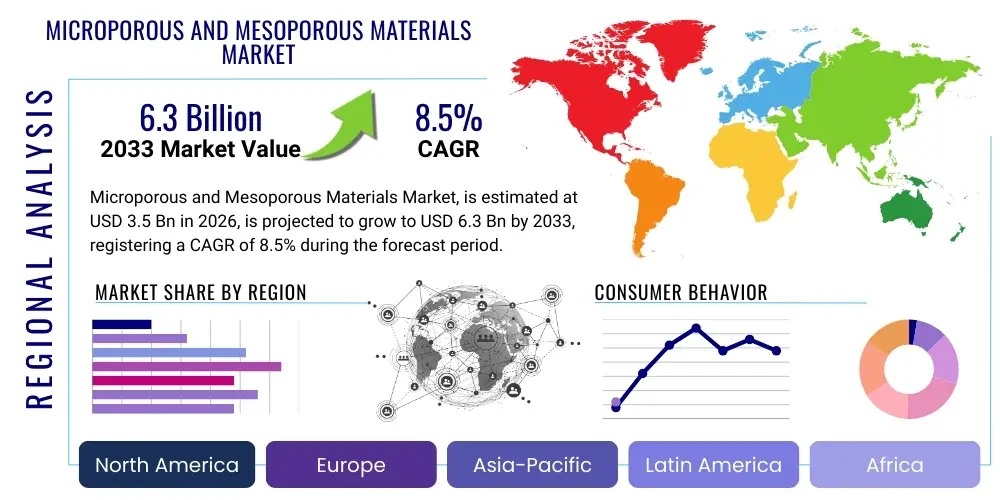

Microporous and Mesoporous Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438787 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Microporous and Mesoporous Materials Market Size

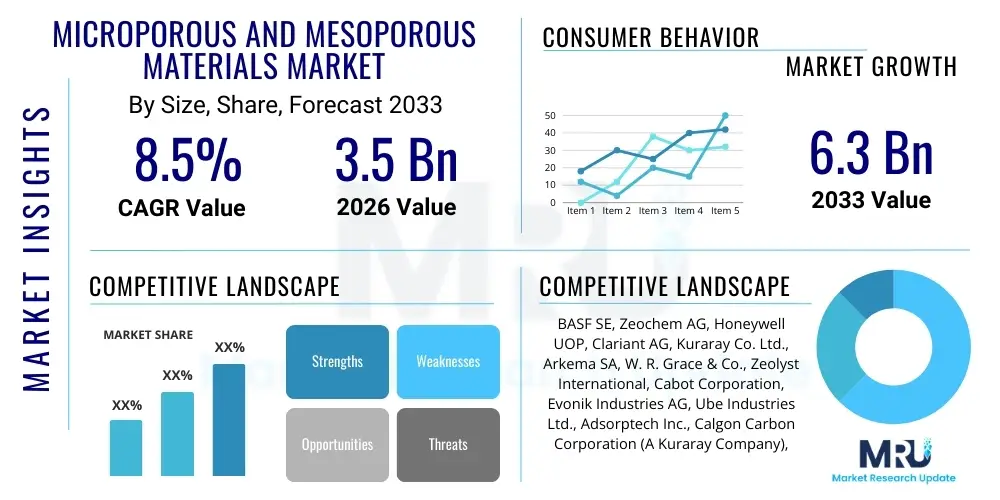

The Microporous and Mesoporous Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033.

Microporous and Mesoporous Materials Market introduction

Microporous and mesoporous materials are defined by the size of their internal pores, with microporous materials exhibiting pore diameters less than 2 nanometers (nm) and mesoporous materials ranging between 2 nm and 50 nm. These materials, which include activated carbons, zeolites, metal-organic frameworks (MOFs), porous silicas, and advanced polymer-based structures, possess exceptionally high surface areas and precisely controlled pore architectures. This unique combination of properties makes them indispensable for applications requiring selective molecular separation, high-efficiency adsorption, and enhanced catalytic activity, fundamentally driving innovation across diverse industrial sectors.

Major applications for these materials span environmental remediation, sophisticated chemical processing, energy storage, and advanced biomedical applications like targeted drug delivery. In the environmental sector, microporous materials excel in gas separation, such as carbon capture and purification, while mesoporous materials are crucial for water filtration and heavy metal removal due to their larger pore volumes enabling faster transport kinetics. The benefits derived from using these materials center on significant improvements in process efficiency, reduced energy consumption in separation processes, and enhanced product selectivity, leading to superior industrial performance compared to conventional bulk materials.

Key driving factors accelerating market expansion include stringent global environmental regulations mandating reduced emissions and cleaner industrial processes, particularly in North America and Europe. Furthermore, the burgeoning demand for high-performance energy storage solutions, such as next-generation lithium-ion batteries and fuel cells, heavily relies on the high surface area and structural stability offered by specialized porous carbons and functionalized MOFs. The continuous advancements in synthesis techniques, leading to reduced production costs and enhanced material stability, are further broadening the commercial viability and adoption rate of these advanced functional materials across emerging economies.

Microporous and Mesoporous Materials Market Executive Summary

The Microporous and Mesoporous Materials Market is characterized by robust business trends driven primarily by the global pivot towards sustainable technologies and high-efficiency chemical synthesis. Key business trends include aggressive investment in scalable manufacturing processes, especially for advanced materials like MOFs and hierarchical zeolites, which offer superior performance characteristics over conventional adsorbents. Consolidation among specialty chemical manufacturers and partnerships between academic research institutions and industrial end-users are accelerating the pace of commercialization, pushing novel porous structures from the laboratory into large-scale industrial applications. There is a noticeable shift in product demand towards tailored, functionalized materials designed for highly specific applications, such as post-combustion CO2 capture and ultra-selective chemical separations.

Regionally, the Asia Pacific (APAC) area dominates the market volume, propelled by rapid industrialization, high levels of chemical manufacturing, and increasing regulatory pressure in countries like China and India to address air and water pollution. However, North America and Europe remain the leaders in terms of high-value innovation, focusing heavily on R&D for next-generation energy and biomedical applications, driving higher Average Selling Prices (ASPs) for specialized materials. Regional trends also show increasing adoption of porous materials in Latin America and the Middle East for oil and gas purification and petrochemical processing, driven by infrastructure investments and optimization mandates within the energy sector.

Segmentation trends indicate that while traditional materials like activated carbon maintain a strong market share due to their cost-effectiveness and versatility, emerging segments, particularly Metal-Organic Frameworks (MOFs) and Covalent Organic Frameworks (COFs), are projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is attributed to their exceptional tunability, precise pore size distribution, and crystalline nature, making them ideal for highly specialized applications in gas storage, drug delivery, and advanced catalysis. The application segment is overwhelmingly led by catalysis and adsorption, but the energy storage and separation segments are experiencing explosive growth, fueled by advancements in electric vehicle battery technology and enhanced industrial purification standards.

AI Impact Analysis on Microporous and Mesoporous Materials Market

Users frequently inquire about how Artificial Intelligence (AI) can accelerate the discovery and optimization of novel porous materials, particularly regarding predicting material stability, synthesizing conditions, and performance characteristics in complex environments. Common concerns revolve around whether AI can effectively handle the massive combinatorial possibilities inherent in MOF and COF synthesis and if it can reliably screen thousands of potential candidates faster than conventional high-throughput experimentation. The expectations are high, focusing on AI's ability to personalize material design, reduce costly laboratory errors, and drastically shorten the time-to-market for specialized adsorbents and catalysts, thereby disrupting traditional R&D methodologies.

The core themes identified through user query analysis involve predictive modeling for property optimization, automated synthesis route planning, and real-time process control during manufacturing. Specifically, users are keen to understand how machine learning models, trained on extensive crystallographic databases and simulation data, can guide researchers toward optimal synthesis parameters (temperature, solvent, pressure) required to produce target materials with specific porosity and functionality. Furthermore, there is strong interest in using AI for quality control during commercial production, ensuring batch-to-batch consistency and predicting material degradation under operational stress, which is critical for long-term industrial deployments in environments such as flue gas stacks or chemical reactors.

In essence, AI is viewed as the catalyst for the next generation of porous material development, moving beyond trial-and-error chemistry to a data-driven approach. This analytical capability is essential for managing the complexity of materials like hierarchical zeolites and multi-component MOFs, where subtle changes in the precursor or reaction environment can lead to vastly different structural and functional outcomes. The immediate impact is visible in computational materials science, where AI algorithms are already generating virtual libraries of millions of potential materials and screening them for performance in areas like hydrogen storage and methane conversion, significantly streamlining the research pipeline and unlocking previously unachievable material designs.

- AI-driven acceleration of novel material discovery and computational screening of billions of potential structures.

- Optimization of synthesis parameters using machine learning to maximize yield, purity, and control pore size distribution.

- Predictive modeling of material stability, adsorption capacity, and catalytic performance under varying operating conditions.

- Automation of high-throughput experimentation (HTE) labs, reducing reliance on manual testing cycles.

- Enhanced quality control and real-time process monitoring during large-scale manufacturing of porous materials.

- Facilitation of personalized material design for highly specific industrial separation or drug delivery requirements.

- Development of digital twins for porous reactors and separation columns to simulate long-term performance and maintenance needs.

DRO & Impact Forces Of Microporous and Mesoporous Materials Market

The Microporous and Mesoporous Materials Market is profoundly shaped by a confluence of strong drivers (D), significant restraints (R), and transformative opportunities (O), which collectively define the impact forces acting upon market growth. The principal drivers stem from the global imperative for environmental sustainability, specifically the urgent need for efficient carbon capture technologies and advanced water purification systems. These drivers are bolstered by increasing energy demands, which require superior materials for efficient gas storage (e.g., natural gas, hydrogen) and high-performance battery components, propelling innovation across the materials science landscape. Furthermore, the precision offered by these materials for complex chemical and pharmaceutical separations provides a robust, demand-side pull from high-value industries seeking process optimization.

Conversely, the market faces considerable restraints primarily related to the high cost and complexity of synthesizing certain advanced porous materials, notably highly crystalline MOFs and tailored mesoporous silicas, which require specialized reagents and precise process control. Scalability remains a major challenge; transitioning successful lab-scale synthesis methods to economically viable industrial production volumes often requires extensive engineering investment and new manufacturing protocols, leading to slower commercial adoption rates than anticipated for novel structures. Additionally, concerns regarding the long-term hydrothermal and chemical stability of some materials, particularly under harsh industrial operating conditions, introduce performance risk and necessitate ongoing materials research to enhance durability.

The opportunities within the sector are extensive and transformative, centered on emerging applications in the healthcare and energy sectors. Significant opportunities lie in the development of materials for targeted and controlled drug delivery systems, leveraging the high loading capacity and tunable release kinetics of mesoporous structures. Furthermore, the transition to green energy sources presents substantial opportunities in next-generation battery technologies (e.g., Li-S batteries) and sustainable hydrogen production and storage. The burgeoning field of direct air capture (DAC) represents a multi-billion dollar opportunity, heavily reliant on highly selective and regenerable microporous materials, positioning the market at the forefront of climate change mitigation strategies.

Segmentation Analysis

The Microporous and Mesoporous Materials Market is complexly segmented based on material type, pore structure morphology, end-use application, and geographical region, reflecting the diversity of functional characteristics and industrial requirements. Understanding these segments is crucial for strategic market positioning, as growth rates vary significantly depending on the maturity of the material segment and the adoption rate within specific application areas. The material type segmentation distinguishes between established, high-volume products like activated carbon and zeolites, and rapidly evolving, high-value materials such as Metal-Organic Frameworks (MOFs) and high-surface-area porous polymers, each serving distinct functional roles due to their unique pore properties and chemical affinity.

- By Material Type:

- Activated Carbon

- Zeolites

- Mesoporous Silica

- Metal-Organic Frameworks (MOFs)

- Porous Polymers and Resins (e.g., Hypercrosslinked Polymers)

- Others (e.g., Carbon Nanotubes, Ordered Mesoporous Carbons)

- By Pore Size Morphology:

- Microporous Materials (Pore size < 2 nm)

- Mesoporous Materials (Pore size 2 nm – 50 nm)

- Hierarchical Porous Materials (Containing multi-modal porosity)

- By Application:

- Catalysis

- Adsorption and Separation (Gas separation, Liquid separation)

- Ion Exchange

- Energy Storage (Batteries, Supercapacitors)

- Drug Delivery and Biomedical Applications

- Water Treatment and Environmental Remediation

- Others (Sensors, Thermal Insulation)

- By End-Use Industry:

- Chemical and Petrochemical

- Energy and Power Generation

- Pharmaceutical and Biotechnology

- Automotive

- Food and Beverage

- Environmental Management

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Microporous and Mesoporous Materials Market

The value chain for microporous and mesoporous materials is complex, starting with the synthesis of highly purified precursor chemicals and extending through specialized manufacturing processes to the diverse industrial and consumer end-users. The upstream segment involves the sourcing and preparation of critical raw materials, such as specific metal salts, organic linkers (for MOFs), high-purity silicates (for mesoporous silica), and precursor carbons. The quality and cost stability of these precursors significantly influence the final product characteristics and profitability. Effective upstream procurement strategies focus on securing reliable supplies of high-purity chemical reagents necessary for controlled synthesis, particularly for novel, complex materials like COFs and designer zeolites where impurity control is paramount.

The midstream stage centers on the manufacturing process itself, encompassing advanced synthesis techniques such as hydrothermal methods, sol-gel processing, template synthesis, and advanced crystallization protocols. This stage requires significant intellectual property and specialized equipment to control pore size distribution, crystallinity, and functionalization. Following synthesis, materials undergo purification, activation (e.g., thermal or chemical activation for activated carbon), and surface functionalization to enhance performance for specific applications like CO2 capture or specific catalytic reactions. Efficiency in manufacturing and scalability of proprietary synthesis methods are key competitive advantages in this segment.

The downstream distribution channel involves specialized sales and technical support tailored to industrial requirements. Distribution is often segmented into direct sales channels for large industrial customers (e.g., petrochemical refineries or major pharmaceutical manufacturers) who require custom specifications and indirect distribution through chemical distributors and agents, particularly for smaller R&D orders or standard product lines like bulk activated carbon. Technical competence in application engineering is vital in the downstream phase, as successful adoption often depends on optimizing the material's integration into the customer's existing equipment, such as fixed-bed reactors, adsorption columns, or battery assemblies.

Microporous and Mesoporous Materials Market Potential Customers

Potential customers for microporous and mesoporous materials span a wide array of high-tech and heavy industries, all seeking enhanced efficiency, sustainability compliance, and superior product quality through molecular-level engineering. The largest and most established customer base resides within the Chemical and Petrochemical sectors, utilizing these materials extensively as highly selective catalysts for cracking, isomerization, and separation processes. Refineries rely heavily on zeolites and specialized silica-alumina catalysts to improve yield and reduce operational costs in fuel production, making them essential consumables in continuous industrial processes.

The Energy sector represents a rapidly expanding customer base, particularly manufacturers of advanced batteries and gas storage systems. Companies developing electric vehicles, grid energy storage solutions, and hydrogen fuel infrastructure are major purchasers of high-surface-area porous carbons and tailor-made MOFs, leveraging their lightweight nature and massive capacity for ion intercalation or gas adsorption. This segment is characterized by stringent quality requirements and demand for consistent, high-volume supply chains capable of meeting the rigorous standards of automotive and energy equipment manufacturers.

Furthermore, the Pharmaceutical and Biotechnology industries are crucial high-value customers, where mesoporous silica and certain MOFs are employed in complex roles such as controlled and targeted drug delivery systems, diagnostics, and chromatographic separation of chiral compounds. These customers prioritize materials with extreme purity, biocompatibility, and precise control over release kinetics. The Environmental sector, including companies focused on air pollution control and water purification, constitutes another core customer group, demanding customized adsorbents for everything from volatile organic compound (VOC) removal to desalination and heavy metal sequestration, driven by increasing public health and regulatory pressures worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Zeochem AG, Honeywell UOP, Clariant AG, Kuraray Co. Ltd., Arkema SA, W. R. Grace & Co., Zeolyst International, Cabot Corporation, Evonik Industries AG, Ube Industries Ltd., Adsorptech Inc., Calgon Carbon Corporation (A Kuraray Company), Tricat Inc., Porous Materials Inc., Nippon Chemical Industrial Co. Ltd., Imerys, NanoPore Incorporated, MOF Technologies, Strem Chemicals Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Microporous and Mesoporous Materials Market Key Technology Landscape

The technology landscape for microporous and mesoporous materials is rapidly evolving, driven by the necessity for precise control over pore architecture, surface chemistry, and structural stability. Traditional synthesis methods, such as hydrothermal synthesis for zeolites and chemical activation for carbon, remain foundational but are increasingly being complemented by advanced techniques that allow for fine-tuning material properties. A major technological focus is template synthesis, which uses structure-directing agents (SDAs) or micelles (for mesoporous silica) to precisely dictate the final pore size and connectivity. Furthermore, researchers are continuously refining the solvothermal and mechanochemical synthesis methods, particularly for MOFs, aiming to reduce energy consumption, increase yield, and eliminate hazardous solvents, thereby improving the sustainability and scalability of production.

A critical technological trend involves the development of hierarchical porous materials, which combine the high selectivity of micropores with the enhanced mass transport facilitated by mesopores. Technologies enabling hierarchical structure formation, such as dual-templating or post-synthetic modification, are gaining importance, especially in high-throughput applications like complex catalysis where rapid diffusion into and out of the pore structure is essential. Advances in post-synthetic modification techniques also allow for the targeted functionalization of internal pore surfaces with specific chemical groups, enhancing material performance in applications like CO2 capture, where affinity for the target molecule is paramount. The ability to graft specific ligands onto MOF nodes or pore walls is a key area of technological differentiation.

Beyond synthesis, advancements in characterization and manufacturing technology are equally important. High-resolution analytical techniques, including advanced Gas Adsorption (BET analysis) for surface area calculation, Transmission Electron Microscopy (TEM) for morphological visualization, and X-ray Diffraction (XRD) for crystallinity assessment, are becoming more standardized and automated, ensuring rigorous quality control. Furthermore, the commercial scaling of continuous flow synthesis reactors is replacing batch processing for some materials, offering significant economic benefits by improving consistency and reducing cycle times, thereby addressing one of the primary historical restraints associated with the commercial viability of sophisticated porous structures. Integrating AI and computational modeling into these synthesis and characterization workflows represents the cutting edge of technological adoption in this market.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing regional market, primarily driven by expansive industrial activity, high-volume chemical manufacturing, and increasing investments in energy infrastructure, particularly in China, Japan, South Korea, and India. The rapid adoption of microporous materials in environmental remediation, including air purification and water treatment, is a major regional catalyst, largely due to intensifying governmental efforts to curb pollution stemming from dense urbanization and industrial growth. Furthermore, the region is a global hub for electronics and battery manufacturing, creating massive demand for porous carbons and advanced electrolytes essential for energy storage devices.

- North America: North America is characterized by robust investment in R&D and a strong focus on high-value, specialized applications, especially in the pharmaceutical and advanced energy sectors. The region leads in the commercialization of novel materials like MOFs for highly selective applications such as natural gas purification, specialized medical separations, and advanced carbon capture technologies, often supported by significant federal funding and private venture capital. Stringent environmental regulations in the US and Canada specifically drive the demand for high-efficiency adsorbents to comply with clean air and water mandates, favoring premium, high-performance porous structures over commodity alternatives.

- Europe: Europe maintains a significant market position, distinguished by its leadership in sustainable chemistry, circular economy initiatives, and automotive industry applications. European manufacturers, particularly in Germany and France, are major producers and consumers of high-quality zeolites for catalytic converters and specialized adsorbents for industrial gas drying and separation processes. The regional market is also focused on leveraging mesoporous materials for advanced biomedical research and developing large-scale industrial solutions for sustainable hydrogen storage and CO2 utilization, underpinned by the EU's ambitious Green Deal objectives.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, primarily driven by the petrochemical, oil and gas, and water treatment sectors. Countries like Brazil and Mexico are increasing their adoption of zeolites and activated carbon for refining processes and improving urban water infrastructure. Market growth here is closely tied to infrastructure investment and the optimization of existing industrial assets, where cost-effective and reliable separation and catalytic materials are prioritized.

- Middle East and Africa (MEA): The MEA region's market is highly concentrated around the oil, gas, and petrochemical industries. Microporous materials are essential for gas sweetening (removing H2S and CO2), natural gas dehydration, and catalytic refining processes. Significant infrastructure development projects and investments in renewable energy, particularly in the UAE and Saudi Arabia, are opening new opportunities for porous materials in energy storage and water desalination applications, though political and economic volatility can sometimes impact major project timelines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Microporous and Mesoporous Materials Market.- BASF SE

- Zeochem AG

- Honeywell UOP

- Clariant AG

- Kuraray Co. Ltd.

- Arkema SA

- W. R. Grace & Co.

- Zeolyst International

- Cabot Corporation

- Evonik Industries AG

- Ube Industries Ltd.

- Adsorptech Inc.

- Calgon Carbon Corporation (A Kuraray Company)

- Tricat Inc.

- Porous Materials Inc.

- Nippon Chemical Industrial Co. Ltd.

- Imerys

- NanoPore Incorporated

- MOF Technologies

- Strem Chemicals Inc.

Frequently Asked Questions

Analyze common user questions about the Microporous and Mesoporous Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between microporous and mesoporous materials and their main commercial uses?

Microporous materials possess pore diameters less than 2 nanometers, providing high selectivity crucial for gas separation, molecular sieving, and heterogeneous catalysis (e.g., zeolites in refining). Mesoporous materials have pores between 2 and 50 nanometers, offering high surface area combined with faster mass transport kinetics, making them ideal for high-volume adsorption, drug delivery, and electrochemical energy storage applications (e.g., mesoporous silica and carbons).

Which material segment, Activated Carbon or Metal-Organic Frameworks (MOFs), is projected to achieve the highest growth rate?

While Activated Carbon holds the largest current market volume due to its cost-effectiveness and broad application base in water and air purification, Metal-Organic Frameworks (MOFs) are consistently projected to achieve the highest Compound Annual Growth Rate (CAGR). This rapid growth is driven by MOFs' superior structural tunability, ultra-high porosity, and bespoke performance capabilities in niche, high-value markets like advanced gas storage, specialized catalysis, and targeted biomedical applications, commanding premium pricing and expanding commercialization efforts.

What are the major technological challenges constraining the mass adoption of advanced porous materials like MOFs?

The primary constraints revolve around industrial scalability and material stability. Synthesizing advanced materials consistently at high volumes often involves complex, energy-intensive, and solvent-heavy batch processes, leading to high production costs compared to commodity adsorbents. Furthermore, many novel MOFs and tailored mesoporous structures exhibit insufficient hydrothermal or chemical stability under harsh industrial operating conditions, which necessitates continued R&D focusing on enhancing their durability and regeneration cycles for long-term industrial deployment.

How significant is the role of microporous and mesoporous materials in the context of carbon capture technology?

Microporous and mesoporous materials are fundamentally essential for both pre-combustion and post-combustion carbon capture and sequestration (CCS). Highly selective microporous materials, such as specific MOFs and zeolites, are utilized as high-performance solid adsorbents to selectively capture CO2 from flue gas streams or directly from the air (Direct Air Capture). The high adsorption capacity and potential for low-energy regeneration offered by these tailored materials are critical to making large-scale, economically viable carbon capture technologies feasible, positioning them at the center of global climate mitigation strategies.

Which geographical region leads the market in terms of production and consumption, and what factors drive this dominance?

The Asia Pacific (APAC) region leads the market in terms of both production capacity and consumption volume, primarily due to intense, continuous industrialization across countries like China, India, and South Korea. This dominance is driven by the vast presence of chemical manufacturing and petrochemical processing facilities, coupled with growing environmental concerns that necessitate the extensive use of adsorbents and catalysts for regulatory compliance. High demand for energy storage components, fueled by the booming electric vehicle and electronics industries in APAC, further cements the region's market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager