Microchannel Plate Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433279 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Microchannel Plate Detector Market Size

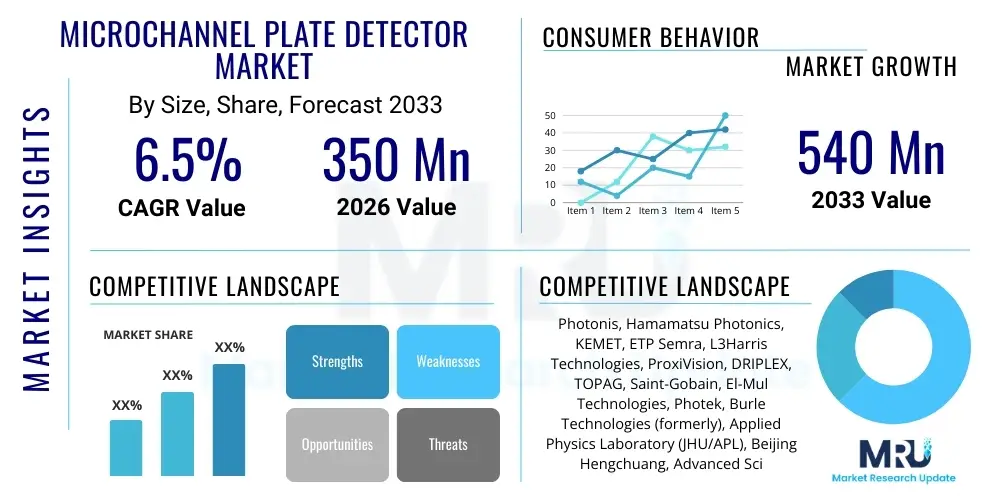

The Microchannel Plate Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $350 Million in 2026 and is projected to reach $540 Million by the end of the forecast period in 2033.

The consistent expansion in the Microchannel Plate (MCP) Detector market is primarily fueled by escalating demand across high-precision scientific applications, particularly in time-of-flight mass spectrometry (ToF-MS) and advanced space-based astronomy. These detectors, recognized for their superior temporal resolution and high gain capabilities, are becoming indispensable tools for detecting low-flux particles and photons. Furthermore, advancements in MCP manufacturing techniques, such as Atomic Layer Deposition (ALD) coatings for enhanced stability and lifetime, are contributing significantly to their wider adoption in commercial and defense sectors.

Geopolitical factors, including increased global defense spending focused on electronic warfare and advanced surveillance technologies, also underpin market growth. MCPs are foundational components in third-generation image intensifier tubes (I2Ts), crucial for modern night vision devices. The market trajectory is further bolstered by sustained governmental investment in fundamental physics research and the continuous deployment of sophisticated satellite missions requiring robust and sensitive photon detection systems capable of operating in harsh environments.

Microchannel Plate Detector Market introduction

The Microchannel Plate Detector Market revolves around devices utilized for the detection and amplification of charged particles (electrons, ions) or ultraviolet/soft X-ray photons. An MCP functions as a dense array of tiny, parallel channels, or microchannels, typically fabricated from lead glass. When a particle or photon strikes the inner wall of a microchannel, it initiates a cascade of secondary electron emissions, resulting in an output signal that is millions of times stronger than the initial event. These detectors are prized for their ultra-fast response time, excellent spatial resolution, and extremely high vacuum compatibility, making them essential across numerous high-technology domains.

The primary applications of MCP detectors span astrophysics, plasma diagnostics, high-energy physics, electron microscopy, and forensic analysis. In scientific research, they are crucial for accurately measuring the time and position of particles, thereby enhancing the resolution and sensitivity of instruments like Time-of-Flight mass spectrometers (ToF-MS) used extensively in chemical analysis and proteomics. In the defense sector, their application in image intensification tubes transforms low-light conditions into visible images, providing a critical operational advantage.

Key market driving factors include the escalating complexity of scientific experiments demanding detectors with picosecond temporal resolution, the replacement cycle of aging image intensifiers in military hardware, and the persistent technological push toward larger active areas and improved signal-to-noise ratios. The inherent benefits, such as high gain, fast response, robustness, and suitability for ultra-high vacuum environments, ensure their sustained demand despite competition from solid-state alternatives in certain wavelength ranges.

Microchannel Plate Detector Market Executive Summary

The Microchannel Plate Detector market is positioned for steady expansion, driven by synergistic growth across specialized scientific instrumentation and mission-critical defense applications. Business trends indicate a strong focus on improving MCP lifetime through advanced fabrication processes, particularly leveraging materials science improvements like ALD techniques to prevent channel saturation and maintain high operational stability over extended periods. Furthermore, vendors are strategically investing in developing detectors with larger formats and curved geometries to meet the specific requirements of next-generation astronomical telescopes and large-area particle tracking systems, moving away from traditional small-format MCPs.

Regionally, North America maintains market dominance, primarily due to substantial governmental and private sector funding directed towards aerospace, defense research, and major university physics departments. The Asia Pacific region, however, is rapidly emerging as a significant growth hub, characterized by increasing investments in industrial inspection technologies, materials science research, and growing defense modernization programs in countries like China, India, and South Korea. This shift is stimulating localized production and reducing reliance on traditional Western suppliers, fostering increased competition and technological diffusion across the globe.

Segmentation trends highlight the Microchannel Plate (High Gain) segment as a key driver, catering to extremely sensitive measurements in astrophysics and quantum sensing where maximizing the signal from scarce events is paramount. Application-wise, the Scientific Research and Defense & Aerospace sectors remain the most lucrative, although niche growth in medical imaging, particularly in specialized PET (Positron Emission Tomography) scanners utilizing photon timing, suggests diversification opportunities. The market overall is optimizing toward customizable solutions, emphasizing flexibility in pore size, gain curves, and detector stacking configurations to meet highly specialized end-user needs efficiently.

AI Impact Analysis on Microchannel Plate Detector Market

Common user questions regarding AI's influence center on how computational power can overcome inherent MCP limitations, specifically concerning signal processing, noise reduction, and long-term calibration stability. Users frequently inquire about integrating machine learning algorithms to automate the analysis of complex, high-volume data generated by MCP detectors in fields like mass spectrometry and particle physics, where event reconstruction is computationally intensive. Key concerns also revolve around utilizing AI for real-time fault detection in large MCP arrays used in large-scale experiments and leveraging predictive analytics to model and compensate for detector aging and gain degradation, thereby extending operational life and improving measurement fidelity without hardware replacement.

AI algorithms, particularly deep learning models, are being increasingly deployed to enhance the performance and longevity of MCP detector systems. In data analysis, AI facilitates pattern recognition in high-dimensional datasets, allowing researchers to quickly identify weak signals buried in background noise or classify particle interactions more accurately than traditional thresholding methods. This is particularly vital in fields like environmental monitoring via ToF-MS, where trace compounds must be quickly and reliably identified. Furthermore, in the manufacturing phase, AI-driven quality control systems are optimizing the MCP production yield by precisely correlating manufacturing parameters (e.g., thermal treatment, etching processes) with final device performance metrics like gain uniformity and dark count rate.

The integration of machine learning also addresses the complexity of detector calibration. As MCP gain naturally degrades over time, often non-uniformly across the detector surface, AI models can be trained on historical performance data to predict future degradation patterns and apply corresponding correction factors in real time. This capability significantly reduces the required recalibration downtime and maintenance costs, improving the overall efficiency and reliability of long-duration experiments, such as those conducted on satellites or deep-sea observatories.

- AI enhances real-time noise filtering and background suppression in particle detection signals.

- Machine learning algorithms optimize event classification and reconstruction in high-energy physics.

- Predictive maintenance models forecast and compensate for MCP gain degradation, extending detector lifetime.

- AI-driven image processing improves the spatial resolution and clarity of images derived from image intensifier tubes (I2Ts).

- Automated quality control systems utilize computer vision to inspect MCP channel geometry during manufacturing, boosting yield.

- Data fusion techniques, powered by AI, integrate MCP data with other sensor inputs for comprehensive measurement systems.

DRO & Impact Forces Of Microchannel Plate Detector Market

The Microchannel Plate Detector market is shaped by a confluence of accelerating drivers rooted in high-stakes scientific endeavor and defense modernization, balanced against stringent manufacturing restraints and compelling future technological opportunities. Key drivers include increasing global spending on deep space exploration missions requiring highly sensitive UV and X-ray detectors, and the rising global incidence of mass spectrometry applications in pharmaceutical research and materials science. Restraints predominantly center on the intricate and costly manufacturing process of MCPs, which demands ultra-precision glass drawing and chemical processing, leading to high unit costs and limited production scalability compared to semiconductor alternatives. Opportunities are largely concentrated in emerging fields such as quantum computing and single-photon detection for secure communication, where MCPs' timing capabilities are irreplaceable.

Impact forces currently skew positively toward demand, driven by the replacement cycle of aging night vision technology in major military forces globally and the continuous push for improved temporal resolution in experimental physics. The restraint posed by manufacturing complexity is being mitigated slightly through technological advancements, such as the adoption of silicon-based MCPs (Si-MCPs), which leverage established semiconductor fabrication techniques to potentially lower production costs and improve uniformity, although Si-MCPs are still maturing technologically compared to traditional glass MCPs. Moreover, regulatory hurdles regarding the export of high-end image intensification technology remain a significant external constraint, particularly affecting sales to certain international markets.

The market faces inherent competition from alternative detector technologies, such as intensified CCDs (ICCDs) and advanced hybrid photodetectors (HPDs), which offer competitive performance characteristics in specific applications, particularly where ultra-high gain is not the primary requirement. However, the unique combination of high gain, fast timing, and radiation hardness offered by traditional MCPs ensures their continued necessity in high-vacuum, high-energy environments. The overarching impact force remains the sustained, non-negotiable need for extreme sensitivity and speed in fundamental research, which perpetually compels investment in MCP technology development.

Segmentation Analysis

The Microchannel Plate Detector market is strategically segmented based on crucial technical characteristics, including Type, Application, and Channel Diameter, reflecting the diverse requirements of end-user industries. Analyzing these segments provides a clear view of where technological investment is concentrated and where future revenue streams are most likely to emerge. The Type segmentation distinguishes between Standard MCPs, designed for general purpose applications; High Gain MCPs, featuring specialized coatings or curved channels for enhanced amplification; and Custom MCPs, tailored for unique experimental setups, often involving large or irregularly shaped active areas. This segmentation underscores the industry's shift towards performance optimization and bespoke solutions for complex scientific endeavors.

In terms of Application, the market is heavily dominated by the Defense & Aerospace sector, which utilizes MCPs extensively in image intensification tubes for night vision, and the Scientific Research segment, covering high-energy physics, vacuum UV spectroscopy, and mass spectrometry. The proliferation of ToF-MS in drug discovery and environmental monitoring has particularly propelled the scientific research segment. Furthermore, Channel Diameter segmentation, ranging from fine diameters (6 µm and below) optimized for high spatial resolution to larger diameters (10 µm and above) favored for ease of manufacturing and robust operation, allows manufacturers to tailor products precisely to the required resolution and quantum efficiency trade-offs demanded by the application.

- By Type

- Standard Microchannel Plate (MCP)

- High Gain Microchannel Plate (MCP)

- Custom and Specialized Microchannel Plates (e.g., large area, curved)

- By Application

- Scientific Research (Mass Spectrometry, High-Energy Physics, Spectroscopy)

- Defense & Aerospace (Night Vision, Target Acquisition, Satellite Instrumentation)

- Medical Imaging (Specialized PET Scanners)

- Industrial Inspection (Electron Microscopy, Vacuum Diagnostics)

- By Channel Diameter

- 6 µm and Below (High Resolution)

- 8 µm

- 10 µm

- 12 µm and Above (Higher Gain/Robustness)

Value Chain Analysis For Microchannel Plate Detector Market

The Microchannel Plate Detector value chain begins with highly specialized upstream suppliers providing critical raw materials, predominantly high-quality lead glass or borosilicate glass tubing, which must meet extremely tight tolerances for chemical composition and uniformity to ensure consistent electrical resistance and secondary emission properties. This upstream phase also involves the supply of critical fabrication materials such as high-purity etching chemicals (acids) and advanced coating materials (e.g., atomic layer deposition precursors for alumina or magnesium oxide coatings). The uniqueness of the MCP manufacturing process—involving drawing, slicing, etching, and hydrogen reduction—means that material quality is paramount and often dictates the final performance characteristics, such as gain and lifetime, of the finished MCP device.

The middle segment of the value chain is dominated by highly specialized manufacturers who possess proprietary knowledge in core MCP fabrication techniques, particularly the specialized drawing process (e.g., boule assembly and drawing) necessary to create millions of highly parallel microchannels, and the subsequent activation processes that establish the necessary semiconducting layer on the inner channel walls. These manufacturers then integrate the MCPs into complete detection assemblies, often combining them with photocathodes, phosphors, and high-voltage power supplies to form functioning detectors or image intensifier tubes (I2Ts). Due to the complexity and precision required, this stage presents significant entry barriers, leading to market concentration among a few key global players.

Downstream distribution channels are bifurcated into direct sales to large governmental, defense, and research organizations (e.g., NASA, CERN, military procurement agencies) and indirect sales facilitated through specialized distributors and system integrators. Direct channels are prevalent for high-volume, custom, or highly strategic defense contracts. Indirect channels are crucial for reaching smaller university labs and specialized industrial OEMs who integrate MCP detectors into their final products, such as mass spectrometers or electron microscopes. The crucial interaction here is the detailed technical consultation provided by the manufacturers or distributors to ensure the correct MCP configuration (pore size, bias angle, L/D ratio) is selected for the specific experimental conditions.

Microchannel Plate Detector Market Potential Customers

The potential customer base for Microchannel Plate Detectors is highly technical and specialized, primarily comprising institutions and corporations involved in fundamental research, security, and high-precision analytical instrumentation. Major buyers include governmental defense agencies globally, which continually procure MCP-based image intensifiers for troop equipment modernization and sophisticated surveillance systems. Furthermore, national and international space agencies (like NASA and ESA) are perennial customers, requiring rugged, reliable MCP detectors for deep space missions focused on collecting data from UV, soft X-ray, and low-energy particle sources, where alternative detectors cannot withstand the operational environment or match the sensitivity requirements.

Academic and research institutions, encompassing university physics and chemistry departments, national laboratories (e.g., particle accelerators, fusion research centers), and large-scale experimental facilities (e.g., synchrotrons), form a significant segment. These end-users typically purchase raw MCPs or custom assemblies for integration into time-of-flight mass spectrometers, electron diffraction systems, and advanced spectroscopy setups where picosecond timing resolution is non-negotiable. The procurement often involves competitive bidding processes focused heavily on detector performance metrics such as gain, quantum efficiency, and active area uniformity.

The industrial and medical sectors represent a growing segment of potential customers, particularly Original Equipment Manufacturers (OEMs) specializing in analytical instrumentation. Manufacturers of high-end mass spectrometers rely heavily on MCPs for ion detection. Similarly, developers of advanced medical imaging devices, such as next-generation PET (Positron Emission Tomography) scanners that leverage the ultra-fast timing capabilities of MCPs for Time-of-Flight measurements (ToF-PET), are increasingly becoming key buyers. These customers require high reliability, long operational life, and consistent quality, often purchasing in moderate to high volumes for integration into commercially marketed systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million |

| Market Forecast in 2033 | $540 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Photonis, Hamamatsu Photonics, KEMET, ETP Semra, L3Harris Technologies, ProxiVision, DRIPLEX, TOPAG, Saint-Gobain, El-Mul Technologies, Photek, Burle Technologies (formerly), Applied Physics Laboratory (JHU/APL), Beijing Hengchuang, Advanced Scientific Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microchannel Plate Detector Market Key Technology Landscape

The Microchannel Plate Detector market is defined by a highly advanced technological landscape focusing on enhancing three core performance metrics: gain stability, quantum efficiency, and operational lifetime. The foundational technology remains the precise fabrication of high aspect ratio capillaries in lead glass, but significant advancements are occurring through the incorporation of novel coating techniques. Specifically, Atomic Layer Deposition (ALD) has emerged as a transformative technology. ALD allows for the deposition of ultra-thin, highly uniform films of materials like alumina (Al2O3) or magnesium oxide (MgO) onto the inner walls of the microchannels. This process significantly enhances the secondary electron emission yield, improving gain and, crucially, offering superior protection against ion scrubbing and gas contamination, thus dramatically extending the operational lifespan of the MCP, a major historical challenge for these devices.

Another pivotal technological area is the development and commercialization of Silicon Microchannel Plates (Si-MCPs). Unlike traditional glass MCPs, Si-MCPs utilize established semiconductor lithography and etching techniques (Deep Reactive-Ion Etching - DRIE) to define the microchannel structures. This offers potential advantages in terms of channel regularity, precise pore geometry control, and scalability, potentially leading to lower unit costs in high volumes compared to the labor-intensive glass drawing process. While Si-MCPs are still overcoming challenges related to achieving equivalent gain performance to optimized glass MCPs, particularly in high-vacuum environments, they represent a disruptive force, especially for applications where large format arrays and precise uniformity are critical, such as large-scale particle physics experiments and medical imaging arrays.

Furthermore, the technology landscape includes continuous innovation in photocathode integration and readout mechanisms. For UV and visible light detection, optimizing the photocathode material (e.g., highly sensitive CsI, CsTe, or multialkali compounds) and its deposition process onto the MCP input face is crucial for maximizing quantum efficiency. Readout technology is also evolving rapidly, moving beyond simple anode or resistive anode encoders to sophisticated pixelated readouts, such as cross-strip (XS) anodes or advanced custom ASIC (Application-Specific Integrated Circuit) integration. These advanced readouts enable highly precise, high-speed spatial and temporal event mapping, which is essential for differentiating simultaneous particle impacts and achieving ultimate detector performance in modern analytical instruments.

Regional Highlights

Regional dynamics within the Microchannel Plate Detector market are shaped significantly by concentrations of advanced research infrastructure, aerospace and defense manufacturing hubs, and government investment levels in high-technology sectors. North America, particularly the United States, commands a substantial market share. This dominance stems from massive, sustained funding for national defense programs that utilize MCPs in advanced night vision and targeting systems, coupled with the presence of globally leading research institutions and national laboratories (e.g., NASA centers, DoE labs). These institutions are continuous drivers of demand for state-of-the-art MCP technology in space-based instrumentation and high-energy physics experiments. The robust ecosystem of specialized manufacturers and system integrators further solidifies North America's leadership in both technological innovation and market revenue generation.

Europe represents the second-largest market, characterized by significant governmental investment channeled through collaborative multinational organizations such as CERN (European Organization for Nuclear Research) and ESA (European Space Agency). European scientific infrastructure necessitates high-performance MCPs for particle detection and astronomical observations. Countries like Germany, France, and the UK host major defense contractors and established MCP manufacturers (such as Photonis), maintaining a strong internal supply chain. The European focus tends to be highly specialized, emphasizing quality, longevity, and radiation hardness for long-duration scientific missions. Strict regulatory environments, however, occasionally pose challenges for rapid commercialization compared to the US market.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period. This rapid expansion is fueled by increasing defense spending and ambitious space programs in key nations such as China, India, and Japan. Furthermore, APAC is experiencing burgeoning growth in the adoption of analytical instruments, particularly Time-of-Flight Mass Spectrometry (ToF-MS), across burgeoning pharmaceutical, environmental, and materials science industries. Localized manufacturing capabilities are improving, driven by government policies aimed at technological self-sufficiency, which in turn stimulates regional demand and reduces reliance on expensive imports, making APAC a critical future hub for both production and consumption of MCP detectors.

- North America: Market leader due to high defense expenditures, dominance in aerospace R&D (NASA, DoD), and extensive use in major physics laboratories. Key focus on next-generation image intensifiers and space instrumentation.

- Europe: Strong demand driven by multinational scientific collaborations (CERN, ESA) and established indigenous manufacturers. Focus on high-reliability, radiation-hardened detectors for fundamental physics.

- Asia Pacific (APAC): Fastest-growing region, powered by rapid defense modernization, expanding national space programs, and increasing adoption of ToF-MS instruments in industrial and scientific sectors, particularly in China and India.

- Latin America (LATAM): Emerging market characterized by selective academic and governmental procurement for specific research projects, highly reliant on imported finished detectors.

- Middle East and Africa (MEA): Growth primarily concentrated in defense and security applications, driven by regional conflicts and national surveillance modernization efforts; market size remains smaller compared to major regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microchannel Plate Detector Market.- Photonis

- Hamamatsu Photonics

- L3Harris Technologies

- ETP Semra (A brand of SGE/Trajan Scientific and Medical)

- ProxiVision GmbH (Subsidiary of Xenon Corporation)

- Saint-Gobain (Specific Advanced Materials Division)

- Photek Ltd.

- El-Mul Technologies Ltd.

- KEMET Corporation (Specific MCP business lines)

- Applied Physics Laboratory (JHU/APL - Research & Specialty Manufacturing)

- DRIPLEX Inc.

- TOPAG Lasertechnik GmbH (Distributor/Integrator)

- Advanced Scientific Instruments (ASI)

- MCTRONIX Systems Inc.

- Beijing Hengchuang Glass Technology Co., Ltd.

- Dewa Precision Manufacturing Co., Ltd.

- Burle Technologies, Inc. (Legacy technology holder)

- Custom Sensors & Technologies (CST)

- X-Ray & Sensors LLC

- VDS Vosskühler GmbH

Frequently Asked Questions

Analyze common user questions about the Microchannel Plate Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for High Gain Microchannel Plates (MCPs)?

Demand for High Gain MCPs is primarily driven by the need for enhanced sensitivity in detecting low-flux particles and photons in fields like deep space astrophysics, quantum communication, and high-resolution mass spectrometry. These advanced detectors offer superior signal amplification (gain up to 10^7) and ultra-fast timing, critical for experiments where maximizing the signal from scarce events is necessary for accurate data acquisition.

How does Atomic Layer Deposition (ALD) technology impact the longevity of Microchannel Plates?

ALD significantly improves MCP longevity by depositing highly uniform, protective coatings (such as alumina or MgO) onto the inner channel walls. This coating increases the secondary electron emission yield, maintaining high gain stability, and, more importantly, protects the detector surface from ion scrubbing and residual gas contamination, substantially extending the useful operational lifetime compared to uncoated or traditionally fabricated MCPs.

What are the key differences between traditional glass MCPs and emerging Silicon MCPs (Si-MCPs)?

Traditional glass MCPs are fabricated using high-temperature drawing processes and chemical etching, offering established high gain. Si-MCPs utilize standard semiconductor manufacturing techniques (lithography and DRIE etching) for precise channel definition. While Si-MCPs offer superior channel uniformity and potential for large-scale, low-cost production, traditional glass MCPs currently maintain a performance edge in achieving ultra-high gain and operating optimally under high vacuum conditions.

Which application segment holds the largest market share for Microchannel Plate Detectors?

The Defense & Aerospace segment holds the largest market share. This is attributed to the critical role MCPs play in military applications, predominantly as the core component of image intensifier tubes (I2Ts) utilized in night vision goggles and advanced targeting systems, as well as in sophisticated satellite-based surveillance and scientific instrumentation.

What are the primary challenges restraining growth in the Microchannel Plate Detector market?

The primary restraints include the high unit cost and complexity associated with the specialized manufacturing process of lead glass capillaries, which limits scalability. Additionally, the market faces competition from maturing solid-state detectors (e.g., APDs, SiPMs) in certain low-light applications, and the sector is often subject to strict international export control regulations (e.g., ITAR/EAR) due to the military applicability of the technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager