Mexican Restaurants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435101 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Mexican Restaurants Market Size

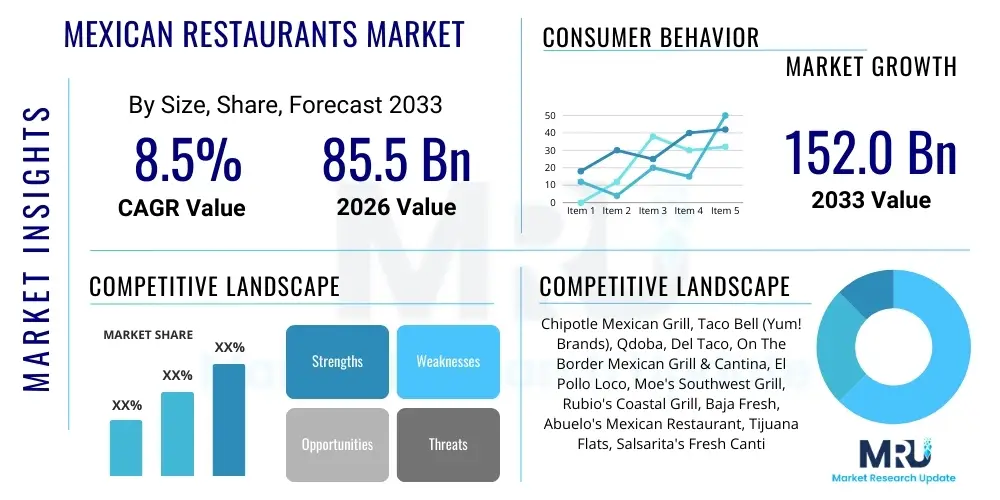

The Mexican Restaurants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 85.5 Billion in 2026 and is projected to reach USD 152.0 Billion by the end of the forecast period in 2033.

Mexican Restaurants Market introduction

The Mexican Restaurants Market encompasses a diverse range of establishments dedicated to preparing and serving traditional and contemporary Mexican cuisine, spanning from quick-service restaurants (QSRs) and casual dining establishments to high-end fine dining concepts. This market segment has experienced robust growth driven primarily by the increasing globalization of food trends, significant demographic shifts, and the inherent adaptability of Mexican cuisine to varying consumer preferences, including dietary restrictions and demands for fresh ingredients. Products offered range widely, including foundational dishes like tacos, burritos, enchiladas, and quesadadas, often prepared using standardized or regional specialty recipes, ensuring a broad appeal across consumer segments seeking both familiarity and novel culinary experiences.

Major applications of the Mexican restaurant model extend beyond traditional dine-in services, significantly incorporating extensive takeout, delivery, and catering options, particularly for corporate events and family gatherings. The operational benefits provided by Mexican cuisine concepts often include high ingredient versatility, relatively low food preparation complexity for core menu items, and strong consumer loyalty fueled by the perceived authenticity and comfort associated with the food. Furthermore, the modern Mexican restaurant frequently serves as a cultural nexus, promoting cultural appreciation and offering diverse flavor profiles that cater to the evolving, adventurous palate of the global consumer base. This continuous innovation in menu offerings, coupled with efficient service models, solidifies the market's strong position within the broader global foodservice industry.

Key driving factors accelerating the market’s expansion include the rising disposable incomes in emerging economies, aggressive expansion strategies by major international chains aiming for market penetration, and a sustained consumer trend favoring dishes that balance indulgence with perceived health benefits, often achieved through customized ingredient selection and preparation methods. The market benefits significantly from the cultural narrative surrounding fresh, customizable ingredients, allowing operators to emphasize transparency in sourcing and preparation. Additionally, the proliferation of third-party delivery services has dramatically extended the geographic reach and accessibility of these restaurants, capturing market share from traditional home cooking and other casual dining categories.

Mexican Restaurants Market Executive Summary

The Mexican Restaurants Market is currently undergoing significant transformation, characterized by distinct business trends focused on digitalization and operational efficiency, alongside notable shifts in regional and segment dynamics. Business trends emphasize the integration of sophisticated technology, including advanced point-of-sale (POS) systems, data analytics for personalized marketing, and significant investment in ghost kitchen models to optimize fulfillment for digital orders. This technological pivot is essential for maintaining competitive edge in a saturated market and addressing rising labor costs. Furthermore, sustainable sourcing practices, focusing on ethical and local produce, are becoming key differentiators for both large chains and independent operators, directly influencing brand perception and attracting environmentally conscious consumers.

Regional trends highlight the continued dominance of North America, particularly the United States, as the primary revenue generator due to deep cultural integration and high frequency of consumption. However, the Asia Pacific (APAC) region, specifically countries like Australia, Japan, and India, is registering the fastest growth rates, driven by Westernization of diets, increasing urbanization, and the introduction of international fast-casual brands. Europe also shows steady growth, particularly in the UK, Germany, and Spain, where consumer demand for diverse international flavors is consistently strong. Operators in these regions are adapting menus to local tastes while maintaining core authenticity, a crucial strategy for successful internationalization.

Segment trends underscore the enduring strength of the Quick Service Restaurant (QSR) segment, which commands the largest market share owing to its convenience, speed, and affordability, exemplified by major global chains. Conversely, the fast-casual segment is experiencing the most rapid growth, offering a premium experience characterized by higher quality ingredients, customizable options, and modern, inviting environments, bridging the gap between traditional QSR and full-service dining. Within the fine dining segment, there is a distinct move toward highly authentic regional Mexican cuisine, emphasizing specialized ingredients, intricate preparation techniques, and an elevated beverage program, appealing to high-disposable-income consumers seeking unique culinary exploration.

AI Impact Analysis on Mexican Restaurants Market

Analysis of common user questions regarding AI’s impact on the Mexican Restaurants Market reveals a strong focus on two primary themes: operational efficiency and personalized customer experience, counterbalanced by concerns over maintaining authenticity and reducing human interaction. Users frequently inquire about how AI can streamline back-of-house operations, specifically asking about predictive inventory management to minimize food waste and optimize ordering schedules based on demand forecasting. There is considerable interest in AI-powered kitchen automation, particularly for repetitive tasks like ingredient preparation and cooking oversight, aiming to mitigate chronic labor shortages and ensure consistent food quality across multiple locations. Simultaneously, users express high expectations for AI tools that enhance the front-end experience, such as highly personalized menu recommendations based on past order history, dietary needs, and real-time specials.

A key concern highlighted by user queries is the potential trade-off between efficiency and the perceived cultural authenticity and warmth traditionally associated with dining out. Users want AI to improve service speed without dehumanizing the dining experience. Therefore, successful AI implementation centers on augmenting human labor rather than replacing it entirely, focusing on data-driven decision-making and seamless digital interaction points. The market recognizes AI’s role in managing complex delivery logistics, optimizing routing for third-party platforms, and leveraging natural language processing (NLP) for sophisticated, accurate order taking via voice bots or specialized self-service kiosks. These technological advancements are pivotal for chains seeking to scale rapidly while maintaining quality standards and minimizing operational variability, driving the next wave of competitive differentiation.

- AI-driven predictive analytics optimizes supply chain management, reducing food spoilage and procurement costs.

- Implementation of robotic process automation (RPA) in food preparation tasks ensures consistency and addresses skilled labor shortages.

- Machine learning algorithms personalize menu recommendations, dynamically adjusting offerings based on customer data and real-time factors like weather.

- Advanced chatbot and voice-bot integration enhances order accuracy for drive-thrus and digital platforms, improving customer service efficiency.

- AI-powered surveillance and quality control systems monitor food safety standards and operational compliance in kitchens.

DRO & Impact Forces Of Mexican Restaurants Market

The market dynamics of the Mexican Restaurants Market are shaped by powerful Drivers and significant Opportunities that outweigh prevailing Restraints, subject to specific Impact Forces that dictate competitive behavior. Key drivers include the massive demographic growth and cultural influence of Hispanic populations globally, particularly in North America, which has mainstreamed Mexican cuisine. The consumer demand for customizable, fresh, and perceived healthier options, often associated with fast-casual Mexican concepts emphasizing ingredients like whole grains, fresh vegetables, and lean proteins, further stimulates growth. Conversely, major restraints involve the intensely competitive nature of the foodservice sector, which compresses profit margins, coupled with persistent volatility in raw material costs (e.g., avocados, certain spices) and severe labor shortages across all service levels, necessitating increased reliance on automation and technology to sustain operations.

Significant opportunities are presented by the untapped potential of plant-based and fusion Mexican cuisine, attracting vegetarian, vegan, and flexitarian consumer segments, offering unique menu items that maintain flavor authenticity while accommodating dietary trends. The strategic adoption of digitalization, expanding capacity through cloud kitchens and enhancing the proprietary delivery ecosystem, offers a crucial pathway for growth and increased operational reach, especially in densely populated urban markets. Regarding Impact Forces, the bargaining power of buyers (consumers) is high, driven by numerous readily available alternatives (high competitive rivalry) and ease of switching between brands based on price, quality, and convenience. This forces operators to focus intensely on value proposition, loyalty programs, and differentiating factors.

Furthermore, the bargaining power of suppliers is moderate to high, particularly concerning specialized or globally sourced ingredients crucial for authenticity, such as specific chili varieties or specialty cheeses, which introduces risk into the supply chain. The threat of new entrants remains high, especially in the QSR and fast-casual segments, where lower barriers to entry and scalable business models (franchising) allow quick market penetration. Substitutes pose a continuous threat, ranging from other international cuisines (e.g., Asian, Italian) to healthy meal kits and supermarket prepared foods, requiring Mexican restaurants to consistently innovate both in menu design and customer experience to maintain market relevance and customer engagement.

Segmentation Analysis

The Mexican Restaurants Market is extensively segmented based on service style, ownership structure, location, and primary offering, reflecting the diverse consumption habits and operational models prevalent across the global foodservice industry. Segmentation allows businesses to strategically tailor their marketing efforts, menu pricing, and operational scale to specific consumer needs, whether focusing on speed and affordability (QSR) or experience and culinary innovation (Fine Dining). The primary segmentation criteria revolve around the balance between price point, speed of service, and quality of ingredients, which fundamentally defines the competitive landscape within each sub-market. Analyzing these distinct segments provides stakeholders with clarity regarding growth vectors and optimal investment pathways.

- Type:

- Quick Service Restaurants (QSR)

- Casual Dining

- Fast Casual

- Fine Dining

- Location:

- Urban

- Suburban

- Rural

- Ownership:

- Chained Restaurants (Franchised and Corporate-Owned)

- Independent Restaurants

- Service Model:

- Dine-in

- Takeout and Drive-Thru

- Delivery (Third-Party and Proprietary)

Value Chain Analysis For Mexican Restaurants Market

The value chain for the Mexican Restaurants Market begins with upstream activities centered on the procurement and processing of raw materials, which are critical components defining the authenticity and quality of the final product. Upstream analysis involves rigorous sourcing of key ingredients, including various meats, specific produce (e.g., corn, beans, avocados, chilies), dairy products, and specialty spices. Given the rising consumer demand for transparency, traceability, and sustainability, many large chains are investing heavily in robust supply chain management systems and forming direct partnerships with farms. Efficiency in this stage minimizes costs and ensures high-quality consistency, crucial for managing the volatility often associated with agricultural commodities. The logistics of cold storage and transportation of perishable goods from domestic and international suppliers are foundational to maintaining operational standards.

Midstream activities encompass the internal preparation and operational stages, where raw materials are transformed into finished menu items. This stage includes initial food preparation (cutting, marinating), cooking, assembly, and strict adherence to food safety protocols. Distribution channels within the value chain are multifaceted, including direct delivery from centralized commissaries to individual restaurant outlets, indirect distribution via large foodservice distributors (Sysco, US Foods), and increasingly, reliance on sophisticated internal logistics for handling high volumes. The shift towards proprietary mobile ordering and third-party delivery services (DoorDash, Uber Eats) has drastically altered the downstream flow, requiring optimized packaging, temperature control technology, and efficient order fulfillment systems to preserve product quality during transit.

Downstream analysis focuses heavily on the final customer interaction, encompassing the point of sale, dining experience, and post-purchase feedback mechanisms. Direct channels include the traditional dine-in experience, drive-thru services, and company-owned digital platforms. Indirect channels primarily involve major third-party delivery aggregators, which extend market reach but introduce additional commission costs and reliance on external logistics management. Success downstream is highly dependent on service quality, speed, and the seamless integration of digital technologies, such as customized mobile apps and loyalty programs, which enhance customer retention and lifetime value. Continuous feedback loop mechanisms are utilized to refine menus, service execution, and address any supply chain inconsistencies perceived by the end consumer.

Mexican Restaurants Market Potential Customers

The primary customer base for the Mexican Restaurants Market is broad and diversified, encompassing multiple demographics defined by lifestyle, income level, and culinary preferences, with a strong focus on younger generations and urban populations seeking convenience and cultural immersion. Millennials and Generation Z represent a substantial and rapidly expanding segment, driven by their preference for experiential dining, high rates of adoption of third-party delivery services, and demand for highly customizable meals that align with evolving dietary trends, such as plant-based options and specific allergen accommodations. This group prioritizes speed, technology integration (mobile ordering, self-service kiosks), and clear brand alignment with ethical sourcing and social responsibility, often favoring fast-casual concepts that offer perceived higher quality than traditional QSRs.

Another crucial customer segment includes busy families and middle-income consumers who value the combination of convenience, affordability, and appeal to diverse tastes offered by QSR and casual dining Mexican establishments. For these consumers, Mexican food serves as an easy, reliable option for quick weeknight dinners or casual weekend gatherings, often leveraging value meals and family bundles. Furthermore, there is a dedicated segment of sophisticated food enthusiasts and high-net-worth individuals who patronize fine dining Mexican establishments, seeking authentic, regionally specific cuisine, innovative preparation techniques, and an elevated beverage program featuring high-end tequila and mezcal selections. This group values culinary skill, detailed ingredient sourcing stories, and a polished, experiential service model, demonstrating inelastic demand for premium experiences.

Finally, the corporate sector constitutes a significant potential customer base for catering services, utilizing Mexican restaurants for office lunches, large meetings, and professional events. The inherent suitability of Mexican cuisine for large-format, customizable catering trays (taco bars, build-your-own bowls) makes it a popular choice. Targeting these corporate accounts requires restaurants to develop specialized, reliable logistics and packaging capabilities. Successful engagement with all these customer groups hinges on leveraging data analytics to understand purchasing patterns, optimize menu pricing dynamically, and deploy targeted promotional campaigns across various digital and traditional marketing channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.5 Billion |

| Market Forecast in 2033 | USD 152.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chipotle Mexican Grill, Taco Bell (Yum! Brands), Qdoba, Del Taco, On The Border Mexican Grill & Cantina, El Pollo Loco, Moe's Southwest Grill, Rubio's Coastal Grill, Baja Fresh, Abuelo's Mexican Restaurant, Tijuana Flats, Salsarita's Fresh Cantina, Freebirds World Burrito, Chevys Fresh Mex, Rosa Mexicano, Velvet Taco, Taco Bueno, P.F. Chang's China Bistro, Taco John's, Local and Regional Chains. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mexican Restaurants Market Key Technology Landscape

The modern Mexican Restaurants Market is heavily reliant on technological innovation to improve efficiency, enhance the customer experience, and manage the complexity of multi-channel ordering. The fundamental technology backbone involves sophisticated Point-of-Sale (POS) systems, which have evolved beyond simple transaction processing to integrated management hubs. These advanced POS solutions now handle inventory tracking in real-time, manage labor scheduling, integrate seamlessly with proprietary and third-party delivery platforms, and provide detailed data analytics on sales performance and consumer preferences. The ability of modern POS systems to centralize data from dine-in, drive-thru, and digital orders is crucial for large chains looking to optimize menu engineering and identify bottlenecks in the service flow, transforming operational management from reactive to predictive.

Further driving the technological landscape is the proliferation of digital ordering and fulfillment infrastructure, dominated by mobile applications and specialized self-service kiosks. These tools not only reduce labor requirements at the front of the house but also increase order accuracy and provide crucial personalization data. Ghost kitchens, or dark kitchens, represent a revolutionary operational model enabled by technology, allowing brands to expand market reach in urban centers without the significant capital expenditure of a full-service storefront. These kitchens rely exclusively on optimized technology stacks—including automated food preparation equipment, robotic arms for basic tasks, and advanced routing software—to manage high volumes of delivery-only orders efficiently, maximizing geographical service radius and reducing delivery times, which directly impacts customer satisfaction in the highly competitive delivery space.

Looking forward, technologies like Artificial Intelligence (AI) and Machine Learning (ML) are moving into predictive roles, influencing everything from dynamic pricing models based on fluctuating demand and inventory levels to sophisticated customer relationship management (CRM) systems that personalize loyalty rewards and marketing communications. Blockchain technology is also gaining traction, particularly for ensuring transparency and traceability of premium or ethically sourced ingredients, offering a secure, immutable ledger that can communicate the farm-to-table journey directly to the consumer, bolstering brand trust and authenticating quality claims, a major differentiator in the fast-casual and fine dining sectors.

Regional Highlights

The global Mexican Restaurants Market exhibits distinct consumption patterns and growth trajectories across major geographical regions, influenced by cultural adoption, demographic factors, and economic maturity. North America, dominated by the United States and Canada, remains the undisputed primary market, accounting for the largest revenue share. This dominance is attributed to high immigration levels, the deep-seated cultural integration of Mexican cuisine into the national diet, and the aggressive expansion of major global QSR and fast-casual chains. The U.S. market is characterized by intense competition and rapid technological adoption, particularly in areas like mobile ordering and drive-thru optimization, driven by consumer demand for ultimate convenience.

Europe represents a high-potential market, currently experiencing moderate to high growth, particularly in Western European nations such as the United Kingdom, France, and Germany. Growth here is fueled by increasing international travel, rising consumer interest in diverse ethnic foods, and the establishment of localized Mexican food brands that cater to European palates while maintaining key authentic elements. The European market tends to show a higher preference for premium, fast-casual concepts that emphasize fresh, non-processed ingredients and sustainable sourcing practices, reflecting the region's strong food safety and ethical consumption trends. However, market penetration is slower than in North America due to less established supply chains for specialty ingredients.

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR) during the forecast period. Urbanization, rising disposable incomes, and the exposure of middle-class populations to Western diets are key accelerators in countries like China, Japan, and Australia. Mexican concepts are often introduced as novel international cuisine, commanding premium pricing, especially in metropolitan centers. Operators must strategically adapt flavor profiles and spice levels to suit local tastes, a key requirement for market acceptance. Latin America, while the origin of the cuisine, presents a mature market characterized by strong independent and regional chains, with global chains focusing on maintaining market share through franchising and targeted localized menu offerings.

- North America (Dominant Market): Characterized by high frequency of consumption, robust chain operations, and leadership in integrating digital ordering and drive-thru efficiency. Significant market saturation necessitates continuous innovation in menu offerings and service models.

- Europe (High Growth Potential): Driven by increasing consumer desire for international flavors and preference for fast-casual formats emphasizing freshness and quality. UK and Nordic countries show strong affinity for customizable bowls and burritos.

- Asia Pacific (Fastest Growth): Expansion catalyzed by urbanization and the westernization of diets; major focus on adapting flavor profiles for local palates and leveraging technological infrastructure for delivery optimization in dense cities.

- Latin America (Mature and Authentic): Focus on maintaining regional culinary authenticity; market growth driven by economic recovery, tourism, and increasing franchising activity by international QSR players targeting local middle-class consumers.

- Middle East & Africa (Emerging Market): Growth tied to expatriate populations and high disposable income tourism hubs; development concentrated in major cities (Dubai, Riyadh, Johannesburg) focusing on high-end casual dining and premium fast-casual offerings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mexican Restaurants Market.- Chipotle Mexican Grill

- Taco Bell (Yum! Brands)

- Qdoba

- Del Taco

- On The Border Mexican Grill & Cantina

- El Pollo Loco

- Moe's Southwest Grill

- Rubio's Coastal Grill

- Baja Fresh

- Abuelo's Mexican Restaurant

- Tijuana Flats

- Salsarita's Fresh Cantina

- Freebirds World Burrito

- Chevys Fresh Mex

- Rosa Mexicano

- Velvet Taco

- Taco Bueno

- P.F. Chang's China Bistro (Operating certain Mexican concepts/subsidiaries)

- Taco John's

- Wahoo's Fish Taco

Frequently Asked Questions

Analyze common user questions about the Mexican Restaurants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the fast-casual Mexican restaurant segment globally?

The fast-casual segment growth is primarily driven by consumer demand for high-quality, fresh, and customizable ingredients, combined with the convenience and speed of service traditionally associated with quick-service models. Focus on transparency, ethical sourcing, and modern dining environments also appeals heavily to younger, health-conscious demographics, accelerating market penetration relative to traditional QSRs.

How significant is the role of delivery platforms in the overall Mexican Restaurants Market revenue?

Delivery platforms represent a highly significant revenue channel, especially post-2020, often accounting for over 25% of total sales for many major chains. The operational shift towards efficient off-premise dining, supported by optimized packaging and integration with third-party aggregators, is essential for reaching consumers demanding maximum convenience and extending the restaurant’s geographical market reach.

Which technology is most critical for improving operational efficiency in large Mexican restaurant chains?

The most critical technology is integrated Point-of-Sale (POS) systems linked to predictive Artificial Intelligence (AI) analytics. This integration allows chains to manage real-time inventory, forecast ingredient demand accurately to minimize waste, optimize labor scheduling based on expected foot traffic, and seamlessly manage transactions across dine-in, drive-thru, and digital ordering channels for unified operational control.

What are the primary challenges related to sustainability and supply chain management in this market?

Primary challenges include managing the extreme price volatility of key commodities such as avocados and specific chilies, ensuring labor standards and ethical sourcing practices throughout the supply chain, and reducing the high volume of food waste inherent in high-volume fresh preparation concepts. Traceability technology, like blockchain, is increasingly being adopted to address consumer demands for verified, sustainable sourcing.

Is the market leaning more towards authentic regional Mexican cuisine or fusion concepts?

The market is experiencing parallel growth in both areas. Fine dining and sophisticated casual concepts are successfully promoting highly authentic regional Mexican cuisine (e.g., Oaxacan or Yucatán specialties). Simultaneously, QSR and fast-casual segments frequently employ fusion concepts, incorporating elements like global protein choices or non-traditional flavor combinations to attract a broader consumer base seeking culinary novelty alongside familiarity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager