Methylpentene Copolymer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433023 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Methylpentene Copolymer Market Size

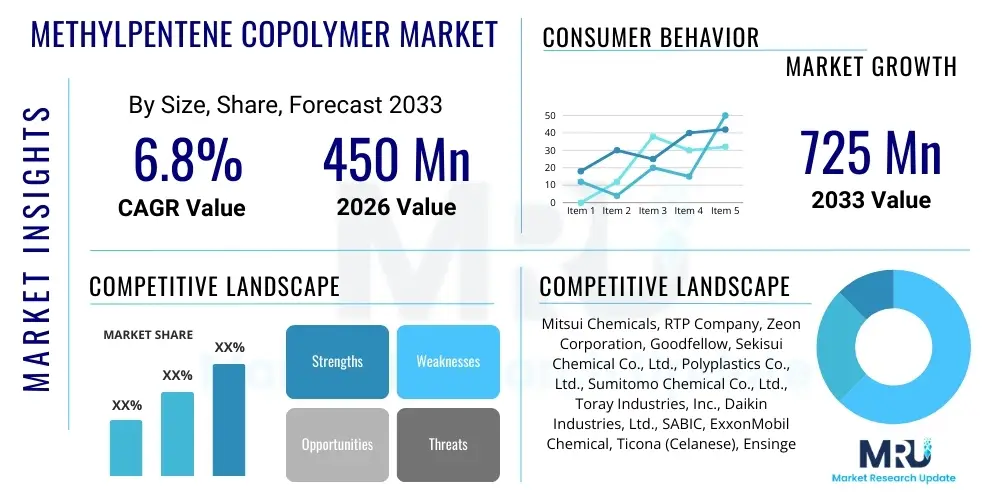

The Methylpentene Copolymer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 725 Million by the end of the forecast period in 2033.

Methylpentene Copolymer Market introduction

The Methylpentene Copolymer Market, primarily driven by the unique properties of Poly(4-methyl-1-pentene) or PMP (often marketed as TPX), constitutes a specialized segment within the advanced polymers industry. This thermoplastic possesses an exceptionally low density, excellent transparency, superior heat resistance, and high gas permeability, making it indispensable in high-performance applications. Methylpentene copolymers are utilized where traditional polyolefins fail to meet demanding thermal or optical requirements, particularly in healthcare and specialized industrial sectors. The distinct chemical structure, involving copolymerization to enhance flexibility and processability compared to homopolymers, provides tailored solutions for end-users seeking lightweight, high-temperature resistant materials with dielectric properties.

The product's description centers on its transparent nature, which rivals glass, combined with the shatter resistance inherent in plastics. Major applications span high-precision optical components, laboratory apparatus (like beakers and syringes that require sterilization), and critical electronic components requiring low dielectric constant and low dissipation factor. Its physiological inertness and capability to withstand repeated sterilization cycles (autoclave) make it a crucial material in the medical and pharmaceutical packaging industries. Furthermore, its use in food processing membranes and microwavable containers highlights its versatility and compliance with stringent regulatory standards across various geographic regions.

Driving factors for sustained market growth include the escalating demand for high-performance medical devices, especially disposable components that require high clarity and heat resistance. The burgeoning electronics sector, specifically the need for advanced packaging materials with superior electrical insulation properties, further propels adoption. Increased investments in laboratory infrastructure globally, coupled with a persistent trend toward material lightweighting in industrial applications, solidify the demand landscape for methylpentene copolymers throughout the forecast period. The replacement of traditional materials like glass and polycarbonate in specific niche applications due to PMP's superior characteristics also acts as a significant market catalyst.

Methylpentene Copolymer Market Executive Summary

The Methylpentene Copolymer Market is positioned for robust expansion, underpinned by strong business trends focusing on material innovation and application diversification. Key commercial strategies currently emphasize the development of specialty grades tailored for specific medical regulatory requirements (e.g., USP Class VI compliance) and enhanced UV stability for outdoor applications. A major business trend involves capacity expansion by leading manufacturers, predominantly in Asia Pacific, to meet the surging demand from the expanding healthcare and semiconductor fabrication sectors. Furthermore, strategic partnerships between polymer producers and specialized compounders are becoming common to optimize processing techniques and facilitate the introduction of customized copolymer formulations into niche markets, driving both volume and value growth across the polymer supply chain.

Regionally, Asia Pacific (APAC) dominates the consumption and production landscape, characterized by rapid industrialization, extensive expansion of electronics manufacturing bases (particularly in China, Taiwan, and South Korea), and massive growth in medical device production outsourcing. North America and Europe, while mature, remain crucial high-value markets, emphasizing premium grades used in advanced diagnostics, specialized analytical chemistry instrumentation, and high-frequency electrical components. Regional trends are influenced heavily by environmental regulations; while PMP is inherently recyclable, the push for bio-based or sustainable alternatives presents a challenge and a long-term opportunity for research and development, particularly in European markets prioritizing circular economy principles. Investment in R&D infrastructure related to polymer science is highest in these Western regions, driving technological advancement.

Segment trends highlight the dominance of the Medical & Healthcare sector by application, followed closely by the Electronics & Electrical segment. Within the grade type segmentation, standard injection molding grades currently hold the largest share, but specialized copolymer grades designed for enhanced flexibility or ultra-high clarity (e.g., for optical lenses) are exhibiting the highest growth rate. The Film & Sheet processing segment is rapidly expanding due to the material’s utility in gas-permeable membranes and specialized packaging films. This segment’s growth is fueled by increasing industrial filtration requirements and the ongoing substitution of conventional packaging materials with high-barrier, heat-resistant copolymer alternatives.

AI Impact Analysis on Methylpentene Copolymer Market

Common user questions regarding AI's influence on the Methylpentene Copolymer Market often revolve around predictive modeling for material performance, optimization of complex polymerization processes, and automated quality control during high-volume manufacturing. Users are keen to understand how AI can reduce variability in copolymer composition, thereby ensuring consistent optical and thermal properties critical for end-use applications like optics and medical devices. Key concerns often address the integration cost of AI systems into existing legacy manufacturing infrastructure and the necessary data standardization required to train robust machine learning models effectively. Expectations include significantly accelerated R&D cycles for new copolymer formulations, optimized supply chain logistics predicting raw material fluctuations, and enhanced factory floor automation leading to higher yields and reduced waste in this high-value specialty polymer sector.

The practical integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Methylpentene Copolymer production landscape is primarily focused on operational efficiency and advanced material discovery. AI algorithms are increasingly deployed to analyze vast datasets generated during the reactor operation, including temperature profiles, catalyst consumption rates, and monomer input ratios. This analytical capability allows manufacturers to fine-tune production parameters in real-time, minimizing batch-to-batch inconsistency which is crucial for maintaining the stringent specifications required by medical and electronic end-users. Furthermore, predictive maintenance utilizing sensor data and ML models ensures maximum uptime of expensive polymerization equipment, directly impacting the profitability of this capital-intensive market.

In the downstream application areas, AI assists in the design and optimization of products utilizing methylpentene copolymers. For instance, in optical applications, AI simulations can quickly model the light transmission and refractive indices of new copolymer blends, dramatically reducing the need for extensive physical prototyping. Similarly, in medical device manufacturing, AI-driven computer vision systems are deployed for non-destructive, rapid quality inspection of molded components, detecting microscopic defects that could compromise sterile integrity or functional performance. This convergence of AI-enhanced manufacturing and design capabilities is reducing time-to-market for complex copolymer products, providing a competitive edge to companies that strategically invest in these digital technologies.

- AI-powered simulation accelerates the discovery and testing of novel copolymer formulations.

- Machine learning optimizes polymerization reaction conditions, improving material consistency and yield.

- Predictive analytics enhances supply chain resilience by forecasting raw material (4-methyl-1-pentene) supply and demand fluctuations.

- Automated quality inspection systems utilizing computer vision ensure zero-defect standards for critical medical and electronic components.

- AI models facilitate real-time process control and fault diagnosis in complex reactor environments, minimizing downtime.

DRO & Impact Forces Of Methylpentene Copolymer Market

The Methylpentene Copolymer Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. Key drivers include the material's superior optical clarity, high heat resistance (high melting point and dimensional stability), and exceptionally low dielectric constant, which are critical requirements in the rapidly growing 5G communications infrastructure and advanced medical diagnostics markets. Conversely, major restraints involve the high manufacturing cost associated with the specialty catalysts and complex polymerization processes required, leading to a significantly higher price point compared to commodity polyolefins. The limited awareness of PMP/TPX properties among mainstream design engineers outside niche fields also acts as a barrier to broader market penetration. However, substantial opportunities arise from the increasing demand for sustainable and recyclable high-performance polymers, as PMP offers a highly efficient, lightweight option that aligns with energy reduction targets in electronics and transportation, opening new avenues in specialized battery components and advanced filtration.

The impact forces influencing the market trajectory are categorized by intensity and immediacy. High-impact forces include stringent medical regulations (requiring certified, inert materials) and the exponential growth of sophisticated diagnostic equipment, which necessitate the specific thermal and chemical inertness offered by methylpentene copolymers. Medium-impact forces involve fluctuating raw material prices, as monomer sourcing and purity can directly affect production costs and, consequently, market pricing strategies. Low-impact, but persistent forces include competition from alternative high-performance plastics like specialized polycarbonates or fluoropolymers in certain high-temperature applications, necessitating continuous material performance enhancement through copolymer modification.

These forces necessitate strategic responses from market participants. To mitigate the high cost restraint, companies are focusing on optimizing catalyst systems and scaling production volumes. To leverage the opportunities, R&D efforts are heavily skewed towards broadening the application base beyond traditional medical and electronics sectors, targeting specialized automotive lighting components and advanced separation membranes, thereby enhancing the overall resilience and growth potential of the Methylpentene Copolymer Market over the forecast period. The fundamental need for materials that can survive aggressive sterilization techniques (like gamma irradiation or autoclaving) ensures that the medical sector remains the core anchor, insulating the market from broader economic volatility experienced by commodity polymers.

Segmentation Analysis

The Methylpentene Copolymer Market is meticulously segmented across dimensions including product type (grade), application, and end-use industry, reflecting the material’s highly specialized nature. Segmentation based on product type generally involves differentiating between standard injection molding grades, extrusion grades, and specialty grades tailored for specific optical or gas permeability requirements, which allows manufacturers to cater precisely to diverse technical specifications across multiple industries. The primary end-use industries, namely Medical & Healthcare, Electronics & Electrical, Food & Beverage Packaging, and Industrial/Chemical Processing, showcase distinct demand drivers and regulatory environments, justifying tailored marketing and product development strategies. This detailed segmentation allows stakeholders to accurately gauge market potential within high-growth niche areas, thereby optimizing resource allocation and maximizing profitability in a premium polymer market.

- By Type:

- Standard Grade Methylpentene Copolymer

- High-Purity/Medical Grade Methylpentene Copolymer

- Optical Grade Methylpentene Copolymer

- Enhanced Flexibility Grade Methylpentene Copolymer

- High-Flow Injection Molding Grade

- By Application:

- Injection Molding (e.g., medical apparatus, laboratory ware)

- Extrusion (e.g., pipes, tubing, profiles)

- Film & Sheet (e.g., gas separation membranes, release films)

- Blow Molding

- By End-Use Industry:

- Medical & Healthcare (e.g., syringes, sterilization trays, diagnostics)

- Electronics & Electrical (e.g., high-frequency circuits, insulation, LED molds)

- Food & Beverage Packaging (e.g., microwavable containers, wrappers)

- Chemical & Industrial Processing (e.g., corrosion-resistant parts, analytical instruments)

- Optics (e.g., light guides, lenses)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, Rest of MEA)

Value Chain Analysis For Methylpentene Copolymer Market

The value chain for the Methylpentene Copolymer Market begins with upstream activities centered on the procurement and refinement of raw materials, primarily 4-methyl-1-pentene monomer, which is typically derived from petroleum feedstocks (propylene). This stage involves complex chemical synthesis and purification processes to achieve the high purity standards necessary for effective polymerization. Manufacturers rely on specialized Ziegler-Natta or metallocene catalysts, which are high-cost inputs, demanding significant capital investment in reaction technology. Upstream analysis highlights that supply stability and pricing volatility of the monomer and catalyst components significantly dictate the final polymer cost and market accessibility, positioning raw material suppliers and catalyst producers as key leverage points in the chain.

The midstream segment is characterized by the polymerization and compounding of the resin. Leading copolymer producers operate specialized high-pressure or slurry reactors to synthesize the Methylpentene Copolymer (PMP/TPX), followed by pelletization and custom compounding to introduce stabilizers, flow modifiers, or colorants tailored for specific applications (e.g., medical sterilization stability). Distribution channels are critical, often involving a mix of direct sales to large, specialized converters (particularly in the medical and electronics sectors) and indirect sales through authorized regional distributors and agents who manage inventory and provide technical support to smaller fabricators. Due to the specialty nature of the material, technical expertise transfer and quality assurance documentation are integral components of the distribution process, ensuring that the unique properties of the copolymer are maintained during processing.

The downstream segment encompasses the conversion, fabrication, and final consumption. Converters utilize various processing techniques, including high-precision injection molding for medical consumables, extrusion for films and tubing, and blow molding for containers. End-users, such as medical device manufacturers, electronics component producers, and industrial equipment firms, integrate these components into finished products. The direct channel is often preferred for high-volume, critical component purchases by multinational healthcare or tech companies, ensuring tight quality control and dedicated supply. Conversely, the indirect channel facilitates broader market reach, supporting smaller specialized processors who require just-in-time delivery and local technical assistance, making both channels indispensable for overall market penetration and growth.

Methylpentene Copolymer Market Potential Customers

The primary end-users and buyers of Methylpentene Copolymer are organizations operating in highly regulated and technologically demanding environments where material performance cannot be compromised. The largest consumer base resides within the Medical & Healthcare sector, including manufacturers of disposable diagnostic kits, laboratory equipment (e.g., test tubes, centrifuges), and surgical instruments that require exceptional thermal stability for steam sterilization (autoclavability) and chemical inertness. These buyers prioritize high-purity, USP Class VI certified grades, demanding rigorous documentation and reliable long-term supply agreements, making them critical, high-value customers for PMP suppliers.

Another significant group of potential customers is found in the Electronics & Electrical industry, particularly companies involved in high-frequency data transmission and advanced semiconductor manufacturing. These buyers utilize the copolymer for its ultra-low dielectric constant, which minimizes signal loss in components such as antenna covers, internal wiring insulation, and high-frequency circuit substrates (like 5G/6G components). Given the accelerating pace of miniaturization and increasing operating frequencies, these customers require materials with precise and consistent electrical properties, representing a rapidly growing segment that demands technological superiority over cost efficiency.

Furthermore, specialized industrial processing companies constitute a stable customer base, particularly those dealing with aggressive chemicals or requiring high-performance separation technologies. These customers include manufacturers of gas separation membranes (due to PMP's high permeability), specialized filters, and chemical storage components where resistance to heat and a wide range of solvents is essential. Food processing and packaging companies also represent a niche, albeit steady, customer segment, specifically those needing clear, high-temperature containers for ready-to-eat meals or sterilization processes. These diverse customer groups underscore the value of PMP as a versatile, specialty polymer solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 725 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Chemicals, RTP Company, Zeon Corporation, Goodfellow, Sekisui Chemical Co., Ltd., Polyplastics Co., Ltd., Sumitomo Chemical Co., Ltd., Toray Industries, Inc., Daikin Industries, Ltd., SABIC, ExxonMobil Chemical, Ticona (Celanese), Ensinger GmbH, Westlake Chemical, LyondellBasell. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Methylpentene Copolymer Market Key Technology Landscape

The technology landscape for the Methylpentene Copolymer market is predominantly shaped by advancements in polymerization catalysis and advanced compounding techniques designed to optimize material performance and processability. Key technologies revolve around the use of highly selective coordination catalysts, specifically specialized Ziegler-Natta or metallocene catalysts, which allow for precise control over the molecular weight distribution and co-monomer incorporation. This precision is critical for tailoring the material's glass transition temperature, flexibility, and overall thermal stability, ensuring the final copolymer meets the demanding specifications required in medical applications such as sterilization resistance and physiological inertness. Continued research focuses on improving catalyst efficiency and longevity, thereby reducing production costs and enhancing overall yield during the synthesis phase, which is crucial for market competitiveness.

In the processing domain, innovations in extrusion and injection molding technology are paramount. Due to the relatively high melt viscosity and complex crystallization behavior of Methylpentene Copolymer, specialized equipment designed for high-temperature processing with optimized melt flow paths is required. Manufacturers are increasingly utilizing advanced compounding techniques, including reactive extrusion, to incorporate performance enhancers such as UV stabilizers, antioxidants, and reinforcing fillers while maintaining the inherent clarity of the polymer. Furthermore, sophisticated film technology, particularly solution casting and melt blown processes, is being refined to produce ultra-thin, highly uniform membranes critical for gas separation and filtration applications, leveraging the copolymer’s unique permeability characteristics for industrial processes.

The market also benefits from technological developments in analytical instrumentation and quality control. Non-destructive testing methods, including advanced spectroscopic techniques and high-resolution microscopy, are employed to verify the homogeneity and purity of the copolymer batches, especially for optical and medical grades. Trace element analysis and detailed molecular structure characterization are standard procedures, ensuring compliance with global regulatory bodies (e.g., FDA, EMA). Future technological focus is shifting toward continuous polymerization processes and incorporating smart manufacturing (Industry 4.0) principles, utilizing sensor networks and data analytics to achieve unparalleled control over the synthesis environment, further solidifying the material’s position as a premium specialty polymer.

Regional Highlights

- Asia Pacific (APAC)

- North America

- Europe

- Latin America (LATAM)

- Middle East & Africa (MEA)

The Asia Pacific region currently holds the largest share in terms of both production capacity and consumption volume for the Methylpentene Copolymer Market. This dominance is attributed to several factors, including the region's status as a global manufacturing hub for electronics and electrical components, particularly in countries like China, South Korea, and Taiwan, which heavily utilize PMP for high-frequency insulation and components due to its low dielectric constant. Furthermore, the rapid expansion of the healthcare infrastructure and growing demand for affordable, high-quality disposable medical devices across populous nations like India and China significantly drives the demand for autoclavable and chemically inert PMP grades. Localized manufacturing offers distinct cost advantages and shorter supply chains compared to importing specialty polymers from the West, encouraging further capital investment in polymer synthesis facilities within the region.

Market growth in APAC is further fueled by increasing governmental focus on domestic pharmaceutical production and the rising complexity of diagnostic technologies. Japan, historically a pioneer in PMP technology through key domestic manufacturers, continues to maintain a strong market presence, focusing heavily on premium, high-purity optical and medical grades. South Korea and Taiwan exhibit robust demand driven by their advanced semiconductor and display panel industries, requiring sophisticated release films and protective coatings made from PMP. The regional dynamics necessitate a flexible manufacturing approach capable of scaling volumes while adhering to highly varied national regulatory standards.

Investment trends in APAC are leaning towards expansion of compounding capabilities to customize PMP for specific regional applications, especially in areas related to food packaging sterilization and industrial filtration. The competitive landscape is intense, with both global market leaders and regional chemical giants vying for market share. The continuous shift of global electronics assembly and medical manufacturing to this region ensures that APAC will remain the primary engine of growth for the Methylpentene Copolymer Market throughout the forecast period, requiring continuous supply chain optimization and technology transfer to meet escalating technical demands.

North America represents a high-value market characterized by early adoption of advanced medical technologies and stringent regulatory frameworks. The demand for Methylpentene Copolymer in the U.S. and Canada is primarily concentrated in the Medical & Healthcare sector, driven by a mature industry focused on highly specialized in-vitro diagnostics, advanced analytical laboratory equipment, and complex surgical components that rely on PMP's superior resistance to autoclaving and inertness. The high concentration of major medical device manufacturers and research institutions ensures a steady, premium-priced demand for high-purity, USP Class VI compliant copolymer grades. Innovation in material science and product design remains a key driver in this region, often setting global standards for polymer application.

The electronics sector in North America also contributes significantly, particularly in specialized areas such as aerospace, defense, and high-performance computing, where PMP's exceptional electrical properties are utilized for insulation and high-frequency circuit components. Unlike APAC, where demand is often volume-driven for consumer electronics, North American demand emphasizes performance criticality and regulatory compliance in niche, high-margin applications. The established R&D ecosystem supports the collaborative development of new PMP applications, focusing on next-generation technologies like advanced optics and sensor protection.

Market expansion strategies in North America focus on enhancing technical support and customizing material grades to meet proprietary customer requirements, rather than solely on increasing bulk production capacity. Environmental concerns and the push towards sustainability also influence purchasing decisions, with end-users increasingly valuing materials that contribute to lightweighting and energy efficiency in complex systems. The region acts as a benchmark for quality and technological application, influencing global market trends, despite having a smaller volume share compared to Asia.

The European market for Methylpentene Copolymer is defined by a strong emphasis on sustainability, strict chemical regulations (such as REACH), and highly advanced manufacturing capabilities, particularly in Germany, France, and the UK. The primary demand driver is the sophisticated medical device and pharmaceutical packaging industry, which necessitates polymers capable of extreme chemical and thermal resistance for sterilization and purity maintenance. European manufacturers are focused on material circularity, leading to increased interest in the life-cycle assessment and end-of-life management of PMP products, positioning it favorably as a lightweight, long-lasting alternative to glass.

Furthermore, the automotive sector in Europe, known for its innovation in lightweighting and electrical vehicle (EV) technologies, is beginning to explore PMP for specialty applications, including sensor housings and internal lighting components where high temperature resistance and low weight are critical. The region also maintains a substantial market for industrial separation and filtration membranes, capitalizing on the high gas permeability of PMP for various chemical processes and environmental control systems. Regulatory adherence and quality traceability are paramount for engaging in the European supply chain, placing a premium on certified and traceable material sources.

Investment in Europe is primarily directed toward application development centers and technical service capabilities rather than large-scale monomer production, given the region's focus on specialty chemicals and high-value manufacturing. The market growth here is steady and quality-driven, emphasizing premium, specialized grades that command higher prices. Geopolitical factors, particularly supply chain security following recent global disruptions, have also led European end-users to seek reliable, regionalized sourcing options, favoring polymer suppliers with strong continental operational footprints.

The Latin American Methylpentene Copolymer market is nascent but exhibits significant growth potential, driven primarily by improving healthcare access and increased foreign investment in manufacturing. Brazil and Mexico are the dominant markets, benefiting from expanding domestic medical device manufacturing and increased electronics assembly operations. Demand is largely concentrated in standard and injection molding grades used for basic laboratory equipment and packaging components, often serving as a cost-effective substitute for glass in clinical settings.

Market development in LATAM is hampered by economic volatility and reliance on imported specialty polymers, making the market price-sensitive. However, the ongoing modernization of industrial infrastructure and the steady growth of the food and beverage sector (requiring advanced packaging solutions) provide consistent underlying demand. Local distributors play a crucial role in managing logistics, inventory, and technical translation for end-users, acting as the critical link between global suppliers and regional converters.

Long-term growth is tied to political and economic stability and the successful implementation of public health initiatives, which directly impact the procurement of medical consumables. While currently a smaller contributor to global revenue, the region represents a key future market for volume expansion, provided local processing capabilities continue to mature and regulatory environments standardize to attract further international investment in high-performance polymer applications.

The Middle East and Africa market for Methylpentene Copolymer is highly localized, with the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) being the main demand centers, driven by substantial investment in healthcare infrastructure and rapid diversification away from oil economies. The utilization of PMP in MEA is primarily focused on large-scale medical projects, advanced laboratory analytics, and specialized industrial filtration requirements in the oil & gas and petrochemical sectors, leveraging the polymer's superior chemical resistance in harsh operational environments.

Demand in Africa remains small, concentrated mainly in South Africa and high-growth urban centers, primarily targeting medical and potable water applications where material purity is critical. Growth across the MEA region is characterized by large, project-based procurement rather than sustained high-volume consumption. The hot climate and need for UV stable materials in outdoor applications also present a niche opportunity for specialized PMP grades, though challenges related to logistics and technical expertise persist.

Key market participants are focusing on establishing strong distribution networks and offering technical training to local converters to ensure optimal material processing. The region holds strategic importance due to its expanding petrochemical base, potentially offering future opportunities for localized monomer production, which could significantly alter the supply chain dynamics and potentially reduce the high import costs currently restraining wider market adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Methylpentene Copolymer Market.- Mitsui Chemicals, Inc. (TPX brand leader)

- RTP Company (Custom Compounds)

- Zeon Corporation

- Goodfellow (Specialty Materials)

- Sekisui Chemical Co., Ltd.

- Polyplastics Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Daikin Industries, Ltd.

- SABIC (Saudi Basic Industries Corporation)

- ExxonMobil Chemical

- Ticona (Celanese Corporation)

- Ensinger GmbH (Processor/Compounder)

- Westlake Chemical Corporation

- LyondellBasell Industries N.V.

- Dongguan Lishun Materials Co., Ltd.

- Kaneka Corporation

- Kuraray Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Asahi Kasei Corporation

Frequently Asked Questions

Analyze common user questions about the Methylpentene Copolymer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Methylpentene Copolymer (PMP/TPX)?

Methylpentene Copolymer (PMP or TPX) is widely used in applications requiring high heat resistance, optical clarity, and chemical inertness. Primary sectors include Medical & Healthcare (autoclavable labware, disposable syringes), Electronics (high-frequency insulation, LED molds), and advanced Industrial Processing (gas separation membranes and filtration media).

How does the cost structure of Methylpentene Copolymer compare to commodity polymers?

PMP is significantly higher in cost compared to commodity polymers like polyethylene (PE) or polypropylene (PP). This premium pricing is due to the high cost of specialized catalysts, complex polymerization processes, and lower production volumes associated with this specialty polymer, limiting its use to high-performance, high-value applications.

Which region dominates the Methylpentene Copolymer production and consumption market?

The Asia Pacific (APAC) region currently dominates the market, driven by its expansive electronics manufacturing sector and the rapidly growing demand for advanced medical devices, particularly in China, Japan, and South Korea. APAC hosts the largest operational production capacities.

What specific properties make Methylpentene Copolymer suitable for medical applications?

Its suitability stems from its exceptional transparency, superior resistance to aggressive chemicals, and crucial ability to withstand high-temperature sterilization techniques, such as autoclaving (steam sterilization), without dimensional deformation or chemical leaching. It is also often compliant with USP Class VI standards.

What are the main growth drivers for the Methylpentene Copolymer market over the next decade?

Key growth drivers include the continuous expansion of the global medical device sector (especially diagnostics), the roll-out of 5G/6G communication infrastructure demanding ultra-low dielectric materials, and increasing technological requirements in industrial gas separation and high-purity chemical handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager