Microfilm and Microfiche Equipment and Supplies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439242 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Microfilm and Microfiche Equipment and Supplies Market Size

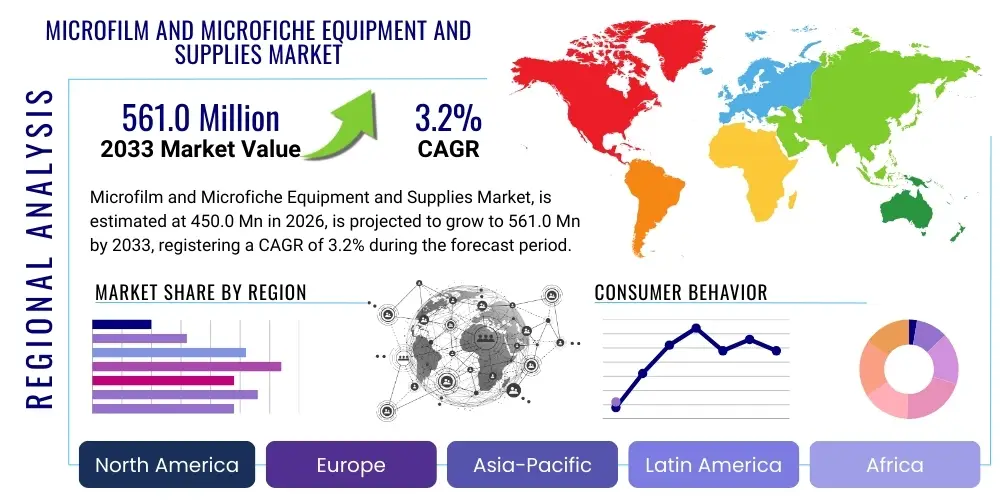

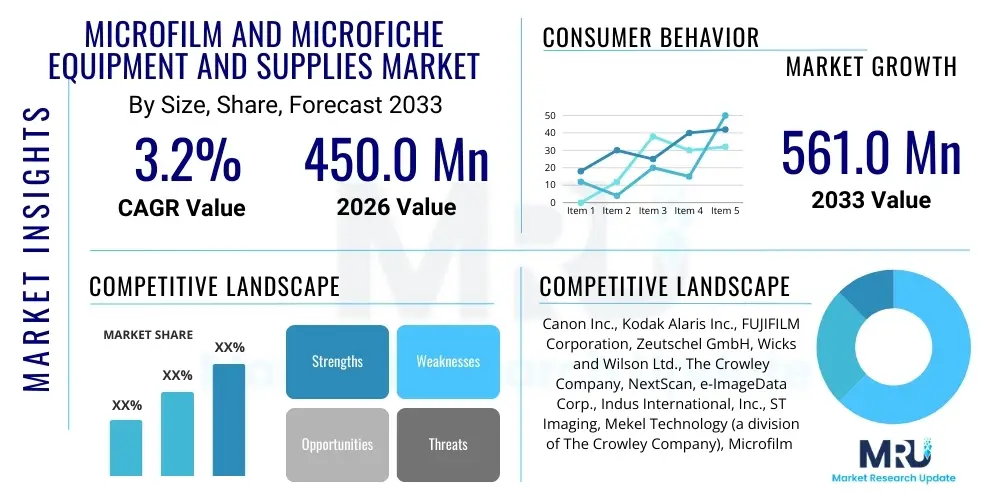

The Microfilm and Microfiche Equipment and Supplies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.2% between 2026 and 2033. The market is estimated at USD 450.0 Million in 2026 and is projected to reach USD 561.0 Million by the end of the forecast period in 2033. This consistent, albeit moderate, growth underscores the enduring relevance of micrographic technologies within specific sectors, primarily driven by critical archival, preservation, and regulatory compliance demands.

Microfilm and Microfiche Equipment and Supplies Market introduction

The Microfilm and Microfiche Equipment and Supplies Market encompasses the entire ecosystem surrounding analog image capture and retrieval for long-term document preservation. This includes a diverse range of products from specialized cameras used to capture images onto film, to various readers, scanners, and duplicators designed for accessing, digitizing, or copying microforms. Essential supplies such as raw microfilm rolls, microfiche sheets, cartridges, spools, and archival storage solutions are also integral to this market, facilitating the complete lifecycle of micrographic records.

Major applications for these technologies predominantly lie within sectors with stringent archival requirements, including government agencies, national and public libraries, financial institutions for transactional record-keeping, healthcare organizations for patient history preservation, and legal firms for case documentation. The enduring benefits of microfilm and microfiche stem from their unparalleled longevity, data integrity, and immunity to obsolescence from software or hardware changes, making them a gold standard for permanent recordkeeping and disaster recovery. These factors ensure that even in a highly digitized world, microforms maintain a critical, albeit niche, market presence.

The market is driven by several key factors, including the continuous need for immutable archival backups, regulatory mandates requiring long-term physical preservation of sensitive data, and the inherent security advantages of analog storage which is immune to cyber threats. Furthermore, the increasing demand for hybrid archiving solutions, where physical microforms complement digital records, provides a sustained impetus. The ability to create true master archives that do not rely on specific operating systems or file formats positions microfilm and microfiche as essential tools for cultural heritage institutions and organizations planning for data accessibility across centuries.

Microfilm and Microfiche Equipment and Supplies Market Executive Summary

The Microfilm and Microfiche Equipment and Supplies market, while mature, exhibits stable business trends characterized by a persistent demand for high-integrity, long-term archival solutions. The primary business driver remains the critical need for governmental, historical, and financial institutions to preserve information over extended periods, often centuries, safeguarding against technological obsolescence and digital vulnerabilities. Companies operating within this space are increasingly focusing on providing integrated solutions that bridge the gap between analog archives and digital accessibility, offering advanced scanning technologies that facilitate efficient digitization while maintaining the physical integrity of the original microform. Strategic partnerships with digital archiving service providers are also becoming prevalent, allowing businesses to offer comprehensive data management solutions.

Regional trends indicate varied growth patterns and drivers across geographies. North America and Europe, with their extensive historical archives and well-established regulatory frameworks for data preservation, represent the largest and most stable markets. Here, demand is often driven by ongoing archival maintenance, specialized digitization projects for historical collections, and compliance with strict data retention laws. The Asia Pacific region is showing a gradual increase in adoption, particularly in emerging economies where institutions are establishing robust archival infrastructures, sometimes leveraging microfilm for its cost-effectiveness and durability in challenging environmental conditions. Latin America, the Middle East, and Africa continue to represent smaller, yet growing, markets, often driven by government initiatives to digitize national records while maintaining physical backups for security and longevity.

Segmentation trends reveal that the market for microfilm and microfiche scanners, particularly high-volume, high-resolution models, is experiencing renewed interest due to the accelerating push for digitization projects. While the sales of new analog cameras and processors have stabilized, the demand for consumables such as raw film, chemicals, and archival storage media remains consistent, driven by existing installations and ongoing capture processes. The service segment, including microform digitization services, maintenance, and technical support, is a significant growth area, reflecting organizations' desires to leverage their existing microform assets in a digital environment without entirely abandoning the physical format. End-user segments like libraries, museums, and government archives continue to be the predominant consumers, underscoring the market's foundational role in cultural and institutional memory preservation.

AI Impact Analysis on Microfilm and Microfiche Equipment and Supplies Market

User inquiries concerning AI's impact on the Microfilm and Microfiche Equipment and Supplies Market often revolve around two central themes: the potential for AI to render analog archiving obsolete and, conversely, its capacity to enhance the utility and accessibility of existing microform collections. Users frequently express concerns about the long-term viability of traditional methods in an AI-driven world, questioning whether AI-powered search and analysis tools will negate the need for physical archives. However, there is also significant interest in how AI could be leveraged to streamline the digitization process of microforms, improve indexing and metadata creation, and enable advanced content analysis from scanned images, thereby breathing new life into vast, underutilized analog repositories and bridging the gap between historical physical records and modern digital access.

- AI-powered Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) can significantly enhance the accuracy and speed of text extraction from digitized microfilm and microfiche images, enabling full-text search capabilities for previously inaccessible content.

- Machine learning algorithms can automate the classification and indexing of scanned microform documents, reducing manual labor and improving metadata quality, making vast archives more discoverable.

- AI can facilitate advanced image processing for quality enhancement during microform scanning, correcting for faded text, scratches, or other imperfections, thereby optimizing the digital output.

- Natural Language Processing (NLP) tools can analyze the extracted text from microforms to identify entities, themes, and relationships, generating rich insights from historical data that were previously too time-consuming to uncover manually.

- Predictive analytics could be applied to archival management, helping institutions anticipate storage needs, identify at-risk film, or prioritize digitization projects based on estimated usage or preservation urgency.

- AI-driven anomaly detection can be used during the scanning process to identify errors or missing information in microform collections, ensuring comprehensive and accurate digitization.

- Integration of AI with digital asset management (DAM) systems allows for seamless incorporation of digitized microform content into broader digital workflows, enhancing content discoverability and utility.

DRO & Impact Forces Of Microfilm and Microfiche Equipment and Supplies Market

The Microfilm and Microfiche Equipment and Supplies market is influenced by a complex interplay of drivers, restraints, and opportunities that shape its trajectory. Key drivers include the unparalleled longevity and tamper-proof nature of microforms, making them ideal for compliance with stringent regulatory mandates requiring long-term data preservation, particularly in governmental, financial, and legal sectors. The inherent immunity of analog microforms to cyber threats, software obsolescence, and hardware failures provides a critical security advantage, reinforcing their role as an ultimate backup solution. Furthermore, the persistent need for cultural heritage institutions, libraries, and archives to preserve historical records, often for centuries, sustains demand for reliable micrographic solutions. The emergence of hybrid archiving strategies, combining the benefits of physical microforms with digital accessibility, also drives investment in scanning and digitization equipment.

However, several restraints challenge market growth. The significant upfront cost associated with setting up and maintaining micrographic infrastructure, including specialized cameras, processors, and climate-controlled storage, can be prohibitive for some organizations. The perception of microfilm and microfiche as an outdated or niche technology, often associated with slower retrieval times compared to digital systems, deters new adoption outside of core archival functions. Moreover, the shrinking pool of skilled personnel trained in micrographic processes, from film processing to equipment maintenance, poses operational challenges. The continuous advancement and increasing affordability of digital storage solutions and cloud-based archiving services also present competitive pressures, prompting some organizations to lean entirely towards digital-first strategies, albeit with inherent long-term risks regarding data integrity and format obsolescence.

Despite these restraints, significant opportunities exist for market players. The growing emphasis on data security and disaster recovery planning, especially in an era of escalating cyber threats, highlights the unique value proposition of offline, analog backups. There is a substantial opportunity in providing integrated solutions that combine high-quality microform digitization with advanced digital asset management systems, enabling organizations to leverage their physical archives digitally. Developing more user-friendly and automated microform scanning equipment, potentially incorporating AI-driven indexing and image enhancement, could expand the market. Furthermore, emerging markets in Asia Pacific, Latin America, and Africa, where institutions are still building their archival foundations and seeking cost-effective, durable preservation methods, represent untapped growth potential. Specialized services, including archival consulting, long-term storage solutions, and bespoke digitization projects for unique historical collections, also offer avenues for market expansion and value creation.

Segmentation Analysis

The Microfilm and Microfiche Equipment and Supplies Market is comprehensively segmented to provide a detailed understanding of its various components, applications, and end-users. This granular breakdown allows for precise market analysis, identifying key trends and growth opportunities within specific niches. The primary segmentation categories include product type, covering everything from the machinery used to create and read microforms to the essential consumable supplies. Application segmentation clarifies the diverse scenarios in which these technologies are deployed, highlighting their utility across various informational and archival needs. Furthermore, end-user categories delineate the institutional and corporate segments that rely on micrographic solutions, offering insights into their specific requirements and purchasing behaviors.

Understanding these segments is crucial for manufacturers, suppliers, and service providers to tailor their offerings effectively. For instance, the demand for high-end microform scanners is driven largely by institutions undergoing large-scale digitization projects, while the consistent need for raw film and processing chemicals is sustained by ongoing record capture activities in regulatory-heavy industries. Each segment faces unique drivers and restraints, from technological advancements influencing scanner design to budget constraints affecting the adoption rates of archival services among smaller institutions. The interplay between these segments often dictates overall market dynamics, with a shift in one area potentially influencing demand in another.

The geographical segmentation further refines this analysis, revealing regional disparities in adoption rates, regulatory environments, and the maturity of archival practices. Developed regions with extensive historical archives tend to focus on maintenance, digitization, and hybrid solutions, while developing regions might still be investing in fundamental microfilming capabilities. This multi-faceted segmentation provides a robust framework for strategic planning, product development, and targeted marketing efforts, ensuring that market participants can effectively navigate the complexities of this specialized and vital industry.

- By Product Type

- Microfilm Cameras

- Planetary Cameras

- Rotary Cameras

- Microfilm Readers

- Microfilm Scanners

- Roll Film Scanners

- Microfiche Scanners

- Jacket Scanners

- Aperture Card Scanners

- Microfiche Readers

- Processors

- Duplicators

- Microfilm and Microfiche Supplies

- Raw Microfilm

- Microfiche Sheets

- Chemistry & Processing Supplies

- Cartridges & Spools

- Storage Cabinets & Enclosures

- Cleaning & Maintenance Supplies

- Microfilm Cameras

- By Application

- Archival & Records Management

- Data Preservation

- Document Imaging & Conversion

- Information Retrieval

- Disaster Recovery & Security Backup

- Intellectual Property & Legal Documentation

- By End-User

- Government Agencies (National Archives, Public Records Offices)

- Libraries & Educational Institutions (Universities, Research Libraries)

- Financial Services (Banks, Insurance Companies)

- Healthcare Sector (Hospitals, Medical Archives)

- Legal Sector (Law Firms, Courts)

- Corporate & Business Archives

- Museums & Cultural Heritage Institutions

- Service Bureaus

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Microfilm and Microfiche Equipment and Supplies Market

The value chain for the Microfilm and Microfiche Equipment and Supplies Market begins with upstream activities focused on the production of raw materials and specialized components. This includes manufacturers of photographic film base materials, silver halides, and various chemicals essential for film processing, as well as suppliers of precision optical components, electronic parts, and mechanical assemblies required for cameras, readers, and scanners. Key players in this upstream segment are typically chemical companies, optical manufacturers, and specialized electronics component providers, who supply to the equipment manufacturers. The quality and availability of these upstream inputs directly influence the performance and cost-effectiveness of the final micrographic products, emphasizing the importance of robust supply chain management and quality control within this foundational stage.

Midstream activities involve the manufacturing and assembly of the actual microfilm and microfiche equipment, including high-precision cameras, advanced scanners, readers, processors, and duplicators. This stage also encompasses the production of finished microforms and associated supplies, such as pre-packaged film rolls, microfiche sheets, cartridges, and archival storage solutions. Companies like Kodak Alaris, Zeutschel, and Crowley Company operate within this segment, focusing on R&D to enhance imaging capabilities, improve scanner efficiency, and develop more durable and stable micrographic media. The manufacturing process often involves complex engineering and stringent quality checks to ensure the longevity and fidelity of the archived information, which is a paramount concern for end-users relying on these systems for permanent recordkeeping.

Downstream activities center on the distribution channels and end-user engagement. Products reach end-users through a combination of direct sales from manufacturers, specialized distributors, and value-added resellers (VARs) who often provide installation, training, and ongoing technical support. Service bureaus also play a crucial role, offering microfilming, microfiche conversion, and digitization services to organizations that prefer to outsource these complex tasks. Direct sales channels are common for large government contracts or specialized institutional purchases, while indirect channels leverage a network of partners to reach a broader customer base, particularly for consumables and smaller equipment. The distribution network must be capable of handling delicate film media and precision equipment, ensuring proper handling and timely delivery to maintain product integrity. Ultimately, the efficiency and reliability of these distribution channels are critical for meeting the diverse needs of libraries, archives, government bodies, and corporations that depend on microform technology for their long-term preservation strategies.

Microfilm and Microfiche Equipment and Supplies Market Potential Customers

Potential customers for Microfilm and Microfiche Equipment and Supplies are primarily institutions and organizations with an imperative for long-term data preservation, regulatory compliance, and robust disaster recovery strategies. Government agencies, including national archives, public records offices, and various departments (e.g., land registry, judicial systems), represent a foundational customer segment. These entities often mandate the preservation of historical documents, legal records, and administrative data for centuries, relying on the immutable nature of microforms. Their need spans new microfilming projects for ongoing record capture as well as digitization efforts for existing microform collections, driving demand for both equipment and services. The inherent security against cyber threats and technological obsolescence makes microforms an indispensable component of their comprehensive information governance policies.

Another significant customer base includes libraries and educational institutions, particularly university libraries, research centers, and public library systems. These organizations are responsible for preserving vast collections of historical newspapers, rare books, manuscripts, and dissertations, ensuring continued access for researchers and future generations. They often invest in microfilming to preserve deteriorating originals or to create archival masters for digitization projects. Their procurement typically involves high-quality microform cameras, readers, and scanners, along with continuous supplies of archival-grade film and storage solutions. The emphasis here is on image fidelity and the longevity of the media to withstand heavy usage and the passage of time, supporting academic research and cultural heritage preservation missions.

Furthermore, the financial services sector, including banks, insurance companies, and investment firms, constitutes a vital segment, driven by strict regulatory requirements for transaction record retention and audit trails. While increasingly digital, many financial institutions maintain microform backups for critical records to comply with long-term retention laws and to serve as an ultimate, secure offline archive. Healthcare organizations also rely on microforms for patient records and administrative documents, especially for historical files that must be kept for decades. Legal firms and courts similarly utilize micrographic solutions for case files and official documents, valuing the tamper-proof and legally admissible nature of microform records. These diverse end-users prioritize data integrity, security, and long-term accessibility, making them consistent consumers of micrographic equipment, supplies, and related services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.0 Million |

| Market Forecast in 2033 | USD 561.0 Million |

| Growth Rate | 3.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Inc., Kodak Alaris Inc., FUJIFILM Corporation, Zeutschel GmbH, Wicks and Wilson Ltd., The Crowley Company, NextScan, e-ImageData Corp., Indus International, Inc., ST Imaging, Mekel Technology (a division of The Crowley Company), Microfilm Shop Ltd., Image Access GmbH, Genus plc, GRM Document Management, Inotec GmbH, SMA Electronic Document GmbH, Bookeye (Image Access), ScanPro (e-ImageData), Microform Imaging, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microfilm and Microfiche Equipment and Supplies Market Key Technology Landscape

The technology landscape for the Microfilm and Microfiche Equipment and Supplies Market is characterized by a blend of established analog methodologies and innovative digital integration. At the core, traditional microfilming technologies, such as planetary cameras and rotary cameras, continue to evolve with improvements in optics, automation, and image stability, ensuring high-fidelity capture for master archives. Microfilm and microfiche processors have also seen advancements, offering more precise chemical controls and environmentally friendlier processes to ensure archival longevity of the film. These foundational technologies are crucial for the creation of new microform records, providing the immutable physical backups required by many institutions.

However, the most dynamic technological developments are observed in the scanning and digitization segment. Modern microfilm and microfiche scanners now feature high-resolution CCD/CMOS sensors, advanced illumination systems, and sophisticated image processing software that can automatically enhance image quality, correct skew, and remove noise or artifacts from old and damaged film. Technologies like LED lighting have replaced traditional lamps, offering longer lifespan and more consistent illumination. Automated feeder systems and batch processing capabilities significantly increase throughput, making large-scale digitization projects more feasible and cost-effective. These scanners are designed to bridge the gap between the analog world of microforms and the digital realm, transforming physical archives into searchable, accessible digital databases.

Furthermore, software integration plays a critical role. Many contemporary scanning solutions come bundled with or are compatible with advanced Optical Character Recognition (OCR) and Intelligent Character Recognition (ICR) software, which can extract searchable text from scanned images, transforming passive image files into active data. Digital image management systems (DIMS) and enterprise content management (ECM) platforms are often integrated with these scanning workflows, allowing for seamless indexing, metadata creation, and long-term storage of digitized microform content. The emphasis is on creating hybrid systems that leverage the long-term preservation benefits of microforms while providing the immediate accessibility and analytical capabilities of digital data, ensuring that historical information remains relevant and usable in a rapidly evolving technological environment.

Regional Highlights

- North America: This region holds a significant share of the market, primarily driven by robust government archives (e.g., National Archives and Records Administration - NARA), extensive university libraries, and strict regulatory compliance requirements within the financial and legal sectors. There is a strong emphasis on maintaining existing microform archives while simultaneously undertaking large-scale digitization projects, leading to high demand for advanced scanners and archival services.

- Europe: Similar to North America, Europe boasts a mature market with numerous national libraries, cultural heritage institutions, and government bodies that prioritize long-term preservation. Countries like the UK, Germany, and France are major players, investing in both traditional microfilming for new records and sophisticated scanning solutions to make vast historical collections digitally accessible, often driven by EU directives on data preservation and access.

- Asia Pacific (APAC): The APAC region is experiencing moderate growth, particularly in emerging economies like India and Southeast Asian countries, where institutions are establishing their archival infrastructures. While still adopting fundamental microfilming technologies for cost-effective, durable record-keeping, there is also a growing interest in hybrid solutions that combine microforms with digital access. Japan and South Korea, with their advanced technological landscapes, also contribute significantly to the market, especially in high-end scanning and integrated archival solutions.

- Latin America: This region presents a developing market for microfilm and microfiche, driven by government initiatives to preserve national historical records and administrative documents. Economic factors can sometimes lead to slower adoption rates for advanced technologies, but the foundational need for secure, long-term physical archives ensures a consistent demand for basic equipment and supplies.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, especially in countries investing in modernizing their public administration and cultural preservation efforts. The demand is primarily from governmental archives and national libraries seeking reliable, long-term preservation methods that are resilient to environmental challenges and technological shifts. The focus is often on establishing initial microfilming capabilities and securing critical data.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microfilm and Microfiche Equipment and Supplies Market.- Canon Inc.

- Kodak Alaris Inc.

- FUJIFILM Corporation

- Zeutschel GmbH

- Wicks and Wilson Ltd.

- The Crowley Company

- NextScan

- e-ImageData Corp.

- Indus International, Inc.

- ST Imaging

- Mekel Technology (a division of The Crowley Company)

- Microfilm Shop Ltd.

- Image Access GmbH

- Genus plc

- GRM Document Management

- Inotec GmbH

- SMA Electronic Document GmbH

- Bookeye (Image Access)

- ScanPro (e-ImageData)

- Microform Imaging, Inc.

Frequently Asked Questions

Analyze common user questions about the Microfilm and Microfiche Equipment and Supplies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using microfilm and microfiche in the digital age?

Microfilm and microfiche offer unparalleled longevity, data integrity, and immunity to cyber threats and technological obsolescence. They serve as a secure, immutable, offline backup for critical records, ensuring access for centuries without dependence on specific hardware or software, complementing digital archives for robust disaster recovery and compliance.

Is the Microfilm and Microfiche Equipment and Supplies market still growing, or is it becoming obsolete?

While a mature market, it is not obsolete and continues to grow steadily, albeit moderately. Growth is driven by ongoing archival needs, regulatory compliance, and increasing demand for hybrid archiving solutions that combine the permanence of microforms with digital accessibility, particularly for government, libraries, and financial institutions.

How does AI impact the future of microfilm and microfiche archiving?

AI is transforming microform archiving by enhancing digitization, improving indexing with OCR/ICR, automating metadata creation, and enabling advanced content analysis from scanned images. This allows vast analog collections to become digitally searchable and more accessible, bridging the gap between historical physical records and modern digital utilities without replacing the physical archive itself.

Who are the main end-users for microfilm and microfiche equipment and supplies?

The primary end-users are government agencies, national and public libraries, educational institutions, financial services, healthcare organizations, and legal firms. These sectors require long-term, secure, and legally compliant preservation of sensitive and historical documents, making microforms an essential part of their record-keeping strategies.

What are the key technologies involved in modern microfilm and microfiche solutions?

Key technologies include advanced microfilm cameras for high-fidelity capture, high-resolution scanners with sophisticated image processing software for digitization, and integrated OCR/ICR technologies for text extraction. These are often combined with digital image management systems (DIMS) to create comprehensive hybrid archiving solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager