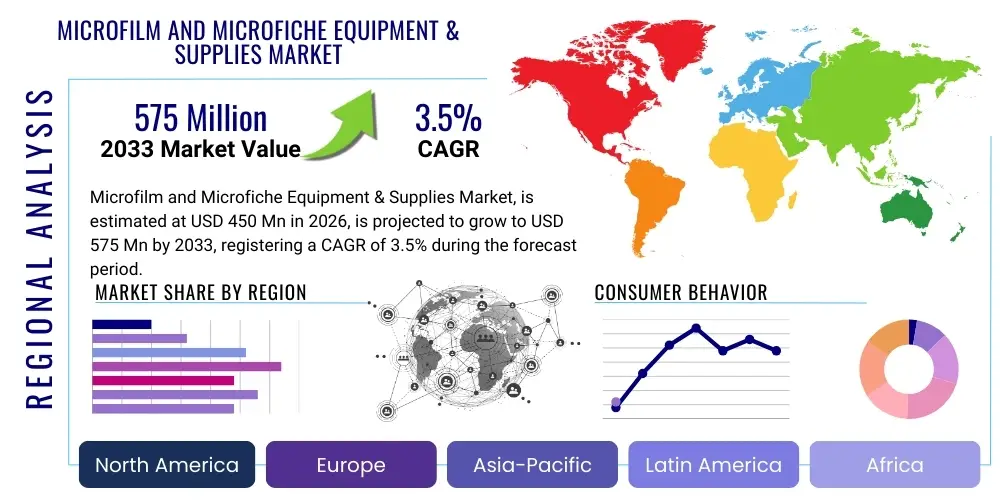

Microfilm and Microfiche Equipment & Supplies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438990 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Microfilm and Microfiche Equipment & Supplies Market Size

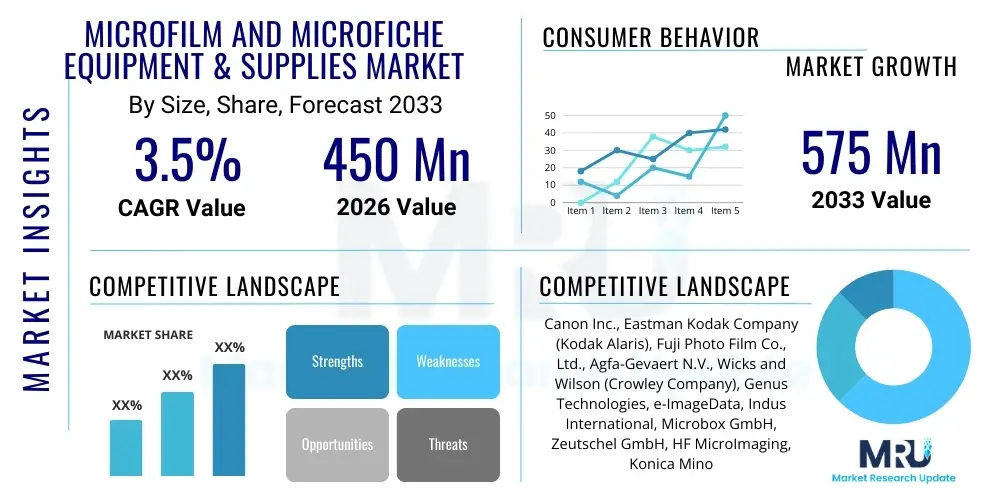

The Microfilm and Microfiche Equipment & Supplies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 575 Million by the end of the forecast period in 2033.

Microfilm and Microfiche Equipment & Supplies Market introduction

The Microfilm and Microfiche Equipment & Supplies Market encompasses the manufacturing, distribution, and maintenance of specialized apparatus and consumables used for the preservation, archiving, and retrieval of documents in analog photographic formats. Despite the widespread adoption of digital technologies, microfilm and microfiche remain critical formats, particularly within institutional settings requiring long-term, legally compliant archival solutions. The market involves sophisticated equipment such as planetary and rotary cameras (for capturing source documents), high-speed scanners (for digitization and hybrid systems), reader-printers (for viewing and copying), and automated retrieval systems, alongside essential supplies like silver halide film, polyester film, processing chemicals, and storage cartridges.

Major applications for this technology span regulated sectors including government archives, historical libraries, financial institutions, and specialized medical records departments. These sectors rely on microform for its inherent stability, longevity (up to 500 years when properly stored), security against cyber threats, and acceptance as a legal record in many jurisdictions globally. The product's primary function is disaster recovery and ensuring the immutable preservation of intellectual property and vital records, acting as the ultimate backup layer beneath digital infrastructures. The inherent physical separation and non-reliance on specific software or hardware formats further cement its role as a dependable archival medium.

The market is predominantly driven by stringent regulatory requirements mandating the long-term preservation of critical data, particularly in industries like pharmaceuticals, legal services, and finance. Furthermore, the burgeoning demand for high-quality digitization of existing microform collections fuels the sales of hybrid scanner equipment that bridges the gap between analog archives and modern digital access platforms. While digitalization presents a competitive challenge, it simultaneously creates opportunities for equipment providers who specialize in converting legacy microforms into searchable digital assets, thereby extending the utility and relevance of the installed microform base.

Microfilm and Microfiche Equipment & Supplies Market Executive Summary

The Microfilm and Microfiche Equipment & Supplies Market is navigating a complex transition, characterized by declining demand for purely analog capture devices but significant growth in hybrid scanning and specialized supplies designed for archival longevity. Key business trends indicate a pivot towards service-oriented models, where major manufacturers focus on providing maintenance contracts, archival consulting, and large-scale digitization projects rather than solely relying on new equipment sales. This shift ensures the sustainability of the existing microform infrastructure, leveraging the high value of proprietary film processing and scanning technologies. Innovation is centered on improving image quality and throughput speed for microform scanners, facilitating integration with cloud-based document management systems (DMS) to create robust, multi-layered archival solutions.

Regionally, the market dynamics show divergence. North America and Europe, possessing vast historical archives, represent mature markets with stable demand primarily for supplies, maintenance, and high-end conversion scanners utilized by national libraries, universities, and government agencies for preservation and access. In contrast, the Asia Pacific region, particularly developing economies, shows nascent growth in new microform implementation, driven by regulatory compliance in banking and insurance sectors seeking secure, low-cost long-term storage solutions immune to rapid technological obsolescence. Furthermore, the Middle East and Africa are emerging as niche markets where government entities are investing in foundational archival facilities, recognizing microform's benefits for preserving cultural heritage in challenging environmental conditions.

Segment trends reveal that the Supplies segment, including specialized silver halide films and cartridges, maintains the largest market share due to recurring institutional replenishment needs. However, the Equipment segment's growth is primarily propelled by advanced, high-resolution microform scanners capable of rapid digital conversion (hybrid readers/scanners). End-user analysis highlights the Government and Public Sector as the dominant consumer, driven by immutable legal and historical preservation mandates. Technology adoption is increasingly focused on integrating microform output directly into digital workflows through sophisticated indexing and Optical Character Recognition (OCR) software tailored for microform image quality correction, thereby maximizing the usability of the preserved data.

AI Impact Analysis on Microfilm and Microfiche Equipment & Supplies Market

Common user questions regarding AI's influence typically revolve around whether artificial intelligence will completely obviate the need for physical archives, or conversely, if AI can enhance the utility of existing microform collections. Users express concern over the potential automation of skilled microform technician roles and seek clarification on how AI tools can efficiently extract structured data from historically poor-quality microform images. The analysis reveals a consensus that AI is not a replacement for the physical security and permanence offered by microform but rather a powerful adjunct technology. Key themes center on leveraging AI for improved quality control during digitization, automated metadata extraction, and sophisticated indexing that makes analog content digitally searchable and accessible, dramatically reducing the manual effort traditionally associated with microform management.

AI’s influence is primarily manifested in the software layer of hybrid scanning systems. Machine learning models are being developed and implemented to automatically assess the quality of scanned microform images, correcting distortions, adjusting exposure, and performing de-skewing operations in real-time, which significantly enhances the fidelity of the digitized output. Furthermore, specialized OCR engines, trained on diverse historical typefaces and degradation patterns common in microform, are transforming previously inaccessible data into searchable text. This not only streamlines the conversion process but also increases the return on investment for organizations with large backlogs of analog records, repositioning microform as a crucial, upstream data source for big data analytics and historical research.

The expectation among professional archivists and market stakeholders is that AI will institutionalize the concept of a hybrid archival environment. Instead of viewing microform as a defunct technology, AI tools validate its importance by making the physical archival layer more responsive and integrable with modern digital discovery platforms. This symbiosis ensures that microform maintains its status as the definitive, unalterable preservation layer while AI handles the complexity of making that data immediately relevant and usable in a digital context. Consequently, demand for high-end scanners equipped with proprietary AI-driven software packages is projected to increase, shifting investment focus from simple readers to sophisticated data conversion workstations.

- AI-powered Quality Control: Automated detection and correction of image defects during microform scanning (e.g., dust, scratches, low contrast).

- Enhanced OCR and Indexing: Use of specialized machine learning models to accurately extract text and metadata from low-resolution or degraded microfiche and microfilm.

- Predictive Maintenance: AI algorithms analyze equipment performance data to predict component failure in complex scanners and processors, minimizing downtime.

- Data Structure Recognition: Automated identification of form fields and tables within scanned microform documents for efficient data migration into modern databases.

- Hybrid Workflow Optimization: AI systems manage the prioritization and scheduling of documents for digitization based on user access patterns and regulatory requirements.

DRO & Impact Forces Of Microfilm and Microfiche Equipment & Supplies Market

The Microfilm and Microfiche Equipment & Supplies Market operates under a distinct set of drivers, restraints, and opportunities dictated by the unique longevity and security profile of the technology. The primary driving force remains stringent regulatory compliance across industries requiring 30 to 100 years of data retention, where microform often serves as the only medium guaranteed to meet these mandates without requiring expensive technology migrations. Simultaneously, the threat of catastrophic data loss, whether due to cyber attacks, system failures, or natural disasters, reinforces the perceived value of physical, off-site microform backups. The critical impact forces include the historical necessity of preservation, the economic viability of long-term storage, and the ongoing need to integrate analog assets into digital platforms, making hybrid solutions the central focus of market growth.

Restraints largely center on the high initial capital investment required for specialized filming and processing equipment, along with the perception among younger IT professionals that the technology is obsolete, leading to a shortage of skilled technicians capable of maintenance and operation. The overwhelming preference for immediate digital access in most routine business operations also limits new widespread adoption outside of niche archival sectors. However, these restraints are counterbalanced by significant opportunities. The global push for the digitization of cultural heritage and governmental records provides a massive addressable market for sophisticated high-speed microform scanners and conversion services. Furthermore, advancements in film technology (e.g., archival polyester film) and processing chemicals offer enhanced environmental stability and storage longevity, appealing directly to institutional buyers focused on multi-generational archival solutions.

The ultimate market stability is anchored by the realization that while digital storage is essential for access, microform is indispensable for permanence. The impact forces confirm the market's trajectory toward specializing in high-security, high-reliability hybrid systems. Suppliers are shifting their business models to offer comprehensive archival solutions, integrating state-of-the-art scanning hardware with specialized software and consulting services. This strategic realignment ensures that the market does not merely survive on legacy demand but evolves as the trusted, legally defensible, and physically secure component of modern information governance frameworks, particularly for governmental, legal, and historical records.

Segmentation Analysis

The Microfilm and Microfiche Equipment & Supplies Market is structurally segmented primarily based on the type of product (Equipment vs. Supplies) and the functional mechanism (Capture, Processing, Reading/Scanning). The Supplies segment, encompassing consumables like raw film stock, chemical developers, and storage containers, generates consistent revenue streams driven by the continuous operation of established archives globally. Conversely, the Equipment segment is differentiated by technological complexity, ranging from basic readers to highly specialized, high-throughput planetary cameras and hybrid scanners, with the latter commanding premium pricing due to integrated software capabilities necessary for digital migration. Analyzing the end-user landscape further clarifies market demands, with Government and Academia representing the highest value segments due to statutory and historical preservation mandates, respectively.

- By Product Type:

- Equipment (Cameras, Processors, Reader/Printers, Scanners, Duplicators)

- Supplies (Film Rolls, Microfiche Jackets, Chemicals, Storage Cartridges)

- By Format:

- Microfilm (16mm, 35mm)

- Microfiche (COM, Jacket Fiche, Step-and-Repeat Fiche)

- By Technology Type:

- Analog Systems

- Hybrid Systems (Scanning Equipment)

- By End-User Industry:

- Government and Public Sector (National Archives, Regulatory Bodies)

- Libraries and Educational Institutions (Universities, Research Centers)

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Corporate Archives and Legal Services

Value Chain Analysis For Microfilm and Microfiche Equipment & Supplies Market

The value chain for the Microfilm and Microfiche Market is highly specialized, beginning with the upstream supply of precision materials. This involves raw material manufacturers producing specialized chemical compounds for film emulsions (e.g., silver halide) and high-grade polyester substrates necessary for long-term archival stability. Upstream activities are concentrated among a few global chemical and film technology providers who adhere to stringent international standards (e.g., ISO 18901) regarding archival permanence. The manufacturing stage converts these materials into final film stock and constructs the highly precise mechanical and optical components required for cameras and scanners. Due to the precision required, manufacturing is often consolidated, creating high barriers to entry.

Midstream activities involve the production of the equipment itself—cameras, processors, and, most importantly in the modern market, sophisticated hybrid scanners and digital conversion hardware. This stage is dominated by established original equipment manufacturers (OEMs) specializing in optics, robotics, and integrated imaging software. Distribution channels are typically specialized: Direct sales are common for high-value equipment and governmental contracts, enabling manufacturers to provide immediate installation and training. Indirect channels, primarily specialized value-added resellers (VARs) and distributors, handle the recurring supply of film and chemicals, often paired with localized maintenance services.

Downstream, the market focuses on service delivery to the end-users. This includes installation, ongoing maintenance and repair contracts for specialized equipment, and large-scale digitization services (often outsourced to service bureaus). Direct distribution via proprietary sales forces is crucial for providing complex consultative sales and support to government and large institutional clients who require custom archival solutions. The final stage involves the end-user (e.g., archives or records management departments) storing and retrieving the microform assets. The reliance on expert technicians for both processing and maintenance reinforces the value of comprehensive service contracts within the downstream segment, driving significant long-term revenue for key market players.

Microfilm and Microfiche Equipment & Supplies Market Potential Customers

Potential customers for Microfilm and Microfiche Equipment and Supplies are predominantly institutions and enterprises operating within regulatory environments that necessitate long-term, legally compliant data preservation. The core customer base comprises governmental bodies, including national archives, land registries, judicial systems, and defense departments, which are mandated to maintain permanent records accessible regardless of future technological shifts. These agencies are consistently high-volume buyers of film supplies, archival storage systems, and specialized retrieval equipment. The demand is often non-discretionary, driven by law and public trust, ensuring a stable market foundation.

Another crucial customer segment includes academic and research institutions, specifically large university libraries, historical societies, and museums. These organizations utilize microform to preserve fragile historical documents, newspapers, and dissertations, ensuring scholarly access to primary sources that cannot be reliably digitized or are too delicate for repeated handling. Their purchasing decisions focus heavily on the archival quality of the film supplies and the resolution capabilities of the scanning equipment used for patron access and inter-library loan programs. These entities often invest heavily in hybrid scanners to create digital surrogates of their collections while maintaining the original microform for preservation.

Furthermore, highly regulated commercial sectors such as Banking, Financial Services, and Insurance (BFSI), as well as Healthcare and Pharmaceuticals, represent substantial niche markets. Financial institutions use microform for audit trails, long-term mortgage records, and transaction histories where data immutability is paramount. Healthcare providers and pharmaceutical companies rely on microform to archive patient medical histories and clinical trial results to meet regulatory retention periods that often exceed digital storage lifespan guarantees. These commercial customers prioritize the speed and reliability of capture equipment (e.g., COM recorders or rotary cameras) and robust retrieval systems integrated into their legacy records management infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 575 Million |

| Growth Rate | 3.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Inc., Eastman Kodak Company (Kodak Alaris), Fuji Photo Film Co., Ltd., Agfa-Gevaert N.V., Wicks and Wilson (Crowley Company), Genus Technologies, e-ImageData, Indus International, Microbox GmbH, Zeutschel GmbH, HF MicroImaging, Konica Minolta, Northern Micrographics, Inc., NextScan, The Microfilm Depot, Image Access GmbH, Micronex Systems, LLC, Photomatrix, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microfilm and Microfiche Equipment & Supplies Market Key Technology Landscape

The technology landscape in the microform market is primarily defined by the evolution of hybrid systems designed to bridge analog preservation with digital accessibility. The most significant technological advancements are centered on high-resolution scanning technology. Modern microform scanners, such as those employing linear array CCD or CMOS sensors, offer optical resolutions far exceeding historical capabilities, often reaching 18,000 DPI. This high fidelity is crucial for capturing fine details on historical documents or engineering drawings, maximizing the effectiveness of downstream processing like Optical Character Recognition (OCR). These advanced scanners often integrate proprietary software that corrects for film degradation, color casts, and geometric distortions inherent in older microform stock, ensuring the resulting digital images meet archival quality standards (e.g., FADGI guidelines).

Another pivotal technological area is the development of Computer Output Microfilm (COM) recorders and specialized processors. While traditional COM has seen declining use due to digital alternatives, high-end, dedicated microform processors utilizing automated chemical management and precise temperature control are essential for ensuring the longevity of archival film stock. Adherence to ISO standards for archival processing requires advanced chemical monitoring systems that minimize residual thiosulfate, a major cause of film degradation. Furthermore, newer film stocks are utilizing advanced polyester bases over older cellulose acetate, enhancing physical durability and resistance to environmental stress, reflecting ongoing materials science improvements within the supplies segment.

The technology is increasingly becoming integrated into a comprehensive workflow architecture, moving beyond standalone devices. Key innovations include automated film loading and retrieval systems, which reduce manual handling and increase throughput for large-scale digitization projects. Software integration is paramount, with scanning solutions now providing direct connectivity to enterprise content management (ECM) systems, cloud storage services, and metadata indexing platforms. This allows the newly digitized microform content to be instantly indexed and searchable, transforming static archives into dynamic data assets. The convergence of precise optics, robust mechanical handling, and sophisticated image processing software defines the competitive edge in the modern microform equipment market.

Regional Highlights

The Microfilm and Microfiche Equipment & Supplies Market exhibits distinct operational patterns across the major global regions, heavily influenced by historical archiving practices, regulatory frameworks, and the volume of existing legacy records. North America, particularly the United States, represents a highly mature market characterized by immense governmental and institutional archives, including the National Archives and Records Administration (NARA). Demand here is focused almost exclusively on high-speed, high-resolution hybrid scanning equipment necessary for massive digitization projects, coupled with a robust recurring need for archival-grade supplies like specialized film and processing chemicals to maintain current and future film masters. The regulatory environment, especially the Freedom of Information Act and various industry-specific retention laws (e.g., HIPAA for healthcare), solidifies microform's status as the final layer of secure preservation.

The North American market is also highly service-driven. Due to the aging population of original microform cameras and processors installed in the 1970s and 1980s, there is significant market demand for specialized maintenance, repair, and consulting services. Key players often maintain large service teams to support complex legacy systems in federal agencies and major research libraries. Technological adoption is skewed towards integrated digital solutions; customers seek scanners that not only capture images but also automatically perform indexing and metadata tagging, allowing seamless ingestion into modern digital asset management systems. This focus on intelligent digitization services ensures steady revenue streams even in the absence of mass adoption of new analog capture equipment.

Europe mirrors North America in its maturity and focus on preservation, driven by strong cultural heritage preservation initiatives and the need to comply with varied national archival laws. Countries like Germany, France, and the UK possess centuries of records, necessitating continuous investment in microform technology. The European market, however, places a particularly high emphasis on archival film quality standards (CEN/ISO norms) and the environmental sustainability of processing chemicals. Regional growth is spurred by government-funded projects aimed at democratizing access to historical documents, fueling demand for hybrid reader-scanners in municipal and regional archives.

European Union directives and national laws requiring long-term, verifiable records for financial and legal purposes continue to reinforce the use of microfilm as the preservation master, even where digital copies exist for daily use. The presence of specialized manufacturers and service bureaus across Central and Western Europe indicates a strong ecosystem dedicated to maintaining and migrating microform assets. Furthermore, the market in Eastern Europe is showing slow but steady modernization, with governments investing in centralized archival facilities, generating moderate demand for both foundational equipment and modern scanning solutions to address accumulated historical backlogs efficiently and securely.

The Asia Pacific (APAC) region presents the most dynamic growth potential, exhibiting a dual-market structure. Developed economies such as Japan and South Korea have mature archival markets similar to the West, with established infrastructure and steady supply demands. However, rapidly developing nations like China, India, and Indonesia are experiencing increasing institutional demand for new microform systems. This demand is driven by rapid industrialization, the need to formalize legal and land ownership records, and regulatory mandates in the burgeoning financial services and insurance sectors that require long-term, reliable archiving methods in environments often susceptible to IT infrastructure volatility or cybersecurity threats.

In APAC, new installations of analog capture equipment are more common compared to Western markets, particularly for ensuring the permanence of essential government records where digital infrastructure is still developing or lacks long-term trust guarantees. The market is highly price-sensitive but values reliability and robustness. Localized service and supply networks are crucial for market penetration. Furthermore, the sheer volume of governmental records being created annually in large population centers provides a massive, consistent demand base for continuous film production and processing, positioning APAC as a major consumer of archival supplies throughout the forecast period.

Latin America (LATAM) is characterized by uneven market maturity, with countries like Brazil and Mexico having significant installed bases, while others are in earlier stages of development. The primary driver in LATAM is the necessity of preserving public records against political instability and historical document fragility. Governmental and judicial systems are the leading end-users, investing in microform to ensure the security and continuity of legal evidence and land registries. Challenges include economic fluctuations and import dependencies for high-end equipment, which often makes maintenance and spares supply a critical factor in purchasing decisions. The market generally relies on distributors and regional service partners who can provide technical support across dispersed geographical areas.

Recent trends in LATAM involve specific investments in hybrid scanners, often funded through international grants or regional modernization programs, focusing on the conversion of valuable historical archives into digital formats for scholarly and public access, while preserving the microform master. This gradual shift toward hybrid systems provides opportunities for international vendors who can offer scalable, rugged equipment suitable for varying environmental conditions and infrastructure stability found across the subcontinent.

The Middle East and Africa (MEA) represent the smallest, yet growing, regional segment. Demand is concentrated in national archives, petroleum industry records, and military/defense sectors where security and physical permanence are paramount concerns. Countries in the GCC region (e.g., Saudi Arabia, UAE) are investing significantly in new, state-of-the-art national archival centers as part of national development visions, leading to high-value contracts for initial equipment installation (cameras, processors) and comprehensive supply agreements. Microform is highly valued in these regions for its ability to withstand high temperatures and humidity when stored correctly, offering an environmental stability advantage over certain digital media.

In specific African nations, the market is emerging, driven by foundational requirements for securing governmental and historical records. Access to specialized technical expertise and reliable power infrastructure remains a challenge, necessitating equipment that is durable and relatively easy to maintain. The overall growth in MEA, while starting from a smaller base, is expected to accelerate, particularly as regulatory frameworks demanding secure data retention mature within the financial and public sectors, aligning with global best practices for immutable data preservation.

- North America: Dominant demand for high-speed hybrid scanners and archival supplies; mature market focused on digitization and maintenance of vast federal archives.

- Europe: Strong emphasis on cultural heritage preservation and adherence to strict ISO archival standards; stable demand for high-quality supplies and specialized scanning technology.

- Asia Pacific (APAC): Fastest growing region; dual market with mature segments (Japan) and emerging markets (China, India) showing new installation growth driven by regulatory compliance in finance and government.

- Latin America (LATAM): Growth concentrated in government and judicial sectors for legal record preservation; focused on durable equipment and regional service networks.

- Middle East and Africa (MEA): Emerging market driven by national archival projects and high-security requirements in defense and energy sectors; high value placed on physical data permanence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microfilm and Microfiche Equipment & Supplies Market.- Canon Inc.

- Eastman Kodak Company (Kodak Alaris)

- Fuji Photo Film Co., Ltd.

- Agfa-Gevaert N.V.

- Wicks and Wilson (Crowley Company)

- Genus Technologies

- e-ImageData

- Indus International

- Microbox GmbH

- Zeutschel GmbH

- HF MicroImaging

- Konica Minolta

- Northern Micrographics, Inc.

- NextScan

- The Microfilm Depot

- Image Access GmbH

- Micronex Systems, LLC

- Photomatrix, Inc.

- Tameran

- Mekel Technology (Crowley Company)

Frequently Asked Questions

Analyze common user questions about the Microfilm and Microfiche Equipment & Supplies market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why is Microfilm still used in the era of advanced digital storage?

Microfilm and microfiche remain essential for long-term data preservation (500+ years) because they are immune to technological obsolescence, cyber threats, and are legally recognized as immutable archival masters. Digital storage, by contrast, requires constant migration and is vulnerable to system failure and hacking.

What is the primary factor driving demand for new microform equipment?

The primary factor driving demand is the necessity for hybrid scanning solutions. Institutions require high-speed, high-resolution scanners to convert their vast existing analog microform archives into accessible, searchable digital formats while preserving the film master for regulatory compliance and disaster recovery purposes.

How does AI technology impact the Microfilm market?

AI technology enhances the market by improving the efficiency and quality of digitization. AI-powered software automatically corrects image defects during scanning and uses advanced OCR to accurately extract metadata and searchable text from the microform images, integrating analog content into modern digital workflows.

Which end-user segment dominates the consumption of microform equipment and supplies?

The Government and Public Sector consistently dominate the market. This segment, including national archives, regulatory bodies, and judicial systems, is mandated by law to preserve vital, historical, and public records for decades, ensuring continuous, high-volume consumption of archival film supplies and dedicated equipment.

What is the difference between Microfilm and Microfiche and their primary uses?

Microfilm is a photographic film stored on a roll (spool), suitable for sequential or continuous records (like newspapers or chronological documents). Microfiche is a flat sheet of film, organized into rows and columns, typically used for structured records such as catalogs, reports, or individual patient files, offering faster access to specific images.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager