Metallographic Cutting Machine Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438719 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Metallographic Cutting Machine Sales Market Size

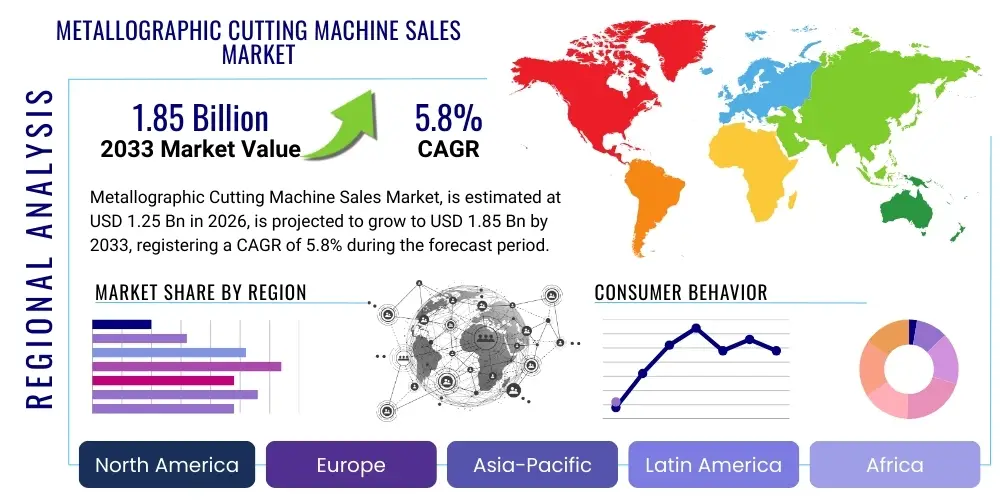

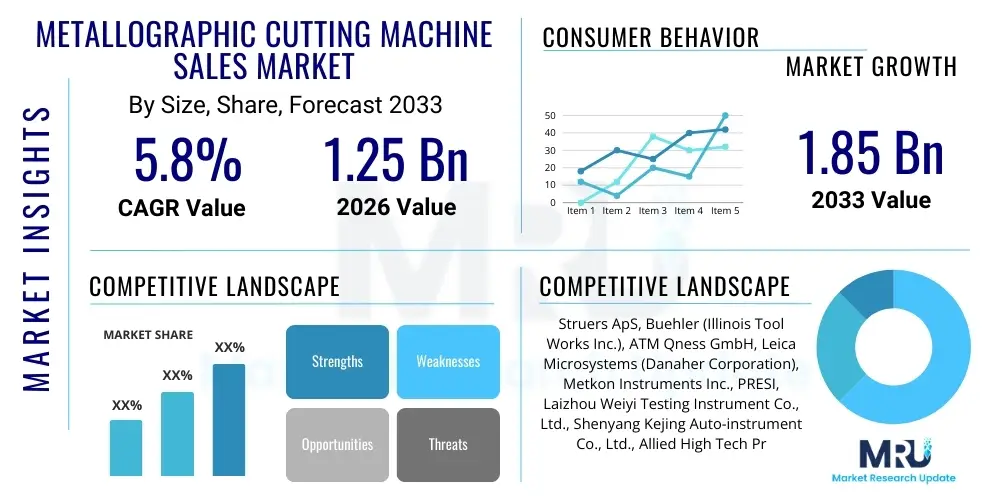

The Metallographic Cutting Machine Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Metallographic Cutting Machine Sales Market introduction

The Metallographic Cutting Machine Sales Market encompasses the global trade of precision instruments designed for preparing material samples for microstructural analysis. These machines are crucial in material science, engineering, and quality control processes, as they facilitate the accurate and deformation-free sectioning of hard materials, composites, ceramics, and metals. Proper sample preparation is foundational for subsequent metallographic examination (polishing, etching, and microscopy), ensuring that the observed microstructure accurately reflects the bulk material properties. The demand for these sophisticated cutting machines is directly proportional to the stringency of quality assurance protocols across critical manufacturing sectors.

Metallographic cutting machines, often categorized as abrasive cutters or precision cutters, utilize specialized blades (diamond, silicon carbide, or aluminum oxide) to achieve clean, cool, and precise cuts, minimizing heat-affected zones and mechanical distortion which could compromise analytical results. Key applications span across the automotive industry for component failure analysis, the aerospace sector for high-reliability material inspection, and the burgeoning electronics industry for examining solder joints and semiconductor packaging integrity. The primary benefit these machines offer is the ability to maintain the integrity of the material structure, a non-negotiable requirement for ISO standards compliance and advanced research initiatives.

Market growth is significantly driven by the escalating global investment in research and development concerning novel materials, particularly lightweight alloys and high-performance composites essential for electric vehicles and advanced infrastructure. Furthermore, the stringent regulatory environment governing material safety and quality in developed and rapidly industrializing economies mandates the use of reliable sample preparation equipment. The continuous advancement in automation and digital control features integrated into newer models—allowing for programmable cutting parameters and enhanced safety features—further catalyzes adoption across academic institutions and industrial laboratories focused on maximizing throughput and reproducibility.

Metallographic Cutting Machine Sales Market Executive Summary

The global Metallographic Cutting Machine Sales Market is experiencing robust growth fueled by technological advancements in automated sample preparation and increasing demand from high-precision engineering sectors. Key business trends indicate a shift towards fully automated, high-throughput systems capable of handling complex geometries and diverse material hardnesses. Manufacturers are focusing on integrating IoT capabilities for remote diagnostics and predictive maintenance, enhancing machine uptime and operational efficiency for end-users. Consolidation within the market remains moderate, though strategic partnerships focusing on software integration and global distribution are becoming more prevalent, aimed at offering integrated materialographic solutions rather than standalone equipment.

Regionally, the Asia Pacific (APAC) market dominates the consumption landscape, driven by massive manufacturing bases in China, Japan, and South Korea, particularly within automotive, electronics, and steel production. North America and Europe maintain strong market shares, characterized by demand for high-end, precision-oriented machinery utilized in aerospace, medical device manufacturing, and advanced research facilities. Emerging regional trends involve significant public and private investment in material science laboratories in nations across Southeast Asia and Latin America, promoting foundational infrastructure development that requires state-of-the-art sample preparation technology.

Segment trends reveal that the semi-automatic and automatic machine types are capturing increasing market share due to their enhanced repeatability and reduced operator dependence compared to manual machines. In terms of end-users, the Automotive and Transportation sector remains the largest segment, driven by constant requirements for quality assurance in engine components, chassis materials, and battery technologies. However, the Electronics and Semiconductor segment is poised for the fastest growth, necessitated by the need for ultra-precise cutting techniques (like low-speed precision cutting) required for delicate, miniaturized components.

AI Impact Analysis on Metallographic Cutting Machine Sales Market

Users commonly inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can automate the notoriously skill-dependent processes of metallographic sample preparation. Key concerns revolve around the integration of AI for optimizing cutting parameters (speed, force, coolant flow) based on material composition and geometry, thereby reducing operator variability and preparation time. Expectations are high regarding AI's potential to provide real-time quality control checks, identifying and correcting potential cutting defects (such as excessive burning or deformation) as they occur, leading to perfect sample integrity on the first attempt. Users also anticipate AI-driven diagnostics for equipment health and predictive maintenance scheduling, minimizing costly unplanned downtime in busy industrial laboratories.

- Optimization of Cutting Parameters: AI algorithms analyze material hardness and microstructure to automatically set optimal cutting speed and force, reducing thermal damage and deformation.

- Predictive Maintenance: ML models utilize operational sensor data (vibration, temperature, current draw) to forecast equipment failure, scheduling preventative maintenance proactively.

- Real-time Quality Assurance: Image recognition coupled with AI monitors the cutting process for signs of sample damage or preparation faults, alerting the operator instantly.

- Automated Sample Handling: Robotics guided by AI streamline the transfer of samples through subsequent preparation steps (cutting, mounting, polishing), improving throughput in high-volume labs.

- Data Integration and Workflow Automation: AI systems integrate cutting data with subsequent microscopic analysis, creating comprehensive digital records for traceability and auditing purposes.

DRO & Impact Forces Of Metallographic Cutting Machine Sales Market

The Metallographic Cutting Machine Sales Market is primarily driven by the burgeoning demand for superior quality control across high-stakes industries, coupled with global regulatory pressures mandating detailed material verification. Opportunities are significantly expanding due to breakthroughs in additive manufacturing (3D printing), which necessitates rigorous metallographic examination of complex, printed structures and novel alloys. However, the market faces restraints, chiefly the high initial capital investment required for advanced automated systems and the lack of standardization in sample preparation protocols across highly diverse industrial applications. These forces create a dynamic environment where precision requirements and technological integration serve as powerful market impact multipliers, pushing manufacturers towards developing smarter, more versatile, and cost-efficient cutting solutions.

A key driver includes the global expansion of the aerospace and defense sector, demanding materials with zero defects, especially in critical components like turbine blades and structural airframe parts, requiring absolute precision in sample preparation. Furthermore, the rapid growth of the electric vehicle (EV) market fuels demand for cutting machines capable of handling complex battery materials and lightweight structural components. Conversely, a major restraint is the specialized nature of the equipment, which limits the total addressable market compared to general-purpose machinery, and the reliance on highly skilled technical staff for complex operations and maintenance. This skill gap can hinder adoption in smaller laboratories or developing regions.

The opportunity landscape is significantly bolstered by the growing emphasis on forensic engineering and failure analysis, particularly in infrastructure projects and product liability cases, where metallographic evidence is crucial. Technological impact forces, such as the miniaturization of electronic components, push the demand for ultra-precision cutters (like linear precision saws) capable of preparing samples without inducing microcracks or contamination. The continuous iteration in abrasive materials and cooling systems also acts as a positive force, improving the speed and quality of the preparation process, thereby enhancing the overall value proposition of new equipment.

Segmentation Analysis

The Metallographic Cutting Machine Sales Market is segmented primarily based on the degree of automation (Type), the type of final application (End-User), and the geographic region. Segmentation by Type distinguishes between manual, semi-automatic, and fully automatic machines, reflecting the trade-off between cost, throughput, and repeatability desired by the user. End-User segmentation provides insight into where the highest demand originates, identifying key sectors such as automotive, aerospace, heavy machinery, and research institutions, each with distinct requirements regarding sample size, material hardness, and cutting speed. This analytical framework allows market participants to tailor their product offerings and distribution strategies effectively based on regional industrial concentration and technological maturity.

- By Type:

- Manual Metallographic Cutting Machines

- Semi-Automatic Metallographic Cutting Machines

- Automatic/Precision Metallographic Cutting Machines

- By End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- Heavy Industrial Machinery

- Electronics and Semiconductor

- Research and Academia

- Medical Devices and Biomedical Engineering

- Oil and Gas/Energy Sector

- By Region:

- North America (NA)

- Europe (EU)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Metallographic Cutting Machine Sales Market

The value chain for metallographic cutting machines begins with upstream activities involving the sourcing of high-precision components, including specialized motors, electronic controls (PLCs, microprocessors), durable chassis materials, and critical consumable inputs like high-grade abrasive or diamond cutting wheels. Key suppliers in this stage must meet stringent quality metrics, as the performance and longevity of the final cutting machine heavily depend on the reliability of these core components. Investment in R&D, particularly in software development for automation and control interfaces, constitutes a significant value-add early in the chain, differentiating premium equipment manufacturers from commodity producers.

Midstream activities involve the design, manufacturing, and assembly of the cutting machines. This phase includes precision engineering of the cutting chamber, incorporation of advanced cooling systems (recirculation units), and rigorous calibration processes to ensure dimensional accuracy and cutting plane parallelism. Distribution forms a critical link, often relying on specialized distributors or agents who possess technical expertise in materialography. Direct sales models are common for large industrial or government contracts, enabling manufacturers to provide immediate technical consultation and customized installation services, capturing a higher margin but requiring greater internal logistical resources.

Downstream activities focus on sales, post-sales support, and consumables supply. The effectiveness of the indirect distribution channel relies on training local representatives in application support and basic maintenance. Indirect channels are prevalent in geographically dispersed markets, while direct sales are preferred in regions with high concentrations of advanced research labs. Crucially, the recurring revenue stream generated from the sale of consumables (cutting blades, coolant additives, cleaning agents) is a significant component of the value chain, ensuring continuous customer engagement and high lifetime customer value for equipment providers.

Metallographic Cutting Machine Sales Market Potential Customers

Potential customers for metallographic cutting machines are primarily organizations engaged in production, quality assurance, research, and failure analysis of engineering materials. These customers typically operate sophisticated laboratories requiring instruments capable of producing highly specific and repeatable samples. The largest segment of end-users includes quality control departments within major manufacturing operations, such as automotive OEMs (Original Equipment Manufacturers) and Tier 1 suppliers, who utilize these machines to verify the integrity and specifications of metal, composite, and ceramic parts crucial for safety and performance compliance.

Another significant customer base resides in the academic and governmental research sectors. Universities, national labs, and material testing facilities continually require high-precision cutting machines for fundamental materials science investigation, new alloy development, and standardized certification testing. These institutions often demand versatility and the highest level of precision, favoring low-speed diamond cutters for delicate or brittle materials. Furthermore, specialized industries like aerospace manufacturing and nuclear energy facilities, due to their stringent zero-defect requirements and regulatory oversight, are premium buyers of fully automated, high-end metallographic solutions.

Emerging potential customers include contract testing laboratories (CT Labs) that provide outsourced material analysis services to smaller manufacturers who cannot justify the investment in their own dedicated labs. Additionally, the rapid expansion of the electronics industry, particularly in micro-component fabrication and printed circuit board (PCB) analysis, drives demand for precision cutters capable of handling highly sensitive, multi-layered assemblies without inducing thermal stress or delamination. These diverse buyer segments share a common need for non-destructive or minimal-damage sample preparation that ensures the reliability of subsequent microscopic analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Struers ApS, Buehler (Illinois Tool Works Inc.), ATM Qness GmbH, Leica Microsystems (Danaher Corporation), Metkon Instruments Inc., PRESI, Laizhou Weiyi Testing Instrument Co., Ltd., Shenyang Kejing Auto-instrument Co., Ltd., Allied High Tech Products, Inc., Qualitest International Inc., Kemet International, Fretz Metallurgical Equipment, ZwickRoell GmbH & Co. KG, Chennai Metco Pvt. Ltd., Nanjing T-Bota Scietech Instruments & Equipment Co., Ltd., Brillant (GmbH), Beijing Ke’ao New Materials Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metallographic Cutting Machine Sales Market Key Technology Landscape

The technological landscape of the metallographic cutting machine market is defined by a shift from traditional, manual abrasive cutting towards fully automated, precision-controlled systems designed to enhance sample quality and repeatability. A key technological development is the integration of advanced servo motors and programmable logic controllers (PLCs) that allow for precise control over cutting speed (RPM), feed rate (mm/min), and cutting force (N). This level of control is paramount to preventing thermal damage or mechanical deformation in sensitive materials, which is particularly critical for composite materials and high-strength steels. Modern machines often feature pulsed cutting modes and oscillating movements to further reduce friction and improve coolant access to the cutting zone, ensuring the integrity of the sample surface.

Another significant technological focus lies in the development of sophisticated cooling and recirculation systems. Effective cooling is essential to dissipate the heat generated during the abrasive process, which can drastically alter the microstructure of the material. Contemporary systems utilize powerful pumps and highly efficient filtration units to maintain optimal coolant flow and cleanliness, extending the life of the cutting wheel and improving preparation efficiency. Furthermore, the consumables themselves represent a significant technological area; manufacturers are continually innovating in abrasive wheel composition (e.g., specialized aluminum oxide or diamond-embedded segments) to optimize performance for specific material classes, from extremely hard alloys to soft, ductile metals.

The rise of Industry 4.0 principles has accelerated the adoption of digital technologies within cutting machines. Features such as touch-screen interfaces, internal memory for storing preparation methods, and network connectivity (IoT) are becoming standard. These integrations allow laboratories to remotely monitor machine status, track usage statistics, and ensure preparation protocol compliance across multiple units globally. For ultra-precision applications, low-speed precision cutters utilizing thin diamond blades remain essential, representing a niche but high-value technological segment focused on minimal material loss and deformation, vital for failure analysis in electronics and biomedical implants.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by immense industrial expansion in China, India, and Southeast Asia. The region benefits from massive investment in automotive manufacturing, consumer electronics production, and heavy infrastructure projects. High volume requirements in QC/QA labs, particularly in steel and metal production, propel the demand for robust, high-throughput automatic cutting machines.

- North America: North America represents a mature market characterized by high demand for advanced, precision-oriented equipment used in specialized sectors like aerospace and defense, medical device manufacturing, and high-level academic research. The region emphasizes automation, data integrity, and compliance with rigorous material certification standards, favoring premium, technology-integrated solutions.

- Europe: Europe maintains a strong market share, particularly due to the automotive sector (Germany, France, Italy) and the established presence of global material science R&D centers. Demand is driven by strict EU directives on product quality and traceability. There is a strong uptake of ergonomic and environmentally friendly cooling systems, reflecting regional sustainability mandates.

- Latin America (LATAM): LATAM is an emerging market with moderate growth, primarily supported by mineral extraction, primary metal processing, and increasing foreign direct investment in manufacturing (Mexico, Brazil). Market penetration is generally focused on semi-automatic and manual machines due to cost considerations, though demand for automated systems is rising with infrastructure modernization.

- Middle East and Africa (MEA): Growth in MEA is concentrated around the petrochemical, oil and gas, and construction sectors, particularly in the GCC countries. Investment in new refineries and material testing centers drives demand for reliable, high-capacity cutting machines suitable for large samples and failure analysis related to infrastructure integrity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metallographic Cutting Machine Sales Market.- Struers ApS

- Buehler (Illinois Tool Works Inc.)

- ATM Qness GmbH

- Leica Microsystems (Danaher Corporation)

- Metkon Instruments Inc.

- PRESI

- Allied High Tech Products, Inc.

- Kemet International

- Laizhou Weiyi Testing Instrument Co., Ltd.

- Shenyang Kejing Auto-instrument Co., Ltd.

- Qualitest International Inc.

- ZwickRoell GmbH & Co. KG

- Chennai Metco Pvt. Ltd.

- Brillant (GmbH)

- Nanjing T-Bota Scietech Instruments & Equipment Co., Ltd.

- Fretz Metallurgical Equipment

- Beijing Ke’ao New Materials Technology Co., Ltd.

- Shanghai Tiansu Automation Equipment Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Metallographic Cutting Machine Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the Automatic Metallographic Cutting Machine segment?

The Automatic segment is expanding rapidly due to the rising need for high repeatability, reduced operator error, and increased throughput in industrial quality control labs. Automation allows for complex, pre-programmed cuts and integrates features such as precise force regulation and sequential cutting, which is crucial for certifying high-reliability components in aerospace and medical sectors.

How does the choice between abrasive cutting and precision cutting impact end-users?

Abrasive cutting is used for larger, harder industrial samples where speed and capacity are prioritized, often resulting in a larger heat-affected zone. Precision cutting (usually low-speed diamond wheel cutting) is reserved for delicate, small, or brittle samples (like electronic components or ceramics) where minimal deformation and material loss are paramount, though it is significantly slower.

Which industry segment holds the largest market share for these cutting machines?

The Automotive and Transportation industry holds the largest market share globally. This dominance is driven by the continuous necessity for metallographic testing of powertrain components, safety structures, and new lightweight materials (including those used in EV batteries) to comply with stringent safety and performance standards.

What technological innovations are currently defining market competition?

Market competition is defined by the integration of smart technologies, specifically IoT connectivity for remote monitoring, AI-driven process optimization for cutting parameters, and enhanced environmental controls like closed-loop coolant filtration systems. Emphasis is also placed on developing cutting wheels with superior material compatibility and longevity.

What is the primary restraint challenging the adoption of high-end metallographic cutters?

The primary restraint is the high initial capital investment required for automated, high-precision systems. This cost barrier limits adoption among smaller laboratories and academic institutions in developing regions, leading them to opt for less expensive manual or semi-automatic models, even if they compromise on repeatability and speed.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager