MICE Tourism Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432648 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

MICE Tourism Market Size

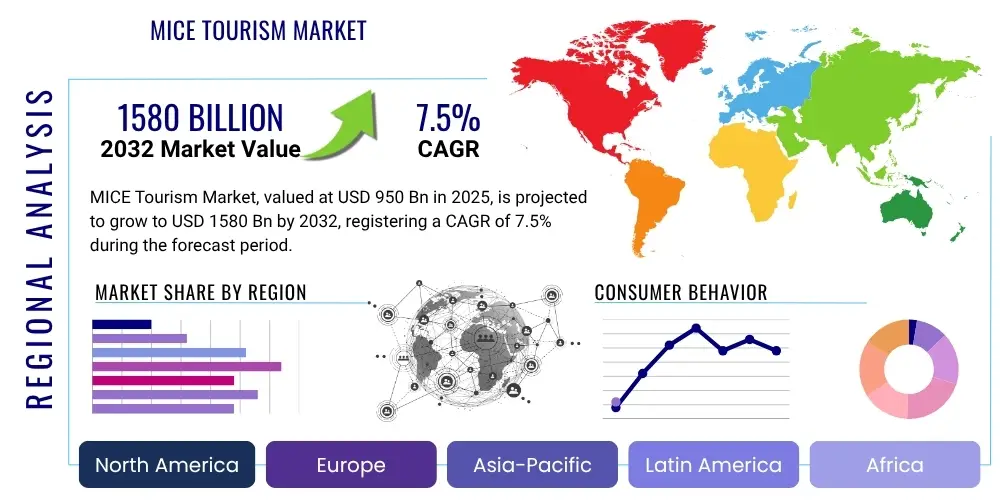

The MICE Tourism Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 800 Billion in 2026 and is projected to reach USD 1,425 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated pace of globalization, the necessity for specialized B2B networking, and robust infrastructure development across emerging economies specifically designed to host large-scale international events.

The post-pandemic recovery has injected significant momentum into the MICE sector, transitioning from virtual platforms back to face-to-face engagements which are universally recognized for generating superior networking quality and deal closures. Furthermore, major corporations are increasingly allocating larger budgets to incentive travel programs, recognizing the direct correlation between these rewards and employee performance, loyalty, and overall organizational motivation. This increased investment validates the return on experience (ROE) offered by high-value MICE events, solidifying the market's trajectory towards its forecasted valuation.

Geographic diversification is also playing a critical role in market size expansion, with emerging destinations in the Asia Pacific and the Middle East heavily investing in convention centers, luxury accommodations, and streamlined visa processes. These regions are capturing a larger share of the international meetings market, often competing effectively on cost, novelty, and the integration of advanced event technologies. The sustained governmental support for tourism and business travel, coupled with private sector innovation in event management software and sustainable practices, underpins the robust financial forecast for the MICE tourism ecosystem through 2033.

MICE Tourism Market introduction

MICE Tourism, an acronym standing for Meetings, Incentives, Conferences, and Exhibitions, represents a highly specialized segment within the broader travel and hospitality industry that caters exclusively to business-related group travel and events. Unlike leisure tourism, MICE activities are characterized by structured agendas, specific professional objectives, and significant economic impact on the host destination, often including extensive usage of conference centers, hotels, transportation, and specialized event services. The foundational product of the MICE market is the provision of seamless, high-quality environments and services necessary for professional gatherings, ranging from small corporate board meetings and incentive trips rewarding top employees, to massive international trade shows and academic conferences that draw thousands of participants.

Major applications of MICE tourism span virtually every industry sector, including pharmaceuticals, technology, finance, automotive, and academic research, acting as critical platforms for knowledge transfer, product launches, partnership formation, and policy discussion. The inherent benefits derived from participating in MICE events include accelerated professional development, instantaneous access to market innovations, fostering crucial industry partnerships, and substantial revenue generation for participating businesses through direct sales and lead generation. For host cities and countries, MICE tourism provides significant non-seasonal revenue, enhances international reputation, and supports local job creation across various service sectors.

The primary driving factors propelling the MICE market forward include the relentless pace of digital transformation necessitating periodic physical collaboration for strategic alignment, the imperative for companies to boost internal morale through unique incentive experiences, and the persistent global need for specialized trade platforms. Furthermore, the increasing accessibility of international travel, coupled with government initiatives promoting business tourism as an economic development tool, consistently fuels demand. The shift towards incorporating sustainability and wellness elements into event planning is also driving innovation in venue selection and service provision, ensuring the sector remains relevant and attractive to modern corporate demands.

MICE Tourism Market Executive Summary

The MICE Tourism Market is currently navigating a period of dynamic resurgence, characterized by strong demand for high-touch, personalized event experiences that integrate technology seamlessly while prioritizing sustainability. Key business trends indicate a significant consolidation among global event management companies and hotel chains, aiming to offer integrated, end-to-end solutions that simplify planning for corporate clients. There is also a pronounced shift towards smaller, more frequent regional meetings (SMERF segment), complementing the enduring demand for mega-conferences, optimizing corporate travel spend while maximizing localized impact. Furthermore, the incorporation of sophisticated data analytics is enabling planners to better predict attendance, personalize content delivery, and measure the tangible Return on Investment (ROI) of events, driving operational efficiency across the sector.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth, propelled by massive infrastructure investments in emerging hubs like Singapore, Bangkok, and Dubai (often categorized under MEA but acting as a major global crossroad). Europe maintains its leadership in hosting large-scale academic and professional conferences due to its established convention infrastructure and cultural significance, while North America continues to dominate the incentive travel segment, leveraging its mature hospitality sector and strong corporate base. Crucially, political stability and geopolitical openness remain the single most significant factor influencing regional event hosting decisions, prompting destinations to proactively market safety and convenience.

Segmentation trends highlight the increasing importance of the 'Incentives' segment, which is increasingly becoming experiential, moving beyond standard packages to incorporate unique cultural immersion and sustainable adventure tourism. Technology providers within the 'Meetings' and 'Conferences' segments are focusing on hybrid event solutions, ensuring maximum reach and engagement regardless of physical presence. The market is also seeing robust growth in niche exhibitions focusing on highly specialized B2B industries, moving away from generalized trade fairs, thus emphasizing quality lead generation and highly targeted participant engagement over sheer volume.

AI Impact Analysis on MICE Tourism Market

User queries regarding AI's influence on the MICE Tourism Market primarily revolve around operational efficiency, personalization capabilities, and the potential displacement of human roles. Common concerns address how AI can streamline complex event logistics, such as venue booking and personalized itinerary creation, without sacrificing the human element crucial for relationship building. Users are keen to understand the feasibility of AI-powered chatbots and virtual assistants handling delegate inquiries, the application of predictive analytics for attendance forecasting and minimizing food waste, and the long-term impact of AI-driven tools on event management costs and service quality across the value chain, focusing heavily on enhancing attendee experience through hyper-personalization.

Artificial Intelligence is rapidly transforming the MICE ecosystem, evolving from simple data processing tools into strategic partners capable of optimizing every stage of event planning and execution. In the pre-event phase, AI algorithms analyze historical attendance data, social media sentiment, and demographic information to recommend optimal event dates, locations, and tailored marketing campaigns, dramatically improving registration rates and demographic targeting accuracy. During the event, AI enhances the attendee experience through smart networking recommendations, AI-powered matchmaking based on professional profiles, and real-time translation services, eliminating language barriers and maximizing the value of interactions for participants.

The post-event impact of AI focuses heavily on quantifying ROI and improving future events. AI models automate the tedious task of surveying attendees, analyzing feedback (both textual and sentiment-based) instantly, and generating comprehensive reports detailing engagement levels for various sessions and speakers. This predictive feedback loop allows event organizers to adapt quickly and justifies future investments by demonstrating measurable business outcomes. Despite initial concerns regarding job displacement, the prevailing consensus is that AI serves as an augmentation tool, freeing up human planners to focus on high-value creative and strategic tasks that require emotional intelligence and complex decision-making.

- AI-driven predictive analytics for attendance and optimal venue selection.

- Automated personalized delegate matchmaking and networking facilitation.

- Real-time multilingual translation services for international conferences.

- AI chatbots and virtual assistants for 24/7 delegate support and inquiry handling.

- Optimization of logistical supply chains, including catering and accommodation allocations.

- Enhanced security measures through AI-powered facial recognition and crowd management.

DRO & Impact Forces Of MICE Tourism Market

The MICE Tourism market is significantly influenced by a complex interplay of forces, where globalization and the strategic need for face-to-face interaction act as powerful Drivers (D), while geopolitical instability and high operational costs serve as Restraints (R). The overarching Opportunities (O) lie in the rapid adoption of hybrid event models and sustainability mandates, compelling the industry to innovate and cater to a new generation of environmentally conscious and digitally fluent professionals. These internal and external factors create dynamic Impact Forces, constantly shaping investment decisions and technological priorities within the hospitality and event management sectors.

Primary drivers include the exponential growth in specialized knowledge sectors requiring dedicated conference platforms, increased corporate spending on incentive programs to retain talent, and governmental investments in MICE infrastructure to boost economic diversification. Conversely, the market faces significant restraints from unpredictable global health crises that necessitate swift cancellations or transitions to virtual formats, the persistently high cost of international travel and premium venue rentals, and regulatory hurdles concerning cross-border data privacy (GDPR compliance being a key concern). These restraints necessitate robust contingency planning and flexible contractual arrangements across the value chain to mitigate financial risk and ensure business continuity.

Opportunities for expansion are abundant, particularly in leveraging experiential technology such as Augmented Reality (AR) and Virtual Reality (VR) for pre-event marketing and on-site engagement, creating richer, more memorable delegate experiences. The market can capitalize on the growing demand for secondary and tertiary cities as MICE destinations, offering unique cultural flavor and cost efficiencies compared to traditional hubs. The ultimate impact force is the pressure for measurable sustainability, pushing venues and organizers towards net-zero carbon event certifications and comprehensive social responsibility programs, which are increasingly non-negotiable requirements for major corporate clients and large international associations, fundamentally altering procurement processes.

Segmentation Analysis

The MICE Tourism Market segmentation provides a granular view of distinct market behaviors, allowing providers to tailor services precisely to the needs of different event types and participant demographics. The market is primarily segmented based on the Activity Type (Meetings, Incentives, Conferences, and Exhibitions), Revenue Stream (Accommodation, Transportation, Food & Beverage, and Others), and Geographic Location. This multi-dimensional analysis reveals varying growth rates across segments, with Incentive travel showing high expenditure per participant, and Exhibitions generating the largest overall venue revenue due to size and duration. Understanding these segment dynamics is crucial for strategic resource allocation, particularly in developing specialized infrastructure like large convention centers versus boutique luxury retreat venues.

The segmentation by Activity Type highlights the contrasting operational demands: Meetings are typically smaller and require advanced AV technology, Incentives are focused on high-end luxury and unique experiences, Conferences prioritize content delivery and large seating capacities, and Exhibitions demand vast floor space and intricate logistics for booth construction and tear-down. Furthermore, the segmentation by end-user industry (e.g., corporate, association, government, educational) influences purchasing behavior; corporate clients emphasize quantifiable ROI and efficiency, while associations prioritize legacy, knowledge sharing, and delegate engagement. The rapid evolution of the market post-2020 has emphasized the 'Hybrid Events' model as a cross-cutting segment that impacts all traditional activity types, requiring simultaneous management of both physical and digital attendees, fundamentally altering revenue structures by diversifying income streams.

- Activity Type:

- Meetings

- Incentives

- Conferences (Conventions)

- Exhibitions (Trade Shows)

- Revenue Stream:

- Accommodation

- Transportation

- Food & Beverage

- Venue Rental

- Other Services (A/V, Technology, Registration)

- Industry End-Use:

- Corporate

- Association

- Government

- Educational

- Others (SMERF - Social, Military, Educational, Religious, Fraternal)

Value Chain Analysis For MICE Tourism Market

The MICE Tourism value chain is a complex structure involving multiple stakeholders, starting with upstream suppliers and extending through to direct service providers and downstream customers. Upstream analysis focuses on foundational elements such as destination marketing organizations (DMOs), convention and visitor bureaus (CVBs), and specialized infrastructure developers responsible for creating and maintaining convention centers, airports, and regional transportation networks. These upstream entities heavily influence the attractiveness and logistical feasibility of a destination by providing essential data, strategic coordination, and governmental liaison services that are critical before any event planning commences.

The core of the value chain consists of direct service providers, including professional conference organizers (PCOs), destination management companies (DMCs), hotel groups, and specialized technology vendors (e.g., registration software, hybrid event platforms). These entities coordinate the tangible execution of the event. Distribution channels are varied, incorporating direct sales teams targeting large corporate accounts, indirect distribution via third-party meeting planners (TPMPs) and travel management companies (TMCs) like American Express GBT and BCD Travel, and digital channels such as proprietary booking platforms (e.g., Cvent) which aggregate services and venues. The choice between direct and indirect distribution often depends on the scale and complexity of the event, with large international conferences typically utilizing robust indirect channel partnerships.

Downstream analysis centers on the end-users—the corporations, associations, and government bodies that commission the MICE services—and the ultimate participants (delegates and exhibitors). The post-event phase includes feedback mechanisms, financial reconciliation, and the collection of data that fuels the upstream DMOs and planners for future event optimization. Efficiency in the value chain is paramount, as coordinating travel, accommodation, venue setup, and technological integration across multiple geographic boundaries requires seamless information flow and strong collaborative agreements between all intermediaries to deliver a successful, high-quality MICE experience for the demanding corporate client.

MICE Tourism Market Potential Customers

The primary customer base for the MICE Tourism Market is highly diversified yet fundamentally rooted in organizations requiring formal, structured interactions for business continuity, knowledge exchange, or incentive purposes. Potential customers are categorized into four major groups: Corporate entities, which utilize MICE services primarily for internal sales meetings, product launches, training sessions, and employee incentive travel; Associations (both trade and professional), which require large annual congresses and regional educational seminars to facilitate networking and credentialing; Government bodies, which host international summits, bilateral negotiations, and specialized policy conferences; and the Educational sector, which manages academic conferences and student exchange programs. Each group exhibits unique buying cycles and venue preferences, demanding specialized packages.

Corporate clients, representing the largest spending segment, focus heavily on the measurable return on investment (ROI) of the event, prioritizing venues that offer advanced technology, luxury accommodations, and logistical efficiency, often favoring established, globally recognized hotel brands and major convention centers in accessible business hubs. Conversely, international associations are often bound by geographic rotation policies and require expansive facilities capable of hosting thousands of delegates, prioritizing local support from Convention and Visitor Bureaus (CVBs) to ensure community engagement and comprehensive destination services for their diverse membership. Furthermore, the rising importance of specialized small and medium-sized enterprises (SMEs) creates a growing customer segment seeking flexible, cost-effective meeting solutions, often driving demand for mid-tier hotel meeting spaces and virtual/hybrid platforms.

The criteria for selecting MICE services are dictated by factors such as destination safety, cost of attendance, ease of visa processing, quality of infrastructure (especially reliable high-speed internet), and the availability of professional local expertise (DMCs and PCOs). Event planners, acting as the immediate buyers, rigorously assess vendors based on established sustainability credentials, capacity for personalized service, and demonstrated ability to manage complex logistics under pressure. Consequently, the most successful providers are those capable of offering flexible, bundled services that minimize the administrative burden on the end-user organization while maximizing the perceived value and experience for the attending delegates, securing repeat business from highly demanding customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 800 Billion |

| Market Forecast in 2033 | USD 1,425 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marriott International, Hilton Worldwide, Accor, Cvent, BCD Travel, Expedia Group, Carlson Wagonlit Travel, American Express Global Business Travel, InterContinental Hotels Group (IHG), Hyatt Hotels Corporation, Kuoni Group, ConferenceDirect, ATPI, Reed Exhibitions, Informa Markets, Freeman, Messe Frankfurt, TUI Group, Mandarin Oriental Hotel Group, Global Experience Specialists (GES). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MICE Tourism Market Key Technology Landscape

The technology landscape within the MICE Tourism market is undergoing rapid evolution, shifting from rudimentary reservation systems to sophisticated, integrated platforms that manage the entire event lifecycle. The core technology stack includes comprehensive Event Management Software (EMS) that handles registration, abstract management, exhibitor logistics, and scheduling. Central to modern MICE operations is the reliance on robust Customer Relationship Management (CRM) tools, which allow organizers to track attendee preferences and engagement metrics, facilitating personalized communication and targeted content delivery, thereby optimizing the return on engagement (ROE) for both sponsors and delegates. Furthermore, high-speed, reliable Wi-Fi and 5G connectivity are now non-negotiable technological necessities for all venues, supporting the vast data requirements of hybrid events.

A major trend is the accelerated adoption of virtual and augmented reality (VR/AR) technologies. VR is utilized extensively for venue scouting, allowing international planners to virtually tour potential locations and assess capacity without incurring substantial travel costs. AR applications enhance the onsite experience through interactive wayfinding, digital program guides, and immersive product demonstrations at exhibitions, blurring the lines between the physical and digital event space. Additionally, mobile event apps have matured beyond simple scheduling tools; they now integrate payment processing, real-time polling, and sophisticated peer-to-peer networking features, ensuring continuous engagement even outside formal session times, driving higher sponsor visibility.

Future technological investments are heavily focused on sustainability and data security. Blockchain technology is beginning to be explored for secure ticketing and verifiable credential management, ensuring fraud reduction and simplified cross-border transactions. Moreover, sophisticated data analytics, powered by machine learning, are used to measure the carbon footprint of events, automate sustainability reporting, and optimize resource usage, such as predicting catering needs precisely to minimize food waste. This technological pivot emphasizes efficiency, security, and environmental responsibility, reflecting the evolving priorities of corporate and association event buyers who demand transparent, measurable, and risk-mitigated execution for all MICE activities.

Regional Highlights

The MICE Tourism market exhibits significant regional diversity, driven by varying economic growth rates, government investment priorities, and established cultural norms regarding business travel. North America, characterized by a mature corporate sector and robust technological adoption, remains a dominant market leader, particularly in hosting large corporate meetings and high-value incentive programs. The region's strength is underpinned by major convention centers in cities like Las Vegas, Orlando, and Chicago, which benefit from extensive airlift capacity and a strong network of professional event organizers. However, high labor costs and complex union regulations pose constant challenges, driving some price-sensitive events towards international locations.

Europe holds a strategic position, leading in association meetings and academic conferences, leveraging its historical appeal, strong inter-country connectivity (particularly within the Schengen Area), and world-class rail networks. Major hubs such as London, Paris, Berlin, and Barcelona benefit from deep institutional knowledge and a dense concentration of multinational corporate headquarters. The focus in Europe is heavily skewed towards sustainability and cultural integration, often requiring venues and organizers to demonstrate strict adherence to environmental standards. Geopolitical stability post-Brexit and the management of regional travel complexities continue to be key factors influencing destination selection within the continent.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by massive government investments in new infrastructure, rising disposable incomes facilitating higher incentive travel budgets, and a burgeoning corporate environment demanding more B2B interaction. Destinations like Singapore, Shanghai, Seoul, and Sydney are aggressively competing by offering state-of-the-art facilities, streamlined digital services, and targeted incentive packages. The Middle East and Africa (MEA), primarily led by the Gulf Cooperation Council (GCC) nations like the UAE and Qatar, are also rapidly expanding their MICE capabilities, positioning themselves as critical global crossroads and capitalizing on major international events (like global expos and sporting championships) to showcase their hospitality and logistical prowess. Latin America, though facing occasional political and economic instability, shows significant potential in specialized segments like medical and energy conferences, particularly in markets such as Mexico and Brazil, which are focused on developing their regional trade capabilities and infrastructure.

- North America: Dominant in corporate meetings and technology integration; characterized by high per-event spending, particularly in incentive travel targeting major tech and financial sectors.

- Europe: Leader in large international association conferences and academic summits; strong focus on regulatory compliance, legacy destinations, and sustainability mandates.

- Asia Pacific (APAC): Highest projected growth rate driven by infrastructure development and government support; emerging hubs gaining market share through competitive pricing and technological innovation (e.g., smart venues).

- Middle East & Africa (MEA): Strategic global positioning and significant investment in luxury hospitality and specialized event infrastructure; focused on becoming a primary intersection for East-West business travel.

- Latin America (LAMEA): Growing demand for regional trade and medical conferences; faced with challenges related to infrastructure consistency and economic volatility but offering unique cultural experiences for incentive groups.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MICE Tourism Market.- Marriott International

- Hilton Worldwide

- Accor

- Cvent

- BCD Travel

- Expedia Group

- Carlson Wagonlit Travel (CWT)

- American Express Global Business Travel (Amex GBT)

- InterContinental Hotels Group (IHG)

- Hyatt Hotels Corporation

- Kuoni Group

- ConferenceDirect

- ATPI

- Reed Exhibitions (RX)

- Informa Markets

- Freeman

- Messe Frankfurt

- TUI Group

- Mandarin Oriental Hotel Group

- Global Experience Specialists (GES)

Frequently Asked Questions

Analyze common user questions about the MICE Tourism market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Incentive Travel segment in MICE tourism?

Growth in incentive travel is primarily driven by the corporate necessity to attract and retain top talent through high-value, unique experiential rewards. These programs are increasingly focusing on sustainability, personalization, and exotic or culturally immersive destinations to maximize employee engagement and loyalty.

How are hybrid events changing the MICE market structure?

Hybrid events are fundamentally reshaping revenue models by combining physical and virtual attendance, increasing event reach beyond geographic constraints. This shift requires significant investment in specialized AV technology, reliable digital platforms, and expertise in managing two simultaneous participant experiences.

Which geographical region is expected to show the highest growth in MICE tourism?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid urbanization, massive government investment in convention infrastructure, and the expansion of the corporate sector in major economic hubs like China, India, and Southeast Asia.

What is the most significant restraint impacting MICE market expansion?

Geopolitical volatility and unpredictable global health crises remain the most significant restraints. These factors create massive logistical and financial uncertainty, requiring robust contingency planning, flexible cancellation policies, and rapid adaptation to virtual formats to mitigate risk for both planners and attendees.

What role does sustainability play in modern MICE destination selection?

Sustainability has transitioned from a desirable feature to a mandatory requirement. Major corporate and association clients demand venues and organizers demonstrate clear environmental, social, and governance (ESG) compliance, impacting decisions related to catering, waste management, energy consumption, and local community engagement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager