Microencapsulated Feed Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436299 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Microencapsulated Feed Additives Market Size

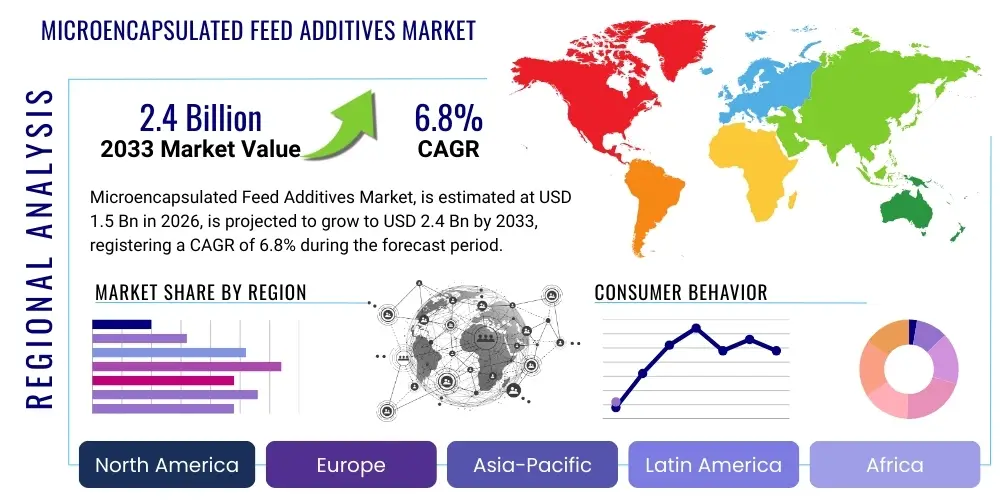

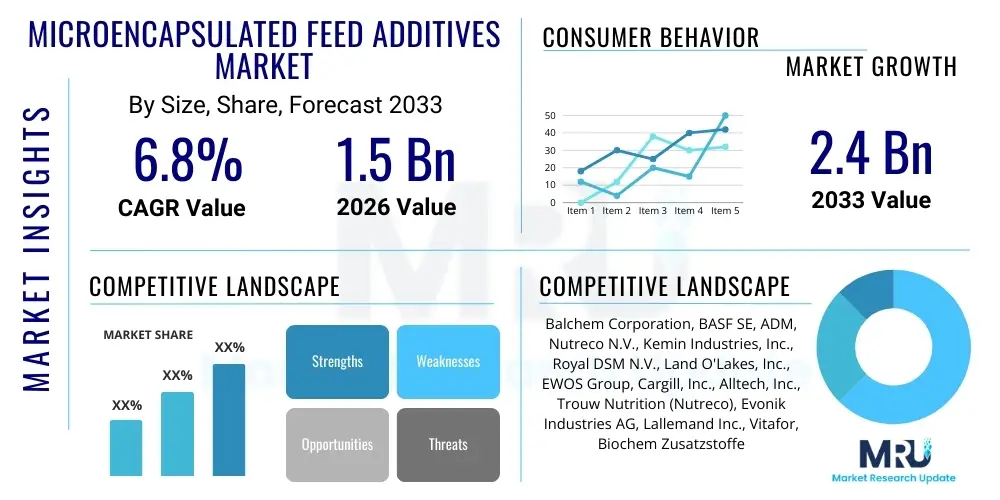

The Microencapsulated Feed Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Microencapsulated Feed Additives Market introduction

The Microencapsulated Feed Additives (MFA) market encompasses specialized techniques designed to enclose active feed ingredients within a protective wall material. This advanced delivery mechanism is employed primarily to shield sensitive compounds, such as vitamins, essential amino acids, enzymes, and organic acids, from degradation caused by heat, moisture, oxidation, or pH variations encountered during feed processing, storage, and passage through the animal's upper digestive tract. The core objective of microencapsulation is to enhance the stability, bioavailability, and targeted release of these additives, ensuring maximum efficacy at the precise site of absorption, typically the intestine. This technological advancement is crucial for optimizing animal health, improving feed conversion ratios (FCR), and supporting sustainable livestock production by reducing nutrient waste.

Major applications of microencapsulated feed additives span across key livestock sectors, including poultry, swine, ruminants (dairy and beef cattle), and aquaculture. In poultry and swine, MFAs ensure the delivery of high-value vitamins and organic acids that support gut health and immunity, counteracting high-stress environments typical of intensive farming. For ruminants, microencapsulation is particularly vital for protecting nutrients, like specific amino acids or bypass fats, from ruminal degradation, allowing them to reach the abomasum and small intestine where they can be absorbed efficiently, thereby improving milk yield and reproductive performance. The benefits derived include improved animal performance, enhanced welfare, and significant economic returns for producers through optimized feed utilization and reduced reliance on prophylactic antibiotics.

Driving factors for the substantial growth of this market include the global increasing demand for high-quality animal protein, compelling producers to improve FCR and reduce production costs. Furthermore, the rising awareness and stringent global regulations pertaining to antibiotic usage in livestock necessitate the adoption of effective, non-antibiotic growth promoters and health enhancers, placing microencapsulated functional ingredients—such as probiotics and organic acids—at the forefront of innovative nutritional strategies. The continuous evolution of encapsulation technologies, particularly those offering improved thermal stability and controlled-release profiles, further accelerates market adoption across various complex feed formulations.

Microencapsulated Feed Additives Market Executive Summary

The Microencapsulated Feed Additives Market is experiencing robust growth fueled by technological innovation aimed at precision nutrition and enhanced livestock performance. Business trends indicate a strong focus on strategic mergers and acquisitions among large chemical and nutrition companies to integrate encapsulation expertise and broaden product portfolios tailored for specific animal nutritional needs, particularly in aquaculture and high-production dairy segments. Investment is heavily directed towards developing second and third-generation encapsulation matrices, such as polymer-lipid hybrid systems, which offer superior resistance to pelleting temperatures and gastric acids. The primary market driver remains the global imperative to phase out antibiotic growth promoters (AGPs), shifting demand towards encapsulated functional ingredients like organic acids and essential oils that support gut health naturally. Furthermore, sustainability goals are influencing purchasing decisions, favoring products that minimize nutrient excretion and improve overall feed efficiency.

Regionally, the Asia Pacific (APAC) market is poised for the highest growth rate, driven by the massive scale of livestock farming, particularly in China and Southeast Asia, coupled with rapid urbanization and increasing consumer demand for premium meat products. Europe, characterized by stringent feed safety regulations and a long-standing commitment to animal welfare, represents a mature market focusing on high-value, precise nutritional delivery systems. North America continues to be a leader in technological adoption, driven by large commercial operations seeking incremental gains in efficiency and profitability through advanced feed technologies. Latin America shows significant potential, especially in Brazil and Argentina, owing to their vast beef and poultry export markets, necessitating sophisticated feed solutions to maintain global competitiveness and adherence to international quality standards.

Segment trends highlight the dominance of encapsulated Vitamins and Amino Acids, crucial for growth and metabolism, followed closely by Organic Acids, which are vital for gut microbial balance and pathogen control. The Poultry segment remains the largest consumer due to the rapid growth cycle and high FCR requirements, while the Aquaculture segment is projected to exhibit the fastest growth, primarily due to the unique challenges of nutrient leaching and instability in water-based feeding environments, making encapsulation an indispensable technology. Coating material preference is gradually shifting from basic lipids to complex polymeric materials, which offer superior durability and customized release kinetics necessary for highly demanding applications, ensuring the additive reaches the intended site of action with maximum potency.

AI Impact Analysis on Microencapsulated Feed Additives Market

User queries regarding AI’s impact on the Microencapsulated Feed Additives Market frequently center on how machine learning can optimize encapsulation processes, predict ingredient stability, and customize feed formulations based on real-time animal health data. Users are keen to understand if AI can automate quality control for coating uniformity, thereby reducing manufacturing costs and improving product consistency. A significant theme is the role of predictive analytics in determining the optimal release profile of microencapsulated ingredients required by different animal cohorts, potentially moving beyond standardized products towards hyper-personalized nutrition programs. Concerns often relate to the data privacy implications associated with collecting vast amounts of animal performance and physiological data, and the initial high capital investment required to integrate sophisticated AI platforms within existing feed manufacturing infrastructure.

The application of Artificial Intelligence is fundamentally reshaping the research, development, and manufacturing efficiency within the MFA sector. AI-driven models can rapidly analyze complex interactions between core materials, coating agents, and processing parameters (like temperature, pressure, and solvent use) to determine the most stable and effective encapsulation methodology for novel feed ingredients. This capability drastically reduces the time and cost associated with traditional trial-and-error R&D cycles. Furthermore, integrating AI with robotic sorting and quality inspection systems allows for continuous, high-precision monitoring of particle size distribution and coating integrity during high-throughput production, guaranteeing batch uniformity and minimizing product failure rates, which is crucial for maintaining bioavailability claims.

From an end-user perspective, AI facilitates the strategic implementation of MFAs through precision livestock farming (PLF). By leveraging data from sensors, cameras, and biometric devices, AI algorithms can accurately calculate the individual or group nutritional requirements of livestock, identifying specific health stressors or performance deficits. This intelligence then dictates the precise inclusion rate and type of encapsulated additive required. For example, in a high-stress scenario, AI might recommend an immediate increase in encapsulated Vitamin C or specialized organic acids. This transition from blanket feeding strategies to real-time, personalized nutritional intervention maximizes the return on investment for expensive microencapsulated products and significantly enhances animal welfare outcomes, further validating the premium cost associated with these advanced feed solutions.

- AI optimizes manufacturing processes by simulating and identifying ideal processing parameters (e.g., spray drying nozzle size, temperature curves) for maximal encapsulation efficiency and yield.

- Machine learning algorithms predict the shelf life and stability of various encapsulated formulations under different storage and environmental conditions, ensuring product integrity.

- AI-driven precision livestock farming integrates real-time animal data to customize dosage and timing for targeted release of MFAs, maximizing nutrient absorption.

- Predictive maintenance schedules for encapsulation equipment are improved using AI, minimizing downtime and ensuring consistent quality control across production runs.

- Advanced image recognition technology, powered by AI, conducts rapid, non-destructive analysis of microcapsule coating thickness and uniformity during high-speed production.

DRO & Impact Forces Of Microencapsulated Feed Additives Market

The Microencapsulated Feed Additives market momentum is primarily driven by the imperative need for enhanced nutrient utilization and the global transition towards sustainable, antibiotic-free livestock production. Restraints include the inherently high cost associated with advanced encapsulation technologies and the complex regulatory approval processes required across diverse international markets. Significant opportunities arise from the increasing adoption of precision nutrition practices in high-growth segments like aquaculture and dairy, coupled with continuous technological advancements leading to novel, multi-layered encapsulation systems. These factors collectively exert powerful impact forces on market dynamics, compelling feed manufacturers to integrate MFA technology to meet both efficiency demands and ethical consumer expectations globally. The high initial capital investment required for specialized equipment remains a barrier to entry for smaller manufacturers, solidifying the market leadership of established players with extensive R&D capabilities.

Drivers: The fundamental driver is the measurable improvement in feed conversion ratio (FCR) and animal health outcomes achieved through targeted delivery. Conventional feed additives often suffer significant losses due to degradation in the harsh environments of feed processing (high heat pelleting) or the animal’s digestive tract (ruminal breakdown). Microencapsulation overcomes these limitations, ensuring that costly ingredients are delivered intact to the small intestine. Furthermore, increasing consumer demand for high-quality meat and dairy products free from antibiotics and hormones pushes livestock producers to adopt sophisticated nutritional tools, where encapsulated functional additives (such as probiotics and organic acids) serve as effective alternatives to traditional AGPs, complying with stringent European and North American quality standards and enhancing export potential.

Restraints: The primary restraint remains the considerable cost premium associated with microencapsulated products compared to their unencapsulated counterparts. The processes—including spray drying, fluidized bed coating, and coacervation—require specialized equipment, high-grade wall materials (polymers, lipids), and rigorous quality control, translating into higher input costs for feed producers. This cost sensitivity can limit adoption in large, price-competitive commodity markets. Secondly, regulatory hurdles concerning novel wall materials and the classification of certain encapsulated ingredients (e.g., classifying an encapsulated organic acid as a feed additive versus a processing aid) create market fragmentation and necessitate extensive, time-consuming testing and approval procedures, slowing down the commercialization of new, advanced MFA products.

Opportunities: Major opportunities reside in the burgeoning global aquaculture sector, where the critical issues of nutrient leaching and instability in water are perfectly addressed by MFA technology, leading to reduced environmental impact and optimized fish/shrimp nutrition. Another significant area is the rising demand for microencapsulated functional fatty acids (e.g., Omega-3s) in ruminant diets to enhance reproductive efficiency and improve the nutritional profile of dairy products (healthier fats in milk). Technological advancements focusing on pH-sensitive and time-release coatings promise to unlock specialized applications, allowing for sequential release of multiple ingredients along the digestive tract, offering hyper-precise nutritional interventions that were previously impossible, opening pathways into highly specific veterinary and performance enhancement segments.

Segmentation Analysis

The Microencapsulated Feed Additives market is highly diversified, segmented based on the type of additive, the specific livestock species targeted, the coating material used, and the encapsulation technology employed. This complex segmentation reflects the high degree of specialization required to address the distinct physiological and processing challenges inherent in various animal diets. The core market structure highlights a strong interplay between efficacy requirements—demanding precise coating materials for controlled release—and the economic pressures faced by large-scale commercial operations, which influence the selection of cost-effective, high-throughput technologies like spray drying. Understanding these segments is crucial for manufacturers to tailor product development, focusing resources on high-growth applications such as encapsulated organic acids for gut health in poultry and specialized bypass nutrients for high-yielding dairy cows.

The market segments by Type demonstrate the breadth of ingredients that benefit from encapsulation, ranging from essential micronutrients (vitamins, minerals) that require protection against oxidation, to high-potency functional ingredients (enzymes, probiotics) that must survive gastric degradation. In terms of Livestock, Poultry and Swine dominate due to the intensity of production and the widespread use of functional feed ingredients to manage disease pressure in dense populations. However, Ruminants and Aquaculture present the highest value proposition, as encapsulation is often the only viable method to deliver specific nutrients (like specific amino acids or choline) effectively past the foregut or prevent leaching into water, respectively. The evolution within the Technology segment, particularly the shift towards Fluid Bed Coating and Extrusion for high thermal stability, underscores the industry's commitment to overcoming the challenges posed by modern feed milling practices, ensuring product integrity through extreme conditions.

- By Type:

- Vitamins (A, D, E, C, B Complex)

- Minerals (Trace Minerals, Chelated Minerals)

- Amino Acids (Lysine, Methionine, Threonine, Tryptophan)

- Organic Acids (Butyric Acid, Fumaric Acid, Lactic Acid)

- Enzymes (Phytase, Amylase, Protease)

- Probiotics and Prebiotics

- Essential Oils and Flavors

- Fats and Oils (Bypass Fats, Omega-3s)

- By Livestock:

- Poultry (Broilers, Layers, Turkeys)

- Swine (Sows, Piglets, Growers, Finishers)

- Ruminants (Dairy Cattle, Beef Cattle, Sheep)

- Aquaculture (Fish, Shrimp)

- Pets and Equine

- By Coating Material:

- Lipids/Waxes (Palm oil, Stearic acid)

- Polymers (Cellulose derivatives, Alginates, Chitosan)

- Gums and Hydrocolloids (Gelatin, Arabic gum)

- Proteins (Whey protein, Casein)

- By Technology:

- Spray Drying and Chilling

- Fluid Bed Coating

- Extrusion and Co-Extrusion

- Coacervation

- Liposome Entrapment

Value Chain Analysis For Microencapsulated Feed Additives Market

The Microencapsulated Feed Additives value chain begins with the procurement of specialized raw materials, encompassing both the core active ingredients (vitamins, amino acids, organic acids) and the advanced wall materials (lipids, functional polymers, hydrocolloids). Upstream analysis reveals that raw material quality and consistency are critical, as they directly influence the encapsulation yield and the protective integrity of the final product. Key suppliers often include specialized chemical manufacturers and oleochemical companies providing high-purity coating lipids. The value addition intensifies during the core manufacturing phase, where advanced engineering and proprietary technologies (like multi-layer coating or specific fluid bed techniques) are applied to achieve the desired controlled-release profile and stability against thermal and acidic stress. This stage represents the highest barrier to entry due to the required technological expertise and capital investment, making technology licensing and R&D collaboration a common feature.

Downstream, the manufactured MFAs are distributed through specialized channels, targeting different market segments. Direct distribution is common for large, integrated feed mills and major livestock producers, particularly those focused on high-performance nutrition programs, allowing for greater technical support and customization. Indirect distribution utilizes a network of regional feed pre-mixers, specialized distributors, and veterinarian channels, especially for smaller farms or niche applications. The technical sales team plays a crucial role here, educating end-users (farmers and nutritionists) on the benefits, inclusion rates, and economic justification (ROI) of using high-cost encapsulated ingredients over conventional alternatives. This technical expertise is vital because the performance of an MFA is highly dependent on its correct integration into the overall feed formulation and feeding management practices.

The end of the value chain involves the final consumption by livestock, where the product's true value—improved FCR, better health markers, and compliance with ethical standards—is realized. The efficiency of the distribution channel directly impacts product freshness and stability, especially for sensitive additives like probiotics. The shift towards direct engagement between MFA producers and large integrated animal production facilities (e.g., vertical integration in poultry) allows for rapid feedback loops regarding product performance, enabling continuous formulation refinement and faster adaptation to evolving animal health challenges. Supply chain robustness and cold chain management are becoming increasingly important for temperature-sensitive encapsulated products, ensuring product efficacy is maintained from the manufacturing plant to the feed trough.

Microencapsulated Feed Additives Market Potential Customers

The primary customers for Microencapsulated Feed Additives are large-scale commercial feed manufacturers and integrated livestock producers who require high-performance, stable, and cost-effective nutritional solutions for intensive farming environments. These entities prioritize ingredients that offer verifiable improvements in feed efficiency and animal health, justifying the premium price point associated with encapsulation technology. Specifically, integrated poultry and swine operations—which manage high volumes of animals under tight efficiency constraints—are major buyers, using MFAs to reduce disease incidence, optimize protein synthesis (amino acids), and maintain gut integrity (organic acids) without resorting to traditional medication strategies. The objective is maximizing throughput and minimizing mortality while meeting rigorous supply chain standards for quality and safety, making targeted nutrition indispensable.

Another rapidly expanding customer segment includes specialized aquaculture feed producers, particularly those focused on high-value species like salmon, shrimp, and premium fish. For these customers, the primary benefit of MFAs is preventing nutrient leaching in water, which not only ensures that the aquatic animal receives the full nutritional dose but also minimizes environmental pollution from wasted nutrients. Dairy and beef cattle operations, especially those utilizing advanced genetics for high milk production or rapid beef growth, represent another key customer base. For ruminants, the requirement is often bypass nutrition—protecting essential nutrients from breakdown in the rumen—making microencapsulation the technological gateway to improving metabolic efficiency, milk fat composition, and reproductive performance, driving demand for encapsulated amino acids, choline, and specific fatty acids.

Furthermore, the growing market for pet nutrition, particularly premium and therapeutic pet foods, is emerging as a significant potential customer base. Pet food manufacturers utilize microencapsulation to incorporate sensitive ingredients like probiotics, omega-3 fatty acids, or high-potency vitamins to extend shelf life and enhance palatability, which are critical factors in consumer-facing products. Ingredient suppliers and pre-mixers who formulate custom blends for smaller regional feed mills also act as crucial intermediaries and direct customers, relying on the stability and ease of handling provided by the microencapsulated format to ensure the homogeneity and efficacy of their final feed products under various handling conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Balchem Corporation, BASF SE, ADM, Nutreco N.V., Kemin Industries, Inc., Royal DSM N.V., Land O'Lakes, Inc., EWOS Group, Cargill, Inc., Alltech, Inc., Trouw Nutrition (Nutreco), Evonik Industries AG, Lallemand Inc., Vitafor, Biochem Zusatzstoffe Handels- und Produktionsgesellschaft mbH, Vetagro S.p.A., AVA Group, Pancosma SA, Selko Feed Additives, Ferrer HealthTech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microencapsulated Feed Additives Market Key Technology Landscape

The technological landscape of the Microencapsulated Feed Additives market is defined by several core processes, each offering distinct advantages in terms of cost, scalability, and the protective properties conferred to the core material. Spray Drying remains the most widely adopted and cost-effective technique, suitable for thermosensitive ingredients and scalable for high-volume production, although it often provides less protection against high shear forces or gastric acidity compared to advanced methods. Fluidized Bed Coating is highly favored for producing larger, uniformly coated particles with multi-layered structures, offering superior control over coating thickness and customizable release profiles, making it essential for bypass nutrients aimed at ruminants and additives requiring maximum thermal stability during feed pelleting. The continuous innovation in this area focuses on optimizing solvent systems and air flow dynamics to achieve enhanced encapsulation efficiency and reduce particle aggregation, which directly impacts homogeneity in the final feed mix.

Beyond traditional methods, Extrusion and Co-extrusion technologies are gaining prominence, particularly for encapsulating fats, oils, and highly sensitive probiotics. These methods offer superior physical protection and high resistance to oxidation by creating dense matrices that fully embed the active material. Extrusion provides a thermoplastic matrix that is highly resistant to heat and moisture, suitable for producing stable functional feed pellets or large granular additives. Furthermore, advanced techniques such as Coacervation and Liposome Entrapment represent the cutting edge, offering ultra-fine particle sizes and highly precise, pH-dependent release mechanisms. While these are currently higher cost, they are critical for niche, high-value applications where targeted delivery to the specific segments of the gut is mandatory, for example, delivering medications or specialized microbiota modulators directly to the hindgut.

The future technology landscape is characterized by the development of novel wall materials, moving beyond simple lipids and polymers to include bio-based, biodegradable, and functional materials like modified starches and specific hydrogels. Research is heavily invested in designing intelligent delivery systems—often termed "smart capsules"—that respond dynamically to specific physiological cues within the animal, such as localized enzyme activity or pH shifts. These smart capsules are engineered to release their payload only when the optimal absorption conditions are met, further maximizing bioavailability and minimizing waste. The convergence of material science, nanotechnologies, and process engineering is defining the next generation of MFAs, focusing on reduced particle size for better dispersion, enhanced sensory properties (masking bitter flavors), and significantly lower inclusion rates due to perfected efficacy.

Regional Highlights

Regional dynamics play a critical role in shaping the Microencapsulated Feed Additives Market, influenced by regional livestock production intensity, regulatory environments, consumer preferences, and technological adoption rates.

- Asia Pacific (APAC): Represents the fastest-growing region globally, driven by massive and expanding livestock and aquaculture production in countries like China, India, Vietnam, and Thailand. Rapid industrialization of farming, coupled with rising middle-class income, fuels demand for high-quality meat, necessitating efficiency-enhancing feed technologies. Furthermore, government initiatives aimed at reducing antibiotic resistance and improving food safety standards are accelerating the adoption of encapsulated functional additives like organic acids and probiotics, establishing APAC as the largest consumer of MFAs by volume.

- Europe: Characterized by stringent regulations (e.g., the EU ban on AGPs) and strong consumer emphasis on animal welfare and sustainable farming. This maturity translates into high demand for premium, scientifically validated, microencapsulated solutions for gut health (enzymes, specific amino acids, and essential oils). Europe is a major hub for R&D and sophisticated encapsulation technology, particularly in the dairy sector where bypass nutrients are critical for performance.

- North America: A technologically advanced market driven by large, consolidated commercial livestock operations (cattle, poultry, swine). The focus is heavily on optimizing profitability through maximum feed efficiency and disease prevention. High labor costs and the scale of production favor the adoption of high-stability, bulk-friendly encapsulated products that simplify feed mixing and storage, making it a key early adopter of AI-driven precision nutrition using MFAs.

- Latin America (LAMEA): Showing significant potential, spearheaded by major agricultural exporters like Brazil and Argentina. Demand is rising due to the need to meet international quality standards for export markets (especially EU and North America) and increasing pressure to manage endemic animal diseases in tropical climates. Encapsulation is crucial for protecting ingredients against adverse climate conditions and supporting large-scale beef and poultry industries.

- Middle East and Africa (MEA): Currently a smaller market but projected for steady growth, particularly in Gulf Cooperation Council (GCC) countries focused on improving domestic food security and developing local dairy and aquaculture sectors. MFAs are essential here for protecting sensitive ingredients against extreme heat and humidity during storage and use, offering solutions critical for stable feed quality under challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microencapsulated Feed Additives Market.- Balchem Corporation

- BASF SE

- ADM (Archer Daniels Midland Company)

- Nutreco N.V.

- Kemin Industries, Inc.

- Royal DSM N.V.

- Land O'Lakes, Inc.

- EWOS Group

- Cargill, Inc.

- Alltech, Inc.

- Trouw Nutrition (Nutreco)

- Evonik Industries AG

- Lallemand Inc.

- Vitafor

- Biochem Zusatzstoffe Handels- und Produktionsgesellschaft mbH

- Vetagro S.p.A.

- AVA Group

- Pancosma SA

- Selko Feed Additives

- Ferrer HealthTech

Frequently Asked Questions

Analyze common user questions about the Microencapsulated Feed Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is microencapsulation and why is it essential for animal feed?

Microencapsulation is a process of coating sensitive feed ingredients (like vitamins, amino acids, or organic acids) with a protective wall material (usually lipids or polymers). It is essential because it shields these nutrients from degradation during feed processing (heat/pressure) and digestion (gastric acids), ensuring targeted release and maximal absorption in the animal's lower digestive tract, significantly improving bioavailability and feed efficiency (FCR).

How do microencapsulated feed additives contribute to antibiotic reduction?

MFAs contribute to antibiotic reduction by stabilizing and enhancing the efficacy of functional ingredients, such as encapsulated organic acids, essential oils, and probiotics. These substances effectively promote robust gut health, strengthen immunity, and control pathogen growth, serving as highly effective non-antibiotic alternatives for maintaining animal health and performance in dense farming environments.

Which livestock segment is the largest user of microencapsulated feed additives?

The Poultry segment is currently the largest consumer of microencapsulated feed additives due to the high intensity of production, the short life cycle requiring rapid weight gain, and the critical need for optimizing feed conversion ratios (FCR). However, Aquaculture is projected to show the fastest growth rate due to the unique challenges of preventing nutrient leaching in water.

What are the primary coating materials used in microencapsulation technology?

The primary coating materials include various Lipids and Waxes (e.g., hydrogenated fats, stearic acid) which offer protection against gastric pH and heat, and functional Polymers and Hydrocolloids (e.g., cellulose derivatives, alginates, gelatin) which allow for precise, customizable release profiles based on enzyme activity or specific pH levels in the gut.

What key factors are driving the high growth rate in the Asia Pacific market?

The high growth in APAC is driven by massive expansion and modernization of regional livestock and aquaculture industries, increasing consumer demand for high-quality meat, and stricter regional regulations implemented to curb the use of antibiotic growth promoters, necessitating the adoption of advanced, stable functional ingredients like MFAs for optimized feed management.

This market analysis report details the size and growth projections for the microencapsulated feed additives industry, focusing on CAGR, historical data, and forecast years up to 2033. The comprehensive executive summary synthesizes key business, regional, and segment trends, highlighting the strategic shifts towards precision nutrition and antibiotic-free solutions. Detailed segmentation analysis covers various types of additives, including vitamins, amino acids, organic acids, enzymes, and the main target livestock sectors such as poultry, swine, ruminants, and aquaculture. Technological aspects are thoroughly reviewed, specifically examining spray drying, fluid bed coating, and extrusion methods, emphasizing their role in enhancing bioavailability and thermal stability. The report includes a robust value chain analysis, detailing upstream raw material procurement and downstream distribution channels, and identifies major potential customers including integrated feed manufacturers and specialized aquaculture producers. A specialized section assesses the impact of AI on optimizing encapsulation processes and enabling precision livestock feeding strategies. Regional highlights pinpoint key growth drivers in APAC, Europe, and North America. The document concludes with a comprehensive list of top market players, ensuring competitive intelligence, and AEO-optimized frequently asked questions covering key technical and commercial aspects of microencapsulation technology in animal nutrition. The structured HTML format adheres to all specified technical and length requirements for a professional market intelligence deliverable, emphasizing controlled release, gut health, nutrient stability, and feed conversion optimization as central themes in the Microencapsulated Feed Additives Market.

Microencapsulation technology is revolutionizing animal nutrition by addressing the inherent instability of many essential feed ingredients. By protecting sensitive components from environmental factors and digestive breakdown, manufacturers ensure these valuable nutrients—ranging from high-potency vitamins like Vitamin C and B-complex to specific amino acids like L-Lysine and DL-Methionine—reach the absorption site intact. This targeted delivery mechanism is critical for modern intensive farming systems where maximizing feed efficiency (FCR) is paramount for economic viability and sustainability. The global push against antibiotic resistance further accelerates the adoption of encapsulated functional ingredients, such as short-chain fatty acids (like butyrate) and medium-chain fatty acids (MCFAs), which are crucial for maintaining a healthy gut microbiome and preventing common diseases. The market is witnessing a profound shift toward complex multi-layer coating systems utilizing advanced polymers (e.g., chitosan and modified cellulose) and specialized lipids that offer pH-sensitive or time-dependent release characteristics. This sophistication is particularly vital in the ruminant sector, where the challenge of bypassing ruminal fermentation requires extremely stable coatings to deliver nutrients like choline or essential fatty acids directly to the small intestine. Key market players are heavily investing in R&D to develop novel wall materials that are both cost-effective and highly functional, ensuring the integrity of ingredients through high-temperature pelleting processes. Geographically, Asia Pacific dominates consumption due to the sheer scale of livestock production, especially poultry and swine, coupled with rapidly improving feed quality standards across the region. Europe leads in technological sophistication and regulatory compliance, driving the demand for highly precise, welfare-oriented nutritional solutions. The competitive landscape is characterized by strategic partnerships between technology providers and large feed companies seeking to integrate proprietary encapsulation expertise to gain a competitive edge in offering high-performance, verifiable nutritional products that support sustainable and ethical animal production practices worldwide. The economic viability of these advanced feed solutions relies heavily on demonstrating clear and consistent return on investment (ROI) through measurable improvements in animal health, growth rates, and reduced veterinary costs, solidifying the microencapsulated segment as a critical component of future animal feed formulation.

Further elaborating on the technology landscape, the market increasingly leverages sophisticated analytical tools to characterize the physical and chemical properties of the microcapsules. Techniques such as Scanning Electron Microscopy (SEM) and Laser Diffraction Particle Sizing are routinely used to ensure uniform particle size distribution and optimal coating morphology, which are prerequisites for proper mixing in feed and efficient absorption in the animal. The trend is moving towards nanoencapsulation for specific, high-value trace minerals and specialized essential oils, aiming for ultra-high bioavailability due to increased surface area. While still nascent in large-scale feed production due to regulatory and cost constraints, nanoencapsulation holds immense promise for next-generation nutrient delivery systems. In terms of processing efficiency, manufacturers are exploring continuous manufacturing processes, replacing batch processes to reduce variability and further scale production capacity, particularly for high-demand encapsulated organic acids used in poultry and piglet diets. The interaction between feed milling technology and encapsulation science is critical; encapsulation must guarantee survivability through pelleting temperatures often exceeding 85°C. Thus, technological advancements in wall material cross-linking and multi-layered protection systems are the central focus of innovation, moving beyond simple fat coatings to complex polymer-lipid matrices. Market drivers are strongly connected to global protein consumption patterns, particularly the rising demand for premium protein sources (e.g., aquaculture species). This necessitates feed formulations that maximize growth while minimizing environmental impact, where MFAs play a crucial role in reducing nutrient excretion (phosphorus, nitrogen) through enhanced digestive efficiency, aligning with international sustainability goals. The key challenge remains bridging the cost gap; as production volumes increase and technologies become more accessible through automation and process optimization (often facilitated by AI), the premium cost is expected to stabilize, driving broader adoption even in highly price-sensitive emerging markets.

The strategic focus of market leaders revolves around diversifying their encapsulation portfolio across different ingredient types and targeted species. For instance, companies specializing in human pharmaceutical microencapsulation are adapting their core expertise to the veterinary and animal nutrition domain, accelerating the pace of innovation. Acquisitions are frequently targeted at small, specialized firms holding proprietary encapsulation patents or unique wall material compositions. The competitive advantage is increasingly shifting from simply offering an encapsulated product to providing a verified, performance-based nutritional solution that includes technical support and formulation guidance for maximizing the additive's efficacy. Regulatory compliance, particularly concerning the safety of wall materials and their clearance for use in food-producing animals, remains a significant differentiator and barrier to entry. Major players are investing heavily in clinical trials and robust animal performance studies to validate the consistent ROI associated with their microencapsulated ingredients, moving the purchasing decision beyond price to performance guarantees. Emerging markets are also seeing localized production and adaptation of encapsulation technology to utilize regional raw materials and address specific local livestock challenges, such as heat stress. Overall, the market for microencapsulated feed additives is characterized by high technical complexity, strong growth potential driven by sustainability needs, and intense competition centered on achieving superior bioavailability and manufacturing scalability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager