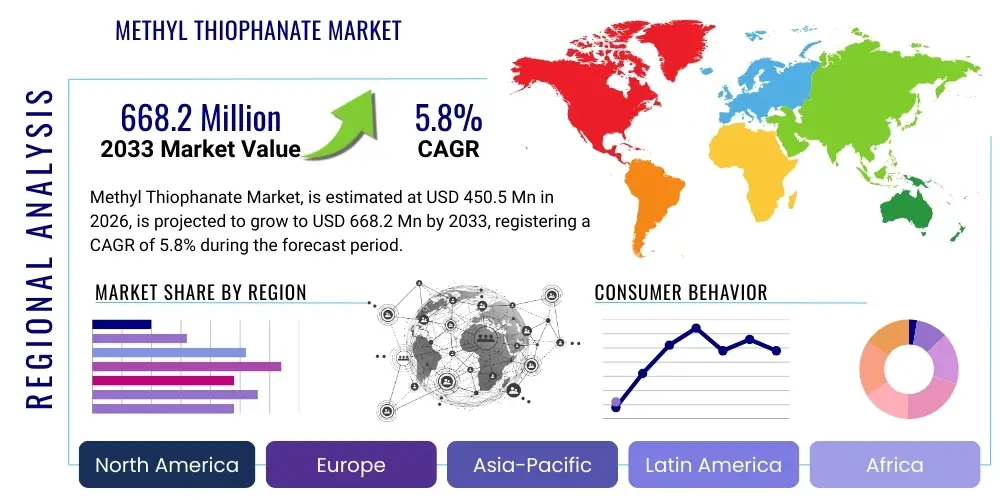

Methyl Thiophanate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438598 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Methyl Thiophanate Market Size

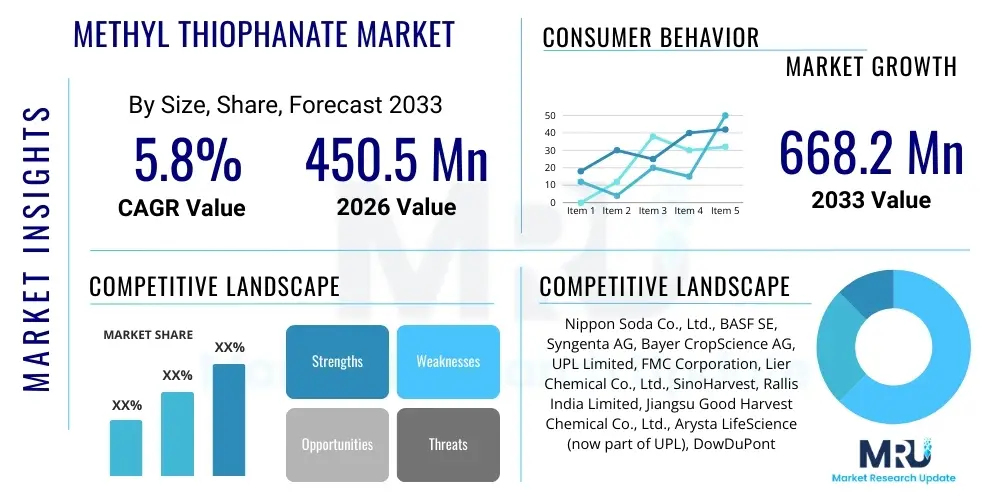

The Methyl Thiophanate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 668.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the persistent necessity for effective disease control in high-value agricultural systems worldwide, despite increasing regulatory scrutiny and the industry's continuous effort to manage the emergence of fungicide-resistant pathogen strains. The systemic nature and broad efficacy of Methyl Thiophanate against economically significant fungal diseases, particularly in large-acreage crops and intensive horticulture, underpin its steady demand, ensuring its critical role in contemporary integrated pest management (IPM) programs.

Methyl Thiophanate Market introduction

Methyl Thiophanate, a highly effective systemic fungicide belonging to the benzimidazole group, is essential in global crop protection, distinguished by its active breakdown into Carbendazim—the primary fungitoxic entity—once absorbed by the plant. This conversion grants the product superior mobility within the vascular system, providing protection to new growth and roots, which is crucial for maximizing yield potential and crop quality. Developed originally by Nippon Soda, its application spectrum is exceptionally broad, targeting critical pathogens like Fusarium, Cercospora, and various types of rust and scab, which cause substantial economic losses if left unchecked. Its usage is particularly concentrated in preventative and curative treatments for perennial crops where consistent disease management is paramount for long-term productivity.

The core utility of Methyl Thiophanate lies in its versatility across various crop types and application methods, including foliar sprays, soil drenching, and increasingly, seed treatments. The global agriculture sector relies on its residual activity, which offers extended protection periods, thereby reducing the frequency of application and associated operational costs for farmers. However, the reliance on this chemical class has led to the development of widespread resistance among certain fungal populations, specifically those targeting high-frequency crops. Consequently, modern market strategy focuses on selling Methyl Thiophanate as part of a rotational schedule or in pre-mixed formulations, enhancing its sustainability profile and maintaining long-term field performance.

Major driving factors sustaining the Methyl Thiophanate market include the sustained expansion of export-driven high-value crops, stringent quality standards imposed by international markets requiring blemish-free produce, and the lack of readily available, economically competitive alternatives with an identical mode of systemic action. Benefits encompass reduced phytotoxicity, suitability for various formulation types (especially water-based SCs), and efficient control over diseases such as powdery mildew in grapes and apples, and dollar spot in turf grass. The market dynamics dictate that manufacturers must invest heavily in formulation technology and robust stewardship programs to address resistance and regulatory concerns, ensuring the continued viability of this foundational fungicide.

Methyl Thiophanate Market Executive Summary

The Methyl Thiophanate market demonstrates resilience amid challenges, characterized by pivotal business trends emphasizing specialization and geographical realignment. There is a noticeable trend toward the consolidation of technical grade manufacturing in competitive Asian markets, coupled with increasing international scrutiny over quality standards, driving demand for 97% TC purity levels to satisfy stringent import regulations in the EU and North America. Key industry participants are heavily investing in developing proprietary, environmentally safer formulations, particularly advanced microencapsulated or flowable concentrates that minimize occupational exposure risks and improve biological effectiveness through enhanced rainfastness and better systemic uptake. Furthermore, strategic alliances are being formed between generic manufacturers and specialty distributors to ensure deep penetration into regional agricultural hubs in Latin America and Southeast Asia, regions experiencing significant acreage growth and high demand for crop protection chemicals.

Regional trends highlight a bipolar market structure: mature markets like North America and Europe prioritize product stewardship, resistance management, and regulatory compliance, resulting in premium pricing and stable but slow growth. In stark contrast, the Asia Pacific and Latin American regions exhibit rapid volume growth, propelled by the urgent need to protect major commodity crops like rice, soybeans, and cereals from pervasive fungal diseases. APAC’s production dominance ensures competitive global supply, but its internal consumption growth, driven by India's expanding agriculture sector and China's focus on high-quality production, solidifies its critical importance. Latin America's increasing reliance on export-oriented agriculture mandates the use of highly effective systemic fungicides, underpinning robust regional expansion despite economic volatility.

Segmentation analysis underscores the enduring importance of the Fruits and Vegetables application segment due to the high return on investment derived from disease prevention in these sensitive crops. Formulation trends show a consistent move away from older Wettable Powders (WP) toward Suspension Concentrates (SC), which are easier to handle and offer superior environmental properties. Moreover, the segmentation based on Purity Level confirms that technical innovation is focused on producing high-grade material to facilitate complex co-formulations. Successful market navigation requires a keen understanding of pathogen resistance development within these specific segments, forcing producers to continually adapt their product offerings to maintain efficacy and farmer trust, specifically through the introduction of synergistic combination products that incorporate diverse modes of action alongside Methyl Thiophanate.

AI Impact Analysis on Methyl Thiophanate Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning can optimize the application of systemic fungicides like Methyl Thiophanate, particularly regarding dose calibration, disease prediction accuracy, and resistance management. Key themes revolve around leveraging AI-driven predictive modeling to forecast fungal outbreaks based on localized weather data and soil conditions, enabling timely, localized fungicide application rather than routine preventative spraying. There is also significant concern regarding the integration cost and accessibility of such technologies for smallholder farmers, alongside expectations that AI could drastically reduce the total volume of Methyl Thiophanate used per hectare, thereby addressing regulatory pressures related to environmental residues and promoting more sustainable practices within the crop protection lifecycle.

Furthermore, the integration of AI extends into the formulation and supply chain optimization aspects. In manufacturing, machine learning models are being utilized to optimize the synthesis process for Methyl Thiophanate, predicting the effects of subtle changes in temperature or pressure on product yield and purity, ensuring consistency across batches. In the commercial phase, AI algorithms analyze market demand fluctuations and regional disease pressure forecasts to optimize inventory placement and logistics, ensuring that complex, multi-component Methyl Thiophanate formulations are available to farmers precisely when the risk of outbreak is highest. This predictive capacity mitigates losses associated with both overstocking and critical supply shortages during peak agricultural seasons.

The transformative effect of AI also manifests in enhanced product stewardship. Digital platforms powered by machine learning provide agronomists and farmers with real-time feedback on the efficacy of rotational strategies. By simulating various fungicide rotation scenarios and predicting the likelihood of resistance evolution under different application protocols, AI tools ensure that Methyl Thiophanate remains an effective tool in the long term. This technological integration not only increases the return on investment for farmers but also reinforces the sustainability profile of the compound, aligning its use with global regulatory mandates for reduced pesticide input and improved environmental accountability.

- AI enhances predictive disease modeling, optimizing the timing and location of Methyl Thiophanate applications, leading to reduced overall usage volume and extended compound lifetime.

- Machine learning algorithms analyze large datasets (weather, historical infection rates, sensor data, crop health indices) to calibrate the precise, minimum effective dose, mitigating resistance risks associated with sub-lethal dosing.

- Robotics and autonomous sprayers, guided by AI vision systems, ensure targeted application only to affected plant areas (spot spraying), minimizing off-target drift, worker exposure, and total active ingredient load per hectare.

- AI-driven supply chain optimization improves forecasting for Methyl Thiophanate demand, reducing inventory costs and ensuring timely product availability during critical infection windows, especially for specialized formulations.

- Digital agricultural platforms utilize AI to provide real-time, data-backed recommendations to farmers on fungicidal rotation strategies, supporting better resistance management protocols and optimizing tank-mix partners for maximum efficacy.

- Predictive analytics in manufacturing optimizes chemical synthesis parameters, ensuring higher purity technical grade material (e.g., 97% TC) and reducing the energy consumption associated with the complex production chain.

- AI-enabled image analysis systems diagnose fungal infection types and severity rapidly in the field, ensuring the correct systemic fungicide (or combination product containing Methyl Thiophanate) is selected instantly.

DRO & Impact Forces Of Methyl Thiophanate Market

The market for Methyl Thiophanate operates under distinct forces that govern its global trajectory. Drivers are deeply rooted in global food security demands, specifically the sustained need to protect staple crops from devastating fungal diseases such as leaf blight, rusts, and powdery mildews, which can cause 30-50% yield losses if uncontrolled. Methyl Thiophanate’s reputation as a highly cost-effective systemic treatment with broad-spectrum activity makes it the preferred initial defense line in many developing agricultural systems. Furthermore, the expansion of modern irrigation techniques and protected agriculture (greenhouses) in semi-arid regions creates environments highly conducive to fungal growth, consequently bolstering demand for potent, systemic fungicides capable of managing these high-humidity environments.

Conversely, significant restraints hinder unfettered market expansion, chiefly the globally recognized issue of fungal resistance to the benzimidazole class. This biological phenomenon shortens the effective lifespan of the product, requiring continuous and expensive product stewardship campaigns and mandated usage restrictions by regulatory bodies. Compounding this challenge are stringent regulatory restraints in key OECD markets. The EU’s continuous review of pesticide active substances based on endocrine disruption potential and persistent environmental residue characteristics (PBT criteria) threatens the long-term registration status, leading manufacturers to seek safer, less persistent alternatives or focus disproportionately on markets with more lenient regulations, potentially fragmenting the global supply chain.

Opportunities for market players are concentrated in two primary areas: innovation in multi-mode-of-action combination products and strategic pivot towards non-traditional applications. Co-formulating Methyl Thiophanate with strobilurins (QoIs) or triazoles (DMIs) creates synergistic effects, improving efficacy and delaying resistance, presenting a premium product offering. Non-traditional growth avenues include specialty applications in post-harvest protection, preserving high-value fruits during long transit, and increased utilization as a soil treatment to control root-borne diseases in high-density planting systems. Impact forces include macroeconomic factors such as volatility in crude oil prices, which directly affect the cost of synthesis precursors and packaging materials, alongside geopolitical trade tensions that can disrupt the movement of technical grade material from Asian manufacturing hubs to formulation sites globally. Climate change also acts as an impact force, shifting disease patterns and requiring farmers to rely more heavily on robust fungicides during unpredictable weather events.

Segmentation Analysis

Segmentation analysis of the Methyl Thiophanate market reveals targeted strategies deployed by manufacturers to meet diverse global agricultural needs. The segmentation by Purity Level (95% TC vs. 97% TC) highlights a market maturation, where demand is shifting towards higher purity technical material. This shift is critical because higher purity reduces the variability in the final formulated product and ensures better compliance with tight regulatory specifications regarding inactive ingredients and impurities, especially those tracked by European agencies. Formulators serving export-oriented growers prioritize 97% TC to minimize batch failures and ensure maximum efficacy and regulatory acceptance of their end products.

The Formulation segment is pivotal, reflecting the evolution of user preferences and environmental safety mandates. Wettable Powders (WP) remain cost-effective but pose challenges related to dusting, handling safety, and tank mixing. Suspension Concentrates (SC), characterized by extremely fine particle dispersion in water, offer improved efficacy, reduced exposure risk for applicators, and better compatibility in complex tank mixes, driving their increasing market share, particularly in developed regions. Specialized forms like microencapsulation (CS) are emerging, offering controlled release properties, which further reduces application frequency and prolongs the residual activity, aligning with modern sustainability goals.

- By Purity Level:

- 95% Technical Grade (TC): Utilized primarily in generic or cost-sensitive markets, offering a baseline for standard formulations.

- 97% Technical Grade (TC): Preferred for advanced, export-compliant formulations and high-specification mixtures due to enhanced stability and reduced impurities.

- Other Purity Levels (e.g., intermediates, lower grades): Used for specific, often local, industrial applications or further processing.

- By Formulation:

- Wettable Powder (WP): Traditional, cost-effective formulation, high market share in developing regions.

- Suspension Concentrate (SC): Modern, high-performance formulation offering superior handling, rainfastness, and better systemic uptake; gaining market dominance.

- Dustable Powder (DP): Niche use, mainly for seed or specific soil treatments.

- Emulsifiable Concentrate (EC): Less common for Thiophanate but utilized in specific tank-mix scenarios requiring oil-based carriers.

- Others (e.g., Granules, Capsule Suspensions): Specialized formulations for controlled release or targeted soil application.

- By Application:

- Fruits and Vegetables (e.g., Apples, Grapes, Tomatoes, Citrus): Highest value segment requiring frequent protection against surface blemishes and rots.

- Cereals and Grains (e.g., Wheat, Barley, Rice, Maize): Largest volume segment, crucial for managing foliar and seed-borne diseases across extensive acreage.

- Oilseeds and Pulses (e.g., Soybeans, Cotton, Peanuts): Essential for controlling diseases like white mold and leaf spot, critical for yield preservation.

- Ornamentals and Turf: High-specification market for controlling fungal diseases in public spaces, golf courses, and commercial nurseries.

- Others (e.g., Sugar Beet, Tobacco, Forestry): Minor applications addressing highly specific regional fungal threats.

Value Chain Analysis For Methyl Thiophanate Market

The upstream segment of the Methyl Thiophanate value chain is characterized by a high degree of technical expertise and dependency on petrochemical derivatives. Synthesis begins with complex, multi-step organic chemistry involving intermediate suppliers, where the purity and cost of precursors like thiourea and specific aromatic compounds are major determinants of final product economics. Manufacturing of the technical grade active ingredient (AI) is concentrated in facilities, primarily in China and India, which possess the necessary infrastructure and cost advantages for chemical production at scale. Quality control protocols at this stage are extremely stringent, focusing on minimizing hazardous impurities and maximizing the yield of the desired 97% TC material, which requires continuous process optimization and regulatory oversight to comply with international standards such as ISO certification.

The midstream component involves the intricate process of formulation, packaging, and branding. Global agrochemical giants and large generic companies invest heavily in formulation science to transform the raw TC material into usable commercial products (SC, WP). Formulation involves selecting the appropriate inert ingredients—dispersants, anti-caking agents, and wetting agents—to ensure optimal product performance and stability, a key differentiator in the competitive market. The distribution channel is vast and complex, often involving multi-tiered structures. Global distribution is typically handled by large-scale multinational companies (MNCs) that utilize specialized logistics for handling hazardous materials, moving product to regional hubs. These hubs then feed national distributors, who, in turn, supply thousands of local retailers, agricultural cooperatives, and direct farm delivery services.

Downstream activities center on end-user interaction and technical support. Direct sales models are often employed for large commercial farms or high-value perennial operations where technical consultation on resistance management and product rotation is essential. Indirect channels rely heavily on local dealer networks and agricultural advisors (agronomists) who serve as key opinion leaders, translating complex product application instructions into actionable advice for farmers. The final consumption is driven by the perceived efficacy, local recommendations, and price point relative to competing non-benzimidazole chemistries. Effective product stewardship, including training on safe use and dosage management, is critical throughout the downstream chain to maintain brand integrity and regulatory compliance, particularly concerning Maximum Residue Levels (MRLs) in harvested crops destined for export.

Methyl Thiophanate Market Potential Customers

The primary consumers of Methyl Thiophanate products are commercial agricultural entities engaged in high-intensity cropping systems where fungal diseases pose a continuous threat to economic yields. This includes large-scale farm cooperatives specializing in commodity crops like wheat and soybeans, where efficient, systemic protection across vast acreage is essential. Furthermore, high-value horticultural producers, such as vineyard owners, apple growers, and commercial greenhouse operators focusing on export-grade fruits and vegetables, represent critical buyers who prioritize superior disease control and acceptable residue profiles to meet international market standards.

Secondary customer segments include professional turf and ornamental management companies, municipal parks departments, and forestry services that utilize Methyl Thiophanate formulations for managing specific foliar and soil-borne diseases in non-food crops. These institutional buyers focus on product safety for public areas and long-lasting efficacy. Seed treatment companies are also significant consumers, utilizing the product for prophylactic treatment of planting material to protect seedlings during the crucial early development phase against soil-borne pathogens, ensuring robust crop establishment.

The purchasing decisions of these end-users are driven primarily by demonstrated field efficacy against target diseases, cost-per-acre application rate, and local regulatory approval. Given the resistance concerns associated with benzimidazoles, sophisticated customers increasingly seek combination products that integrate Methyl Thiophanate into a resistance management strategy. Therefore, manufacturers must target buyers who are committed to integrated pest management (IPM) practices and are willing to invest in premium, steward-managed formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 668.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Soda Co., Ltd., BASF SE, Syngenta AG, Bayer CropScience AG, UPL Limited, FMC Corporation, Lier Chemical Co., Ltd., SinoHarvest, Rallis India Limited, Jiangsu Good Harvest Chemical Co., Ltd., Arysta LifeScience (now part of UPL), DowDuPont (now Corteva Agriscience), ADAMA Agricultural Solutions Ltd., Chemtura Corporation (now part of Lanxess), Kenvos Biotech Co., Ltd., Shandong Luba Chemical Co., Ltd., Hubei Sanonda Co., Ltd., Hebei Weiyong Biochemical Co., Ltd., Zhejiang Xinnong Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., and Gharda Chemicals Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methyl Thiophanate Market Key Technology Landscape

The technological evolution in the Methyl Thiophanate sector is driven by the dual goals of maximizing biological efficacy and minimizing environmental footprint, starting at the chemical synthesis stage. Manufacturers are employing advanced catalyst systems and continuous flow chemistry to optimize the conversion efficiency of intermediate chemicals into the Thiophanate molecule, significantly improving process safety and reducing the energy intensity per kilogram of active ingredient produced. Furthermore, analytical technologies like High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS) are essential for ensuring the ultra-high purity (>97% TC) required, rigorously monitoring trace impurities that could be problematic for regulatory submission or formulation stability.

Formulation technology represents a critical competitive battleground. The development of next-generation Suspension Concentrates (SC) relies on sophisticated milling and micronization techniques that reduce particle size to the nano or sub-micron level. This fine particle size increases the total surface area, leading to better suspension stability, superior coverage upon application, and enhanced systemic uptake by the plant. Another key innovation is the use of specialized polymeric coating materials to create Capsule Suspensions (CS), which encapsulate the Methyl Thiophanate, providing controlled release kinetics. This technology not only extends the fungicidal protection period but also potentially shields the active ingredient from premature degradation by UV light or heavy rainfall, optimizing its environmental persistence profile.

On the application side, the adoption of sensor-based technologies and precision agriculture systems is revolutionizing usage patterns. Growers are increasingly utilizing Normalized Difference Vegetation Index (NDVI) mapping and multi-spectral drone imagery to identify early signs of fungal stress before visible symptoms appear. This data, often processed by AI tools, feeds into Variable Rate Technology (VRT) sprayers, which can modulate the application rate of Methyl Thiophanate in real time across a field. This VRT application minimizes chemical load in healthy areas, drastically reducing overall input costs, lowering residue concerns, and strategically reducing exposure frequency for pathogens, which is the cornerstone of effective resistance management in high-use chemistries like Methyl Thiophanate.

Regional Highlights

- Asia Pacific (APAC): APAC accounts for the largest market share, predominantly due to the sheer volume of key crops like rice, vegetables, and fruit grown across China, India, and Southeast Asia, coupled with high fungal disease pressure from tropical and sub-tropical climates. Production capacity is heavily centered here, ensuring low manufacturing costs. The growth is fueled by expanding domestic consumption and the region's role as a vital global supplier of both technical grade material and formulated products. However, quality control and regulatory harmonization across diverse nations remain complex challenges.

- North America: This region is characterized by high operational efficiency and advanced farming practices. Methyl Thiophanate usage is highly regulated, focusing on specific high-value crops (e.g., peanuts, turf, ornamental plants, and pome fruits) where alternative chemistries may face their own limitations. Demand is stable, driven by the need for superior quality control and strict adherence to EPA guidelines, which necessitates the use of high-purity SC and combination products to minimize resistance development and manage residue levels.

- Europe: The European market faces existential pressures due to the EU regulatory framework (Regulation 1107/2009) and the "Farm to Fork" strategy, which mandates pesticide reduction. While registrations are tightly controlled, Methyl Thiophanate retains relevance in specific segments, particularly Southern European vineyards and protected vegetable cultivation, where its systemic properties are irreplaceable. The market demands advanced, low-dose formulations and rigorous data demonstrating ecological safety and MRL compliance for continued use.

- Latin America: Representing a significant growth engine, the Latin American market, particularly Brazil, Argentina, and Mexico, depends heavily on Methyl Thiophanate for its expansive soybean, corn, and coffee cultivation. Systemic action is crucial for managing widely dispersed fungal diseases over large, mechanized farms. Market growth is robust, often driven by favorable registration processes and high commodity prices encouraging investment in potent crop protection tools to secure export yields.

- Middle East and Africa (MEA): This is an emerging market characterized by rapid growth in specialized agriculture, notably protected cultivation in water-scarce Gulf nations (UAE, Saudi Arabia) and expansion of traditional crops in Turkey and Egypt. Demand is primarily met through imports. Regulatory standards vary widely, presenting both opportunities for rapid market entry and risks related to inconsistent product quality or counterfeiting, demanding strong local partnerships for distribution and technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methyl Thiophanate Market.- Nippon Soda Co., Ltd.

- BASF SE

- Syngenta AG

- Bayer CropScience AG

- UPL Limited

- FMC Corporation

- Lier Chemical Co., Ltd.

- SinoHarvest

- Rallis India Limited

- Jiangsu Good Harvest Chemical Co., Ltd.

- Arysta LifeScience (now part of UPL)

- Corteva Agriscience

- ADAMA Agricultural Solutions Ltd.

- Lanxess (Chemtura integration)

- Kenvos Biotech Co., Ltd.

- Shandong Luba Chemical Co., Ltd.

- Hubei Sanonda Co., Ltd.

- Hebei Weiyong Biochemical Co., Ltd.

- Zhejiang Xinnong Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Gharda Chemicals Ltd.

- Red Sun Group Co., Ltd.

- AgriChem SA

- Hefei Xingyu Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Methyl Thiophanate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Methyl Thiophanate, and why is it considered systemic?

Methyl Thiophanate is a systemic benzimidazole fungicide that metabolizes rapidly within the plant into Carbendazim. Carbendazim disrupts fungal cell division by inhibiting beta-tubulin polymerization. It is systemic because the plant absorbs the chemical via roots and foliage and translocates it throughout the vascular system, providing both protective and curative coverage to new growth.

Which crop applications drive the highest value and volume demand for Methyl Thiophanate?

The highest value is driven by the Fruits and Vegetables segment, including high-return crops like grapes, apples, and specialty vegetables. The largest volume consumption, however, is driven by staple field crops within the Cereals and Grains segment (e.g., wheat, rice) across large agricultural regions in Asia Pacific and Latin America.

How is Methyl Thiophanate resistance managed in major agricultural production systems?

Resistance is managed through strict compliance with Fungicide Resistance Action Committee (FRAC) guidelines, primarily requiring rotation with fungicides from different chemical groups (non-benzimidazoles, such as triazoles or strobilurins) and increasing reliance on pre-mixed, co-formulated products that feature two or more active ingredients with distinct modes of action.

What are the key differences between Wettable Powder (WP) and Suspension Concentrate (SC) formulations?

WP is a traditional, cost-effective powder form that requires careful mixing and can create dust exposure risks. SC is a modern liquid formulation utilizing ultra-fine particles dispersed in water, offering superior stability, easier handling, better rainfastness, enhanced systemic uptake, and reduced applicator exposure risks, making it the preferred format in developed markets.

What regulatory constraints significantly affect the future market growth of Methyl Thiophanate, particularly in Europe?

Market growth is constrained globally by stringent Maximum Residue Limits (MRLs) and continuously reviewed toxicology data. In Europe, growth is severely restricted by the EU's proactive elimination policy targeting active substances that exhibit potential endocrine disruption or PBT (Persistent, Bioaccumulative, Toxic) properties, leading to application limits and the constant threat of registration removal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager