Metastases Spinal Tumor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436382 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Metastases Spinal Tumor Market Size

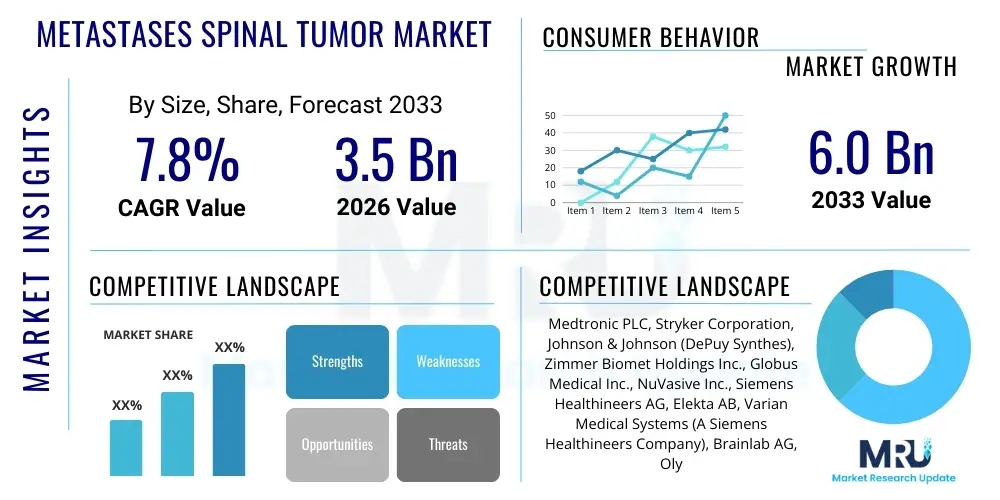

The Metastases Spinal Tumor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Metastases Spinal Tumor Market introduction

The Metastases Spinal Tumor Market is defined by the range of diagnostic tools, therapeutic devices, and systemic treatments utilized for managing secondary malignant neoplasms originating outside the spine but migrating to the vertebral column. Spinal metastases are the most prevalent tumors affecting the spine and often result in significant morbidity, including severe pain, loss of neurological function, and pathological fractures. The necessity for highly specialized, often complex, interventions is driven by the global aging demographic and the corresponding rise in primary cancer incidence, notably breast, lung, prostate, and renal cancers. Advances in systemic cancer therapies have extended patient survival, concomitantly increasing the duration during which metastatic spread to the spine can occur, thus sustaining high demand for effective local treatment solutions.

Core offerings within this market spectrum include advanced neuro-imaging technologies like high-resolution MRI and PET-CT for precise lesion characterization and staging. Therapeutically, the market is broadly divided into surgical solutions—encompassing complex spinal stabilization and decompression procedures often utilizing minimally invasive techniques and advanced instrumentation—and radiation oncology, dominated by high-precision methods such as Stereotactic Body Radiation Therapy (SBRT). The overarching product description emphasizes high precision, patient safety, and functional outcome preservation. Major applications focus on achieving local tumor control, alleviating mechanical instability, minimizing or reversing neurological deficits, and enhancing overall quality of life for cancer patients living with spinal disease burden.

The market growth is robustly propelled by key driving factors including continuous technological breakthroughs in surgical robotics and radiation delivery systems, which allow for safer and more effective treatment of previously inoperable tumors. Furthermore, increased multidisciplinary collaboration among oncologists, neurosurgeons, and radiation oncologists is leading to integrated treatment pathways, optimizing the sequence and combination of therapies. The primary benefits realized by utilizing market products involve rapid pain palliation, restoration of mobility, and significantly improved localized disease control, factors that are increasingly prioritized in modern oncology care. The inherent severity and complex management requirements associated with spinal metastases ensure high-value procedures and sustained technological investment across the supply chain.

Metastases Spinal Tumor Market Executive Summary

The Metastases Spinal Tumor Market is characterized by dynamic shifts toward less invasive, high-precision treatment modalities, underpinning its substantial projected growth trajectory. Key business trends include the convergence of advanced diagnostics with therapeutic delivery, leading to bundled solutions where capital equipment providers (e.g., Siemens Healthineers, Varian) offer integrated software ecosystems encompassing planning, navigation, and treatment execution. There is a strong business emphasis on demonstrating the long-term cost-effectiveness of high-dose, short-course treatments like SBRT versus conventional, protracted therapies. Consolidation and strategic partnerships between specialized device manufacturers and large hospital networks are common strategies to ensure market access and drive the adoption of new robotic and navigation technologies.

Regionally, North America maintains its leadership position, propelled by high healthcare expenditure, established clinical centers of excellence, and supportive regulatory pathways that facilitate the rapid commercialization and adoption of innovative surgical and radiological solutions. Europe follows, displaying a mature market structure influenced by stringent health technology assessment (HTA) requirements, favoring solutions that offer verifiable long-term value. The Asia Pacific (APAC) region is emerging as the primary growth engine, fueled by the accelerating expansion of oncology infrastructure, increased public and private investment in healthcare capacity, and rising awareness of advanced treatment options, particularly in populous nations like China and India, where large patient pools drive procedural volume growth.

Segmentation analysis reveals pivotal shifts in therapeutic preference. While surgical intervention remains essential for immediate spinal cord compression, the radiotherapy segment, specifically SBRT, is witnessing unparalleled growth due to its non-invasiveness and superior conformality. The Primary Cancer Site segment confirms that metastases from highly prevalent cancers (Lung, Breast) contribute the bulk of market demand, necessitating tailored therapeutic device development. Regarding end-users, large academic hospitals and comprehensive cancer centers continue to dominate procurement due to their capability to manage complex, multidisciplinary cases requiring extensive capital investment in integrated diagnostic and therapeutic platforms, although specialized ambulatory centers are beginning to absorb certain lower-complexity palliative procedures.

AI Impact Analysis on Metastases Spinal Tumor Market

Analysis of common user questions reveals a collective focus on how Artificial Intelligence (AI) can enhance precision, speed, and personalization within the Metastases Spinal Tumor treatment pathway. Key concerns revolve around AI's ability to swiftly process massive quantities of multimodal imaging data (MRI, CT, PET) to accurately delineate metastatic lesions from normal bone and soft tissue, an intricate and time-consuming manual task prone to inter-observer variability. Users are keen to understand how AI-driven predictive modeling, utilizing radiomics and clinical outcome data, can accurately forecast the risk of future events, such as spinal instability or neurological decline, thereby enabling prophylactic intervention rather than reactive care. Expectations center on AI's potential to standardize and optimize complex treatment planning protocols, especially for highly precise radiation delivery.

AI's fundamental impact is manifesting across the entire care continuum, starting with enhanced diagnostic workflow efficiency. Deep learning algorithms are being trained to automatically identify, quantify, and track metastatic tumor volumes in the spine with high accuracy, often surpassing human performance in consistency. This accelerated diagnostic phase allows clinicians to initiate definitive therapy much faster. Furthermore, integrating AI into Electronic Health Records (EHRs) allows for sophisticated risk stratification. By analyzing historical patient cohorts, AI models can predict the likelihood of survival, response to systemic treatments, and the risk of complications post-intervention, providing the multidisciplinary team with invaluable, data-driven insights to personalize care plans, particularly in complex cases where treatment goals often shift between curative and palliative intent.

Within the therapeutic domain, AI is transformative for radiation oncology and surgical navigation. In Stereotactic Body Radiation Therapy (SBRT), AI algorithms dramatically reduce the time required for organ-at-risk segmentation, particularly critical structures like the spinal cord and cauda equina, by automating complex contouring tasks while maintaining geometric accuracy. This automation minimizes planning bottlenecks and enhances the quality of dose distribution. For surgical procedures, machine learning is utilized to refine robotic navigation systems, optimizing trajectory planning for screw insertion and ensuring precise tumor resection margins while minimizing invasiveness. This technological advancement directly contributes to improved neurological outcomes and reduced perioperative morbidity, establishing AI as a core engine for next-generation treatment protocols in spinal oncology.

- AI-driven deep learning models enable rapid, automated detection and segmentation of metastatic lesions on complex spinal imaging.

- Machine learning algorithms significantly reduce treatment planning time for SBRT by automating the delineation of critical organs-at-risk.

- Predictive AI models use radiomic features to forecast the risk of pathological fracture and guide prophylactic surgical stabilization decisions.

- Robotic surgical platforms integrate AI to optimize trajectories for minimally invasive spinal implant placement, enhancing precision and safety.

- AI facilitates personalized systemic therapy recommendations by correlating genetic markers and tumor characteristics with anticipated treatment response.

- Natural Language Processing (NLP) speeds up clinical documentation and aids in aggregating data for large-scale clinical research studies.

- Advanced computer vision supports real-time quality assurance during radiotherapy delivery, verifying beam alignment and patient positioning.

DRO & Impact Forces Of Metastases Spinal Tumor Market

The Metastases Spinal Tumor Market is significantly influenced by a converging set of dynamic forces encapsulated by its Drivers, Restraints, and Opportunities (DRO). A primary Driver is the substantial global increase in the incidence and prevalence of primary cancers, which directly translates into a higher volume of patients developing spinal metastases. Compounding this, advancements in oncology care have extended overall patient survival rates, increasing the window for metastatic disease manifestation. The continuous evolution and widespread clinical adoption of precision technologies, such as SBRT, robotic navigation for Minimally Invasive Spine Surgery (MISS), and specialized vertebral stabilization devices, further propel market expansion by offering more effective, less morbid treatment solutions.

Conversely, significant Restraints pose challenges to unconstrained growth. The high capital investment required for state-of-the-art equipment—including high-energy linear accelerators, intraoperative imaging systems, and robotic surgery suites—limits accessibility, particularly in developing economies and non-specialized hospitals. Furthermore, the specialized, multidisciplinary nature of spinal oncology requires highly trained professionals (neurosurgeons, radiation oncologists, musculoskeletal oncologists) whose scarcity presents a major human capital bottleneck. Regulatory hurdles for novel spine implants and the variability in reimbursement policies across different national health systems create financial and operational constraints that slow down the rapid, universal uptake of new technologies and procedural techniques.

The foremost Opportunities lie in leveraging data science and AI to optimize personalized medicine approaches, allowing clinicians to tailor treatment intensity based on individual tumor biology and patient prognosis, thus improving resource utilization and outcomes. There is vast potential in expanding the market geographically into underserved emerging economies through partnerships and localized manufacturing, provided favorable regulatory and reimbursement conditions can be established. Impact Forces, such as the accelerating pace of technological innovation, particularly in targeted radiation delivery and bio-absorbable/smart implant technology, exert powerful upward pressure. Furthermore, sustained demographic shifts, characterized by increasing life expectancy, ensure a continually expanding patient base requiring specialized metastatic spinal care throughout the forecast period, cementing the market's long-term growth trajectory.

Segmentation Analysis

The thorough segmentation of the Metastases Spinal Tumor Market provides granular visibility into key areas of technological deployment and clinical preference, guiding strategic market participation. Segmentation by Treatment Type is critical, highlighting the shift away from broad-field external beam radiation towards highly focused Stereotactic Body Radiation Therapy (SBRT), which offers superior dose escalation and local control. Surgery remains the definitive intervention for immediate neurological compromise or mechanical instability, subdivided into complex stabilization using specialized instrumentation, tumor resection, and decompression procedures. Systemic therapy, encompassing modern immunotherapies and targeted agents, is frequently used synergistically, influencing the clinical environment where local treatments are applied.

The differentiation by Primary Cancer Site (Lung, Breast, Prostate, Renal) is essential because the behavior, radio-sensitivity, and systemic management of metastases vary significantly depending on the original tumor location, necessitating distinct product features and clinical pathways. For instance, the high incidence and unique osteoblastic/osteolytic nature of breast and prostate cancer metastases drive substantial demand for vertebral stabilization and palliative care solutions. Diagnosis Method segmentation (MRI, CT, PET-CT, Biopsy) reflects the increasing reliance on integrated imaging modalities to improve initial staging and monitor treatment response, with PET-CT becoming crucial for identifying additional distant disease burden.

Finally, End-User segmentation provides insight into procurement power and procedural volume distribution. Hospitals, particularly large university and regional trauma centers, dominate the market due to the infrastructure required for emergency and high-complexity procedures. However, the specialized care provided by dedicated Specialty Cancer Centers often drives the adoption of cutting-edge, high-cost technologies (e.g., robotic SBRT), as these centers focus on highly optimized, patient-centric oncology pathways. This multi-dimensional segmentation facilitates precise targeting of sales efforts and development strategies tailored to specific clinical needs and institutional capabilities.

- By Treatment Type:

- Surgery (Decompression, Stabilization/Fixation, Resection)

- Radiotherapy (Stereotactic Body Radiation Therapy SBRT, Conventional External Beam Radiation Therapy EBRT)

- Systemic Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy)

- By Primary Cancer Site:

- Lung Cancer Metastases

- Breast Cancer Metastases

- Prostate Cancer Metastases

- Renal/Kidney Cancer Metastases

- Other Cancers (Melanoma, Thyroid, Gastrointestinal)

- By Diagnosis Method:

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET-CT)

- Biopsy

- By End-User:

- Hospitals

- Specialty Cancer Centers

- Ambulatory Surgical Centers (ASCs)

Value Chain Analysis For Metastases Spinal Tumor Market

The value chain in the Metastases Spinal Tumor Market is sophisticated and highly regulated, starting with the upstream processes centered on R&D and specialized material sourcing. Upstream analysis involves manufacturers obtaining high-grade, biocompatible materials, such as specific medical-grade titanium or PEEK (Polyetheretherketone) for implants, along with specialized components (magnets, detectors, computing hardware) essential for high-precision imaging and radiation delivery systems. Research and development activities, particularly those focusing on new surface coatings for implants, AI integration into planning software, and enhancing the therapeutic window of SBRT, represent the primary value addition at this stage. Strict intellectual property protection and adherence to quality standards (ISO 13485) are vital for successful upstream operations.

Midstream activities encompass the manufacturing, assembly, and rigorous quality assurance testing of complex devices and instruments. For surgical devices, this involves precision machining and sterilization. For capital equipment (LINACs, MRI scanners), this includes software integration, calibration, and system validation. Distribution channel strategies are bifurcated: high-capital equipment is typically sold via direct sales forces due to the necessity for extensive technical installation, maintenance contracts, and specialized training packages. Consumables, standardized implants, and surgical disposables often flow through indirect channels, leveraging established medical distributors and specialized logistics providers that manage inventory efficiently across multiple geographical regions.

Downstream analysis focuses on clinical service delivery by specialized professionals. End-Users (Hospitals and Specialty Cancer Centers) serve as the primary conduits for patient care, translating high-technology products into clinical outcomes. The value captured downstream is heavily reliant on the operational efficiency of the hospital, the expertise of the treating multidisciplinary team, and effective post-treatment follow-up and monitoring. Direct interaction with patients and payors occurs here, making reimbursement mechanisms and clinical efficacy documentation critical to sustaining market profitability. Continuous feedback loops from clinicians to manufacturers are essential for iterative product improvement and maintaining market relevance in a rapidly evolving therapeutic landscape.

Metastases Spinal Tumor Market Potential Customers

The acquisition of products and services within the Metastases Spinal Tumor Market is concentrated within institutions capable of delivering complex, integrated oncology care. The primary target customers are tertiary care hospitals and large university medical centers. These institutions require comprehensive solutions spanning advanced diagnostic equipment, a full inventory of spinal implants for stabilization and reconstruction, and multiple modalities of cancer treatment, including sophisticated radiation delivery platforms. Their purchasing decisions are driven by the need for high throughput, ability to handle complex patient cases, clinical prestige, and long-term total cost of ownership, heavily favoring vendors offering integrated technological ecosystems and robust post-sales support, including education and maintenance.

A second crucial customer segment comprises specialized Comprehensive Cancer Centers, often functioning as standalone facilities or within a hospital network, dedicating resources exclusively to oncology. These centers are early adopters of cutting-edge, often premium-priced, technologies such as robotic surgery and advanced SBRT, prioritizing clinical trial participation and innovative treatment protocols. For these customers, the differentiation lies in superior clinical efficacy and the ability to attract highly complex referrals. They are significant purchasers of AI-enabled planning software and personalized medicine diagnostics, driven by a mission to optimize patient-specific outcomes and minimize treatment morbidity.

Emerging potential customers include specialized pain management clinics and Ambulatory Surgical Centers (ASCs) that handle simpler palliative interventions, such as radio-frequency ablation (RFA) or kyphoplasty/vertebroplasty for pain relief and stabilization of uncomplicated fractures. While their individual procurement volumes are lower for capital equipment, their aggregate demand for specialized needles, bone cements, and minimally invasive delivery systems is considerable. Furthermore, governmental bodies and national health services act as influential purchasers or regulators, heavily impacting technology adoption based on public health mandates, budgetary constraints, and centralized procurement processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic PLC, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings Inc., Globus Medical Inc., NuVasive Inc., Siemens Healthineers AG, Elekta AB, Varian Medical Systems (A Siemens Healthineers Company), Brainlab AG, Olympus Corporation, Accuray Incorporated, Boston Scientific Corporation, Nevro Corp., Alphatec Holdings Inc., RTI Surgical Holdings Inc., Inari Medical Inc., GE Healthcare, Philips Healthcare, Smith & Nephew PLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metastases Spinal Tumor Market Key Technology Landscape

The Metastases Spinal Tumor Market is significantly defined by the deployment of highly sophisticated technological solutions aimed at improving precision and minimizing invasiveness. A cornerstone technology is advanced image guidance and navigation systems utilized in surgical settings. These systems, often integrated with intraoperative CT (O-arm or similar) or robotic platforms, allow neurosurgeons and orthopedic oncologists to achieve millimeter-level accuracy during pedicle screw placement, spinal decompression, and tumor resection. This technology is critical for safely navigating the complex anatomy of the spine and protecting adjacent neural structures, making Minimally Invasive Spine Surgery (MISS) feasible and highly effective in tumor management.

In radiation oncology, the dominant technology is Stereotactic Body Radiation Therapy (SBRT), delivered by sophisticated Linear Accelerators (LINACs) and dedicated robotic radiosurgery systems (e.g., CyberKnife). These platforms incorporate highly advanced features such as real-time tracking of patient and tumor motion, high-definition beam shaping via micro-multileaf collimators, and integrated image verification (IGRT). SBRT technology allows for the delivery of ablative radiation doses in a few fractions, effectively treating resistant tumors while minimizing the dose to the spinal cord via steep dose gradients, a technological feat essential for the safety and efficacy of spinal radiosurgery. The effectiveness of SBRT is intrinsically linked to the underlying treatment planning software, which increasingly incorporates AI and biological optimization algorithms.

Furthermore, biomedical engineering contributes through the innovation of specialized spinal implants designed specifically for oncological reconstruction. These implants often feature modular designs to accommodate varying degrees of resection and advanced materials intended to integrate effectively in compromised bone environments. Augmentation techniques, such as vertebroplasty and kyphoplasty utilizing high-viscosity bone cement (PMMA), remain foundational for rapid palliative pain relief and mechanical stabilization of compression fractures. The convergence of these technological streams—advanced imaging, precision radiation delivery, and specialized implant systems—forms the high-value core of the current and future Metastases Spinal Tumor Market landscape.

Regional Highlights

The global distribution and maturity of the Metastases Spinal Tumor Market vary substantially across major geographical regions, reflecting differences in healthcare spending, technological readiness, and disease epidemiology. North America, encompassing the United States and Canada, leads the global market in terms of revenue share. This dominance is attributed to universal access to cutting-edge technologies, including robotic surgical systems and dedicated SBRT platforms, robust healthcare insurance and reimbursement mechanisms that support high-cost procedures, and the presence of numerous key market players and pioneering academic research institutions that drive clinical protocol advancements and rapid adoption of innovative treatments.

- North America: Market leadership maintained through high procedural volumes, technological leadership in robotic surgery and advanced SBRT (high linear accelerator density), and established clinical guidelines promoting aggressive multidisciplinary treatment for spinal metastases. Demand is highly inelastic to price, favoring best-in-class performance.

- Europe: A mature market characterized by slower but steady growth, heavily influenced by government healthcare systems and stringent Health Technology Assessment (HTA) requirements. Western Europe (Germany, France, UK) are key revenue drivers, focusing on integrating cost-effective minimally invasive techniques and refining patient selection criteria for optimal resource utilization.

- Asia Pacific (APAC): The fastest-growing region, powered by rapidly expanding economies and healthcare modernization, notably in China, India, South Korea, and Southeast Asia. The large patient population base and increasing accessibility to private medical care and insurance coverage are major drivers, creating high demand for both capital equipment and specialized surgical consumables.

- Latin America (LATAM): Exhibits moderate, concentrated growth, primarily driven by investments in advanced oncology centers in major urban areas (Brazil, Mexico). Market penetration is challenged by economic instability and variable public health funding, often limiting the widespread adoption of high-cost capital equipment outside of private hospital groups.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) nations, where significant public investment has created world-class healthcare facilities, leading to high-end technology procurement. The broader African continent faces substantial infrastructure and access barriers, resulting in lower current market penetration but significant long-term potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metastases Spinal Tumor Market.- Medtronic PLC

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings Inc.

- Globus Medical Inc.

- NuVasive Inc.

- Siemens Healthineers AG

- Elekta AB

- Varian Medical Systems (A Siemens Healthineers Company)

- Brainlab AG

- Olympus Corporation

- Accuray Incorporated

- Boston Scientific Corporation

- Nevro Corp.

- Alphatec Holdings Inc.

- RTI Surgical Holdings Inc.

- Inari Medical Inc.

- GE Healthcare

- Philips Healthcare

- Smith & Nephew PLC

Frequently Asked Questions

Analyze common user questions about the Metastases Spinal Tumor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Metastases Spinal Tumor Market?

The Metastases Spinal Tumor Market is projected to exhibit a CAGR of 7.8% during the forecast period from 2026 to 2033, driven by increasing cancer incidence and advancements in precision oncology treatments like SBRT.

Which treatment modality is currently seeing the highest rate of technological innovation and adoption?

Stereotactic Body Radiation Therapy (SBRT) is experiencing the highest rate of innovation, offering high-precision, non-invasive local control for spinal metastases, minimizing damage to critical structures like the spinal cord.

How is Artificial Intelligence (AI) influencing diagnosis and treatment planning in this market?

AI is critically influencing the market by enhancing diagnostic image analysis for rapid lesion identification and optimizing treatment planning, particularly in radiation oncology, by automating dose contouring and improving prediction models for spinal instability.

Which region currently dominates the Metastases Spinal Tumor Market?

North America holds the largest market share due to its advanced healthcare infrastructure, significant R&D investment in robotic and image-guided surgery, and favorable reimbursement landscape for specialized high-cost oncology procedures.

What are the primary challenges restraining the growth of the spinal tumor market?

Key challenges include the substantial initial capital expenditure required for high-precision equipment (e.g., LINACs and surgical robotics), complexity of multidisciplinary treatment protocols, and a global shortage of highly specialized oncology professionals.

What is the role of Minimally Invasive Spine Surgery (MISS) in treating spinal metastases?

MISS is crucial for spinal stabilization and decompression, offering reduced patient morbidity, lower blood loss, faster recovery times, and decreased interference with subsequent systemic or radiation therapies compared to traditional open surgical approaches.

Which primary cancer sites contribute most significantly to the volume of spinal metastases?

Metastases originating from Lung, Breast, and Prostate cancers are the most significant contributors to the volume of spinal tumor cases globally, dictating the focus of market research and therapeutic development.

Why are specialized cancer centers gaining prominence as key end-users?

Specialized cancer centers are gaining prominence because they offer concentrated expertise and integrated multidisciplinary care models necessary for complex spinal oncology cases, driving the adoption of premium, cutting-edge technologies.

How do reimbursement policies affect the adoption of advanced spinal tumor treatments?

Reimbursement policies significantly influence adoption; consistent and favorable coverage for complex procedures like SBRT and robotic surgery accelerate market penetration, whereas variable or delayed coverage creates constraints, especially in emerging economies.

What technologies are considered essential for accurate spinal tumor diagnosis?

Essential diagnostic technologies include high-resolution Magnetic Resonance Imaging (MRI), Computed Tomography (CT), and advanced Positron Emission Tomography-Computed Tomography (PET-CT) for precise localization and metabolic assessment of the lesions.

What role does bone cement augmentation play in spinal metastasis treatment?

Bone cement augmentation, specifically vertebroplasty and kyphoplasty, plays a vital role in providing immediate pain relief and biomechanical stabilization for vertebral compression fractures caused by metastases, often used palliatively or adjunctively with radiation.

How is the concept of personalized medicine integrating into the spinal tumor market?

Personalized medicine integrates through genomic and radiomic analysis, using AI models to predict treatment response, tailoring systemic therapies, and optimizing local intervention strategies based on the unique biological characteristics of the tumor and the patient.

What factors are driving the anticipated rapid growth in the Asia Pacific (APAC) market?

Rapid growth in APAC is primarily driven by expanding healthcare infrastructure, rising cancer prevalence among large populations, increasing governmental health spending, and improving access to specialized oncology treatment modalities.

What are the main segments covered in the Metastases Spinal Tumor Market report?

The report segments the market by Treatment Type (Surgery, Radiotherapy, Systemic Therapy), Primary Cancer Site (Lung, Breast, Prostate), Diagnosis Method (MRI, CT, PET), and End-User (Hospitals, Specialty Centers).

How do technological advancements in implants contribute to market growth?

Advancements in specialized spinal implants, including biocompatible materials and modular systems, improve the efficacy and longevity of spinal stabilization procedures in fragile cancer patients, driving demand for these high-value components.

What is the distinction between conventional EBRT and SBRT for spinal metastases?

Conventional EBRT uses lower doses over many fractions, while SBRT uses highly concentrated, focused doses delivered in fewer fractions (1-5), offering superior biological effectiveness and local control while critically sparing adjacent healthy tissue like the spinal cord.

How does the aging population worldwide affect the market size?

The aging global population significantly drives market size, as age is a primary risk factor for most common primary cancers, directly correlating with an increased incidence of metastatic spread to the spine.

What challenges exist in the upstream segment of the value chain?

Upstream challenges involve maintaining strict quality control over specialized raw materials (e.g., medical-grade titanium) for implants and ensuring a stable, traceable supply chain for high-end components required for complex medical devices.

Do pharmaceutical companies play a role in this medical device and procedure-heavy market?

Yes, pharmaceutical companies play a critical role via systemic therapy (targeted therapies, immunotherapies) which are often used adjunctively with local treatments (surgery/radiation) to manage the underlying cancer and improve long-term prognosis.

What constitutes an ‘Impact Force’ in the context of this market analysis?

An Impact Force refers to powerful, overarching trends, such as sustained demographic shifts (aging) or rapid technological acceleration (AI, robotics), that fundamentally and persistently alter market growth trajectories and investment priorities.

What are the typical end-users for high-capital radiation oncology equipment?

High-capital radiation oncology equipment, such as advanced LINACs used for SBRT, are typically purchased by large university hospitals, regional cancer centers, and specialized, high-throughput oncology clinics.

How do competitive strategies address the need for multidisciplinary coordination?

Competitive strategies focus on integrated software platforms that connect diagnostic imaging, surgical planning, and radiation delivery systems, facilitating seamless data flow and multidisciplinary consensus among treating physicians.

What is the forecast for the market value by 2033?

The market is projected to reach an estimated value of USD 6.0 Billion by the end of the forecast period in 2033, demonstrating substantial expansion in specialized oncology care.

Is there a difference in treatment approach for lung versus prostate cancer spinal metastases?

Yes, prostate cancer metastases are often sensitive to hormonal therapy and may respond well to lower doses of radiation, whereas lung cancer metastases are typically aggressive and require high-dose SBRT or immediate surgical decompression.

What role does intraoperative imaging play in contemporary spinal tumor surgery?

Intraoperative imaging (e.g., O-arm or dedicated CT) is essential for providing real-time 3D anatomical feedback, verifying implant placement, confirming tumor margins, and enhancing the safety and precision of complex minimally invasive procedures.

How do regulatory environments in North America compare to Europe?

North America (FDA) often offers accelerated pathways for breakthrough devices but requires extensive clinical data; Europe (MDR) has stringent compliance requirements focusing heavily on risk management and post-market surveillance.

What is the significance of neurological preservation in spinal tumor treatment?

Neurological preservation is paramount; interventions prioritize maintaining or restoring spinal cord function, as neurological deficits severely impact patient quality of life, making precise tumor decompression and spinal stability core goals of therapy.

Are robotic systems widely adopted in spinal tumor surgery?

Adoption of robotic systems is growing rapidly, particularly in established markets (US, Western Europe) where precision, reduced invasiveness, and improved accuracy in pedicle screw placement and tumor navigation are highly valued, offsetting the initial capital cost.

What is the biggest opportunity identified in the developing APAC market?

The biggest opportunity lies in addressing the underserved patient population by establishing comprehensive, accessible oncology treatment centers and facilitating technology transfer for advanced radiation and surgical platforms.

How does the market address complications like pathological fractures?

The market addresses pathological fractures primarily through prophylactic or acute stabilization using specialized spinal implants and bone cement augmentation (kyphoplasty/vertebroplasty), ensuring structural integrity and rapid pain relief.

How does the focus on patient quality of life influence treatment decisions?

The focus on quality of life increasingly mandates the use of minimally invasive techniques (MISS, SBRT) to minimize pain, reduce recovery time, and preserve mobility, shifting the focus from mere survival extension to functional independence.

What role does standardization of clinical protocols play in market maturation?

Standardization of clinical protocols ensures consistency in care delivery, promotes the efficient use of specialized equipment, and validates the efficacy of new treatments, facilitating broader adoption and favorable reimbursement globally.

Why is the distinction between osteolytic and osteoblastic metastases important for device manufacturers?

Osteolytic (bone-destroying) lesions require immediate stabilization products, while osteoblastic (bone-forming) lesions may necessitate different imaging strategies and are often more responsive to specific systemic agents, guiding implant design and material choices.

What is the primary function of advanced beam shaping technologies in SBRT?

Advanced beam shaping (e.g., multileaf collimators) allows radiation oncologists to conform the radiation dose precisely to the irregular shape of the spinal tumor while sparing the highly sensitive adjacent spinal cord tissue, maximizing therapeutic ratio.

Are specialty clinics considered a high-growth segment for spinal tumor treatment?

Yes, specialty cancer centers are a high-growth segment as they focus on complex oncology cases, investing heavily in state-of-the-art equipment and specialized personnel, driving the adoption of premium-priced therapeutic solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager