Metallocene Catalyst Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436186 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Metallocene Catalyst Market Size

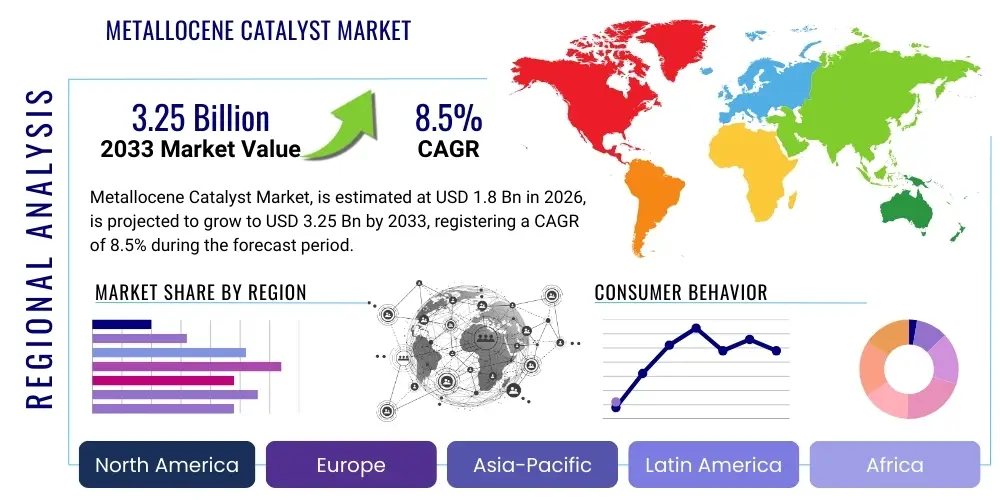

The Metallocene Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.25 Billion by the end of the forecast period in 2033.

Metallocene Catalyst Market introduction

The Metallocene Catalyst Market encompasses advanced chemical compounds, primarily transition metal complexes containing cyclopentadienyl ligands, utilized as highly efficient and selective polymerization catalysts. These catalysts, often referred to as single-site catalysts, revolutionized polymer science by allowing for unprecedented control over polymer microstructure, resulting in materials with superior mechanical, optical, and processing properties compared to conventional Ziegler-Natta catalysts. Key products derived from metallocene catalysis include Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), and specialty Polypropylene (PP) resins.

The primary benefit of utilizing metallocene catalysts lies in their ability to produce polymers with a narrow molecular weight distribution (MWD) and uniform comonomer incorporation. This structural precision leads to enhanced material performance characteristics such as higher impact strength, improved clarity, greater tensile strength, and reduced haze in films. These characteristics make metallocene-catalyzed polymers indispensable in critical applications across the packaging, automotive, construction, and consumer goods sectors, driving continuous demand for advanced catalyst formulations.

Driving factors for this specialized market include the escalating global demand for high-performance plastics, particularly in flexible packaging where thin films require exceptional strength and clarity. Furthermore, the increasing adoption of LLDPE and specialty elastomers in sophisticated applications, such as medical devices and high-voltage cable insulation, necessitates the unique performance attributes that only metallocene technology can reliably deliver. Innovations in catalyst support technology and the development of constrained geometry catalysts (CGCs) are further expanding the market's application landscape.

Metallocene Catalyst Market Executive Summary

The Metallocene Catalyst Market is currently characterized by intense technological competition and a strong focus on sustainability and material efficiency. Business trends indicate a shift toward developing tailored catalyst solutions capable of handling diverse feedstock streams, including bio-based olefins, to meet evolving environmental regulations and consumer preferences. Major petrochemical players are investing heavily in process optimization and capacity expansion, particularly in high-growth regions like Asia Pacific, where polymerization plant construction is accelerating to serve massive domestic and export markets for flexible and rigid packaging solutions. The integration of advanced computational chemistry techniques is streamlining the discovery and scaling of new metallocene structures.

Regional trends highlight the Asia Pacific as the dominant market, driven by rapid industrialization, high consumption rates in China and India, and significant investments in downstream polymer processing capabilities. North America and Europe, while mature, remain crucial hubs for research, development, and the production of premium, specialized metallocene grades required for advanced applications such as high-temperature automotive components and precision medical packaging. Regulatory pressures in Europe concerning plastic waste and circular economy mandates are simultaneously driving innovation toward recyclable, high-purity metallocene-based polymers.

Segment trends underscore the dominance of the Polyethylene (PE) application segment, specifically LLDPE, owing to its versatility in film and packaging applications. Catalyst manufacturers are focusing on maximizing productivity and optimizing product yield, leading to the rapid commercialization of supported metallocene systems that offer better handling and integration into existing polymerization processes. The constrained geometry catalyst (CGC) segment is experiencing robust growth due to its capability to produce specialized plastomers and elastomers with unique flexibility and sealing properties, capturing high-value niches within the market.

AI Impact Analysis on Metallocene Catalyst Market

Common user questions regarding AI's impact on the Metallocene Catalyst Market primarily revolve around how machine learning can accelerate catalyst discovery, optimize polymerization reactor conditions, and predict polymer properties before synthesis. Users are keen to understand if AI can reduce the high cost and long development cycles associated with traditional high-throughput experimentation (HTE) for new catalyst systems. Key concerns also address the integration of complex simulation data (molecular dynamics, DFT calculations) with real-world plant operational data to enhance predictive maintenance and quality control in polymer production lines. The overarching theme is the expectation that AI and material informatics will be transformative tools for achieving novel catalyst efficiency, rapid material design, and sustainable manufacturing practices.

- AI accelerates the discovery of novel metallocene structures by screening vast chemical spaces using computational models.

- Machine learning algorithms predict optimal catalyst synthesis parameters, minimizing trial-and-error in laboratory scale-up.

- Predictive analytics optimize polymerization reactor temperatures, pressures, and residence times to maximize product yield and quality consistency.

- AI-driven material informatics correlates catalyst structure with final polymer properties (e.g., MWD, density, crystallinity) for customized material development.

- Advanced process control utilizing AI minimizes off-spec production, improving efficiency and reducing waste in polymer manufacturing facilities.

- Implementation of digital twins models sophisticated reactor hydrodynamics, enabling virtual testing of new catalyst formulations.

- AI tools enhance intellectual property management by identifying potential patent spaces for new single-site catalyst compositions.

DRO & Impact Forces Of Metallocene Catalyst Market

The Metallocene Catalyst Market is fundamentally driven by the expanding need for high-performance, lightweight plastics across various industries, coupled with stringent quality requirements that conventional catalysts struggle to meet. However, high capital investment requirements and complex patent landscapes pose significant constraints. The opportunity lies in leveraging sustainability trends by developing catalysts suitable for recycled and bio-based feedstocks, while the overarching impact forces stem from technological sophistication and intense competition among established chemical giants.

Drivers: Key market drivers include the rapid expansion of the flexible packaging industry, demanding superior film strength and clarity achievable only through metallocene LLDPE. Furthermore, the automotive sector's continuous drive for lightweighting vehicles to improve fuel efficiency and reduce emissions necessitates high-strength, durable metallocene elastomers and polypropylene grades. Global capacity expansions in polyethylene and polypropylene production, particularly in cost-effective regions, directly boost the consumption of these specialized catalysts, as polymerization processes become more demanding regarding catalytic efficiency.

Restraints: Significant restraints include the high initial cost of metallocene catalysts compared to their conventional counterparts (Ziegler-Natta), which can deter smaller producers. The market is also heavily regulated by complex and overlapping patent issues, restricting access to key technologies and increasing licensing costs. Furthermore, the sensitivity of metallocene catalysts to impurities in the olefin feed stream necessitates ultra-pure raw materials, adding complexity and operational expense to the polymerization process, especially in older manufacturing facilities.

Opportunities: Opportunities abound in the development of next-generation supported catalysts that offer improved stability and productivity in industrial reactors. The push toward circular economy solutions creates demand for metallocene systems that can handle impurities derived from chemical recycling processes or catalysts capable of copolymerizing sustainable monomers (e.g., bio-ethylene). Furthermore, diversification into niche high-value applications, such as specialized sealants, advanced composite matrices, and insulation materials for electric vehicles, provides substantial growth avenues.

Segmentation Analysis

The Metallocene Catalyst Market is primarily segmented based on catalyst type (Zirconocene, Titanocene, Hafnocene), the polymer application (Polyethylene, Polypropylene, Elastomers), and the final application industry (Packaging, Automotive, Construction). Understanding these segments is crucial as market dynamics vary significantly—for instance, zirconocene catalysts dominate the production of high-performance PE, while specialized titanocene and hafnocene systems are gaining traction in ultra-high molecular weight applications and specialty copolymer synthesis. The choice of catalyst directly impacts the physical and mechanical properties of the resulting polymer, dictating its suitability for specific end-use environments.

The most lucrative segment remains Polyethylene (PE) production, encompassing LLDPE, MDPE, and HDPE, due to the sheer volume of global demand for packaging materials. However, the fastest-growing segment is expected to be elastomers and specialty polyolefins, driven by the increasing need for high-performance sealing solutions, biomedical components, and flexible film additives. Technological advancements focus on enhancing the thermal stability and longevity of these catalysts, enabling their use under harsher industrial conditions and improving overall cost-effectiveness for polymer manufacturers.

Segmentation analysis allows key market players to tailor their product offerings, focusing on high-productivity systems for bulk plastics or high-selectivity systems for niche, high-margin products like plastomers. The complexity of metallocene chemistry necessitates specialized manufacturing capabilities, leading to clear differentiation between firms specializing in commodity polymer catalysts and those focused on premium, patented formulations for advanced materials used in sectors like aerospace and electronics.

- By Catalyst Type:

- Zirconocene Metallocene Catalysts

- Titanocene Metallocene Catalysts

- Hafnocene Metallocene Catalysts

- Other Metallocene Types (e.g., Constrained Geometry Catalysts - CGCs)

- By Polymer Type:

- Metallocene Polyethylene (mPE)

- m-LLDPE (Linear Low-Density Polyethylene)

- m-HDPE (High-Density Polyethylene)

- m-MDPE (Medium-Density Polyethylene)

- Metallocene Polypropylene (mPP)

- Specialty Polyolefins and Elastomers (e.g., Plastomers, Polyolefin Elastomers - POE)

- Metallocene Polyethylene (mPE)

- By Application (End-Use Industry):

- Packaging (Flexible and Rigid)

- Automotive Components

- Construction Materials

- Consumer Goods

- Wires and Cables (Insulation)

- Medical and Healthcare

- Adhesives and Sealants

- Lubricants and Chemicals

Value Chain Analysis For Metallocene Catalyst Market

The value chain for the Metallocene Catalyst Market begins with complex upstream activities involving the synthesis of high-purity transition metal precursors and specialized ligands (e.g., substituted cyclopentadienes). This foundational stage requires highly skilled chemical synthesis and robust quality control, often involving proprietary processes. Suppliers in this segment include specialty chemical manufacturers that provide key raw materials like zirconium tetrachloride, titanium compounds, and intricate organic ligands, ensuring the purity necessary for effective single-site catalysis. Upstream integration and secure supply chain management are critical due to the sensitivity of these precursors to contamination and price volatility.

The midstream segment involves the actual production of the metallocene catalyst, frequently supported on silica or alumina, followed by rigorous testing and optimization for specific polymerization processes. Major catalyst manufacturers (the core market players) invest heavily in R&D to optimize catalyst loading, activation protocols (using co-catalysts like Methylaluminoxane - MAO), and the physical form of the catalyst (powder, granular) to ensure seamless integration into large-scale polymerization reactors. Distribution channels are typically direct, involving long-term supply agreements between catalyst producers and large petrochemical companies (polymer manufacturers).

The downstream segment encompasses the polymer producers who purchase and utilize the metallocene catalysts to create specialized polyolefins. These downstream users then sell the resulting high-performance resins to converters and fabricators who produce the final goods (e.g., films, moldings, pipes). Direct distribution is essential for providing technical support regarding reactor operation and troubleshooting, while indirect channels may involve specialized distributors for smaller volume or regional polymer producers. The high performance and unique properties of metallocene polymers justify a premium price at the downstream level, ensuring value capture throughout the chain from precursor synthesis to final consumer product.

Metallocene Catalyst Market Potential Customers

The primary customers and end-users of metallocene catalysts are global petrochemical conglomerates and regional polymer producers operating large-scale polymerization facilities. These buyers are typically focused on maximizing reactor throughput, achieving precise control over polymer specifications (especially MWD and density), and maintaining cost efficiency. Their buying decisions are heavily influenced by catalyst activity, stability, and the ability of the resulting polymer to meet stringent specifications for high-value applications, such as specialty films, high-pressure pipes, and advanced molding compounds for durable goods.

Secondary potential customers include specialized resin compounders and niche polymer manufacturers focused on high-performance elastomers (e.g., POE/POP) used in applications requiring superior flexibility, clarity, and sealing performance, such as automotive gaskets or medical tubing. These customers require highly tailored catalyst systems that often involve proprietary co-catalyst technologies. The trend towards in-house production of specialized resins by large industrial groups, aiming for greater control over material properties, further solidifies these petrochemical majors as the most significant consumption nodes in the market.

The ultimate buyers, though indirectly purchasing the catalyst, are the industries utilizing the resulting polymers. These include the flexible packaging sector (demanding high-clarity and strength films), the automotive industry (seeking lightweight, durable components), and the construction sector (utilizing superior, long-lasting piping and insulation). Catalyst suppliers must therefore align their R&D efforts not just with polymer producers, but also with the long-term material demands originating from these crucial end-use sectors to ensure future market relevance and sustained demand for high-performance polyolefins.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.25 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LyondellBasell Industries N.V., Exxon Mobil Corporation, DOW Inc., SABIC, Chevron Phillips Chemical Company LLC, TotalEnergies SE, INEOS Group Holdings S.A., Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., Wanhua Chemical Group Co., Ltd., China Petrochemical Corporation (Sinopec), Mitsui Chemicals, Inc., Grace Davison, Tosoh Corporation, Idemitsu Kosan Co., Ltd., Zibo Luhua Hongjin New Material Co., Ltd., Albemarle Corporation, Advanced Polymer Systems (APS), Sino-Japan Chemical Co., Ltd., Quantum Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metallocene Catalyst Market Key Technology Landscape

The technological landscape of the metallocene catalyst market is dominated by single-site catalysis, which refers to the uniform active sites present in the catalyst structure, enabling precise control over the polymer chain growth and resulting in exceptionally narrow molecular weight distribution (MWD). The shift from early homogeneous metallocene systems (soluble in the reaction medium) to heterogeneous, supported metallocenes represents a key technological advancement. Supported catalysts, typically utilizing silica or alumina as carriers, offer better compatibility with established industrial slurry and gas-phase polymerization processes, improving catalyst handling and reducing reactor fouling, thereby significantly enhancing commercial viability and productivity.

Another pivotal technology is the development of Constrained Geometry Catalysts (CGCs), pioneered by Dow Chemical, which feature a unique half-sandwich structure where the cyclopentadienyl ring is tethered to the metal center. CGCs exhibit exceptional ability to incorporate bulky comonomers like octene, even at high polymerization temperatures, leading to the creation of advanced polyolefin elastomers (POEs) and plastomers with unique elasticity, flexibility, and processing characteristics. This technology has unlocked high-value applications in automotive interiors, footwear, and flexible packaging seals, pushing the performance boundaries beyond what standard metallocene catalysts can achieve.

The emerging technological frontier involves high-throughput experimentation (HTE) coupled with computational chemistry (Density Functional Theory - DFT) to rapidly screen and optimize new ligand designs. Research is focusing on developing catalysts that are robust against poisons (impurities), highly productive at lower concentrations, and capable of producing polymers with highly specialized molecular architectures, such as bimodal or multimodal MWDs, directly in a single reactor. Furthermore, advancements in co-catalyst technology, moving away from high-cost MAO toward modified aluminum alkyls and boron compounds, are essential for improving the overall economic attractiveness and sustainability profile of metallocene catalysis.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily fueled by the massive polymer production capacity expansion in China, India, and Southeast Asia. The region’s growth is driven by rising domestic demand for packaged goods, infrastructure development, and the establishment of new petrochemical mega-projects utilizing metallocene technology to produce high-performance LLDPE and mPP for export and local consumption. Government initiatives supporting manufacturing and favorable cost structures further cement APAC’s dominant position, focusing heavily on bulk mPE production.

- North America: North America is characterized by high technological maturity and a strong focus on innovation, particularly in specialty and high-margin metallocene products, including advanced elastomers and plastomers for the automotive and energy sectors (e.g., cable insulation). The region benefits from abundant, low-cost natural gas feedstock (shale gas), making it a competitive hub for large-scale PE and PP production, driving demand for high-efficiency catalysts and supported metallocene systems.

- Europe: The European market emphasizes stringent regulatory compliance and sustainability, driving demand for metallocene-catalyzed polymers used in high-purity medical applications, food contact packaging, and circular economy solutions. Innovation here centers on catalysts that enable easier recycling and those compatible with bio-based or chemically recycled feedstocks. While growth rates are moderate compared to APAC, the average value per ton of metallocene polymer produced is high due to the focus on specialized, premium grades.

- Latin America (LATAM): Growth in LATAM is tied to fluctuating economic stability and investment cycles, though countries like Brazil and Mexico exhibit steady demand for metallocene polymers in packaging and construction sectors. The market is increasingly influenced by major global players establishing localized production or distribution centers to serve the developing consumer base.

- Middle East and Africa (MEA): MEA is a rapidly growing region, particularly the Middle Eastern petrochemical hub (KSA, UAE), which leverages vast oil and gas reserves to become a major global exporter of bulk polymers. Significant investments in world-scale polymerization plants are driving substantial consumption of metallocene catalysts to produce high-quality PE and PP for international markets, establishing the region as a major force in global polymer supply.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metallocene Catalyst Market.- LyondellBasell Industries N.V.

- Exxon Mobil Corporation

- DOW Inc.

- SABIC

- Chevron Phillips Chemical Company LLC

- TotalEnergies SE

- INEOS Group Holdings S.A.

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- China Petrochemical Corporation (Sinopec)

- Mitsui Chemicals, Inc.

- Grace Davison

- Tosoh Corporation

- Idemitsu Kosan Co., Ltd.

- Zibo Luhua Hongjin New Material Co., Ltd.

- Albemarle Corporation

- Advanced Polymer Systems (APS)

- Sino-Japan Chemical Co., Ltd.

- Quantum Chemical

Frequently Asked Questions

Analyze common user questions about the Metallocene Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between metallocene and Ziegler-Natta catalysts?

Metallocene catalysts are single-site catalysts, meaning they have uniform active centers, which allows for precise control over the polymer architecture, resulting in narrow molecular weight distribution (MWD), superior optical clarity, and enhanced mechanical strength. In contrast, Ziegler-Natta catalysts are multi-site, producing a broader range of polymer chains and less uniform material properties.

Which application segment drives the highest demand for metallocene catalysts?

The Polyethylene (PE) segment, specifically the production of Linear Low-Density Polyethylene (LLDPE) and High-Density Polyethylene (HDPE), is the largest driver of demand. Metallocene-LLDPE (m-LLDPE) is highly valued for producing strong, thin films used extensively in flexible packaging, contributing significantly to market volume.

How do Constrained Geometry Catalysts (CGCs) impact the metallocene market?

CGCs, a specialized type of metallocene, allow for the efficient incorporation of bulky comonomers, enabling the production of high-performance polyolefin elastomers (POEs) and plastomers. This capability expands the metallocene market into high-value specialty areas like flexible seals, automotive components, and advanced medical materials, boosting premium segment growth.

Why is the Asia Pacific region the dominant market for metallocene catalysts?

The Asia Pacific region, particularly China and India, dominates due to rapid industrialization, massive investments in new polymerization capacity, and surging domestic consumer demand for high-quality packaging and plastic products. Favorable government policies and lower operational costs compared to Western regions further solidify its market lead.

What are the key technological restraints limiting wider adoption of metallocene catalysts?

Key restraints include the significantly higher cost of metallocene catalysts compared to traditional alternatives, the high sensitivity to impurities in the olefin feedstock requiring stringent purification processes, and the complexity associated with navigating the extensive, overlapping patent landscape governing catalyst compositions and synthesis methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager