Micro-stereolithography Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431639 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Micro-stereolithography Market Size

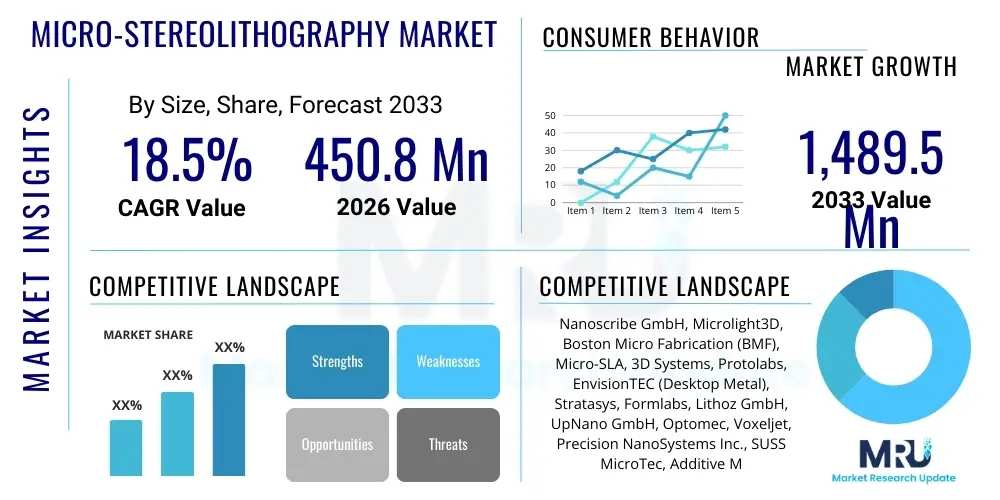

The Micro-stereolithography Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450.8 million in 2026 and is projected to reach USD 1,489.5 million by the end of the forecast period in 2033.

Micro-stereolithography Market introduction

Micro-stereolithography (Micro-SLA) represents a specialized subset of additive manufacturing technologies, focusing on the fabrication of intricate three-dimensional structures with feature sizes often falling below the 100-micrometer threshold. This technology utilizes a photosensitive liquid resin that is selectively cured layer-by-layer using a focused light source, typically a UV laser or digital light processing (DLP) projector. Unlike conventional SLA, Micro-SLA systems are characterized by high-resolution optics, precision motion stages, and specialized resins optimized for extremely small feature fidelity, enabling the creation of complex geometries indispensable for micro-electro-mechanical systems (MEMS), microfluidics, and biomedical devices. The market growth is inherently tied to the increasing demand for miniaturization across various high-tech sectors, coupled with the need for rapid prototyping and mass customization of microscopic components.

The primary applications of Micro-SLA span several critical and rapidly evolving industries. In the medical field, it is pivotal for producing highly detailed microneedle arrays, micro-implants, and sophisticated scaffolds for tissue engineering. The technology's ability to create smooth surfaces and complex internal geometries at a micro-scale makes it superior to traditional subtractive manufacturing methods when dealing with materials often sensitive to machining stress. Furthermore, in the electronics and telecommunications sectors, Micro-SLA is used to manufacture optical interconnects, specialized micro-lenses, and components for advanced sensors, where dimensional accuracy and material integrity are paramount for functional performance.

Key benefits driving the adoption of Micro-SLA include unprecedented design freedom at the micro-scale, significantly reduced production cycle times compared to injection molding for low-volume specialty parts, and the ability to work with a growing palette of functional materials, including biocompatible and high-strength engineering polymers. The major driving factors encompass the burgeoning research and development activities in microfluidics for drug discovery and diagnostics, the imperative for advanced packaging solutions in semiconductors, and the continuous push towards smaller, lighter, and more complex medical devices. These factors collectively establish Micro-SLA as a foundational technology enabling the next generation of miniature precision devices and systems.

Micro-stereolithography Market Executive Summary

The Micro-stereolithography Market is experiencing robust expansion, fundamentally driven by pervasive miniaturization trends across the life sciences, engineering, and electronics industries. Business trends indicate a shift towards integrated solutions, where manufacturers are offering turnkey systems that combine high-resolution printing hardware with specialized software for design optimization and proprietary functional resins. Key market players are actively pursuing strategic partnerships with academic institutions and specialized biotech firms to co-develop novel materials capable of meeting stringent performance requirements, particularly for applications involving high-temperature resistance or specific optical properties. The competitive landscape is characterized by niche specialization, with companies focusing either on ultra-high resolution (sub-10 µm) for photonics or high throughput systems for batch production in microfluidics, indicating market maturity through segmentation.

Regionally, North America continues to dominate the market, primarily due to the high concentration of advanced research facilities, major MEMS manufacturers, and substantial government and private investment into biomedical engineering and advanced defense systems. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by aggressive governmental support for local electronics manufacturing hubs, the rapid expansion of the medical device industry in countries like China and South Korea, and increasing adoption of 3D printing technologies in commercial fabrication services. Europe maintains a strong position, particularly in the precision engineering and automotive sectors, leveraging Micro-SLA for tooling and complex prototype generation, supported by strong EU funding for industrial innovation initiatives.

Segment trends reveal that the application segment is currently dominated by Microfluidics and Lab-on-a-Chip devices, owing to the technology’s unique capability to create complex internal channels and features necessary for precise fluid handling. Furthermore, the material segment shows high growth in functional polymers, including ceramic-loaded and metallic nanoparticle-infused resins, which are expanding the functional scope of printed parts beyond mere prototyping into end-use components. The technology segment highlights the increasing commercial viability of two-photon polymerization (2PP) techniques, although traditional DLP-based Micro-SLA remains the dominant method due to its balance of speed, cost-effectiveness, and adequate resolution for most mainstream applications. These segment dynamics underscore the market's trajectory towards industrial-scale production rather than purely research-focused implementation.

AI Impact Analysis on Micro-stereolithography Market

User queries regarding the impact of Artificial Intelligence (AI) on the Micro-stereolithography Market predominantly revolve around optimizing print parameters, improving material development cycles, and enhancing quality control. Users are keen to understand how AI can reduce the inherently complex trial-and-error process associated with high-resolution printing, where minor variations in light intensity, material viscosity, or printing speed can drastically affect outcome fidelity. Key themes include the potential for AI algorithms to predict and compensate for geometric distortions (such as warpage or shrinkage) in real-time, thereby increasing yield rates, and using machine learning (ML) to rapidly screen novel resin formulations for desired mechanical or biological properties, accelerating innovation in specialized functional materials. Expectations center on autonomous printing systems requiring minimal operator intervention and delivering predictable, repeatable micro-scale components, addressing the industry's need for higher automation and stringent quality assurance standards.

- Process Optimization: AI and Machine Learning models are utilized to analyze vast datasets of successful and failed prints, enabling real-time adjustments to exposure time, laser power, and platform movement, minimizing defects like overcure or undercure specific to micro-scale features.

- Predictive Maintenance: AI algorithms monitor the performance and degradation of critical system components, such as high-resolution lenses, galvanometer mirrors, and light sources, predicting maintenance needs to ensure continuous operation and high print fidelity required for precision manufacturing.

- Material Informatics: Generative AI and ML accelerate the discovery and formulation of new photosensitive resins, predicting the performance characteristics (e.g., stiffness, biocompatibility, optical transparency) of novel chemical compositions based on structural inputs, drastically shortening R&D cycles.

- Quality Assurance (QA): Computer vision systems powered by deep learning automatically inspect printed micro-structures for dimensional accuracy and surface finish flaws against CAD models, providing instantaneous feedback and replacing time-consuming, subjective manual inspection processes.

- Design Optimization: AI-driven topology optimization tools are employed to generate complex, functional micro-geometries, ensuring structural integrity while minimizing material usage, particularly crucial in demanding applications like biomedical scaffolds and high-efficiency heat exchangers.

DRO & Impact Forces Of Micro-stereolithography Market

The Micro-stereolithography Market is significantly shaped by a dynamic interplay of propelling drivers, technical and economic restraints, and emerging opportunities, which together constitute the critical impact forces steering its evolution. The primary driver is the exponentially growing demand for highly complex, customized, and miniaturized components across high-value sectors such as biotechnology and advanced electronics, where traditional fabrication techniques cannot achieve the required precision and complexity. This is coupled with the inherent advantage of Micro-SLA in generating prototypes and small batches rapidly, reducing time-to-market for innovative products. Conversely, the market faces constraints related to the high cost of sophisticated Micro-SLA equipment and specialized, often proprietary, photosensitive resins. Additionally, scaling the technology for true mass production remains a technical hurdle, requiring improved speed and larger build volumes while maintaining ultra-high resolution. The limited palette of readily available end-use materials, particularly engineering-grade thermoplastics, also restricts broad industrial adoption, forcing users to rely on specialized, often expensive, polymer formulations.

Opportunities for market expansion are abundant, particularly in the realm of advanced functional materials and hybrid manufacturing processes. The integration of Micro-SLA with conventional fabrication methods, such as micro-molding or thin-film deposition, promises to create multi-material, multi-functional micro-devices, opening doors in areas like integrated optics and flexible electronics. Significant opportunity also lies in penetrating emerging vertical markets, including customized drug delivery systems and high-throughput screening platforms in pharmaceutical research. Furthermore, continuous technological advancements aimed at improving print speed through innovations in light source delivery (e.g., faster scanning or enhanced DLP arrays) and automated post-processing solutions are expected to lower the cost barrier and increase the accessibility of Micro-SLA systems to smaller research labs and contract manufacturers, thereby expanding the potential customer base globally.

The overall impact forces are strongly positive, indicating a high-growth environment. While restraints related to material limitations and system costs exert moderate pressure, the powerful drivers arising from technological dependence on miniaturization in global high-tech industries provide a substantial upward momentum. The long-term trajectory is defined by the convergence of Micro-SLA with complementary technologies like AI, which promises to mitigate existing production constraints related to yield and complexity. This convergence solidifies Micro-SLA's role as an indispensable tool for micro-manufacturing, pushing the market towards significant value realization over the forecast period as opportunities in bioprinting and integrated electronics mature into commercial applications.

Segmentation Analysis

The Micro-stereolithography Market is comprehensively segmented across several dimensions, including technology type, application, material, and end-user industry, enabling a detailed analysis of market dynamics and adoption patterns. The segmentation by technology highlights the dominant role of Digital Light Processing (DLP)-based SLA due to its speed and scalability relative to conventional laser-scanning SLA, although specialized technologies like Two-Photon Polymerization (2PP) command a significant share in ultra-high resolution, research-intensive applications. Analyzing the market through the application lens is critical, revealing Microfluidics and the fabrication of Micro-Optics as the highest growth and largest value segments, reflecting global investment in point-of-care diagnostics and integrated photonics. Material segmentation is crucial as material properties dictate functional outcomes, with Standard Resins forming the base volume, while highly specialized segments such as Ceramic Composites and Biocompatible Polymers drive the high-value, niche market growth.

- By Technology:

- Laser-Scanning Stereolithography (SLA)

- Digital Light Processing (DLP) Micro-SLA

- Two-Photon Polymerization (2PP)

- Micro Continuous Liquid Interface Production (Micro-CLIP)

- By Application:

- Microfluidics and Lab-on-a-Chip Devices

- Micro-Optics (Lenses, Waveguides, Optical Interconnects)

- MEMS and Micro-Sensors

- Micro-Implants and Microneedles (Biomedical)

- Micro-Tooling and Molds

- Micro-Actuators and Robotics Components

- By Material:

- Standard Photosensitive Resins

- Engineering-Grade Polymers (High-temperature, High-strength)

- Biocompatible and Biodegradable Resins

- Ceramic and Composite Resins (Loaded with nanoparticles)

- By End-User Industry:

- Healthcare and Biotechnology (Pharmaceuticals, Medical Devices)

- Electronics and Semiconductor Industry

- Academic and Research Institutions

- Aerospace and Defense

- Telecommunications

Value Chain Analysis For Micro-stereolithography Market

The value chain of the Micro-stereolithography Market is characterized by highly specialized stages, beginning with material formulation and culminating in specialized micro-component manufacturing. The upstream segment is dominated by chemical manufacturers and material scientists who develop and supply high-purity photopolymer resins. This involves intricate chemistry to control viscosity, cure speed, and post-cure mechanical properties at the micro-scale, making the supplier power for specialized resins relatively high. Key players in this stage invest heavily in proprietary material research, focusing on functional resins like those with high dielectric constants, biocompatibility, or thermal stability, ensuring tight control over the final product quality and intellectual property.

The midstream comprises the Micro-SLA equipment manufacturers (OEMs). These companies focus on integrating ultra-precision optical components, advanced motion control systems, and high-performance software tailored for micro-resolution. Distribution channels for Micro-SLA systems typically involve a mix of direct sales teams for major industrial and research clients and specialized indirect distributors who provide localized technical support and application expertise. Due to the highly technical nature of the equipment, robust post-sale support, including maintenance and calibration, forms a crucial part of the value proposition, often differentiating competitors.

The downstream segment encompasses the end-users and service providers, including contract manufacturing organizations (CMOs) specializing in microfabrication, academic research labs, and dedicated R&D departments within large corporations (e.g., medical device manufacturers or semiconductor firms). Direct sales are prevalent when OEMs sell directly to major end-users requiring integrated in-house capabilities. Indirect channels are utilized by smaller firms or those seeking rapid prototyping services, relying on specialized service bureaus that operate the costly Micro-SLA equipment. This downstream interaction emphasizes application expertise, where the ability to transition a complex micro-design into a reliable physical component is the primary source of value creation.

Micro-stereolithography Market Potential Customers

The potential customers and end-users of Micro-stereolithography technology are concentrated in industries requiring exceptionally high precision, complex geometry, and customized, low-volume production of miniature components. The primary buyers are specialized R&D departments and dedicated production units within the healthcare and biotechnology sectors. These customers purchase systems or services to fabricate microfluidic chips for drug discovery, customized medical micro-implants, precise microneedle arrays for transdermal drug delivery, and intricate scaffolds necessary for tissue engineering and regenerative medicine applications, where dimensional stability and biocompatibility are non-negotiable requirements.

Another major segment of buyers includes manufacturers in the electronics, semiconductor, and telecommunications industries. These companies leverage Micro-SLA for producing high-fidelity components such as micro-lenses, specialized optical components like waveguides and splitters, and intricate packaging components for MEMS devices and advanced sensors. The need to integrate complex optical pathways or create high-precision, non-planar structures that are impossible with conventional lithography drives their adoption. These customers often require high-throughput capabilities and materials with specific electrical or thermal properties, demanding customized system configurations and material development partnerships.

Furthermore, academic institutions and government research laboratories constitute a significant user base, driving innovation and demanding the most cutting-edge, ultra-high-resolution systems (such as 2PP technology). These organizations use Micro-SLA for fundamental research in areas like micro-robotics, photonics, and advanced materials science. Contract manufacturing organizations (CMOs) and specialized additive manufacturing service bureaus also form a growing customer category, purchasing Micro-SLA systems to offer specialized high-precision fabrication services to smaller companies that cannot afford the high capital expenditure associated with purchasing and maintaining the equipment internally, thus democratizing access to the technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.8 million |

| Market Forecast in 2033 | USD 1,489.5 million |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nanoscribe GmbH, Microlight3D, Boston Micro Fabrication (BMF), Micro-SLA, 3D Systems, Protolabs, EnvisionTEC (Desktop Metal), Stratasys, Formlabs, Lithoz GmbH, UpNano GmbH, Optomec, Voxeljet, Precision NanoSystems Inc., SUSS MicroTec, Additive Manufacturing Technologies, Nano Dimension, Exaddon, Alvéole, Shenzhen UnionTech 3D Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micro-stereolithography Market Key Technology Landscape

The Micro-stereolithography technology landscape is highly fragmented and characterized by competition between high-throughput methods and ultra-high-resolution techniques. The dominant commercial method remains Digital Light Processing (DLP) Micro-SLA, which uses a high-resolution projector to flash entire layers simultaneously. This parallel processing capability significantly boosts printing speed compared to point-by-point laser scanning, making it suitable for industrial applications like high-volume microfluidic chip production and micro-tooling. Innovations in DLP technology focus on enhancing the pixel density of projectors and integrating dynamic compensation mechanisms to counteract material shrinkage and distortion inherent at the micro-scale, thereby improving overall dimensional accuracy and yield rates for precision components.

At the apex of resolution capability sits Two-Photon Polymerization (2PP), often marketed as Nanolithography or Nano-SLA. This technique utilizes a highly focused femtosecond laser to cure photopolymer only at the focal point, achieving resolutions well into the nanometer range (sub-100 nm). While significantly slower and more capital-intensive than DLP, 2PP is indispensable for cutting-edge research in integrated photonics, advanced biomaterials, and the creation of highly complex 3D micro-scaffolds for cellular studies. Recent advancements in 2PP focus on increasing throughput through multi-foci approaches, where multiple laser beams are used simultaneously, attempting to bridge the gap between resolution and productivity.

Emerging and specialized techniques, such as Micro Continuous Liquid Interface Production (Micro-CLIP), derived from the larger CLIP technology, aim to achieve ultra-fast, continuous printing by using an oxygen-permeable window to create a "dead zone" of uncured resin, preventing polymerization near the window surface. This technology promises to deliver parts at unprecedented speeds, potentially revolutionizing micro-production for applications requiring moderately high resolution but exceptionally high throughput. Furthermore, the integration of advanced sensors and closed-loop control systems—often leveraging AI—is becoming standard across all Micro-SLA platforms to monitor and adjust critical process variables like temperature, light dose uniformity, and resin level in real-time, moving the technology closer to reliable, high-precision manufacturing standards.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the robust presence of leading research institutions, advanced medical device manufacturers, and substantial defense R&D spending. The U.S. acts as the central hub, aggressively adopting Micro-SLA for applications in advanced semiconductor packaging, precision instrumentation, and personalized medicine, supported by a mature venture capital ecosystem that fuels technological startups in the micro-additive manufacturing space.

- Europe: Europe is a critical market characterized by strong emphasis on precision engineering, automotive R&D, and regulatory leadership in medical devices. Countries like Germany and Switzerland are key users, utilizing Micro-SLA for micro-tooling, specialized jigs and fixtures, and complex components for micro-robotics. EU-funded initiatives promoting advanced manufacturing and smart factories further accelerate the integration of these high-precision technologies into existing industrial value chains.

- Asia Pacific (APAC): Expected to exhibit the highest CAGR during the forecast period. Growth is stimulated by rapid industrialization, massive investments in local electronics manufacturing (especially in China, South Korea, and Taiwan), and the expanding base of regional contract manufacturing organizations (CMOs). Increasing demand for domestic medical devices and governmental policies supporting technological self-sufficiency are major drivers pushing rapid adoption of high-resolution 3D printing capabilities.

- Latin America (LATAM): The LATAM market is nascent but growing steadily, primarily driven by adoption in academic research institutions and initial uptake in localized medical and dental technology manufacturing. Investment remains focused on high-value pilot projects, with Brazil leading the region in terms of R&D infrastructure and industrial applications, particularly in customizing biomedical prototypes.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, owing to national diversification strategies that prioritize technology and healthcare infrastructure development. Adoption is currently centered around state-funded universities and specialized oil and gas sector research requiring high-precision sensors and testing equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro-stereolithography Market.- Nanoscribe GmbH

- Microlight3D

- Boston Micro Fabrication (BMF)

- Micro-SLA

- 3D Systems

- Protolabs

- EnvisionTEC (Desktop Metal)

- Stratasys

- Formlabs

- Lithoz GmbH

- UpNano GmbH

- Optomec

- Voxeljet

- Precision NanoSystems Inc.

- SUSS MicroTec

- Additive Manufacturing Technologies

- Nano Dimension

- Exaddon

- Alvéole

- Shenzhen UnionTech 3D Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Micro-stereolithography market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Micro-stereolithography over traditional manufacturing?

Micro-stereolithography (Micro-SLA) offers unparalleled capability in creating complex, highly intricate 3D geometries with resolutions down to the sub-micrometer scale (often below 10 micrometers). Unlike methods such as machining or lithography, Micro-SLA allows for the fabrication of fully 3D internal structures, critical for microfluidic channels, complex optical components, and custom biomedical scaffolds.

Which industries are the major drivers of Micro-SLA market growth?

The primary industries driving market growth are Healthcare and Biotechnology (for drug delivery systems, microneedles, and customized implants), and Electronics and Semiconductors (for micro-optics, advanced sensor packaging, and micro-electromechanical systems (MEMS)). The global push for device miniaturization is the foundational catalyst across all sectors.

What are the key material limitations facing the Micro-stereolithography market?

The market is restrained by the limited availability of high-performance, functional engineering-grade resins compared to macro-scale 3D printing. While standard photopolymers are common, highly specialized materials such as high-temperature thermoplastics, high-strength ceramics, or specific electrically conductive polymers suitable for micro-SLA processes remain proprietary, costly, or challenging to formulate, restricting widespread industrial adoption for end-use parts.

How does Two-Photon Polymerization (2PP) differ from standard DLP Micro-SLA?

DLP Micro-SLA is a rapid, parallel process that cures an entire layer using a projection image, offering resolutions typically above 10 micrometers with high throughput. In contrast, 2PP uses an ultra-focused laser to cure material only at the focal point (two-photon absorption), providing significantly higher resolution (often below 1 micrometer or nanometer scale) but operating at a much slower speed, making it ideal for specialized research and nano-fabrication rather than mass production.

Which geographical region leads the global Micro-stereolithography market?

North America currently leads the global market in terms of revenue share. This dominance is attributed to high expenditure in advanced biomedical research, a strong presence of MEMS and semiconductor manufacturers, and a robust environment for technological innovation and early adoption of high-precision additive manufacturing technologies, particularly in the United States.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager