Micro Switch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435567 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Micro Switch Market Size

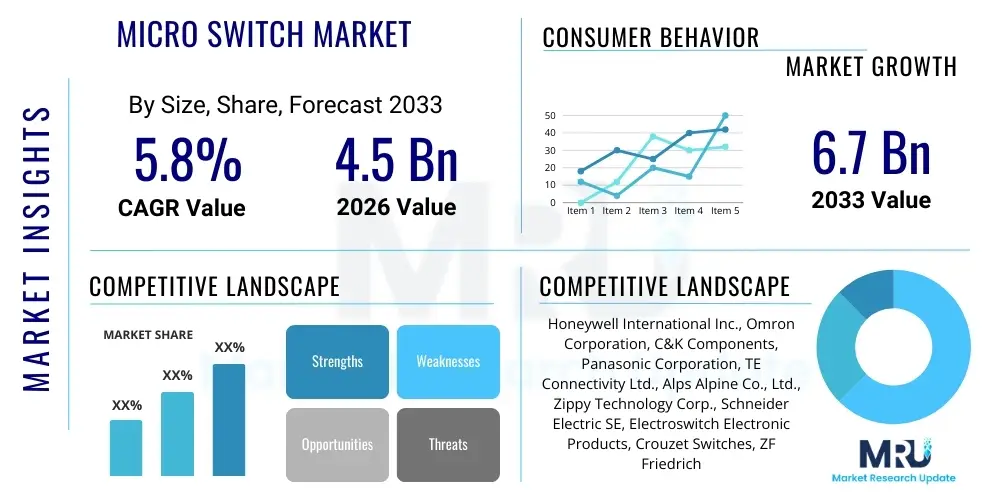

The Micro Switch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Micro Switch Market introduction

The Micro Switch Market encompasses the manufacturing and distribution of small, highly sensitive electrical switches characterized by an actuating mechanism that requires minimal force to operate, thereby generating a rapid, decisive switching action. These electromechanical components are essential for detecting presence, positioning, and limits in complex machinery and consumer devices. Due to their reliability, precision, and compact size, micro switches are indispensable in applications requiring consistent performance over millions of cycles. The core function involves converting mechanical motion into an electrical signal, a fundamental requirement across diverse industries ranging from precision industrial machinery to highly sensitive medical equipment and robust automotive systems.

Products within this market range significantly in terms of material composition, contact configuration (e.g., normally open, normally closed), electrical rating, and protection level (e.g., IP rating for dust and water resistance). Major applications span across industrial automation, where they serve as limit switches and safety interlocks; automotive components, utilized in door latches, gear shift selectors, and steering wheel controls; and consumer electronics, including keypads, control panels, and home appliances. The versatility of micro switches, especially those designed for harsh environments or extreme miniaturization, ensures their continued relevance despite the rise of solid-state sensor technologies, largely due to their tactile feedback, simplicity of integration, and proven durability in high-vibration settings.

Key driving factors propelling the market include the global expansion of industrial automation and smart manufacturing initiatives, commonly referred to as Industry 4.0. The increasing production of electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly boosts demand, as these vehicles incorporate numerous micro switches for battery management systems, charging infrastructure, and sophisticated internal control interfaces. Furthermore, continuous technological advancements focusing on reducing switch size while increasing durability, operating temperature ranges, and current handling capacity are solidifying the micro switch’s position as a critical component in modern, high-density electronic assemblies and mission-critical systems where mechanical reliability is paramount.

Micro Switch Market Executive Summary

The Micro Switch Market is undergoing steady expansion, driven primarily by robust growth in the automotive sector, particularly the rapid transition toward electric and autonomous vehicles, and sustained investment in industrial automation infrastructure worldwide. Business trends indicate a strong focus on developing highly specialized, sealed micro switches (high IP ratings) capable of functioning reliably in extreme conditions, addressing the needs of heavy machinery and outdoor infrastructure. Furthermore, key players are emphasizing strategic acquisitions and collaborations to integrate advanced sensor capabilities alongside traditional mechanical switching, aiming to provide comprehensive electromechanical solutions that cater to the demanding requirements of high-precision instruments and medical devices.

Regional trends highlight the Asia Pacific (APAC) region as the dominant manufacturing and consumption hub, fueled by large-scale electronic manufacturing bases in China, South Korea, and Japan, coupled with rapid infrastructure development in India and Southeast Asia. North America and Europe maintain strong market positions, primarily due to high adoption rates in premium automotive manufacturing, aerospace and defense, and stringent regulatory environments that necessitate reliable safety-rated components. Segment trends show that the miniature and subminiature switch categories are experiencing the fastest growth, directly reflecting the consumer electronics industry’s relentless pursuit of device miniaturization and the growing necessity for compact, lightweight components across all major application sectors.

The competitive landscape is characterized by established global suppliers maintaining market share through brand reputation, stringent quality control, and extensive distribution networks, alongside niche manufacturers specializing in high-performance or ultra-miniature switches. The market is moderately fragmented, but consolidation efforts are visible, particularly as companies seek to secure supply chain efficiencies and diversify their product portfolios to include specialized Hall effect sensors and integrated modules alongside their core micro switch offerings. Strategic emphasis is increasingly placed on optimizing the lifecycle cost and reducing the total cost of ownership (TCO) for industrial buyers, promoting the shift towards premium, high-cycle durability switches over standard models.

AI Impact Analysis on Micro Switch Market

User queries regarding the impact of Artificial Intelligence (AI) on the Micro Switch Market primarily focus on whether smart sensors and predictive maintenance algorithms will replace traditional mechanical switches, and conversely, how AI-driven manufacturing necessitates more reliable physical inputs. Users are concerned about the longevity of electromechanical components in smart systems and the role micro switches play in enabling human-machine interface (HMI) feedback that AI systems interpret. Key themes emerging from these questions suggest a strong expectation that while AI will optimize the performance and lifespan of systems using micro switches, the need for tactile feedback and failsafe mechanical inputs (especially in safety-critical applications) will ensure their continued relevance.

AI’s influence is subtle but profound, largely operating upstream in design optimization and downstream in operational efficiency. In the design phase, AI-driven simulations allow engineers to model stress points and predict failure rates of micro switches under specific operating conditions, leading to the development of components with significantly enhanced durability and performance profiles optimized for specific end-use environments, such as high-temperature automotive applications. Furthermore, AI-enhanced quality control systems in manufacturing ensure that production tolerances are exceptionally tight, minimizing defects and improving overall batch reliability, which is crucial for components deployed in mission-critical applications where failure is unacceptable.

Downstream, the integration of AI and Machine Learning (ML) in predictive maintenance systems indirectly supports the micro switch market. In industrial automation, continuous operational data (such as current draw changes or slight variations in actuation force detected by proximity sensors) is analyzed by AI to predict the optimal time for switch replacement before catastrophic failure occurs. This capability reduces unplanned downtime, enhancing the overall value proposition of high-quality, long-life micro switches. While AI-enabled solid-state sensing technologies pose a competitive threat in certain low-force sensing applications, micro switches remain essential where a physical, verifiable break/make connection or distinct tactile feedback is required, often serving as crucial backup or primary input mechanisms interpreted by the overarching AI control system.

- AI optimizes micro switch design by simulating stress and predicting mechanical fatigue under specific application loads.

- Predictive maintenance systems utilizing ML analyze operational data, indirectly extending the perceived life and enhancing the perceived reliability of micro switches.

- AI-enhanced quality control improves manufacturing precision, reducing defects and guaranteeing tight tolerances for sensitive applications.

- The rise of sophisticated human-machine interfaces (HMIs) demands reliable tactile feedback, a core capability provided by mechanical micro switches, feeding structured input to AI controllers.

- Autonomous systems require robust, redundant input sensors; micro switches often serve as failsafe limiters or emergency stops, critical for safety protocols managed by AI.

DRO & Impact Forces Of Micro Switch Market

The Micro Switch Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively influencing the market trajectory and competitive landscape. Key drivers include the massive global push towards industrial automation (Industry 4.0), necessitating robust sensors and limit controls, and the surging demand from the Electric Vehicle (EV) industry, where micro switches are integrated into charging ports, battery thermal management systems, and safety interlocks. These forces are amplified by the increasing demand for durable, sealed, and miniature switches required by modern high-density electronics and medical diagnostic equipment, where reliability over millions of cycles is non-negotiable.

However, the market faces significant restraints, primarily stemming from intense competition from alternative, non-contact sensing technologies, such as Hall Effect sensors and optical sensors, which offer longer lifecycles and immunity to mechanical wear in specific use cases. Furthermore, material costs, particularly for high-performance contact materials (like gold and silver alloys) required to meet high current/low-voltage precision demands, can fluctuate, placing pressure on manufacturers’ margins. The complexity associated with designing switches for extreme environments—requiring advanced sealing (high IP ratings) and specialized housing materials—also acts as a restraining force, demanding continuous investment in R&D and specialized manufacturing processes.

Opportunities abound, centering on the development of smart micro switches integrated with communication capabilities (IoT readiness), enabling real-time diagnostics and condition monitoring, thus merging mechanical reliability with digital intelligence. The expansion into untapped geographical areas, particularly emerging economies adopting mechanized manufacturing and consumer electronics at scale, represents a substantial growth avenue. Moreover, regulatory standards emphasizing functional safety and component longevity in critical infrastructure and transportation sectors create a lucrative opportunity for vendors specializing in certified, high-reliability micro switches capable of meeting stringent safety integrity level (SIL) requirements.

Segmentation Analysis

The Micro Switch Market is systematically segmented based on crucial parameters including the type of actuation mechanism, current rating, application industry, and geographical region. Understanding these segmentations provides critical insight into market trends, competitive positioning, and targeted product development efforts. Segmentation based on type typically differentiates between standard micro switches, miniature micro switches, subminiature micro switches, and sealed switches (with high ingress protection). This differentiation is fundamental as it determines the physical footprint and the environmental suitability of the component, directly impacting adoption across space-constrained applications like consumer wearables versus harsh industrial settings like heavy machinery.

Further analysis by current rating separates switches designed for low-power signal circuitry (low current/low voltage, often utilizing gold contacts for precision) from those handling high-power load circuitry (high current/high voltage, typically using silver contacts for thermal performance). The application segmentation—covering automotive, industrial, consumer electronics, aerospace and defense, and medical—is crucial for strategic planning, as each sector presents unique demands concerning durability, certification requirements, lifecycle expectations, and volume procurement patterns. For instance, the automotive segment requires switches compliant with AEC-Q200 standards, driving higher quality and testing requirements compared to general consumer electronic components.

- By Type:

- Standard Micro Switch

- Miniature Micro Switch

- Subminiature Micro Switch

- Sealed Micro Switch (High IP Rating)

- Basic Switch

- By Application:

- Automotive (Door latches, HVAC, Gear Shifters, Charging Ports)

- Industrial Automation and Control (Limit Switches, Safety Interlocks)

- Consumer Electronics (Appliances, Keypads, Power Tools)

- Medical Devices (Diagnostic Equipment, Patient Monitoring)

- Aerospace and Defense

- HVAC Systems and Building Automation

- By Current Rating:

- Low Current (Signal Switching)

- High Current (Load Switching)

- By Contact Material:

- Silver Alloy

- Gold Plated

- Other Materials

Value Chain Analysis For Micro Switch Market

The value chain for the Micro Switch Market begins with the upstream suppliers of raw materials, primarily involving specialized plastics for housing, high-grade metals (copper, brass, nickel) for internal mechanisms, and crucial contact materials such as silver, gold, and various alloys that determine electrical performance and lifecycle. The procurement and quality of these raw materials are paramount, as they directly dictate the mechanical precision and electrical reliability of the final product. Fluctuations in precious metal prices significantly impact manufacturing costs, prompting key market players to focus on strategic sourcing and long-term contracts to ensure supply stability and cost predictability for high-volume production runs.

The manufacturing stage involves highly automated processes, including precision stamping, injection molding, welding, and assembly, often performed in controlled environments, especially for sealed or medical-grade switches. Expertise in tool design, materials science, and clean manufacturing techniques provides a significant competitive advantage. Downstream activities involve rigorous testing and quality assurance, where products are subjected to lifecycle testing (measuring millions of actuations), environmental resistance tests (temperature, humidity), and specific industry certifications (e.g., UL, CE, CCC, AEC-Q200). Specialized certification processes add considerable value and are critical entry barriers for high-stakes applications.

Distribution channels for micro switches are typically diverse, including direct sales to large Original Equipment Manufacturers (OEMs) in the automotive and industrial sectors, and indirect sales through a network of specialized electronic component distributors and regional resellers serving smaller enterprises and maintenance, repair, and operations (MRO) markets. Distributors play a crucial role in maintaining inventory, providing technical support, and managing localized logistics. The rise of e-commerce platforms specializing in industrial components is also transforming indirect distribution, offering increased reach and efficiency for standard product lines, while high-volume customized switches still rely heavily on direct manufacturer relationships.

Micro Switch Market Potential Customers

Potential customers for micro switches are highly diverse, spanning all sectors that rely on electromechanical interfaces for position detection, limit control, or user input. The primary end-users are large-scale Original Equipment Manufacturers (OEMs) who integrate these components directly into their final products. The automotive industry represents a cornerstone customer segment, utilizing micro switches extensively in vehicles for functions like power window controls, seat adjustment mechanisms, door locks, charging system interlocks in EVs, and critical safety cut-off switches in braking systems, demanding switches with extreme temperature tolerance and high vibration resistance.

The industrial automation and machinery sector constitutes another major customer base, where micro switches function as essential limit switches on CNC machines, conveyor systems, assembly lines, and heavy duty equipment, ensuring precise movement control and operator safety. These industrial buyers prioritize robust housing, high IP ratings (protection against dust and fluids), and exceptional mechanical lifecycle counts. Furthermore, the consumer electronics and appliance manufacturing sector, encompassing white goods (washing machines, refrigerators, ovens) and small electronic devices (keyboards, gaming controllers), demands high-volume, cost-effective subminiature switches that offer reliable tactile feedback and longevity suitable for daily consumer use.

Specialized segments include manufacturers of medical diagnostic and treatment devices, requiring ultra-reliable, often gold-contact micro switches for precise positioning in laboratory equipment, infusion pumps, and surgical tools, where failure risks are unacceptable. Additionally, the aerospace and defense industry requires specialized, certified micro switches built to withstand extreme environmental pressures and rigorous quality standards for use in flight control surfaces, cockpit controls, and specialized military communication equipment. These sectors often require highly customized switch designs and low-volume, high-specification procurement, representing a premium customer segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Omron Corporation, C&K Components, Panasonic Corporation, TE Connectivity Ltd., Alps Alpine Co., Ltd., Zippy Technology Corp., Schneider Electric SE, Electroswitch Electronic Products, Crouzet Switches, ZF Friedrichshafen AG (ZF Switches & Sensors), Johnson Electric Holdings Limited, NKK Switches, Marquardt Group, Mico Controls Inc., Solteam Electronics Co., Ltd., E-Switch, Inc., Schaltbau Holding AG, Grayhill Inc., ITW Switches. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micro Switch Market Key Technology Landscape

The technology landscape of the Micro Switch Market is characterized by continuous refinement aimed at increasing mechanical lifespan, improving electrical load handling, and achieving extreme miniaturization while maintaining reliability. A primary technological focus involves advanced contact material research, specifically optimizing silver and gold alloy compositions to minimize contact resistance, reduce arcing, and extend the number of cycles before failure, particularly in harsh, high-vibration environments like those found in heavy industry and transportation. Innovations in sealing technology, utilizing sophisticated materials like specialized epoxy resins and advanced elastomeric seals, are enabling the production of micro switches with IP67 and IP68 ratings, making them impervious to dust and water and suitable for outdoor or submerged applications, thereby broadening their usage in demanding industrial and infrastructure projects.

Furthermore, significant technological development is concentrated on mechanical design optimization. This includes employing Finite Element Analysis (FEA) to perfect the spring mechanism geometry (lever and plunger design), ensuring consistent snap action force and reduced variance across millions of actuations. This precision engineering minimizes contact bounce and maximizes operational speed, crucial for high-frequency switching tasks in modern control systems. The shift towards miniaturization, particularly in the subminiature segment, requires complex internal structures and highly precise manufacturing tolerances, often pushing the boundaries of micro-assembly techniques to integrate switches into extremely confined spaces, such as those found in portable medical devices and high-density computing peripherals.

Integration technology is another critical area. While the core product remains electromechanical, manufacturers are increasingly integrating micro switches with peripheral electronics, such as basic signal conditioning circuits or diagnostic sensors. This integration allows the switch to be IoT-ready, providing data on its usage frequency, temperature profile, and even predicting potential failure through small shifts in operational characteristics. This move enhances the switch’s value proposition beyond simple signal generation, positioning it as a smart component within a larger, networked control architecture, enabling true condition-based monitoring and preventative maintenance strategies in industrial and automotive applications.

Regional Highlights

Regional dynamics play a vital role in shaping the demand and supply structure of the Micro Switch Market, with distinct growth drivers and regulatory requirements influencing local market development. Asia Pacific (APAC) remains the undisputed powerhouse, dominating both manufacturing capacity and consumption volume, driven primarily by China's extensive electronics supply chain, Japan and South Korea's high-tech automotive and industrial robotics sectors, and the accelerating pace of infrastructure and appliance manufacturing in India and Southeast Asian nations. APAC benefits from lower manufacturing costs and high-volume demand from domestic and international OEMs establishing production bases within the region, positioning it as the primary catalyst for global market growth.

North America and Europe represent mature markets characterized by high demand for specialized, high-reliability micro switches, especially in the premium automotive, aerospace, defense, and medical segments. Strict regulatory frameworks, such as Functional Safety standards (ISO 26262 in automotive and IEC 61508 in industrial safety), mandate the use of certified, durable components, driving higher Average Selling Prices (ASPs) and emphasizing quality over sheer volume. The strong presence of global automotive giants and the rapid adoption of advanced industrial automation technologies ensures sustained, albeit more moderate, growth rates in these regions, with a strong emphasis on smart features and integrated diagnostic capabilities.

Latin America, and the Middle East and Africa (MEA), are emerging markets offering significant future growth potential. Latin America's growth is spurred by expanding industrialization and manufacturing activity, particularly in countries like Brazil and Mexico, which serve as regional manufacturing hubs for global firms. MEA’s market is influenced by large-scale government investments in infrastructure, energy projects (including renewable energy), and the nascent development of automotive assembly plants. While currently smaller in size, these regions are expected to see accelerated adoption rates as industrial infrastructure matures and local manufacturing complexity increases, requiring more sophisticated and reliable electromechanical components.

- Asia Pacific (APAC): Dominates manufacturing and consumption; strong growth driven by China, Japan (robotics, automotive), and accelerating industrialization in India and Southeast Asia. Focus on high-volume, competitive pricing, and subminiature components.

- North America: Mature market characterized by high-reliability demand in aerospace, defense, and premium automotive sectors. Strong emphasis on high-specification, certified switches and integrated sensing solutions.

- Europe: Driven by strict safety regulations (Functional Safety standards) and the robust German automotive industry (including EV technology). High demand for sealed, durable switches suitable for heavy industry and complex machinery.

- Latin America: Emerging growth market, propelled by increasing manufacturing activity, particularly in automotive components and regional industrial automation projects.

- Middle East and Africa (MEA): Growth tied to infrastructure development, energy sector investments (oil, gas, renewables), and initial stages of localized high-tech manufacturing adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micro Switch Market.- Honeywell International Inc.

- Omron Corporation

- C&K Components

- Panasonic Corporation

- TE Connectivity Ltd.

- Alps Alpine Co., Ltd.

- Zippy Technology Corp.

- Schneider Electric SE

- Electroswitch Electronic Products

- Crouzet Switches

- ZF Friedrichshafen AG (ZF Switches & Sensors)

- Johnson Electric Holdings Limited

- NKK Switches

- Marquardt Group

- Mico Controls Inc.

- Solteam Electronics Co., Ltd.

- E-Switch, Inc.

- Schaltbau Holding AG

- Grayhill Inc.

- ITW Switches

Frequently Asked Questions

Analyze common user questions about the Micro Switch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Micro Switch Market?

The primary factor driving market growth is the global acceleration of industrial automation initiatives (Industry 4.0) and the exponential increase in the production and adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), which utilize numerous micro switches for safety interlocks, charging systems, and internal control mechanisms, demanding high durability and precision.

How do Hall Effect sensors compete with traditional micro switches?

Hall Effect sensors compete by offering non-contact switching, resulting in theoretically infinite mechanical life and immunity to mechanical wear. However, micro switches are preferred in applications requiring verifiable mechanical contact, distinct tactile feedback, or where high current load switching is necessary, as Hall Effect sensors typically handle lower currents and require complex external circuitry.

Which application segment holds the largest share in the Micro Switch Market?

The Industrial Automation and Control segment, alongside the Automotive segment, typically holds the largest market share due to the ubiquitous need for limit switches, safety interlocks, and position detection in machinery and vehicle control systems. The automotive sector, specifically, is forecast to exhibit the highest growth rate due to EV integration.

What is the significance of IP ratings in the Micro Switch Market?

Ingress Protection (IP) ratings are crucial, especially IP67 and IP68, as they indicate the switch's resistance to dust and moisture intrusion. High IP ratings are mandatory for switches used in harsh environments, such as outdoor heavy machinery, processing facilities, or automotive underbody applications, ensuring component reliability and preventing premature electrical failure.

What role does miniaturization play in current micro switch technology?

Miniaturization is a dominant technological trend, enabling the use of micro switches in high-density electronic assemblies, consumer wearables, and compact medical instruments. Subminiature and ultra-subminiature switches are achieving high demand as manufacturers continuously seek smaller components without compromising on the requisite electrical capacity or mechanical lifecycle durability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager