Microfiber Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431970 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Microfiber Leather Market Size

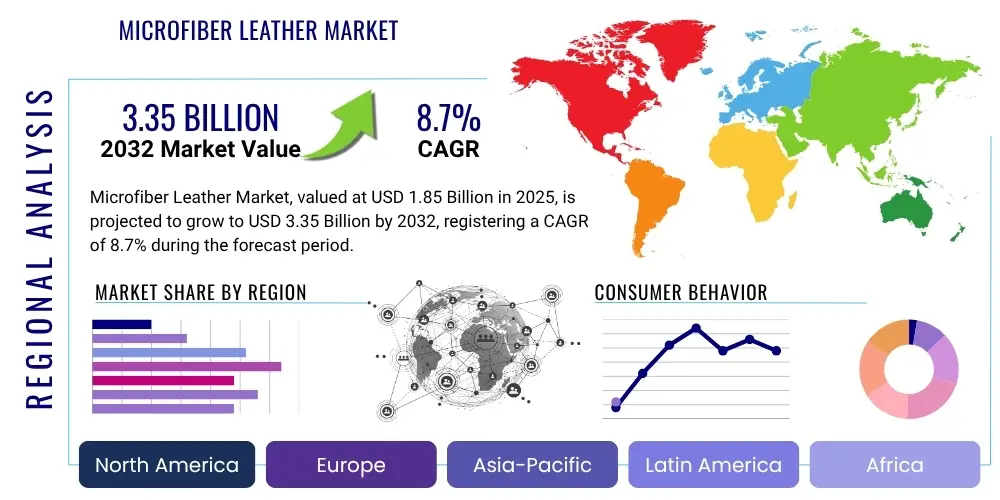

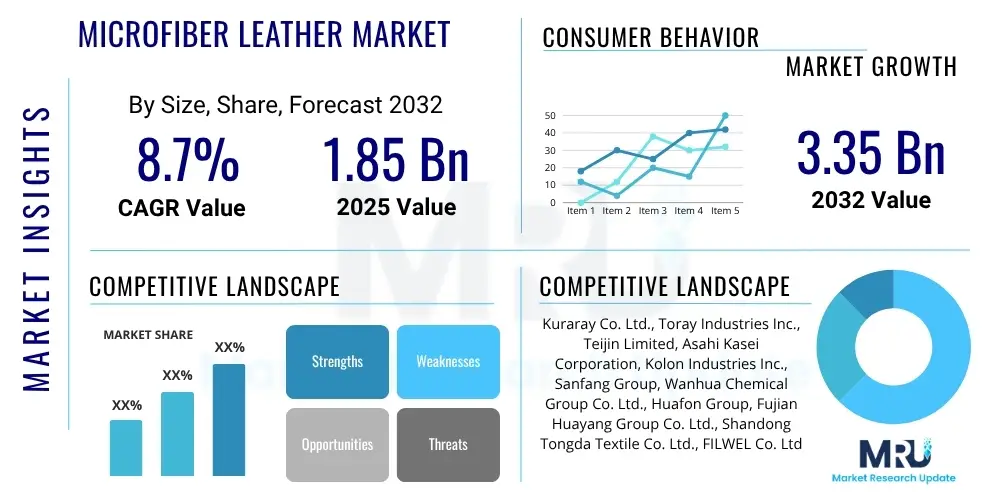

The Microfiber Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by increasing consumer preference for sustainable and high-performance synthetic materials that mimic the aesthetic and tactile qualities of genuine leather without the associated ethical and environmental drawbacks. The expansion of application scope, particularly in the automotive interior and high-end fashion sectors, further validates the market's significant potential for capitalization during the specified forecast period.

Microfiber Leather Market introduction

Microfiber leather, often referred to as synthetic leather or micro-synthetic leather, represents a highly sophisticated form of artificial leather produced using advanced non-woven technology combined with polyurethane resins. This material distinguishes itself from traditional PU or PVC leather substitutes due to its intricate structure, which closely mirrors the fibrous matrix of natural collagen found in dermis. The superior tensile strength, abrasion resistance, breathability, and luxurious feel offered by microfiber leather position it as a premium alternative in various industries. The manufacturing process involves creating a sea-island type superfine fiber bundle structure, enhancing the durability and performance characteristics necessary for demanding applications like automotive upholstery and high-use furniture, thereby catering to the dual demands of quality and longevity in modern consumer goods.

The primary applications of microfiber leather are diverse, spanning footwear, automotive interiors, furniture upholstery, clothing, and various accessories, including bags and wallets. In the footwear industry, it provides excellent water resistance and flexibility, making it ideal for sports shoes and protective boots. For automotive manufacturers, the material offers enhanced safety features, easy maintenance, and weight reduction compared to natural leather, aligning perfectly with modern vehicle design objectives focused on efficiency and aesthetic appeal. Key benefits driving market adoption include its uniform quality, consistent availability, and lower production variability compared to natural hides. Furthermore, the ability to tailor microfiber leather to specific thickness, texture, and color requirements provides designers with unprecedented creative flexibility, fueling its rapid integration into fast-moving consumer goods and durable luxury items alike.

Driving factors for the market expansion are multi-faceted, heavily influenced by global shifts towards ethical sourcing and environmental responsibility. Growing regulatory pressures concerning animal welfare and the high ecological footprint associated with traditional leather tanning processes accelerate the adoption of synthetic alternatives. Additionally, the increasing disposable income in emerging economies, coupled with a rising demand for affordable luxury products, positions microfiber leather as an attractive middle ground offering premium feel at a competitive price point. Technological advancements focused on improving the bio-based content and recyclability of microfiber further solidify its long-term market viability, ensuring that the material meets future sustainability standards while continuously enhancing its performance characteristics to outperform conventional materials in specialized industrial applications.

Microfiber Leather Market Executive Summary

The Microfiber Leather Market is characterized by vigorous growth, primarily fueled by strong business trends focusing on sustainability and product performance upgrades across major end-use industries, particularly automotive and furniture. Key business trends indicate significant investment in R&D aimed at developing solvent-free and bio-based microfiber leather, addressing environmental concerns associated with traditional solvent-based manufacturing. Manufacturers are also consolidating partnerships with major original equipment manufacturers (OEMs) in the automotive sector to secure long-term supply agreements for premium vehicle interiors. The shift towards electrification in the automotive industry further boosts demand, as lighter, durable synthetic materials are preferred to maximize battery efficiency and extend vehicle range, positioning microfiber leather as a critical component in future mobility solutions and driving substantial capital expenditure in advanced production lines.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, driven by massive manufacturing capacities in countries like China, which is both a major producer and consumer. Rapid urbanization and expansion of the domestic automotive and consumer electronics markets in India and Southeast Asia are expected to spur exponential demand in these sub-regions. Conversely, North America and Europe demonstrate mature market demand, characterized by strict quality standards and a strong consumer emphasis on eco-labeling and certified sustainable materials. These regions are focused on premium applications and are driving innovation in recycled content and closed-loop manufacturing processes for synthetic materials, influencing global standard setting for material performance and regulatory compliance, thereby dictating the pace of material innovation globally.

Segmentation trends highlight the dominance of the non-woven cloth substrate segment due to its superior durability and tensile strength, crucial for high-stress applications. The polyurethane (PU) segment, particularly wet process PU, currently holds a majority share, although dry and hot-melt process technologies are gaining traction due to their reduced environmental impact and improved energy efficiency. In terms of application, the automotive industry represents the largest and fastest-growing segment, driven by the shift away from natural leather in new vehicle production. The furniture and upholstery segment also maintains substantial momentum, capitalizing on the material's resilience against wear and tear in commercial and residential settings. These dynamic segment shifts necessitate strategic resource allocation and targeted marketing efforts by market participants to capture evolving pockets of high-value demand efficiently.

AI Impact Analysis on Microfiber Leather Market

User queries regarding the impact of Artificial Intelligence on the Microfiber Leather Market frequently revolve around optimizing production efficiency, enhancing quality control, and customizing material properties. Common themes include how AI can reduce waste during the complex coating and finishing stages, the potential for predictive maintenance in large-scale manufacturing lines, and the use of machine learning algorithms to rapidly match material color and texture specifications to high-end designer requirements. Users are highly interested in the integration of AI-powered vision systems for real-time defect detection, which promises to elevate the consistency of microfiber leather, a critical factor in premium applications like luxury goods and high-specification automotive interiors. Furthermore, there is significant inquiry into how AI can optimize supply chain logistics, particularly managing volatile raw material procurement and complex international distribution networks, ensuring a steady and reliable supply of specialized synthetic fibers and polyurethane resins to global manufacturing hubs.

The core expectation centers on AI's ability to transition microfiber leather manufacturing from a historically batch-process-oriented system to a continuous, self-optimizing operation. AI integration enables sophisticated modeling of molecular interactions during the wet process, allowing manufacturers to precisely control pore structure and fiber entanglement, leading to materials with enhanced breathability and superior tactile feel. This level of precision, unattainable through conventional control systems, allows companies to minimize variance between batches, resulting in lower rejection rates and substantial cost savings. The deployment of generative AI models is also beginning to influence product design, enabling designers to rapidly simulate how different material compositions will perform under various environmental stressors, significantly shortening the development cycle for new product lines such as bio-based or recycled content microfiber leather alternatives, driving innovation at an unprecedented speed.

Concerns often raised relate to the initial capital investment required for implementing AI infrastructure, the necessity for specialized data science expertise within manufacturing teams, and data security challenges related to proprietary processing parameters. However, the long-term competitive advantage offered by AI, especially in predictive quality assurance and yield optimization, outweighs these barriers. The application of machine learning in material science is facilitating the development of next-generation microfiber leather with novel functionalities, such as self-cleaning properties or integrated heating elements, moving the material beyond a mere replacement for natural leather into a category of its own. This predictive, data-driven approach is essential for maintaining market leadership and responding swiftly to dynamic global market demands for sustainable, high-performance synthetic materials, securing the future relevance of the product category.

- AI-driven optimization of raw material blending ratios to achieve precise tactile and strength characteristics.

- Predictive maintenance analytics deployed on high-speed coating and finishing equipment to minimize unexpected downtime and enhance throughput.

- Machine learning algorithms utilized for real-time quality control and automated defect detection in patterned and textured microfiber rolls.

- AI integration in supply chain management for optimizing inventory levels of polyurethane resins and microfibers, mitigating procurement risks.

- Generative AI tools assisting product developers in simulating and designing novel microfiber structures for targeted end-use performance (e.g., enhanced thermal resistance).

- Automated energy management systems utilizing AI to minimize power consumption during high-energy processes like drying and solvent recovery.

DRO & Impact Forces Of Microfiber Leather Market

The Microfiber Leather Market is navigating a complex landscape defined by strong demand drivers rooted in sustainability and performance, balanced against significant regulatory and competitive restraints. The primary driver is the increasing global emphasis on ethical consumption and animal welfare, which positions microfiber leather as a morally superior substitute to natural leather. Performance superiority, including greater durability, consistent quality, and enhanced resistance to hydrolysis and UV exposure compared to cheaper synthetic leathers, further accelerates adoption across premium sectors. The growing demand from the electric vehicle (EV) sector, where weight reduction is crucial for battery range, strongly favors microfiber leather over heavier natural hides. These powerful internal dynamics are augmented by technological improvements that continuously lower the material’s production cost and improve its environmental profile, making it a compelling choice for mass-market penetration and high-end niche applications simultaneously, creating a positive feedback loop for market growth.

Restraints primarily involve the high initial manufacturing cost compared to standard PU or PVC synthetic leather, which limits its adoption in extreme budget segments. Regulatory scrutiny concerning the use of certain chemicals, particularly DMF (Dimethylformamide) used in some wet-process microfiber production, poses a significant hurdle, driving manufacturers towards investing heavily in more expensive, solvent-free technologies (like the aqueous process). Furthermore, the market faces strong competition from other advanced material substitutes, including bio-based leathers derived from mushroom mycelium or fruit waste, which appeal strongly to the deeply conscious consumer segment. These competing materials, while currently smaller in scale, represent a long-term threat requiring continuous R&D investment to maintain the competitive edge of polyurethane-based microfiber structures against novel bio-engineered alternatives.

Opportunities for market growth lie in the rapid expansion of the luxury goods segment globally, particularly in Asian markets, where demand for durable, non-animal-based high-end materials is soaring. Manufacturers can capitalize on this by marketing microfiber leather not merely as a substitute but as a performance-enhanced material capable of achieving textures and finishes impossible with natural hides. Another significant opportunity is the development and commercialization of fully circular microfiber leather solutions, utilizing recycled synthetic fibers and biodegradable or bio-derived polymers. Impact forces influencing the market structure include the increasing stringency of global chemical regulations (such as REACH in Europe), which pressures non-compliant producers, and fluctuating raw material prices, particularly for petrochemical-derived PU resins, necessitating robust supply chain risk mitigation strategies. The collective force of these drivers and opportunities substantially outweighs the restraining factors, leading to the projected strong CAGR through the forecast period, cementing microfiber leather's position as a future-proof material in material science innovation.

Segmentation Analysis

The Microfiber Leather Market segmentation provides a granular view of demand distribution based on composition, manufacturing process, and end-use application, enabling stakeholders to focus strategic efforts. The material composition segmentation differentiates between the primary structural components, mainly focusing on the type of polymer used for coating and saturation, which dictates the material's final physical and chemical properties. Process segmentation is crucial as it directly impacts both the material's performance and its environmental footprint, with the shift towards eco-friendly methods gaining significant market share. Application analysis reveals the most lucrative growth areas, showing a clear dominance of consumer-facing industries requiring high durability and aesthetic versatility, allowing for targeted product development tailored to industry-specific requirements and performance benchmarks.

Further analysis within the end-use applications reveals nuanced requirements across various sectors. The footwear segment demands high flexibility and breathability, particularly for athletic and casual shoes, driving demand for thinner, softer microfiber types. Conversely, the automotive segment requires exceptional resistance to UV light, high temperatures, and abrasion, favoring thicker, chemically resistant formulations to withstand the harsh conditions of vehicle interiors over extended lifecycles. The furniture and interior design sector values the material's easy maintenance and resistance to staining, positioning it as a highly functional and durable option for both commercial and residential upholstery. Understanding these unique demands allows manufacturers to fine-tune production parameters, ensuring optimal product-market fit and maximizing revenue generation across diverse consumption channels.

Technological segmentation, particularly the evolution from traditional solvent-based wet processes to more sustainable dry and solvent-free production techniques, is rapidly altering the competitive landscape. While the wet process offers certain performance advantages in terms of creating highly porous structures, the dry process minimizes volatile organic compound (VOC) emissions, aligning with modern industrial environmental compliance mandates. Companies investing heavily in solvent-free methods are strategically positioning themselves as leaders in sustainability, appealing to environmentally conscious brands and governments enforcing stringent eco-standards. This segmentation dynamic is not merely technical but represents a fundamental shift in market values, prioritizing long-term environmental sustainability alongside immediate material performance metrics, necessitating continuous innovation in polymerization and coating technologies.

- By Type:

- Polyurethane (PU) Microfiber Leather

- Nylon Microfiber Leather

- Polyester Microfiber Leather

- By Production Process:

- Wet Process (Solvent-based)

- Dry Process (Solvent-free/Hot-melt)

- Aqueous Process

- By Application:

- Automotive Interiors

- Footwear (Shoes, Boots)

- Furniture & Upholstery

- Bags & Luggage

- Apparel & Accessories

- Others (Sports Goods, Electronics Cases)

- By End-User Industry:

- Automotive

- Consumer Goods

- Construction & Interior Design

- Textile & Apparel

Value Chain Analysis For Microfiber Leather Market

The value chain of the Microfiber Leather Market is initiated at the upstream phase, characterized by the procurement and production of specialized raw materials. This includes the synthesis of ultra-fine synthetic fibers, typically polyester or polyamide (nylon), which form the core structure, and the production of high-grade polyurethane resins, which are essential for coating and binding. Key upstream participants are large chemical companies and synthetic fiber manufacturers whose technological capabilities determine the quality and cost structure of the final product. Optimization in this stage, particularly through vertically integrated operations or strategic long-term supply agreements, is crucial for maintaining competitive pricing and ensuring consistent quality, given the specialized nature and high purity requirements of these chemical inputs, which are subject to global petrochemical market fluctuations and complex regulatory compliance standards.

The core manufacturing and processing phase involves complex, multi-stage production techniques, including non-woven mat formation, chemical coagulation (in the wet process), surface grinding, dyeing, and specialized finishing treatments (like embossing or perforation) to mimic natural leather textures. This middle segment of the value chain is highly capital-intensive, requiring advanced machinery and proprietary technology. Distribution channels vary significantly based on the end-use application. Direct distribution is common for large-volume purchasers such as major automotive OEMs or global furniture manufacturers, enabling rigorous quality checks and customized supply arrangements. Indirect channels, involving distributors, agents, and wholesalers, are utilized for penetrating fragmented markets like small-scale fashion accessories or regional footwear manufacturers, providing necessary logistical support and inventory management services across dispersed geographical areas.

The downstream segment focuses on the integration of microfiber leather into final consumer products. This involves cutting, sewing, and assembly by end-product manufacturers in sectors ranging from luxury vehicle seating to mass-market handbags. The final value captured depends heavily on brand perception, design innovation, and market positioning. For instance, high-end automotive brands utilize microfiber leather to enhance luxury and performance narratives, justifying premium pricing. The efficiency of the entire value chain is increasingly reliant on digitalization and traceability systems to assure consumers of the material’s ethical and environmental sourcing, especially concerning solvent usage and waste management. Continuous coordination between polymer suppliers, microfiber producers, and application manufacturers is vital to rapidly adapt to changing aesthetic trends and strict industry performance requirements globally.

Microfiber Leather Market Potential Customers

The primary potential customers and end-users of microfiber leather span several large industrial sectors that prioritize durability, aesthetic appeal, and increasingly, sustainability. Automotive manufacturers constitute the largest and most valuable customer segment, utilizing microfiber leather extensively for seating upholstery, steering wheel covers, door panels, and headliners. The rigorous performance specifications required in the automotive industry—including flame retardancy, exceptional lightfastness, and resistance to temperature extremes—make advanced microfiber leather formulations an ideal choice. The transition to electric vehicles (EVs) further solidifies this segment's importance, as materials that reduce cabin weight while maintaining a luxurious feel are highly sought after to optimize vehicle performance metrics and battery range, driving large-scale, consistent procurement contracts.

The second major customer group resides in the footwear and apparel industries. Footwear manufacturers, particularly those focusing on high-performance athletic shoes, safety boots, and quality casual wear, leverage microfiber leather for its flexibility, water resistance, and consistent thickness, which aids in automated manufacturing processes. Within the apparel sector, the material is increasingly used in outerwear and accessories like belts and gloves, appealing to brands committed to offering animal-free products without compromising on the perceived quality or texture. These customers value the material's ability to be easily cleaned and its longevity, offering consumers a durable alternative that withstands frequent use and varying environmental conditions, contributing positively to product lifecycles and reducing material turnover.

Another rapidly expanding customer base includes furniture and interior design companies involved in both residential and commercial projects. Microfiber leather upholstery is highly favored in hospitality, healthcare, and corporate environments due to its exceptional resistance to spills, easy sanitization, and superior resilience against physical abrasion compared to many traditional fabric or synthetic options. The ability of the material to maintain its aesthetic integrity over years of heavy use makes it a cost-effective, long-term solution for high-traffic environments. These diverse customer profiles, ranging from high-volume automotive assembly lines to specialized luxury goods producers, underscore the material's versatility and its successful positioning across different price points and functional requirements within the global manufacturing ecosystem, ensuring broad market acceptance and continuous demand generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kuraray Co., Ltd., Toray Industries, Inc., Asahi Kasei Corporation, Kolon Industries, Sanfang, Wenzhou Huanghe Dinema Co., Ltd., Huafon Group, Teijin Limited, Clarino (Kura-Seiren), Zhejiang Hexin Holdings, FILWEL Co., Ltd., Double Elephant, Guangzhou Ruigou Leather Co., Ltd., Meida Group, Zhejiang Hongfa Synthetic Leather Co., Ltd., Shandong Jinfeng Microfiber Co., Ltd., Yantai Huide Synthetic Leather Co., Ltd., Fujian Polytech Co., Ltd., Anhui Anli Material Technology Co., Ltd., Sanling Microfiber. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microfiber Leather Market Key Technology Landscape

The technological landscape of the Microfiber Leather Market is defined by continuous innovation aimed at enhancing material performance, reducing environmental footprint, and improving manufacturing efficiency. The foundational technology involves the use of sea-island fiber spinning techniques to create incredibly fine, high-density non-woven base fabrics. This allows for superior consistency and strength compared to conventional fabrics. Significant technological advances are focused on the surface coating and impregnation phases, specifically moving away from Dimethylformamide (DMF)-based wet coagulation systems to aqueous-based and dry-process technologies. Aqueous polyurethane dispersion (PUD) technology is emerging as a critical differentiator, significantly reducing VOC emissions and solvent usage, which is paramount for compliance with strict environmental regulations like those in Europe and North America, positioning firms mastering this technology for market advantage.

Another major technological focus area is surface finishing and texture replication. Advanced embossing and engraving technologies, often utilizing laser precision and high-pressure rolling, allow manufacturers to replicate the complex grain patterns and tactile feel of exotic leathers with remarkable fidelity. Furthermore, functionalization technologies are gaining traction, including the integration of UV stabilizers, anti-microbial treatments, and enhanced fire retardants directly into the polyurethane matrix, enabling the material to meet specialized requirements for aviation, marine, and healthcare applications. These technological improvements are crucial as microfiber leather is increasingly competing not just on price, but on superior engineered performance and ethical sourcing credentials, demanding constant refinement of chemical formulations and process control mechanisms to ensure batch-to-batch consistency and high consumer satisfaction.

The industry is also witnessing strong R&D activity in developing bio-based microfiber leather, substituting traditional petrochemical-derived polyurethane with renewable biopolymers sourced from corn, soy, or other plant materials. This shift represents a long-term strategy to achieve carbon neutrality and appeal to the growing segment of customers demanding fully sustainable materials. Automation and Industry 4.0 principles are being applied to production lines, incorporating sophisticated sensors and AI-driven process controls to optimize parameters such as drying time, coating thickness, and curing temperature, minimizing energy consumption and maximizing yield. These technological investments create a high barrier to entry for new players and solidify the competitive edge of established manufacturers who can afford and effectively manage these complex, high-precision manufacturing systems, driving the evolution of microfiber leather from a simple synthetic alternative to a highly advanced engineered material with customizable features.

Regional Highlights

The global Microfiber Leather Market exhibits distinct regional dynamics driven by manufacturing capacity, regulatory environments, and consumer preferences. The Asia Pacific (APAC) region currently dominates the global market both in terms of production volume and consumption value. China serves as the world's largest manufacturing hub for microfiber leather, benefiting from economies of scale, robust chemical supply chains, and extensive governmental support for the textile and manufacturing sectors. Rapid economic expansion in emerging economies like India, Vietnam, and Indonesia is fueling massive domestic demand across the automotive, footwear, and consumer goods sectors, further strengthening APAC's market leadership. The region is also the epicenter for investment in new, cleaner production technologies as local governments begin to impose stricter environmental standards on heavy industry, balancing high production output with increasing demands for sustainable manufacturing practices and solvent reduction.

Europe represents a mature market characterized by high consumer awareness, stringent environmental regulations (REACH), and a strong focus on premium and luxury applications. European demand is driven by the high-end automotive sector (e.g., German luxury brands) and sophisticated furniture design industries, which demand certified, low-VOC, and ethically sourced materials. European manufacturers often lead innovation in aqueous and dry-process microfiber technologies to meet these stringent regulatory and consumer demands for eco-labeled products. The market growth in Europe is steady but highly focused on value-added products, such as those incorporating recycled content or bio-based polymers, reflecting a market willingness to pay a premium for verified sustainability credentials and superior engineering.

North America is another key consumption market, with demand concentrated in automotive and high-quality upholstery applications. The region's growth is spurred by shifting consumer preferences towards durable, easy-to-maintain synthetic materials, particularly in the high-volume vehicle market. While the manufacturing base is less concentrated than in APAC, North American brands and OEMs exert significant influence over material specifications and procurement standards globally, often prioritizing suppliers who can demonstrate full compliance with specific safety and performance metrics, such as California’s Proposition 65 requirements. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets showing accelerated growth, primarily driven by investments in new construction and infrastructure projects, which necessitate large volumes of durable upholstery for commercial spaces and rapidly expanding domestic vehicle production and importation, gradually diversifying the global consumption footprint away from traditional regions.

- Asia Pacific (APAC): Dominates production and consumption; driven by manufacturing hubs in China and rapid demand growth in India and Southeast Asia for footwear and automotive applications. Focus on scaling production and adopting cleaner technologies.

- Europe: High-value market focused on premium automotive and luxury goods; characterized by stringent regulatory compliance (REACH) and strong demand for solvent-free and bio-based microfiber alternatives.

- North America: Significant consumption market driven by the automotive industry and consumer demand for durable, performance-oriented upholstery; emphasis on high safety standards and specific brand certifications.

- Latin America (LATAM): Emerging market growth driven by urbanization, construction projects, and expanding domestic manufacturing sectors, increasing demand for affordable, yet durable, synthetic materials.

- Middle East and Africa (MEA): Growth tied to infrastructure development and rising disposable incomes, favoring high-quality upholstery for commercial and residential sectors, often imported from Asian suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microfiber Leather Market.- Kuraray Co., Ltd.

- Toray Industries, Inc.

- Asahi Kasei Corporation

- Kolon Industries

- Sanfang

- Wenzhou Huanghe Dinema Co., Ltd.

- Huafon Group

- Teijin Limited

- Clarino (Kura-Seiren)

- Zhejiang Hexin Holdings

- FILWEL Co., Ltd.

- Double Elephant

- Guangzhou Ruigou Leather Co., Ltd.

- Meida Group

- Zhejiang Hongfa Synthetic Leather Co., Ltd.

- Shandong Jinfeng Microfiber Co., Ltd.

- Yantai Huide Synthetic Leather Co., Ltd.

- Fujian Polytech Co., Ltd.

- Anhui Anli Material Technology Co., Ltd.

- Sanling Microfiber

Frequently Asked Questions

Analyze common user questions about the Microfiber Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Microfiber Leather and how does it differ from traditional PU leather?

Microfiber leather is a high-grade synthetic material made from ultra-fine microfiber bundles coated with polyurethane (PU), replicating the internal structure of genuine leather. Unlike standard PU leather, which is typically just a PU layer applied to a fabric backing, microfiber leather offers superior strength, breathability, abrasion resistance, and a more natural, luxurious feel due to its dense, porous fiber structure, making it highly durable for premium applications.

Is Microfiber Leather considered sustainable or environmentally friendly?

Microfiber leather is generally considered a more sustainable alternative to natural leather due to its animal-free origin. Sustainability credentials are significantly enhanced when the material is produced using solvent-free processes (like the aqueous or dry process) which minimize VOC emissions and utilize recycled polyester or bio-based polyurethanes. The focus is shifting towards circular economy models and minimizing the use of chemicals like DMF.

Which application segment drives the highest demand for Microfiber Leather?

The Automotive Interiors segment represents the largest and fastest-growing application for Microfiber Leather. This demand is driven by the requirement for durable, lightweight, easy-to-clean, and high-performance materials for seating, dashboards, and trim, which is especially critical in the expanding electric vehicle (EV) sector where weight reduction is necessary for range optimization and efficiency.

What is the projected Compound Annual Growth Rate (CAGR) for the Microfiber Leather Market?

The Microfiber Leather Market is projected to exhibit a strong growth trajectory, anticipated to register a Compound Annual Growth Rate (CAGR) of 7.8% between the forecast years of 2026 and 2033, driven by global shifts toward ethical and performance-enhanced synthetic alternatives across major consumer goods and durable sectors.

How is AI impacting the manufacturing and quality control of Microfiber Leather?

AI is transforming the Microfiber Leather sector by optimizing complex production parameters, minimizing material waste through precise raw material blending, and enabling real-time, high-precision quality control using machine vision systems. This leads to reduced defect rates, enhanced batch consistency, and lower energy consumption, significantly improving overall manufacturing efficiency and product reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager