularly in Europe?

Stringent regulatory environments, especially in the European Union, are the primary restraint on market volume growth. These regulations enforce lower application rates, mandate the incorporation of bittering agents for safety, and impose significant restrictions on use near water bodies due to aquatic contamination risks. This has forced manufacturers to prioritize investment in advanced, safer pellet formulations and precision application technologies (AEO: Variable Rate Technology) to maintain compliance and market viability, shifting the focus from volume to high-value, precise solutions.

What technological innovations are being implemented to improve the safety and environmental profile of metaldehyde products?

Key technological innovations center on formulation science, specifically high-durability, extruded pellets that resist dissolution in rain and improve targeting, minimizing environmental runoff. Furthermore, the inclusion of bittering agents (like Bitrex) deters accidental ingestion by non-target mammals and pets. Advanced application through precision agriculture tools (GPS-guided VRT) ensures the chemical is applied only to necessary hotspots, dramatically reducing the overall quantity released into the environment.

Which regional market is anticipated to show the highest growth rate for metaldehyde consumption?

The Asia Pacific (APAC) region is projected to register the highest growth rate in the metaldehyde market. This growth is primarily fueled by rapid agricultural intensification, increasing production of high-value fruits, vegetables, and rice, coupled with favorable climatic conditions conducive to slug and snail proliferation. While regulations are becoming more structured, they are generally less restrictive than those in mature Western markets, enabling greater product adoption and usage growth.

How does the segmentation by application influence product development strategies for manufacturers?

Segmentation by application dictates specialized product development. The massive commercial agriculture segment demands cost-effective, high-volume, and VRT-compatible formulations. Conversely, the horticulture and non-crop segments require specialized, high-margin, ultra-safe, and often aesthetically discrete formulations suitable for residential areas, greenhouses, or turf management, leading manufacturers to differentiate their offerings based on targeted safety features and application methods rather than generic bulk supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Metaldehyde Market Size Report By Type (99% Metaldehyde, 98% Metaldehyde), By Application (Agricultural, Gardening, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Metaldehyde Market Statistics 2025 Analysis By Application (Agricultural, Gardening), By Type (99% Metaldehyde, 98% Metaldehyde), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Metaldehyde Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (98% Metaldehyde, 99% Metaldehyde), By Application (Gardening, Agricultural, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager