Micro Lens Arrays Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432439 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Micro Lens Arrays Market Size

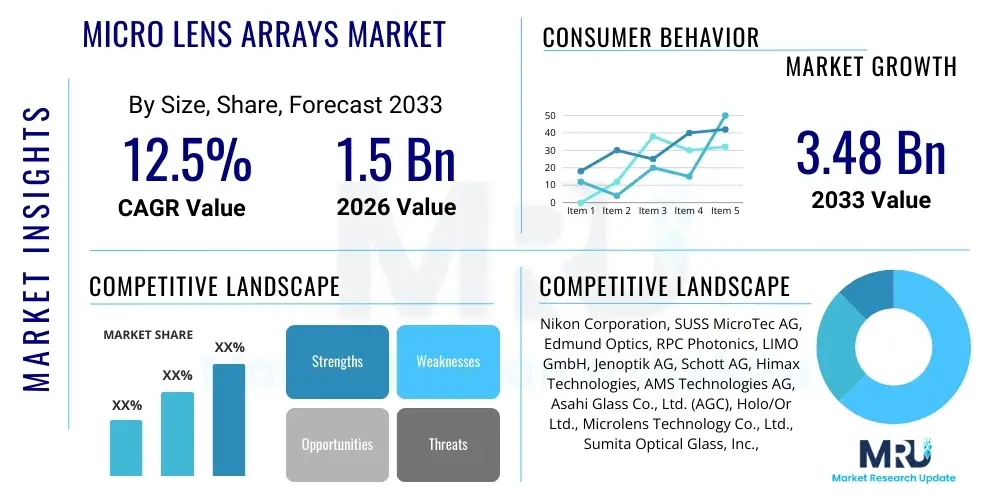

The Micro Lens Arrays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.48 Billion by the end of the forecast period in 2033.

Micro Lens Arrays Market introduction

The Micro Lens Arrays (MLAs) Market encompasses the design, fabrication, and application of optical components featuring multiple microscopic lenses arranged in a one-dimensional or two-dimensional array. These arrays are critical components in modern optical systems due to their ability to manipulate light fields, homogenize illumination, enhance coupling efficiency, and enable sophisticated imaging and sensing functions within confined spaces. MLAs are typically characterized by lens diameters ranging from a few micrometers to several hundred micrometers, demanding high precision in manufacturing processes such as photolithography, deep reactive ion etching (DRIE), and nanoimprint lithography. The intrinsic advantages of MLAs, including their compact size, lightweight nature, and high integration capability, make them indispensable across several high-growth technological sectors.

The primary applications driving the adoption of MLAs include advanced displays, particularly in virtual reality (VR) and augmented reality (AR) headsets where they improve image quality and efficiency; optical sensors used in 3D imaging and facial recognition; medical diagnostic tools like endoscopy and microscopy; and complex automotive systems such as LiDAR for autonomous driving. The product versatility of MLAs allows them to be manufactured using diverse materials, including glass, polymers, silicon, and specialized ceramics, catering to specific requirements regarding refractive index, thermal stability, and mechanical resilience. The shift toward miniaturization in consumer electronics and the escalating demand for high-performance optical coherence tomography (OCT) systems in healthcare are fundamentally contributing to the market's expansion.

Major driving factors influencing the market trajectory include the rapid commercialization of metaverse-related hardware, necessitating efficient light management solutions for near-eye displays, and the proliferation of complementary metal-oxide-semiconductor (CMOS) image sensors that utilize microlenses to maximize photon capture. Furthermore, the increasing integration of sophisticated optical metrology in industrial quality control and the continuous advancements in micro-fabrication techniques, which reduce production costs and increase yield rates for high-density arrays, further propel market growth. However, challenges related to managing chromatic aberration, ensuring uniform lens profiles across large substrates, and establishing standardized testing protocols remain points of focus for industry stakeholders seeking to maximize performance and scalability.

Micro Lens Arrays Market Executive Summary

The Micro Lens Arrays market is experiencing robust growth fueled by transformative shifts in consumer electronics, automotive sensor technology, and advanced medical imaging. Business trends highlight a strong focus on strategic partnerships between specialized MLA manufacturers and end-product integrators, particularly in the APAC region where consumer electronics production is concentrated. There is a noticeable trend toward using advanced materials like specialized polymers for increased flexibility and lower cost in high-volume applications, contrasting with the demand for robust fused silica MLAs in high-power laser systems. Investment is escalating in advanced lithography and etching techniques to achieve sub-micron precision, enabling next-generation optical computing and communication applications. Companies are actively pursuing patents related to novel lens geometries, such as non-spherical and freeform microlenses, to overcome conventional optical limitations and improve light focusing efficiency, thereby gaining a significant competitive edge in niche markets like photonics integrated circuits (PICs).

Regional trends indicate that North America and Europe lead in research and development, particularly concerning high-end military, aerospace, and advanced medical device applications, driven by high adoption rates of LiDAR and advanced surgical tools. Conversely, the Asia Pacific region, led by China, Japan, and South Korea, dominates the market share regarding volume and revenue, primarily due to the massive scale of manufacturing for smartphones, high-definition displays, and VR/AR devices. The rapid expansion of 5G infrastructure in APAC is also stimulating demand for MLAs in optical communications hardware. Emerging economies are beginning to show increased potential, especially in leveraging MLAs for localized manufacturing of industrial sensors and automotive components, prompting global players to establish regional fabrication facilities to minimize logistical complexities and capitalize on local supply chain integration.

Segmentation trends confirm that the Refractive MLA segment holds the largest market share due to its straightforward design and high efficiency in standard light focusing and homogenization tasks. However, the Diffractive MLA segment is projected to exhibit the fastest CAGR, driven by its lightweight nature and superior performance in beam shaping and color separation required by miniaturized display and spectrometer applications. Regarding material, Glass MLAs remain critical for applications demanding high thermal and chemical stability, such such as high-power lasers and harsh automotive environments, while Polymer MLAs are increasingly preferred in consumer-grade sensors and displays where cost-effectiveness and mass production capabilities are paramount. The Application segment analysis demonstrates that Displays and Sensors collectively represent the dominant revenue streams, with rapid acceleration projected for the Medical Devices and Optical Communication sectors as integrated optics become the standard for diagnostics and high-speed data transmission.

AI Impact Analysis on Micro Lens Arrays Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Micro Lens Arrays Market frequently center on how AI can enhance MLA design complexity, optimize manufacturing processes for yield and precision, and accelerate the performance of AI-enabled optical systems that rely on MLAs, such as LiDAR and computer vision. Key themes include the use of machine learning (ML) algorithms for inverse design, where AI defines the optimal lens geometry based on desired optical output; concerns about integrating AI-driven defect detection in high-volume production lines; and expectations regarding MLAs enabling high-density integration necessary for neuromorphic computing and optical AI hardware. Users are keenly interested in whether AI can fundamentally reduce the time-to-market for specialized, non-standard MLA designs required by advanced sensing applications, moving beyond traditional iterative simulation techniques.

- AI-driven Inverse Design: Utilizing machine learning to rapidly generate complex, custom MLA geometries (freeform, non-spherical) that achieve superior optical performance compared to traditionally designed arrays, significantly shortening the R&D cycle.

- Manufacturing Optimization: Implementation of AI and computer vision systems for real-time monitoring of etching and lithography processes, predicting and compensating for process variations, thus maximizing yield and uniformity, especially for critical sub-micron features.

- Enhanced Optical Sensing: MLAs are core components in advanced LiDAR and 3D sensing systems; AI algorithms interpret the complex light patterns generated by MLA-equipped sensors, enabling higher accuracy in object detection, facial recognition, and medical diagnostics.

- Data Processing Efficiency: In optical computing and neuromorphic hardware, MLAs facilitate the physical manipulation of light fields for rapid data processing, with AI acting as the software layer managing and optimizing these optical computations.

- Defect Detection and Quality Control: AI models trained on vast datasets of acceptable and defective arrays automate and accelerate quality checks, moving beyond manual inspection to ensure every lenslet meets stringent performance criteria across the substrate.

- Personalized Optics: ML techniques enable the development of adaptive optics using MLAs, adjusting light patterns dynamically based on real-time input data, crucial for personalized vision correction or advanced projection mapping.

DRO & Impact Forces Of Micro Lens Arrays Market

The Micro Lens Arrays market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities. A primary driver is the pervasive demand for miniaturization across all electronic devices, requiring compact and efficient light manipulation that only MLAs can provide effectively, particularly in high-density sensor arrays used in robotics and IoT. This is coupled with the explosive growth of augmented and virtual reality (AR/VR) technology, which relies heavily on MLAs for high-fidelity, high-efficiency near-eye displays essential for immersive user experiences. Key restraints include the inherent complexity and high initial capital expenditure associated with high-precision manufacturing processes, such as e-beam lithography and hot embossing, necessary to achieve nanometer-scale accuracy. Additionally, ensuring uniformity and minimizing defects across large substrate areas, particularly when scaling production, poses significant technical hurdles. Conversely, the market is presented with significant opportunities arising from the emergence of optical computing and the integration of MLAs into photonic integrated circuits (PICs), enabling ultralight and high-speed data centers, alongside the increasing use of MLAs in advanced medical imaging techniques like photoacoustic imaging and miniature endoscopes.

Impact forces within the MLA market dictate competitive intensity and market accessibility. The increasing demand for light homogenization and beam shaping in LED lighting and display backlights exerts a consistent pull on the market (Driver Force). However, the necessity for highly specialized materials and proprietary fabrication techniques limits new entrants (Restraint Force). The potential for MLAs in novel applications such as advanced solar concentrators and optical cloaking represents significant future growth avenues (Opportunity Force). Competitive rivalry remains high among established players who possess patented manufacturing technologies, especially concerning high-refractive-index materials. Supplier power is moderate; while raw materials like specialized polymers and fused silica are readily available, the machinery for nanostructuring is highly specialized, granting moderate power to equipment manufacturers. Buyer power is strong, especially from large volume purchasers like display and automotive Tier 1 suppliers, who demand high quality at competitive prices, pushing manufacturers toward process efficiency gains and cost reductions.

Technological impact is the most influential force, with rapid developments in wafer-level optics (WLO) enabling the mass production of low-cost, high-performance arrays. The integration of MLAs into sophisticated sensing platforms, such as multi-spectral cameras and advanced optical authentication systems, creates new application niches. Moreover, stringent regulatory requirements, particularly in medical and aerospace sectors, impact design specifications and material choices, forcing players to invest heavily in certification and validation. The sustained pressure for high-resolution, glare-free optical systems across consumer electronics ensures that MLA innovation remains a core priority for the overall photonics industry, solidifying its role as an enabling technology essential for future technological advancements, thereby driving continuous investment in R&D aimed at achieving even smaller pitch sizes and higher fill factors.

Segmentation Analysis

The Micro Lens Arrays market is comprehensively segmented based on material, type, fabrication technology, and end-use application, providing a granular view of market dynamics and specialized opportunities. The segmentation by material—primarily focusing on Glass, Polymer, and Silicon—is crucial as material choice dictates optical performance characteristics such as transmission spectrum, thermal stability, and maximum power handling. Glass MLAs dominate high-reliability sectors, while Polymer MLAs are gaining traction due to cost-efficiency and moldability for mass-market consumer electronics. Segmentation by Type distinguishes between Refractive MLAs, which rely on curvature for light manipulation, and Diffractive MLAs, which use surface relief patterns to achieve beam shaping, with diffractive optics being preferred for spectral separation and phase control. Fabrication technology segmentation, including photolithography, deep etching, and diamond turning, reflects the varying precision and scalability required for different applications. Finally, the application segmentation highlights the key revenue streams, showing massive growth in Displays, Sensors (LiDAR, CMOS), and Medical Devices, indicating the widespread utility of these components across critical industrial sectors.

- By Material:

- Glass (Fused Silica, Borosilicate)

- Polymer (PMMA, Polycarbonate, Epoxy Resins)

- Silicon and Other Semiconductors

- By Type:

- Refractive Micro Lens Arrays (Spherical, Aspherical, Freeform)

- Diffractive Micro Lens Arrays (Fresnel Lenses, Binary Optics)

- By Fabrication Technology:

- Photolithography and Etching (DRIE)

- Reflow Techniques

- Hot Embossing and Molding

- Diamond Turning

- Laser Direct Writing (LDW)

- Nanoimprint Lithography (NIL)

- By Application:

- Displays (AR/VR Headsets, Backlighting, Projection Systems)

- Sensors and Detectors (CMOS Image Sensors, LiDAR, 3D Sensing, Wavefront Sensing)

- Medical Devices (Endoscopy, OCT Systems, Lab-on-a-Chip)

- Optical Communication (Fiber Coupling, Data Center Interconnects)

- Automotive (HUDs, Driver Monitoring Systems)

- Industrial and Metrology (Beam Homogenization, Optical Inspection)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Micro Lens Arrays Market

The value chain for the Micro Lens Arrays market begins with upstream activities involving raw material procurement, primarily high-grade optical glass substrates, specialized photoresists, and high-purity polymers. Key suppliers in this stage include specialized chemical companies and substrate manufacturers who provide materials optimized for micro-fabrication processes requiring extreme purity and dimensional stability. The core value addition occurs during the manufacturing stage, where specialized companies execute high-precision processes such as lithography, plasma etching, reflow, and mastering for molding tools. This stage demands significant intellectual property in process control and proprietary mask designs, constituting the highest barrier to entry and the most critical step for quality determination.

Midstream activities involve secondary processing, quality control (QC), and packaging. Rigorous optical metrology, often utilizing interferometry and profilometry, is essential here to verify lenslet uniformity, pitch accuracy, and overall optical performance before integration. The distribution channel is multifaceted. Direct distribution is common for highly customized or low-volume arrays sold directly to R&D institutions, defense contractors, and specialized medical device manufacturers who require close technical collaboration with the MLA producer. This approach ensures specialized technical support and intellectual property protection. Indirect distribution involves sales through established photonics component distributors or specialized sales agents who serve the broad industrial and commercial markets, particularly those requiring standard, high-volume products for display and sensor applications.

Downstream activities center on the integration of MLAs into final products. Major end-users, such as Tier 1 automotive suppliers (for LiDAR and HUDs), consumer electronics giants (for VR/AR optics and smartphone cameras), and major medical equipment manufacturers, integrate these arrays into complex systems. The efficiency and performance of the final product—be it an advanced LiDAR system or a high-resolution projector—are fundamentally dependent on the quality and specifications of the embedded MLA. The downstream demand dictates the R&D direction upstream, pushing manufacturers to innovate toward higher integration levels, wafer-level optics standardization, and lower cost-per-unit for mass applications. The reliance on highly specialized knowledge at every stage ensures that the value chain remains relatively consolidated among a few expert firms capable of achieving the necessary nanometer precision.

Micro Lens Arrays Market Potential Customers

The potential customer base for the Micro Lens Arrays Market is diverse and highly technologically advanced, encompassing large multinational corporations, specialized defense contractors, and cutting-edge research institutions. End-users are typically organizations deeply invested in high-resolution imaging, efficient light energy management, and compact optical system design. Major segments include consumer electronics giants requiring MLAs for miniature cameras, advanced 3D facial recognition modules, and near-eye display optics crucial for AR/VR headsets and smart glasses. The automotive sector is a rapidly expanding customer base, utilizing MLAs extensively in advanced driver-assistance systems (ADAS) via LiDAR units, heads-up displays (HUDs), and in-cabin driver monitoring systems requiring sophisticated light handling and beam shaping.

The medical and life sciences industry represents a high-value customer segment, incorporating MLAs into advanced diagnostic and surgical tools. This includes manufacturers of high-end optical coherence tomography (OCT) systems, micro-endoscopes that require highly efficient light coupling into optical fibers, and lab-on-a-chip devices where MLAs facilitate cellular sorting and fluid control via optical trapping. Furthermore, the industrial sector, including manufacturers of high-power lasers for material processing and companies focused on quality control systems, utilizes MLAs for beam homogenization and uniform illumination in machine vision applications. Finally, telecommunications and data center operators are increasingly becoming buyers, integrating MLAs for improved fiber coupling efficiency and alignment in high-speed optical transceivers and photonic integrated circuits, demonstrating a consistent demand across industries prioritizing optical performance and miniaturization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.48 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nikon Corporation, SUSS MicroTec AG, Edmund Optics, RPC Photonics, LIMO GmbH, Jenoptik AG, Schott AG, Himax Technologies, AMS Technologies AG, Asahi Glass Co., Ltd. (AGC), Holo/Or Ltd., Microlens Technology Co., Ltd., Sumita Optical Glass, Inc., NIL Technology ApS (NILT), LightPath Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micro Lens Arrays Market Key Technology Landscape

The technology landscape of the Micro Lens Arrays market is characterized by a reliance on highly sophisticated micro- and nano-fabrication methods, requiring stringent control over materials and processes to achieve the necessary dimensional precision and optical performance. The dominant manufacturing techniques include photolithography combined with reactive ion etching (RIE) or deep reactive ion etching (DRIE), particularly effective for creating high-aspect-ratio silicon or glass structures that define the microlens array geometry. This technology is foundational for producing high-quality refractive arrays and complex diffractive elements. Another critical technique is the photoresist reflow method, where cylindrical photoresist structures created by lithography are heated above their glass transition temperature, causing them to melt into spherical or hemispherical lens shapes due to surface tension, offering a cost-effective path for creating simple, high-fill-factor spherical MLAs, especially on silicon wafers for CMOS sensors.

A significant trend involves the adoption of wafer-level optics (WLO) technology, which allows for the simultaneous manufacturing of thousands of MLAs on large wafers (typically 8 or 12 inches) before dicing. WLO is essential for driving down unit costs and enabling the massive scale required by consumer electronics and automotive sectors. WLO often employs specialized techniques like hot embossing or nanoimprint lithography (NIL). NIL uses a hard master stamp containing the negative mold of the lens array, which is pressed into a polymer layer on the substrate under heat and pressure. This technique is highly advantageous for replicating sub-wavelength features and complex freeform or diffractive structures with high throughput and fidelity, positioning it as a key enabler for next-generation AR/VR displays that demand extremely high optical precision and integration density.

Further technological advancements include the development of MLAs using advanced materials beyond standard glass and polymers. For high-power laser applications and military optics, fused silica and specialized ceramics are used due to their superior resistance to thermal stress and radiation damage. Ongoing research is also focused on developing adaptive MLAs, which integrate micro-electro-mechanical systems (MEMS) or liquid crystal technology to dynamically change the focal length or beam steering capabilities in real-time. This active control is vital for systems like variable focus lenses in cameras and active wavefront correction in astronomical telescopes or high-speed data communications. Furthermore, the integration of computational optics, where the MLA design is inextricably linked to subsequent digital post-processing algorithms, is broadening the functional capabilities of these arrays, allowing for novel sensing techniques and image reconstruction methods previously unattainable with passive optics.

Regional Highlights

- Asia Pacific (APAC) Dominance: The APAC region, driven primarily by China, Japan, South Korea, and Taiwan, maintains the largest market share and exhibits the highest growth rate globally. This dominance is attributed to the region's massive manufacturing base for consumer electronics, including smartphones, tablets, high-definition television displays, and, increasingly, VR/AR equipment. Key players in CMOS image sensor manufacturing and display technology reside here, creating significant demand for high-volume, low-cost polymer and glass MLAs used for light homogenization and coupling efficiency enhancement. Governments in these nations actively invest in photonics research and semiconductor fabrication facilities, further strengthening regional manufacturing capabilities and driving innovation in wafer-level optics.

- North America (NA) Innovation Leadership: North America holds a significant market share, characterized by its focus on high-value, specialized applications. The region leads in the deployment of MLAs in military and aerospace optics, advanced medical imaging systems (e.g., high-resolution OCT), and sophisticated autonomous vehicle technology, particularly LiDAR sensors. The presence of major tech companies and specialized defense contractors drives demand for high-performance, custom-designed MLAs, often requiring high-stability glass or fused silica materials. Investment in R&D, particularly in silicon photonics and optical computing, positions NA as a leader in technological breakthroughs for complex array designs and integration.

- Europe's Specialized Niche: Europe maintains a strong position, driven by expertise in precision engineering, industrial metrology, and advanced machinery. Germany, Switzerland, and the Netherlands are hotspots for specialized MLA manufacturing, focusing on high-quality optics for industrial laser systems, quality control instruments, and high-end automotive components, including advanced head-up displays (HUDs). European manufacturers often focus on low-to-medium volume, high-precision custom arrays using diamond turning and other high-fidelity techniques for demanding industrial and medical applications where error tolerance is minimal. Regulatory standards in the medical device sector also shape demand for highly certified MLA products in the region.

- Latin America and MEA Growth Potential: These regions currently hold smaller market shares but are exhibiting promising growth, particularly as infrastructure development accelerates. Growth in Latin America is linked to increasing adoption of advanced diagnostics in healthcare and the nascent development of automotive manufacturing. The Middle East and Africa (MEA) see growth driven by governmental investment in smart city initiatives, which require advanced sensor networks and surveillance technologies relying on MLAs for superior imaging. Increased foreign direct investment in local manufacturing hubs is expected to stimulate demand for MLAs in industrial inspection and energy applications in the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro Lens Arrays Market.- Nikon Corporation

- SUSS MicroTec AG

- Edmund Optics

- RPC Photonics

- LIMO GmbH

- Jenoptik AG

- Schott AG

- Himax Technologies, Inc.

- AMS Technologies AG

- Asahi Glass Co., Ltd. (AGC)

- Holo/Or Ltd.

- Microlens Technology Co., Ltd.

- Sumita Optical Glass, Inc.

- NIL Technology ApS (NILT)

- LightPath Technologies, Inc.

- Hoya Corporation

- Zeiss Group (SUSS MicroOptics)

- Fresnel Technologies, Inc.

- Incom, Inc.

- Advanced Microoptic Systems GmbH (AMS)

- Pharma-Optics Co., Ltd.

- Micron Technology, Inc. (In relation to CMOS sensors)

- Shin-Etsu Chemical Co., Ltd.

- Toshiba Corporation (Optics Division)

- Dai Nippon Printing Co., Ltd. (DNP)

- Viavi Solutions Inc.

- Broadcom Inc. (via optical components division)

- II-VI Incorporated (Coherent Corp.)

- Optosigma Corporation

- Teledyne Technologies Incorporated

Frequently Asked Questions

Analyze common user questions about the Micro Lens Arrays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using Micro Lens Arrays over conventional lenses?

MLAs offer significant advantages in terms of compactness, light weight, and high integration density, enabling better light collection efficiency, homogenization, and beam shaping in miniature systems like smartphone cameras, LiDAR sensors, and VR/AR displays where space is severely limited.

Which fabrication technology is most scalable for high-volume Micro Lens Array production?

Wafer-Level Optics (WLO) technology, utilizing techniques like hot embossing and nanoimprint lithography (NIL), is currently the most scalable method for high-volume MLA production. WLO allows simultaneous manufacturing on large semiconductor wafers, drastically reducing unit costs for consumer electronics and automotive applications.

How is the adoption of LiDAR in autonomous vehicles driving the Micro Lens Arrays Market?

LiDAR systems require highly efficient beam shaping and light emission control to accurately map environments. MLAs are critical components used for beam steering, homogenization, and optimizing the coupling between laser diodes/VCSELs and the sensor, ensuring superior range and accuracy in automotive 3D sensing.

What is the difference in application between Refractive and Diffractive Micro Lens Arrays?

Refractive MLAs are primarily used for focusing, collimation, and light homogenization, dominating applications like standard imaging and LED backlights. Diffractive MLAs, utilizing surface relief patterns, are preferred for wavelength separation, color filtering, and complex beam shaping in displays, spectrometers, and advanced holographic systems.

Why are polymer materials increasingly preferred over glass for certain MLA applications?

Polymer MLAs (e.g., PMMA) are increasingly preferred in consumer electronics due to their lower manufacturing cost, suitability for mass production via molding/hot embossing, lightweight nature, and ability to be fabricated on flexible substrates, contrasting with glass MLAs which are chosen for high thermal stability and robust applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager