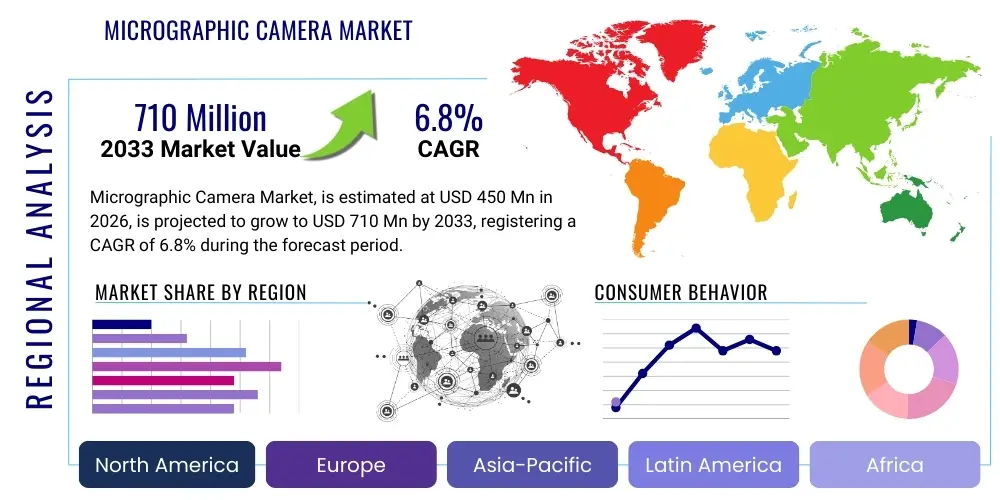

Micrographic Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438981 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Micrographic Camera Market Size

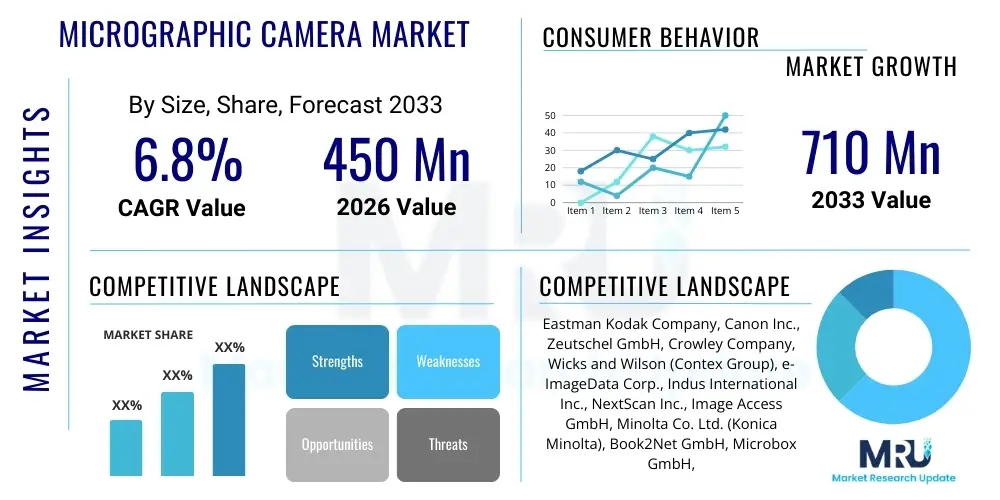

The Micrographic Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Micrographic Camera Market introduction

The Micrographic Camera Market encompasses devices designed specifically for capturing high-resolution digital images of microscopic slides, traditionally used for archiving and analysis in scientific, medical, and industrial fields. These sophisticated cameras replace older film-based microphotography methods, offering superior image quality, immediate data retrieval, and enhanced integration with digital storage systems. The core product incorporates high-sensitivity sensors, specialized optics, and software capable of precise color reproduction and complex image stacking or tiling, making them indispensable tools in modern research and archival processes across sectors reliant on visual data integrity and long-term preservation.

Major applications of micrographic cameras span across diverse industries, predominantly featuring heavily in library and archival sectors for the digitalization of historical records, blueprints, and manuscripts stored on microfilms or microfiches. Beyond cultural preservation, these cameras are crucial in quality control within manufacturing, forensic analysis, and the documentation of pathological samples in healthcare. The inherent benefit of using these systems lies in their ability to efficiently convert vast amounts of analog microform data into searchable, accessible digital formats, thereby dramatically reducing physical storage requirements and improving data sharing capabilities globally. This transition supports remote research and ensures the longevity of critical information.

The market is primarily driven by the escalating global demand for digital archiving solutions, particularly stemming from governmental bodies, large academic institutions, and national libraries seeking to preserve fragile and deteriorating historical records. Furthermore, technological advancements in high-resolution CMOS and CCD sensors, coupled with increasingly powerful image processing software, continually enhance the utility and output quality of micrographic cameras. The shift toward paperless workflows in organizational settings and regulatory mandates requiring long-term data preservation across finance, legal, and healthcare sectors further solidify the foundational growth trajectory of this specialized imaging equipment market.

Micrographic Camera Market Executive Summary

The Micrographic Camera Market is poised for steady expansion, fueled by robust business trends emphasizing digital transformation and information longevity. Key business dynamics include strategic mergers and acquisitions among core technology providers aiming to integrate sophisticated AI-driven indexing and retrieval functionalities into micrographic systems, thereby offering highly automated solutions. Furthermore, increasing investment in large-scale archival projects by national governments is providing consistent revenue streams for manufacturers specializing in high-throughput digital scanning equipment. The push toward integrated document management systems that handle both current digital files and legacy microform assets is a central theme driving product innovation and market demand globally.

Regionally, North America and Europe maintain dominance due to the presence of extensive historical archives and early adoption of regulatory standards necessitating digital preservation. However, the Asia Pacific (APAC) region is demonstrating the fastest growth rate, propelled by rapid urbanization, significant government spending on cultural heritage preservation, and the establishment of new, large data centers requiring efficient microform conversion facilities. Countries such as China and India, possessing vast quantities of historical documents and rapidly growing medical research sectors, are becoming critical consumption hubs, shifting the manufacturing and distribution focus toward tailored, high-volume solutions for dense microform scanning applications.

Segmentation trends highlight the increasing demand for high-end digital microform scanners capable of handling both microfiche and roll microfilm, preferred by major institutional users due to their versatility and throughput speed. While the application segment remains dominated by archival and library use, the adoption of micrographic cameras in medical pathology for slide imaging and in niche industrial quality assurance processes is growing significantly, demanding specialized lenses and illumination techniques. The technology segment shows a strong trend toward software solutions that offer advanced features like automated image enhancement, metadata extraction, and cloud compatibility, moving the market away from purely hardware-centric sales toward comprehensive solution platforms.

AI Impact Analysis on Micrographic Camera Market

User queries regarding the impact of Artificial Intelligence (AI) on the Micrographic Camera Market primarily revolve around how AI can enhance the efficiency of microform digitization and data accessibility. Common concerns include the application of machine learning for automated quality control, the feasibility of using Optical Character Recognition (OCR) and Natural Language Processing (NLP) to index poor-quality, handwritten, or aged microfilmed documents, and the potential for AI algorithms to dramatically reduce the time and human effort required for cataloging and searching digitized archives. Users are highly interested in generative AI's role in image restoration, predicting that AI-driven tools will soon be standard features, moving micrographic cameras from mere capture devices to integrated intelligent data management systems.

AI integration is fundamentally transforming the workflow associated with micrographic capture, moving from labor-intensive manual inspection and indexing to highly automated processes. AI algorithms can analyze captured images in real-time to identify defects such as scratches, dust, or fading on the microfilm, initiating automatic correction or flagging for human review. This drastically improves the consistency and quality of the final digital output, especially when dealing with large volumes of brittle or degraded historical microforms. Furthermore, AI-powered systems are being developed to learn complex patterns within microform layouts, enabling automatic cropping, deskewing, and boundary detection, which accelerates the preparation phase for digitization projects.

The most significant impact of AI is seen in the downstream data utilization phase. AI enables semantic searching within digitized archives by applying advanced OCR and handwriting recognition algorithms that can decipher text previously deemed unsearchable due to age or poor film quality. This transformation converts visual data into actionable, searchable information, greatly increasing the return on investment for large-scale digitization projects. As generative AI models become more sophisticated, they will increasingly be used to contextualize historical data retrieved from microfilms, creating links between disparate documents and effectively democratizing access to historical knowledge previously locked away in analog formats.

- AI enhances image quality through automated defect detection and adaptive image restoration algorithms.

- Machine learning improves throughput by automating frame detection, cropping, and orientation adjustments during scanning.

- Advanced OCR/NLP enables full-text indexing and semantic search capabilities for previously unsearchable microfilmed content.

- AI integration reduces operational costs and minimizes human error in the quality assurance (QA) stage of digitization.

- Predictive analytics help maintenance teams manage camera and sensor performance, minimizing downtime in archival facilities.

DRO & Impact Forces Of Micrographic Camera Market

The Micrographic Camera Market’s trajectory is shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and pervasive impact forces. The primary drivers include global mandates for digital preservation, particularly concerning government and academic records, alongside the inherent longevity and legal acceptance of microform as a preservation medium, which necessitates high-quality capture equipment. Restraints largely center around the high initial capital investment required for professional-grade micrographic systems, particularly in smaller institutions, and the declining proficiency in microform handling among new generations of archivists, posing a challenge to specialized equipment adoption. Opportunities are vast, driven by the integration of AI for automated indexing and the expansion into emerging economies where rapid industrialization generates significant demand for robust long-term data storage solutions.

Impact forces stemming from technological change are significant, particularly concerning the constant evolution of sensor technology (CCD to high-end CMOS) which pushes the boundaries of resolution and capture speed, forcing older equipment into obsolescence more rapidly. Economic forces dictate the pace of large-scale digitization projects, with government budget allocations directly influencing procurement cycles for high-cost professional scanners. Regulatory frameworks, such as those governing healthcare records or legal documents, act as strong drivers, mandating specific preservation formats and demanding verifiable, high-fidelity capture of microform data to maintain legal admissibility. The competitive landscape is characterized by intense focus on software integration, where vendors must offer comprehensive platforms rather than standalone hardware.

The interplay of these factors creates a dynamic market environment where innovation in efficiency is paramount. While digital-native storage solutions pose a long-term existential threat (restraint), the existing massive global installed base of microform requires conversion (driver). Therefore, the market's current phase is dominated by migration technology. The opportunity lies in providing consultative services and integrated hardware/software ecosystems that simplify the transition from analog to digital preservation, leveraging cloud infrastructure for storage and AI for retrieval, thereby positioning micrographic cameras as essential components of modern hybrid archives rather than merely niche tools.

Segmentation Analysis

The Micrographic Camera Market is segmented based on the type of equipment, the specific microform format handled, the technology employed, and the primary end-user application. Segmentation is crucial as it dictates product specifications, such as resolution, throughput speed, and software integration requirements. The market is increasingly differentiating between low-volume desktop scanners, primarily used for retrieval in smaller offices or libraries, and high-volume, production-level scanners required by national archives and large document conversion bureaus. This differentiation helps manufacturers target specific institutional budgets and operational needs, driving competitive specialization in both hardware robustness and software features, particularly concerning batch processing capabilities and image quality controls suitable for fragile originals.

The segmentation by microform format remains fundamental, distinguishing cameras optimized for standard 35mm roll film, 16mm roll film, microfiche, and aperture cards. Each format requires specialized lighting, film transport mechanisms, and lens systems to ensure optimal image capture fidelity and to prevent damage to the potentially irreplaceable originals. Furthermore, the segmentation by end-user application helps to tailor marketing and distribution strategies, recognizing that the legal sector requires high compliance and detailed logging (audit trails) of the scanning process, while the library sector prioritizes color accuracy and the ability to handle various media types, including historical newspapers and fragile manuscripts, demonstrating distinct operational requirements that drive procurement decisions.

- By Product Type:

- High-Volume Production Scanners

- Desktop/Low-Volume Retrieval Scanners

- Overhead Microfilm Scanners

- Portable Micrographic Cameras

- By Microform Format:

- Roll Microfilm (16mm and 35mm)

- Microfiche and Aperture Cards

- Micro-opaque/Ultrafiche

- By Technology:

- CCD Sensor-Based Cameras

- CMOS Sensor-Based Cameras

- High-Resolution Digital Backs

- By End-User Application:

- Libraries and Archives (Academic, National, Public)

- Government and Defense Agencies

- Healthcare and Pathology

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing and Engineering (Aperture Card Scanning)

Value Chain Analysis For Micrographic Camera Market

The value chain for the Micrographic Camera Market begins with upstream activities dominated by specialized component suppliers. This phase involves the procurement of high-fidelity CCD/CMOS sensors, specialized optical lens systems capable of resolving fine detail at high magnification, and precision mechanical components necessary for stable film transport and accurate focusing. Key suppliers often include major international manufacturers of optical glass and advanced digital sensors, ensuring the foundational quality of the camera system. Intense focus is placed on quality control at this stage, as sensor performance and optical clarity are the primary determinants of the final image quality, which is non-negotiable for archival standards. Manufacturers rely on robust supplier relationships to secure cutting-edge sensor technology and ensure component compatibility with integrated software platforms.

Midstream activities involve the camera manufacturing and software development phases. Micrographic camera manufacturers assemble the complex electro-mechanical systems and develop proprietary scanning software that integrates film handling, image capture, processing, and indexing functionalities. This stage adds significant value through intellectual property related to image processing algorithms (e.g., dynamic exposure control, image enhancement) and system reliability. Direct and indirect distribution channels then move the finished products to end-users. Direct sales are common for high-value, specialized production scanners, often involving expert consultation and installation services provided directly by the manufacturer or its subsidiaries, ensuring proper integration into complex archival workflows and providing ongoing support crucial for institutional clients.

Downstream activities are concentrated on the installation, integration, and post-sales maintenance required by institutional buyers. Due to the complexity and longevity requirements of micrographic systems, ongoing maintenance contracts and software updates are major value contributors in the downstream market. Indirect channels, typically value-added resellers (VARs) or system integrators, play a vital role, especially in regional markets, by bundling the micrographic cameras with complementary products such as document management systems (DMS), storage hardware, and migration services. These integrators provide localized technical support and customized workflow solutions, positioning the camera not just as hardware but as a critical component of a larger digital ecosystem for long-term information management.

Micrographic Camera Market Potential Customers

Potential customers for Micrographic Cameras are diverse but generally fall into institutional categories that require the preservation, access, and long-term storage of vast quantities of legacy analog information stored on microform. The primary customer segment comprises large government archives, national libraries, and major academic institutions globally. These entities often possess millions of microfiche and microfilm rolls containing irreplaceable historical, cultural, and legal records that must be digitized for both preservation and public accessibility. Their purchasing decisions are driven by factors such as compliance with preservation standards, high-speed throughput requirements, and the camera system's ability to handle fragile, old microform without causing further degradation, prioritizing robustness and image fidelity above all else.

Another significant customer segment includes commercial document conversion services and Business Process Outsourcing (BPO) firms. These companies specialize in large-scale digitization projects for corporate clients (e.g., banks, insurance companies, utilities) that need to migrate decades of microfilmed business records into digital databases. For these commercial entities, the key purchasing criteria are centered on return on investment (ROI), maximizing throughput (scans per hour), minimizing operational downtime, and ensuring the software allows for efficient batch processing and indexing to meet strict project deadlines and quality mandates set by their clients.

Niche but high-value customers exist within specialized sectors like healthcare pathology departments and engineering firms. In healthcare, micrographic cameras are used to digitize historical tissue slide collections stored on microforms, enabling comparative research and secure digital archiving. Engineering and manufacturing sectors, particularly those dealing with legacy aircraft, automotive, or infrastructure blueprints stored on aperture cards, require specialized micrographic cameras capable of high-resolution scanning of technical drawings. These end-users demand systems integrated with specialized software to measure dimensions, manage complex CAD data references, and ensure the accuracy of highly technical visual information during the digitization process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eastman Kodak Company, Canon Inc., Zeutschel GmbH, Crowley Company, Wicks and Wilson (Contex Group), e-ImageData Corp., Indus International Inc., NextScan Inc., Image Access GmbH, Minolta Co. Ltd. (Konica Minolta), Book2Net GmbH, Microbox GmbH, Digital Check Corp., S-T Imaging, Genus Microfilming, Mekel Technology, FRC Inc., i2s, Avision Inc., Fujitsu Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micrographic Camera Market Key Technology Landscape

The technological landscape of the Micrographic Camera Market is predominantly defined by advancements in digital imaging sensors, precision optics, and sophisticated software for image processing and handling. The shift from older CCD (Charge-Coupled Device) sensors to newer, high-speed CMOS (Complementary Metal-Oxide-Semiconductor) sensors has been critical. CMOS technology offers faster capture rates, lower power consumption, and better performance in low-light conditions, which is essential when dealing with varying density levels and deterioration in historical microforms. These modern sensors, often coupled with global shutters, minimize distortion during high-speed scanning operations, ensuring artifact-free digital output even during high-throughput institutional projects.

Optical systems represent another foundational technology. Micrographic cameras utilize high-magnification, high-resolution lenses specifically designed to resolve the minute details present on microform surfaces. These optics must maintain low distortion and excellent color fidelity across a range of magnifications (e.g., 7.5x to 50x) to accommodate different reduction ratios used in microfilming. Furthermore, advanced illumination technologies, such as LED light sources with precise intensity control, are now standard, ensuring uniform lighting across the film plane and compensating for the often-uneven density characteristics of aged microfilm. These controlled light sources are vital for maximizing the dynamic range of the digital image capture.

However, the real technological differentiator lies in the integration software. Modern micrographic camera systems are platform solutions that incorporate advanced features like automated focusing, real-time image enhancement algorithms (e.g., despeckling, dynamic thresholding), and integral indexing tools. Key technologies include proprietary software development kits (SDKs) that allow seamless integration with existing archival databases and Document Management Systems (DMS). The growing use of AI and machine learning for quality control, automatic metadata extraction, and pattern recognition within scanned images is rapidly setting the new technological standard, requiring manufacturers to invest heavily in software development to remain competitive and meet the evolving demands for automated data retrieval.

Regional Highlights

- North America: North America holds a significant market share, driven by extensive digitization projects within federal and state governments (e.g., National Archives and Records Administration, NARA) and leading academic institutions. The region benefits from early adoption of advanced archival technologies and high awareness regarding legal mandates for data preservation, particularly in the legal and financial sectors. High investment capabilities and the presence of numerous key technology providers solidify its position as a leading revenue generator.

- Europe: Europe represents a mature and highly regulated market, with substantial demand originating from national libraries and cultural heritage organizations focused on preserving centuries of historical records. Strict adherence to preservation standards, supported by organizations like UNESCO, drives continuous investment in high-fidelity micrographic camera systems. Germany, the UK, and France are critical markets, emphasizing precision engineering and long-term service contracts for specialized archival equipment.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development and the increasing focus on digitizing historical and business records across developing economies. Government initiatives in countries like China, India, and South Korea to modernize public services and establish large digital archives are key drivers. The market is highly price-sensitive but shows increasing demand for scalable, high-throughput scanning solutions capable of handling massive backlogs efficiently.

- Latin America (LATAM): The LATAM market is growing steadily, primarily fueled by the need for government agencies and religious organizations to preserve historically significant documents. Market growth is constrained by fluctuating economic conditions and budget limitations, leading to a preference for cost-effective, durable equipment. However, increased foreign investment in archival modernization projects is gradually accelerating the adoption rate of digital micrographic cameras.

- Middle East and Africa (MEA): The MEA region is currently a nascent market, but significant opportunity exists due to planned national initiatives aimed at cultural preservation and the modernization of oil and gas and public sector documentation. Market uptake is largely focused on acquiring specialized production scanners through government tenders, with procurement decisions heavily influenced by comprehensive support and maintenance packages offered by international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micrographic Camera Market.- Eastman Kodak Company

- Canon Inc.

- Zeutschel GmbH

- Crowley Company

- Wicks and Wilson (Contex Group)

- e-ImageData Corp.

- Indus International Inc.

- NextScan Inc. Inc.

- Image Access GmbH

- Minolta Co. Ltd. (Konica Minolta)

- Book2Net GmbH

- Microbox GmbH

- Digital Check Corp.

- S-T Imaging

- Genus Microfilming

- Mekel Technology

- FRC Inc.

- i2s

- Avision Inc.

- Fujitsu Ltd.

Frequently Asked Questions

Analyze common user questions about the Micrographic Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Micrographic Camera Market?

The primary driver is the global necessity for long-term digital preservation and the massive backlog of existing microform records (microfilm and microfiche) held by government, academic, and corporate archives that require high-fidelity conversion into searchable digital formats. Regulatory mandates supporting digital archives also significantly accelerate adoption.

How does AI impact the operational efficiency of micrographic cameras?

AI significantly enhances operational efficiency by automating critical tasks such as image quality control, defect detection, precise frame cropping, and implementing advanced Optical Character Recognition (OCR) for indexing poor-quality or handwritten historical documents, drastically reducing manual labor and processing time.

Which sensor technology is dominating modern Micrographic Camera systems?

Modern micrographic camera systems are increasingly adopting high-resolution CMOS (Complementary Metal-Oxide-Semiconductor) sensors over traditional CCD sensors. CMOS technology offers faster image capture speed, improved low-light performance, and better integration with high-speed processing necessary for production-level scanning.

What are the key segments of the Micrographic Camera Market by end-user?

The market is segmented primarily by large institutional end-users: Libraries and Archives (national and academic), Government and Defense Agencies, and specialized applications in the Healthcare (Pathology) and BFSI (Banking, Financial Services, and Insurance) sectors that require permanent documentation storage.

What is the main challenge restraining market growth?

The main challenge restraining market growth is the high initial capital expenditure required for professional, high-volume production micrographic camera systems, making procurement difficult for smaller institutions and archival facilities with limited budgets, especially in comparison to more general-purpose digital scanners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager