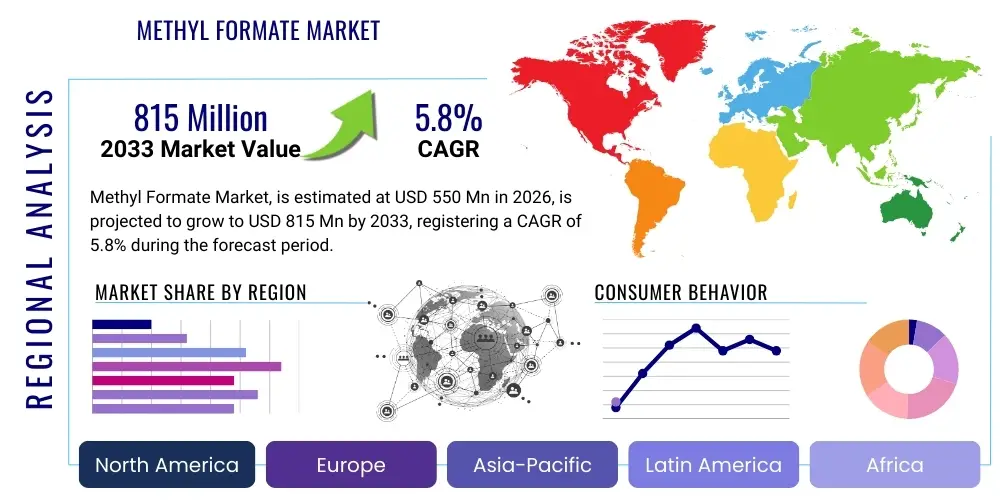

Methyl Formate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434481 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Methyl Formate Market Size

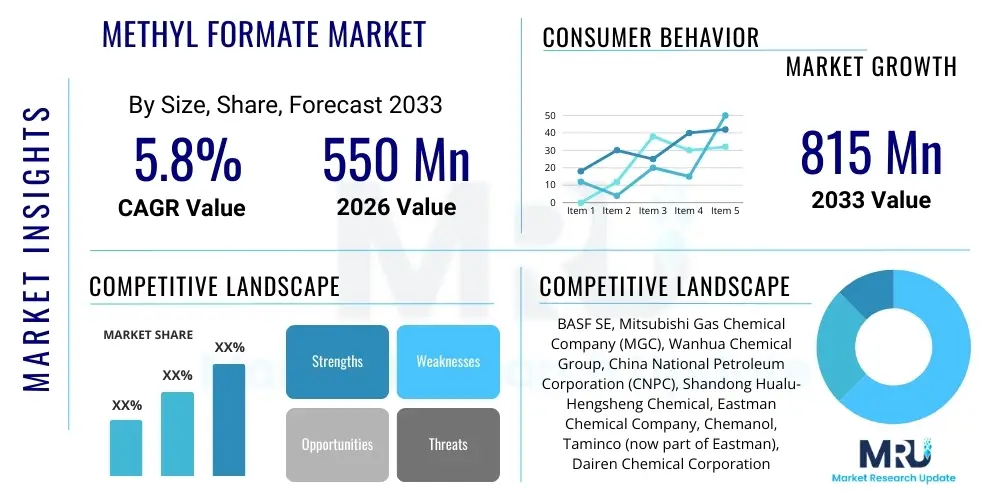

The Methyl Formate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $815 Million USD by the end of the forecast period in 2033.

Methyl Formate Market introduction

Methyl Formate (HCOOCH3) is the simplest ester of formic acid, characterized by its colorless, volatile liquid state and ether-like odor. It serves as a crucial intermediate in the chemical industry, primarily synthesized through the carbonylation of methanol. Due to its high solvency power, low boiling point, and utility as a C1 building block, methyl formate has found extensive application across various sectors, particularly in the production of bulk chemicals like formamide, N,N-Dimethylformamide (DMF), and formic acid itself. Its efficient conversion pathways and relative ease of handling contribute significantly to its industrial relevance.

The primary applications driving market growth include its use as a blowing agent, especially in the production of polyurethane (PU) foams for insulation and construction sectors, replacing ozone-depleting substances. Furthermore, methyl formate is vital in the agrochemical industry, serving as a fumigant and intermediate for synthesizing various herbicides and insecticides. Its role as a solvent is diminishing in some high-volume applications due to regulatory pressures on VOCs, yet it remains indispensable in specialized processes, particularly in the fine chemical and pharmaceutical synthesis where high purity is mandated.

Market benefits are highlighted by its versatility and high reactivity, which enable efficient, high-yield chemical transformations. Key driving factors include the escalating global demand for high-performance insulation materials in green building initiatives, especially in Asia Pacific and Europe, aiming for enhanced energy efficiency. Additionally, the continuous expansion of the agricultural sector, particularly in developing economies, sustains the demand for methyl formate derivatives used in crop protection formulations, thereby solidifying its position as a foundational chemical intermediate.

Methyl Formate Market Executive Summary

The global Methyl Formate market exhibits robust growth driven primarily by technological shifts in the polyurethane foam industry towards environmentally benign blowing agents. Business trends indicate a focus on backward integration by major chemical producers to secure methanol and carbon monoxide supply, thereby stabilizing production costs and improving competitive positioning. Regulatory frameworks concerning volatile organic compounds (VOCs) and greenhouse gases are profoundly shaping product adoption, favoring high-purity grades for pharmaceutical use and emphasizing sustainable production methodologies. Strategic collaborations between chemical manufacturers and end-use applicators in the construction sector are crucial for market penetration, particularly for new generation foam systems.

Regional trends reveal Asia Pacific as the dominant and fastest-growing region, fueled by massive infrastructure development, rapid urbanization, and extensive agricultural activities in China and India. North America and Europe maintain stable demand, characterized by stringent environmental regulations that boost the consumption of methyl formate as a cleaner alternative to certain traditional solvents and foam agents. The shift towards energy-efficient residential and commercial structures in developed markets necessitates continuous supply of high-quality insulation materials, securing methyl formate’s role in these mature regions. Simultaneously, increasing manufacturing capacity expansion, particularly in cost-competitive regions like the Middle East, is altering global supply dynamics.

Segmentation trends highlight the blowing agent application as the largest and most dynamic segment, directly correlated with the robust construction and automotive sectors. The high-purity grade segment is experiencing accelerated demand, specifically within the pharmaceutical and specialty chemical synthesis domains where impurity profiles must meet stringent regulatory standards. Among end-use industries, Construction remains the most significant consumer, followed closely by the Agrochemical sector. Investment trends are increasingly focused on process innovation to minimize energy consumption during synthesis and enhance product specifications tailored for niche, high-value applications.

AI Impact Analysis on Methyl Formate Market

Common user inquiries regarding AI’s influence on the Methyl Formate market often revolve around optimizing synthesis processes, predicting raw material price volatility, and enhancing supply chain resilience. Users are keen to understand how machine learning can improve the efficiency of catalytic reactions (such as methanol carbonylation), minimizing energy inputs and maximizing yield, thereby lowering overall production costs. Another prevalent theme is the use of predictive analytics for demand forecasting across diverse end-use markets (construction, agriculture) and how this data can inform production schedules to reduce inventory waste. Users also frequently question AI's role in developing novel, less toxic methyl formate derivatives or completely new C1 chemistry pathways, addressing long-term sustainability and regulatory compliance concerns.

The application of Artificial Intelligence and advanced analytics is transforming the operational landscape of methyl formate production and distribution. AI models are crucial for real-time monitoring and optimization of complex chemical reactors, adjusting temperature, pressure, and catalyst concentrations instantaneously based on predictive maintenance algorithms, which significantly reduces downtime and ensures consistent product quality. Furthermore, large language models and cognitive systems are utilized to rapidly synthesize information from global regulatory updates concerning VOCs and specific product handling requirements, allowing producers to proactively adjust product formulations and logistics strategies, ensuring seamless market access and compliance.

In the supply chain, AI algorithms manage the volatile pricing of key precursors—methanol and carbon monoxide—by analyzing global oil and gas price fluctuations, geopolitical events, and freight costs, offering optimized procurement strategies. This enhanced visibility and predictive capacity allow manufacturers to buffer against sudden cost spikes, providing more stable pricing for end-users. While AI does not directly alter the chemical properties of methyl formate, its profound influence lies in making its production more economical, environmentally efficient, and strategically aligned with fluctuating global industrial demands, ensuring the long-term viability and competitiveness of the product.

- AI-driven optimization of methanol carbonylation processes leading to higher yield and lower energy consumption.

- Predictive maintenance analytics deployed on production units reducing operational downtime and capital expenditure.

- Machine learning models for highly accurate raw material price forecasting (methanol, natural gas).

- Enhanced supply chain visibility and route optimization for hazardous chemical transportation.

- Accelerated discovery of novel, efficient catalysts for methyl formate synthesis, potentially replacing high-pressure or high-temperature methods.

- Automated compliance monitoring, tracking global chemical regulatory changes impacting methyl formate derivatives.

DRO & Impact Forces Of Methyl Formate Market

The Methyl Formate market trajectory is heavily influenced by a delicate balance of inherent advantages and external constraints, creating a complex impact force matrix. Drivers include the global mandate for superior thermal insulation, which necessitates high-performance blowing agents like methyl formate for polyurethane foams. The increasing use of methyl formate as a precursor for various fine chemicals and pharmaceuticals further solidifies its demand base. However, the market faces significant restraints, chiefly concerning its toxicity, flammability, and volatility, which necessitate rigorous handling and storage protocols, increasing operational costs and limiting adoption in less industrialized settings. Moreover, price volatility of methanol, a key feedstock derived from natural gas or coal, directly impacts the profitability margins of methyl formate manufacturers.

Opportunities for market expansion are abundant, particularly in emerging applications within the healthcare sector, where high-purity methyl formate is used in specific reaction environments and sterilization processes. Significant potential exists in developing markets through infrastructure projects and rising consumer disposable incomes, which spur demand for durable goods incorporating PU foams (e.g., refrigeration, furniture). Furthermore, technological advancements focused on developing encapsulated or low-emission formulations of methyl formate derivatives could mitigate current toxicity concerns, opening avenues for broader industrial use and strengthening market resilience against alternative chemicals.

The impact forces are categorized by environmental and regulatory pressures acting as a major constraint and simultaneously a driver. Regulations phasing out conventional foam blowing agents (HFCs) propel methyl formate adoption (Driver), but increasingly strict worker safety and environmental emission standards (Restraint) force manufacturers to invest heavily in control technologies. This dynamic environment necessitates continuous innovation in process safety and product formulation to maintain market relevance and competitive advantage. The interplay of high demand from key sectors and the stringent control needed for handling the substance defines the current competitive landscape.

Segmentation Analysis

The Methyl Formate market is segmented based on Application, Grade, and End-Use Industry, reflecting the diversity of its utility across industrial and commercial sectors. Segmentation provides a granular view of market dynamics, highlighting the segments contributing most significantly to overall revenue and those exhibiting the highest growth potential. The market structure emphasizes the dual role of methyl formate: as a high-volume commodity chemical used in synthesis and as a specialized functional chemical used in specific processes like foaming or fumigation. Analysis across these dimensions is critical for strategic decision-making, allowing stakeholders to focus resources on the most lucrative and rapidly evolving application areas.

The application segmentation clearly shows the dominance of the blowing agent segment due to regulatory shifts and construction sector growth, overshadowing its traditional role as a simple solvent or fumigant. Grade segmentation, differentiating between technical and high-purity products, underscores the increasing demand from regulated industries, such as pharmaceuticals, which drives premium pricing for specialized grades. Finally, the end-use industry segmentation maps consumption patterns directly to global macroeconomic drivers, with infrastructure development (Construction) and food security needs (Agrochemical) being the primary consumption engines, ensuring persistent market stability and growth.

- Application

- Blowing Agent

- Insecticide/Fumigant

- Solvent (for Cellulose Acetate, Oils, and Fats)

- Fine Chemical Intermediate (for Formic Acid, Formamide, DMF)

- Others (Textile dyeing, Pharmaceutical synthesis)

- Grade

- High Purity Grade (99.5% and above)

- Technical Grade (98% to 99%)

- End-Use Industry

- Construction (Insulation, PU Foams)

- Automotive (Interior components, lightweight materials)

- Pharmaceutical

- Agrochemicals (Herbicides, Pesticides)

- Textile and Leather

- Paints and Coatings

Value Chain Analysis For Methyl Formate Market

The value chain for Methyl Formate begins with the upstream segment, which is highly dependent on the availability and pricing of raw materials, primarily methanol and carbon monoxide. Methanol is predominantly sourced from natural gas or coal synthesis, tying the production costs of methyl formate directly to global energy markets. Key methanol producers often integrate forward into methyl formate production to capture additional value and secure supply chains. The transformation process involves catalyzed reaction systems, often under high pressure, requiring substantial capital investment and specialized technical expertise, highlighting the vertical complexity of this upstream stage.

The midstream phase encompasses the core chemical synthesis, purification, and storage of methyl formate. Producers focus intensely on optimizing catalytic efficiency and managing purification processes to achieve the necessary technical or high-purity grades required by specific downstream users. Quality control is paramount, especially for grades destined for pharmaceutical intermediates, necessitating sophisticated analytical capabilities. The distribution channel is crucial, involving specialized logistics providers skilled in handling hazardous, volatile liquids, including bulk tankers and specialized containers, often adhering to strict international regulations governing chemical transport. Direct sales dominate high-volume segments like blowing agents, while specialized distributors handle smaller volumes for fine chemical synthesis.

The downstream analysis focuses on the numerous end-use applications. Methyl formate is either sold directly as a solvent/fumigant or processed further into derivatives like formic acid or DMF before reaching the final end-users in construction, agriculture, and automotive sectors. The competitiveness in the downstream market is driven by product formulation and technical support provided to end-users (e.g., optimizing PU foam systems). Direct distribution is favored for large industrial buyers (e.g., major foam manufacturers), while indirect channels involving specialized chemical distributors are utilized for reaching smaller manufacturers, research labs, and niche agrochemical formulators.

Methyl Formate Market Potential Customers

Potential customers for Methyl Formate span a wide array of industrial enterprises whose processes require efficient C1 intermediates, high-performance blowing agents, or specialized solvents. The largest segment of buyers resides in the construction industry, specifically manufacturers of rigid polyurethane (PU) and polyisocyanurate (PIR) foams used for building insulation, cold storage facilities, and roofing. These buyers are continuously seeking alternatives to comply with regulations governing ozone depletion and greenhouse gas emissions, making methyl formate (often used as a co-blowing agent) an attractive component.

Another major buying group includes large agrochemical companies that utilize methyl formate as a synthetic precursor or, in some regions, as a direct fumigant for stored commodities. These customers prioritize consistency, bulk supply reliability, and compliance with agricultural safety standards. Furthermore, chemical manufacturers specializing in the production of bulk chemicals like formamide, DMF, and formic acid constitute a foundational customer base, where methyl formate serves as a dedicated, high-volume intermediate necessary for large-scale production cycles.

Niche but high-value buyers include pharmaceutical and fine chemical companies. These entities require high-purity methyl formate for specific synthetic steps, often involving Grignard reactions or other sensitive chemical transformations where residual impurities could compromise the final product quality. For these customers, cost is secondary to purity and regulatory documentation, driving demand for premium-grade products supplied through audited distribution networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $815 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Mitsubishi Gas Chemical Company (MGC), Wanhua Chemical Group, China National Petroleum Corporation (CNPC), Shandong Hualu-Hengsheng Chemical, Eastman Chemical Company, Chemanol, Taminco (now part of Eastman), Dairen Chemical Corporation, Luxi Chemical Group, Gujarat Alkalies and Chemicals Ltd. (GACL), Perstorp Holding AB, Lee Chang Yung Chemical Industry Corp., Shanghai Huayi Group, Feicheng Acid Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methyl Formate Market Key Technology Landscape

The production of methyl formate is dominated by two primary technological pathways: the carbonylation of methanol and the dehydrogenation of methanol. The carbonylation route involves reacting methanol with carbon monoxide under high pressure and temperature, typically utilizing homogeneous base catalysts like sodium methoxide. This is the more widely adopted and economically scalable process globally, especially favored by large producers due to its high selectivity and potential for continuous operation. Recent technological advancements in this area focus heavily on optimizing catalyst systems, moving towards heterogeneous or immobilized catalysts to improve catalyst recovery, reduce waste, and enhance operational safety, thereby significantly lowering overall production costs and environmental impact.

The dehydrogenation of methanol offers an alternative, less common route, particularly suitable when formic acid is the primary target product and methyl formate is an intermediate. This process involves passing methanol vapor over specific metal oxide catalysts at elevated temperatures. While generally less energy-intensive than the carbonylation route, it requires meticulous management of reaction conditions to maintain selectivity and prevent undesired side product formation. Ongoing research aims at developing highly efficient, noble-metal-free catalysts to make this method more economically competitive against carbonylation, especially in regions with access to cheap renewable energy sources.

Beyond synthesis, technological advancements are critical in the application sphere, particularly concerning its use as a blowing agent. Manufacturers are increasingly utilizing sophisticated blending technologies and specialized equipment to ensure safe and efficient incorporation of methyl formate into PU foam formulations. This includes developing pre-blended polyol systems and optimized mixing heads that address the volatility and flammability concerns associated with methyl formate, allowing foam manufacturers to achieve consistent cell structure and superior insulation properties while adhering to rigorous industrial safety standards.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by massive infrastructure expansion and urbanization, especially in China, India, and Southeast Asian nations. The region’s reliance on PU foam for construction insulation, coupled with a robust domestic agrochemical industry, sustains high consumption rates. Furthermore, the presence of major methanol producers and downstream chemical manufacturers establishes APAC as a global production hub. Regulatory environment is becoming stricter, mimicking Western standards, which encourages the transition to cleaner blowing agents.

- North America: The market in North America is characterized by mature end-use industries (automotive and construction) and stringent environmental regulations. Demand is stable, driven mainly by the high adoption rate of energy-efficient building standards (e.g., LEED certification), which requires high-R-value insulation. The region emphasizes safety and environmental compliance, thus favoring high-purity methyl formate grades and demanding sophisticated logistical infrastructure for transport and storage.

- Europe: Europe is a significant consumer, marked by pioneering environmental policies (e.g., the F-Gas regulation) that favor methyl formate as a transitional or permanent replacement for high global warming potential (GWP) alternatives in foaming. The market is highly influenced by the automotive sector’s drive towards lightweight materials and the continuous effort to retrofit existing buildings with better insulation. Innovation is concentrated in catalyst research and green synthesis routes to comply with REACH and other complex chemical safety standards.

- Latin America (LATAM): LATAM presents moderate growth potential, tied closely to economic stability and infrastructure investment cycles in countries like Brazil and Mexico. The agrochemical segment is particularly strong, given the importance of agriculture in the regional economy. Challenges include fragmented regulatory landscapes and reliance on imported raw materials or finished methyl formate, impacting price stability.

- Middle East and Africa (MEA): The MEA region is emerging as a critical production center, leveraging abundant access to cheap natural gas (a methanol precursor). Demand is rising, particularly in the Gulf Cooperation Council (GCC) states due to large-scale construction projects and the need for efficient cooling/insulation solutions in extreme climates. However, local consumption in many parts of Africa remains low, primarily focused on imported agrochemical products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methyl Formate Market.- BASF SE

- Mitsubishi Gas Chemical Company (MGC)

- Wanhua Chemical Group

- China National Petroleum Corporation (CNPC)

- Shandong Hualu-Hengsheng Chemical

- Eastman Chemical Company

- Chemanol (formerly Sipchem)

- Dairen Chemical Corporation

- Luxi Chemical Group

- Gujarat Alkalies and Chemicals Ltd. (GACL)

- Perstorp Holding AB

- Lee Chang Yung Chemical Industry Corp.

- Shanghai Huayi Group

- Feicheng Acid Chemicals

- Taminco (now part of Eastman)

- Ashland Global Holdings Inc.

- MOL Group

- Lotte Chemical Corporation

- Sinopec

- Celanese Corporation

Frequently Asked Questions

Analyze common user questions about the Methyl Formate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of Methyl Formate demand in the construction sector?

The primary driver is the global regulatory push to phase out high global warming potential (GWP) blowing agents (like HFCs) used in polyurethane (PU) foam insulation. Methyl formate is utilized as an efficient, low-GWP co-blowing agent, directly supporting energy efficiency mandates and green building standards across residential and commercial construction projects globally.

How does the volatility of methanol prices affect the Methyl Formate market?

Methanol is the primary raw material for methyl formate synthesis. Price volatility in the global methanol market, which is closely linked to natural gas and crude oil prices, directly impacts the production cost and profit margins of methyl formate manufacturers. High raw material costs can force producers to raise end-product prices, potentially affecting competitiveness against alternative chemical intermediates.

What is the main application of Methyl Formate in the agrochemical industry?

In the agrochemical industry, methyl formate is principally used as a versatile chemical intermediate for synthesizing key compounds, including various herbicides, insecticides, and pesticides. It also finds niche use as a fumigant for stored crops, though this application is subject to strict regulatory controls due to safety concerns.

Why is Asia Pacific considered the dominant region in the Methyl Formate Market?

Asia Pacific dominates the market due to robust economic growth fueling unprecedented infrastructure development (leading to massive demand for insulation materials), extensive agricultural activity requiring agrochemicals, and the significant operational capacity of major chemical manufacturing plants located primarily in China and India.

What are the major challenges related to the handling and storage of Methyl Formate?

The major challenges stem from Methyl Formate’s physical properties: it is highly volatile, flammable, and toxic upon high exposure. Handling requires specialized, explosion-proof equipment, stringent ventilation systems, and adherence to strict safety protocols (including specialized training and personal protective equipment) to mitigate health risks and ensure compliance with chemical safety regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager