Methylamine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437951 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Methylamine Market Size

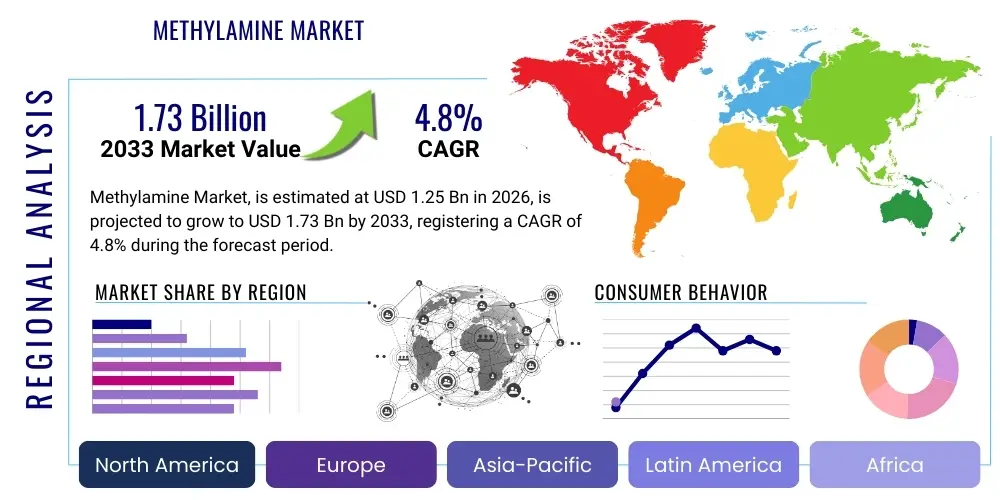

The Methylamine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.73 Billion by the end of the forecast period in 2033.

Methylamine Market introduction

Methylamine, a colorless, flammable gas derived from the reaction of ammonia and methanol, serves as a fundamental building block in the chemical industry. It exists primarily in three forms: Monomethylamine (MMA), Dimethylamine (DMA), and Trimethylamine (TMA). These derivatives possess distinct chemical properties that make them indispensable intermediates in a vast array of downstream applications, including the synthesis of pharmaceuticals, agrochemicals, solvents, rubber chemicals, and specialized polymers. The market dynamics are intrinsically linked to the performance of these major end-use sectors, particularly the accelerating demand for high-efficacy pesticides and sophisticated, small-molecule drug components globally. Methylamine production is typically centered around large petrochemical complexes, requiring precise control over temperature and pressure to achieve desired ratios of the various derivatives, which significantly influences cost structures and supply chain stability within the global market.

The core applications of methylamine highlight its strategic importance. MMA is crucial for manufacturing intermediates for carbamate pesticides and specific pharmaceutical active ingredients. DMA is extensively utilized in the production of solvents such as Dimethylformamide (DMF) and Dimethylacetamide (DMAC), which are vital in the textiles, electronics, and coatings industries, alongside its role in rubber processing aids and water treatment chemicals. TMA finds its niche primarily in choline chloride production, which is essential for animal nutrition, and in the synthesis of quaternary ammonium salts used as surfactants and disinfectants. This broad application spectrum ensures consistent, diversified demand for methylamine, insulating the market partially from volatility in any single end-use sector.

Market growth is substantially driven by the rising global population, which necessitates increased agricultural output and, consequently, higher consumption of agrochemicals derived from methylamine, such as methomyl and carbofuran. Furthermore, the expansion of the generic and branded pharmaceutical industries, particularly in emerging economies, propels the demand for methylamine as a key precursor in complex drug synthesis. However, the market faces regulatory constraints related to the handling and transportation of methylamine, which is a hazardous substance. Successful navigation of these complex regulatory landscapes, coupled with innovations in sustainable production methodologies, are key factors determining market players' competitive advantage and overall market expansion throughout the forecast period.

Methylamine Market Executive Summary

The global Methylamine Market is characterized by moderate but stable growth, driven predominantly by strong consumption patterns in the Asia Pacific region, led by China and India, which are major hubs for pharmaceutical and agrochemical manufacturing. Key business trends include capacity expansion by established players and a strategic shift towards integrated production facilities to enhance cost efficiency and supply chain resilience. Regionally, while APAC dominates volume, North America and Europe maintain a stronghold on high-purity methylamine derivatives for specialized pharmaceutical applications, commanding premium pricing. A critical segment trend is the sustained high demand for Monomethylamine (MMA) and Dimethylamine (DMA) due to their integral roles in high-volume industrial solvents and the continuous need for high-efficacy crop protection solutions globally. The market structure remains moderately consolidated, emphasizing long-term supply contracts to mitigate the raw material price fluctuations inherent in methanol and ammonia feedstocks, which directly influence the final product cost structures across all geographical boundaries.

Significant competitive pressures stem from the necessity to comply with stringent environmental, health, and safety (EHS) regulations pertaining to methylamine production and storage. Companies are investing heavily in advanced catalyst technology to optimize the selectivity toward desired methylamine derivatives (MMA, DMA, or TMA), thereby reducing waste and improving operational efficiency. The ongoing macroeconomic factors, such as fluctuating energy costs and global supply chain disruptions, have intermittently impacted feedstock procurement, requiring businesses to maintain robust inventory management strategies. Furthermore, the shift towards bio-based or synthetic methanol pathways for feedstock generation presents a long-term strategic pivot for leading manufacturers aiming for sustainability and reduced reliance on conventional petrochemical sources. These strategic alignments are pivotal in maintaining market share and capitalizing on emerging opportunities in niche applications such as specialized polymers and high-performance electronic materials.

In terms of segmentation, the dominance of the agrochemical application segment is expected to continue, although the pharmaceutical segment is projected to exhibit the fastest growth rate, fueled by substantial global investments in drug development and manufacturing decentralization. Emerging markets are also showing increasing uptake of advanced methylamine derivatives in areas like water treatment and pulp and paper processing, expanding the traditional application base. The market’s future trajectory will be closely tied to regulatory decisions in key agricultural economies regarding pesticide registration and usage, alongside the overall health and investment levels within the global chemical and life sciences sectors. Manufacturers focusing on process intensification and establishing regional distribution hubs closest to major consumption centers will likely gain a substantial competitive edge in the highly logistics-sensitive methylamine supply chain landscape.

AI Impact Analysis on Methylamine Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Methylamine Market frequently revolve around optimizing complex chemical processes, enhancing supply chain prediction, and accelerating regulatory compliance. Users often seek confirmation on whether AI can significantly improve the yield and selectivity of MMA, DMA, and TMA production—a traditionally challenging chemical synthesis requiring precise kinetic control. Another key concern focuses on AI’s role in managing hazardous material logistics, including predicting optimal transportation routes and minimizing risks associated with storage and handling. Furthermore, there are expectations that AI-driven R&D tools could shorten the development cycle for new agrochemical or pharmaceutical compounds that utilize methylamine as a primary intermediate, thereby impacting long-term demand forecasting and innovation speed within end-user sectors.

The deployment of AI, particularly machine learning models and predictive analytics, is beginning to revolutionize the operational efficiency within methylamine manufacturing plants. These advanced analytical tools ingest vast quantities of real-time sensor data—including temperature, pressure, reactant flow rates, and catalyst degradation indicators—to identify correlations that human operators might overlook. By continuously refining reaction parameters, AI algorithms can ensure maximum utilization of feedstock materials (methanol and ammonia) and fine-tune the MMA/DMA/TMA output ratio based on immediate market demand, resulting in significant cost savings and reduced energy consumption. This capability to optimize selectivity is critical, as market pricing for the individual methylamine derivatives can vary substantially, necessitating flexible production schedules guided by algorithmic demand projections, thereby transforming traditional batch process management.

Beyond the manufacturing floor, AI algorithms are playing an increasingly vital role in sophisticated supply chain management, crucial for a hazardous bulk chemical like methylamine. Predictive maintenance models utilize AI to anticipate equipment failures, minimizing unexpected downtime and ensuring steady supply. Furthermore, AI tools are analyzing geopolitical risks, weather patterns, and port congestion data to optimize the global movement of methylamine and its derivatives, particularly in regions where transport infrastructure is volatile. In regulatory affairs, AI-powered systems assist in rapid synthesis of Material Safety Data Sheets (MSDS) updates and ensure adherence to diverse international chemical handling standards, thereby reducing the compliance burden and administrative costs associated with global trade and distribution of methylamine products.

- Process Optimization: AI-driven models enhance catalyst selectivity and reaction yield, minimizing methanol and ammonia waste in the synthesis of MMA, DMA, and TMA.

- Predictive Maintenance: Utilization of machine learning on plant sensor data to foresee equipment failure, significantly reducing unplanned downtime and improving asset longevity.

- Supply Chain Resilience: AI algorithms analyze global logistics data, optimizing hazardous material routing and storage to ensure timely and safe delivery to agrochemical and pharmaceutical clients.

- Demand Forecasting Accuracy: Advanced analytics provide highly accurate predictions of demand fluctuations across end-user segments, enabling producers to align variable production capacity efficiently.

- Quality Control Automation: AI vision systems and process monitoring reduce human error in quality inspection, ensuring high-purity methylamine grades required by the pharmaceutical sector.

- Regulatory Compliance Acceleration: AI tools assist in the rapid assessment of new chemical regulations and automate documentation processes (e.g., permits, safety data sheets) for cross-border shipments.

DRO & Impact Forces Of Methylamine Market

The Methylamine Market is shaped by a confluence of accelerating drivers related to global food security and healthcare, counterbalanced by regulatory and inherent operational restraints, creating substantial opportunities for strategic growth through technological innovation. Primary drivers include the expanding need for efficient crop protection chemicals derived from methylamine, mandatory for feeding the rapidly growing global population, coupled with the increasing role of methylamine derivatives in complex pharmaceutical synthesis, especially in emerging high-growth drug markets. However, the market faces significant restraints due to stringent governmental regulations regarding the handling, storage, and transportation of hazardous chemicals, alongside the inherent volatility and cost sensitivity of key feedstocks, namely methanol and ammonia, which directly impact manufacturing margins and competitive pricing structures globally. These competing forces collectively determine the market's overall growth trajectory and necessitate continuous operational adaptation among key industry participants.

A major driving force is the relentless demand from the global agrochemical industry. Methylamine is a non-substitutable precursor for several high-volume herbicides and insecticides essential for modern farming practices. As arable land diminishes and climate change introduces new pest challenges, the reliance on high-performance agrochemicals remains robust, thereby sustaining methylamine consumption. Concurrently, the rise of chronic diseases and the subsequent growth in drug discovery and manufacturing, particularly in specialized fields like oncology and anti-infectives, continues to push the demand for high-purity methylamine derivatives (MMA and DMA) as essential chemical building blocks. These drivers create a stable foundational demand that underlies the market’s steady projected CAGR, making it relatively resilient to short-term economic downturns, especially when compared to more discretionary chemical markets tied directly to consumer goods production cycles.

The key restraining factors necessitate careful strategic planning. The volatility in methanol and natural gas prices, tied to global energy markets, presents an unpredictable cost burden on methylamine producers, requiring sophisticated hedging strategies. Furthermore, the high capital expenditure required for establishing methylamine synthesis plants, coupled with the specialized infrastructure needed for safe handling and bulk transportation, creates substantial barriers to entry, concentrating market power among existing large-scale producers. Opportunities, conversely, lie in developing more sustainable and cost-effective production methods, such as utilizing bio-methanol, and aggressively targeting high-margin niche applications like specialized solvents for batteries, carbon capture technologies, and advanced electronic manufacturing, which require ultra-pure DMA and TMA derivatives and offer substantial premium potential compared to traditional bulk agrochemical applications.

- Drivers:

- High Global Demand for Agrochemicals: Methylamine is critical for synthesizing essential pesticides and herbicides necessary for agricultural productivity.

- Expansion of Pharmaceutical Manufacturing: Increasing use of methylamine as a non-substitutable precursor in small-molecule drug synthesis, particularly in Asia.

- Growing Solvent Market: Increased application of DMA and TMA derived solvents (DMF, DMAC) in electronics, polymer manufacturing, and advanced textiles.

- Demand for Animal Nutrition: Rising global meat consumption fuels demand for choline chloride (derived from TMA) used in animal feed supplements.

- Restraints:

- Feedstock Price Volatility: Fluctuations in the cost of methanol and ammonia, linked to global oil and gas prices, squeeze profit margins.

- Strict Regulatory Environment: High operational costs associated with compliance concerning the storage, transport, and handling of hazardous chemicals.

- High Barrier to Entry: Significant capital expenditure and technological know-how required for efficient, selective methylamine production.

- Opportunities:

- Development of Bio-based Methylamine: Utilizing sustainable bio-methanol feedstock pathways to meet growing corporate sustainability goals.

- Penetration into High-Purity Applications: Targeting niche markets such as semiconductor manufacturing and advanced battery electrolytes requiring ultra-pure DMA.

- Process Intensification: Adoption of novel catalytic systems (e.g., zeolites) to improve reaction efficiency and selectivity, lowering operational expenses.

- Impact Forces:

- Threat of New Entrants: Low to Moderate, due to high capital investment and regulatory hurdles.

- Bargaining Power of Suppliers: Moderate to High, driven by volatile commodity prices (methanol, natural gas).

- Bargaining Power of Buyers: Moderate, concentrated among large agrochemical and pharmaceutical buyers who rely on long-term contracts.

- Threat of Substitutes: Low, as methylamine's role in core applications (e.g., DMF, specific agrochemicals) is chemically unique and difficult to replace economically.

- Intensity of Competitive Rivalry: High, focused on maximizing plant utilization, cost leadership, and securing long-term supply agreements.

Segmentation Analysis

The Methylamine Market segmentation provides a crucial framework for understanding supply-demand dynamics and strategic market positioning across different product forms, applications, and regional consumption patterns. The primary segmentation is based on derivative type: Monomethylamine (MMA), Dimethylamine (DMA), and Trimethylamine (TMA). DMA consistently holds the largest market share due to its extensive use in high-volume solvents like DMF and DMAC, essential across diverse industrial sectors, including chemical processing, electronics, and textiles. However, MMA and TMA segments are exhibiting specialized growth, particularly in customized pharmaceutical synthesis and animal nutrition, respectively, signaling diversification in market value away from traditional bulk chemical usage.

The segmentation by application further highlights the market's stability and growth drivers. Agrochemicals constitute the dominant end-use segment globally, driven by the synthesis of insecticides and herbicides crucial for global food security. Despite its size, this segment often faces cyclical demand based on planting seasons and regional regulatory shifts. In contrast, the pharmaceutical segment, while smaller in volume, demands extremely high-purity methylamine derivatives and offers significantly higher profit margins, presenting a key growth area for producers focusing on quality control and specialized manufacturing capabilities. The differentiation between these high-volume, low-margin versus low-volume, high-margin applications dictates manufacturing strategy and investment priorities for leading market participants worldwide.

Furthermore, segmentation based on form (gaseous vs. aqueous solution) is important for logistics and regional market dynamics. While methylamine is often handled in bulk as an aqueous solution for ease of transportation and safety, specific applications, such as specialized chemical synthesis, might require the gaseous form. Regional analysis confirms Asia Pacific’s undisputed leadership in both production and consumption volume, capitalizing on low-cost feedstock availability and the rapid expansion of downstream industries. North America and Europe remain pivotal high-value markets, emphasizing stringent quality control and innovation in environmentally sustainable production and application technologies, often importing specialized derivatives from Asian and Middle Eastern producers who benefit from superior feedstock access and scale economies.

- By Derivative Type:

- Monomethylamine (MMA): Used primarily in carbamate pesticides, surfactants, and specific drug intermediates.

- Dimethylamine (DMA): Largest segment; crucial for solvents (DMF, DMAC), rubber chemicals (accelerators), and synthesis of specialized polymers.

- Trimethylamine (TMA): Key precursor for choline chloride (animal feed) and quaternary ammonium compounds (disinfectants, surfactants).

- By Application:

- Agrochemicals: Synthesis of insecticides (e.g., carbofuran, methomyl) and herbicides. (Largest segment)

- Pharmaceuticals: Used in the manufacture of antihistamines, anesthetics, and various active pharmaceutical ingredients (APIs). (Fastest-growing segment)

- Solvents: Production of Dimethylformamide (DMF) and Dimethylacetamide (DMAC) for textile, electronic, and chemical reaction use.

- Feed Additives/Animal Nutrition: Production of Choline Chloride.

- Rubber Processing Chemicals: Used as accelerators and curing agents.

- Others: Water treatment chemicals, surfactants, photographic chemicals.

- By Form:

- Aqueous Solution: Predominant form for storage and bulk transport due to safety and handling ease.

- Anhydrous (Gaseous): Used in specialized, high-purity chemical reactions requiring dry conditions.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Methylamine Market

The Methylamine market's value chain commences with the sourcing of critical upstream raw materials, primarily methanol and ammonia. Methanol production relies heavily on natural gas or coal (especially in China), while ammonia production is also highly energy-intensive, making the initial cost of methylamine extremely sensitive to global energy market fluctuations and specific regional feedstock costs. Key producers often benefit from backward integration into methanol or ammonia synthesis, which provides significant cost advantages and stable supply, critical in the competitive bulk chemical sector. The initial production phase involves the highly exothermic catalytic reaction of methanol and ammonia, where the challenge lies in maximizing the desired derivative selectivity (MMA, DMA, or TMA) which requires specialized reactors and proprietary catalyst technology to control product ratios based on immediate market demand.

The midstream segment involves the processing, separation, and purification of the crude methylamine mixture into commercial-grade derivatives. This stage requires substantial energy input for distillation and sophisticated separation technologies, particularly for achieving the ultra-high purity levels demanded by the pharmaceutical and electronics solvent markets. Strict adherence to quality standards is paramount, especially for regulatory-sensitive applications. Downstream activities involve the chemical transformation of MMA, DMA, and TMA into intermediate products—such as DMF, methomyl, or choline chloride—which are then sold directly to end-user industries. The efficiency of this downstream processing, often handled by the same major chemical conglomerates, directly impacts the profitability and final market pricing of the derivatives.

Distribution channels for methylamine are highly controlled due to its classification as a flammable, toxic, and corrosive substance. Direct sales dominate, particularly for large-volume customers in the agrochemical and solvent sectors, often managed through long-term supply agreements ensuring secure delivery using specialized rail cars, tanks, and pipelines. Indirect channels, involving third-party specialized chemical distributors, are utilized primarily for smaller, regional customers or those requiring specialized packaging and handling services. The strong reliance on specialized hazardous goods logistics ensures that the distribution segment adds significant value, demanding robust safety protocols and strong partnerships with experienced logistics providers capable of navigating complex international chemical transportation regulations and offering Just-In-Time (JIT) inventory management solutions.

Methylamine Market Potential Customers

Potential customers for methylamine span several major industrial sectors, categorized primarily by their need for specific methylamine derivatives (MMA, DMA, or TMA) as essential chemical precursors. The largest group comprises manufacturers within the agrochemical industry, who utilize methylamine derivatives extensively for synthesizing a wide range of crop protection products, including carbamate insecticides and various herbicides required for maintaining global agricultural productivity. These customers are typically large, multinational corporations that demand high-volume, consistent supply under strict quality specifications, making supply stability and competitive pricing the key determinants in procurement decisions. Their purchasing power is significant, often leading to long-term contractual arrangements that dictate a substantial portion of the methylamine market’s capacity allocation annually, ensuring stable base demand.

The second major customer segment is the pharmaceutical industry, including both large pharmaceutical companies and specialized Contract Manufacturing Organizations (CMOs). These entities require ultra-high purity grades of methylamine derivatives, primarily MMA and DMA, for the synthesis of Active Pharmaceutical Ingredients (APIs), anesthetics, and specific research chemicals. This segment is characterized by lower volume requirements compared to agrochemicals, but higher value realization due to the stringent regulatory landscape and the necessity for exceptional purity and documented quality assurance protocols. Suppliers targeting the pharmaceutical sector must invest heavily in dedicated purification facilities and robust quality management systems (e.g., ISO 9001 and specific GMP standards) to meet the non-negotiable quality and audit requirements of these highly sophisticated buyers.

Other vital customers include industrial chemical producers and specialty manufacturers. This category encompasses producers of solvents (Dimethylformamide, Dimethylacetamide), who rely on DMA; rubber processing companies using DMA for accelerators; and manufacturers of animal feed supplements, who purchase TMA for choline chloride synthesis. Additionally, niche industrial customers in water treatment, textile dyeing, and electronics are emerging as increasingly important buyers of specialized derivatives, particularly as the demand for high-performance solvents for advanced manufacturing processes grows. These varied customer bases underscore the market's dependence on diversified industrial expansion, ranging from fundamental agricultural needs to cutting-edge electronic manufacturing processes, solidifying methylamine's role as a ubiquitous industrial precursor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.73 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | E. I. du Pont de Nemours and Company, Mitsubishi Chemical Corporation, BASF SE, Arkema S.A., Taminco (Eastman Chemical Company), Balaji Amines Ltd., Chemcon Speciality Chemicals Ltd., Gujarat Alkalies and Chemicals Limited (GACL), Chemanol (Methanol Chemicals Company), Shandong Haiteng Chemical Co., Ltd., China National Petroleum Corporation (CNPC), Luxi Chemical Group Co., Ltd., Zibo Luzhong Chemical Co., Ltd., Saudi Basic Industries Corporation (SABIC), Mitsui Chemicals, Inc., Linde PLC, Air Products and Chemicals, Inc., Dow Inc., Jining Zhonghe Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methylamine Market Key Technology Landscape

The technology landscape for the Methylamine Market is dominated by the established catalytic reaction between methanol and ammonia, typically employing proprietary alumina or silica-alumina catalysts under high temperature and pressure conditions. The core challenge lies in controlling the selectivity to optimize the ratio of the three products (MMA, DMA, and TMA) according to prevailing market needs, as all three are simultaneously produced in varying quantities. Recent technological advancements focus heavily on developing highly specialized zeolitic catalysts, which offer enhanced pore structures and tailored acidity profiles. These next-generation catalysts allow producers much greater control over the reaction kinetics, leading to significantly higher yields of the most demanded derivative, often DMA or MMA, while reducing the formation of less desirable byproducts, thereby improving overall process economics and energy efficiency during the subsequent separation phase.

Process intensification techniques represent another critical technological trend. Continuous flow reactors and reactive distillation columns are being adopted to replace traditional batch processing methods. These innovations offer substantial improvements in safety, throughput, and energy consumption. Continuous flow processing minimizes the inventory of hazardous materials at any given time, enhancing operational safety and facilitating easier scalability. Furthermore, the integration of advanced process control systems (APCS), often leveraging AI and machine learning algorithms discussed previously, ensures real-time optimization of reaction conditions. This allows for rapid adaptation to fluctuating feedstock purity or slight changes in catalyst activity, maintaining high product consistency required for sensitive downstream applications like pharmaceuticals, thus standardizing quality across production batches regardless of external variables.

Finally, sustainability and feedstock diversification are driving major technological R&D efforts. Given the industry's reliance on fossil fuels for methanol and ammonia, there is increasing investment in technologies that utilize bio-based methanol derived from biomass gasification or waste streams. Although these bio-methanol pathways are currently more costly than conventional methods, the push for decarbonization and corporate sustainability mandates are making them commercially relevant, particularly in Europe. Additionally, novel separation technologies, such as advanced membrane filtration systems or energy-efficient cryogenic distillation methods, are being researched to lower the massive energy requirement associated with separating the three methylamine isomers, which remains one of the largest operational costs in the entire value chain and a major focus for long-term technological disruption.

Regional Highlights

The Methylamine Market exhibits significant regional disparities in terms of production capacity, consumption volume, regulatory environment, and growth rates, with Asia Pacific (APAC) serving as the undisputed global powerhouse. APAC accounts for the largest share of both consumption and manufacturing, primarily driven by the massive chemical, pharmaceutical, and particularly the agrochemical industries in China and India. China, benefiting from abundant and relatively cheap coal-derived methanol, hosts several of the world’s largest methylamine production facilities, catering not only to its burgeoning domestic demand but also serving as a major exporter of both the base chemicals and their derivatives, such as DMF. The high growth rate in this region is sustained by urbanization, necessitating high agricultural output, and government policies favoring local production of APIs and intermediates, resulting in continuous capacity additions throughout the forecast period.

North America and Europe, while possessing slower growth rates compared to APAC, remain crucial high-value markets focused on specialized, ultra-high-purity derivatives. In these regions, the demand is heavily weighted towards the pharmaceutical and high-tech solvent applications, necessitating stringent quality control and high compliance standards. Regulatory pressures, particularly in the European Union, pertaining to hazardous chemical handling and environmental impact, drive manufacturers to invest in cleaner, more energy-efficient production technologies, often favoring sustainable feedstock sources where economically feasible. North American demand is resilient, supported by the large domestic agricultural sector and stable consumption by the integrated petrochemical industries, although production often faces challenges from fluctuating natural gas prices that influence domestic ammonia costs and subsequently, methylamine production economics.

Latin America and the Middle East & Africa (MEA) represent significant emerging markets, contributing to the global consumption surge. Latin America's market growth is intimately tied to the agricultural sector expansion in countries like Brazil and Argentina, creating strong, localized demand for methylamine-based agrochemicals. The MEA region is becoming strategically important due to its strong position in inexpensive natural gas resources, which enables low-cost methanol and ammonia production, positioning countries like Saudi Arabia as competitive regional suppliers of base methylamine chemicals. Investment in local downstream chemical processing capabilities is increasing across the MEA, reducing reliance on imports and driving regional market integration, although political and economic instability remains a potential risk factor affecting long-term investment and secure distribution channels.

- Asia Pacific (APAC): Dominates the global market in terms of volume and capacity. Growth fueled by expansive agrochemical production in India and China, and large-scale solvent manufacturing for electronics. Key focus is on cost leadership and rapid capacity expansion.

- North America: Stable market with mature regulatory frameworks. Demand is highly focused on high-ppurity methylamine for pharmaceutical synthesis and high-performance solvents, supported by a technologically advanced user base.

- Europe: Characterized by stringent environmental regulations and a strong emphasis on sustainability. Manufacturers prioritize innovative catalyst technology and process efficiency. Strong demand from specialized chemical and high-value pharmaceutical manufacturing sectors.

- Latin America: Growth driven by burgeoning agricultural demands, particularly in Brazil and Argentina, leading to increased regional consumption of methylamine-derived insecticides and herbicides.

- Middle East & Africa (MEA): Emerging production hub leveraging low-cost feedstock (natural gas) for methanol and ammonia production. Developing downstream industries are increasing internal consumption and regional export capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methylamine Market.- E. I. du Pont de Nemours and Company

- Mitsubishi Chemical Corporation

- BASF SE

- Arkema S.A.

- Taminco (Eastman Chemical Company)

- Balaji Amines Ltd.

- Chemcon Speciality Chemicals Ltd.

- Gujarat Alkalies and Chemicals Limited (GACL)

- Chemanol (Methanol Chemicals Company)

- Shandong Haiteng Chemical Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Luxi Chemical Group Co., Ltd.

- Zibo Luzhong Chemical Co., Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Mitsui Chemicals, Inc.

- Linde PLC

- Air Products and Chemicals, Inc.

- Dow Inc.

- Jining Zhonghe Chemical Co., Ltd.

- Shandong Mingda Chemical Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Methylamine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Methylamine Market?

The primary growth drivers include the non-stop global demand for highly effective agrochemicals (pesticides and herbicides) essential for food production and the expanding requirement for methylamine as a critical chemical intermediate in the synthesis of various pharmaceutical active ingredients (APIs).

Which derivative of methylamine holds the largest market share globally?

Dimethylamine (DMA) currently accounts for the largest market share due to its extensive use in producing high-volume industrial solvents like Dimethylformamide (DMF) and Dimethylacetamide (DMAC), which are critical across the electronics and chemical processing sectors.

What is the main challenge facing methylamine manufacturers regarding production?

The central manufacturing challenge is managing feedstock price volatility (methanol and ammonia) and achieving high selectivity toward the desired derivative (MMA, DMA, or TMA) during the catalytic reaction to maximize economic efficiency and minimize byproduct formation.

How significant is the Asia Pacific region in the global Methylamine Market?

The Asia Pacific region is exceptionally significant, dominating both production capacity and consumption volume, driven by large agrochemical and pharmaceutical manufacturing bases in countries such as China and India, making it the fastest-growing geographical market.

In what specialized applications is high-purity methylamine derivative demand increasing?

Demand for ultra-high-purity derivatives, particularly DMA, is rapidly increasing in specialized applications such as solvents for lithium-ion battery manufacturing and cleaning agents used in the fabrication of advanced semiconductors and high-performance electronic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dimethylamine Market Size Report By Type (40% Solution, 50% Solution, 60% Solution), By Application (Agriculture, Chemicals, Pharmaceuticals, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Methylamine Market Statistics 2025 Analysis By Application (Pesticides, N-methylpyrrolidone, Alkylalkanolamines, Pharmaceuticals), By Type (Gas, Liquid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Trimethylamine (TMA) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Anhydrous Liquified Gas, TMA 100%, Aqueous Solution, TMA 50%), By Application (Animal Nutrition, Chemicals and Pharmaceuticals, Electronics Industry, Oil & Gas Treatment, Pulp & Paper Industry, Water Treatment Solutions), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Methylamine Consumption Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gas, Liquid), By Application (Pesticides, N-methylpyrrolidone, Alkylalkanolamines, Pharmaceuticals, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Monomethylamine (Mma) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Monomethylamine Anhydrous, Monomethylamine (60%), Monomethylamine (50%), Monomethylamine (40%), Other), By Application (Pesticides, Solvents, Pharmaceuticals, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager