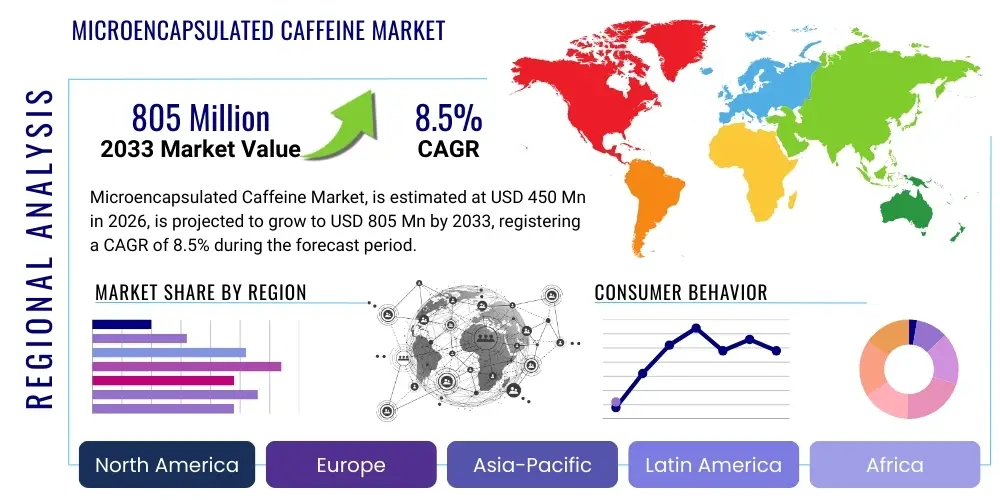

Microencapsulated Caffeine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437282 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Microencapsulated Caffeine Market Size

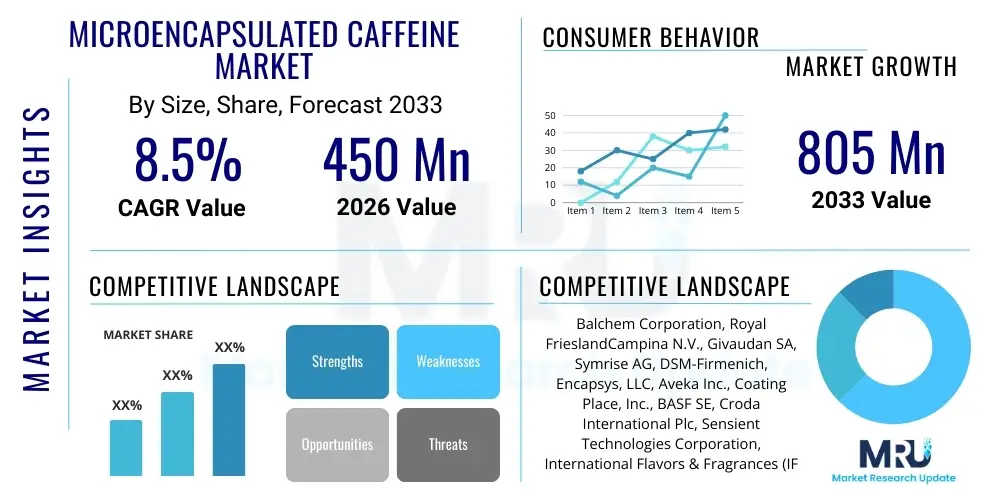

The Microencapsulated Caffeine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 805 Million by the end of the forecast period in 2033.

Microencapsulated Caffeine Market introduction

The Microencapsulated Caffeine Market encompasses the manufacturing and distribution of caffeine that has been entrapped within a protective wall material, typically polymers, lipids, or hydrocolloids. This process shields the active ingredient from environmental factors such as heat, moisture, oxidation, and pH fluctuations, thereby enhancing stability, masking bitter taste, and facilitating controlled or sustained release. The core product is a functional ingredient designed to improve efficacy and consumer experience across various industrial applications, primarily driven by the rising demand for enhanced performance and health-focused products in nutraceuticals and functional beverages. Product variations include liposomal encapsulation, microspheres, and complex coacervation techniques, each tailored to specific release mechanisms required by the end product formulation.

Major applications of microencapsulated caffeine span the Food and Beverage sector, particularly in energy drinks, functional waters, and performance foods, where sustained energy release without the sharp peak and crash associated with traditional caffeine consumption is highly valued. Furthermore, the pharmaceutical and personal care industries utilize this technology to incorporate stable caffeine into topical creams, anti-aging products, and specialized drug delivery systems, benefiting from improved bioavailability and targeted delivery. The key benefit is the ability to formulate products with precise dosage control and extended functional duration, appealing directly to consumers seeking convenience, improved efficacy, and sensory modification, particularly the elimination of caffeine's characteristic bitter taste.

Driving factors fueling this market include the growing global interest in sports nutrition and active lifestyle supplements, necessitating ingredients that offer superior performance and sustained energy. Regulatory approvals supporting the use of microencapsulation technologies in food applications, alongside advancements in material science enabling cost-effective and highly efficient encapsulation methods, are crucial accelerators. The pervasive trend of functionalization in the beverage industry, seeking novel ways to differentiate products and offer added health benefits, cements microencapsulated caffeine's position as a premium functional ingredient. Moreover, the increasing consumer awareness regarding the advantages of controlled-release formulations over instant-release compounds significantly contributes to market expansion across all geographic regions.

Microencapsulated Caffeine Market Executive Summary

The Microencapsulated Caffeine Market is experiencing robust expansion driven by pronounced consumer preference shifts towards functional foods, performance nutrition, and sophisticated pharmaceutical delivery systems. Current business trends indicate a strong focus on developing plant-based and clean-label encapsulating materials, moving away from synthetic polymers to align with organic and natural ingredient demands. Strategic mergers, acquisitions, and technological partnerships between ingredient suppliers and specialized encapsulation technology firms are common, aiming to secure proprietary techniques and expand application scope, especially in high-growth segments like personalized nutrition. Furthermore, manufacturers are investing heavily in improving particle size uniformity and optimizing encapsulation efficiency to achieve predictable release profiles, which is critical for medical and sports applications.

Regional trends reveal that North America and Europe dominate the market initially due to advanced regulatory frameworks favoring novel food ingredients and high penetration of sports nutrition brands. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by rapid urbanization, increasing disposable incomes, and the burgeoning demand for convenience and energy-boosting beverages in countries like China and India. The regional emphasis in APAC is often centered on integrating microencapsulated caffeine into traditional remedies and mass-market functional tea/coffee products. Regulatory harmonization efforts across economic blocs are simplifying cross-border trade of specialized ingredients, accelerating the global proliferation of encapsulated caffeine solutions.

Segment trends highlight the dominance of the Food and Beverages application, particularly within the energy and sports nutrition sub-segments, which value the controlled release properties for sustained physical performance. By core material, synthetic caffeine encapsulation remains the most prevalent due to cost-effectiveness, although natural caffeine extracts are rapidly gaining market share due to clean-label appeal. The technology segment is witnessing a shift towards nanofabrication and complex coacervation, offering improved encapsulation efficacy and stability for volatile or sensitive core materials. The nutraceutical end-user category is expected to exhibit the fastest growth, capitalizing on the shift from therapeutic drugs towards preventative wellness supplements that utilize advanced ingredient delivery systems for optimized efficacy.

AI Impact Analysis on Microencapsulated Caffeine Market

Users frequently inquire about AI's role in optimizing the physical and chemical parameters of microencapsulation processes, asking if AI can predict the ideal wall material or processing conditions for specific release profiles. Key themes include leveraging machine learning (ML) for enhanced R&D efficiency, particularly in screening novel polymers and predicting ingredient stability under various storage conditions. Concerns often revolve around the high initial investment required for integrating AI-driven systems into existing production lines and the need for specialized data science expertise within ingredient manufacturing teams. Expectations are high regarding AI's ability to streamline quality control (QC), optimize supply chain logistics for temperature-sensitive materials, and accelerate the development cycle of next-generation encapsulation technologies, ultimately leading to higher efficiency and reduced manufacturing costs.

AI's primary influence centers on predictive modeling and process optimization. Traditional methods of microencapsulation often involve extensive trial-and-error to achieve desired particle size, morphology, and release kinetics. ML algorithms, trained on vast datasets of encapsulation parameters (e.g., pH, temperature, shear rate, material concentrations), can accurately predict the output characteristics, significantly reducing the experimental workload. This accelerated R&D cycle enables companies to respond quicker to market demands for specialized release profiles, such as multi-stage or trigger-specific release systems, enhancing product differentiation and speed-to-market for novel functional ingredients.

Furthermore, AI is transformative in managing complex manufacturing operations and ensuring stringent quality control standards required in pharmaceutical and high-end nutraceutical applications. AI-powered sensors and computer vision systems monitor production in real-time, detecting deviations in particle uniformity or wall thickness that might compromise the ingredient's stability or efficacy. In supply chain management, AI algorithms optimize inventory levels for expensive raw materials and predict optimal storage and transportation routes, mitigating risks associated with material degradation. This holistic integration of AI, from material discovery to logistical optimization, is positioning AI as an indispensable tool for maintaining competitive advantage in the high-precision microencapsulated caffeine sector.

- AI-driven predictive modeling optimizes encapsulation parameters (wall material selection, core-to-wall ratio) for desired release profiles.

- Machine learning accelerates R&D by simulating process outcomes, drastically reducing physical experimentation time and associated costs.

- AI enhances real-time quality control (QC) by monitoring particle size distribution and morphology using computer vision systems.

- Predictive maintenance schedules for encapsulation equipment are improved, minimizing downtime and ensuring consistent production scale-up.

- AI algorithms optimize supply chain logistics, predicting material degradation risk and ensuring integrity during transport and storage.

DRO & Impact Forces Of Microencapsulated Caffeine Market

The Microencapsulated Caffeine market dynamics are shaped by strong demographic drivers, stringent regulatory oversight, and constant technological innovation. Key drivers include the skyrocketing global demand for functional beverages and energy supplements that promise sustained focus and performance without the associated jitters or digestive discomfort common with non-encapsulated caffeine. Restraints primarily involve the high complexity and cost associated with scaling up advanced microencapsulation technologies, particularly nanoparticle and liposomal systems, alongside consumer skepticism regarding highly processed or 'engineered' food ingredients. Opportunities abound in expanding applications into new functional categories, such as pet nutrition and specialized medical foods, and in developing environmentally sustainable, biodegradable wall materials to meet increasing corporate social responsibility (CSR) demands.

Impact forces on the market are multifaceted, stemming from both internal industry structure and external consumer trends. Technological advances, particularly in spray drying and fluid bed coating—the dominant encapsulation methods—are continuously lowering production costs and improving encapsulation efficiency, acting as a major positive force. Regulatory scrutiny, particularly concerning the maximum permissible caffeine levels in various consumer product categories (especially for children and adolescents), exerts a constraining force that requires manufacturers to implement highly accurate dosage control, which microencapsulation facilitates. Competitive rivalry remains high, forcing continuous innovation in release profiles and taste-masking capabilities to maintain market positioning.

The overall market trajectory is highly dependent on addressing the economic barrier to entry for small and medium-sized enterprises (SMEs) interested in utilizing complex encapsulation. While drivers like the clean-label trend mandate the exploration of natural encapsulation agents (e.g., starch, proteins), the performance and cost-effectiveness of synthetic polymers often still provide a significant competitive edge. The COVID-19 pandemic acted as a major impact force, globally accelerating consumer focus on immunity and cognitive health supplements, directly increasing the demand for stable, high-efficacy ingredients like microencapsulated caffeine. Successful market navigation requires a strategic balance between minimizing production costs, achieving superior functional benefits, and adhering to evolving global food safety and labeling requirements.

Segmentation Analysis

The segmentation of the Microencapsulated Caffeine Market provides a detailed perspective on application trends, material preferences, and technology adoption rates across various end-use industries. The market is primarily categorized by Type of Encapsulation, Core Material Source, Application, and End-Use. Understanding these segments is crucial for stakeholders to identify optimal investment areas and customize product offerings. The growth rate differential across segments is significant; while spray drying dominates in volume due to cost-efficiency (Technology), complex methods like liposomes are gaining traction rapidly in high-value segments (e.g., premium cosmetics and pharmaceuticals) due to superior controlled-release properties and high encapsulation loads. The increasing sophistication of consumer demands for targeted health outcomes drives the segmentation specificity.

The core material segmentation highlights a dichotomy between synthetic and natural sources. Synthetic caffeine encapsulation offers cost stability and standardized purity, making it suitable for high-volume, price-sensitive applications like soft drinks and energy shots. Conversely, the natural caffeine segment, sourced typically from green coffee beans or guarana extracts, commands a premium and appeals directly to the clean-label and natural supplement market, especially in Europe and North America where consumers prioritize ingredient traceability and perceived healthiness. As sustainability becomes a core focus, innovation in encapsulating agents (wall materials) within the Type segment is critical, moving towards biocompatible and biodegradable options like modified starches and cyclodextrins.

Application-wise, the sports nutrition category is the engine of growth, recognizing the clear benefit of sustained energy delivery crucial for endurance athletes. However, the pharmaceutical application, though smaller in volume, holds immense value due to the strict regulatory requirements and high efficiency demanded for drug delivery mechanisms. This segment drives innovation in achieving precise burst release or zero-order kinetics release profiles. The interplay between these segments demonstrates the versatility of microencapsulation technology, transitioning it from a mere taste-masking solution to an essential functional tool for enhancing ingredient performance and stability across diverse industrial landscapes.

- By Type:

- Liposomes

- Microspheres

- Nanoparticles

- Others (e.g., Coacervates, Inclusion Complexes)

- By Core Material:

- Instant Caffeine

- Natural Caffeine Extracts

- Synthetic Caffeine

- By Application:

- Food & Beverages (Energy Drinks, Functional Foods, Confectionery)

- Pharmaceuticals

- Personal Care & Cosmetics

- Sports Nutrition

- By End-Use:

- Nutraceuticals

- Functional Beverage Manufacturers

- Pharmaceutical Companies

- Cosmetic Formulators

- By Technology:

- Spray Drying

- Fluid Bed Coating

- Coacervation

- Extrusion

Value Chain Analysis For Microencapsulated Caffeine Market

The value chain for microencapsulated caffeine begins with upstream activities involving the sourcing and processing of raw materials. This includes the procurement of the core material (caffeine, either synthetic or natural) and the specialized wall materials (polymers, lipids, hydrocolloids, and stabilizers). Key players in this stage are large chemical manufacturers, specialty ingredient producers, and botanical extractors. Efficiency in this upstream phase is critical, as the cost and purity of both caffeine and the encapsulating agent significantly impact the final product price and encapsulation efficiency. Establishing reliable, long-term supply agreements for high-grade polymers, such as modified starches or complex proteins, is a competitive advantage, especially when dealing with proprietary encapsulation technologies that rely on specific material properties.

Midstream processing involves the core transformation, where specialized encapsulation technologies (e.g., spray drying, coacervation, or liposomal preparation) are executed. This stage requires significant capital investment in machinery, technical expertise, and quality control infrastructure to ensure uniform particle size and integrity of the capsule wall. Companies operating here often hold proprietary intellectual property related to the technology itself. Distribution channels then handle the logistics of moving the microencapsulated powder or liquid dispersion to end-use manufacturers. Direct distribution, where the ingredient producer supplies large food or pharma companies directly, is common for tailored, high-volume orders. Indirect channels utilize specialized ingredient distributors and brokers who manage smaller volumes and geographical dispersion, providing market access to SMEs.

The downstream segment encompasses the final formulation and manufacturing processes undertaken by end-users—such as functional beverage companies, nutraceutical supplement producers, and cosmetic firms. The quality of the microencapsulated caffeine directly influences the stability and shelf life of the final consumer product. End-users evaluate suppliers based not only on cost but crucially on the ingredient's performance (e.g., specific release profile, thermal stability during processing). Ultimately, the value captured in the chain is highest in the midstream and downstream segments, where technological differentiation and successful integration into consumer products create significant margin opportunities, leading to strong pressure for continuous innovation in ingredient functionality.

Microencapsulated Caffeine Market Potential Customers

The primary potential customers and buyers of microencapsulated caffeine are large-scale manufacturers operating within the fast-moving consumer goods (FMCG), pharmaceutical, and specialized healthcare sectors. The largest customer segment encompasses functional beverage and energy drink companies that require stable, tasteless, and high-efficacy caffeine doses to differentiate their products in a saturated market. These companies leverage the controlled-release properties to market products offering sustained energy, minimizing the typical caffeine "crash" and improving the consumer experience. Their purchasing decisions are driven by cost-in-use, regulatory compliance of the wall material, and the ability of the supplier to handle bulk volumes with consistent quality.

Another major segment consists of nutraceutical and dietary supplement manufacturers focused on performance enhancement, cognitive support, and weight management products. These buyers seek encapsulated forms to improve the bioavailability of caffeine and combine it effectively with other sensitive ingredients (vitamins, minerals) without degradation. For nutraceuticals, the potential to combine different release profiles in a single capsule (e.g., combining immediate-release caffeine with sustained-release for dual benefits) is a significant purchasing factor. The pharmaceutical industry constitutes a smaller but highly lucrative customer base, requiring microencapsulation for precise dose management in prescription and over-the-counter drugs targeting alertness, pain relief, or specialized delivery systems, demanding the highest standards of purity and stability documentation.

The Personal Care and Cosmetics industry represents an emerging customer base, integrating microencapsulated caffeine into topical formulations, such as anti-cellulite creams, eye serums, and hair care products. Encapsulation ensures the caffeine remains stable and active until applied and facilitates deep penetration into the skin layers for localized effects. Furthermore, specialized food manufacturers, including those producing performance-enhancing confectionery (gummies, chewable forms) and specialized military rations, are crucial buyers. These diverse end-users emphasize that suppliers must offer flexibility in encapsulation methods and wall material composition to meet varied product matrices and processing requirements, thereby driving customization within the ingredient supply sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 805 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Balchem Corporation, Royal FrieslandCampina N.V., Givaudan SA, Symrise AG, DSM-Firmenich, Encapsys, LLC, Aveka Inc., Coating Place, Inc., BASF SE, Croda International Plc, Sensient Technologies Corporation, International Flavors & Fragrances (IFF), Lycored, Vitabrid C12, Capsulae, Blue California, Rahn AG, Stepan Company, Vantage Specialty Chemicals, Kemin Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microencapsulated Caffeine Market Key Technology Landscape

The technological landscape of the microencapsulated caffeine market is characterized by a blend of established, cost-effective techniques and emerging, high-precision methods. Spray drying remains the most widely adopted technology globally due to its scalability, low operating cost, and proven efficacy in taste masking for large-volume applications like energy drink powders. However, spray drying often results in larger particle sizes and a less precise release profile, limiting its use in applications requiring highly controlled kinetics or ultra-fine particles. Fluidized bed coating is the second dominant method, offering better control over wall thickness and higher encapsulation efficiency, making it preferred for functional food ingredients where precise dosage stability is crucial during cooking or high-temperature processing.

Advanced technologies, particularly coacervation (simple and complex) and liposomal encapsulation, represent the leading edge of innovation. Coacervation allows for the creation of robust, multi-layered capsules with highly concentrated core loads and is favored for pharmaceutical applications requiring specific pH-triggered release in the gastrointestinal tract. Liposomal and nano-encapsulation techniques are specifically deployed for high-value segments like cosmetics and premium nutraceuticals. These methods produce particles in the nano-range, significantly enhancing bioavailability and ensuring maximum stability for sensitive, highly concentrated caffeine extracts, offering superior dermal penetration and systemic absorption compared to traditional microparticles.

Current research and development efforts are focused on improving encapsulation materials to align with sustainability goals and clean-label trends. This involves developing advanced bio-polymers and natural hydrocolloids that can replace synthetic materials without compromising performance characteristics like stability and shelf life. Furthermore, continuous process optimization utilizing AI and automation is transforming production facilities. These technological advancements aim to reduce particle size variability, increase core load, and decrease manufacturing time, driving down the overall cost of high-quality encapsulated caffeine and expanding its potential for integration into previously inaccessible low-viscosity liquid formulations and complex food matrices.

Regional Highlights

Geographically, the microencapsulated caffeine market exhibits differential growth rates and technology adoption based on consumer maturity, regulatory frameworks, and lifestyle trends across major regions. North America holds the largest market share, predominantly driven by the pervasive culture of sports and performance nutrition, high consumption rates of energy drinks, and the presence of major functional ingredient developers. The region benefits from early adoption of advanced encapsulation technologies, focusing heavily on sustained-release formulations that cater to fitness enthusiasts and the demanding professional workforce. The emphasis here is on transparency and natural sourcing, prompting manufacturers to prioritize natural caffeine extracts and clean-label wall materials.

Europe represents the second-largest market, characterized by stringent regulations governing food supplements and an advanced pharmaceutical sector. The demand is particularly strong in Western European countries for premium, functional food products and nutraceuticals focusing on cognitive health and weight management. European consumers place a high value on sustainable sourcing and certified organic ingredients, leading to robust R&D investment in biodegradable and novel plant-derived encapsulating agents. The regulatory environment, particularly the European Food Safety Authority (EFSA) mandates on novel foods and maximum caffeine dosage, shapes the product offerings and technological requirements of suppliers operating within the EU.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This exponential growth is underpinned by rising disposable incomes, shifting dietary habits towards Western-style functional foods, and the massive, youthful population demanding enhanced energy solutions. Countries such as China, Japan, and Australia are key contributors. While cost-effective spray drying is prevalent for mass-market food applications in emerging APAC economies, sophisticated markets like Japan and South Korea demonstrate rapid adoption of nano-encapsulation for advanced cosmetic and high-efficacy health supplements. Local manufacturers are rapidly integrating microencapsulation to mask bitter flavors in traditional functional beverages and instant food products.

- North America: Market leader driven by sports nutrition and high demand for sustained-release formulations. Strong focus on clean label and natural extracts.

- Europe: Second-largest market, characterized by strict regulatory compliance (EFSA) and high adoption in the pharmaceutical and premium nutraceutical segments.

- Asia Pacific (APAC): Fastest-growing region, fueled by urbanization, rising disposable income, and increasing consumer awareness of functional ingredients, with significant growth in beverages.

- Latin America (LATAM): Emerging market showing steady growth, primarily focused on basic microencapsulation for energy drinks and dietary supplements.

- Middle East and Africa (MEA): Niche market with increasing adoption in urban centers for functional dairy and specialized sports supplements, driven by health consciousness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microencapsulated Caffeine Market.- Balchem Corporation

- Royal FrieslandCampina N.V.

- Givaudan SA

- Symrise AG

- DSM-Firmenich

- Encapsys, LLC

- Aveka Inc.

- Coating Place, Inc.

- BASF SE

- Croda International Plc

- Sensient Technologies Corporation

- International Flavors & Fragrances (IFF)

- Lycored

- Vitabrid C12

- Capsulae

- Blue California

- Rahn AG

- Stepan Company

- Vantage Specialty Chemicals

- Kemin Industries

Frequently Asked Questions

Analyze common user questions about the Microencapsulated Caffeine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is microencapsulated caffeine and how does it benefit consumers?

Microencapsulated caffeine is caffeine protected within a tiny shell material, offering enhanced ingredient stability, effective taste masking, and crucial controlled or sustained release. This formulation minimizes the rapid energy spike and subsequent crash typical of regular caffeine, providing prolonged alertness and improved user experience, especially in energy drinks and supplements.

Which application segment drives the highest demand for microencapsulated caffeine?

The Food & Beverages segment, specifically the Sports Nutrition and Functional Beverages sub-segments, represents the highest volume demand. These industries leverage microencapsulation to meet consumer needs for sustained performance, high efficacy, and the ability to combine caffeine with other sensitive ingredients without chemical degradation or sensory conflicts.

What are the primary technological challenges facing the market?

Key technological challenges include scaling up advanced techniques like nanoparticle and liposomal encapsulation economically, ensuring the use of cost-effective and clean-label wall materials, and consistently achieving precise, customizable release profiles (e.g., pH or temperature-triggered) across high-volume production batches.

How does the cost of microencapsulated caffeine compare to standard caffeine?

Microencapsulated caffeine is generally sold at a significant premium compared to standard, bulk powdered caffeine due to the added costs associated with specialized raw wall materials, complex processing equipment, high energy consumption during encapsulation (e.g., spray drying), and rigorous quality control required to ensure capsule integrity and release kinetics.

Which region shows the highest growth potential for microencapsulated caffeine adoption?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This growth is driven by rapidly expanding consumer bases for functional health products, increasing disposable incomes, and the strong adoption of microencapsulation technology by local food and beverage manufacturers seeking product differentiation and enhanced stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager