Metro subway Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432221 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Metro subway Market Size

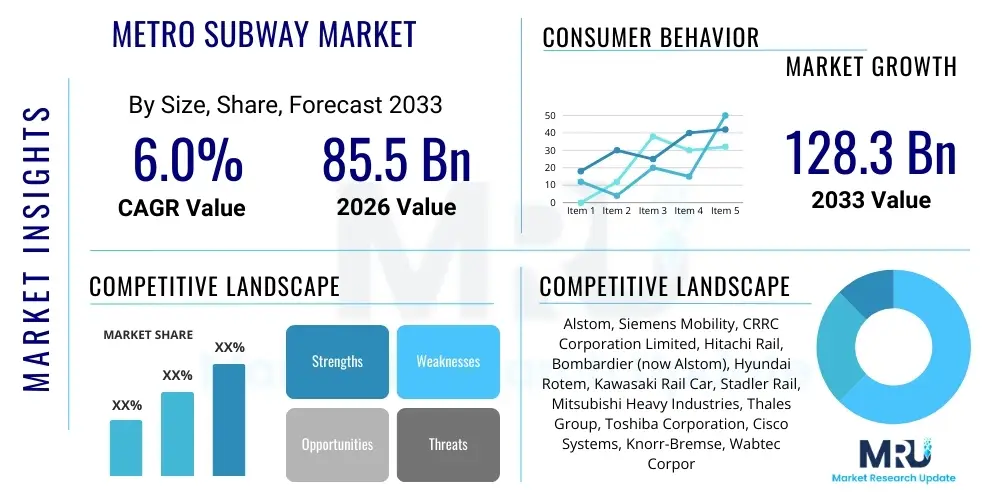

The Metro subway Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at $85.5 Billion USD in 2026 and is projected to reach $128.3 Billion USD by the end of the forecast period in 2033.

Metro subway Market introduction

The Metro subway Market encompasses the planning, development, construction, operation, and maintenance of high-capacity rail transport systems predominantly used in urban and metropolitan areas. These systems are crucial components of smart city infrastructure, designed to alleviate road congestion, reduce carbon emissions, and provide efficient, rapid mass transit options for large populations. Key applications range from daily commuter services and connecting major business districts to linking suburban areas with city centers, playing an indispensable role in urban mobility strategy globally. The market growth is inherently tied to global urbanization rates and increasing government expenditures on public infrastructure modernization.

Product descriptions within this market involve complex integrated systems, including rolling stock (train cars), signaling and communication systems (such as CBTC), power supply infrastructure, track work, and station facilities. Modern metro systems increasingly incorporate automation (driverless trains), advanced safety features, and customer-centric technologies like real-time information systems and integrated ticketing platforms. These systems are deployed across various configurations, including heavy rail, light rail, and hybrid systems, tailored to specific population densities and geographic requirements. The technological evolution is pushing towards greater energy efficiency and reduced operational overheads through predictive maintenance frameworks.

Major driving factors fueling market expansion include sustained population shift towards urban centers, necessitating scalable and reliable transit solutions. Furthermore, governmental initiatives promoting sustainable development goals (SDGs) often prioritize high-capacity electric public transport over private vehicle usage. The economic benefits derived from efficient labor movement and increased productivity, coupled with the political imperative to enhance the quality of life in congested cities, solidify the metro subway market’s foundational importance in the 21st-century urban landscape. Significant capital investments in emerging economies across Asia Pacific are the primary short-to-medium-term catalyst for growth.

Metro subway Market Executive Summary

The Metro subway Market is currently characterized by significant investment cycles driven by infrastructural expansion in developing nations and modernization programs in established economies. Business trends highlight a strong focus on Public-Private Partnerships (PPPs) to manage the massive capital requirements associated with new projects, allowing governments to leverage private sector expertise and financing. Technology integration is central, with market participants increasingly adopting advanced signaling (CBTC) and operational AI tools to enhance safety, efficiency, and reliability. Supply chain optimization remains a key strategic area for rolling stock manufacturers facing pressures from customization demands and regulatory compliance across different geographic regions.

Regional trends indicate that the Asia Pacific (APAC) region, led by China and India, holds the largest market share and exhibits the highest growth potential, primarily due to large-scale, ongoing new network constructions in megacities like Delhi, Mumbai, Shanghai, and Beijing. Conversely, North America and Europe are focused on upgrading legacy systems, replacing aging rolling stock, and integrating advanced automation technologies to maximize throughput on existing lines. Specific to North America, major cities are undertaking expansion projects after a period of relative dormancy, focusing on multimodal integration. The Middle East and Africa (MEA) region is emerging rapidly, fueled by oil wealth reinvestment into sustainable urban mobility, exemplified by major projects in the Gulf Cooperation Council (GCC) nations.

Segmentation trends show that the Rolling Stock segment, though cyclical, represents a significant portion of the market value, driven by high demand for customized, high-performance railcars. However, the Signaling and Communication segment is poised for the fastest technological growth, propelled by the transition from traditional fixed block systems to fully automated, high-density moving block control (Grade of Automation 4 - GoA4). Furthermore, the maintenance and refurbishment services segment is demonstrating steady, resilient growth, reflecting the long asset lifecycles inherent in metro infrastructure, requiring continuous upkeep and modernization to meet evolving performance standards and rider expectations.

AI Impact Analysis on Metro subway Market

User queries regarding AI’s impact on the Metro subway Market overwhelmingly center on two key themes: enhancing operational safety and maximizing system efficiency through automation. Users frequently ask about the practical deployment of Grade of Automation 4 (GoA4) systems, the use of predictive maintenance algorithms to reduce downtime, and the integration of AI-powered passenger flow management systems within stations. There is significant interest in how AI can process vast amounts of sensor data (from tracks, rolling stock, and signaling equipment) to anticipate failures before they occur, thus moving from reactive to proactive maintenance models. Concerns often revolve around data security, regulatory hurdles for autonomous operations, and the long-term workforce implications of shifting towards driverless trains, creating a narrative focused on intelligent infrastructure management and the pursuit of flawless operational uptime.

- AI enables predictive maintenance scheduling, reducing unplanned service disruptions by analyzing vibration, thermal, and performance data from critical components.

- Implementation of advanced Computer Vision (CV) in stations for enhanced crowd control, security monitoring, and optimized emergency response routing.

- Deployment of autonomous driving systems (GoA4), optimizing acceleration, braking, and scheduling to minimize energy consumption and headways between trains.

- AI algorithms optimize energy usage across the network by managing power draw during peak hours and leveraging regenerative braking capacity effectively.

- Improved real-time passenger information systems (PIS) utilizing AI to process network disruptions and rapidly generate optimal alternative travel routes.

- Enhanced cybersecurity measures for critical operational technology (OT) systems within the metro network through machine learning threat detection.

DRO & Impact Forces Of Metro subway Market

The dynamics of the Metro subway Market are shaped by powerful forces including substantial public funding, complex technology integration challenges, and the global imperative for sustainable urban development. Drivers are predominantly centered around the rapid pace of global urbanization, which mandates high-capacity transport infrastructure to prevent economic stagnation in megacities, coupled with significant governmental investment and policy support aimed at decarbonizing transport sectors. Restraints primarily involve the extraordinarily high initial capital expenditure required for network construction, often necessitating long debt repayment cycles, alongside regulatory complexities and lengthy environmental clearance procedures that slow project deployment. Opportunities are vast, focused on integrating metro systems into broader smart city ecosystems, leveraging IoT and 5G connectivity for enhanced operations, and expanding services into peri-urban areas through innovative system configurations like light rail transit (LRT). These factors collectively define the market landscape, pushing innovation while managing inherent financial and execution risks.

Impact forces emphasize the critical role of political stability and economic health, as large-scale metro projects are sensitive to budget allocations and macroeconomic shifts. The force of competitive technology advancement—particularly in signaling, rolling stock materials, and power efficiency—demands continuous R&D expenditure by key market players to maintain relevance and meet increasingly stringent performance standards. Furthermore, public acceptance and demand for connectivity exert significant pressure on authorities to deliver reliable, safe, and integrated services. The continuous demand for lower lifecycle costs, driven by public accountability, compels manufacturers and operators to adopt technologies that optimize operational efficiency and extend the useful life of assets, such as advanced predictive maintenance systems powered by data analytics and AI.

Segmentation Analysis

The Metro subway Market segmentation provides a granular view of distinct revenue streams and technological focuses within the ecosystem. The market is primarily segmented based on System Type (Heavy Rail, Light Rail), Component (Rolling Stock, Signaling, Power Supply, Infrastructure), and Application (Commuter Rail, Intercity/Regional Rail). Heavy Rail systems, characterized by high capacity and fully segregated rights-of-way, dominate core urban transit projects, especially in established megacities, while Light Rail and tram systems are gaining traction for urban extensions and medium-density corridors due to their lower installation cost and greater flexibility in incorporating street running sections. The component segmentation reveals the interplay between capital-intensive equipment (Rolling Stock) and high-technology software and hardware (Signaling), each experiencing unique growth drivers based on global project maturity and modernization waves.

- By System Type:

- Heavy Rail

- Light Rail Transit (LRT)

- Monorail

- By Component:

- Rolling Stock (Car Bodies, Propulsion Systems, Bogies, Interiors)

- Signaling and Communication Systems (CBTC, ATC, Interlocking Systems)

- Power Supply and Distribution (Third Rail, Overhead Catenary System, Substations)

- Infrastructure (Track Works, Stations, Tunnels)

- By Application:

- Commuter Transit (Urban & Suburban)

- Airport Links

- Intercity Services (Hybrid systems)

Value Chain Analysis For Metro subway Market

The Metro subway Market value chain is highly complex, starting with comprehensive upstream analysis involving raw material suppliers (steel, aluminum, specialized electronics) and core technology developers (software for signaling, power components). Upstream activities are critical, given the need for specialized, certified materials that meet stringent safety and longevity standards, often dictated by regulatory bodies like the European Union Agency for Railways (ERA) or regional transport authorities. Key suppliers must maintain rigorous quality control and often engage in long-term contracts with major system integrators and rolling stock manufacturers to ensure stability and compliant component sourcing.

Midstream activities are dominated by large, global system integrators and manufacturers such as Alstom, Siemens, and CRRC, who manage the design, integration, manufacturing, and installation of rolling stock, signaling, and power infrastructure. These integrators act as direct channels to public or private transit operators, managing multi-billion dollar EPC (Engineering, Procurement, and Construction) contracts. The distribution channel is primarily direct, characterized by highly customized, B2G (Business-to-Government) or B2B contracts between the system integrator and the governmental transit authority or operator. Indirect distribution, involving specialized consultancy services or maintenance sub-contractors, plays a secondary but necessary role in project execution and operational phases.

Downstream analysis focuses on the end-users: the operational metro authorities and the commuting public. Operators are responsible for continuous maintenance, service delivery, and ensuring high Grade of Automation (GoA) levels. Demand is driven by the need for system upgrades (modernization cycle) and network expansions (new project cycles). The aftermarket service segment, covering maintenance, repair, overhaul (MRO), and digital services, constitutes a significant, stable revenue stream for the value chain participants, emphasizing the long-term nature of market engagement compared to initial capital outlay.

Metro subway Market Potential Customers

The primary customers for products and services within the Metro subway Market are governmental bodies, public sector transit authorities, and increasingly, private sector entities operating under concession agreements or Public-Private Partnership (PPP) models. These entities serve as the direct buyers (End-Users) responsible for commissioning, funding, and overseeing the construction and operation of metro systems. Examples include city municipal transport departments, national ministries of transport, regional development agencies, and dedicated metro operating companies (such as London Underground, Delhi Metro Rail Corporation, or New York MTA).

Secondary, yet highly influential, potential customers include infrastructure financing institutions and multilateral development banks (e.g., World Bank, Asian Development Bank), as their funding decisions heavily influence which projects proceed and which technologies are prioritized. Furthermore, property developers and large corporations engaging in Transit-Oriented Development (TOD) often become indirect customers by investing in specific metro extensions or connections to enhance the accessibility and value of their commercial and residential real estate holdings, creating demand for localized service infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $85.5 Billion USD |

| Market Forecast in 2033 | $128.3 Billion USD |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alstom, Siemens Mobility, CRRC Corporation Limited, Hitachi Rail, Bombardier (now Alstom), Hyundai Rotem, Kawasaki Rail Car, Stadler Rail, Mitsubishi Heavy Industries, Thales Group, Toshiba Corporation, Cisco Systems, Knorr-Bremse, Wabtec Corporation, CAF (Construcciones y Auxiliar de Ferrocarriles) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Metro subway Market Key Technology Landscape

The technological landscape of the Metro subway Market is undergoing a rapid digital transformation, moving away from legacy mechanical and electrical systems towards highly digitized, interconnected operational environments. The most impactful technology is Communication-Based Train Control (CBTC), which provides continuous, high-precision train location and speed control, enabling reduced headway (the time interval between trains) and consequently increasing line capacity and operational flexibility. CBTC is essential for achieving higher levels of automation, specifically Grade of Automation 4 (GoA4), where trains operate without any on-board staff, significantly lowering operational expenditure in the long term. Adoption rates for CBTC systems are accelerating globally, driven by aging infrastructure modernization needs in Europe and North America and new line construction requirements in APAC demanding maximum throughput.

Furthermore, the integration of the Industrial Internet of Things (IIoT) and advanced sensors into rolling stock and track infrastructure is foundational for the rise of predictive maintenance (PdM). These IoT solutions continuously monitor the health of critical assets—such as traction motors, track conditions, and switch points—transmitting data via high-bandwidth networks (often 5G-enabled) for analysis using Machine Learning (ML) algorithms. This shift allows operators to schedule maintenance based on actual wear and tear rather than fixed time intervals, maximizing asset utilization and minimizing costly unplanned downtime, directly impacting service reliability and customer satisfaction, which are key performance indicators for transit authorities.

Another major area of technological focus is sustainable and resilient power management. This involves the deployment of highly efficient regenerative braking systems, which feed energy back into the network, and the incorporation of robust smart grid technologies to manage peak power demand and integrate renewable energy sources. Future technologies like Digital Twins are also emerging, allowing operators to create precise virtual models of the entire metro network for simulation, testing of new schedules, and planning maintenance activities in a risk-free virtual environment before physical deployment. The confluence of digitization, automation, and sustainability technologies defines the modern competitive edge in this capital-intensive industry.

Regional Highlights

Regional dynamics are highly polarized, reflecting varying stages of urban development and funding availability across continents. Asia Pacific (APAC) stands as the undisputed engine of global growth in the Metro subway Market. This is primarily attributable to massive, ongoing urbanization trends in countries like China, India, and Southeast Asian nations (Indonesia, Vietnam). China continues to lead globally in network length and annual investment, constantly expanding existing systems and building new ones to accommodate burgeoning megacities. India, with its national mission to enhance urban mobility, is seeing simultaneous metro construction across dozens of cities, creating robust demand for both domestic and international system integrators, making APAC the key focal point for rolling stock and signaling providers.

Europe represents a mature market characterized by comprehensive modernization and refurbishment projects. European countries, particularly the UK, Germany, and France, possess some of the world's oldest and most extensive metro networks. The focus here is less on new construction and more on upgrading signaling to CBTC, replacing aging rolling stock to meet stringent environmental standards, and implementing sophisticated digitalization and asset management tools to extend asset lifecycles and improve service levels. Regulatory harmonization through bodies like the ERA is facilitating cross-border operational standardization, impacting technology procurement strategies.

North America is experiencing renewed investment in transit, driven by federal infrastructure bills and local voter initiatives focusing on sustainability and congestion mitigation. Key cities like New York, Los Angeles, and Toronto are undertaking major expansion and modernization projects, though often hampered by higher labor costs and fragmented regulatory environments compared to Europe and APAC. The Middle East (MEA), particularly the GCC states (UAE, Saudi Arabia, Qatar), is a high-value market segment where quality and technology adoption often supersede cost. Driven by rapid city development and global events (like expos and major sporting events), MEA projects incorporate state-of-the-art GoA4 automation, creating lucrative opportunities for highly specialized technology vendors.

- Asia Pacific (APAC): Highest growth region driven by extensive network expansion in China, India, and Southeast Asia; significant demand for new rolling stock and greenfield CBTC projects.

- Europe: Mature market focused on modernization, CBTC upgrades, digital signaling implementation, and replacement of older fleets to meet sustainability targets.

- North America: Renewed focus on infrastructure spending for legacy system maintenance, capacity expansion in major metropolitan areas, and integration of multimodal transport hubs.

- Middle East & Africa (MEA): High-value market segment characterized by investment in fully automated (GoA4) systems and modern, high-specification infrastructure in urban centers like Dubai and Riyadh.

- Latin America (LATAM): Growth driven by selective metro projects in mega-cities (e.g., São Paulo, Mexico City), facing challenges related to economic volatility and reliance on PPP funding models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Metro subway Market.- Alstom

- Siemens Mobility

- CRRC Corporation Limited

- Hitachi Rail

- Hyundai Rotem

- Kawasaki Rail Car

- Stadler Rail

- Mitsubishi Heavy Industries

- Thales Group

- Toshiba Corporation

- Cisco Systems

- Knorr-Bremse

- Wabtec Corporation

- CAF (Construcciones y Auxiliar de Ferrocarriles)

- ABB Ltd.

- Eaton Corporation

- Skoda Transportation

- Bombardier Transportation (now integrated into Alstom)

- Huawei Technologies Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Metro subway market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology driving capacity improvements in the Metro subway Market?

The primary technology is Communication-Based Train Control (CBTC), which replaces fixed-block signaling with continuous train location, allowing metros to safely reduce the time gap (headway) between trains and significantly increase overall line capacity.

Which geographical region exhibits the highest growth rate for new metro construction?

The Asia Pacific (APAC) region, specifically led by countries like China and India, exhibits the highest growth rate due to massive government investments driven by accelerating urbanization and the necessity for scalable mass transit solutions in megacities.

How is predictive maintenance implemented in metro subway operations?

Predictive maintenance uses IoT sensors embedded in rolling stock and track infrastructure to collect real-time data. AI and machine learning analyze this data to predict component failure probability, allowing operators to schedule maintenance proactively before faults lead to service disruptions.

What is the difference between Heavy Rail and Light Rail Transit (LRT) systems?

Heavy Rail typically refers to high-capacity metro systems running on fully segregated, dedicated tracks (often underground or elevated) with high average speeds, while Light Rail (LRT) generally has lower capacity, may operate on street-running sections, and integrates more flexibly into the urban environment.

What role do Public-Private Partnerships (PPPs) play in metro projects?

PPPs are crucial for metro projects, allowing governments to leverage private sector financing, expertise, and efficiency for the planning, construction, and sometimes the long-term operation of the systems, helping to manage the enormous initial capital expenditure required.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager