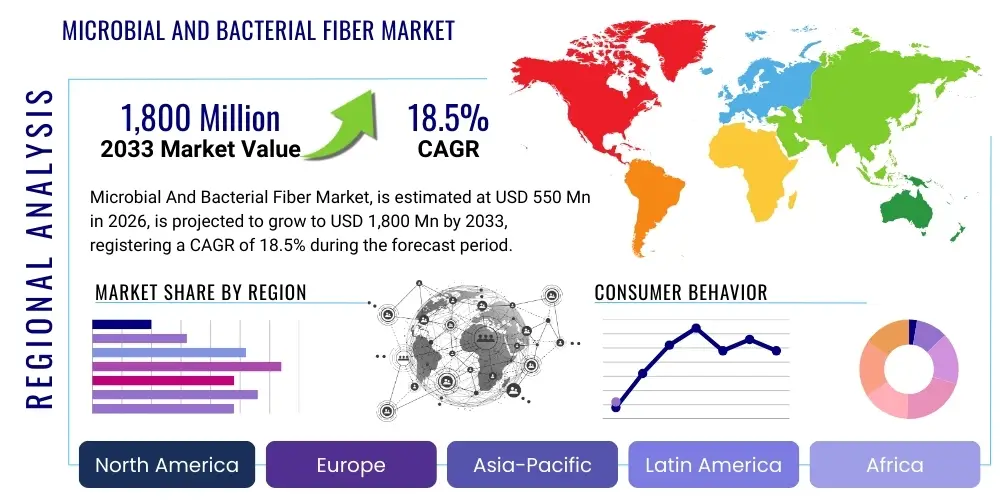

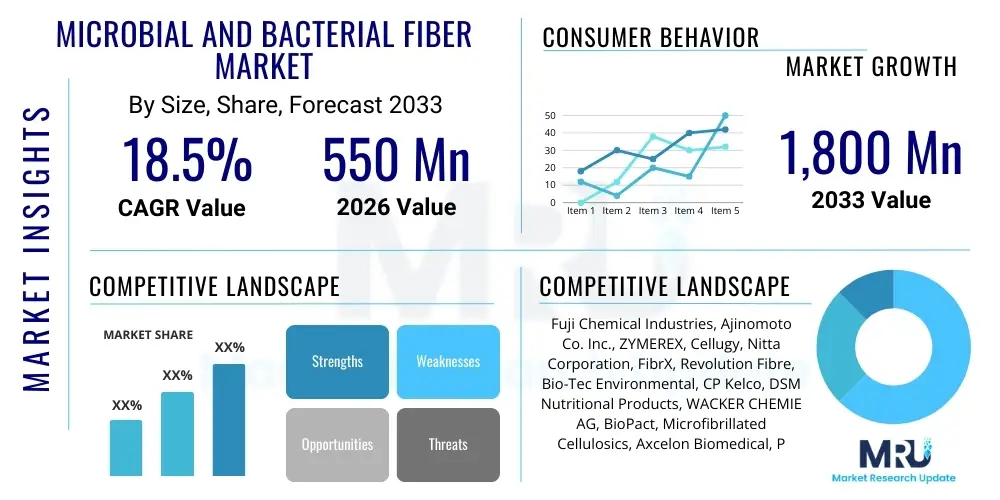

Microbial And Bacterial Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436526 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Microbial And Bacterial Fiber Market Size

The Microbial And Bacterial Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $1,800 Million USD by the end of the forecast period in 2033.

Microbial And Bacterial Fiber Market introduction

The Microbial and Bacterial Fiber Market encompasses high-value biomaterials produced through the fermentation of microorganisms, primarily bacteria, fungi, and microalgae. These fibers, such as Bacterial Cellulose (BC) and various exopolysaccharides, are highly sought after due to their unique physical properties, including high purity, crystallinity, tensile strength, and exceptional water-holding capacity. Unlike traditional plant-based fibers, microbial fibers are chemically uniform and can be produced under controlled, sterile conditions, eliminating issues related to crop variability, seasonality, and the presence of lignin or hemicellulose contaminants. This controlled production environment makes them ideal for sensitive applications in the medical and electronics sectors. Key strains utilized in production often include Komagataeibacter xylinus for BC, and various lactic acid bacteria for dietary fibers, establishing a robust foundation for scalable industrial synthesis.

The primary applications of microbial and bacterial fibers are remarkably diverse, spanning sectors that demand advanced biomaterial performance. In the medical field, bacterial cellulose is extensively used for wound dressings, artificial skin grafts, and drug delivery systems due to its biocompatibility and ability to form robust hydrogels. Within the food and beverage industry, microbial fibers serve as high-performance texturizers, stabilizers, and low-calorie bulking agents, catering to the increasing consumer demand for clean-label and natural ingredients. Furthermore, the material's excellent mechanical strength and lightweight nature position it favorably for advanced functional materials, including biodegradable packaging, acoustic membranes, and flexible electronic substrates. The versatility and sustainable production profile of these fibers are accelerating their adoption across global manufacturing landscapes.

Market growth is primarily driven by the escalating global focus on sustainability and the urgent need for petroleum-free materials. Consumers and industries alike are transitioning away from synthetic polymers, viewing bio-based and biodegradable alternatives as essential for achieving circular economy goals. Furthermore, rapid advancements in synthetic biology and fermentation technology are making microbial fiber production increasingly cost-effective and yield-optimized. Governments and regulatory bodies, particularly in North America and Europe, are providing favorable regulatory frameworks and funding for bioeconomy initiatives, further catalyzing innovation and commercialization within this specialized market segment. These combined factors—sustainability, technological breakthroughs, and supportive policies—underscore the strong upward trajectory of the microbial fiber industry.

Microbial And Bacterial Fiber Market Executive Summary

The Microbial And Bacterial Fiber Market is characterized by vigorous innovation driven by the intersection of synthetic biology and advanced material science, positioning it as a critical component of the global bioeconomy. Current business trends indicate a strong move toward strategic partnerships between specialized biotech firms and large consumer goods or pharmaceutical corporations, focusing on scaling production capacity and integrating microbial fibers into established product lines, particularly in high-growth segments like personalized nutrition and advanced wound care. Geographically, Asia Pacific, led by China and Japan, is emerging as the dominant region for manufacturing and consumption, benefiting from established fermentation infrastructure and strong governmental investment in bio-based manufacturing technologies. North America and Europe, meanwhile, drive innovation in high-value applications such as biodegradable electronics and medical devices, setting the standards for material purity and regulatory compliance. The market is intensely competitive, with companies focusing on strain optimization and continuous fermentation processes to reduce operational costs and achieve economies of scale necessary for widespread commercial adoption.

Segment-wise, Bacterial Cellulose maintains the largest market share owing to its mature production technology and widespread acceptance in biomedical applications, though newer segments, such as microbial dietary fibers (e.g., Gellan Gum substitutes derived from bacteria), are experiencing the fastest growth rate driven by the clean-label trend in the food industry. Technology trends show a significant shift towards utilizing genetic engineering tools like CRISPR to enhance microbial strains for improved fiber yield, tailored mechanical properties, and customized molecular weight distribution, which directly impacts application performance. The market's structural evolution is also marked by increasing regulatory complexity regarding genetically modified organisms (GMOs) used in production, compelling manufacturers to invest heavily in non-GMO synthesis pathways or transparent regulatory compliance processes. This specialization and demand for high-performance characteristics ensure premium pricing power remains strong for advanced microbial fiber products.

In essence, the Microbial And Bacterial Fiber market is transitioning from a niche R&D domain to a mainstream industrial commodity supplier for specialized applications. The focus is shifting from material discovery to process optimization, standardization, and demonstrating life cycle advantages over petrochemical alternatives. Successful market penetration hinges on overcoming current restraints, primarily the high initial capital expenditure for bioreactor setup and the scaling challenges associated with maintaining sterile, large-volume fermentation. However, the compelling performance benefits—such as superior elasticity, purity, and sustainability—continue to attract substantial venture capital and corporate investment, guaranteeing sustained market expansion and establishing microbial fibers as foundational materials for the next generation of sustainable products.

AI Impact Analysis on Microbial And Bacterial Fiber Market

User queries regarding AI's role in the Microbial and Bacterial Fiber Market predominantly center on optimizing bioprocesses, accelerating strain development, and predicting material performance. Users are keenly interested in how Artificial Intelligence (AI) and Machine Learning (ML) can resolve the historical challenges of yield variability and contamination risk inherent in large-scale fermentation. Key themes emerging from these questions include the implementation of predictive maintenance for bioreactors, the use of ML algorithms to analyze complex metabolic pathways for enhanced fiber production, and the acceleration of R&D cycles through virtual screening of microbial strains. Concerns often revolve around the high data requirements for training effective ML models and the necessity for highly skilled personnel to integrate AI systems into traditional biotech manufacturing environments. The overarching expectation is that AI will be the primary tool enabling the leap from pilot-scale production to cost-effective industrial manufacturing, thereby achieving price parity with conventional fibers.

- AI-driven optimization of fermentation parameters (pH, temperature, nutrient feed rates) to maximize fiber yield.

- Machine Learning models utilized for real-time quality control, anomaly detection, and contamination prediction in bioreactors.

- Synthetic biology enhanced by AI to design and engineer microbial strains with superior fiber synthesis efficiency and tailored characteristics.

- Predictive analytics to forecast material performance (e.g., tensile strength, biodegradability) based on initial production metrics, reducing physical testing needs.

- Automation of lab procedures and high-throughput screening for novel fiber-producing microorganisms using robotic and AI interfaces.

- Supply chain optimization using AI for demand forecasting and managing the complex logistics of bio-based material distribution.

DRO & Impact Forces Of Microbial And Bacterial Fiber Market

The market dynamics are governed by a complex interplay of powerful drivers, critical restraints, and substantial opportunities. The primary driver is the pervasive global mandate for sustainable and biodegradable materials, particularly in high-consumption sectors like packaging and textiles, where microbial fibers offer a compelling, earth-friendly alternative to petroleum-derived polymers. Coupled with this is the escalating demand from the biomedical sector for ultra-pure, biocompatible materials for advanced surgical meshes and tissue engineering scaffolds, where the unique structure of bacterial cellulose provides unmatched performance. Restraints largely center on the economic viability of scaling up production, as the initial capital expenditure required for high-volume, sterile bioreactor facilities remains significantly higher than for traditional chemical synthesis processes. Furthermore, the inherent susceptibility of microbial cultures to contamination poses a continuous operational risk, demanding stringent quality control protocols that contribute to overall manufacturing costs. Opportunities arise primarily through continuous innovation in synthetic biology, enabling higher yields and specialized fiber modification, and the expansion into emerging markets, particularly flexible electronics, where these fibers function effectively as flexible substrates.

Impact forces currently skew positively towards growth due to regulatory tailwinds and technological advancements. Regulatory frameworks across major economies are increasingly punitive towards single-use plastics and favorable toward bio-based alternatives, directly boosting demand for microbial fibers. Technological advances in continuous fermentation and digitalization (including AI integration for process control) are slowly mitigating the core restraint of high production costs, thereby strengthening the competitive position of microbial fibers relative to traditional materials. Furthermore, strong consumer pull for natural and functional ingredients in the food sector ensures a constant demand floor for microbial-based dietary fibers and thickeners. The ability of key players to secure intellectual property rights over novel, high-efficiency microbial strains will determine market leadership and exert significant influence over market structure in the next decade.

The market structure is therefore characterized by moderate fragmentation, with significant barriers to entry related to technological expertise and capital investment. Successful navigation of this landscape requires a dual strategy: aggressive investment in R&D to optimize yields and reduce cost (addressing restraints) combined with strategic alliances to access high-volume application markets (leveraging opportunities). The long-term impact force is the established necessity for circular economy models, ensuring that the inherent biodegradability and non-toxicity of these fibers secure their long-term relevance, even if initial market entry costs remain high. This structural necessity for sustainable alternatives acts as a foundational, non-cyclical driver propelling continuous market expansion.

Segmentation Analysis

The Microbial And Bacterial Fiber Market is comprehensively segmented based on the type of fiber produced, the application domain, the source microorganism, and the production process. Segmentation by type, particularly Bacterial Cellulose (BC), holds prominence due to its advanced material properties, while segmentation by application highlights the key high-value sectors driving demand, notably biomedical and functional foods. Analyzing the market through these segments reveals differentiated growth rates, with advanced materials showing high-profit margins and the food and beverage sector offering the largest potential for volume growth and cost reduction through scale. This granular analysis is crucial for stakeholders to tailor their product development and market penetration strategies effectively.

- By Fiber Type:

- Bacterial Cellulose (BC)

- Microbial Alginates

- Microbial Exopolysaccharides (e.g., Xanthan, Gellan Gum, Curdlan)

- Microbial Dietary Fibers (Inulin, Fructans, etc.)

- By Application:

- Biomedical & Pharmaceutical (Wound Dressings, Tissue Engineering, Drug Delivery)

- Food & Beverages (Thickeners, Stabilizers, Texturizers, Dietary Supplements)

- Textiles & Composites (Sustainable Apparel, Specialty Paper, Acoustic Materials)

- Electronics (Flexible Substrates, Speakers, Capacitors)

- Cosmetics & Personal Care (Hydrogel Masks, Emulsifiers)

- By Source Microorganism:

- Bacteria (e.g., Komagataeibacter, Acetobacter, Xanthomonas)

- Fungi (e.g., Mycelium-derived fibers)

- Algae/Microalgae

- By Production Process:

- Static Fermentation

- Agitated (Shaken) Fermentation

- Continuous Fermentation

Value Chain Analysis For Microbial And Bacterial Fiber Market

The value chain for microbial and bacterial fibers begins with rigorous upstream activities focused on strain selection and optimization, where biotech companies invest heavily in synthetic biology to engineer high-yield, robust microbial strains. This stage also includes the sourcing and preparation of raw materials, primarily simple, low-cost carbon sources such as glucose, molasses, or agricultural waste streams, which are critical for fermentation economics. Midstream activities involve the core manufacturing process: large-scale, aseptic fermentation in bioreactors, followed by complex purification steps to remove microbial cells and media residues, ensuring the high purity required for biomedical and electronic applications. The capital intensity and technological expertise required at the upstream and midstream phases constitute significant barriers to entry, determining profitability across the entire chain.

Downstream activities involve the functionalization, formulation, and distribution of the finished fiber product. Depending on the application, the fiber may be dried, processed into hydrogels, molded into specific forms (like wound dressings), or milled into fine powder for food incorporation. Distribution channels are highly segmented: direct sales are prevalent for high-value applications like pharmaceuticals and specialized electronics materials, necessitating deep technical support and collaboration with end-users for product integration. In contrast, indirect channels, utilizing specialized distributors and ingredient suppliers, dominate the food and general industrial segments, focusing on high volume and competitive pricing. The efficiency of the downstream processing—particularly the energy consumption during drying—significantly impacts the final cost structure and the overall sustainability profile of the fiber.

Value creation is maximized through vertical integration or tightly controlled partnerships between strain developers and large-scale fermentation operators. Intellectual property surrounding strain performance and specialized purification techniques generates the highest margin. Transparency in sourcing and sustainable manufacturing practices adds significant market value, especially for consumers pursuing bio-based certifications. The final stage involves the end-user (e.g., food manufacturer, medical device company) transforming the fiber into a final product, where the unique functional advantages of microbial fibers—such as superior texture, enhanced biological activity, or lightweight strength—translate into higher end-product value and consumer acceptance, completing the value cycle.

Microbial And Bacterial Fiber Market Potential Customers

Potential customers for microbial and bacterial fibers are defined by their need for high-performance, biocompatible, and sustainable raw materials that offer properties unattainable through conventional plant or synthetic sources. The largest volume buyers are typically within the Food and Beverage industry, where companies utilize microbial fibers as functional ingredients (e.g., thickeners, fat replacers, and dietary enhancers) to meet the growing consumer demand for healthier, clean-label, and plant-derived products. These customers prioritize cost-effectiveness and consistency of supply. Conversely, customers in the Medical and Pharmaceutical sectors, including biomedical device manufacturers and regenerative medicine specialists, represent the highest-value segment, requiring absolute purity, sterility, and specific mechanical properties for critical applications like surgical repair and drug encapsulation matrices. These buyers prioritize quality assurance, regulatory compliance, and material performance over marginal cost savings, leading to long-term collaborative purchasing agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $1,800 Million USD |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fuji Chemical Industries, Ajinomoto Co. Inc., ZYMEREX, Cellugy, Nitta Corporation, FibrX, Revolution Fibre, Bio-Tec Environmental, CP Kelco, DSM Nutritional Products, WACKER CHEMIE AG, BioPact, Microfibrillated Cellulosics, Axcelon Biomedical, Pro-Formance, Alginate Global, Genencor (IFF), Novozymes, MycoWorks, Ecovative Design |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microbial And Bacterial Fiber Market Key Technology Landscape

The technological backbone of the Microbial And Bacterial Fiber Market relies heavily on advanced bioprocessing and synthetic biology techniques aimed at maximizing yield and customizing fiber characteristics. Core technologies include optimized large-scale fermentation systems, specifically agitated and continuous bioreactor designs that overcome the limitations of traditional static culture methods by enabling higher yields and reduced production cycles. Furthermore, sophisticated downstream processing techniques, such as supercritical fluid extraction and high-pressure homogenization, are essential for achieving the extremely high purity levels demanded by the biomedical and electronics industries. Innovation in this area focuses on making purification energy-efficient and scalable to ensure commercial viability.

The most transformative technologies are rooted in genetic engineering and metabolic pathway optimization. Companies are increasingly utilizing synthetic biology tools like CRISPR-Cas9 to genetically modify microbial strains (e.g., Komagataeibacter) to divert metabolic resources specifically toward fiber synthesis, often leading to strains capable of producing fibers with specific crystallinity, degree of polymerization, or molecular weight profiles. This allows for tailoring the fiber's mechanical properties—such as stiffness, elasticity, and porosity—to precise application requirements, moving beyond generic fiber production. Furthermore, the development of specialized nutrient media utilizing low-cost agricultural or industrial byproducts (waste-to-fiber production) is a critical technological focus area for achieving economic competitiveness and enhancing the overall sustainability profile.

The integration of digital twins and advanced sensor technology represents another pivotal development. These systems allow manufacturers to monitor fermentation conditions in real-time, predict potential operational failures, and automatically adjust parameters to maintain optimal growth kinetics. This level of control, often powered by AI algorithms, significantly reduces batch variability, minimizes contamination risks, and accelerates scale-up from R&D pilots to industrial production volumes. Consequently, the technology landscape is converging towards highly automated, data-driven, and genetically optimized biomanufacturing platforms that are essential for supporting the market's high growth trajectory and ensuring consistent material quality across diverse global facilities.

Regional Highlights

Market expansion is geographically uneven, driven by regional differences in regulatory support, technological capabilities, and end-user market maturity. Asia Pacific (APAC) currently holds a significant market share and is projected to exhibit the highest CAGR during the forecast period. This growth is attributable to substantial investments in industrial biotechnology infrastructure, particularly in China, South Korea, and Japan, coupled with robust domestic demand for microbial dietary fibers in the vast food and beverage sector. The presence of major textile manufacturing hubs in the region also accelerates the adoption of bio-based fibers for sustainable fashion and composites. Government initiatives prioritizing bio-based chemical production further cement APAC's leading position in terms of production volume and competitive pricing strategies.

North America is a key market for high-value applications, demonstrating strong leadership in R&D and specialized medical applications. The region benefits from established venture capital networks and world-class academic institutions that drive innovation in synthetic biology and tissue engineering using advanced bacterial cellulose. Demand here is dominated by the sophisticated biomedical market and early adoption in cutting-edge fields like flexible electronics and advanced materials for defense. Regulatory frameworks, particularly from the FDA, ensure high barriers to entry regarding material purity and clinical validation, distinguishing North America as a quality-focused market segment.

Europe represents a mature market characterized by strong environmental regulations and a high consumer propensity for sustainable products. European initiatives like the European Green Deal are actively promoting bioeconomy sectors, driving the adoption of microbial fibers in sustainable packaging and textiles. While regulatory pressures related to industrial fermentation processes can be strict, they foster innovation in closed-loop systems and sustainable sourcing. Latin America and the Middle East & Africa (MEA) currently represent emerging markets, focused primarily on adopting microbial fibers in agricultural and basic food texturizing applications, with potential for significant growth as local biotechnology industries mature and infrastructure investment increases.

- Asia Pacific (APAC): Dominant in production volume and fastest-growing region, driven by governmental support for industrial biotechnology and massive demand from the food and textile sectors in China, Japan, and South Korea.

- North America: Focuses on high-margin applications, particularly biomedical devices, tissue engineering, and flexible electronics, supported by strong R&D funding and stringent quality standards.

- Europe: Characterized by mature markets and strong regulatory push for sustainability, emphasizing applications in green packaging, biodegradable textiles, and functional food ingredients.

- Latin America (LATAM): Emerging market primarily driven by agricultural applications and basic food texturizing needs; growth dependent on infrastructure improvements and foreign investment.

- Middle East & Africa (MEA): Smallest current market share, with opportunities linked to investments in biotechnology hubs and efforts to diversify economies away from petrochemical dependence, focusing initially on pharmaceutical and cosmetic ingredients.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microbial And Bacterial Fiber Market.- Fuji Chemical Industries

- Ajinomoto Co. Inc.

- ZYMEREX

- Cellugy

- Nitta Corporation

- FibrX

- Revolution Fibre

- Bio-Tec Environmental

- CP Kelco

- DSM Nutritional Products

- WACKER CHEMIE AG

- BioPact

- Microfibrillated Cellulosics

- Axcelon Biomedical

- Pro-Formance

- Alginate Global

- Genencor (IFF)

- Novozymes

- MycoWorks

- Ecovative Design

Frequently Asked Questions

Analyze common user questions about the Microbial And Bacterial Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are Microbial and Bacterial Fibers, and how do they differ from plant fibers?

Microbial and Bacterial Fibers (such as Bacterial Cellulose or exopolysaccharides) are biomaterials synthesized by microorganisms during fermentation. They differ fundamentally from plant fibers (like wood pulp) because they are produced with exceptional purity, lacking lignin and hemicellulose, offering higher crystallinity, and exhibiting superior strength and water-holding capacity, making them ideal for high-precision applications like biomedicine.

Which applications drive the highest revenue in the Bacterial Fiber Market?

The highest revenue segments are currently driven by high-value applications in the Biomedical and Pharmaceutical sector, primarily wound dressings, temporary skin substitutes, and advanced tissue engineering scaffolds, due to the material's biocompatibility and unique hydrogel formation properties. However, volume growth is increasingly driven by the Food and Beverage industry utilizing these fibers as natural thickeners and functional dietary supplements.

What are the main constraints hindering the widespread commercialization of microbial fibers?

The primary constraints are the high initial Capital Expenditure (CAPEX) required to establish large-scale, sterile bioreactor facilities necessary for fermentation, and the associated high operational costs (OPEX). Furthermore, maintaining contamination-free, high-yield production consistently remains a significant technological and logistical challenge compared to mass-produced petrochemical or plant-derived materials.

How is synthetic biology affecting the cost structure and properties of microbial fibers?

Synthetic biology, through tools like genetic engineering, is radically improving the cost structure by enabling higher fiber yields per batch and allowing the use of cheaper, waste-based feedstocks. It also significantly impacts material properties by tailoring the microbial strain to produce fibers with specific, desirable characteristics such as enhanced elasticity or porosity, thus maximizing the fiber’s suitability for specialized industrial integration.

Which region is expected to lead market growth, and why?

The Asia Pacific (APAC) region is expected to lead market growth, demonstrating the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by extensive governmental support for large-scale biotechnology manufacturing, established industrial fermentation infrastructure, and robust domestic demand across massive consumer markets, particularly for functional food ingredients and sustainable textile materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager