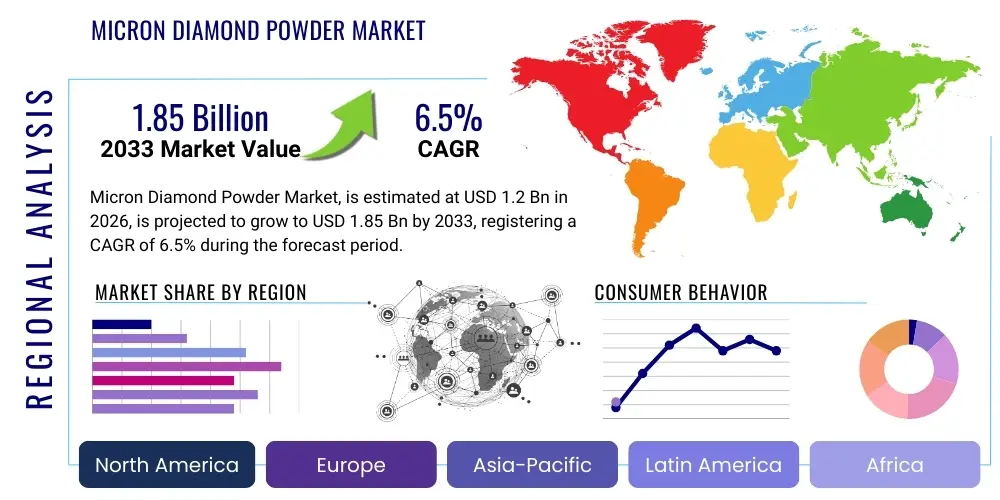

Micron Diamond Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438759 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Micron Diamond Powder Market Size

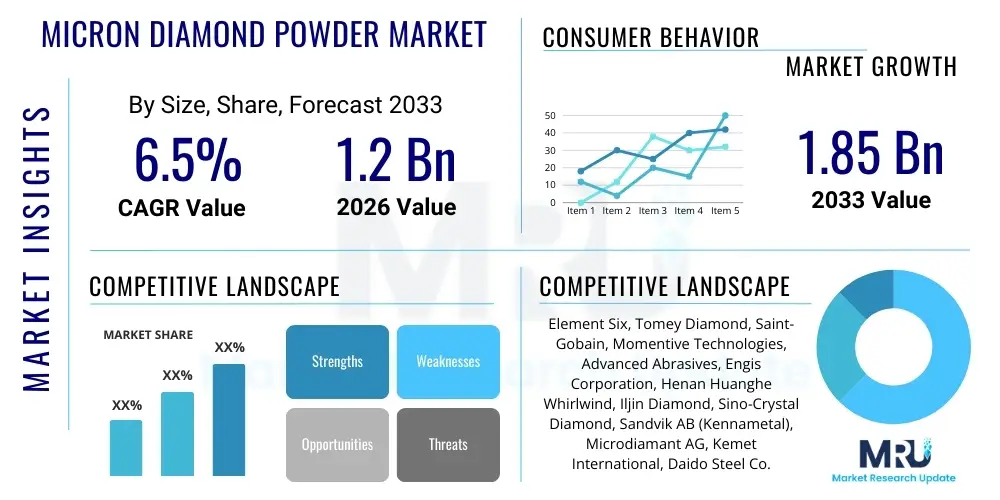

The Micron Diamond Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Micron Diamond Powder Market introduction

Micron diamond powder, characterized by particle sizes typically ranging from sub-micron (nanometer scale) up to 100 microns, is a specialized abrasive material derived primarily from synthetic diamonds. These powders possess exceptional hardness, thermal conductivity, and chemical stability, making them indispensable in highly demanding finishing and polishing applications where material removal and surface finish precision are paramount. The synthesis process, often involving High-Pressure/High-Temperature (HPHT) or Chemical Vapor Deposition (CVD) methods, allows for precise control over particle shape, size distribution, and surface characteristics, which dictates their performance in end-use applications like lapping, grinding, and super-finishing.

The core applications of micron diamond powders span critical high-tech industries, including advanced optics manufacturing, semiconductor wafer processing, precision machinery, and specialized medical device production. In the semiconductor industry, ultra-fine diamond powders are crucial for chemical mechanical planarization (CMP) slurries, ensuring the flatness and uniformity required for advanced chip architecture. For optical components, these powders enable the creation of high-quality lenses and mirrors with minimal surface defects. Their benefits stem directly from their unparalleled hardness, which guarantees efficient material removal rates and superior surface quality, leading to enhanced product lifespan and performance in the final components.

Market growth is predominantly driven by the continuous miniaturization trend in electronics and the increasing demand for high-precision components across industrial sectors. The aerospace and automotive industries require tougher, lighter materials finished to exacting tolerances, further boosting the consumption of diamond powders. Additionally, the rapid expansion of 5G infrastructure and the subsequent surge in demand for compound semiconductors (such as SiC and GaN) necessitate advanced polishing materials, solidifying the vital role of micron diamond powder as an enabling technology for next-generation manufacturing processes.

Micron Diamond Powder Market Executive Summary

The global Micron Diamond Powder Market is positioned for robust expansion, fundamentally supported by escalating demands for precision finishing in high-technology manufacturing sectors such as electronics, aerospace, and advanced materials. Key business trends indicate a strong industry focus on producing highly monodisperse powders and developing tailored surface chemistries to improve dispersion stability in liquid suspension systems, crucial for achieving superior results in CMP and specialized lapping processes. Furthermore, manufacturers are investing heavily in quality control and certification processes to meet stringent industry standards, particularly in demanding sectors like medical devices and high-end optics, driving premium pricing for certified, high-purity grades.

Regional dynamics highlight the Asia Pacific (APAC) region as the dominant and fastest-growing market hub, primarily fueled by the massive concentration of semiconductor fabrication units, consumer electronics production, and automotive manufacturing bases, particularly in countries like China, South Korea, and Taiwan. North America and Europe maintain significant market shares, driven by strong R&D activities, high-value aerospace and defense applications, and the presence of leading abrasive tool manufacturers. The shift of complex manufacturing processes towards APAC, however, continues to reshape the supply chain, necessitating localized production and technical support from key market players to maintain competitive advantage.

Segmentation trends reveal that synthetic diamond powders dominate the market due to superior control over particle geometry and purity compared to natural diamonds. Based on application, the semiconductor and electronics segment holds the largest share, driven by the persistent need for flawless wafer surfaces. Within particle size segmentation, the demand for sub-micron and nanometer-sized particles is witnessing the highest growth rate, directly corresponding to the technological shift towards smaller features and higher integration density in microelectronics, thus requiring increasingly sophisticated and finer abrasive media.

AI Impact Analysis on Micron Diamond Powder Market

User inquiries frequently center on how Artificial Intelligence and machine learning (ML) can optimize the costly and complex production and application of micron diamond powders. Common questions revolve around AI’s potential in predicting optimal synthesis parameters for desired particle characteristics (e.g., shape, crystal structure, and purity), enhancing quality control by automating inspection of particle size distribution (PSD), and formulating high-performance CMP slurries. Users are particularly concerned with whether AI can reduce batch variability, minimize waste, and accelerate the discovery of novel diamond powder surface treatments essential for performance in advanced polishing systems. The overarching expectation is that AI integration will lead to unprecedented levels of precision and efficiency, lowering operational costs and enabling the production of even finer, more consistent abrasive products required for next-generation devices.

The immediate impact of AI is visible in process optimization within manufacturing plants. ML algorithms are utilized to correlate input variables (like temperature, pressure, and catalyst composition in HPHT synthesis) with output metrics such as average particle size and PSD uniformity. This predictive modeling allows manufacturers to dynamically adjust synthesis conditions in real-time, significantly reducing the occurrence of off-spec batches and optimizing raw material usage. Automated visual inspection systems, leveraging computer vision and deep learning, are replacing manual sampling methods, drastically speeding up quality assessment and ensuring consistency, which is a key differentiator in the high-purity abrasives market.

In the application phase, particularly in Chemical Mechanical Planarization (CMP), AI is transforming slurry formulation. ML models analyze large datasets relating slurry composition (including diamond particle concentration, stabilizers, and pH) to polishing metrics (removal rate, defectivity, and non-uniformity across the wafer). This data-driven approach allows end-users, especially semiconductor fabs, to rapidly identify the optimal diamond powder loading and surface chemistry required for specific wafer materials (e.g., silicon carbide or sapphire), thereby maximizing throughput and minimizing expensive defects. Ultimately, AI enhances product performance and accelerates material adoption cycles.

- AI-driven optimization of HPHT synthesis parameters for enhanced particle size distribution uniformity.

- Machine learning algorithms predict optimal catalyst ratios and temperature profiles, reducing batch variability.

- Computer vision systems automate high-speed inspection of diamond powder morphology and purity for quality assurance.

- AI facilitates the rapid development and tuning of high-performance CMP slurry formulations for advanced nodes.

- Predictive maintenance schedules for processing equipment based on AI monitoring to minimize unplanned downtime.

- Enhanced supply chain forecasting and inventory management using predictive analytics based on end-user demand signals.

DRO & Impact Forces Of Micron Diamond Powder Market

The market is predominantly driven by the technological push for high-precision finishing required in advanced electronics and specialized industrial applications. Restraints primarily involve the high cost associated with synthetic diamond production and the challenges in maintaining ultra-high purity standards for sub-micron grades. Significant opportunities lie in the booming market for WBG (Wide Band Gap) semiconductors, such as SiC and GaN, which require diamond powders for effective processing. These market dynamics are shaped by impact forces that balance technological adoption against material complexity and cost efficiency.

Drivers: The paramount driver is the exponential growth of the semiconductor industry, specifically the move towards smaller nodes and the production of complex compound semiconductors that necessitate ultra-smooth, damage-free surfaces achievable only through diamond polishing. The continuous investment in renewable energy technologies, particularly solar panels and high-efficiency LED lighting, also generates sustained demand for abrasive finishing materials. Furthermore, the aerospace and defense sectors consistently demand materials that offer extreme wear resistance and superior finishing quality, increasing the need for highly specialized, tailored micron diamond powders for component fabrication and maintenance.

Restraints: The primary constraint is the substantial capital expenditure and energy consumption required for synthetic diamond manufacturing, especially using the HPHT method, which directly influences the final product price. Maintaining strict control over particle shape, surface chemistry, and achieving near-perfect purity in the sub-micron range remains technically challenging, leading to high rejection rates for sensitive applications. Additionally, the fluctuating prices of raw materials (like graphite and catalyst metals) used in synthesis introduce market volatility, sometimes inhibiting aggressive price competition.

Opportunities: Major growth avenues are emerging from the escalating adoption of SiC and GaN devices in electric vehicles (EVs) and 5G infrastructure, demanding large quantities of high-purity diamond slurry for wafer slicing and polishing. The development of next-generation medical devices, including precision surgical tools and dental implants requiring biocompatible super-finishing, opens specialized niche markets. Furthermore, the geographical expansion of manufacturing capabilities into emerging economies in Southeast Asia and Latin America provides untapped potential for market penetration and establishing localized distribution networks for abrasive consumables.

Segmentation Analysis

The Micron Diamond Powder Market segmentation provides a detailed view of market consumption patterns based on crucial factors, including type (synthetic vs. natural), particle size, application, and end-user industry. Analyzing these segments is essential for stakeholders to understand which product grades are experiencing the highest growth and which industrial sectors are driving volume consumption. The market exhibits a clear preference for synthetic diamonds due to their reproducible properties and customization potential, offering precise control over the morphology required for stringent polishing requirements in optics and electronics.

Segmentation by particle size is the most critical determinant of product application, with the market increasingly shifting towards ultra-fine and sub-micron powders (0-2 microns) to support microelectronics manufacturing, which requires finishes in the nanometer range. While coarser grades (10-40 microns) still hold significant share in heavy-duty grinding and lapping of ceramics and metals, the highest revenue growth is tied to the demand for the finest powders. Furthermore, the application segment highlights the dominance of polishing and lapping processes over grinding, reflecting the increasing focus on achieving superior surface quality in high-value components.

The end-user vertical analysis confirms the centrality of the electronics and semiconductor industry, followed closely by precision machinery and tools. The market is also seeing substantial penetration into niche areas like dental care and jewelry cutting/polishing, utilizing specific grades of diamond powder tailored for biological compatibility and aesthetic finishing, respectively. This diversified application base ensures market stability, mitigating risks associated with reliance on a single industrial cycle.

- By Type:

- Synthetic Diamond Powder

- Natural Diamond Powder

- By Particle Size:

- Sub-micron (Below 1 micron)

- 1 micron to 5 microns

- 6 microns to 15 microns

- Above 15 microns

- By Application:

- Lapping and Polishing

- Grinding

- Drilling

- Wire Drawing Die Production

- By End-User Industry:

- Semiconductors and Electronics

- Optics and Photonics

- Aerospace and Automotive

- Machinery and Tools

- Medical and Dental

- Oil and Gas

Value Chain Analysis For Micron Diamond Powder Market

The value chain for micron diamond powder is highly specialized, beginning with the complex and energy-intensive upstream synthesis process, typically involving HPHT reactors or CVD equipment to produce raw synthetic diamond grit. Upstream activities are dominated by specialized material science companies that focus on optimizing crystal growth and maximizing yield, ensuring the foundational quality of the product. The key challenge at this stage is controlling impurity levels and ensuring consistent crystal morphology, as these factors fundamentally determine the performance of the final abrasive powder.

The midstream processing phase involves the crucial steps of crushing, grading, cleaning, and surface treatment of the raw diamond material to produce micron-sized powders. This stage requires sophisticated sizing equipment, such as air classifiers and sedimentation tanks, to achieve the extremely narrow particle size distributions demanded by high-precision applications. Quality control, including zeta potential measurement and rigorous purity testing, is paramount in this segment. Many manufacturers also perform surface functionalization, tailoring the diamond surface chemistry to ensure optimal dispersion stability and superior performance when incorporated into slurries or bonded tools.

Downstream activities include formulation (where the powders are incorporated into slurries, pastes, or polishing films), distribution, and end-user application. Distribution channels are typically specialized, relying on direct sales to large industrial users (like semiconductor fabs) or indirectly through specialized distributors and abrasive tool manufacturers. Since the product is often consumed as a specialized consumable, robust technical support and just-in-time inventory management are critical components of the indirect channel, ensuring that end-users receive precise grades when needed for sensitive manufacturing processes.

Micron Diamond Powder Market Potential Customers

The primary customers for micron diamond powder are high-tech manufacturers that require unparalleled surface finishing precision for their products, where even minor defects can render expensive components useless. The most significant segment consists of semiconductor fabrication plants (fabs) and wafer processing houses, which use large volumes of ultra-fine diamond slurries for Chemical Mechanical Planarization (CMP) of silicon, sapphire, and wide-bandgap materials like SiC and GaN. These customers seek ultra-high purity, highly dispersed powders essential for achieving the nanometer-scale flatness required for modern integrated circuits.

A second major customer category includes manufacturers of advanced optical components, such as high-power lasers, precision lenses for aerospace, and specialized filters. These users demand powders capable of generating flawless, scratch-free surfaces to ensure maximum light transmission efficiency and minimal scattering. Additionally, manufacturers in the aerospace and automotive sectors, particularly those specializing in engine components, turbine blades, and precision bearings, constitute a vital customer base, utilizing micron diamond powder for lapping and super-finishing wear-resistant alloys and ceramics to achieve extreme dimensional tolerances and reduced friction.

Furthermore, specialized tool manufacturers and dental/medical equipment companies are key buyers. This includes producers of PDC (Polycrystalline Diamond Compact) drill bits used in the oil and gas sector, and dental laboratories requiring fine abrasives for polishing crowns and implants. These customers prioritize durability and precision, often requiring custom-sized or encapsulated diamond particles integrated into rigid matrices or polishing pastes for optimal performance in their respective tooling or finishing processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six, Tomey Diamond, Saint-Gobain, Momentive Technologies, Advanced Abrasives, Engis Corporation, Henan Huanghe Whirlwind, Iljin Diamond, Sino-Crystal Diamond, Sandvik AB (Kennametal), Microdiamant AG, Kemet International, Daido Steel Co. Ltd., Asahi Diamond Industrial Co. Ltd., Shenzhen Fungho Diamond Tools Co. Ltd., Hyperion Materials & Technologies, Industrial Abrasives Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Micron Diamond Powder Market Key Technology Landscape

The manufacturing technology landscape for micron diamond powder is dominated by two primary methods: High-Pressure/High-Temperature (HPHT) synthesis and Chemical Vapor Deposition (CVD). HPHT remains the workhorse for high-volume production of industrial-grade micron powders, utilizing large presses to replicate the natural conditions under which diamonds form. Technological advancements in HPHT focus on achieving tighter control over temperature and pressure gradients within the reaction cell to enhance the uniformity of crystal nucleation and growth, leading to higher purity, more consistent particle shapes, and reduced production cycles. This iterative improvement in HPHT efficiency is critical for meeting the cost demands of large industrial consumers.

CVD technology, though more expensive, is increasingly important for producing thin diamond films and high-purity single crystals, which are subsequently processed into powders. The key technological edge of CVD lies in its ability to produce diamonds with fewer structural defects and lower levels of metallic impurities, making these powders ideal for highly sensitive applications such as radiation detectors, specific optical components, and advanced electronic substrates where even trace contaminants can compromise performance. Research is concentrated on improving plasma chemistry and reactor design to scale up CVD production reliably and cost-effectively for high-end abrasive applications.

Beyond synthesis, the post-processing technology is equally vital. This includes advanced sizing and grading techniques such as dynamic air classification, laser diffraction analysis, and sophisticated sedimentation methods, all aimed at achieving the narrow Particle Size Distribution (PSD) demanded by precision finishing processes. Crucially, surface engineering—where chemical or physical treatments are applied to the diamond particles to optimize their surface energy and compatibility with various polishing vehicle fluids—is a major focus area. Techniques such as plasma treatment and controlled oxidation ensure superior particle dispersion stability in CMP slurries, minimizing agglomeration and maximizing polishing efficiency for critical applications.

Regional Highlights

The regional analysis of the Micron Diamond Powder Market reveals significant differences in demand drivers, technological maturity, and market concentration across key geographical segments. Asia Pacific (APAC) currently holds the dominant share and is projected to exhibit the fastest growth over the forecast period, driven by unparalleled investment in semiconductor manufacturing, particularly in China, Taiwan, and South Korea. These countries are global hubs for consumer electronics and automotive component manufacturing, requiring vast quantities of precision abrasives for wafer slicing, lapping, and polishing. The proliferation of local, high-volume synthetic diamond manufacturers in this region further supports market expansion.

North America and Europe represent mature, high-value markets characterized by demand for specialized, ultra-high-performance micron diamond grades used primarily in aerospace, medical technology, and high-end optics. North America, benefiting from significant defense spending and strong R&D infrastructure, drives innovation in advanced material processing. Europe maintains a strong foothold due to its robust machinery and automotive sectors, with a consistent need for precise abrasive consumables. Although volume growth is slower compared to APAC, the average selling price and emphasis on certified quality remain high in these regions.

The Middle East & Africa (MEA) and Latin America currently account for smaller market shares but present emerging opportunities. MEA demand is primarily linked to the oil and gas sector (for PDC drill bit production) and emerging infrastructure projects. Latin America’s market growth is tied to the local automotive production and mining activities. However, market penetration in these regions often requires navigating complex regulatory environments and establishing reliable, localized distribution channels capable of supplying specialized imported materials efficiently.

- Asia Pacific (APAC): Dominates the market share due to the concentration of semiconductor fabs, consumer electronics production, and automotive manufacturing; exhibiting the highest CAGR fueled by investments in 5G and WBG materials (SiC, GaN). Key consumers include China, South Korea, and Taiwan.

- North America: Significant market share focused on high-specification applications in aerospace, defense, and high-precision medical devices; market characterized by demand for premium, customized, high-purity micron grades and strong presence of R&D focused abrasive companies.

- Europe: Mature market driven by the robust machinery manufacturing, automotive (especially electric vehicle components), and optics industries; focuses heavily on quality certification and sustainable production methods for industrial consumables.

- Latin America (LATAM): Emerging market driven primarily by the automotive industry and localized tool manufacturing, with demand concentrated in general industrial lapping and grinding applications.

- Middle East and Africa (MEA): Smallest segment, with demand heavily weighted towards the energy sector (PDC tools for drilling) and basic industrial maintenance, presenting long-term potential tied to diversification initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Micron Diamond Powder Market.- Element Six

- Tomey Diamond

- Saint-Gobain

- Momentive Technologies

- Advanced Abrasives

- Engis Corporation

- Henan Huanghe Whirlwind

- Iljin Diamond

- Sino-Crystal Diamond

- Sandvik AB (Kennametal)

- Microdiamant AG

- Kemet International

- Daido Steel Co. Ltd.

- Asahi Diamond Industrial Co. Ltd.

- Shenzhen Fungho Diamond Tools Co. Ltd.

- Hyperion Materials & Technologies

- Industrial Abrasives Ltd.

- Diamond Innovations (a subsidiary of Sandvik)

- Superhard Products Ltd.

- Zhengzhou Sino-Crystal Diamond Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Micron Diamond Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is micron diamond powder primarily used for?

Micron diamond powder is primarily utilized for achieving high-precision surface finishes in demanding applications such as lapping, polishing, and super-finishing. Its core applications are found in the semiconductor industry (CMP slurries), advanced optics manufacturing, aerospace components, and specialized tooling where material hardness and surface flatness are critical performance indicators.

How does synthetic diamond powder differ from natural diamond powder in the market?

Synthetic diamond powder dominates the market due to its superior consistency and customizable properties. Manufacturing processes (HPHT and CVD) allow producers to precisely control particle shape, size distribution, and impurity levels, ensuring better performance and predictability in high-precision industrial processes, unlike naturally sourced powders which have inherent variability.

Which industry segment drives the highest demand for sub-micron diamond powder?

The semiconductor and electronics industry is the largest driver of demand for sub-micron (below 1 micron) and nanometer diamond powders. These ultra-fine particles are essential components in Chemical Mechanical Planarization (CMP) slurries, critical for achieving the necessary flawless, ultra-flat surfaces on silicon and compound semiconductor wafers for advanced chip fabrication.

What are the key technological challenges facing micron diamond powder manufacturers?

Key technological challenges include minimizing the energy consumption and high capital investment associated with synthesis methods (HPHT); maintaining extremely narrow and consistent particle size distributions (PSD) in the sub-micron range; and developing robust surface functionalization techniques to ensure stable dispersion in various liquid carriers without agglomeration.

How is the growth of Wide Band Gap (WBG) semiconductors impacting the market?

The rapid adoption of WBG materials like Silicon Carbide (SiC) and Gallium Nitride (GaN) in electric vehicles and 5G infrastructure is significantly boosting the market. These extremely hard materials require high-performance, specialized micron diamond powders and slurries for efficient wafer slicing and polishing, driving high-value demand in the abrasive market segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager