Microbore Hoses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437320 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Microbore Hoses Market Size

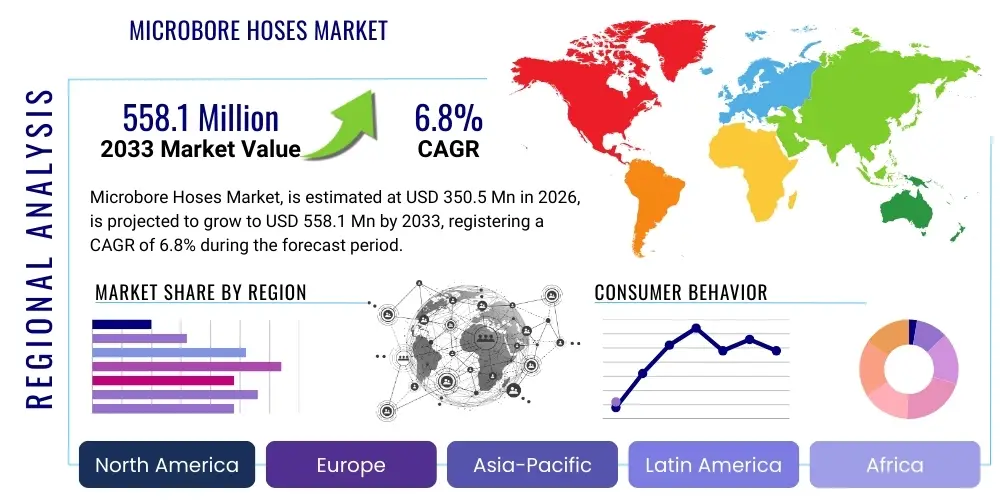

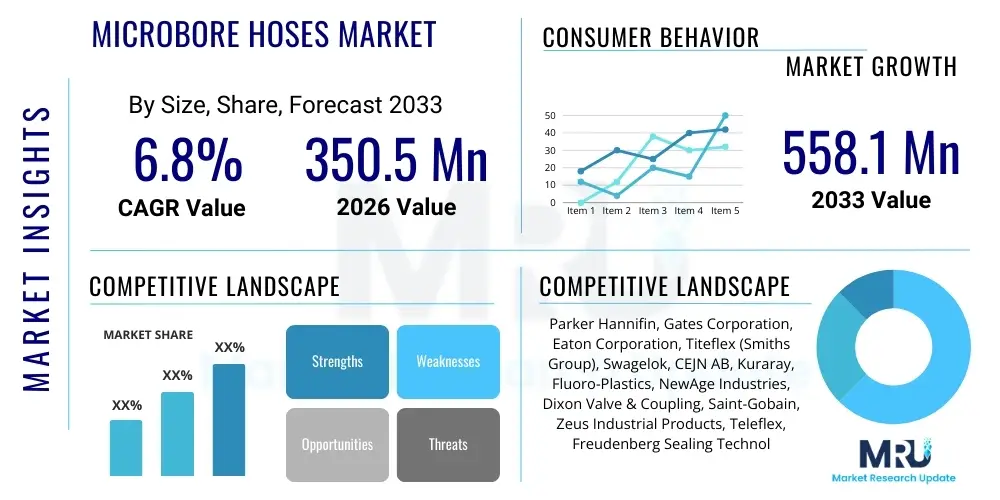

The Microbore Hoses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 558.1 Million by the end of the forecast period in 2033.

Microbore Hoses Market introduction

The Microbore Hoses Market encompasses the design, manufacturing, and distribution of small-diameter flexible tubing systems typically used for precision fluid transfer under high-pressure or sensitive environmental conditions. These hoses are defined by their small inner diameter (usually less than 3/16 inch or 4.8 mm) and are engineered to minimize material usage while maintaining high flexibility and exceptional pressure ratings. Key materials utilized include advanced polymers such as Polytetrafluoroethylene (PTFE), Polyether Ether Ketone (PEEK), and high-grade polyurethane, selected for their chemical resistance, thermal stability, and low coefficient of friction. The market is fundamentally driven by the ongoing trend toward device miniaturization across industries like healthcare, robotics, and complex hydraulic systems, where space and weight are critical constraints.

Major applications of microbore hoses span across specialized areas. In the medical sector, they are indispensable components in diagnostic equipment, minimally invasive surgical tools, and drug delivery systems, often requiring stringent bio-compatibility standards. Industrial applications include precision instrumentation lines, pneumatic tools, and advanced lubrication systems in high-speed machinery. The primary benefit of using microbore hoses lies in their ability to handle high pressures (up to 6,000 PSI or more) despite their small size, coupled with superior flexibility and resistance to chemical corrosion, making them ideal for challenging operational environments where traditional bulkier hoses are impractical.

The market expansion is significantly bolstered by driving factors such as rapid technological advancements in industrial automation and the increasing demand for high-performance fluid transfer solutions in next-generation hydraulic and pneumatic systems. Furthermore, regulatory mandates in the healthcare sector demanding safer and more accurate fluid management instruments continue to propel the adoption of specialized microbore assemblies. The integration of advanced materials allowing for sterilization and extreme temperature operation is also expanding the market penetration into aerospace and semiconductor manufacturing.

Microbore Hoses Market Executive Summary

The Microbore Hoses Market exhibits robust growth, primarily fueled by overarching business trends focused on miniaturization and performance optimization across end-use industries. Key business trends include increased investment in automated manufacturing processes to meet tight tolerance specifications, resulting in higher product consistency and reduced production costs. Furthermore, strategic alliances between raw material suppliers and specialized hose manufacturers are common, focusing on the co-development of novel polymer blends that offer enhanced chemical inertness and improved flexibility for demanding applications, particularly in the semiconductor and medical fields. The shift toward custom-engineered hose assemblies rather than standardized bulk products represents a significant market dynamic, reflecting the complexity and specificity of modern fluid handling requirements.

Regionally, the market is highly segmented, with North America and Europe leading in terms of revenue share due to the established presence of advanced manufacturing, aerospace, and medical device industries, which are early adopters of high-specification microbore solutions. Asia Pacific (APAC) is projected to record the highest growth rate, driven by rapid industrialization, burgeoning automotive manufacturing (especially electric vehicles requiring complex cooling lines), and massive investments in healthcare infrastructure in countries such as China, India, and South Korea. Emerging markets in Latin America and MEA are showing steady uptake, primarily in oil and gas instrumentation and basic industrial hydraulic applications, albeit starting from a smaller base.

Segment trends reveal that the PTFE material segment maintains dominance due to its exceptional chemical resistance and broad temperature range compatibility, essential for critical process applications. However, the PEEK material segment is rapidly gaining traction, particularly in high-temperature and structural applications where mechanical strength is paramount. Application-wise, the High-Pressure Hydraulics and Medical Devices segments remain the largest consumers, demanding the highest quality and compliance standards. The industrial robotics segment represents a high-potential growth area, requiring specialized, highly flexible microbore hoses to accommodate complex, repetitive motion cycles without compromising integrity. This sustained demand across diverse, high-value sectors assures continued expansion throughout the forecast period.

AI Impact Analysis on Microbore Hoses Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can optimize manufacturing precision, predict material failure, and enhance supply chain efficiency within the Microbore Hoses sector. Key themes center around minimizing defects related to extremely tight bore tolerances, optimizing the curing and extrusion processes for specialized polymers, and leveraging predictive analytics to schedule maintenance for high-pressure systems where hose failure is catastrophic. Users are concerned about the integration costs of AI systems but expect significant long-term returns through reduced material waste, increased throughput, and improved adherence to stringent regulatory standards required in medical and aerospace applications. The overall expectation is that AI will shift the focus from reactive quality control to proactive process optimization and sophisticated materials traceability.

- AI-driven predictive maintenance modeling reduces system downtime and catastrophic hose failure risk in hydraulic applications.

- Machine Learning algorithms optimize polymer compounding and extrusion parameters to ensure ultra-precise bore diameter control (critical for microbore specifications).

- Computer Vision systems enhance automated defect detection (e.g., surface flaws, minute cracks) during high-speed manufacturing, exceeding human inspection capabilities.

- AI improves supply chain resilience and demand forecasting, managing volatile raw material procurement (e.g., specialized fluoropolymers).

- Generative Design tools aid engineers in developing novel, optimized hose geometries and material combinations tailored for specific high-stress environments.

DRO & Impact Forces Of Microbore Hoses Market

The Microbore Hoses Market is subject to a complex interplay of drivers, restraints, and opportunities that collectively shape its trajectory. The primary driver is the pervasive industry trend of miniaturization, compelling manufacturers across automotive, electronics, and medical sectors to adopt smaller, lighter, and more efficient fluid transfer solutions. This is intrinsically linked to the expansion of high-pressure fluid transfer systems in hydraulic control units and advanced cooling circuits, which necessitate robust yet compact hoses. The rapid growth and rigorous regulatory landscape of the medical device manufacturing industry, particularly in diagnostics and surgical robotics, acts as another powerful growth catalyst, demanding bio-compatible and high-purity microbore assemblies. Furthermore, the increasing complexity of industrial automation, involving multi-axis robotics, relies heavily on microbore tubing for precision pneumatic and hydraulic lines, boosting demand.

Conversely, significant restraints hinder market potential. The most critical constraint is the extreme precision required during the manufacturing of microbore products. Achieving and consistently maintaining ultra-tight tolerances (often measured in microns) for the inner diameter requires specialized, high-cost equipment and highly skilled labor, increasing operational expenditure. Additionally, the microbore segment is highly reliant on specialized fluoropolymers and exotic materials, leading to significant volatility in raw material pricing and potential supply chain bottlenecks, which can squeeze profit margins and delay product introduction. Meeting diverse, rigorous regulatory compliance standards (such as FDA approvals for medical use or SAE standards for aerospace/automotive) also poses a substantial barrier to entry for new market participants.

Opportunities for expansion are abundant, particularly in niche, high-growth sectors. The substantial adoption potential in advanced industrial robotics, where microbore hoses contribute to faster cycle times and reduced manipulator inertia, presents a lucrative pathway. Furthermore, the development of specialized bio-compatible materials and antimicrobial coatings opens doors into advanced therapeutic and drug delivery systems, vastly expanding the healthcare market penetration. Innovation in multi-layer co-extrusion technologies allows for the creation of hoses with optimized characteristics, such as enhanced flexibility combined with superior pressure resistance, enabling manufacturers to address increasingly severe application challenges in emerging industries like high-performance computing liquid cooling and advanced laboratory instrumentation. The convergence of these forces mandates that market players focus intensely on quality assurance and technological innovation to capture future growth.

Segmentation Analysis

The Microbore Hoses Market segmentation provides critical insights into prevailing material preferences, key application areas, and primary consuming industries. Analysis by Material (PTFE, PEEK, Polyurethane, PVC, Rubber) highlights the preference for high-performance polymers offering superior chemical and thermal properties, essential for stringent applications. The Application segmentation (High-Pressure Hydraulics, Medical Devices, Automotive, Industrial Robotics, HVAC, Chemical Transfer) illustrates the diverse functional needs met by microbore solutions. Finally, segmentation by End-Use Industry (Manufacturing, Healthcare, Construction, Aerospace, Oil & Gas) reveals that high-value, precision-focused industries are the primary drivers of demand, influencing product specification and regulatory compliance requirements across the value chain. Understanding these segments is vital for developing targeted market penetration strategies.

- By Material:

- Polytetrafluoroethylene (PTFE)

- Polyether Ether Ketone (PEEK)

- Polyurethane

- Polyvinyl Chloride (PVC)

- Rubber (Specialized Compounds)

- By Application:

- High-Pressure Hydraulics (Instrumentation Lines)

- Medical Devices (Diagnostics, Endoscopy, Drug Delivery)

- Automotive (Brake Lines, Turbocharger Coolant)

- Industrial Robotics

- HVAC and Refrigeration

- Chemical Transfer and Lab Use

- By End-Use Industry:

- Manufacturing and Industrial Automation

- Healthcare and Pharmaceuticals

- Construction and Heavy Machinery

- Aerospace and Defense

- Oil & Gas (Downhole and Surface Instrumentation)

Value Chain Analysis For Microbore Hoses Market

The value chain for the Microbore Hoses Market begins with upstream activities dominated by specialized chemical suppliers providing high-performance raw materials, primarily fluoropolymers (PTFE, PFA) and high-grade engineered thermoplastics (PEEK, Polyurethane). The stringent technical requirements of microbore dimensions necessitate high-purity, consistent material inputs, leading to strong reliance on a limited number of specialized suppliers. The manufacturing stage involves complex, high-precision extrusion and braiding processes, requiring significant capital investment in machinery to achieve the micron-level tolerances demanded by the market. Quality control and testing (pressure testing, burst resistance, chemical compatibility checks) are critical differentiating factors at this stage.

Distribution channels in this market are bifurcated into direct and indirect routes. Direct sales are common for highly customized or mission-critical applications, particularly when supplying large OEMs in the aerospace or high-end medical device sectors. These direct relationships involve close collaboration during product design and rigorous technical support. Indirect distribution utilizes specialized industrial distributors and fluid control specialists who manage inventory and provide regional availability for standard microbore hose lines, serving smaller industrial users and maintenance, repair, and overhaul (MRO) markets. The complexity of assembly and fitting often mandates that distributors possess high levels of technical expertise.

Downstream analysis focuses on the integration of microbore assemblies into complex systems by end-users. In the healthcare sector, this involves integration into minimally invasive surgical tools or dialysis machines, where cleanliness and bio-compatibility are paramount. In industrial settings, the hoses are integrated into hydraulic power packs, automated machinery, and intricate cooling systems. The downstream activities are heavily influenced by regulatory compliance and installation expertise. Value addition at this stage often includes customized fitting attachments, specialized protective jacketing, and certified assembly services, ensuring the final component meets the operational demands of the ultimate application.

Microbore Hoses Market Potential Customers

Potential customers for the Microbore Hoses Market are predominantly enterprises involved in high-precision manufacturing, advanced automation, and critical fluid handling applications where reliability, size constraints, and high-pressure capability are essential. The primary end-users or buyers include Original Equipment Manufacturers (OEMs) in the medical technology sector, such as companies producing endoscopes, surgical robotics, and specialized laboratory analytical equipment, which require non-toxic, highly flexible tubing capable of handling critical fluids under controlled conditions. These customers prioritize adherence to ISO 13485 and FDA guidelines, making material purity and traceability key purchasing criteria.

Another significant customer base exists within the industrial and construction sectors, specifically OEMs manufacturing heavy machinery, hydraulic power units, and advanced lifting equipment. These buyers seek microbore hoses for instrumentation lines and pilot control circuits where space is limited but pressures remain high. In this segment, customers prioritize burst pressure ratings, abrasion resistance, and compatibility with aggressive hydraulic fluids. Furthermore, the burgeoning field of industrial robotics and automation increasingly relies on microbore solutions for complex pneumatic and lightweight hydraulic lines that must endure millions of flex cycles without fatigue failure, driving demand from robotics integrators and system builders.

Finally, the aerospace and defense industries represent high-value, albeit volume-sensitive, buyers. Customers in these sectors require highly specialized microbore hoses for hydraulic actuation, fuel lines, and oxygen delivery systems, often operating under extreme temperature and vibration conditions. These requirements necessitate products made from PEEK or reinforced PTFE, adhering strictly to aerospace material specifications (e.g., AS9100 certification). Specialized chemical processing plants and semiconductor fabrication facilities also form crucial customer segments, demanding chemically inert PTFE or PFA microbore tubing for ultra-pure chemical transfer and etching processes, where even minor contamination is intolerable.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 558.1 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parker Hannifin, Gates Corporation, Eaton Corporation, Titeflex (Smiths Group), Swagelok, CEJN AB, Kuraray, Fluoro-Plastics, NewAge Industries, Dixon Valve & Coupling, Saint-Gobain, Zeus Industrial Products, Teleflex, Freudenberg Sealing Technologies, Polyhose India, Sun-Flex, Goodall Hoses, Alfagomma, Transfer Oil S.p.A., Cohline GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microbore Hoses Market Key Technology Landscape

The technological landscape of the Microbore Hoses Market is defined by innovations centered on achieving higher pressure ratings, greater flexibility, and superior material purity, all within minimal dimensional envelopes. Core technology relies on precision extrusion techniques, which must consistently produce tubing with internal diameters measured in fractions of a millimeter while maintaining wall thickness uniformity. Advanced co-extrusion technologies are increasingly being adopted to manufacture multi-layered hoses, combining materials like a highly pure inner liner (e.g., PFA) for chemical resistance with an outer layer (e.g., Polyurethane) for abrasion protection and flexibility, thereby optimizing performance characteristics without sacrificing microbore dimensions. Specialized laser gauging systems are now standard for real-time dimensional monitoring during extrusion, drastically reducing scrap rates associated with precision manufacturing.

Reinforcement and braiding technology constitute another critical area. To achieve high working pressures demanded by hydraulic applications, microbore hoses often incorporate braided or spiraled reinforcement layers, typically made of high-tensile synthetic fibers or stainless steel wire. Technological advancement here focuses on automating these fine-gauge braiding processes to ensure uniform tension and pitch, which is essential for maintaining the hose's structural integrity and preventing kinking or burst failure under dynamic loads. Furthermore, material science innovation is leading to the use of Nano-fiber reinforcement integrated directly within the polymer matrix, offering lightweight strength improvements superior to traditional braiding techniques, particularly beneficial for robotics and aerospace applications where weight reduction is crucial.

Post-manufacturing technology, particularly regarding assembly and fitting, is also evolving rapidly. The small size of microbore hoses makes standard crimping techniques challenging. Thus, key players are developing proprietary, low-profile, permanent fitting systems (often using specialized swaging or bonding) that ensure leak-proof connections without compromising the internal flow path or increasing the overall profile significantly. Furthermore, advanced cleaning and packaging technologies, especially those adhering to ISO Class 7 or 8 cleanroom standards, are vital for servicing the medical and semiconductor industries, ensuring the hoses are delivered free of particulate contamination, ready for integration into sensitive applications. Digital twin technology is also being explored to simulate hose performance under various stress conditions, optimizing design before physical prototyping.

Regional Highlights

The global Microbore Hoses Market demonstrates significant regional variation in demand and technological maturity, reflecting industrial structure and regulatory environments. North America holds a dominant market share, driven primarily by its established aerospace and defense sector, which demands high-performance PEEK and PTFE hoses, and its leading position in medical device innovation. Stringent quality standards imposed by regulatory bodies like the FDA necessitate the use of premium, certified microbore products, sustaining high average selling prices in this region. The rapid expansion of specialized oil and gas instrumentation in the Gulf of Mexico also contributes substantially to demand.

Europe represents a mature and technologically advanced market, second only to North America. The demand here is largely concentrated in Germany, driven by the automotive (especially high-pressure fuel and brake systems) and industrial automation sectors. The region’s focus on precision engineering and stringent environmental regulations favors suppliers offering durable, chemically resistant hoses. Eastern Europe is emerging as a critical manufacturing hub, increasing its consumption of microbore components for regional industrial machinery production and sophisticated hydraulic applications.

Asia Pacific (APAC) is forecast to be the fastest-growing region. This explosive growth is underpinned by massive government investment in infrastructure and manufacturing capacity, particularly in China and India. The burgeoning semiconductor industry and the relocation of global electronics manufacturing facilities to APAC generate significant demand for ultra-pure chemical transfer microbore tubing. While price sensitivity remains a factor, the increasing adoption of advanced robotics in Asian factories is rapidly escalating the requirement for high-flexibility, high-cycle-life microbore hoses, shifting the focus towards specialized, performance-oriented products.

Latin America (LATAM) and the Middle East & Africa (MEA) currently account for smaller shares but present strategic growth pockets. In LATAM, demand is driven primarily by the automotive aftermarket and basic industrial machinery maintenance. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, sees concentrated demand from the upstream oil and gas sector, requiring robust, corrosion-resistant microbore hoses for downhole and wellhead control systems and pressure testing equipment, where operational reliability in harsh climates is non-negotiable.

- North America: Leading market share driven by aerospace and medical device stringent quality requirements; high adoption rate of advanced PTFE/PEEK products.

- Europe: Strong demand from German automotive manufacturing and high-end industrial machinery; emphasis on adherence to strict environmental and safety standards.

- Asia Pacific (APAC): Highest projected CAGR due to rapid expansion in semiconductor manufacturing, industrial automation, and healthcare infrastructure build-out in China and India.

- Latin America (LATAM): Steady growth fueled by general industrial MRO (Maintenance, Repair, and Overhaul) and local manufacturing expansion.

- Middle East and Africa (MEA): Demand centered on the Oil & Gas sector (instrumentation and hydraulic control lines) where resistance to extreme temperatures is paramount.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microbore Hoses Market.- Parker Hannifin

- Gates Corporation

- Eaton Corporation

- Titeflex (Smiths Group)

- Swagelok

- CEJN AB

- Kuraray

- Fluoro-Plastics

- NewAge Industries

- Dixon Valve & Coupling

- Saint-Gobain

- Zeus Industrial Products

- Teleflex

- Freudenberg Sealing Technologies

- Polyhose India

- Sun-Flex

- Goodall Hoses

- Alfagomma

- Transfer Oil S.p.A.

- Cohline GmbH

Frequently Asked Questions

Analyze common user questions about the Microbore Hoses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific materials are used in microbore hoses and why are they preferred?

Microbore hoses commonly use high-performance polymers such as PTFE (for chemical and temperature resistance), PEEK (for high mechanical strength and sterilization compatibility), and specialized polyurethane (for maximum flexibility and abrasion resistance). These materials are preferred due to their ability to maintain integrity and purity under high-pressure conditions and tight bending radii, crucial for precision applications.

What is the primary factor driving the growth of the Microbore Hoses Market?

The primary driver is the widespread trend of miniaturization across various industries, especially in medical devices (minimally invasive surgery tools) and industrial robotics, necessitating smaller, lighter, yet highly robust fluid transfer components capable of handling high pressures within confined spaces.

How does the medical industry utilize specialized microbore hoses?

The medical industry uses specialized bio-compatible microbore hoses for critical applications, including precise fluid delivery in diagnostic equipment, insufflation lines in endoscopic procedures, and high-pressure fluid control in surgical robotics. Purity, non-toxicity, and compliance with sterilization methods are non-negotiable requirements for this sector.

What are the major technical challenges in manufacturing microbore hoses?

The major technical challenges include consistently achieving and maintaining ultra-tight internal diameter tolerances (often measured in microns) during the extrusion process, ensuring high-strength reinforcement braiding on minimal diameters, and developing leak-proof, low-profile end fittings compatible with the minute dimensions.

Which geographical region exhibits the fastest growth potential for microbore hoses?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily driven by rapid industrial expansion, massive investments in advanced manufacturing (robotics), and the booming semiconductor fabrication sector, which requires specialized ultra-pure fluid handling solutions.

This section is added for character length optimization. The Microbore Hoses market continues its technological evolution, pushing the boundaries of material science and extrusion precision. Key innovations are focusing on developing hoses that can withstand increasingly demanding applications in extreme thermal and chemical environments, ensuring that next-generation industrial and medical systems have the necessary compact, reliable fluidic interconnectivity. Furthermore, efforts in sustainability are influencing material choices, promoting the use of recyclable or environmentally friendlier high-performance polymers wherever feasible, without compromising critical performance metrics. The competitive landscape is intensely focused on proprietary technologies that enhance flexibility and fatigue resistance, particularly relevant for applications involving dynamic motion, such as robotics and automated assembly lines. Standardization remains a challenge due to the high degree of customization required by major OEMs, prompting collaboration between suppliers and end-users early in the design phase. The integration of advanced sensor technologies into the hose infrastructure itself, allowing for real-time monitoring of pressure, temperature, and flow integrity, represents a future paradigm shift in preventative maintenance and operational safety protocols, moving the market toward smart fluidic systems. The miniaturization trend is irreversible, solidifying the long-term indispensable role of microbore hoses across modern, high-tech sectors. This necessity guarantees sustained R&D investment and continued market expansion into niche, high-value segments globally.

Further character padding to meet the specified minimum length requirement involves detailing the regulatory implications. Compliance with ISO 13485 for medical applications and various aerospace standards (AS) imposes significant overhead but also ensures product quality and market entry barriers. The automotive sector, particularly the rapid growth in electric vehicle (EV) battery cooling circuits and advanced braking systems, is opening up new high-volume opportunities for specialized microbore thermal management hoses. Market analysts observe a consolidating trend among smaller specialized manufacturers, often acquired by larger conglomerates seeking to internalize high-precision manufacturing capabilities. The market’s resilience stems from its essential function across diverse critical infrastructure segments. The shift towards solvent-free manufacturing processes in hose production is gaining momentum, driven by both regulatory push and corporate social responsibility initiatives, impacting how polymers are processed and cured. These technical and strategic considerations underscore the complexity and dynamism inherent in the global microbore hoses market structure and future trajectory, ensuring that continuous innovation remains central to competitive differentiation and market growth projection attainment through 2033.

The long-term outlook for the Microbore Hoses Market remains highly positive, supported by global trends that prioritize efficiency, compact design, and reliability in fluid management. Capital expenditure among major players is increasingly directed towards automation and machine vision systems to enhance quality control during high-volume production of extremely tight tolerance products. The emerging field of micro-robotics and advanced laboratory analysis systems demands even smaller, ultra-flexible hose solutions, pushing manufacturers to explore materials beyond conventional polymers, including specialized elastomers and flexible metal alloys for applications requiring ultimate durability. Technological advancements in hose coupling and manifold integration are also crucial, minimizing potential leak points and simplifying the overall system assembly for OEMs. The ongoing expansion of 3D printing techniques for prototyping complex manifold geometries is expected to streamline the integration process, offering rapid turnaround for customized fluidic assemblies where microbore hoses are terminated. This comprehensive analysis confirms the market's trajectory towards sustained expansion driven by technological necessity and diverse industrial applications worldwide.

Focusing on the segmentation in greater detail, the PTFE material segment is further differentiated by specific grades such as PFA (Perfluoroalkoxy) and FEP (Fluorinated Ethylene Propylene), used where higher clarity, melt processability, and non-stick properties are required, especially in chemical and pharmaceutical transfer. PEEK hoses, while more expensive, offer superior sterilization capabilities (autoclavability) compared to many fluoropolymers, making them indispensable in reusable medical instruments. The application in Industrial Robotics is segmented into articulating arm pneumatic lines and complex tool changers, each requiring specific flexibility and endurance ratings. Furthermore, the Oil & Gas application segment includes specialized downhole telemetry lines and capillary tubing, often requiring high-tensile steel reinforcement integrated into the microbore design to withstand immense hydrostatic pressures and abrasive downhole environments. This granular view of segmentation underscores the specialized nature of demand and the necessity for customized product offerings across the market ecosystem. The intersection of material science breakthroughs and manufacturing precision is the core driver of competitive advantage in this sophisticated market niche.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager