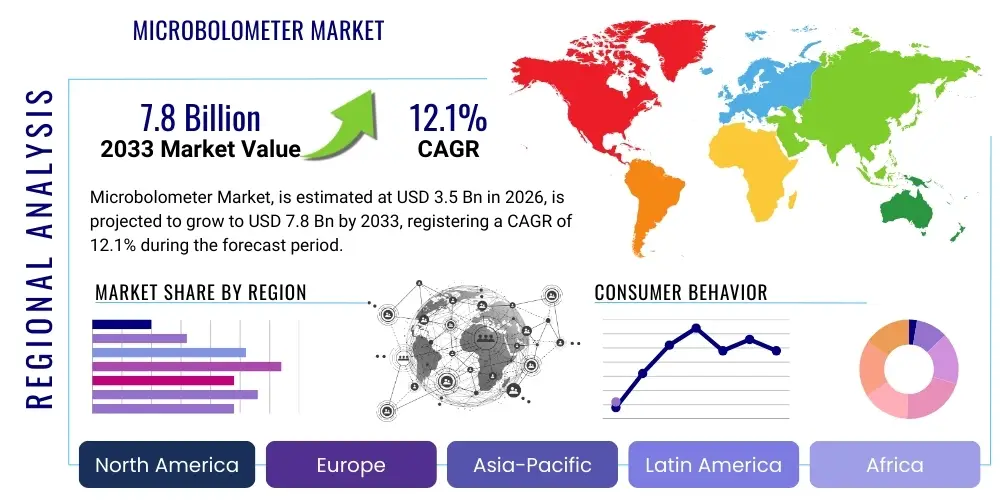

Microbolometer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437605 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Microbolometer Market Size

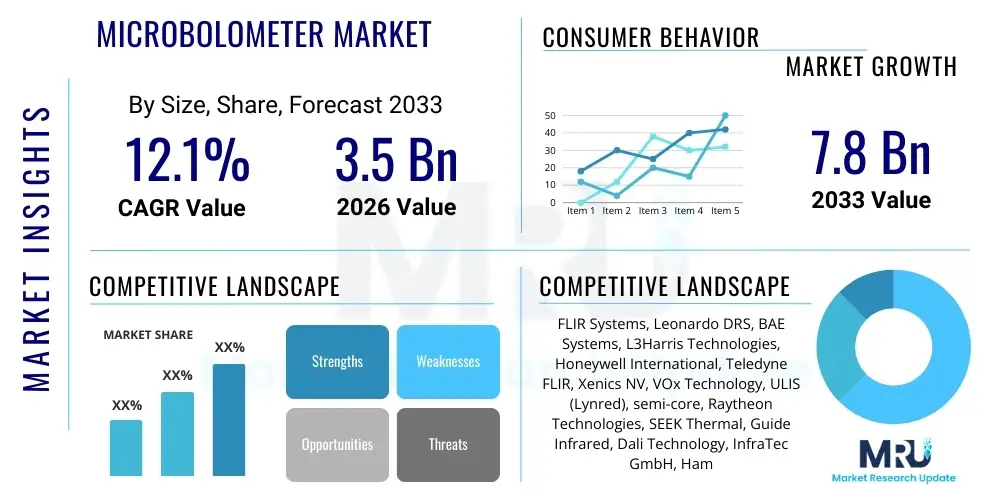

The Microbolometer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.1% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increased global demand for advanced thermal sensing solutions across military, industrial, and increasingly commercial applications, coupled with continuous advancements in sensor technology that enhance performance while reducing manufacturing costs, facilitating broader market penetration.

Microbolometer Market introduction

Microbolometers are specialized thermal sensors that utilize minute changes in temperature, caused by incident infrared radiation, to generate a visual image without the necessity for cryogenic cooling, a significant advantage over traditional infrared detectors. This uncooled operation simplifies system design, reduces power consumption, lowers maintenance costs, and enables extreme miniaturization, making them highly suitable for deployment in portable devices, drones, and constrained spaces. The core technology relies on micro-electro-mechanical systems (MEMS) structures, typically consisting of an array of thermally sensitive resistors, usually Vanadium Oxide (VOx) or Amorphous Silicon (a-Si), fabricated on silicon wafers to maximize thermal isolation and responsiveness.

The primary applications of microbolometers span critical sectors including military and defense for night vision, surveillance, and target acquisition; industrial monitoring for predictive maintenance and quality control; automotive for enhanced driver vision systems (EDVS) and autonomous vehicle safety; and consumer electronics, especially in smart devices and specialized firefighting equipment. Their unique benefit lies in providing passive, non-contact temperature measurement and visual information independent of ambient light conditions, offering a crucial layer of visibility in scenarios where traditional visible-light cameras fail, such as complete darkness, smoke, or fog. The versatility of microbolometers, coupled with falling component prices due to Wafer Level Packaging (WLP) advancements, positions them as indispensable components in the growing ecosystem of smart sensing technologies.

Key driving factors accelerating market adoption include the increasing proliferation of unmanned aerial vehicles (UAVs) and drones in both commercial and military operations, requiring lightweight thermal payloads. Furthermore, stringent safety and security regulations globally necessitate enhanced surveillance capabilities, particularly in critical infrastructure and border control. The automotive industry’s rapid transition toward Level 3 and above autonomous driving also heavily relies on reliable thermal sensors to complement radar and LiDAR systems, ensuring robust pedestrian and obstacle detection regardless of environmental conditions. Continuous improvements in Noise Equivalent Temperature Difference (NETD) and reductions in pixel pitch allow for higher resolution thermal images in smaller physical packages, further boosting the appeal of microbolometer technology across numerous application segments worldwide.

Microbolometer Market Executive Summary

The Microbolometer Market is experiencing robust expansion fueled by a confluence of technological advancements and expanding deployment into mass-market applications previously dominated by visible light or requiring expensive cooled infrared detectors. Current business trends indicate a significant shift towards reduced pixel pitch (moving from 17µm down to 10µm and even 8µm) and the standardization of Wafer-Level Packaging (WLP), which dramatically lowers production costs and enables high-volume manufacturing necessary for automotive and consumer adoption. The competitive landscape is intensely focused on achieving lower Noise Equivalent Temperature Difference (NETD) values, pushing the boundaries of thermal sensitivity crucial for high-performance applications like military targeting and critical industrial inspection, while major players leverage strategic acquisitions to consolidate manufacturing capabilities and expand patent portfolios related to VOx and a-Si material development.

Regionally, North America maintains its dominance primarily due to substantial defense budgets and early adoption of advanced surveillance technologies by government agencies and military forces, alongside strong research and development activities driving cutting-edge innovation. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, propelled by rapid urbanization, massive investment in smart city infrastructure requiring pervasive security solutions, and the burgeoning manufacturing sector’s demand for thermal imaging in industrial automation and predictive maintenance. Europe presents a mature market characterized by stringent safety regulations in the industrial sector and strong adoption in high-end automotive applications, capitalizing on sophisticated sensor integration techniques.

In terms of segment trends, the Vanadium Oxide (VOx) technology segment continues to hold the largest market share owing to its superior temperature coefficient of resistance (TCR) and faster response times compared to Amorphous Silicon (a-Si), though a-Si remains vital for specific low-cost, high-volume consumer products. Application-wise, while Military & Defense remains the largest revenue generator, the Automotive segment, driven by mandatory safety features and the acceleration of autonomous vehicle development, is poised for the most explosive growth in the immediate future. The industrial segment is also steadily growing, spurred by Industry 4.0 initiatives emphasizing non-contact monitoring of electrical and mechanical systems for minimizing downtime and maximizing operational efficiency.

AI Impact Analysis on Microbolometer Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Microbolometer Market primarily revolve around how AI enhances the utility and performance of thermal imaging data, moving beyond simple visualization to intelligent decision-making. Key themes include the ability of AI algorithms to significantly improve target detection and identification accuracy in complex environments, particularly differentiating between genuine threats and clutter, and the utilization of deep learning models for sensor fusion—combining thermal data with visible light, LiDAR, or radar inputs to create a comprehensive environmental map. Users are also highly interested in how AI mitigates the inherent limitations of microbolometers, such as signal noise and atmospheric interference, thereby streamlining processing and facilitating autonomous operation in applications like UAV navigation and robotic inspection. The overall consensus is that AI is transformative, shifting microbolometers from passive data collectors to intelligent, proactive sensing systems.

- AI algorithms enable precise, real-time object recognition and classification, significantly reducing false alarms in security and surveillance systems.

- Deep learning enhances the resolution and quality of low-cost microbolometer images through noise reduction and super-resolution techniques, effectively lowering the required hardware sensitivity (NETD).

- AI facilitates robust sensor fusion, merging thermal data with other sensor modalities (e.g., LiDAR in autonomous vehicles) to ensure reliable perception under all environmental conditions.

- Machine learning models optimize power consumption by intelligently managing sensor duty cycles based on contextual awareness and operational needs, critical for battery-powered devices.

- Predictive maintenance applications use AI to analyze thermal signatures over time, automatically identifying subtle anomalies indicative of equipment failure well before catastrophic breakdowns occur.

- AI integration supports autonomous systems by providing highly reliable environmental data for navigation, obstacle avoidance, and mission planning, especially in complex, unstructured, or low-visibility settings.

DRO & Impact Forces Of Microbolometer Market

The Microbolometer Market dynamics are defined by powerful driving forces rooted in military modernization and industrial automation, contrasted by significant restraints related to manufacturing complexity and export control regulations, yet tempered by promising opportunities in emerging mass-market applications. Drivers include the global proliferation of drones and the critical need for 24/7 surveillance capabilities, alongside the rapid integration of thermal sensors into consumer safety and automotive ADAS systems, benefiting directly from continued miniaturization and cost efficiencies achieved through MEMS manufacturing advancements. Restraints predominantly involve the highly sensitive nature of the technology, leading to strict export control regulations (e.g., ITAR, EAR), which complicate international distribution and market expansion, coupled with the persistent challenge of achieving high uniformity and low noise across large microbolometer arrays during high-volume production.

Opportunities are strongly aligned with future technological ecosystems, particularly the exponential growth of the Internet of Things (IoT) where cheap, highly effective thermal sensors are required for smart building management, pervasive security monitoring, and localized health diagnostics. The shift towards fully autonomous vehicles, which require redundant sensing modalities to ensure operational safety under challenging weather conditions, presents a vast, untapped market potential. Furthermore, continuous investment in R&D aimed at reducing the thermal pixel pitch below 10µm and developing low-cost, vacuum-free packaging techniques will unlock new price points and accessibility, enabling microbolometers to compete directly in markets currently dominated by traditional visible cameras, such as specialized consumer electronics and recreational outdoor gear.

Impact forces analyze how these DRO elements collectively shape the market trajectory. High initial product differentiation driven by patented technology and specialized MEMS expertise acts as a powerful barrier to entry, favoring established manufacturers with deep R&D resources. However, the strong technological substitution threat posed by alternative sensing technologies (e.g., sophisticated LiDAR, radar advancements, or quantum cascade detectors in niche areas) compels manufacturers to continuously innovate and reduce pricing. The profound positive impact of rapid cost reduction through Wafer Level Packaging (WLP) is accelerating market penetration, turning microbolometers from a high-cost military component into a viable, mass-market sensor crucial for next-generation security, transportation, and industrial monitoring systems globally.

Segmentation Analysis

The Microbolometer Market segmentation provides a detailed framework for understanding the diverse technological pathways and end-user demands shaping the industry landscape. Segmentation is primarily based on the core sensing material used (Technology), the specific infrared spectrum utilized (Wavelength), the functional application area (Application), and the immediate buyer type (End-User). The complexity of microbolometer deployment necessitates this granular analysis, particularly distinguishing between high-performance, high-cost defense solutions and rapidly expanding, cost-sensitive commercial and automotive deployments, which rely heavily on advancements in manufacturing efficiency and standardization to achieve necessary scale.

Technological segmentation highlights the competition and specialization between Vanadium Oxide (VOx) and Amorphous Silicon (a-Si) based devices, where VOx traditionally offers superior thermal responsiveness suitable for military specifications, while a-Si provides a lower-cost alternative often favored in industrial and basic commercial surveillance due to easier integration with standard silicon CMOS processing. Wavelength segmentation, focusing mostly on Long-Wave Infrared (LWIR), reflects the physical properties of typical heat signatures and atmospheric transmission windows, optimizing the sensor's effectiveness in common surveillance and detection tasks. The application breakdown reveals shifting market momentum, with significant future growth anticipated outside traditional military reliance, propelled by regulatory mandates in fire safety, industrial automation, and the mandatory inclusion of thermal capabilities in autonomous driving stacks.

- Technology

- Vanadium Oxide (VOx)

- Amorphous Silicon (a-Si)

- Other Technologies (e.g., Polymer-based, Metal Alloys)

- Wavelength

- Long-Wave Infrared (LWIR: 8µm to 14µm)

- Mid-Wave Infrared (MWIR: 3µm to 5µm)

- Short-Wave Infrared (SWIR: 0.9µm to 1.7µm)

- Application

- Military & Defense (Night Vision, Surveillance, Targeting)

- Commercial (Building Surveillance, Firefighting, Maritime Navigation)

- Industrial (Predictive Maintenance, Quality Control, Process Monitoring)

- Automotive (Advanced Driver Assistance Systems - ADAS, Night Vision)

- Healthcare (Thermal Screening, Medical Imaging)

- Consumer Electronics (Smartphones, Wearables, Outdoor Recreation)

- End-User

- Original Equipment Manufacturers (OEMs)

- System Integrators

- Government and Defense Agencies

- Research & Development Institutions

Value Chain Analysis For Microbolometer Market

The microbolometer value chain is complex and highly specialized, beginning with upstream activities focused on the sourcing and preparation of exotic materials, followed by intricate semiconductor fabrication processes, and culminating in downstream integration and distribution to diverse end-users. Upstream analysis involves the procurement of high-purity raw materials, particularly silicon wafers for the substrate and specialized thin-film deposition materials such as Vanadium or Amorphous Silicon, which requires expertise in materials science to ensure the necessary thermal coefficient of resistance and stability. The critical manufacturing step involves Micro-Electro-Mechanical Systems (MEMS) fabrication, where the actual sensor array and pixel structures are micromachined, followed by highly demanding vacuum packaging—increasingly moving towards cost-efficient Wafer-Level Packaging (WLP) to protect the sensitive array from the ambient environment and maintain the necessary vacuum integrity for optimal performance.

The mid-stream encompasses the integration phase, where the microbolometer detector is married with readout integrated circuits (ROICs), sophisticated image processing electronics, and proprietary calibration firmware to compensate for non-uniformity and drift. This integration is often performed by specialized thermal sensor manufacturers or subsystem assemblers who focus on optimizing the sensor performance for specific application requirements (e.g., high frame rate for targeting vs. low power for battery operation). Downstream activities involve distribution channels, which are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) in the defense and automotive sectors, requiring highly customized solutions and long-term supply agreements, and indirect sales through system integrators and distributors targeting smaller industrial, commercial, and consumer markets.

Direct distribution channels are characterized by close collaboration between the microbolometer manufacturer and large defense contractors or Tier 1 automotive suppliers, focusing on deep technical support and high-security handling due to the sensitive nature of the technology. Indirect distribution leverages specialized electronic component distributors and value-added resellers who bundle the microbolometers into complete thermal camera modules or specialized inspection systems, targeting the fragmented industrial maintenance, construction, and commercial security markets. The efficiency of the distribution network, particularly the ability to navigate export controls and regulatory compliance, significantly impacts regional market penetration, making strategic partnerships with regional integrators a critical component of maximizing global market reach and accessing diverse end-user bases effectively.

Microbolometer Market Potential Customers

Potential customers for microbolometer technology represent a broad spectrum of industries, driven by the universal need for reliable, passive, non-contact thermal intelligence across various operating conditions. The primary and highest-value customer segment remains government and defense organizations, including military branches, homeland security, and border patrol agencies, who procure microbolometers embedded in night vision goggles, advanced weapon sights, surveillance systems, and missile guidance platforms. These buyers prioritize high-resolution (low NETD), ruggedized solutions, and often require specialized, high-security supply chain assurances. Outside the defense sector, large Original Equipment Manufacturers (OEMs) form the next critical customer base, particularly those in the automotive industry (e.g., Tesla, Continental, Bosch) integrating thermal cameras into Advanced Driver Assistance Systems (ADAS) to achieve higher levels of vehicle autonomy and passenger safety by detecting pedestrians and animals reliably in poor visibility.

Industrial sector customers are predominantly manufacturing firms, utilities (power, oil & gas), and construction companies that utilize thermal imaging for preventive maintenance, quality assurance, and asset management. These customers, often buying through specialized system integrators, seek robust, easy-to-use cameras or thermal monitoring systems to identify temperature anomalies, detect gas leaks, and assess the thermal efficiency of critical infrastructure, thereby minimizing operational downtime and ensuring regulatory compliance. The emerging customer base includes consumer electronics manufacturers and specialized device makers, such as those producing professional-grade firefighting equipment, outdoor hunting/camping gear, and localized health monitoring devices (fever screening), demanding compact, low-power, and cost-effective sensor modules suitable for integration into high-volume consumer products, reflecting a move towards pervasive, accessible thermal sensing technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 12.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems, Leonardo DRS, BAE Systems, L3Harris Technologies, Honeywell International, Teledyne FLIR, Xenics NV, VOx Technology, ULIS (Lynred), semi-core, Raytheon Technologies, SEEK Thermal, Guide Infrared, Dali Technology, InfraTec GmbH, Hamamatsu Photonics, New Imaging Technologies, NEC Corporation, Graphene-based Sensor Developers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microbolometer Market Key Technology Landscape

The Microbolometer Market is undergoing rapid technological evolution, primarily centered around improvements in detector material science, reduction in pixel size, and highly efficient packaging techniques. The core technological advancements are driven by the quest for higher thermal resolution (lower NETD - Noise Equivalent Temperature Difference) and drastic cost reduction suitable for mass-market deployment. Key innovations involve refining the deposition processes for Vanadium Oxide (VOx) and Amorphous Silicon (a-Si) films to enhance their temperature coefficient of resistance (TCR) and optimize thermal isolation, utilizing advanced MEMS etching techniques to create delicate microstructures that efficiently absorb infrared radiation while minimizing thermal crosstalk, thus boosting sensitivity and response time significantly.

A critical shift in the technology landscape is the move towards smaller pixel pitches, notably shrinking from 17 micrometers (µm) and 12 µm down to 10 µm and 8 µm. This reduction allows manufacturers to achieve the same thermal image resolution in significantly smaller sensor footprints, leading to highly compact and lightweight thermal modules indispensable for applications like micro-UAVs and smartphone integration. Furthermore, advancements in Wafer-Level Packaging (WLP) are revolutionizing the manufacturing process. WLP replaces expensive, individual ceramic vacuum enclosures with sealed packages created at the wafer level using sophisticated bonding techniques. This breakthrough not only dramatically reduces the per-unit cost by enabling high-volume semiconductor fabrication scalability but also decreases the size and weight of the final sensor assembly, making it feasible for mainstream commercial and automotive deployment.

Emerging technologies, while not yet dominating, include the exploration of novel materials such as graphene and lead zirconate titanate (PZT) for potential future microbolometer arrays, promising even greater thermal performance or alternative sensing mechanisms. Furthermore, the integration of advanced on-chip processing and sophisticated algorithms, including built-in non-uniformity correction (NUC) and shutterless operation, are becoming standard features, improving usability and reliability. The convergence of these technological streams—miniaturization, cost-efficiency through WLP, and enhanced thermal sensitivity—is paving the way for microbolometers to transition from niche military components to pervasive, intelligent sensors across the entire technology ecosystem.

Regional Highlights

- North America: North America holds the largest share of the Microbolometer Market, primarily driven by substantial and continuous investments in military modernization programs, including advanced surveillance, tactical systems, and unmanned vehicle technologies by the US Department of Defense. The region is also a hub for cutting-edge R&D, fostering key innovations in small-pixel pitch and sensor fusion for high-performance applications. The presence of major industry players like FLIR Systems (Teledyne FLIR) and Leonardo DRS solidifies its leadership, coupled with growing demand from robust industrial automation and commercial security sectors seeking high-end thermal solutions.

- Europe: Europe represents a mature market characterized by stringent safety and environmental regulations driving adoption in industrial inspection, firefighting, and security sectors. Growth is significantly bolstered by the automotive industry, particularly in Germany and France, where high-end vehicle manufacturers are rapidly integrating thermal imaging into sophisticated ADAS packages. The European Space Agency (ESA) and various defense initiatives also provide steady demand for specialized, high-reliability microbolometer arrays, often manufactured by established regional players like ULIS (Lynred) and InfraTec.

- Asia Pacific (APAC): The APAC region is the fastest-growing market globally, driven by rapid industrialization, massive infrastructure development, and increasing defense expenditures by countries like China, India, and South Korea. The proliferation of smart cities demands extensive surveillance infrastructure, creating vast opportunities for microbolometers in security and traffic management. Furthermore, APAC is a major global manufacturing hub, leading to high utilization of thermal imaging for quality control and predictive maintenance across electronics, automotive parts, and heavy machinery production lines, benefiting greatly from cost-efficient manufacturing scaling.

- Latin America: This region exhibits steady growth, primarily focused on applications related to border surveillance, natural resource monitoring (oil and gas pipelines), and public safety infrastructure modernization. Economic stabilization and increasing governmental focus on critical infrastructure protection are key factors influencing market expansion, though market penetration remains lower than in established regions, relying heavily on imports and system integration expertise.

- Middle East and Africa (MEA): The MEA market is largely influenced by geopolitical factors, leading to strong demand in military and defense applications, homeland security, and surveillance of critical energy infrastructure, particularly oil and gas facilities. Significant government spending on security enhancement and the rising threat of unauthorized access necessitate advanced thermal detection capabilities, driving the procurement of high-specification microbolometer-based cameras and systems, primarily through direct defense contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microbolometer Market.- Teledyne FLIR (formerly FLIR Systems)

- Leonardo DRS

- BAE Systems

- L3Harris Technologies

- Honeywell International Inc.

- Xenics NV

- ULIS (Lynred)

- semi-core

- Raytheon Technologies Corporation

- SEEK Thermal

- Guide Infrared

- Dali Technology

- InfraTec GmbH

- Hamamatsu Photonics K.K.

- New Imaging Technologies (NIT)

- NEC Corporation

- Nippon Ceramic Co., Ltd. (NICERA)

- Venture Technology (VOx Technology Provider)

- Lockheed Martin Corporation

- Northrop Grumman Corporation

Frequently Asked Questions

Analyze common user questions about the Microbolometer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of microbolometers over traditional infrared detectors?

The primary advantage is that microbolometers are uncooled detectors, meaning they operate effectively at room temperature without requiring bulky, expensive, and power-intensive cryogenic cooling systems. This allows for significant miniaturization, lower power consumption, increased reliability, and substantial cost reduction, enabling their use in portable and high-volume commercial applications such as drones and consumer devices.

How is the shift to smaller pixel pitch affecting the Microbolometer Market?

The shift to smaller pixel pitches (e.g., 10µm or 8µm) is a critical market driver, enabling manufacturers to produce higher resolution thermal images using physically smaller sensor arrays. This miniaturization is crucial for market expansion into space-constrained applications like wearable devices, compact security modules, and automotive integration, leading to lower unit costs and higher production yields via advanced semiconductor processing.

Which application segment is expected to drive the highest growth in the Microbolometer Market?

While Military and Defense currently hold the largest market share in revenue, the Automotive segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by the regulatory requirements and technological necessity of integrating reliable thermal sensors into Advanced Driver Assistance Systems (ADAS) and autonomous vehicles to ensure safe operation in challenging visibility conditions.

What are the key differences between Vanadium Oxide (VOx) and Amorphous Silicon (a-Si) microbolometers?

VOx detectors generally offer superior thermal sensitivity (lower NETD) and faster response times due to the material's high temperature coefficient of resistance (TCR), making them preferred for high-performance military and scientific applications. Conversely, a-Si detectors are typically easier to integrate into standard CMOS manufacturing lines, leading to lower production costs and making them highly suitable for high-volume, cost-sensitive commercial and consumer electronics markets.

What role does Wafer-Level Packaging (WLP) play in reducing microbolometer manufacturing costs?

Wafer-Level Packaging (WLP) is pivotal for cost reduction by enabling the creation of vacuum-sealed packages simultaneously across an entire wafer using semiconductor processing techniques, eliminating the need for expensive, individual ceramic packaging. This dramatically reduces material and assembly costs, boosts manufacturing throughput, and results in smaller, more robust sensor modules, vital for mass-market adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thermopile Microbolometer Infrared Detector Market Size Report By Type (Microbolometer IR Detector, Thermopile IR Detector, Pyroelectric IR Detector), By Application (Military and Defense, Automotive, Smart Home, Medicine, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Microbolometer Market Statistics 2025 Analysis By Application (Aerospace & Defense, Automotive, Video Surveillance, Thermography, Other), By Type (Vanadium Oxide (VOx), Amorphous Silicon (a-Si), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Microbolometer Market Statistics 2025 Analysis By Application (Aerospace & Defense, Automotive, Video Surveillance, Thermography), By Type (Vanadium Oxide (VOx), Amorphous Silicon (a-Si), Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager