Metallurgical Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431959 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Metallurgical Equipment Market Size

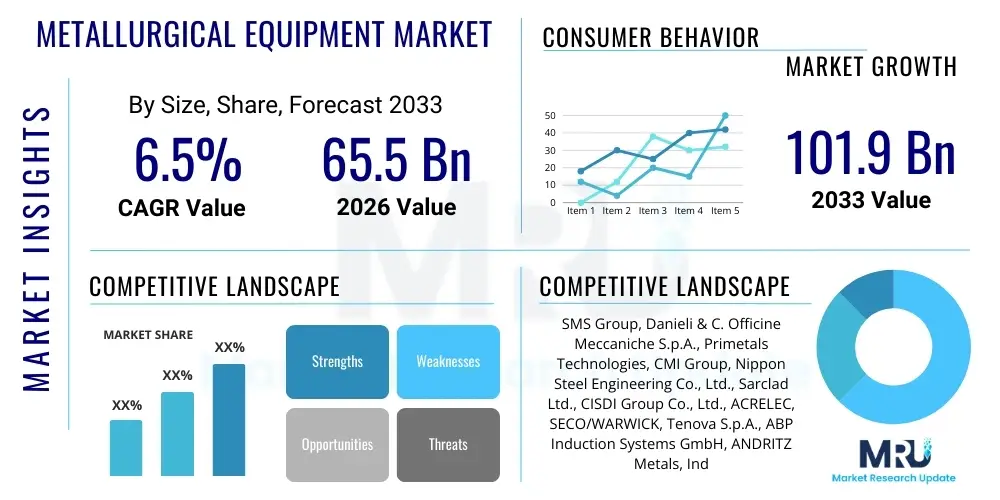

The Metallurgical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 65.5 Billion in 2026 and is projected to reach USD 101.9 Billion by the end of the forecast period in 2033.

Metallurgical Equipment Market introduction

The Metallurgical Equipment Market encompasses machinery and systems vital for processing metals and alloys, spanning the entire production cycle from ore preparation and smelting to casting, forming, and finishing. These sophisticated systems are fundamental to the primary metals industry, including ferrous and non-ferrous sectors such as steel, aluminum, copper, and specialized alloys. Key product categories include blast furnaces, electric arc furnaces (EAFs), induction melting systems, continuous casting machines, rolling mills, forging presses, and specialized heat treatment apparatus. The performance of this equipment directly impacts metal quality, energy efficiency, and operational throughput in demanding industrial environments.

Major applications of metallurgical equipment are concentrated heavily in the construction, automotive, aerospace, and general manufacturing sectors, which require vast quantities of processed metal products. For instance, the demand for high-strength, lightweight steel in the automotive industry drives innovation in rolling mill technology, while infrastructure development necessitates high-volume continuous casting machinery. The benefits of modern equipment include significantly reduced energy consumption through optimized processes, enhanced automation for precision control, and improved environmental compliance, particularly concerning emissions and waste management. Advanced automation systems integration, such as Level 2 and Level 3 automation, further ensures consistency and reduces manual error, contributing to superior product quality and operational safety.

Driving factors for market growth include rapid industrialization and urbanization in emerging economies, notably in Asia Pacific, necessitating extensive steel and metal production capacity expansion. Furthermore, the global emphasis on decarbonization is accelerating the adoption of cleaner technologies, such such as hydrogen-ready furnaces and high-efficiency electric arc furnaces, driving capital investment into new equipment or major modernization projects. Increased demand for specialized and high-performance alloys for electric vehicles (EVs) and renewable energy infrastructure also stimulates investment in advanced secondary metallurgy equipment, ensuring the metallurgical sector remains a cornerstone of global industrial progress and technological advancement.

Metallurgical Equipment Market Executive Summary

The global Metallurgical Equipment Market is characterized by robust investment cycles driven primarily by modernization initiatives focused on energy efficiency and emission reduction, particularly within the steel production landscape. Business trends show a strong shift towards integrated smart manufacturing solutions, leveraging Industrial Internet of Things (IIoT) sensors and predictive maintenance algorithms to minimize downtime and optimize operational parameters. Key vendors are increasingly offering complete turnkey solutions, integrating melting, refining, and casting processes, rather than just standalone machinery. Moreover, geopolitical shifts impacting raw material supply chains are encouraging regional self-sufficiency, leading to localized capacity build-up and technological specialization, especially concerning high-grade steel and advanced material production.

Regionally, Asia Pacific maintains its dominance, spurred by sustained infrastructural spending in China, India, and Southeast Asian nations. However, Europe and North America are experiencing high-value growth driven by the replacement of aging infrastructure and stringent environmental regulations demanding the adoption of greener technologies, such as increased reliance on scrap-based steel production utilizing advanced EAFs. Latin America and the Middle East and Africa (MEA) represent significant future growth opportunities, fueled by nascent industrial expansion and investments in mining and mineral processing capacities. The regional disparity in equipment demand is high; mature markets prioritize digitalization and sustainability, while emerging markets focus on basic capacity expansion and cost-effectiveness.

Segmentation trends highlight the increasing prominence of continuous casting machines (CCMs) and rolling mills, reflecting the high-volume nature of modern metal processing. Within the furnace segment, electric arc furnaces are gaining substantial traction over traditional blast furnaces due to their flexibility and lower carbon footprint, aligning with global climate targets. Furthermore, the rising complexity of alloys requires sophisticated secondary metallurgy equipment, including vacuum degassing units and ladle refining furnaces, exhibiting higher growth rates than primary processing units. The service segment, encompassing maintenance, spare parts, and digital optimization packages, is emerging as a crucial revenue stream for major equipment manufacturers, providing consistent long-term profitability.

AI Impact Analysis on Metallurgical Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Metallurgical Equipment Market frequently revolve around optimizing complex operational processes, such as predictive quality control, energy management in high-temperature environments, and proactive equipment failure detection. Key concerns often focus on the required investment in legacy system integration, data security protocols for proprietary production data, and the need for a specialized workforce capable of maintaining and interpreting AI-driven insights. Users expect AI to significantly reduce variability in metal composition, minimize energy waste during smelting and heating phases, and provide real-time adjustments to casting and rolling parameters, ultimately aiming for zero-defect manufacturing and substantial cost savings across the production lifecycle. The integration of Machine Learning (ML) models is viewed as essential for moving beyond simple process automation toward true cognitive optimization.

AI is transforming the conventional operation of metallurgical plants by enabling high-fidelity digital twins of complex processes like hot rolling and continuous casting. These digital models, powered by machine learning algorithms, allow operators to simulate various scenarios, predict material behavior under stress, and optimize process variables in a risk-free environment before implementing changes on the actual machinery. This predictive capability translates into substantial improvements in yield, reduction in scrap material, and maximization of equipment life. Furthermore, AI-driven computer vision systems are being deployed for automated surface defect detection in finished products, offering precision and speed far exceeding human inspection capabilities, thereby setting new standards for quality assurance in high-volume production settings.

The primary shift introduced by AI lies in transitioning metallurgical operations from reactive maintenance schedules to predictive, condition-based maintenance strategies. By analyzing vast streams of sensor data—including vibration, temperature, acoustic emissions, and motor current signatures—ML algorithms can identify subtle deviations indicative of impending equipment failure days or weeks in advance. This allows maintenance to be scheduled optimally, preventing catastrophic failures, minimizing unscheduled downtime, and significantly extending the lifespan of high-capital machinery such as rolling mill stands and furnace components. This fundamental change not only improves operational efficiency but also reduces the overall Total Cost of Ownership (TCO) for metallurgical assets, making AI integration a critical strategic imperative for market leaders.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature) to forecast equipment failure, dramatically reducing unplanned downtime in rolling mills and continuous casting lines.

- Process Optimization: Machine learning models optimize parameters (e.g., heating temperature, rolling speed) in real-time, leading to reduced energy consumption and improved material yield.

- Quality Control Automation: Computer vision and deep learning systems automate the detection of surface defects in finished products, ensuring consistent, high-precision quality assurance.

- Digital Twin Development: Creation of high-fidelity virtual models for simulation and stress testing of complex metallurgical processes, enhancing operational decision-making.

- Energy Management: AI optimizes energy scheduling and consumption within high-power systems (EAFs, induction furnaces) based on production load and real-time energy prices, maximizing cost savings.

- Smarter Raw Material Blending: Algorithms predict the optimal mix of raw materials (e.g., scrap, iron ore) needed to achieve target metal chemistry with minimal process variations.

- Enhanced Safety Protocols: AI monitors operational zones and worker behavior, identifying potential safety hazards and issuing automated warnings, particularly in hazardous furnace environments.

DRO & Impact Forces Of Metallurgical Equipment Market

The dynamics of the Metallurgical Equipment Market are intricately linked to global economic health, infrastructure cycles, and environmental policy, manifesting in a complex interplay of Drivers, Restraints, and Opportunities. Market propulsion is strongly supported by the need for increased industrial capacity, especially in developing regions where demand for primary metals like steel and aluminum is surging for construction and manufacturing purposes. Simultaneously, the imperative for sustainable production in mature markets acts as a major driver, pushing companies toward investments in high-efficiency, low-emission equipment. These drivers are tempered by significant restraints, particularly the high capital expenditure required for new plant construction or major modernization, coupled with the cyclical nature and volatility of commodity metal prices, which can delay or cancel large-scale projects. However, the opportunity for technological leapfrogging—adopting advanced technologies like automation and AI for optimized operations—presents a compelling growth path for equipment providers and end-users alike.

Impact Forces: The bargaining power of suppliers in this market is moderate to high, as the equipment often involves proprietary technology, specialized engineering expertise, and high barriers to entry for new competitors. Key components, such as high-temperature refractories, advanced sensors, and specialized motors, often come from a limited pool of highly specialized vendors. Conversely, the bargaining power of buyers, typically large steel manufacturers or integrated metal producers, is also high due to the massive size and long-term nature of procurement contracts, allowing them to demand stringent performance guarantees, extensive after-sales service, and competitive pricing. The threat of new entrants is relatively low due to the immense capital requirements, long development cycles, and established relationships between key producers and equipment suppliers, preserving the market structure largely in favor of established global vendors.

Furthermore, the threat of substitutes is primarily technological and regulatory rather than material. While alternative materials like composites or advanced plastics substitute metals in some end-use applications (e.g., automotive lightweighting), the fundamental need for bulk steel, aluminum, and copper remains irreplaceable in infrastructure and heavy industry, thus stabilizing the core demand for metallurgical equipment. Environmental regulations, such as carbon pricing mechanisms and mandated emission standards, exert a powerful and continuous impact, acting as a critical external force that fundamentally reshapes investment priorities, pushing production towards electric-based methods and significantly impacting the viability of older, high-emission equipment, ensuring a continuous cycle of modernization and technological uptake across all major producing regions globally.

Segmentation Analysis

The Metallurgical Equipment Market is systematically segmented based on equipment type, operational process, end-use application, and geographical region to provide granular insights into market dynamics and investment hot spots. The core segmentation by equipment type distinguishes between primary processing machinery (furnaces, converters) and secondary equipment (casting and forming machines), reflecting different stages of metal refinement and shaping. The sophistication and capital intensity vary significantly across these segments, with rolling mills and continuous casting units often dominating in market share due due to their high throughput capacity. The end-use segmentation is crucial, linking equipment demand directly to macro-economic drivers, such as the automotive industry's focus on high-strength steel or the construction sector's need for bulk structural metals, demonstrating a direct correlation between downstream demand variability and equipment investment strategies across the globe.

- By Equipment Type:

- Primary Metal Manufacturing Equipment (e.g., Blast Furnaces, Basic Oxygen Furnaces, Sintering Plants)

- Secondary Metal Manufacturing Equipment (e.g., Electric Arc Furnaces, Ladle Furnaces, Vacuum Degassers)

- Continuous Casting Machines (e.g., Slab Casters, Billet Casters, Bloom Casters)

- Rolling Mills (e.g., Hot Rolling Mills, Cold Rolling Mills, Plate Mills)

- Forging and Pressing Equipment (e.g., Hydraulic Presses, Mechanical Presses)

- Heat Treatment Furnaces and Systems (e.g., Annealing Furnaces, Quenching Systems)

- Material Handling and Auxiliary Equipment (e.g., Cranes, Transfer Cars, Scrap Chargers)

- By Operational Process:

- Melting and Refining

- Casting

- Forming (Rolling, Forging, Extrusion)

- Finishing and Processing

- By End-Use Industry:

- Steel Industry (Ferrous Metals)

- Aluminum Industry

- Copper and other Non-Ferrous Metals

- Foundries and Die Casting

- Aerospace and Defense

- Automotive and Transportation

Value Chain Analysis For Metallurgical Equipment Market

The value chain for metallurgical equipment begins with the upstream segment, dominated by highly specialized component suppliers and raw material providers. This segment includes suppliers of advanced refractories necessary for high-temperature furnace lining, specialized heavy castings and fabrications, proprietary control systems, and complex hydraulic and electrical components. Successful execution in the upstream segment requires intensive R&D to develop materials capable of withstanding extreme thermal and mechanical stresses inherent in metal processing. Key suppliers in this phase often hold significant intellectual property related to materials science and automation technology, giving them substantial leverage in the overall production cost and quality of the final machinery.

The core manufacturing and assembly stage involves the major metallurgical equipment OEMs. These companies focus on design, engineering, system integration, and final assembly of complex machinery like continuous casters and rolling mills. OEMs often manage extensive project lifecycles, from feasibility studies and custom design to commissioning and operator training. Distribution channels are typically direct, given the high capital value and customized nature of the equipment, requiring deep technical engagement between the manufacturer and the end-user. Indirect channels, such as local agents or regional distributors, are occasionally used for smaller standardized components, spares, or less complex equipment, primarily to enhance market penetration in emerging geographies and facilitate faster after-sales service response times.

The downstream segment primarily involves the deployment, operation, and ongoing maintenance of the equipment within integrated steel mills, specialized foundries, and metal processing facilities. This phase is characterized by a strong service component, including maintenance contracts, spare parts supply, technological upgrades, and digitalization services (such as AI integration and process consulting). The relationship between the equipment provider and the end-user is often long-term, spanning the typical 20-30 year operational life of the machinery. End-users’ profitability is directly linked to equipment reliability and efficiency, driving demand for high-quality maintenance and rapid access to proprietary spare parts, which represents a crucial and stable revenue stream for the OEMs throughout the entire service lifecycle.

Metallurgical Equipment Market Potential Customers

The primary customers for metallurgical equipment are large integrated metal producers, encompassing both private sector conglomerates and state-owned enterprises involved in bulk metal production. These end-users, such as major steel producers (e.g., ArcelorMittal, Baowu Steel Group, POSCO) and large aluminum companies, require continuous and substantial investment in heavy-duty, high-capacity machinery to maintain operational efficiency and meet global demand. Their purchasing decisions are driven by strategic factors including capacity expansion, regulatory compliance (especially emission standards), and the need for process optimization to reduce energy costs and improve product quality. The scale of investment often necessitates multi-year procurement contracts and complex financing structures, making the sales cycle long and highly technical.

A secondary, yet rapidly growing, customer segment includes specialized mini-mills and independent foundries. Mini-mills often utilize Electric Arc Furnace (EAF) technology, focusing on scrap metal recycling to produce niche or regional products, driven by localized demand and lower environmental impact compared to integrated mills. These customers prioritize operational flexibility, modular equipment design, and cost-effective maintenance solutions. Foundries specializing in complex parts for the automotive, aerospace, and machinery sectors require advanced casting machines, high-precision heat treatment furnaces, and specialized forging equipment to meet stringent quality specifications and alloy requirements mandated by their respective downstream industries.

Furthermore, governmental and private entities engaged in large-scale infrastructure and energy projects act as indirect drivers, requiring the vast quantities of raw and semi-finished metals that equipment manufacturers help produce. The increasing global focus on electric vehicles (EVs) and renewable energy infrastructure (wind turbines, solar farms) is creating a new tier of specialized customers requiring equipment tailored for producing high-grade electrical steel, battery materials, and specialized, non-ferrous alloys. These niche applications mandate equipment capable of extreme precision, high purity processing, and rapid changeovers, creating lucrative opportunities for vendors focusing on advanced metallurgy and process control systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.5 Billion |

| Market Forecast in 2033 | USD 101.9 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMS Group, Danieli & C. Officine Meccaniche S.p.A., Primetals Technologies, CMI Group, Nippon Steel Engineering Co., Ltd., Sarclad Ltd., CISDI Group Co., Ltd., ACRELEC, SECO/WARWICK, Tenova S.p.A., ABP Induction Systems GmbH, ANDRITZ Metals, Inductotherm Group, Stein Heurtey, Dango & Dienenthal, Vesuvius plc, China National Erzhong Group Co., Taiyuan Heavy Industry Co., Ltd., FIVES Group, Woodings Industrial Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metallurgical Equipment Market Key Technology Landscape

The current technology landscape in the metallurgical equipment sector is dominated by advancements aimed at increasing energy efficiency, enhancing automation, and achieving superior material quality. A major technological focus is the evolution of electric melting systems, particularly ultra-high power (UHP) Electric Arc Furnaces (EAFs), which are central to the shift towards recycled steel production and lower CO2 emissions. Key innovations in EAF technology include optimized electrode control systems, sophisticated slag management, and enhanced off-gas cleaning systems, significantly reducing tapping times and operational costs. Furthermore, continuous casting technology is advancing rapidly, with innovations such as thin-slab casting and endless casting processes maximizing production yield and minimizing energy wastage associated with reheating cycles, providing a competitive edge to adopters of these highly efficient systems.

Digitalization forms another critical layer of technological innovation, epitomized by the widespread adoption of Level 2 automation systems and the integration of the Industrial Internet of Things (IIoT). Level 2 automation involves complex process models and optimization loops that monitor and control critical parameters in real-time, such as temperature profiles in heat treatment processes or gauge control in rolling mills, ensuring precise product specifications are met consistently. IIoT implementation, utilizing thousands of distributed sensors across a plant, enables comprehensive data collection for real-time diagnostics and predictive modeling. This seamless flow of information is essential for implementing sophisticated software tools, including AI-driven predictive maintenance platforms, which optimize asset utilization and reduce the dependency on scheduled, preventative maintenance routines.

In the forming segment, sophisticated rolling mill technologies are being developed to handle increasingly demanding specifications, particularly for advanced high-strength steels (AHSS) required by the automotive sector for lightweighting initiatives. These advancements include advanced gauge control systems using hydraulic short-stroke cylinders, laminar flow cooling systems for precise microstructural control, and specialized roll texturing techniques. Simultaneously, sustainability-driven innovations are becoming paramount; this includes the development of hydrogen injection technologies for blast furnaces and the exploration of carbon capture utilization and storage (CCUS) integration into plant design. These environmental technologies, though costly, represent the future direction of heavy metallurgy, ensuring long-term operational viability in a carbon-constrained global economy.

Regional Highlights

Regional dynamics in the Metallurgical Equipment Market are highly correlated with localized demand for steel and non-ferrous metals, driven by infrastructure investment and automotive production, alongside regional regulatory environments concerning environmental compliance.

- Asia Pacific (APAC): APAC remains the largest and most dynamic market, primarily due to the massive steel production capacities in China and India. The region's growth is fueled by ambitious infrastructure projects, rapid urbanization, and significant manufacturing expansion. While China focuses increasingly on upgrading and consolidating its steel industry to meet stricter environmental targets, countries like India, Vietnam, and Indonesia are in a phase of capacity expansion, driving high demand for new primary and secondary metallurgical equipment. The focus here is on scale, cost-efficiency, and the adoption of modern, continuous processes. The push for localized production of specialty alloys for the regional electronics and automotive supply chains further stimulates investment in advanced equipment.

- Europe: Characterized by high technological maturity and stringent environmental regulations (e.g., the EU Green Deal), Europe's market growth is primarily driven by modernization, replacement cycles, and decarbonization initiatives. Investment is concentrated heavily in high-value, sustainable technologies, such as hydrogen-ready shaft furnaces, advanced EAFs powered by renewable energy, and sophisticated Level 3 automation systems. European manufacturers prioritize efficiency, flexibility, and compliance, making the market highly focused on advanced secondary metallurgy equipment and specialized rolling mills for high-performance metals and alloys.

- North America (NA): The North American market is experiencing robust growth, heavily influenced by reshoring initiatives and significant governmental infrastructure spending (e.g., the Infrastructure Investment and Jobs Act). Demand is strong for high-efficiency EAFs, as scrap metal remains the dominant source for domestic steel production. The focus is on implementing state-of-the-art automation and digital integration, aiming for energy self-sufficiency and high operational reliability. The high labor costs further incentivize investment in automated material handling and robotic inspection systems.

- Latin America (LATAM): LATAM is a market showing steady recovery and potential, driven by mining expansion and increasing regional manufacturing capacity, especially in Brazil and Mexico. While investment cycles can be volatile due to economic instability, there is consistent demand for equipment modernization to boost competitiveness against global players. The focus areas include optimizing existing plant assets and integrating digital solutions to improve yield and reduce operational costs.

- Middle East and Africa (MEA): This region is expanding its primary metal production capacity, particularly in the Middle East (Saudi Arabia, UAE) aiming for economic diversification away from oil. Investments are concentrated in large-scale integrated steel plants, often utilizing Direct Reduced Iron (DRI) technology due to abundant natural gas reserves, creating strong demand for specialized DRI processing and subsequent melting equipment. Africa presents long-term growth potential tied to large-scale infrastructure development and the processing of locally mined minerals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metallurgical Equipment Market.- SMS Group

- Danieli & C. Officine Meccaniche S.p.A.

- Primetals Technologies

- Tenova S.p.A.

- ANDRITZ Metals

- CSTRI Group Co., Ltd. (China Steel Research Institute)

- Vesuvius plc

- SECO/WARWICK

- Inductotherm Group

- Nippon Steel Engineering Co., Ltd.

- Outotec Oyj (Part of Metso Outotec)

- FIVES Group

- Sarclad Ltd.

- ABP Induction Systems GmbH

- Dango & Dienenthal

- Stein Heurtey

- Taiyuan Heavy Industry Co., Ltd.

- CISDI Group Co., Ltd.

- Woodings Industrial Corporation

- EBNER Industrieofenbau GmbH

Frequently Asked Questions

Analyze common user questions about the Metallurgical Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional blast furnaces to Electric Arc Furnaces (EAFs)?

The primary driver is the global pressure for decarbonization and sustainability. EAFs offer a significantly lower carbon footprint, especially when using scrap metal or H2-based Direct Reduced Iron (DRI), aligning with stricter environmental regulations and corporate net-zero commitments globally. EAFs also provide operational flexibility and lower capital intensity compared to new integrated BF-BOF plants.

How is digital transformation impacting the operation and maintenance of rolling mills?

Digital transformation leverages IIoT sensors and AI-driven predictive maintenance (PdM) to analyze real-time data on roll performance, vibration, and temperature. This enables operators to optimize rolling schedules, detect wear before failure, achieve tighter tolerance control, and significantly reduce unscheduled downtime, thereby maximizing mill utilization and product consistency.

Which geographical region represents the highest future growth potential for metallurgical equipment?

While Asia Pacific currently holds the largest market share, emerging economies within APAC (India, Southeast Asia) and modernization efforts in North America driven by reshoring and infrastructure spending show significant growth potential. Latin America and the Middle East are also strategic areas due to new capacity build-up focused on DRI technology and regional self-sufficiency goals.

What is the role of continuous casting technology in enhancing metallurgical efficiency?

Continuous casting machines (CCMs) improve efficiency by converting liquid steel directly into semi-finished products (slabs, billets, blooms) without the need for traditional ingot making and subsequent reheating. This process drastically reduces energy consumption, minimizes material loss, shortens the production cycle, and ensures a higher consistency and quality of the final metal structure.

What are the key technological restraints limiting market growth or adoption of new equipment?

The most significant restraints include the extremely high capital investment required for state-of-the-art machinery, the long operational lifespan of existing legacy equipment which slows replacement cycles, and the shortage of highly skilled technical personnel capable of integrating and managing advanced automation systems (Level 3 and AI) within complex plant environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager